16 Teller Resume Examples

Teller resumes should highlight relevant work experience, essential skills, and education. A good teller resume includes job titles, company names, locations, and dates of employment. It also details job responsibilities and achievements, especially those related to customer service, cash handling, and sales. Skills should be listed clearly to show proficiency in areas important for the role. Education should also be included to show foundational knowledge.

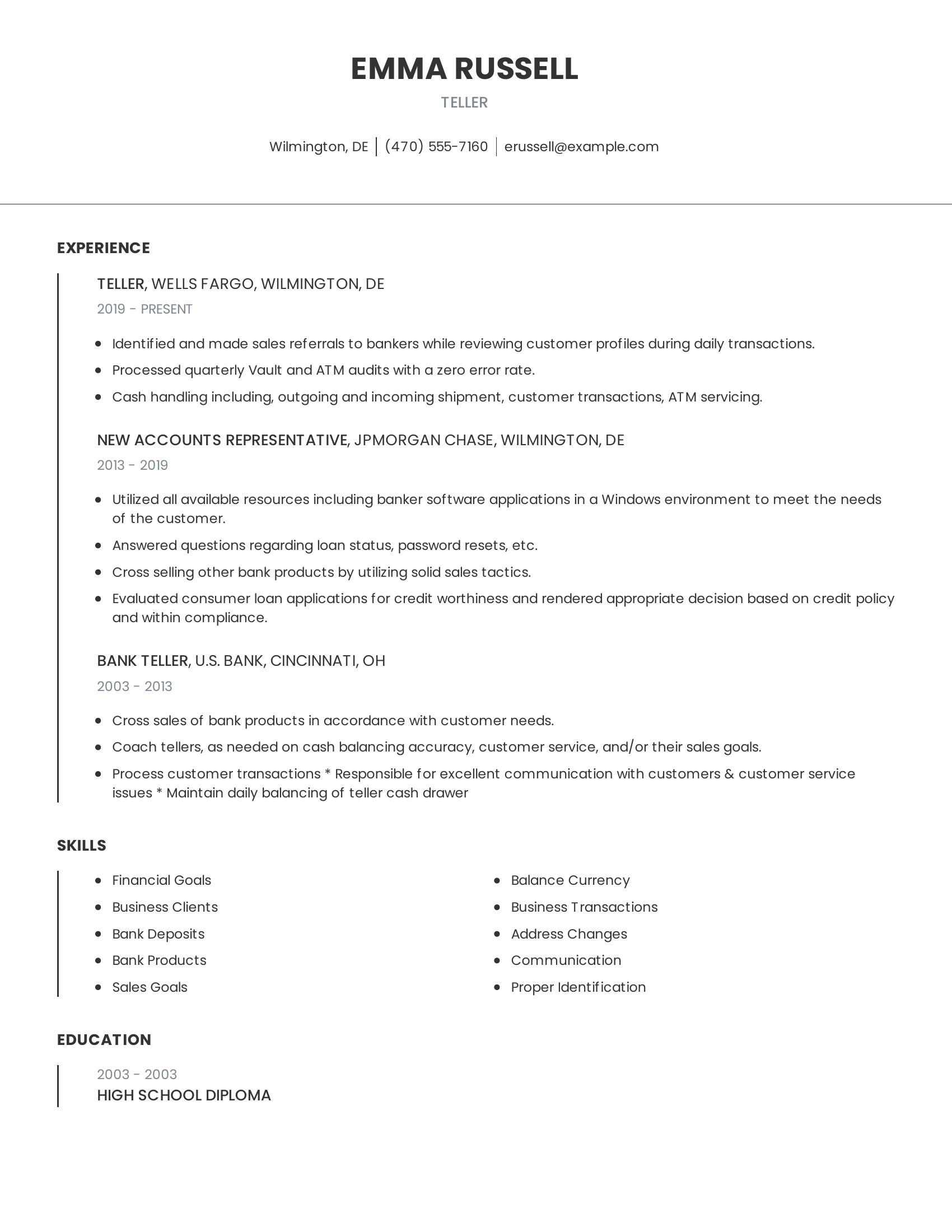

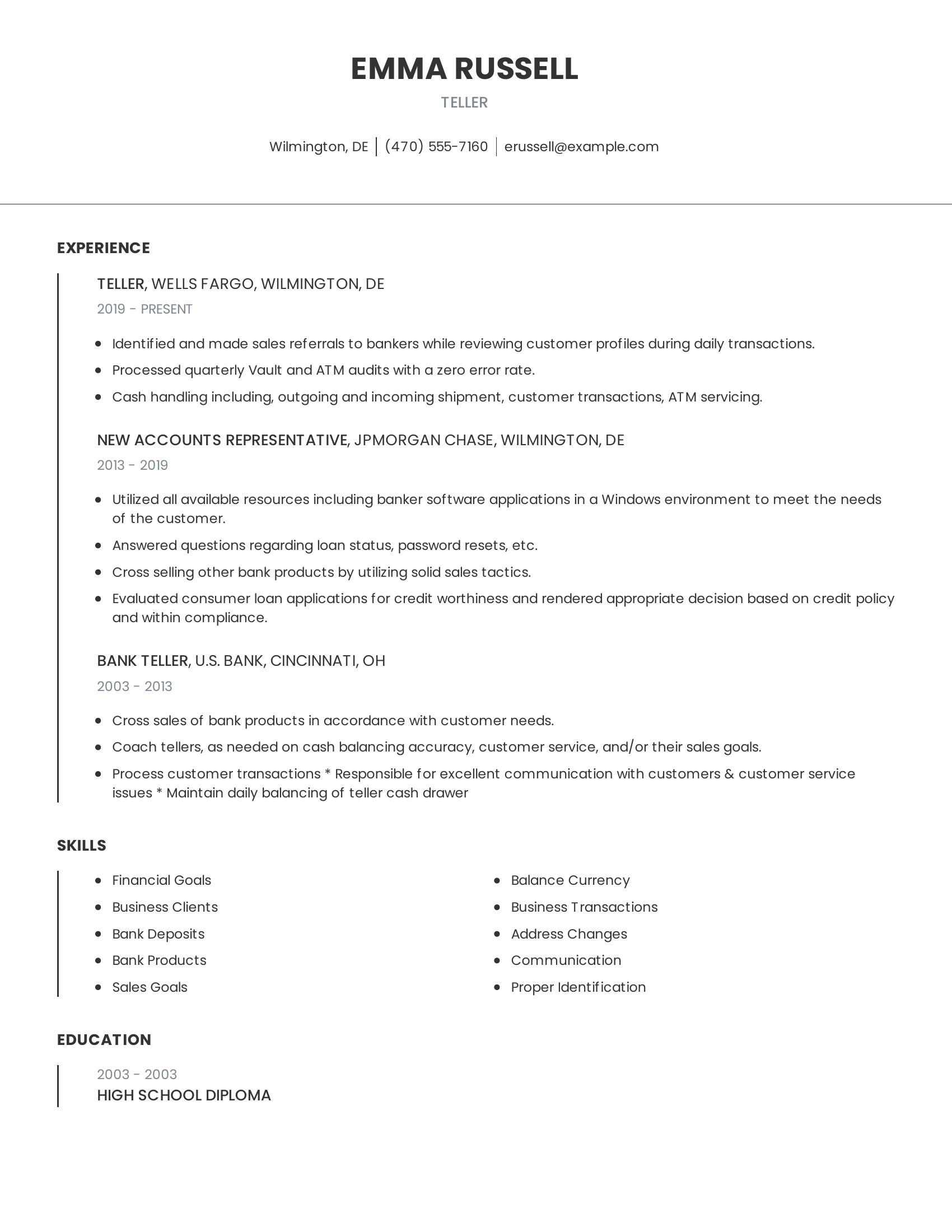

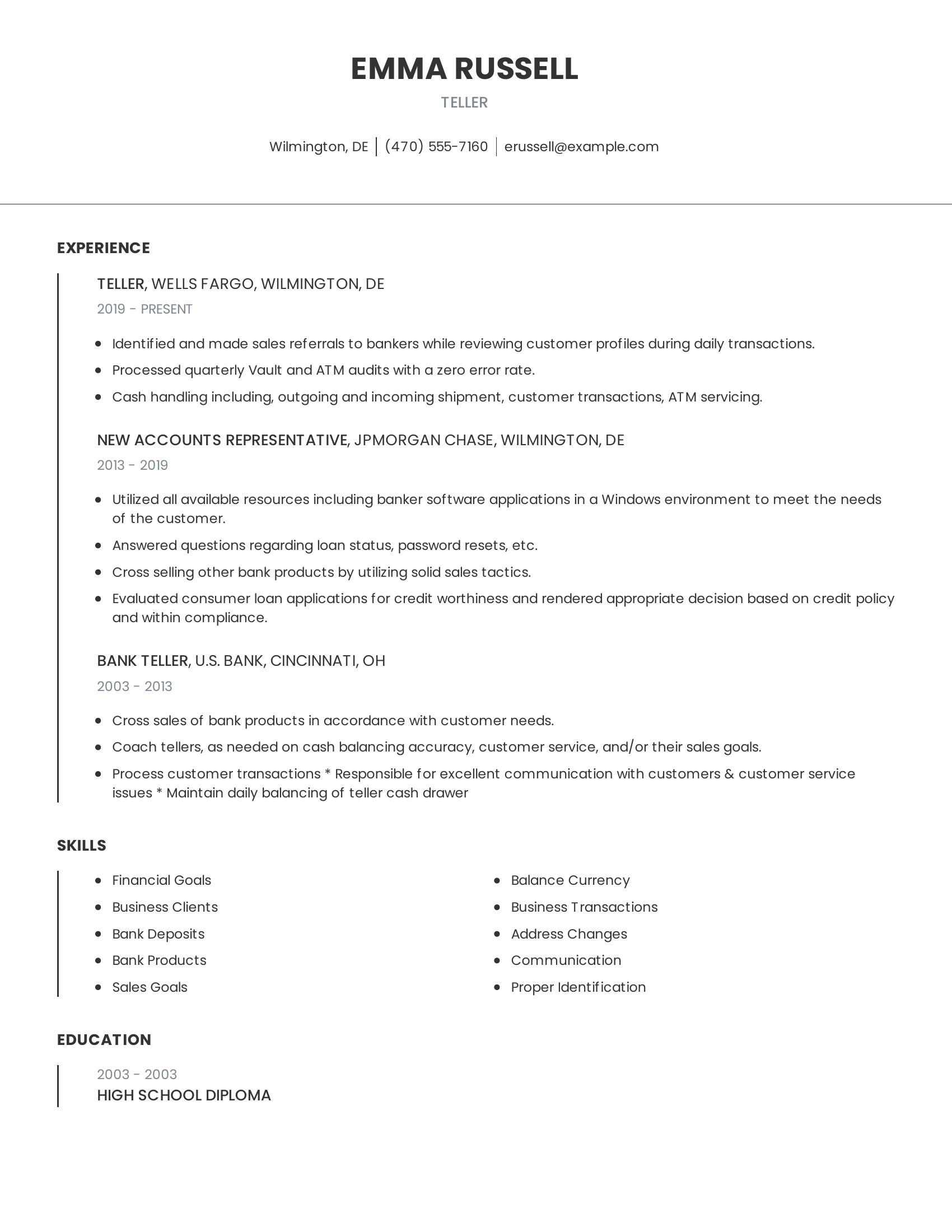

This resume shows extensive experience with multiple banks and detailed job responsibilities like sales referrals and cash handling. It includes clear skills such as financial goals and customer service. The education section, though brief, provides necessary background. This resume is strong due to its thoroughness in detailing relevant experience and skills for a teller role.

Bank teller resumes should highlight experience handling financial transactions, customer service skills, and knowledge of banking products. They should include a clear employment history with specific roles and duties. Skills related to banking, such as currency handling and advisory roles, are important. Education background and contact information are also necessary.

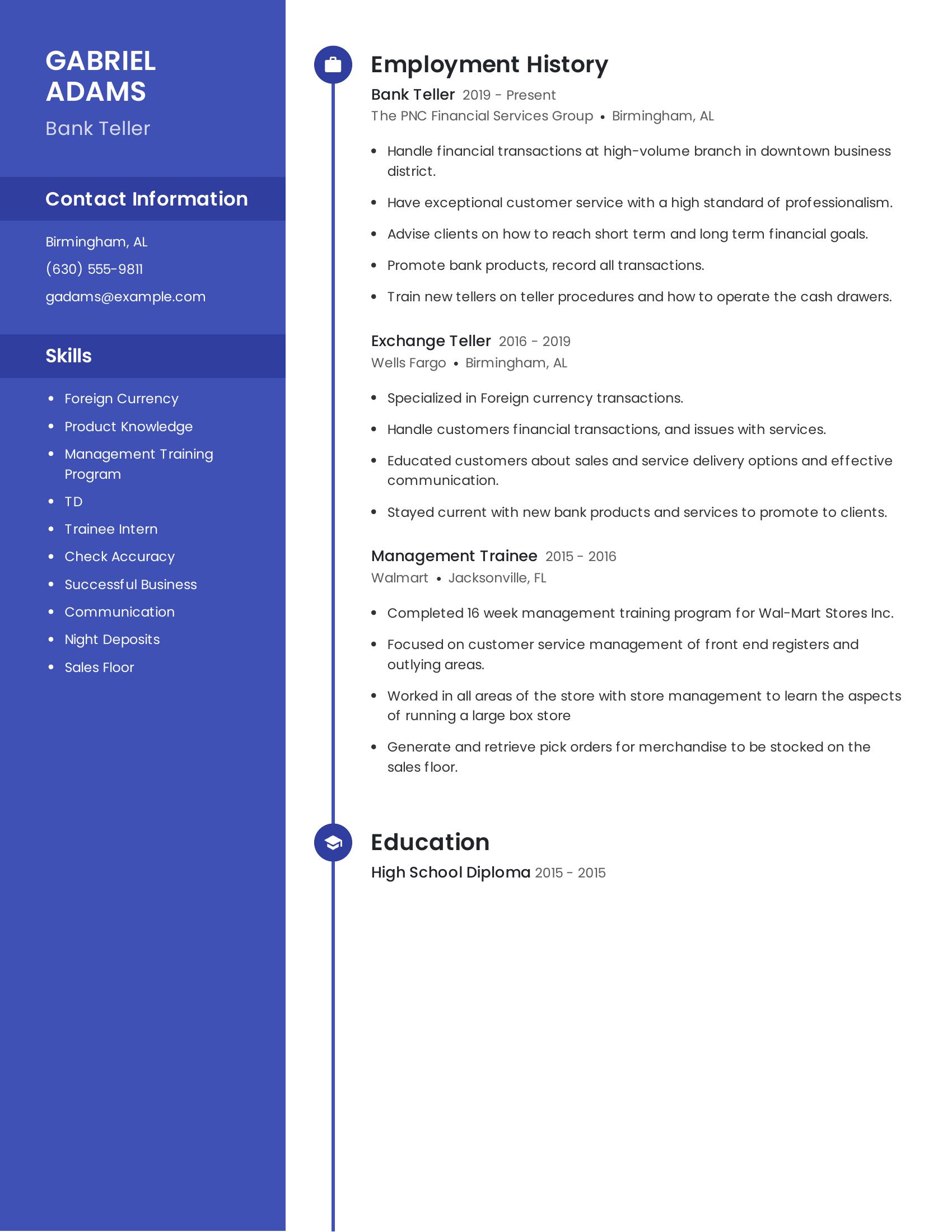

This resume effectively covers the key elements. It lists relevant job experiences like handling financial transactions and advising clients. The skills section includes foreign currency and product knowledge, which are pertinent to the role. Employment history is detailed, mentioning positions at financial institutions and training programs. The resume also includes contact details and educational background.

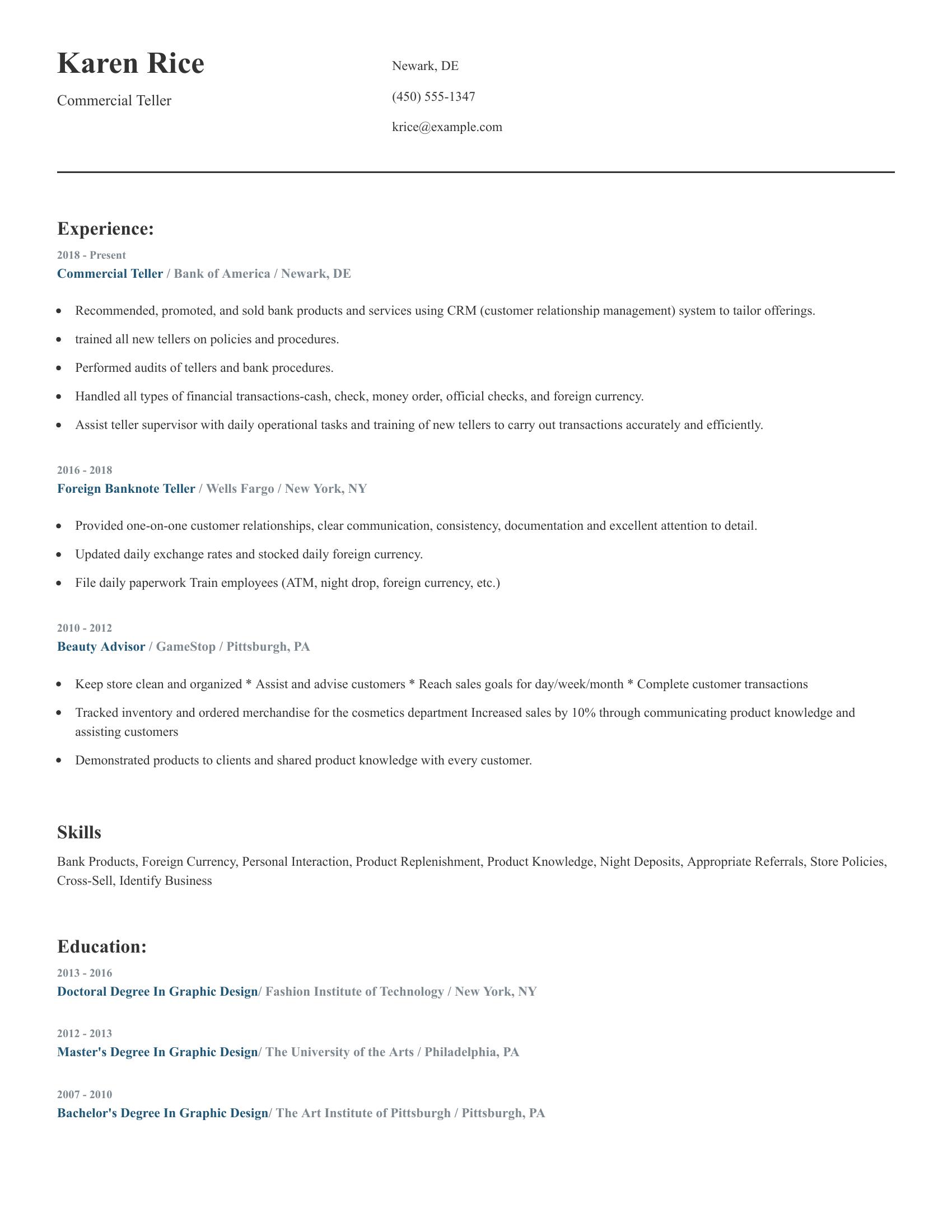

Commercial teller resumes should highlight experience with financial transactions, customer service, and bank operations. Important elements include job history with specific duties, skills relevant to banking, and any educational background. The resume should also demonstrate familiarity with bank products, handling foreign currency, and training new employees.

This resume includes detailed job experience from multiple banks where the applicant performed financial transactions and trained others. It lists skills like handling foreign currency and cross-selling bank products. The educational background in graphic design is mentioned, although it is less relevant to the teller position.

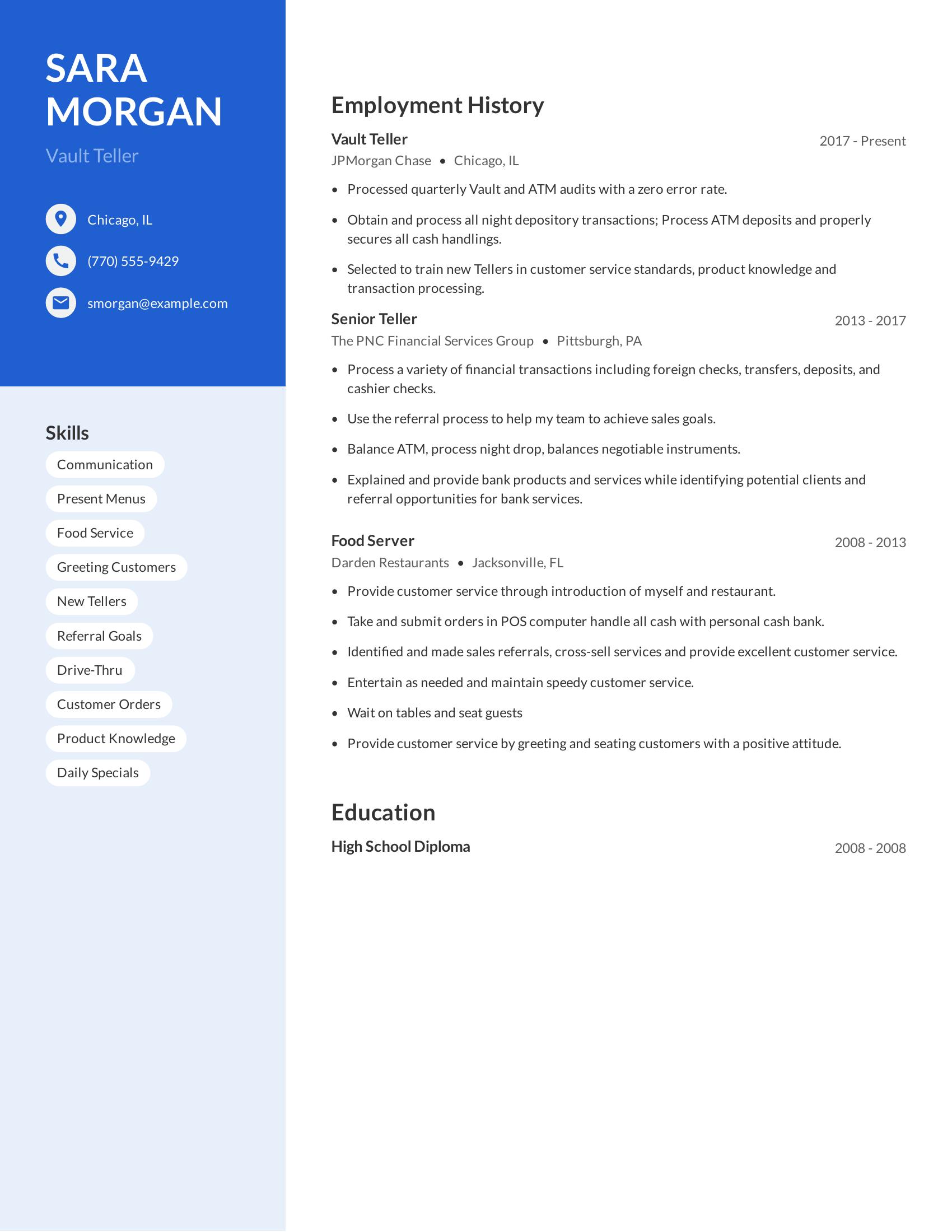

Vault teller resumes should highlight relevant skills and experiences like cash handling, audit processing, and customer service. Good resumes include clear job titles, employment history with dates, specific duties performed, and any special achievements. Also, listing skills that match the job requirements helps.

This resume includes necessary details like the job title "Vault Teller," employment history with dates, and specific tasks performed such as processing ATM deposits and training new tellers. The resume also lists relevant skills like communication and product knowledge. This shows a comprehensive work experience relevant to the role of a vault teller.

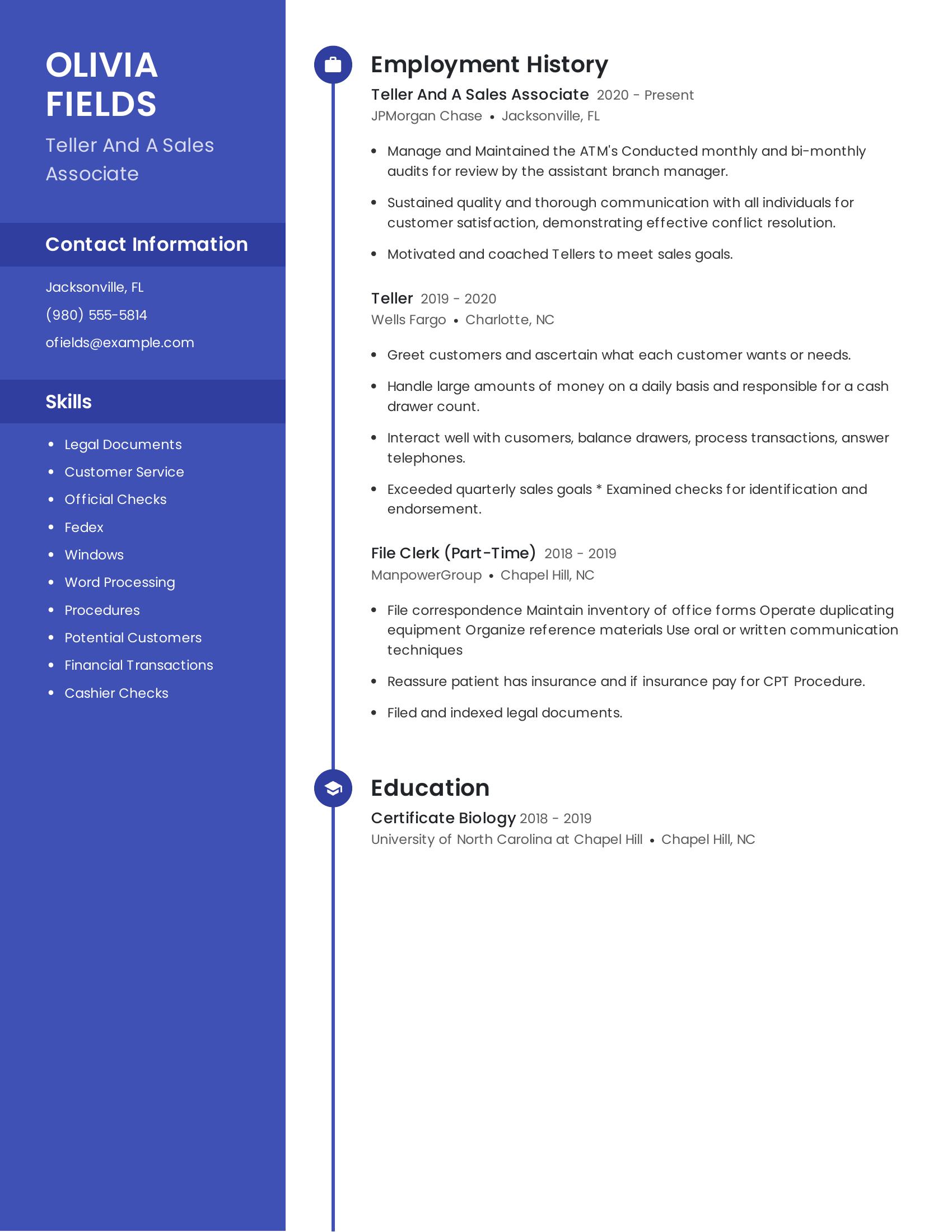

Teller and a sales associate resumes should highlight relevant experience in handling financial transactions, customer service, and sales. Key components include clear contact information, a list of applicable skills, and detailed work history demonstrating specific responsibilities and achievements. Education should also be included to show any relevant qualifications or certifications.

This resume effectively includes those specifics. It provides clear contact information and a comprehensive list of relevant skills such as customer service and financial transactions. The work history section details specific responsibilities and achievements in previous roles, showcasing experience in managing ATMs, conducting audits, and exceeding sales goals. The education section notes a certificate in biology, demonstrating a commitment to further learning.

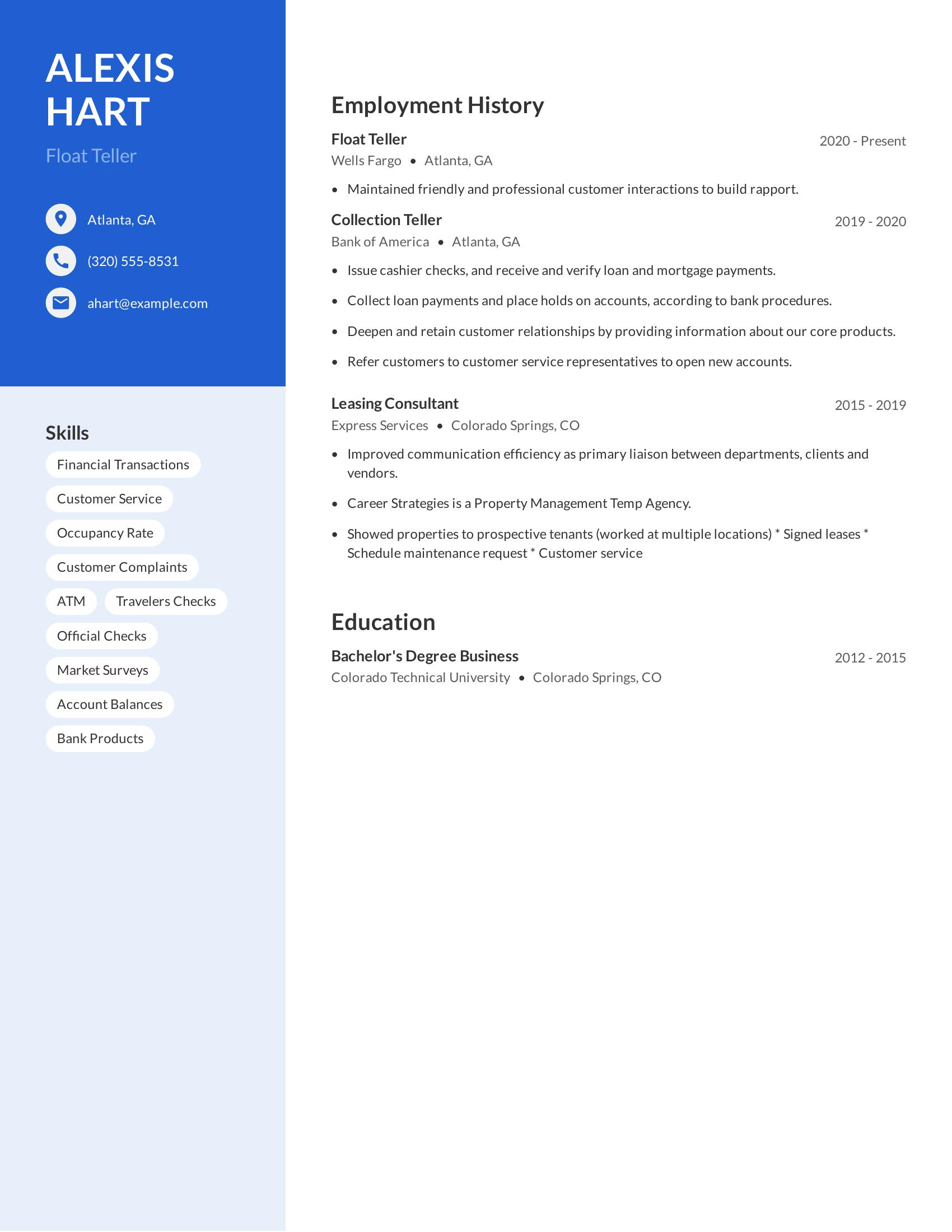

Float teller resumes should highlight experience in financial transactions, customer service, and handling various banking products. They need to include specific job roles, employment history, and relevant skills that demonstrate the ability to manage customer interactions and banking operations effectively. Educational background should be mentioned if it is relevant to the job.

This resume includes relevant skills such as financial transactions, customer service, and handling official checks, which are crucial for a float teller. It lists employment history with clear job titles and responsibilities at well-known banks. The education section shows a bachelor's degree in business, supporting the candidate's qualifications for the role.

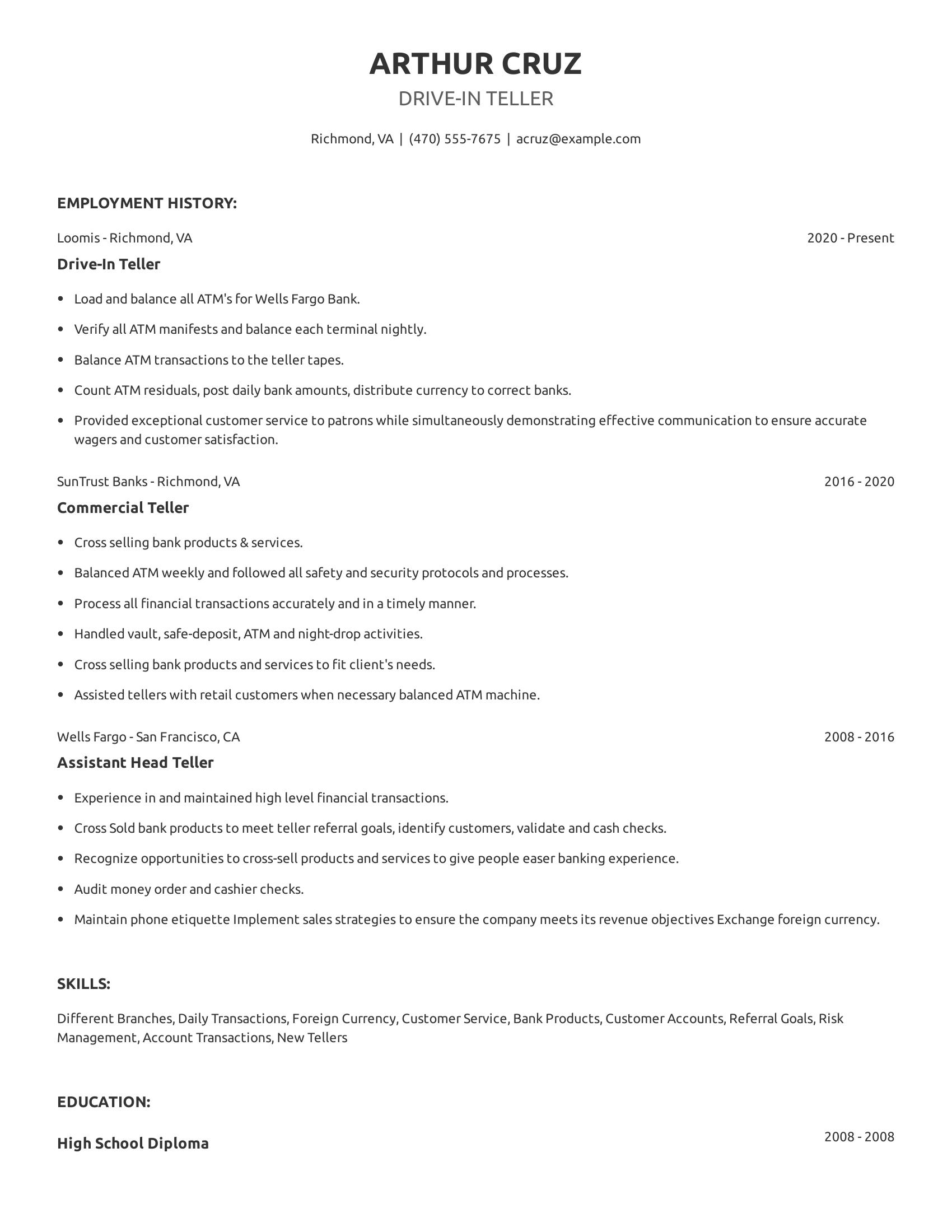

Drive-in teller resumes should highlight relevant experience in banking, customer service, and financial transactions. Key elements include previous job roles, specific tasks handled, and any skills pertinent to the role. Mentioning work history with reputable institutions and detailing responsibilities like balancing ATMs, verifying transactions, and handling customer inquiries are crucial. Educational background and any specific skills related to banking also add value.

This resume includes detailed work experience at various banks, showcasing tasks like loading and balancing ATMs, handling vault activities, and cross-selling bank products. It demonstrates a strong background in financial transactions and customer service. The listed skills such as managing different branches and account transactions align well with the expected duties of a drive-in teller.

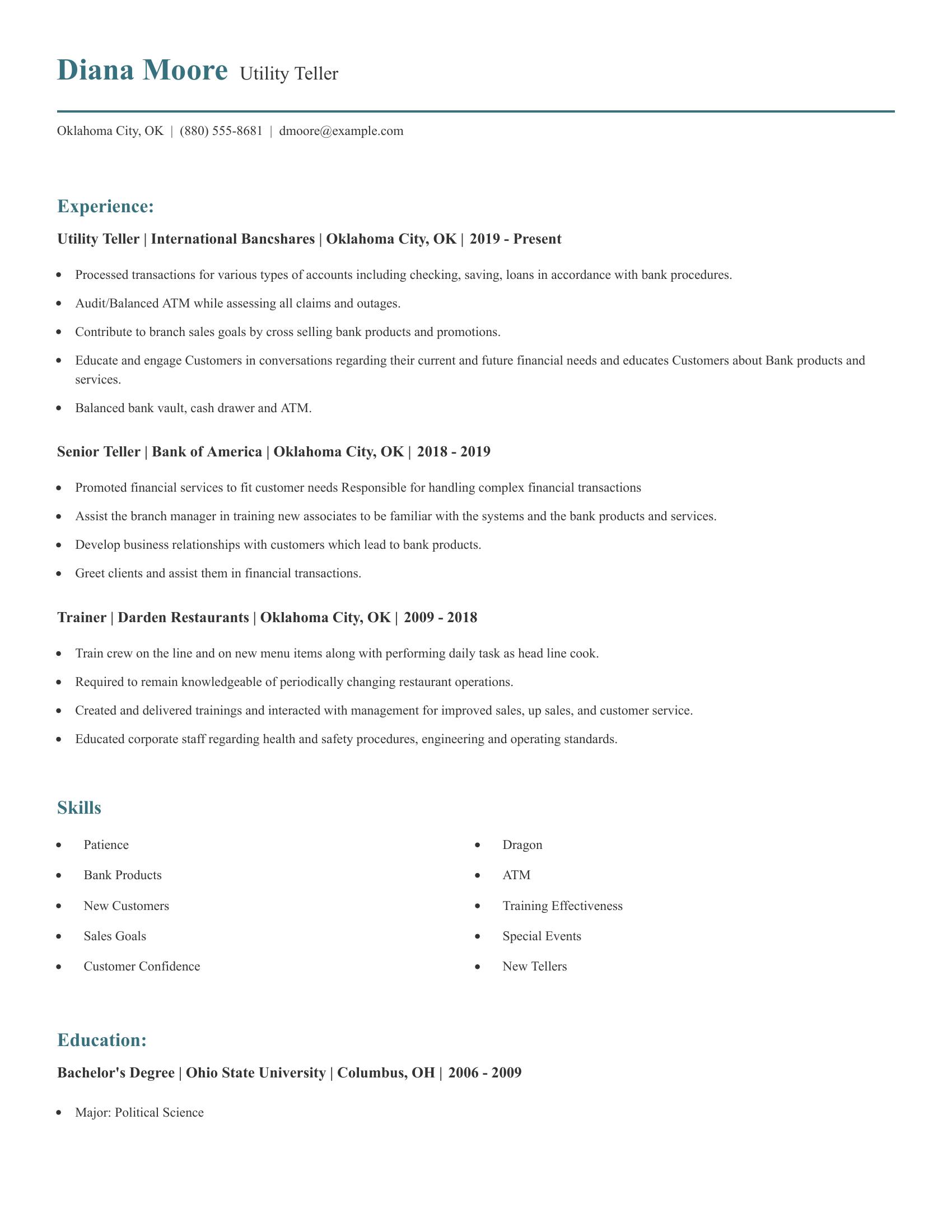

Utility teller resumes should highlight experience with financial transactions, customer service, and bank procedures. It should include positions held, responsibilities, and any specific skills relevant to the role. Education background and specific accomplishments in previous jobs are also important to indicate competence and growth in the field.

This resume includes detailed descriptions of relevant experience, such as processing transactions, balancing ATMs, and cross-selling bank products. It lists positions held in financial institutions and describes responsibilities like handling complex transactions and training new associates. The resume also includes a background in training, which is valuable for customer interactions and staff development. Furthermore, it lists a Bachelor's degree, adding to the candidate's qualifications.

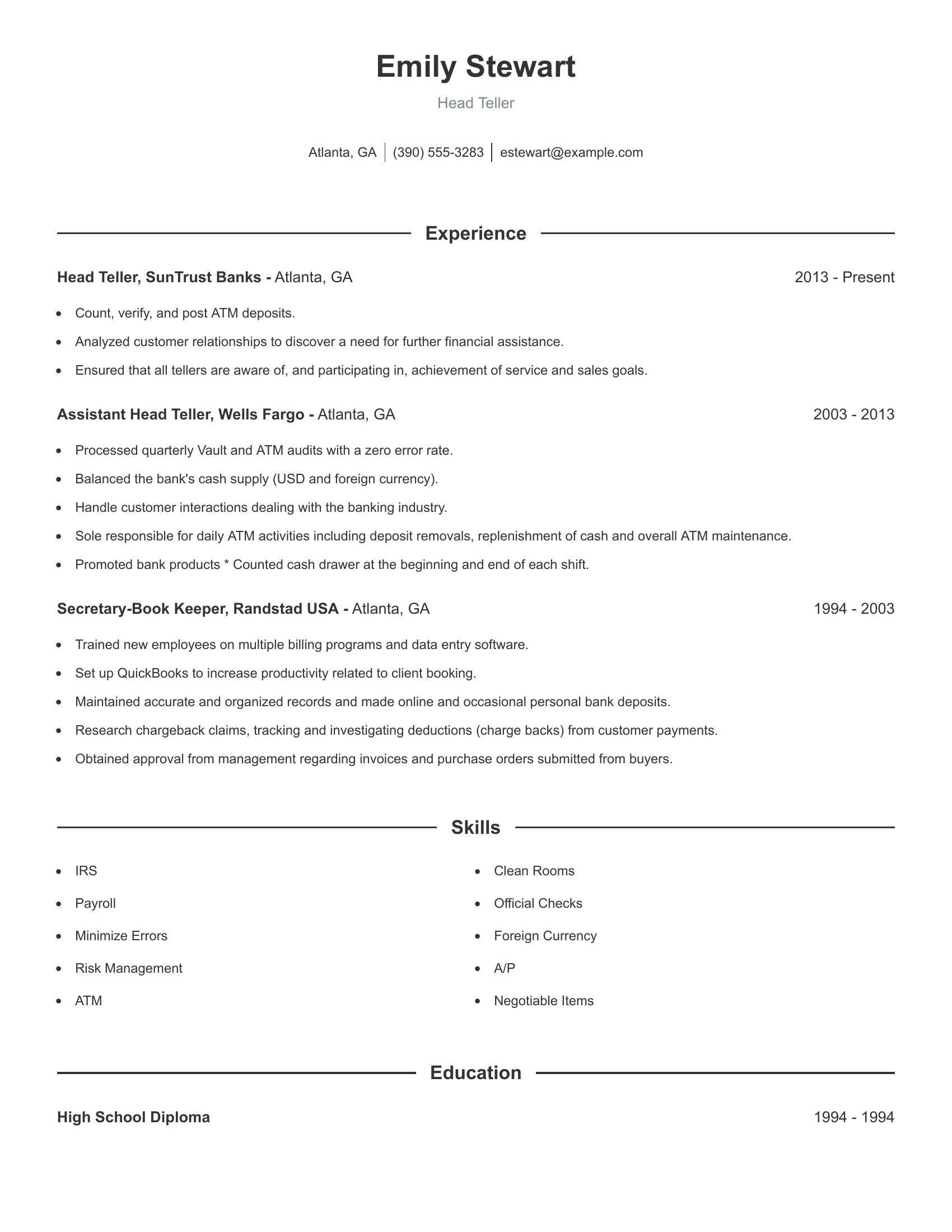

Head teller resumes should highlight experience in managing teller operations, handling cash transactions, and ensuring compliance with banking policies. They should include previous job roles that demonstrate leadership skills, accuracy in financial tasks, and customer service expertise. Emphasize the ability to train staff and handle audits without errors.

This resume includes relevant experience such as managing ATM deposits and customer relationships at a bank. It also shows a history of accurate financial handling with zero error rates in audits. The roles described reflect leadership in training new employees and balancing cash supplies. These elements make for a strong head teller resume.

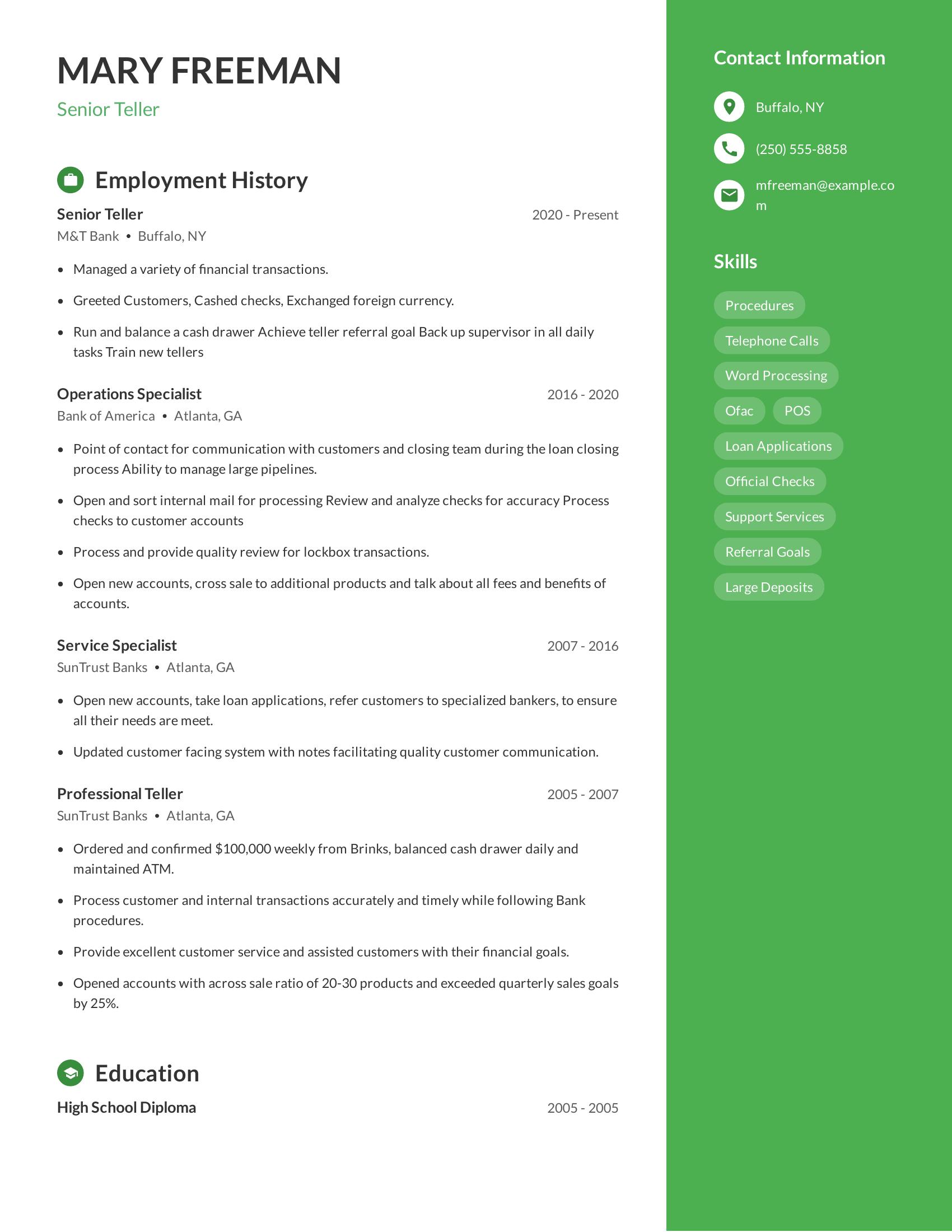

Senior teller resumes should highlight experience in managing financial transactions, customer service skills, and the ability to train and supervise junior tellers. They should also show an understanding of bank procedures, proficiency in handling cash, and experience with various banking software and systems. Including a history of meeting sales goals and processing transactions efficiently is important.

This resume includes relevant work history showcasing positions at multiple banks, highlighting progression from professional teller to senior teller. It details specific duties like managing financial transactions, training new tellers, and balancing cash drawers. The resume also lists skills such as loan applications and word processing, indicating proficiency in necessary banking tasks.

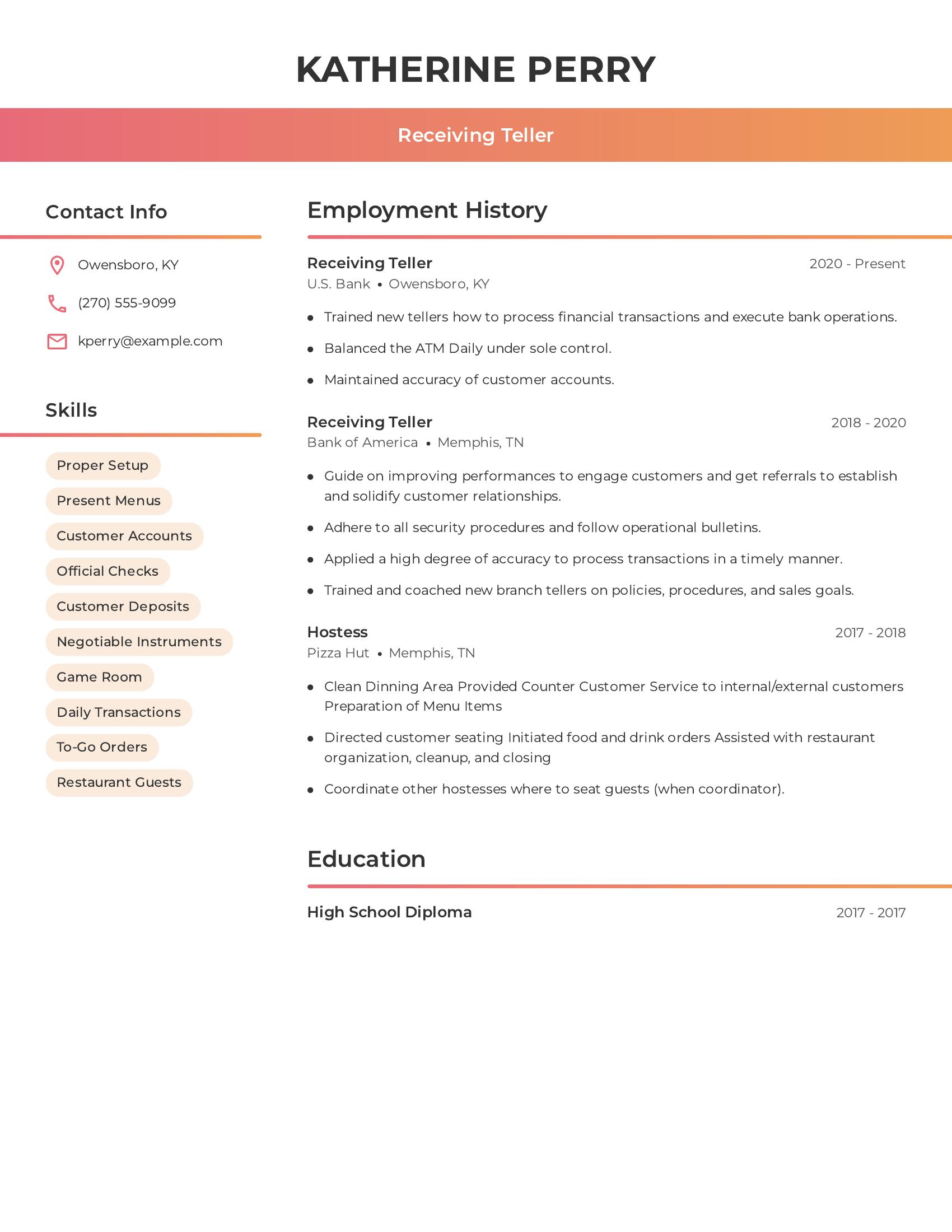

Receiving teller resumes should highlight relevant experience, key skills, and education. The resume should include contact information, a list of skills pertinent to the job, detailed employment history with job titles and responsibilities, and educational background. It is important to show experience in handling financial transactions, customer service, adherence to security procedures, and training new staff.

This resume includes a clear listing of contact information and a concise summary of relevant skills such as managing customer accounts, handling official checks, and balancing daily transactions. The employment history section shows progressive experience as a receiving teller with specific responsibilities that align with the role, such as training new tellers and maintaining accuracy in transactions. Additionally, the resume demonstrates adherence to security procedures and customer service skills.

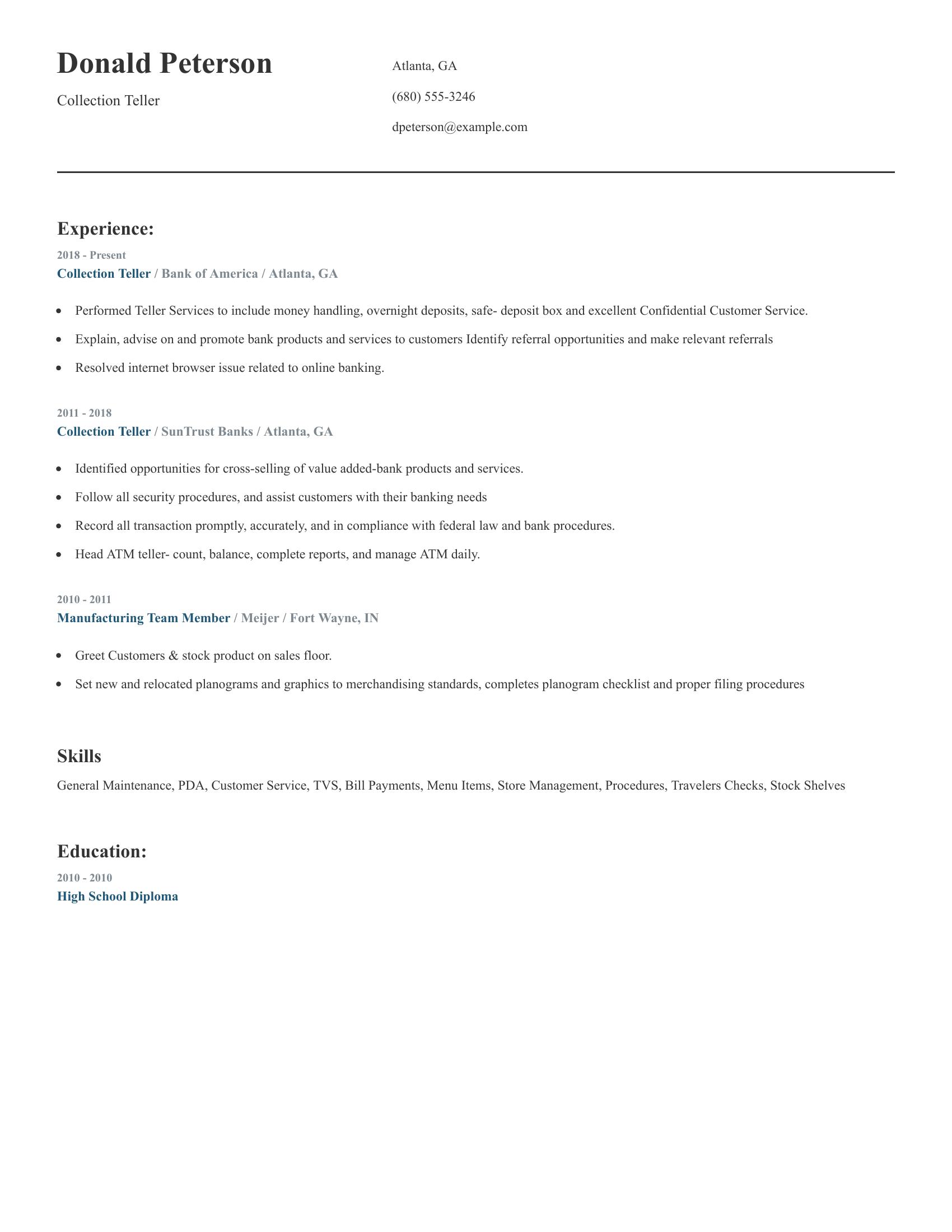

Collection teller resumes should highlight experience in handling cash transactions, customer service, and promoting bank products and services. They should include a history of employment with relevant job titles, responsibilities, and achievements. Skills related to banking procedures, security compliance, and problem-solving are important. Education details and contact information should also be present.

This resume effectively includes specific details such as experience at two banks where the candidate handled teller services, identified referral opportunities, managed ATM operations, and resolved online banking issues. It lists relevant skills like customer service and transaction recording. The resume also provides clear employment dates and educational background.

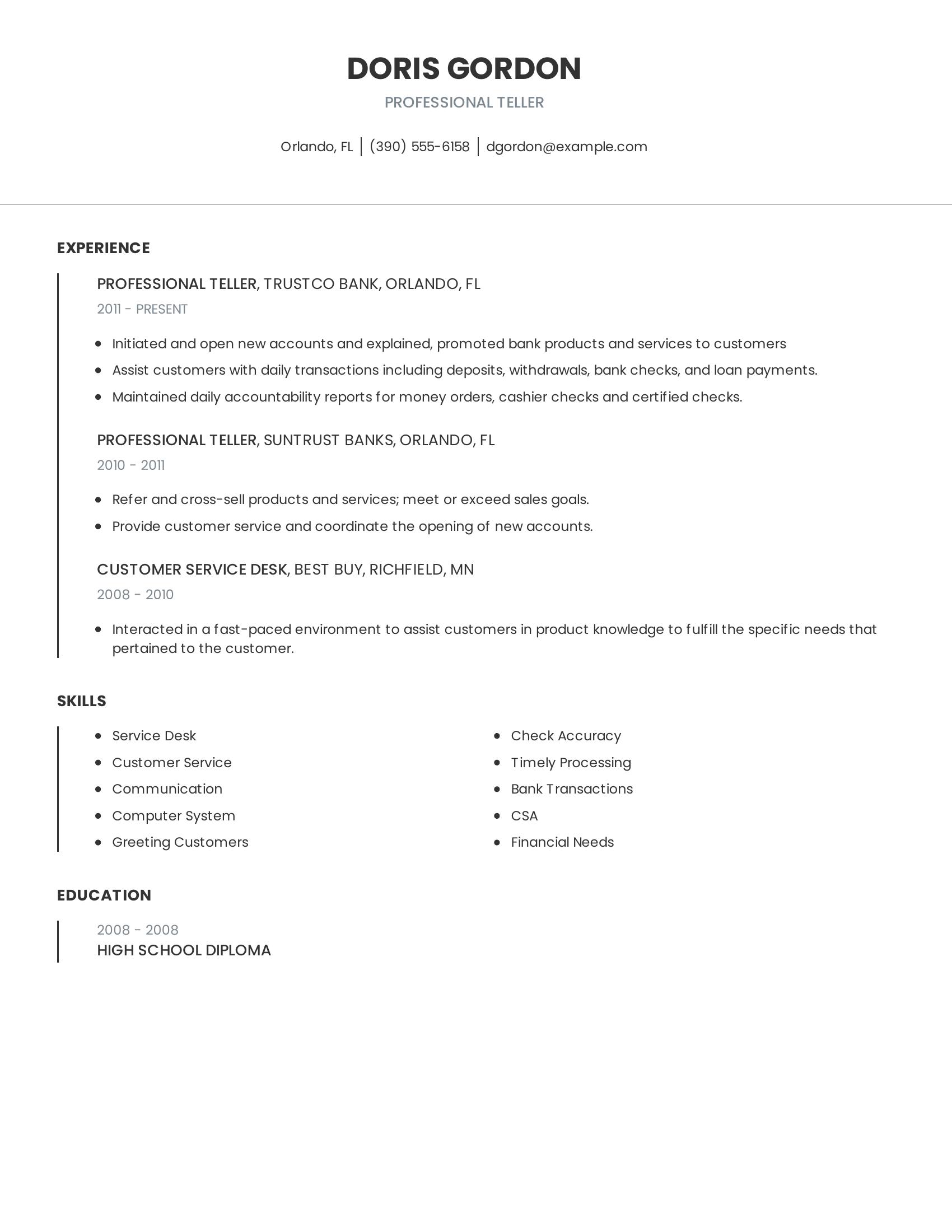

Professional teller resumes should highlight experience in banking, customer service, and financial transactions. They should include clear job titles, employment dates, and concise descriptions of duties performed. Important skills such as communication, computer proficiency, and the ability to handle bank transactions efficiently should be listed. Education details should also be present to provide a complete overview of qualifications.

This resume includes relevant job experiences at two different banks where the individual handled account openings, customer transactions, and sales goals. The skills section lists important abilities like customer service, communication, and accuracy in processing transactions. The education section confirms the candidate's high school completion, making it a well-rounded professional teller resume.

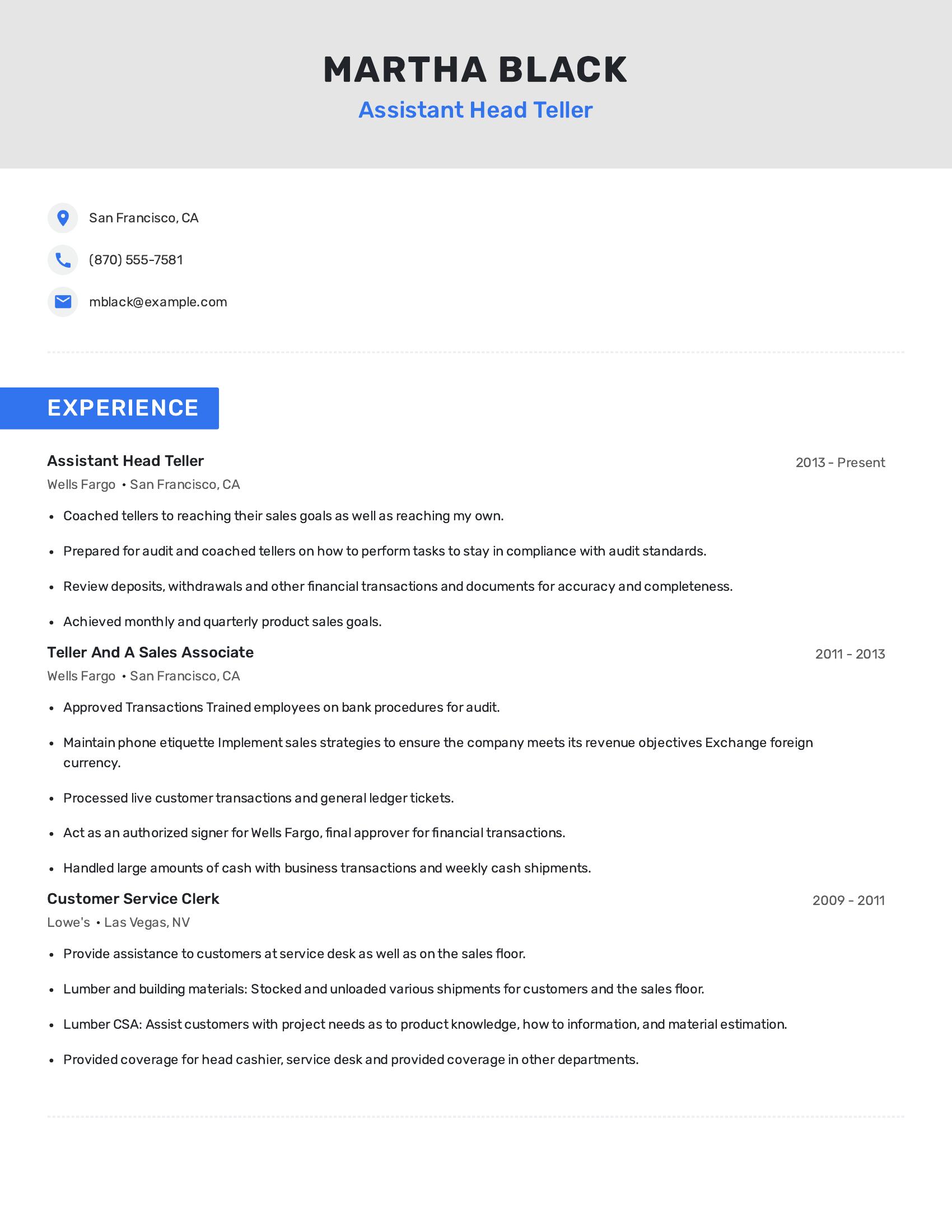

Assistant head teller resumes should highlight experience in managing and coaching teller staff, preparing for audits, and ensuring compliance with financial standards. They should also show proficiency in reviewing financial transactions for accuracy and achieving sales goals. Experience in handling large cash volumes and authorizing transactions is important. Prior roles in customer service and sales can demonstrate versatility and a strong foundation in customer interaction skills.

This resume includes the necessary specifics by detailing the candidate's experience coaching tellers to achieve sales goals, preparing for audits, and reviewing financial transactions for accuracy. It also shows their ability to handle cash transactions and authorize significant financial actions. Previous roles in customer service and sales further showcase their ability to assist customers effectively and train employees on procedures.

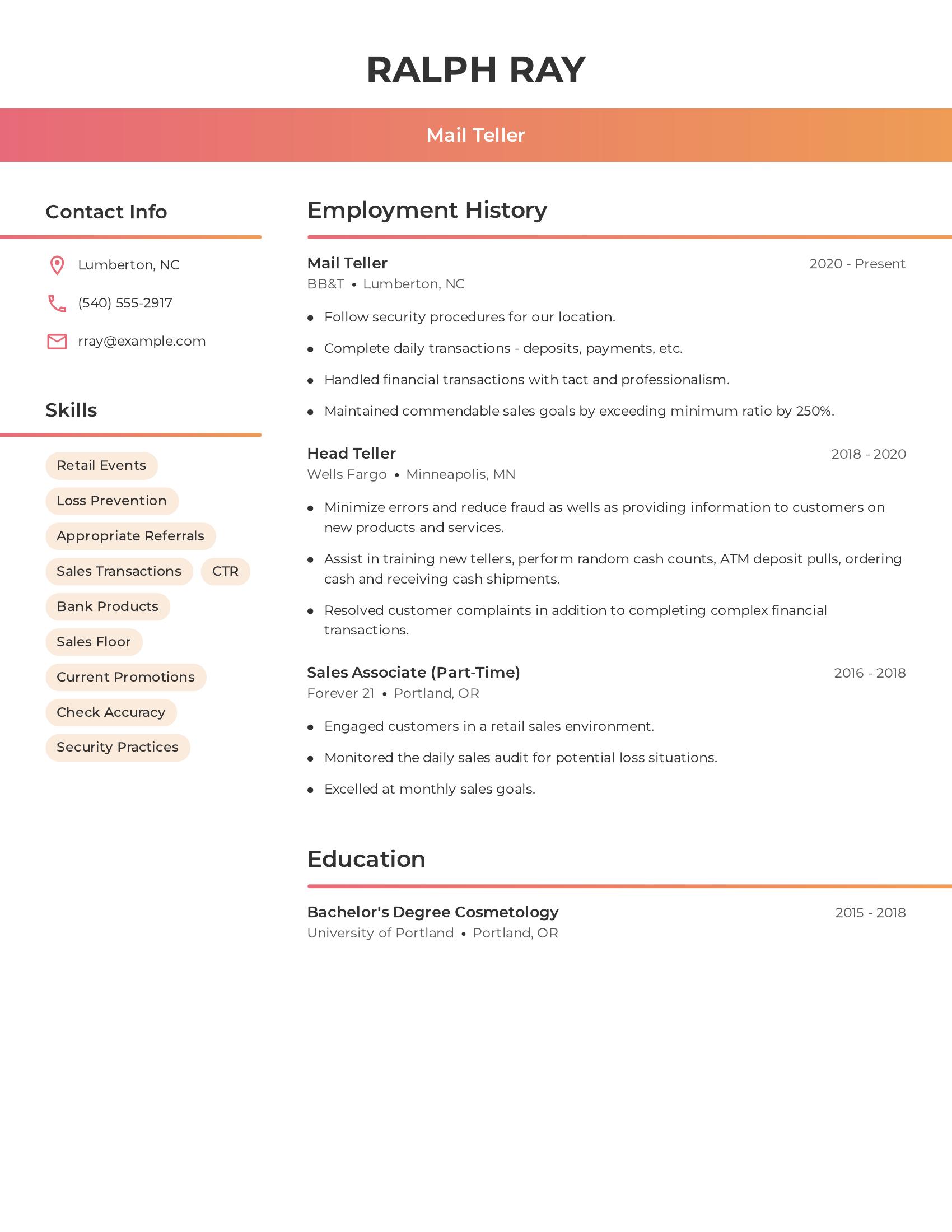

Mail teller resumes should highlight relevant experience in financial transactions, customer service, and security procedures. Key elements include employment history, skills related to the job, and educational background. It should also show specific achievements and responsibilities that demonstrate competence in handling financial operations and customer interactions.

This resume includes relevant work experience such as roles in financial institutions and retail settings. It lists skills like loss prevention, sales transactions, and security practices. The employment history shows a progression from sales associate to head teller, demonstrating growth in the field. Achievements like exceeding sales goals by 250% and assisting in training new tellers are clearly stated, showcasing the candidate's capability in handling complex tasks and contributing to team success.

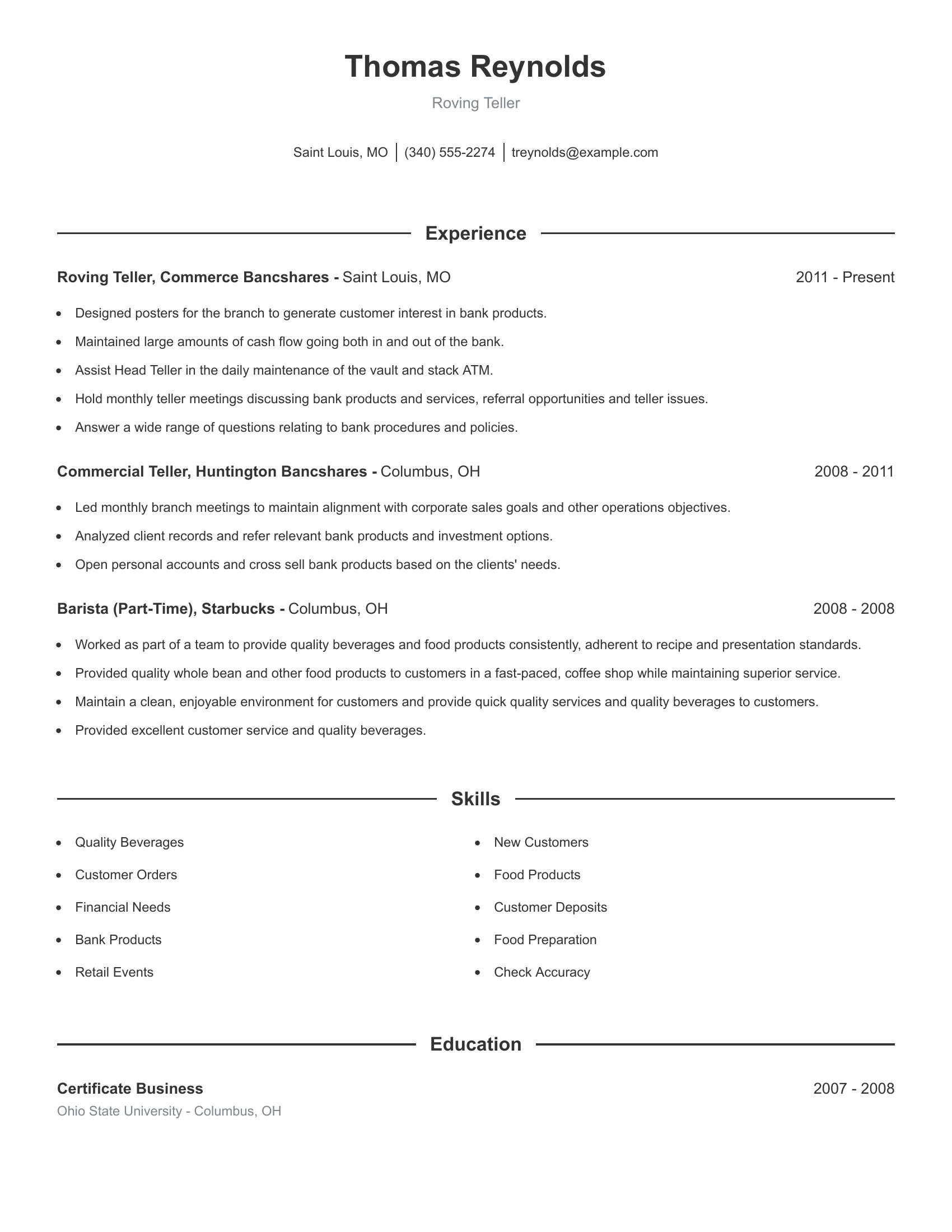

Roving teller resumes should highlight specific banking tasks, customer interaction, and teamwork. They should detail experience with cash handling, assisting in vault maintenance, and conducting meetings about bank products. Experience in similar roles at other financial institutions and relevant education should also be included.

This resume includes detailed responsibilities like maintaining cash flow, assisting with vault tasks, and leading teller meetings. It shows experience at multiple banks and includes a background in customer service. The resume also lists relevant education, demonstrating a well-rounded candidate for the position.

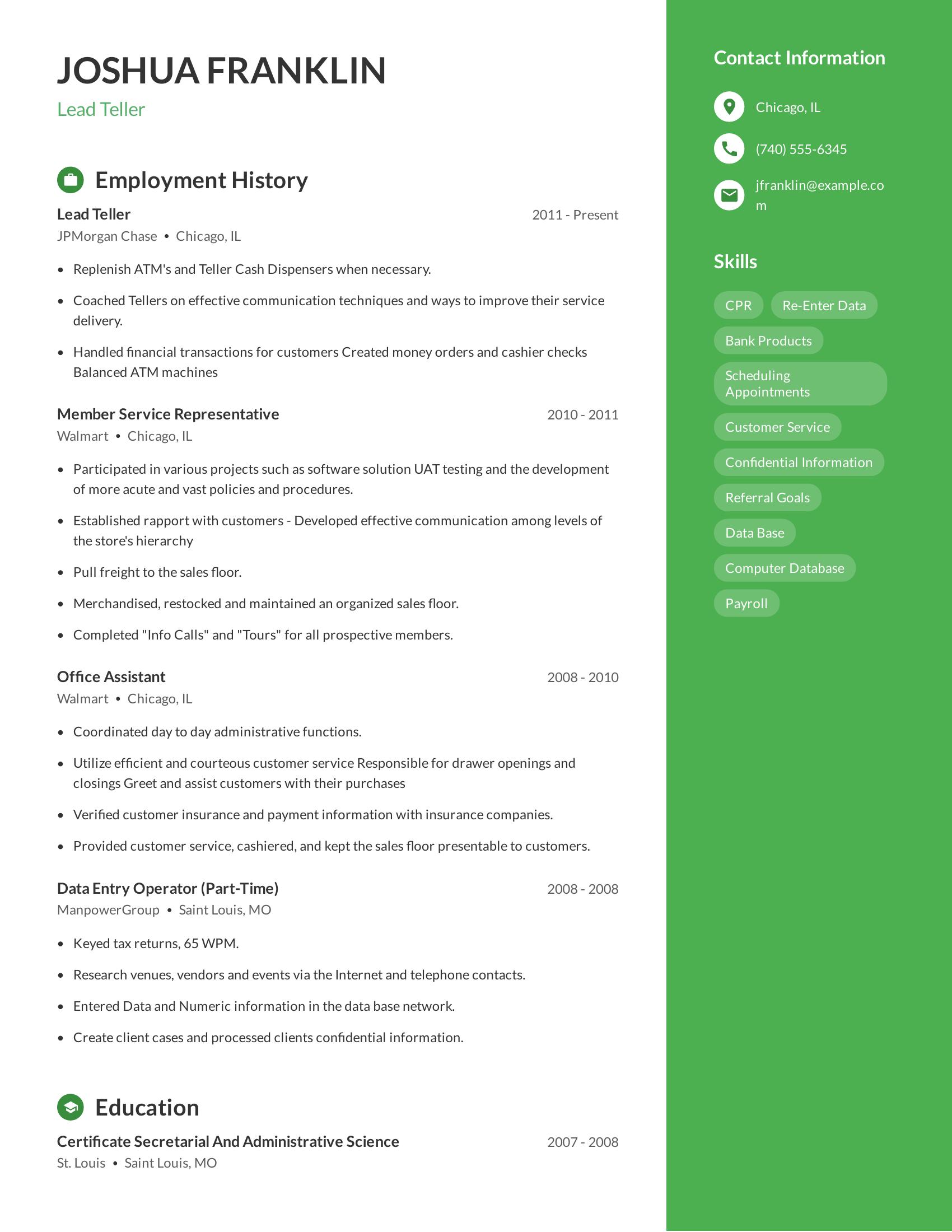

Lead teller resumes should highlight experience in handling financial transactions, coaching staff, and managing cash dispensers. They should show a history of customer service excellence and proficiency in administrative tasks. Essential details include past job titles, employment dates, responsibilities, and relevant skills like data entry and customer service.

This resume includes specifics such as replenishing ATMs, coaching tellers, and handling financial transactions. It lists employment history with dates, showing progression from member service representative to lead teller. The resume also features relevant skills like handling confidential information and scheduling appointments. The inclusion of educational background and contact information further supports its completeness.

Highlight cash handling experience. Mention how many transactions you handled daily and any experience with large sums of money.

Show customer service skills. Describe how you helped customers with their banking needs and resolved issues quickly.

Detail familiarity with banking software. List the systems or programs you used as a teller, such as Fiserv or Jack Henry.

A teller's resume should highlight relevant experience, skills, and education. It should show your ability to handle cash, interact with customers, and use banking software. Include contact information, a professional summary, work experience, education, and skills.

A teller summary should highlight skills in customer service and cash handling. Mention experience with financial transactions and attention to detail.

Be concise and focus on relevant skills. Use action verbs and avoid filler words.

When writing a teller experience section, focus on specific tasks and achievements. Highlight skills relevant to banking like customer service and cash handling. Use clear and concise language.

Use bullet points for easy reading. Quantify achievements when possible. Mention any training or certifications. Tailor the experience to the job description.

A teller needs specific technical skills to handle their duties.

A teller also needs people skills to interact well with customers and colleagues.