16 Underwriter Resume Examples

Underwriter resumes should focus on relevant work experience, specific industry skills, and educational background. Key elements include a clear outline of positions held, duties performed, and notable achievements. A good resume also highlights knowledge of underwriting guidelines, compliance with laws, and familiarity with industry-specific tools and procedures. Contact information should be easy to locate at the top, followed by a chronological list of experience, skills, and education.

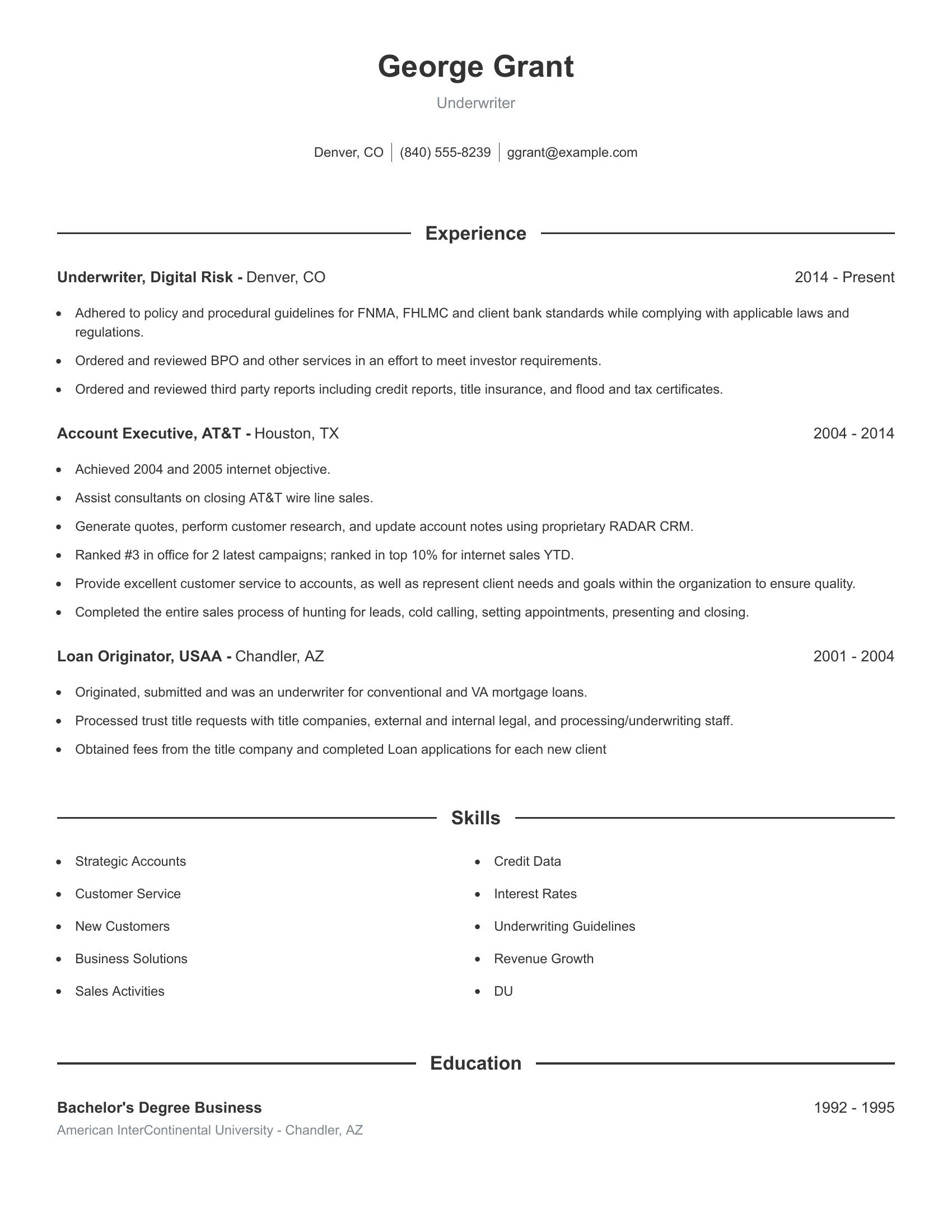

This resume includes a strong emphasis on relevant work experience in the underwriting field. It details positions held at Digital Risk and USAA, showcasing duties such as adhering to policy guidelines and reviewing reports. It also includes experience in related fields like sales at AT&T, which demonstrates a broad skill set. The resume lists valuable skills like customer service and credit data analysis, and it concludes with educational background information that supports the candidate’s qualifications.

Mortgage underwriter resumes include specific elements that highlight the candidate's expertise in loan processing, risk assessment, and decision-making. They should detail experience with different types of loans, familiarity with credit evaluation, and knowledge of industry guidelines. Clear job titles, dates of employment, and concise descriptions of responsibilities are essential. It's also important to demonstrate communication skills and ability to manage multiple tasks effectively.

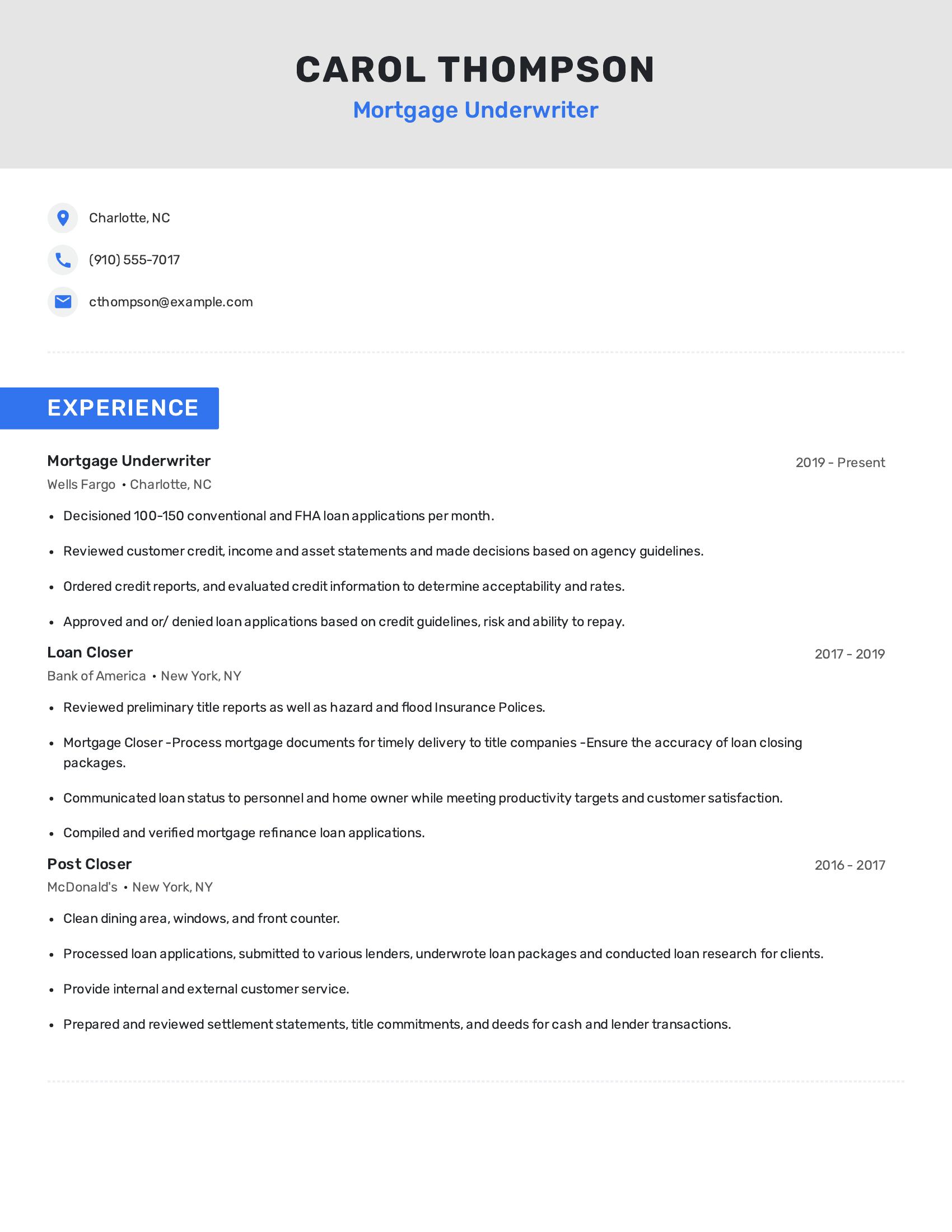

This resume contains relevant job titles and clear descriptions of responsibilities in loan application decisions and credit evaluations. The candidate has experience with both conventional and FHA loans, indicating a well-rounded skill set. The resume also shows progression in roles from post closer to mortgage underwriter, reflecting growth in the field. The inclusion of specific tasks such as reviewing customer credit, asset statements, and preparing settlement statements demonstrates the candidate's thorough understanding of the mortgage process.

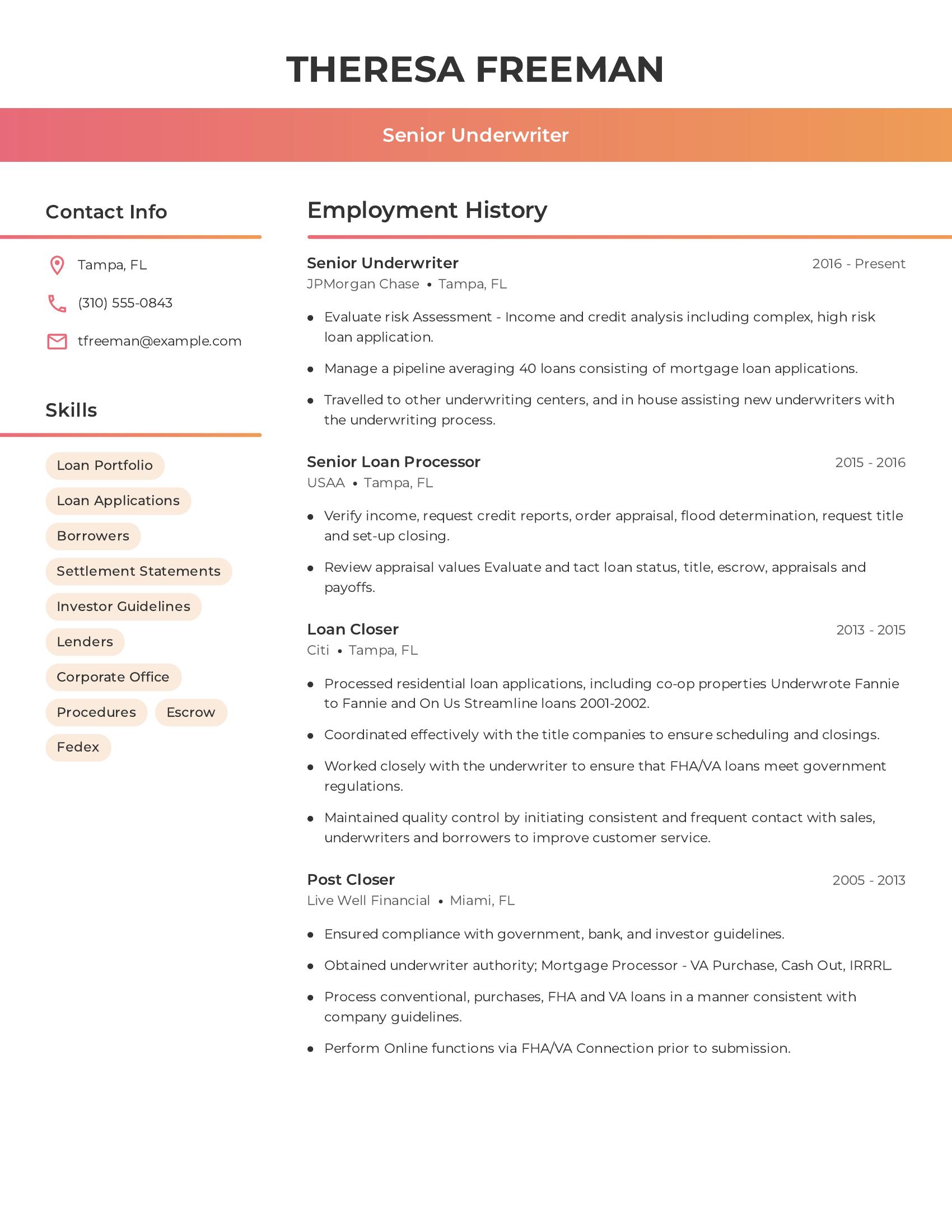

A senior underwriter's resume should highlight a history of relevant employment, expertise in underwriting processes, and familiarity with various loan types and regulations. It should also show skills in risk assessment, pipeline management, and compliance with guidelines. Clear evidence of managing high-volume workloads and collaboration with different departments is important.

This resume includes extensive experience in underwriting and related roles, showcasing a progression from post closer to senior underwriter. It details specific responsibilities like evaluating risk, managing loan pipelines, and ensuring compliance with various guidelines. The inclusion of skills such as loan portfolio management and borrower assessment demonstrates the candidate's comprehensive knowledge in the field.

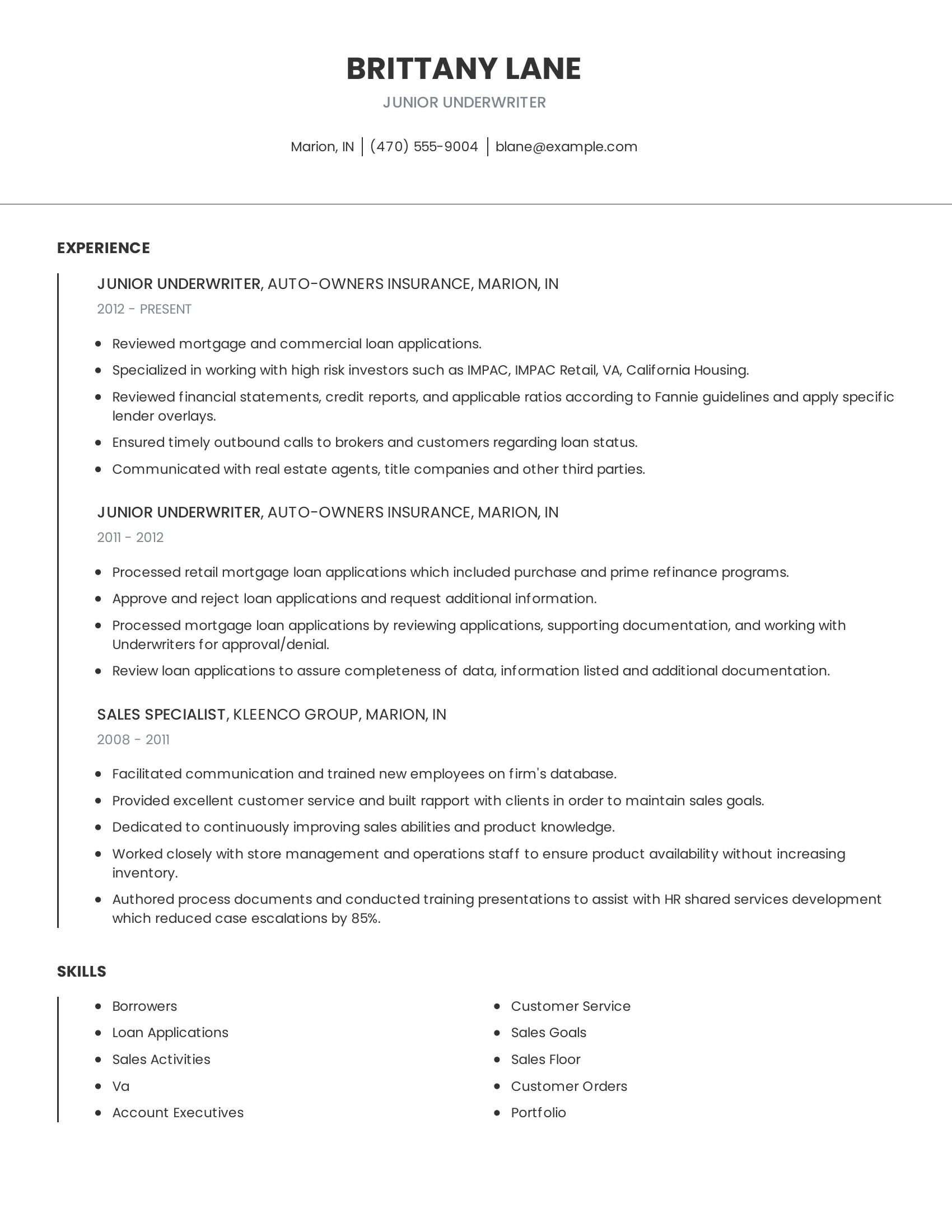

Junior underwriter resumes should highlight relevant work experience, skills in loan processing and financial analysis, and the ability to communicate with various stakeholders. They need to demonstrate a thorough understanding of loan application reviews, financial statement analysis, and adherence to lending guidelines. Key responsibilities often include reviewing applications, financial statements, and credit reports, as well as communicating with brokers, customers, and third parties.

This resume effectively showcases a junior underwriter's experience by detailing specific tasks such as reviewing mortgage and commercial loan applications, processing retail mortgage loans, and working with high-risk investors. It also includes communication skills through interactions with real estate agents and title companies. Additionally, the resume lists relevant skills such as handling loan applications, customer service, and achieving sales goals. This combination of experience and skills paints a clear picture of the candidate's qualifications for a junior underwriter role.

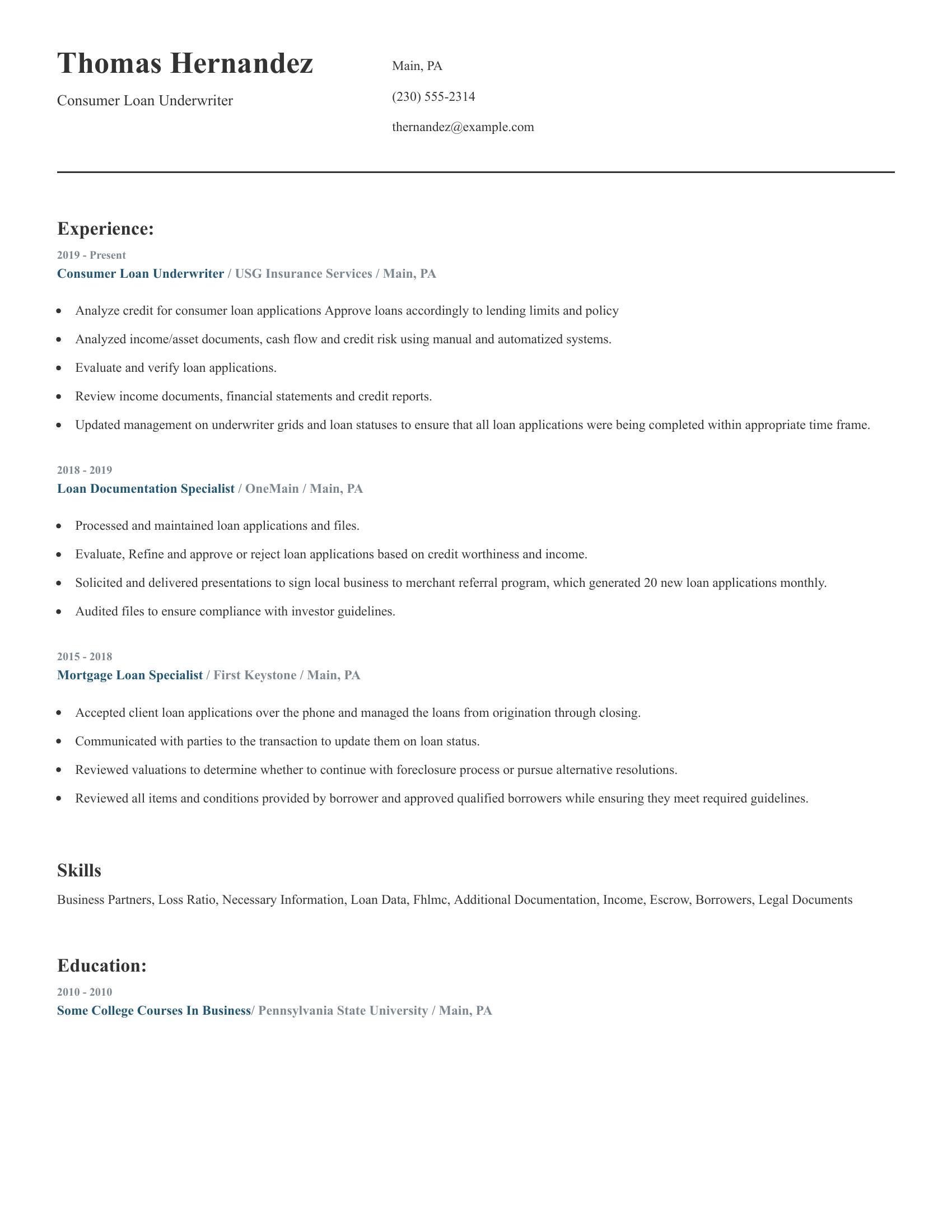

Consumer loan underwriter resumes should highlight relevant experience, key skills, and educational background. Important elements include job titles, company names, and employment dates. The resume should list tasks and responsibilities that show expertise in analyzing credit, reviewing financial documents, and managing loan applications. Skills in evaluating creditworthiness and compliance with guidelines are also important.

This resume includes specific job titles and companies, demonstrating a clear career progression. It lists detailed responsibilities such as analyzing credit, approving loans, and maintaining compliance. The resume also highlights relevant skills like reviewing income documents and managing loan applications. The education section shows some college coursework related to business, supporting the candidate's expertise in the field.

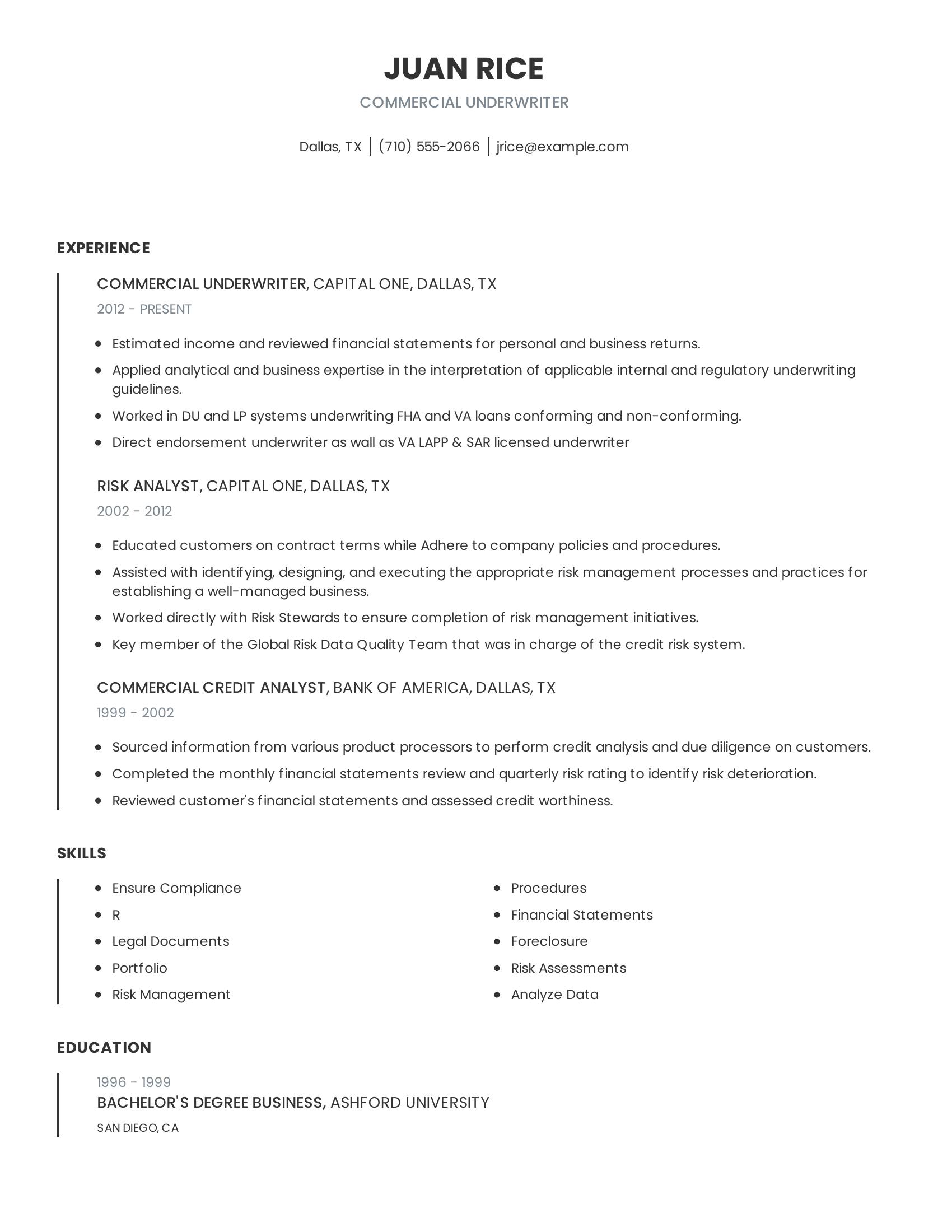

Commercial underwriter resumes should highlight relevant experience, skills in risk assessment, and knowledge of financial statements. They must detail work history with specific responsibilities and roles. Education should be listed with a focus on business or finance-related degrees. Skills should include compliance, legal document handling, and data analysis.

This resume includes specifics like experience in underwriting FHA and VA loans and being a direct endorsement underwriter. It lists roles such as risk analyst and commercial credit analyst, emphasizing tasks like financial statement review and risk management. The skills section is comprehensive, covering crucial areas like compliance and portfolio management. The education entry is clear, showing a degree in business.

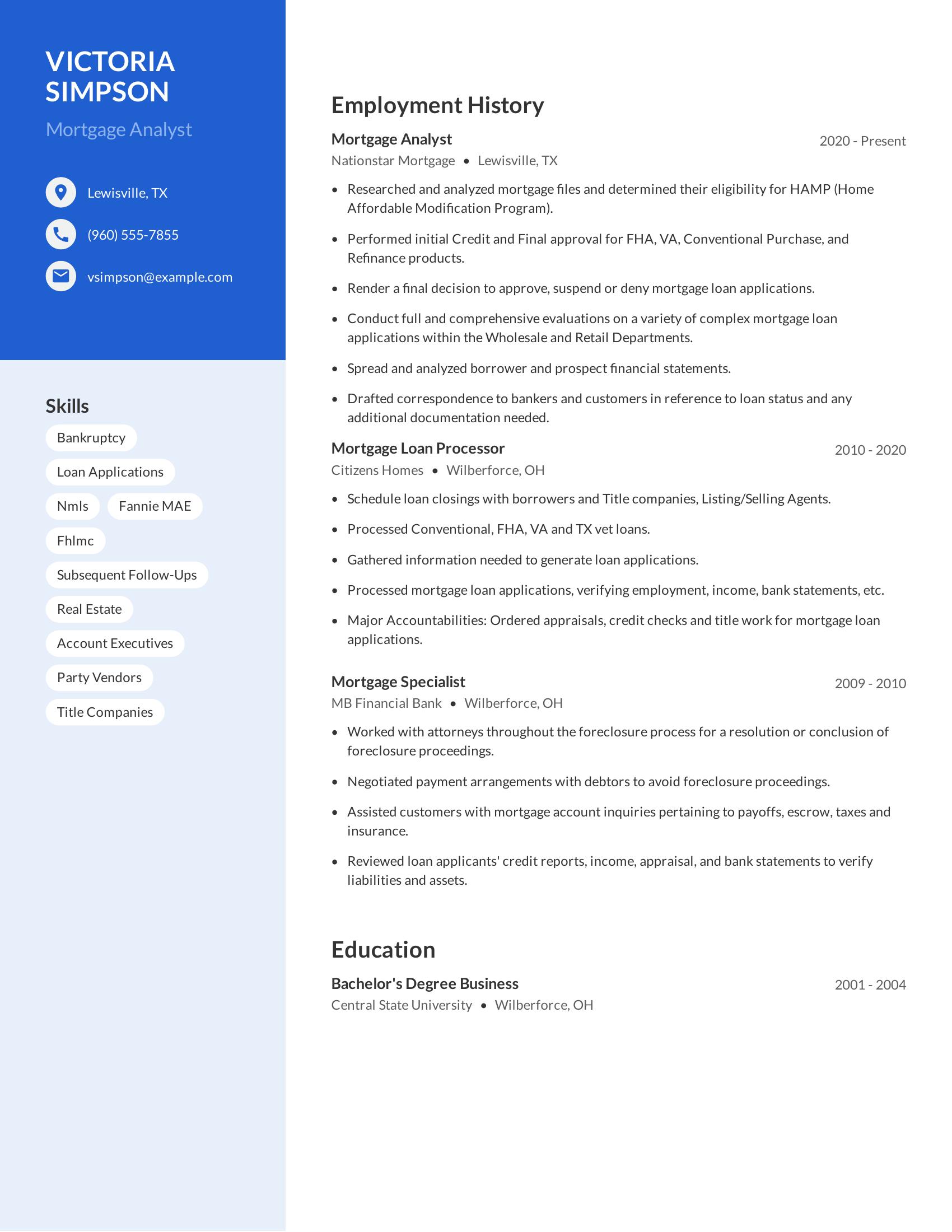

Mortgage analyst resumes should include a clear summary of work experience, relevant skills, and educational background. Key sections typically feature job titles, company names, dates of employment, and specific duties performed. Skills should be relevant to mortgage analysis, such as knowledge of loan applications, financial regulations, and mortgage software. Education should list relevant degrees or certifications.

This resume includes a detailed employment history with specific duties performed at each job, showcasing the candidate's experience in mortgage analysis. The skills section lists relevant abilities like bankruptcy management and loan processing. The education section specifies the degree earned and the institution attended. This resume effectively highlights the essential components needed for a mortgage analyst position.

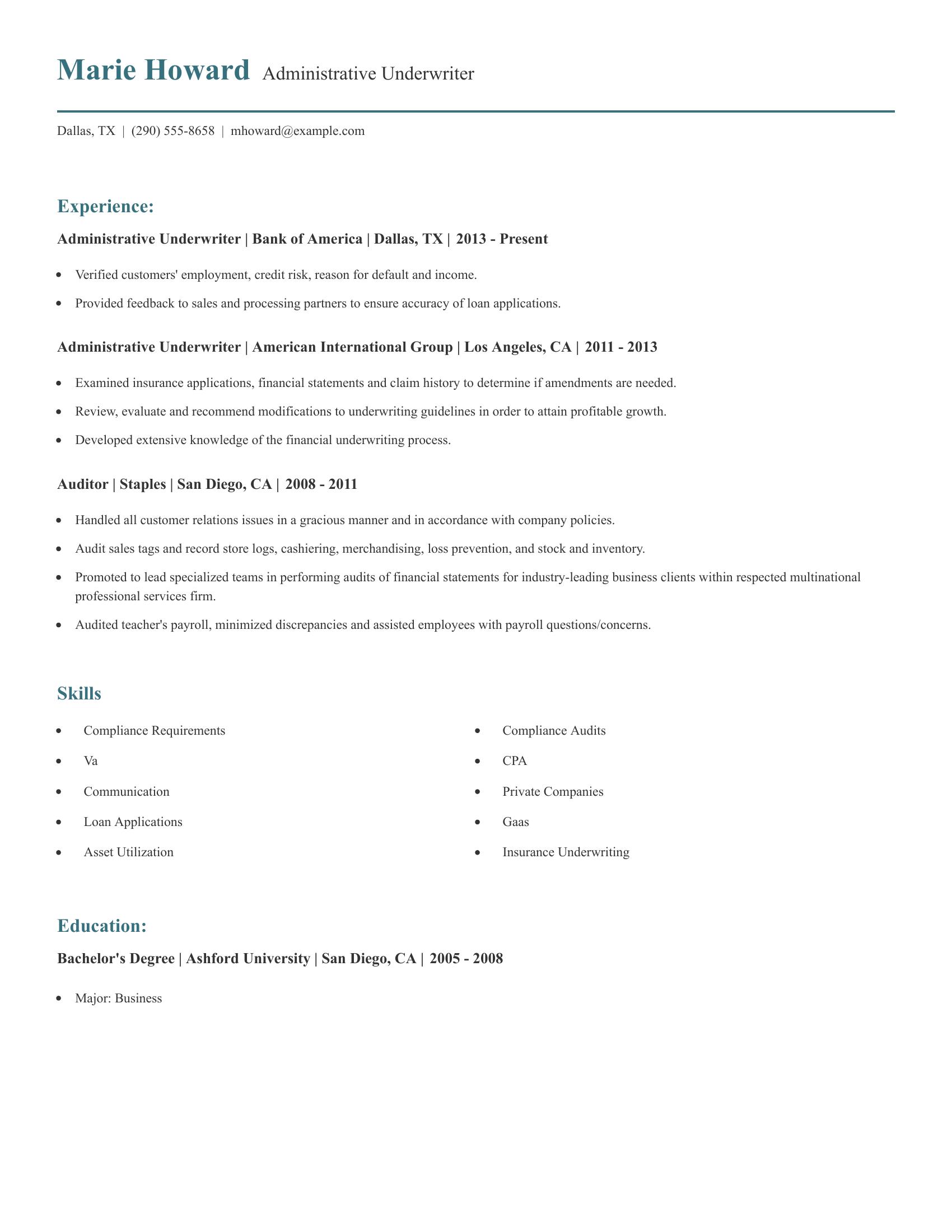

Administrative underwriter resumes should highlight relevant experience, skills, and education. They should feature job titles, company names, locations, and employment dates. These resumes must detail specific tasks and responsibilities, such as verifying customer information, evaluating insurance applications, and making recommendations for underwriting guidelines. Key skills like compliance requirements, loan applications, and communication should be clearly presented. Educational background should include the degree earned, university attended, location, and dates of attendance.

This resume includes the necessary specifics for an administrative underwriter position. It lists job titles with corresponding companies, locations, and employment periods. The resume details relevant tasks such as verifying employment and credit risk at Bank of America and examining insurance applications at American International Group. It also highlights important skills like compliance audits and asset utilization. The education section clearly states the degree earned in business from a university in San Diego.

Underwriting specialist resumes should highlight experience in reviewing and analyzing loan applications, compliance with guidelines, and complex case management. Key skills include understanding underwriting guidelines, managing debt ratios, and handling credit reports. Employment history should demonstrate progression in responsibility and expertise. Education should be relevant to the field, showing a foundation in business or finance.

This resume effectively outlines the necessary elements of an underwriting specialist's background. It lists specific skills such as loan applications and compliance reviews. The employment history shows a clear career progression from junior underwriter to underwriting specialist with detailed job duties that match the role’s requirements. The education section indicates a relevant degree, supporting the candidate's qualifications.

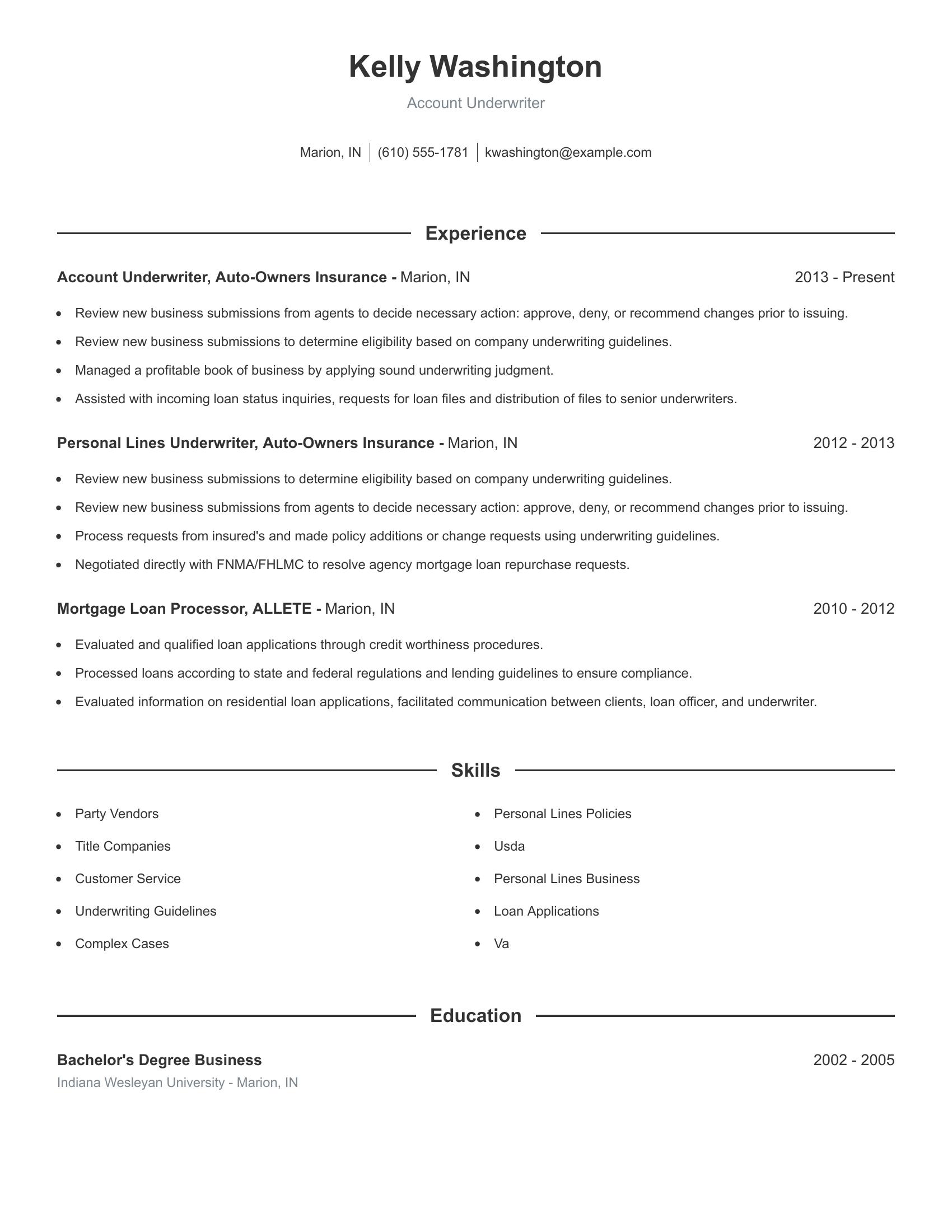

Account underwriter resumes should highlight relevant experience, responsibilities, and skills. Key elements include job titles, companies, locations, and dates of employment. Resumes should mention specific duties like reviewing business submissions, managing books of business, and processing loan applications. Additionally, educational background and relevant skills are important. Clear organization and concise descriptions help employers quickly assess qualifications.

This resume effectively includes the necessary specifics. It lists job titles, companies, locations, and detailed responsibilities. It highlights experience in underwriting and loan processing roles. The resume also mentions education and relevant skills. Despite formatting issues, it provides a thorough overview of the candidate's qualifications.

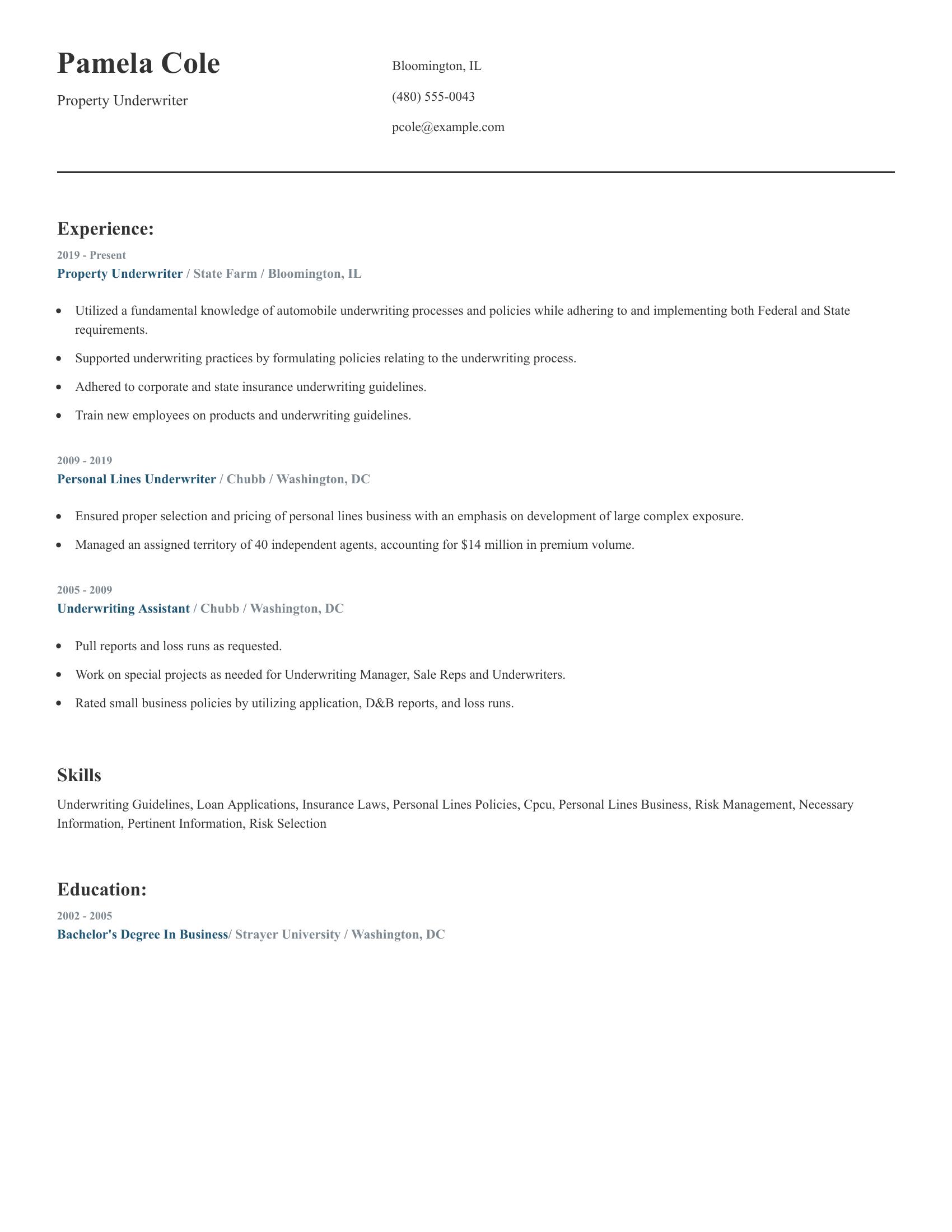

Property underwriter resumes should highlight relevant experience, industry knowledge, and key skills. A good resume includes a clear job history with specific roles and responsibilities. It should show progression in career, and demonstrate understanding of underwriting guidelines and insurance laws. Skills related to risk management, policy formulation, and training are also important. Education credentials that relate to business or finance help round out the resume.

This resume effectively includes those specifics. It shows a career progression from underwriting assistant to property underwriter. The job responsibilities listed indicate a solid grasp of underwriting guidelines, policy formulation, and training new employees. Skills such as risk management and insurance laws are outlined clearly. The education section shows a relevant degree in business, adding further credibility to the candidate's qualifications.

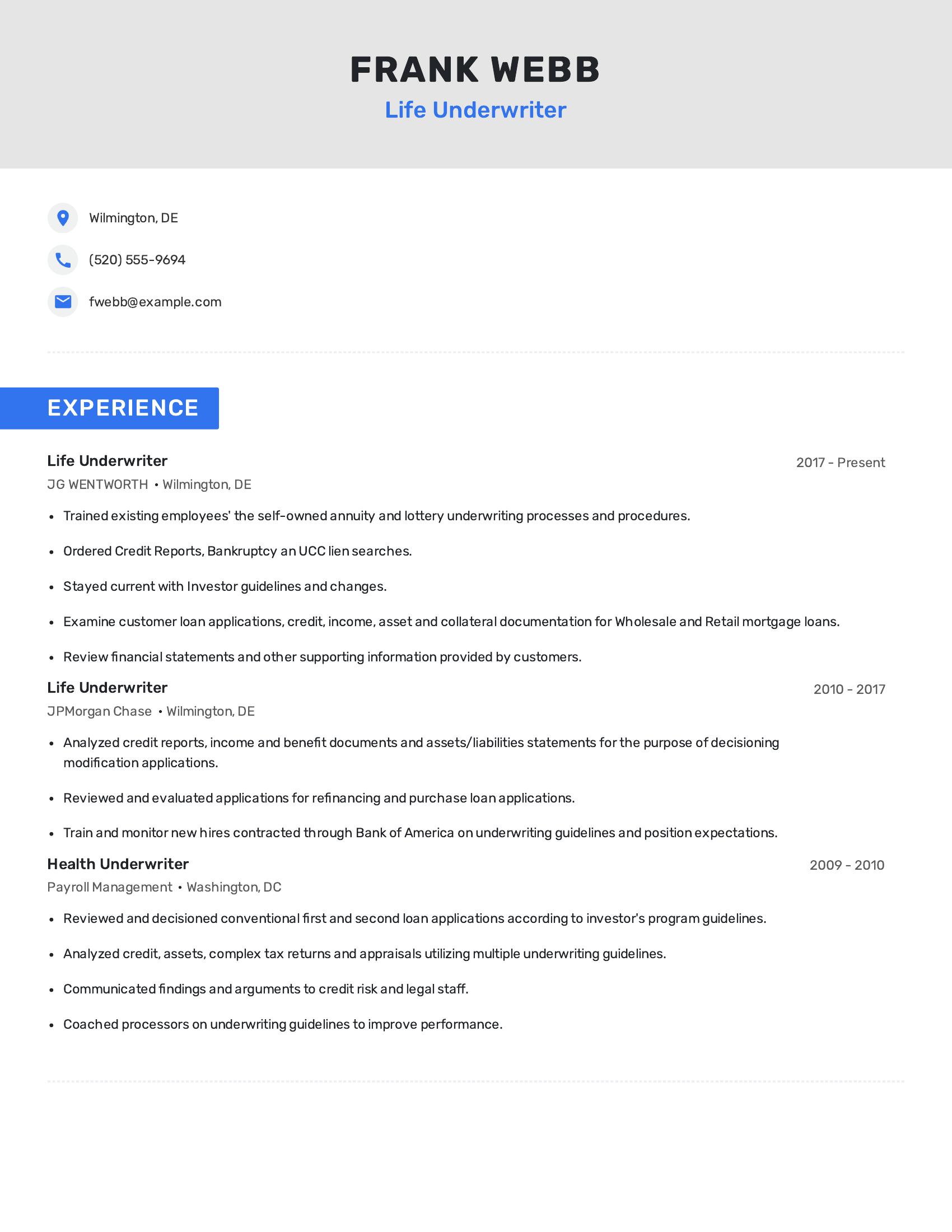

Life underwriter resumes should highlight experience in underwriting, knowledge of financial documentation, and ability to train and mentor staff. Important aspects include assessing credit reports, analyzing loan applications, staying updated on guidelines, and reviewing financial statements. Experience in both life and health underwriting is beneficial. Clear communication and training abilities are also important.

This resume includes relevant experience from 2010 to the present, showcasing roles at multiple companies. The candidate has experience in analyzing credit reports, reviewing loan applications, and training staff. They have worked with various underwriting processes and stayed current with guidelines. The resume effectively demonstrates a strong background in both life and health underwriting.

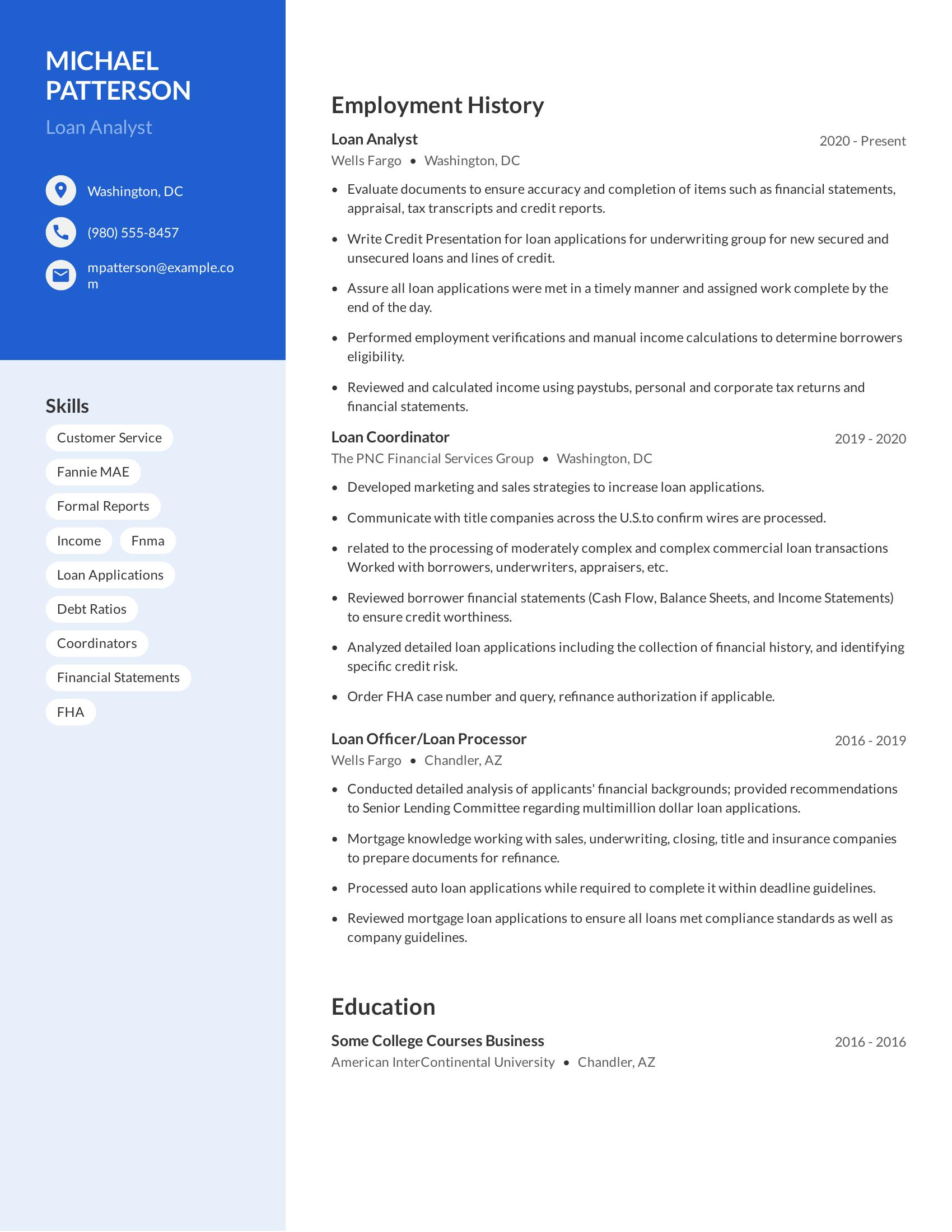

Loan analyst resumes should highlight skills in financial document evaluation, customer service, and loan processing. They should list relevant employment history, showing experience with financial statements, loan applications, and borrower eligibility assessments. Educational background, even if incomplete, adds value. Skills like communication with financial entities and the ability to perform income calculations are important.

This resume effectively demonstrates the necessary skills and experiences. The candidate has experience evaluating financial documents and writing credit presentations. They have worked with various financial entities and processed different types of loans, showcasing a breadth of experience. Even without a completed degree, their coursework in business adds to their qualifications.

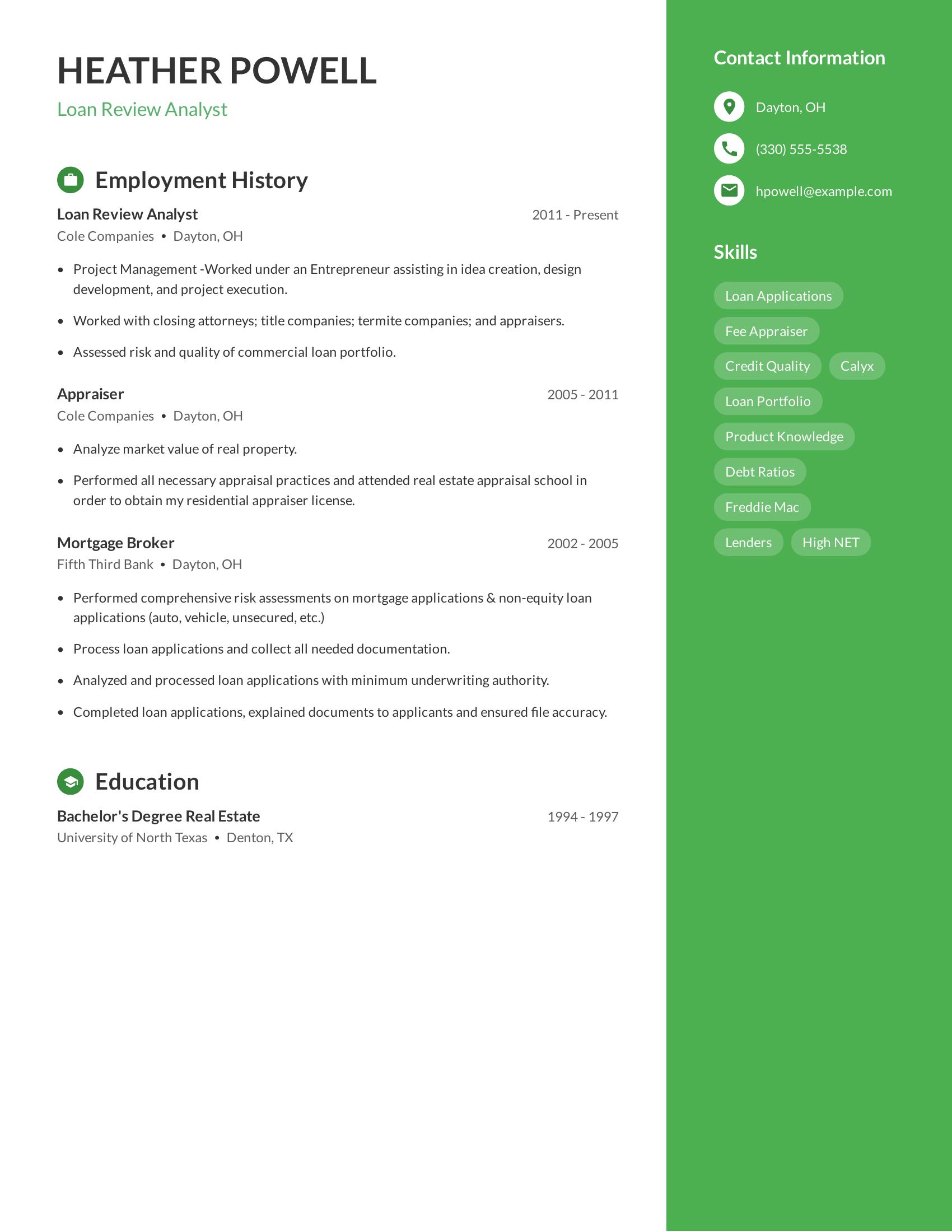

Loan review analyst resumes should include detailed work history, educational background, and relevant skills. It is important to highlight experience in loan assessment, project management, risk analysis, and interaction with various stakeholders like attorneys and appraisers. Good resumes also list specific job titles and durations, providing a clear career trajectory.

This resume includes several key components of a strong loan review analyst resume. It lists job titles and employment periods clearly, demonstrating a progression in the field. The resume details specific tasks like performing risk assessments, managing projects, and processing loan applications. Additionally, it outlines relevant education and includes a comprehensive list of applicable skills.

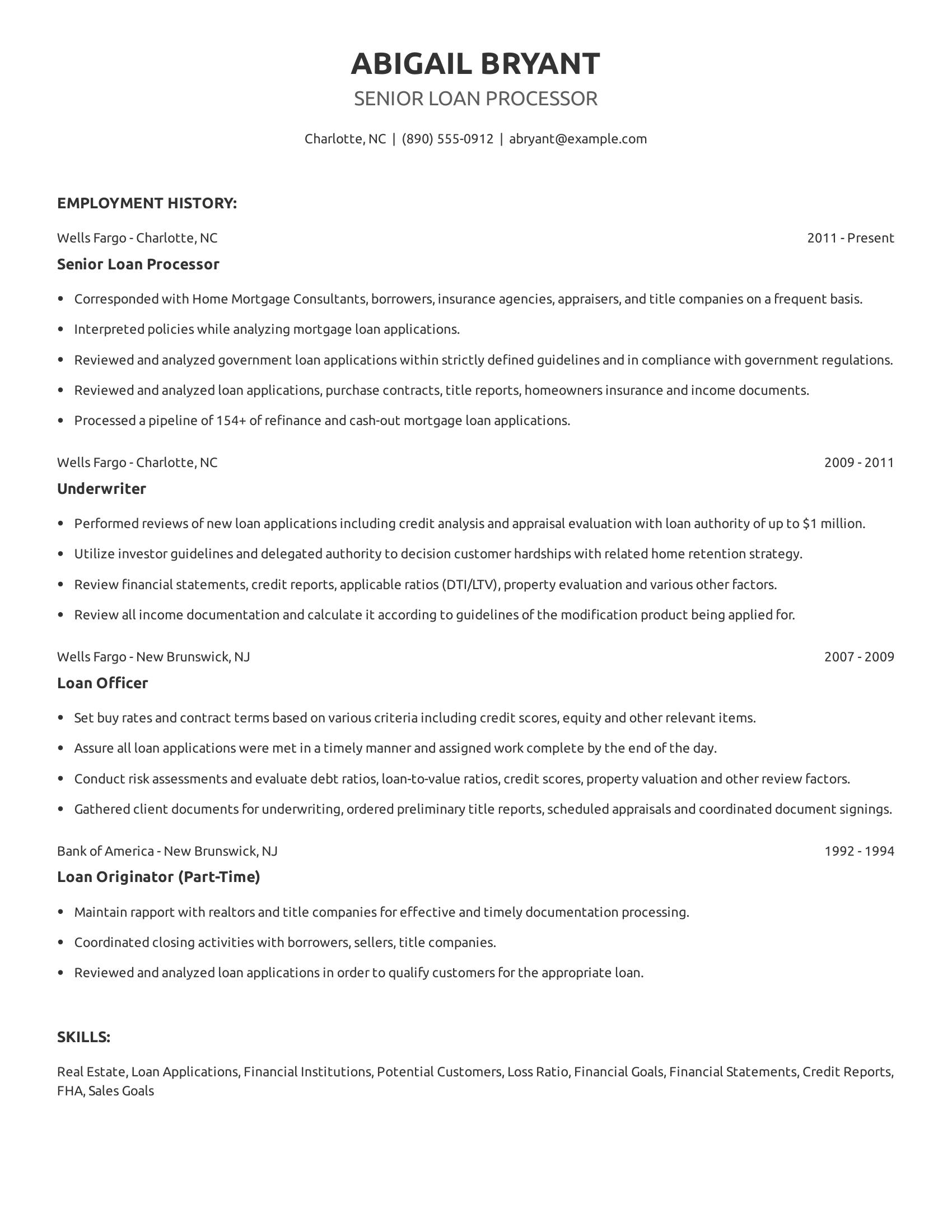

Senior loan processor resumes should highlight a candidate's experience in handling loan applications, their ability to analyze financial documents, and their communication skills with various stakeholders. A good resume includes specific job titles, employment history with dates, and detailed descriptions of duties and responsibilities. It should also feature relevant skills that demonstrate the candidate's capability to manage a high volume of loan processing while adhering to regulations.

This resume effectively includes all the necessary components for a senior loan processor role. It lists detailed employment history with clear job titles and dates, showcasing a progression in responsibilities. The resume also describes specific tasks such as analyzing mortgage loan applications, corresponding with different parties involved in the loan process, and managing a significant pipeline of applications. Additionally, it highlights relevant skills like real estate knowledge and financial statement analysis, which are crucial for the role.

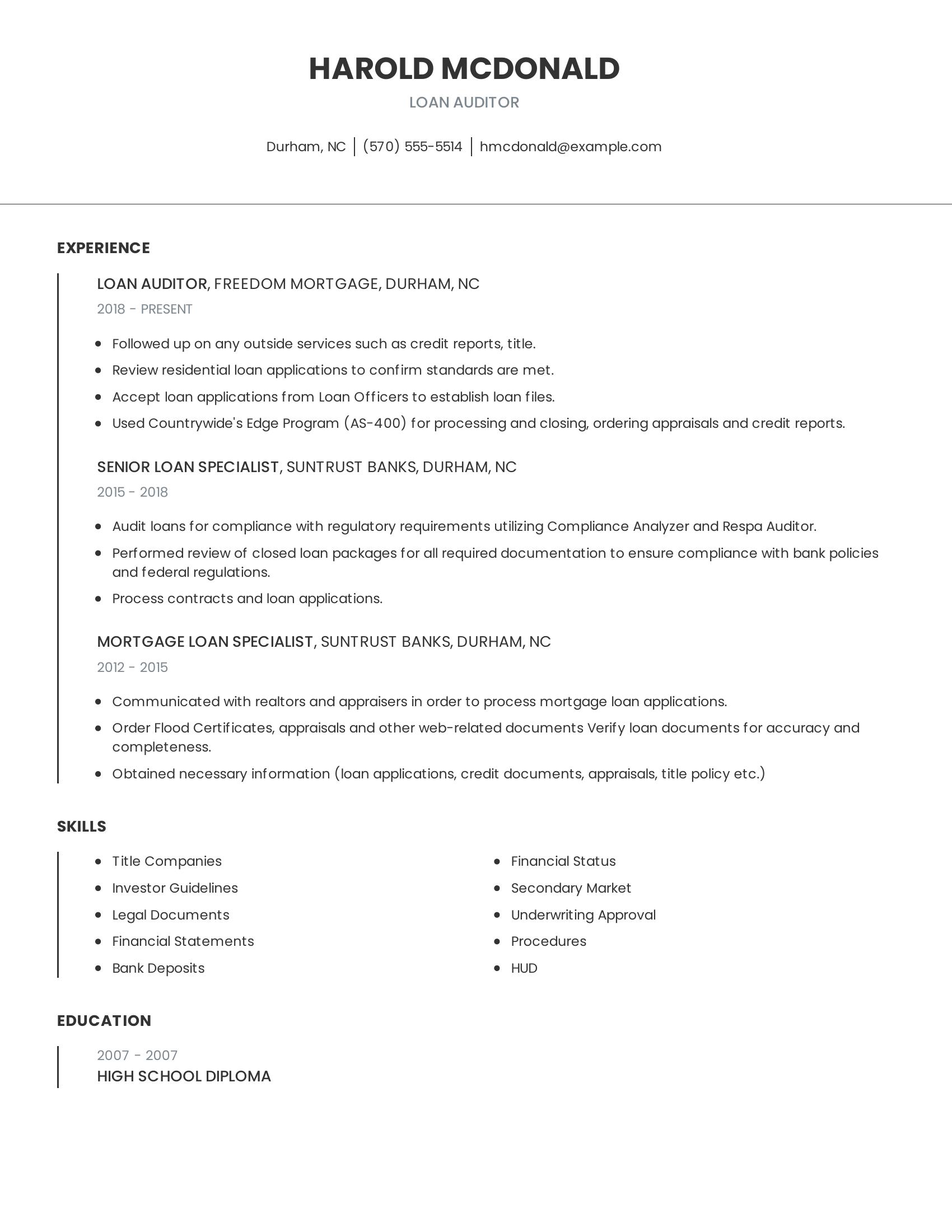

Loan auditor resumes should highlight experience in auditing and processing loans. The resume should include a clear job history that shows progression in related roles, skills pertinent to loan auditing like knowledge of investor guidelines and regulatory compliance, and relevant education. Highlighting specific tools and software used for loan processing and compliance checks is also important.

This resume effectively includes the necessary specifics. It lists job titles and responsibilities that show experience in loan auditing and related tasks. The skills section mentions key areas such as legal documents and financial statements, which are crucial for a loan auditor. The education section, though brief, provides the needed background.

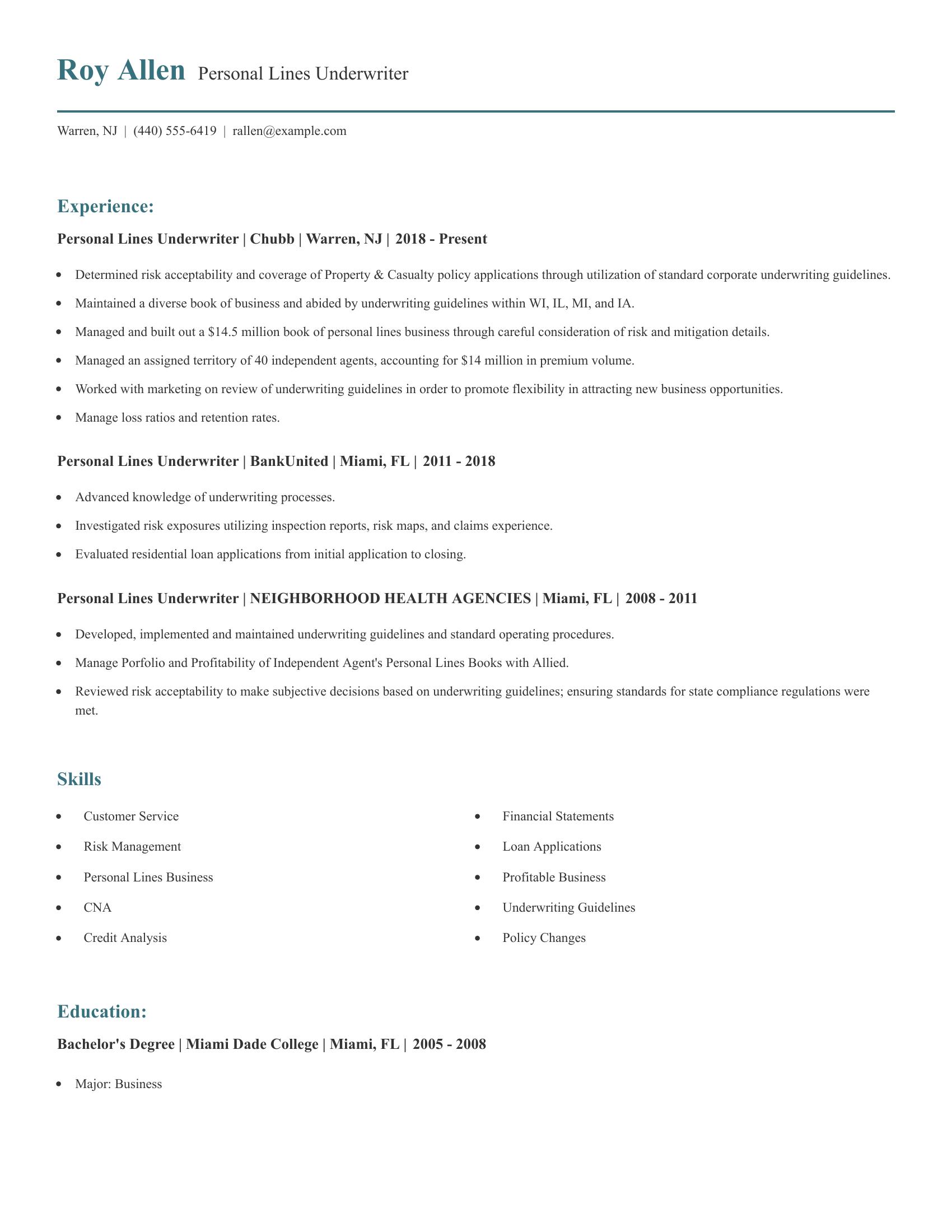

Personal lines underwriter resumes should highlight experience in assessing risk, managing books of business, and working with agents. Key areas include determining coverage acceptability, maintaining underwriting guidelines, and managing loss ratios. Demonstrating experience with risk management tools and compliance with state regulations is also important. Skills in customer service, financial statements, and policy changes are valuable.

This resume includes specifics like managing a $14.5 million book of business and working with 40 independent agents. It shows experience in evaluating risk through inspection reports and risk maps. The resume also lists relevant skills such as risk management, credit analysis, and customer service. Education details include a bachelor's degree in business, which supports the professional experience.

Highlight analytical skills. Showcase your ability to assess financial documents, credit reports, and risk factors. Mention specific tools or software you have used.

Emphasize experience in decision-making. Detail any past roles where you made loan approval decisions or assessed insurance applications. Quantify your impact if possible.

Include relevant certifications. List certifications related to underwriting, like Chartered Property Casualty Underwriter (CPCU) or Associate in Commercial Underwriting (AU).

An underwriter's resume should focus on experience, education, skills, and certifications. Start with a brief professional summary. List past job roles where you worked with risk assessment or financial analysis. Include your education, especially degrees in finance or related fields. Highlight skills like data analysis, attention to detail, and decision-making. Mention relevant certifications such as Chartered Property Casualty Underwriter (CPCU).

A strong underwriter summary should highlight your experience, skills, and achievements. Focus on what makes you stand out.

Keep your underwriter summary clear and concise. Use bullet points to make it easy to read.

A well-written underwriter experience section should highlight your core responsibilities and achievements. Focus on quantifiable results and specific skills.

Follow these tips to make your underwriter experience section stand out. Be concise and relevant.

These are the most important hard skills for an underwriter.

These are the most important soft skills for an underwriter.