15 Tax Preparer Resume Examples

Tax preparer resumes should include relevant job experience, skills, and education. Highlighting roles in tax preparation and compliance is important. It should detail specific responsibilities and achievements. Skills related to tax services, compliance, and audit preparation are crucial. Education should show qualifications relevant to the role.

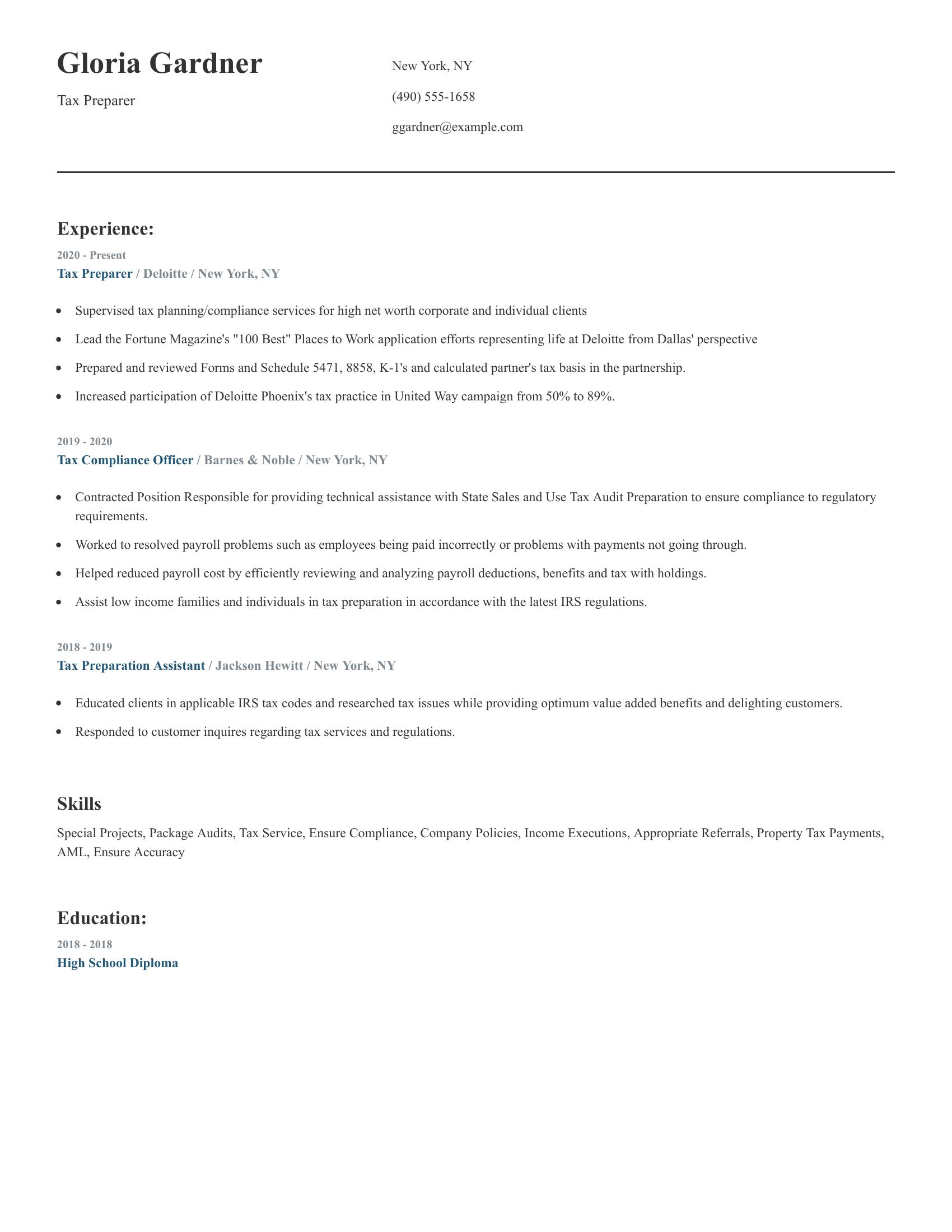

This resume includes strong experience in tax preparation roles at well-known companies. It lists specific duties like supervising tax planning services, preparing tax forms, and increasing participation in campaigns. It also mentions skills such as package audits and ensuring compliance. The education section is brief but relevant, showing a high school diploma.

Tax professional resumes should highlight relevant experience, technical skills, and education. Key components include detailed work history in tax preparation, knowledge of tax software, and familiarity with tax regulations. They should also demonstrate the ability to handle client interactions and resolve tax issues. Educational background in finance or accounting is crucial.

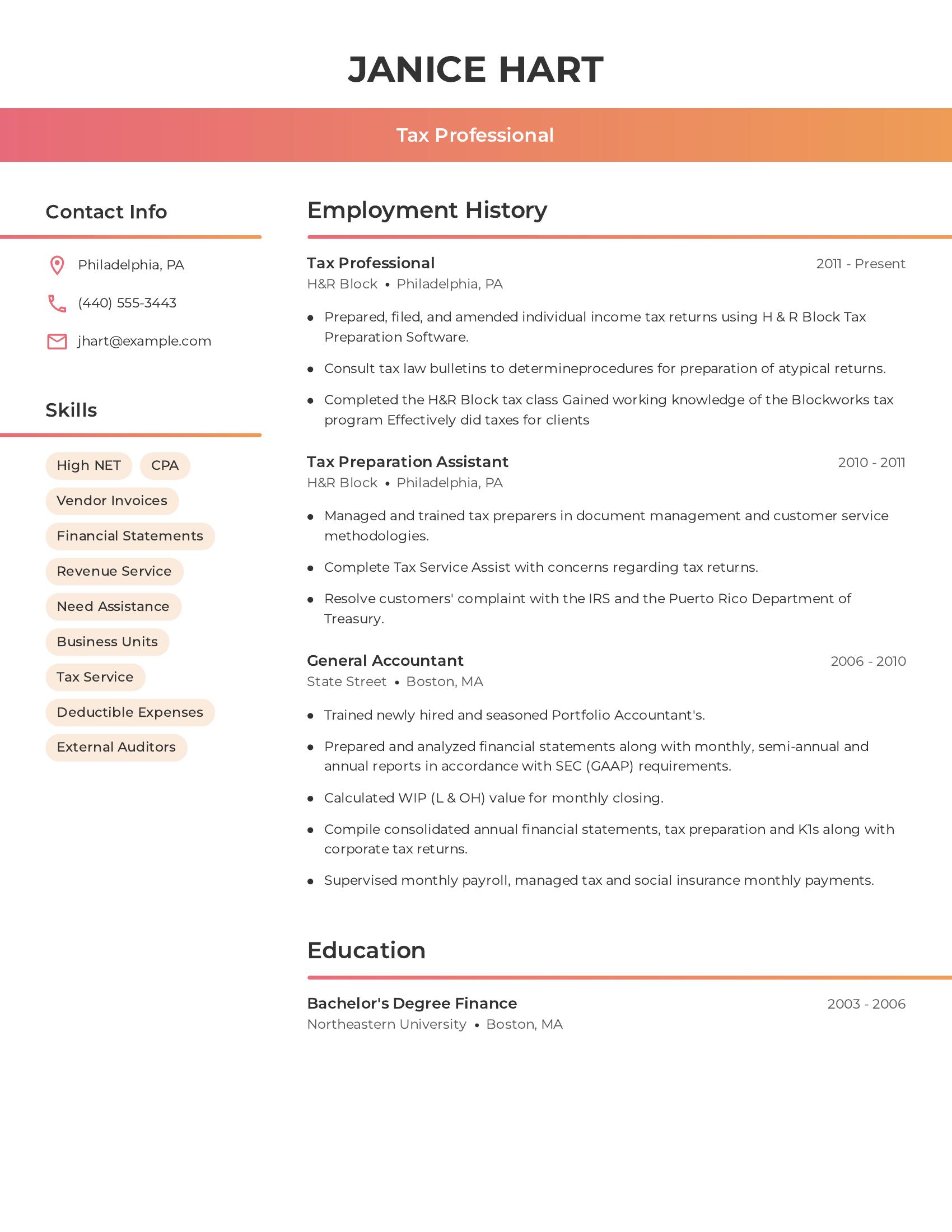

this resume includes clear information about work experience with specific responsibilities like preparing tax returns, consulting tax law bulletins, and managing tax preparers. It lists relevant skills such as using tax preparation software and handling financial statements. The resume also mentions a finance degree and training courses, which show a strong educational foundation.

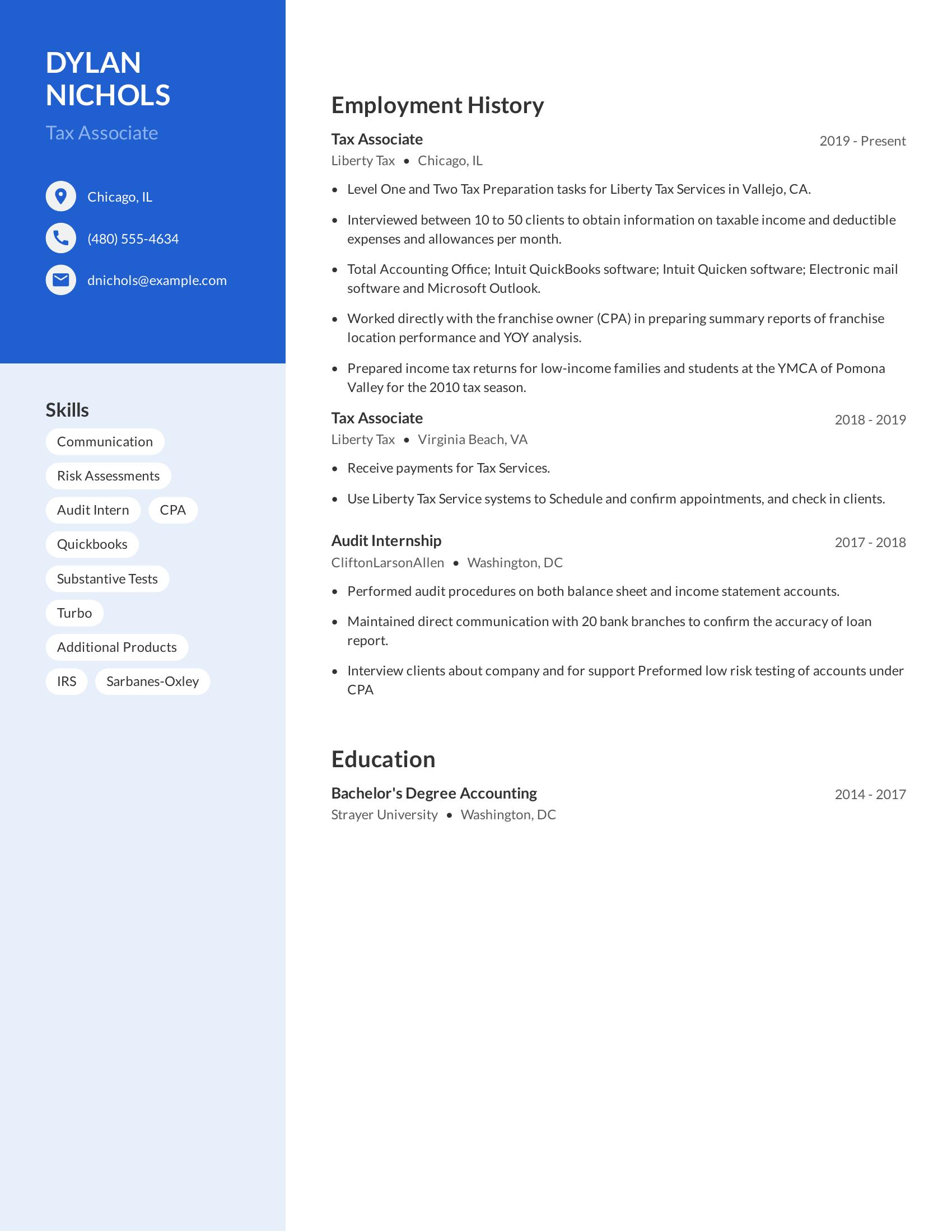

Tax associate resumes should highlight relevant skills, experience, and education. Key components include clear communication abilities, familiarity with tax software, and experience in tax preparation and auditing. It should list employment history with specific tasks and responsibilities to demonstrate expertise. Education details should be included to show relevant academic qualifications.

This resume includes those specifics well. It lists essential skills like communication and risk assessments. The employment history is detailed, showcasing tasks like tax preparation, client interviews, and audit procedures. This demonstrates a solid background in tax-related roles. The education section mentions a relevant degree in accounting, which adds value to the candidate's qualifications.

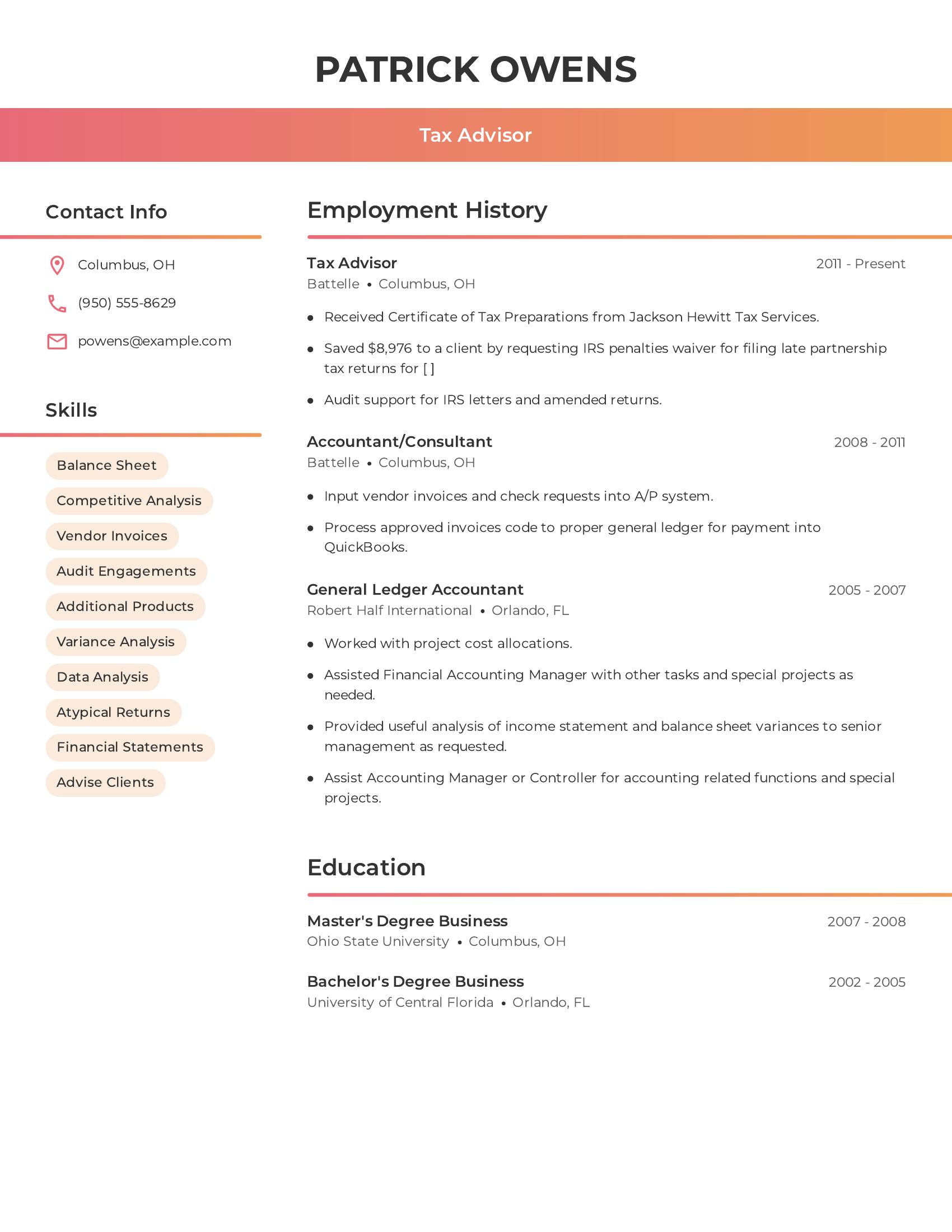

Tax advisor resumes should highlight relevant experience, skills, and education. They should include job titles, companies, locations, and employment dates. Skills should relate to tax advising, such as financial analysis and audit support. Education should list degrees and certifications. The resume must be clear and to the point.

This resume includes all necessary elements. It lists job titles like tax advisor and accountant/consultant with companies and dates. Skills such as balance sheet analysis and audit engagements are included. Education is listed with degrees and a tax preparation certificate. The resume also details specific tasks performed in each role.

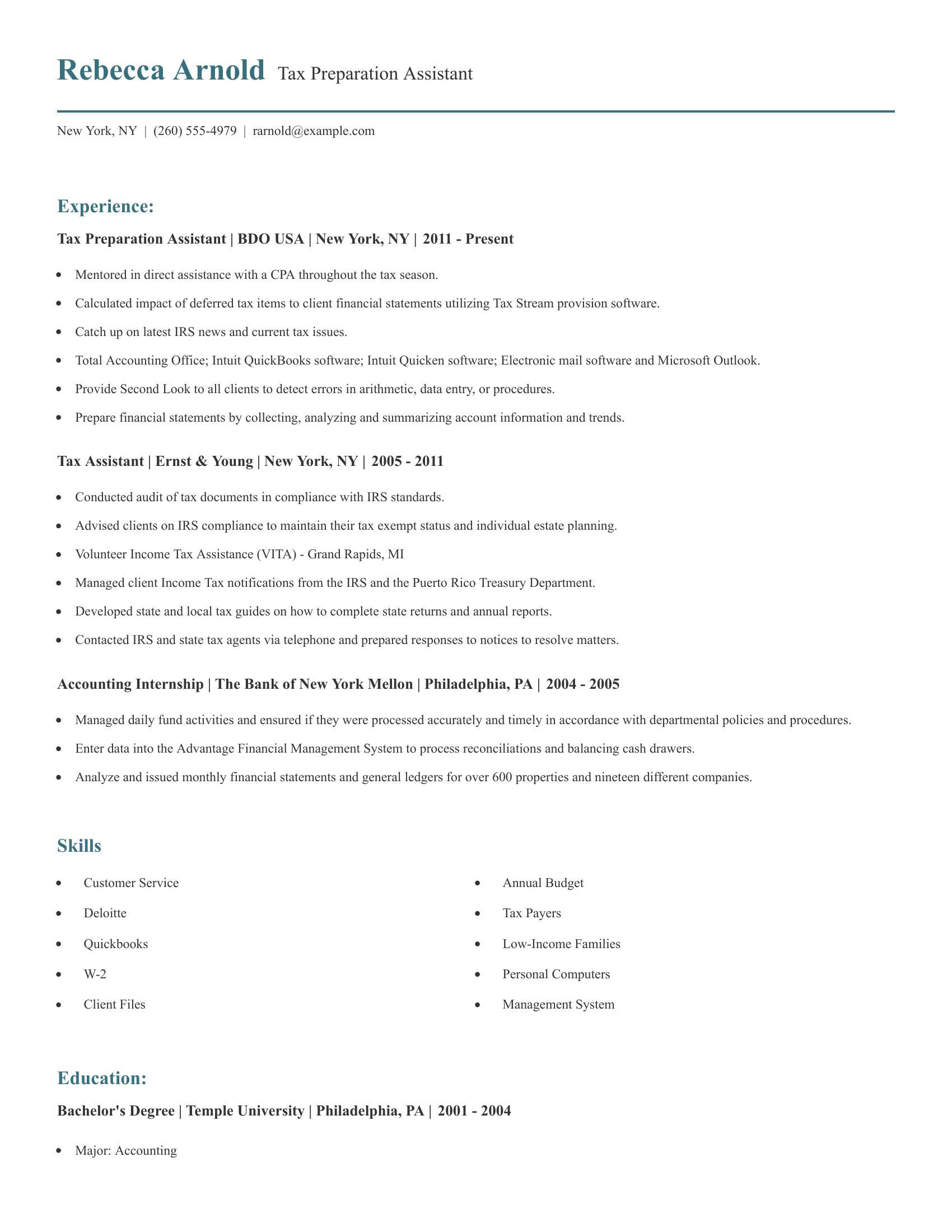

A tax preparation assistant resume should highlight relevant job experience, skills, and education. It should detail specific tasks handled, such as preparing financial statements, auditing tax documents, and advising clients on IRS compliance. Skills related to tax software and customer service are important. The resume should also show the candidate's ability to handle various financial tools and systems.

This resume includes relevant experience such as assisting CPAs, using tax software, preparing financial statements, and conducting audits. It lists specific skills like QuickBooks and customer service. The resume also highlights an accounting degree, which is relevant for a tax preparation assistant role. Experience with multiple employers in the field shows a strong background in tax preparation and management.

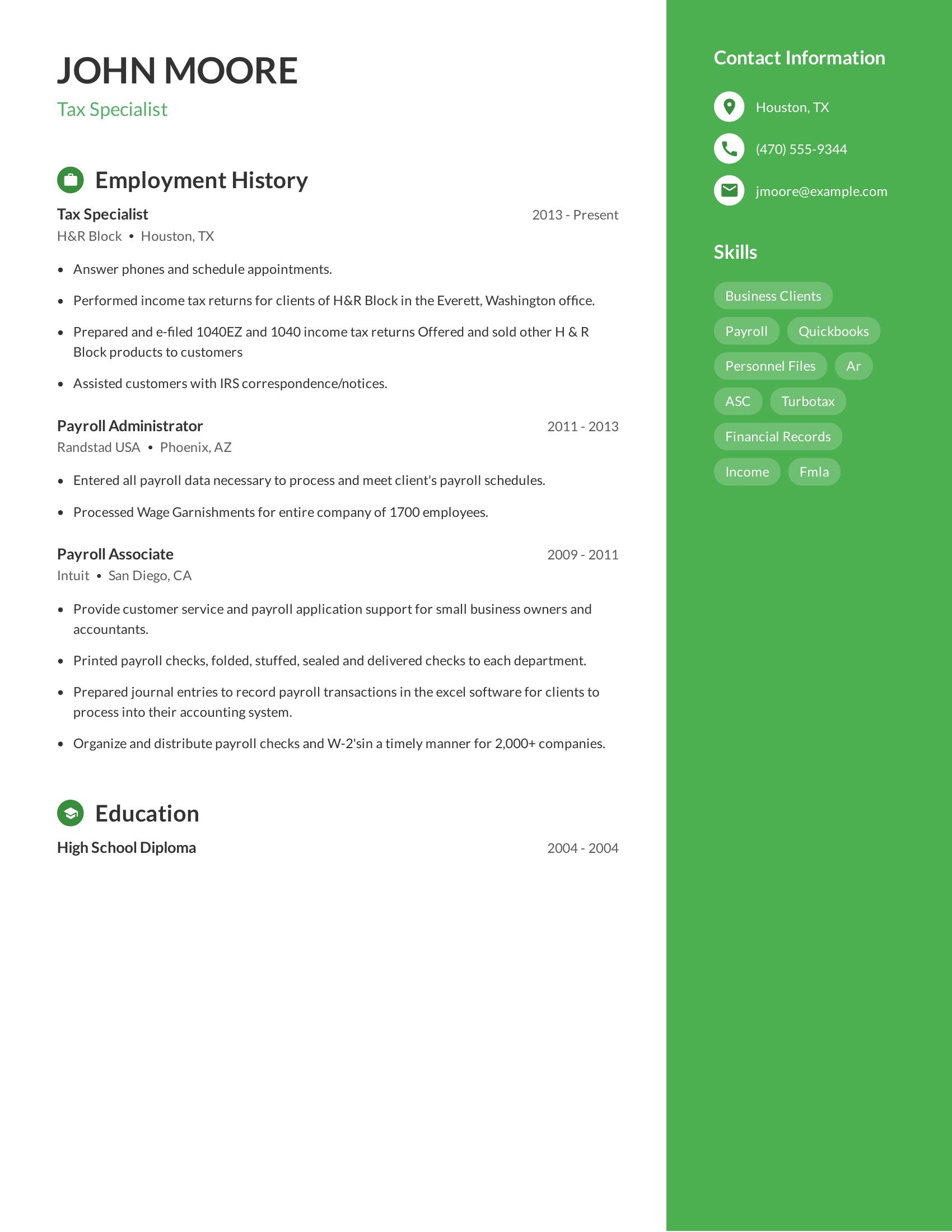

Tax specialist resumes should highlight relevant work experience, education, and skills. They must include job responsibilities and achievements in previous roles. A good resume shows proficiency in tax preparation, payroll administration, and client communication. It should also list technical skills like software proficiency and knowledge of tax laws.

This resume includes specific job duties such as preparing income tax returns, assisting customers with IRS correspondence, and processing wage garnishments. It shows a clear work history with dates and locations. The resume lists relevant skills like QuickBooks, TurboTax, and managing financial records, which are important for the role.

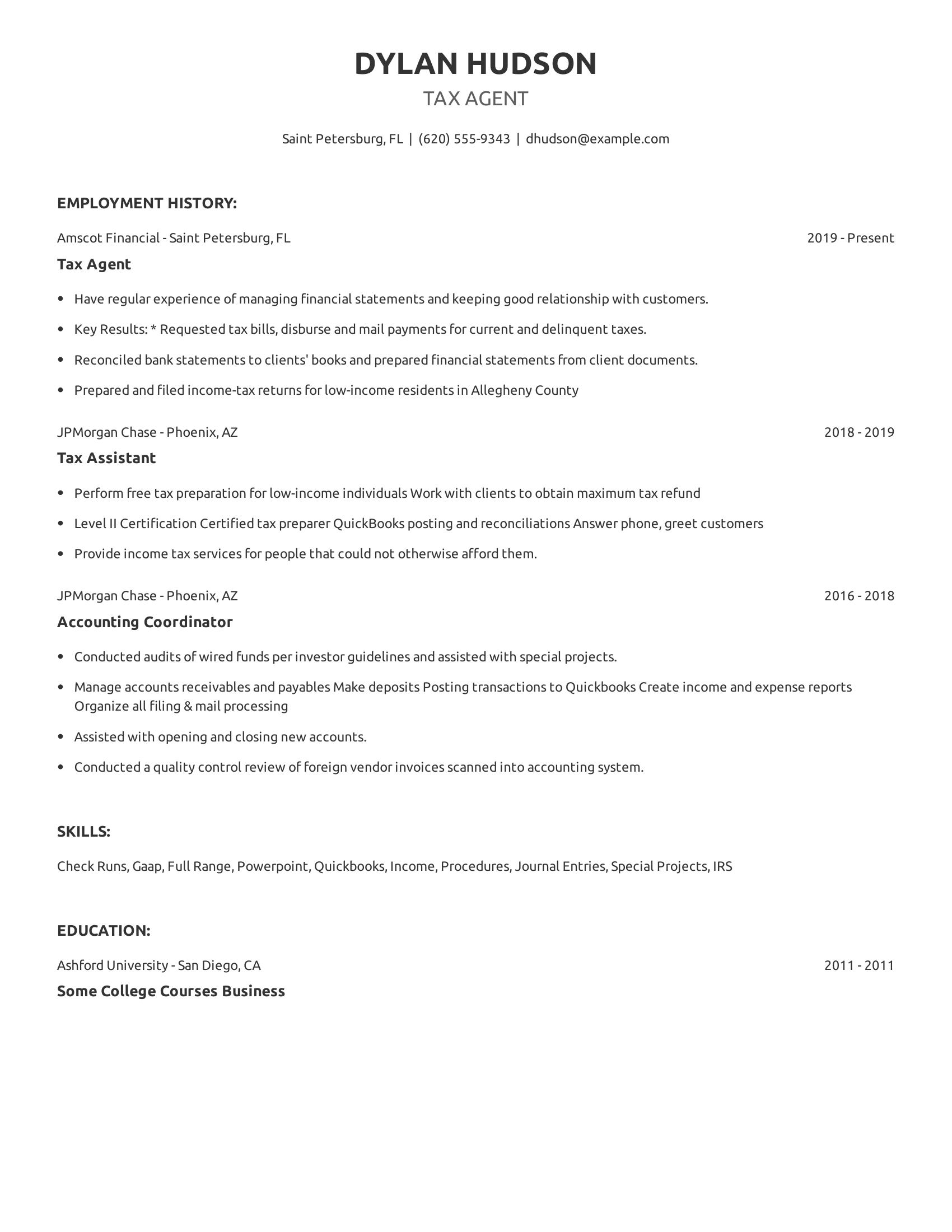

Tax agent resumes should include relevant work experience, skills, and education. Highlighting experience in tax preparation, financial statement management, and client relationships is important. A good resume also lists specific tasks and results achieved in previous roles. Certifications and proficiency in tools like QuickBooks add value.

This resume includes relevant experience in tax preparation, financial statement management, and client interactions. It details tasks like reconciling bank statements, preparing tax returns, and managing accounts receivables. The resume also lists skills such as QuickBooks proficiency and certification in tax preparation, which are crucial for the role.

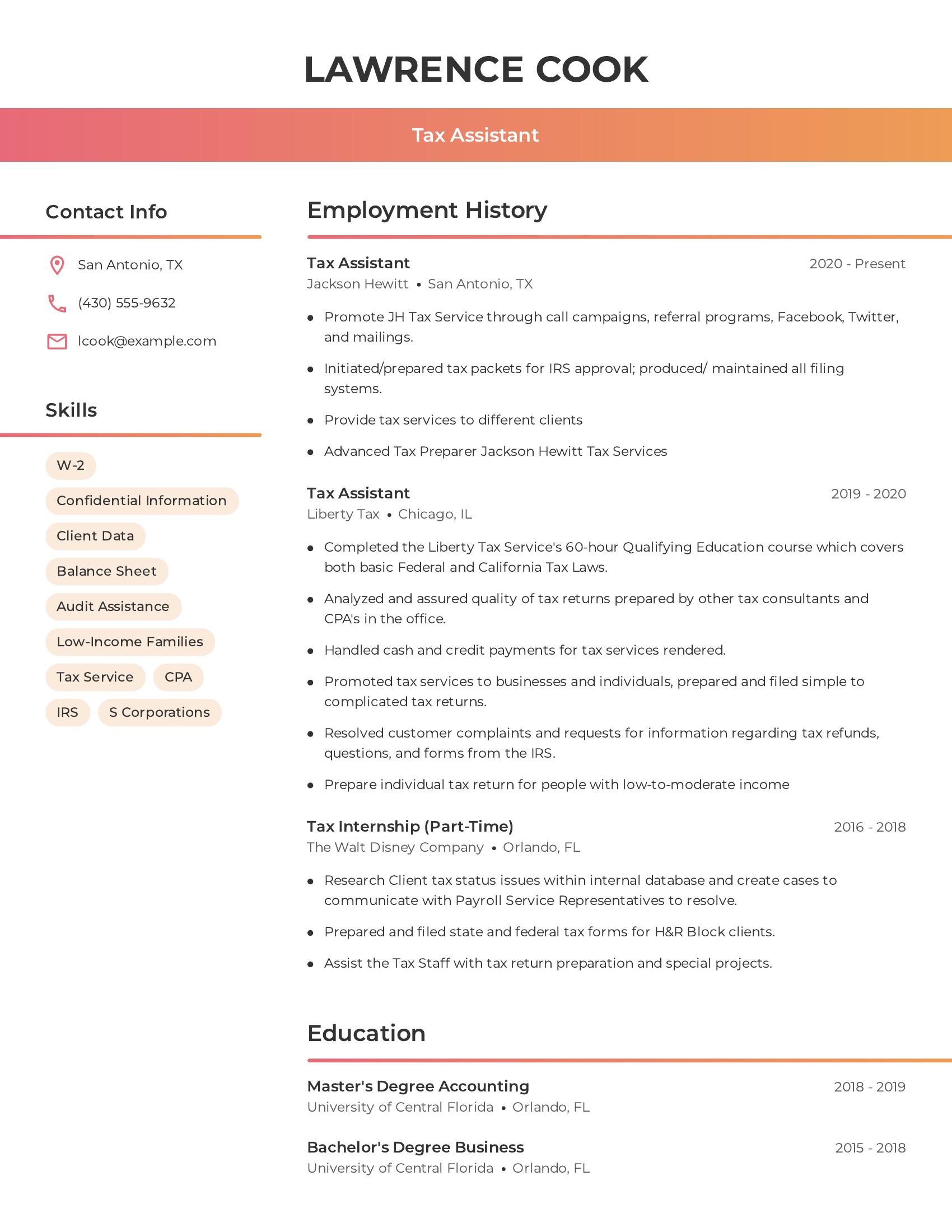

Tax assistant resumes should include contact information, relevant skills, employment history, and education. Skills should focus on tax preparation, client data handling, and familiarity with tax regulations. Employment history should highlight specific tax-related roles and tasks performed. Education should list degrees in relevant fields such as accounting or business.

This resume includes all necessary elements. It lists the candidate's contact information, relevant skills like W-2 and audit assistance, and detailed employment history with specific duties. The education section is complete with degrees in accounting and business. This setup provides a clear picture of the candidate's qualifications for a tax assistant role.

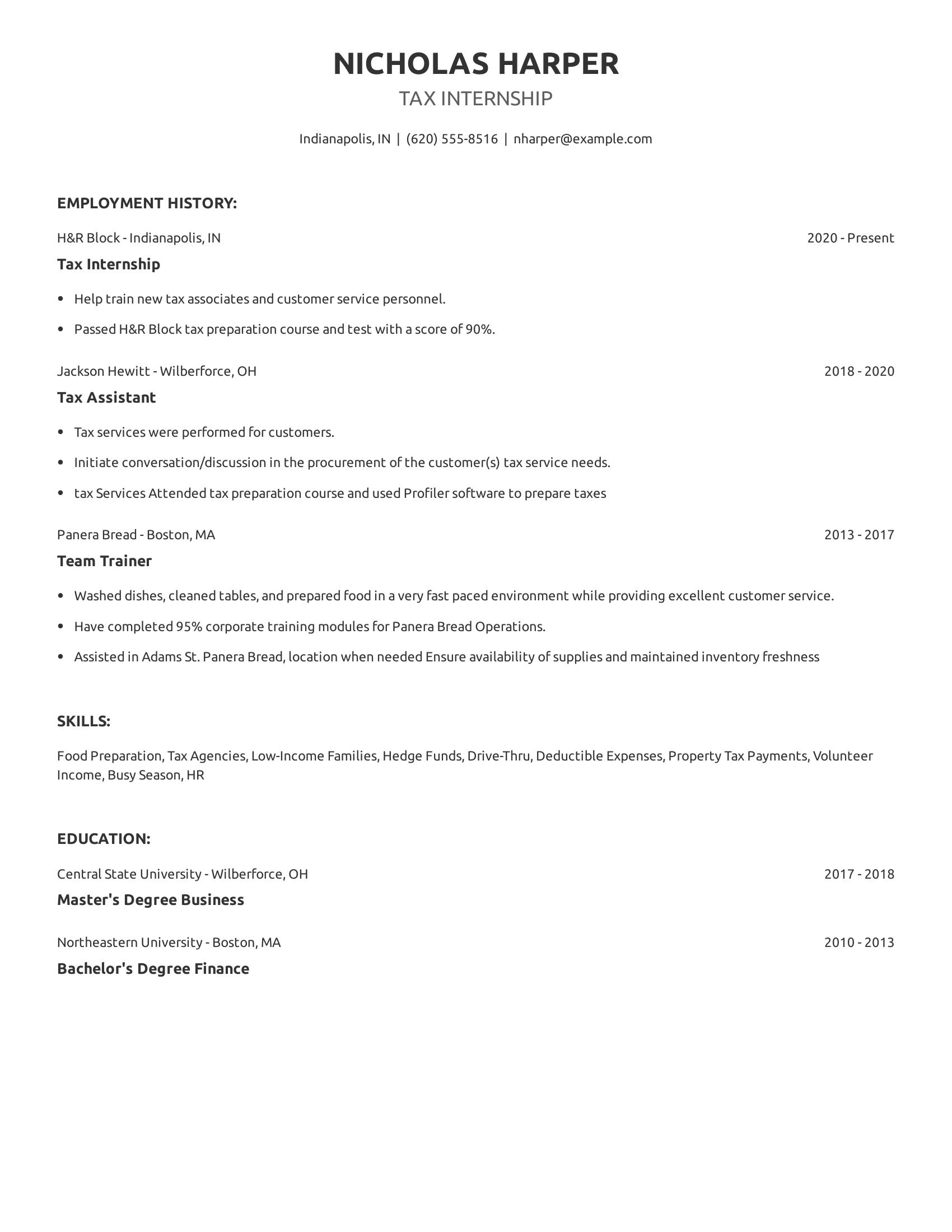

Tax internship resumes should highlight relevant work experience, education, and skills that directly align with the role. Key elements include past internships or jobs in tax preparation, related coursework, and proficiency in relevant software. Additionally, showcasing any customer service experience and certifications can be beneficial.

This resume is strong because it includes specific positions held at tax firms, such as H&R Block and Jackson Hewitt. It also mentions relevant coursework and software proficiency. The inclusion of a master's degree in business and a bachelor's degree in finance demonstrates a solid educational background. The listed skills are pertinent to tax preparation and customer service, which are crucial for a tax internship.

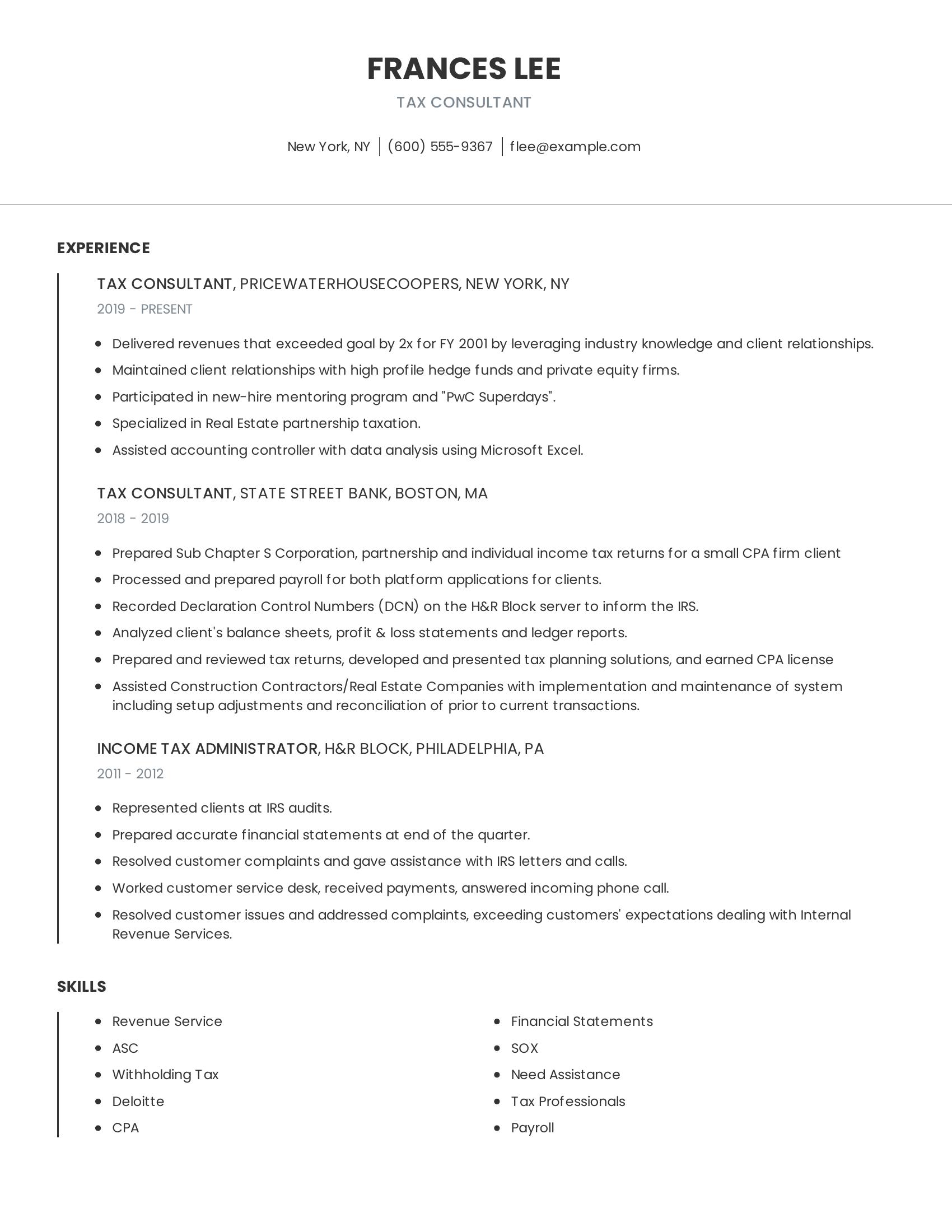

Tax consultant resumes must highlight relevant experience, specific skills, and accomplishments. They should include job titles, company names, locations, and employment dates. Key responsibilities and achievements must be clear and quantifiable. Skills should be listed to show technical proficiency. Certifications and education help demonstrate qualifications.

This resume includes specific job titles, company names, locations, and dates of employment. It clearly outlines responsibilities like preparing tax returns and maintaining client relationships. Quantifiable achievements such as exceeding revenue goals are mentioned. The resume lists relevant skills like payroll processing and data analysis. Certifications like the CPA license are also included.

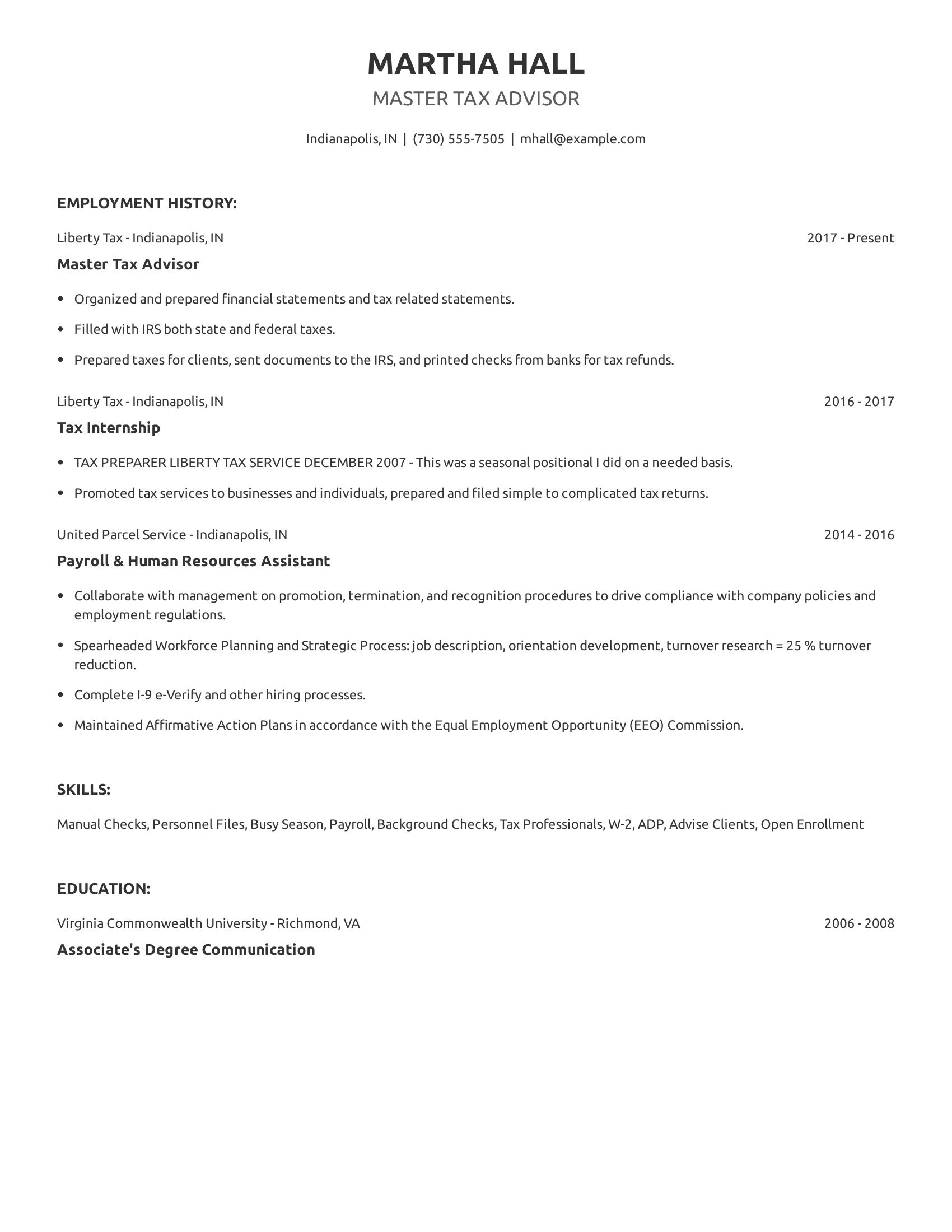

A master tax advisor resume should include clear employment history, relevant skills, and educational background. It must list specific job duties and achievements related to tax preparation and advisory roles. Key details like communication skills, experience with various tax regulations, and client interaction are important.

This resume includes a detailed employment history with specific roles in tax advisory and preparation. It lists practical skills like preparing financial statements and handling both state and federal taxs. The resume also shows experience promoting tax services and managing payroll tasks, indicating a well-rounded professional background.

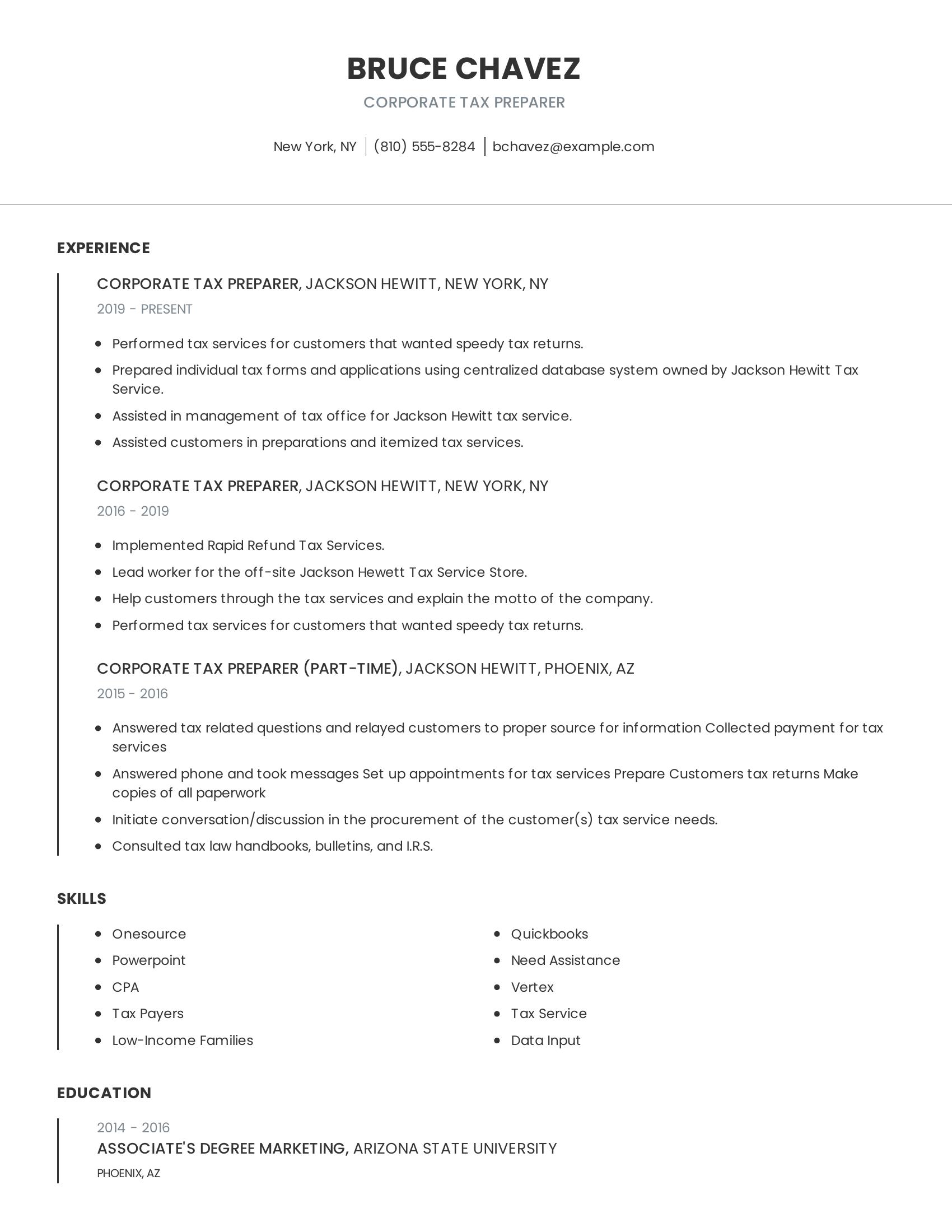

Corporate tax preparer resumes should highlight relevant work experience, skills, and education. They should include job titles, employers, locations, and dates of employment. Key responsibilities such as preparing tax forms, managing tax offices, and consulting tax laws should be listed. Skills like using Onesource, QuickBooks, and being a CPA are important. Education details like degrees and the institutions attended should also be included.

This resume includes specific job titles like corporate tax preparer at Jackson Hewitt with locations and dates. It lists responsibilities such as performing tax services, assisting customers, and managing tax offices. The resume also mentions skills such as Onesource and QuickBooks, and it includes an associate's degree in marketing from Arizona State University.

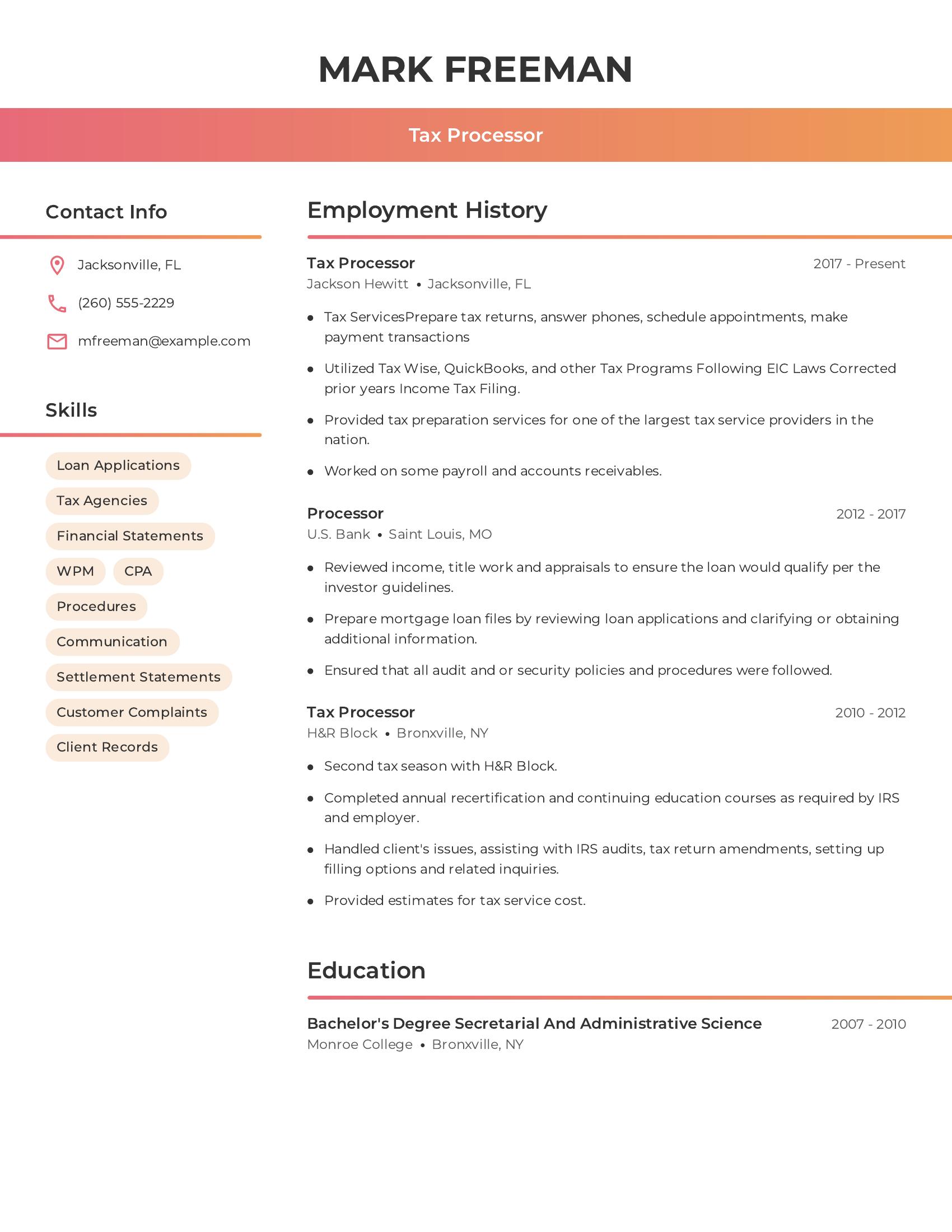

Tax processor resumes should highlight relevant work experience, skills, and education. A good resume for this role includes specific job duties performed at previous positions, relevant skills like handling tax agencies and financial statements, and educational background related to administrative or financial fields. Key aspects to cover are proficiency in tax software, knowledge of tax laws, and the ability to handle client records and complaints effectively.

This resume includes all necessary details for a tax processor position. It lists experience at three different companies, emphasizing duties such as preparing tax returns, handling client issues, and reviewing financial documents. Skills like using Tax Wise and QuickBooks are noted. The education section shows a relevant bachelor's degree, while additional details about handling IRS audits and continuing education demonstrate ongoing professional development.

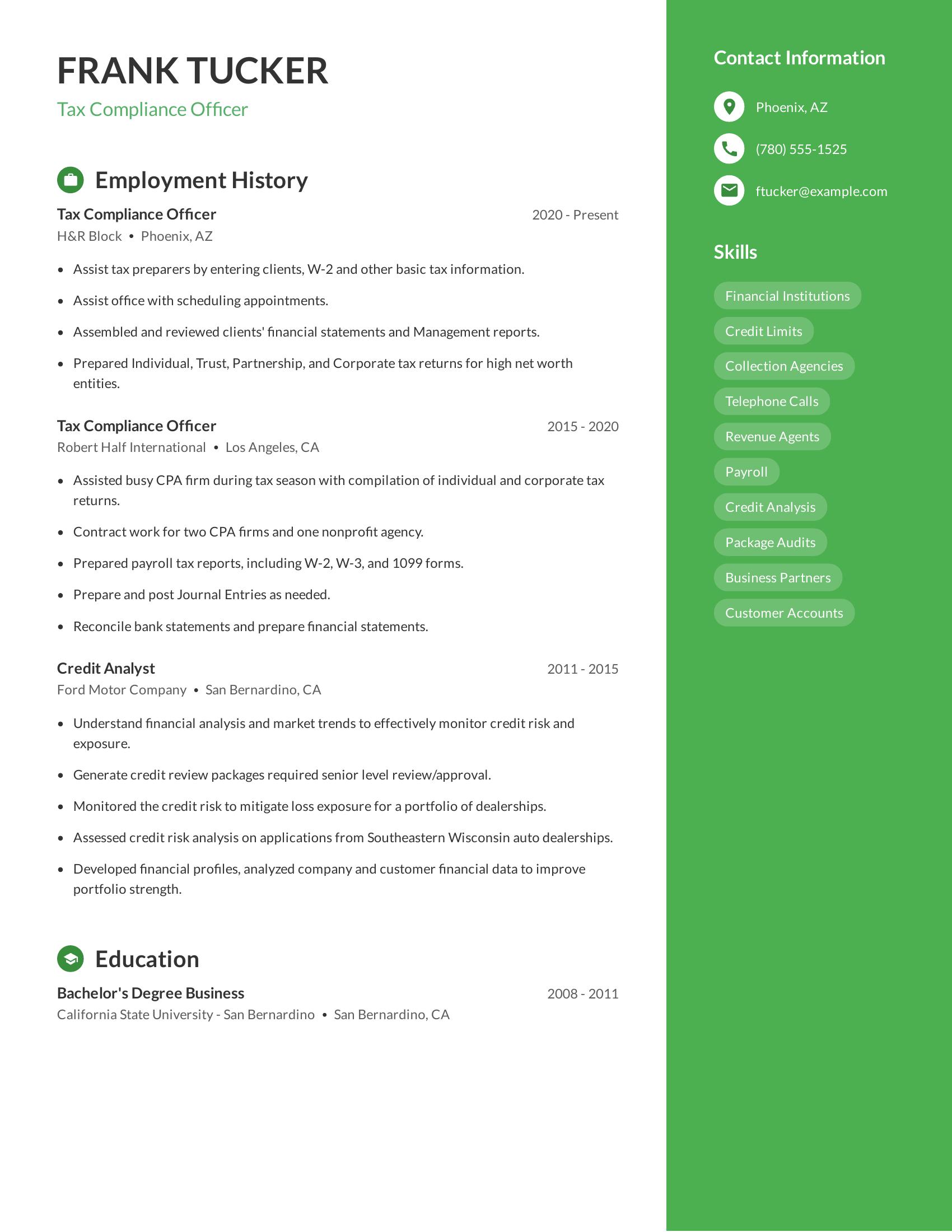

Tax compliance officer resumes should focus on professional experience, educational background, and relevant skills. A good resume highlights a candidate's experience in preparing and reviewing tax returns, financial statements, and payroll reports. It should showcase familiarity with tax laws and regulations. Skills in financial analysis, credit risk assessment, and customer service are also important.

This resume includes relevant job titles and responsibilities, showing the candidate's experience with individual and corporate tax returns. It lists specific tasks like preparing W-2, W-3, and 1099 forms, reconciling bank statements, and posting journal entries. The education section is clear with a business degree that supports the professional experience. Skills are well-documented, covering areas like credit analysis and payroll, which are valuable for a tax compliance officer role.

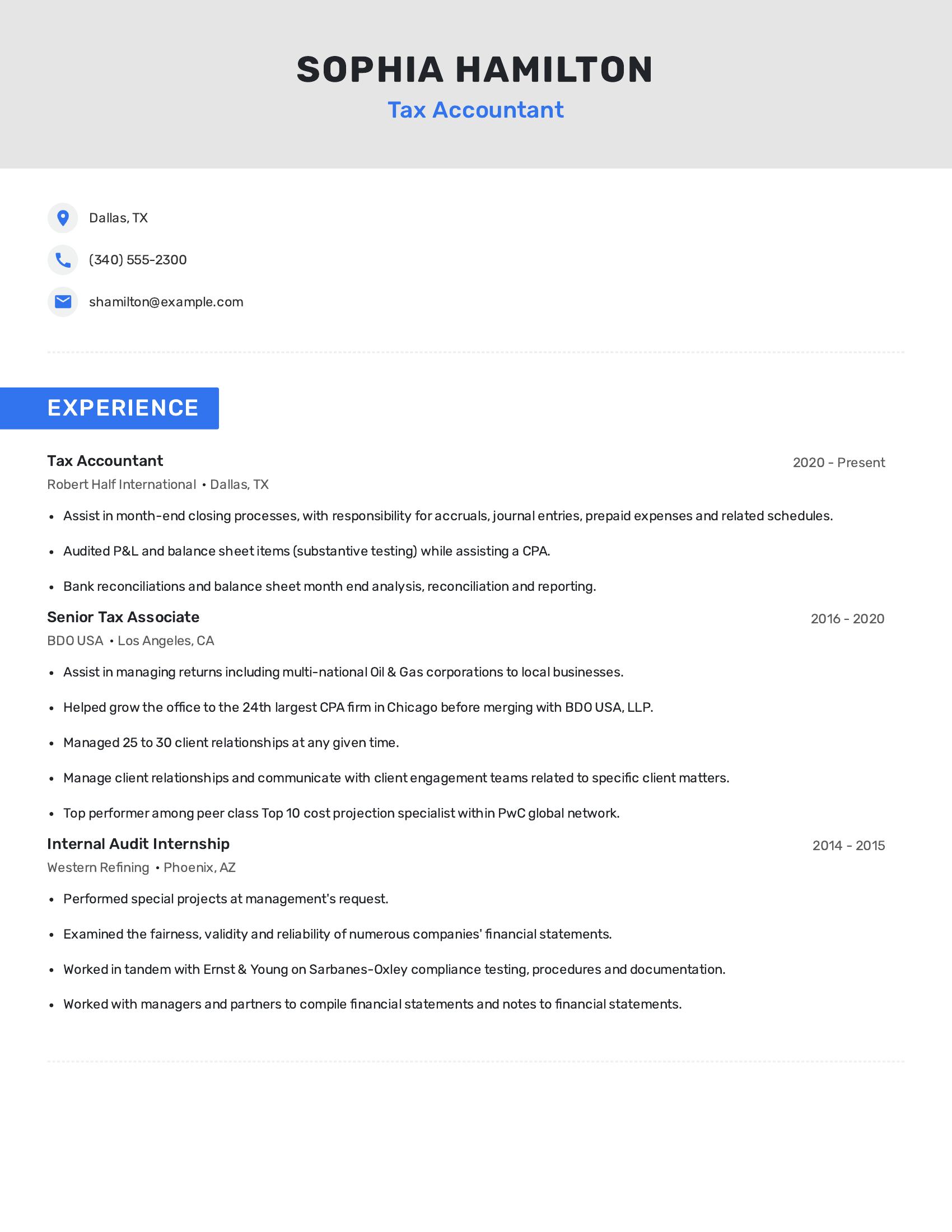

Tax Accountant resumes should highlight relevant experience, technical skills, and professional achievements. Focus on roles that involve financial statement preparation, tax return management, and client relationship management. The resume should also showcase any experience with audits, compliance testing, and project management. Including specific job titles and tenure helps demonstrate a clear career progression.

This resume successfully includes essential elements such as detailed job responsibilities across different positions and companies. It lists specific tasks like month-end closing processes, bank reconciliations, and assisting in audits. The resume also highlights the candidate's experience with multinational corporations and managing multiple client relationships, showing versatility and capability in handling complex tax accounting tasks.

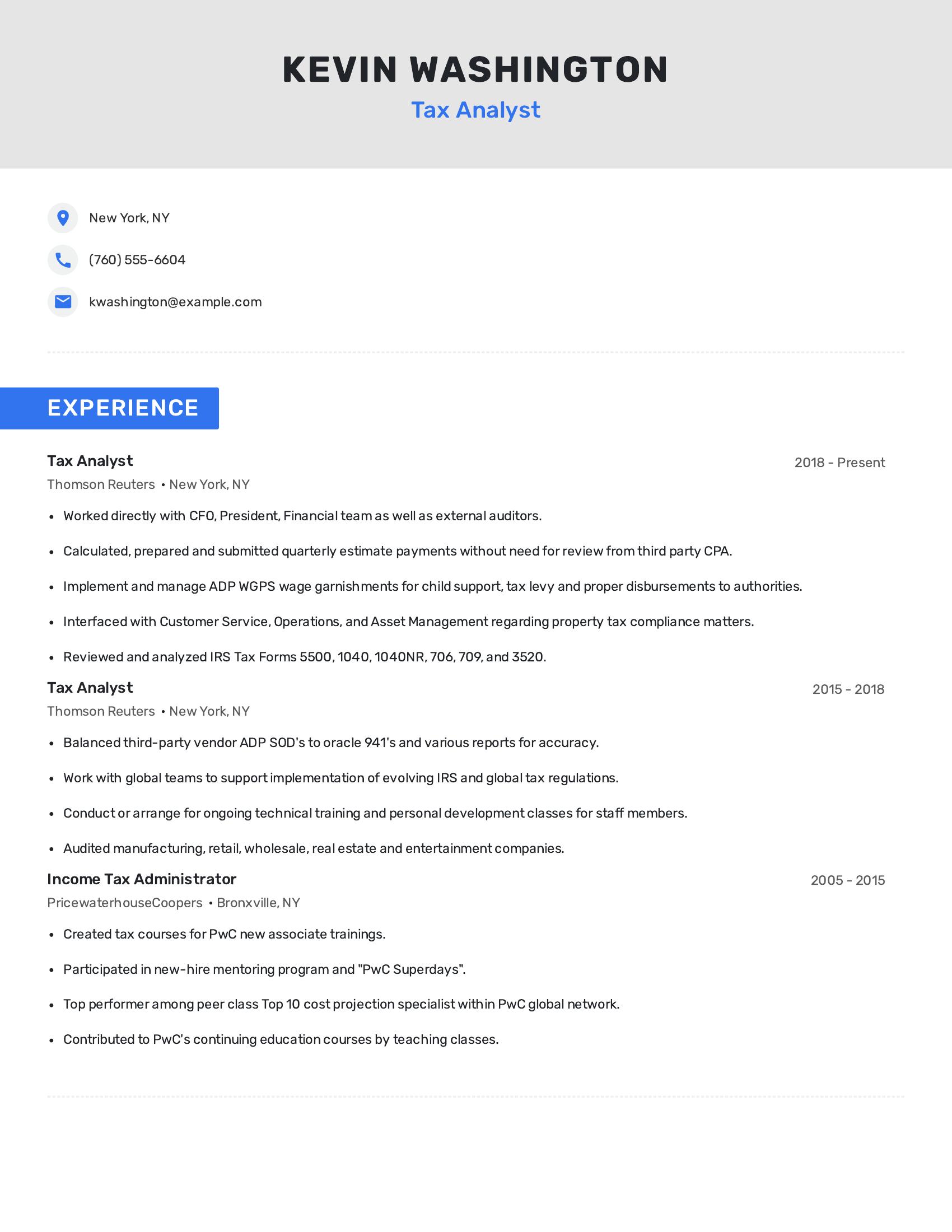

Tax analyst resumes should highlight relevant experience, technical skills, and a strong understanding of tax regulations. Key elements include experience with tax preparation and compliance, familiarity with IRS forms, and the ability to work with financial teams and external auditors. Additionally, showcasing experience with tax software and participation in training or mentoring programs can further strengthen a resume.

This resume effectively includes these elements. It details extensive experience in tax analysis and administration, highlighting direct interaction with senior financial staff and external auditors. The candidate demonstrates proficiency in preparing and submitting tax payments, managing wage garnishments, and reviewing various IRS forms. The resume also emphasizes experience in conducting audits and supporting global tax regulation implementation. Participation in training programs and mentoring shows commitment to professional development.

Highlight relevant certifications. Include certifications like CPA or Enrolled Agent to show you are qualified for tax preparation.

Emphasize experience with tax software. Mention programs like TurboTax or QuickBooks to show you can efficiently handle client tax returns.

Showcase your attention to detail. Provide examples of finding deductions or resolving tax issues to demonstrate your thoroughness in managing client finances.

A tax preparer's resume should highlight their experience, education, certifications, and skills related to tax preparation. Include specific software proficiency and any specialties in tax types. Mention relevant work history with clear job titles and dates. Education should list degrees and institutions. Certifications like CPA or EA are important. Skills should cover tax law knowledge, attention to detail, and client communication.

A tax preparer summary should highlight your experience, skills, and what you bring to the role. Focus on your background in tax preparation and software proficiency.

Keep your summary clear and to the point. Highlight specific skills and accomplishments.

A good tax preparer experience section should be clear and direct. Focus on job duties, accomplishments, and skills. Use action verbs and quantify achievements.

Use these tips to make your experience section stand out. Keep it concise and relevant to the job.

A tax preparer needs to know specific technical skills to do their job well.

A tax preparer also needs good interpersonal skills to interact with clients and colleagues.