16 Personal Banker Resume Examples

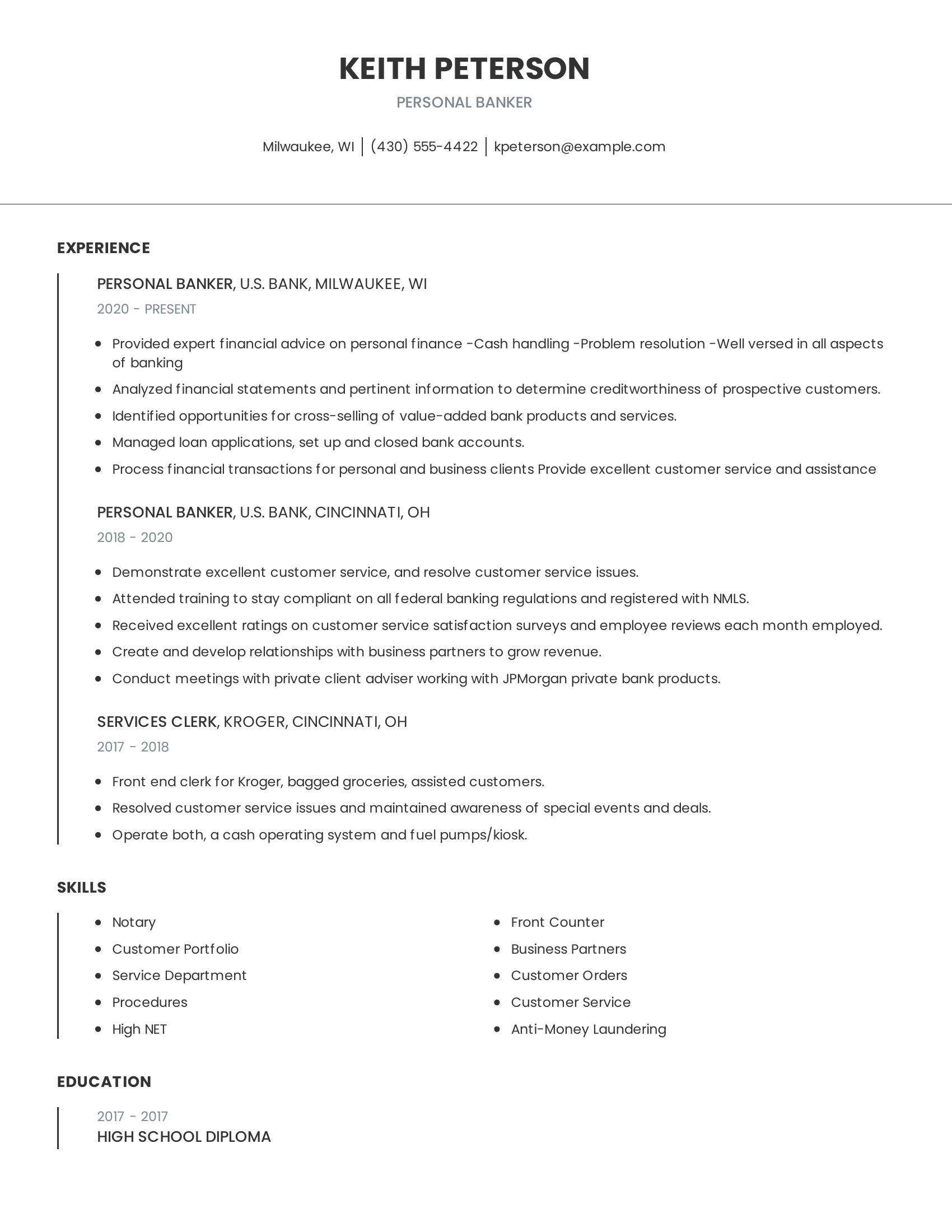

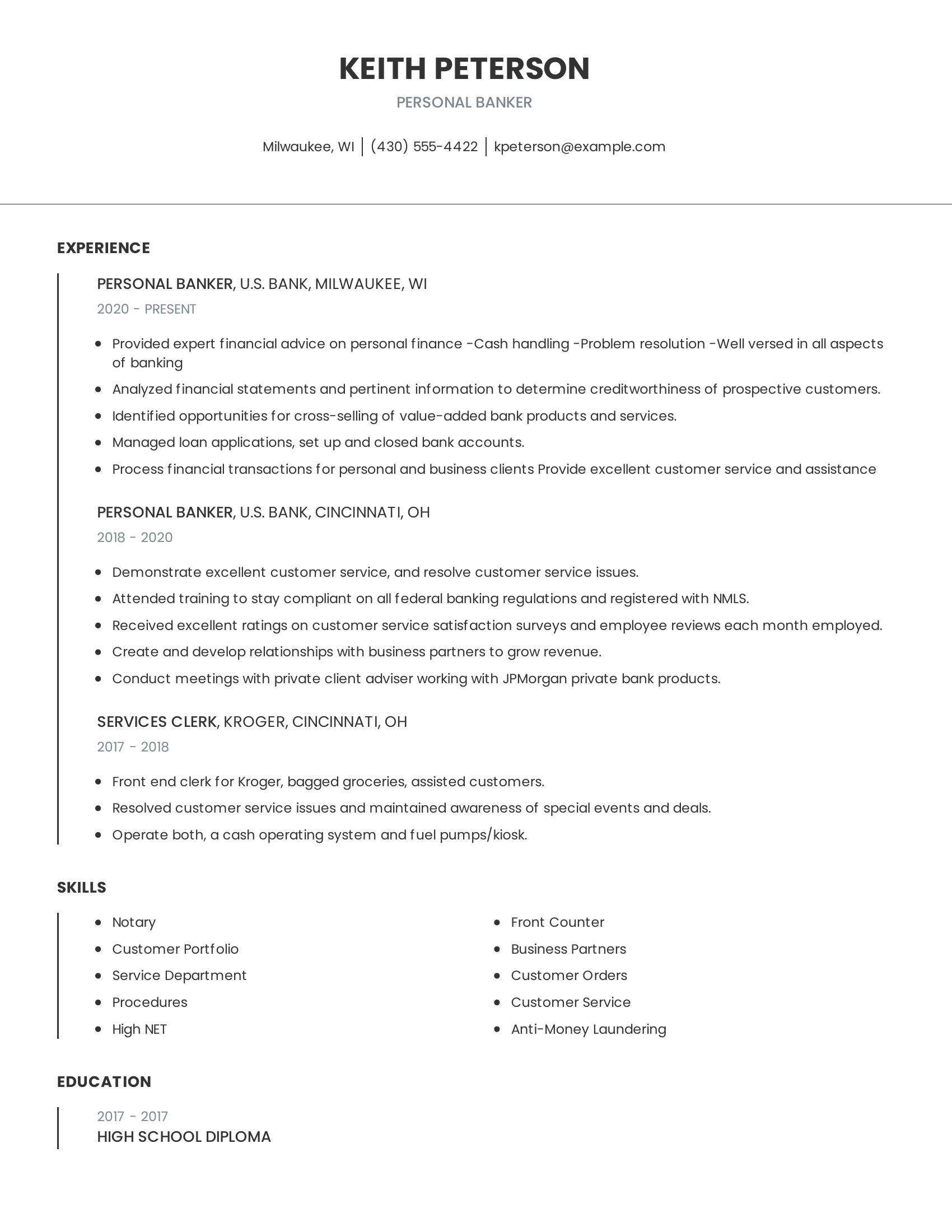

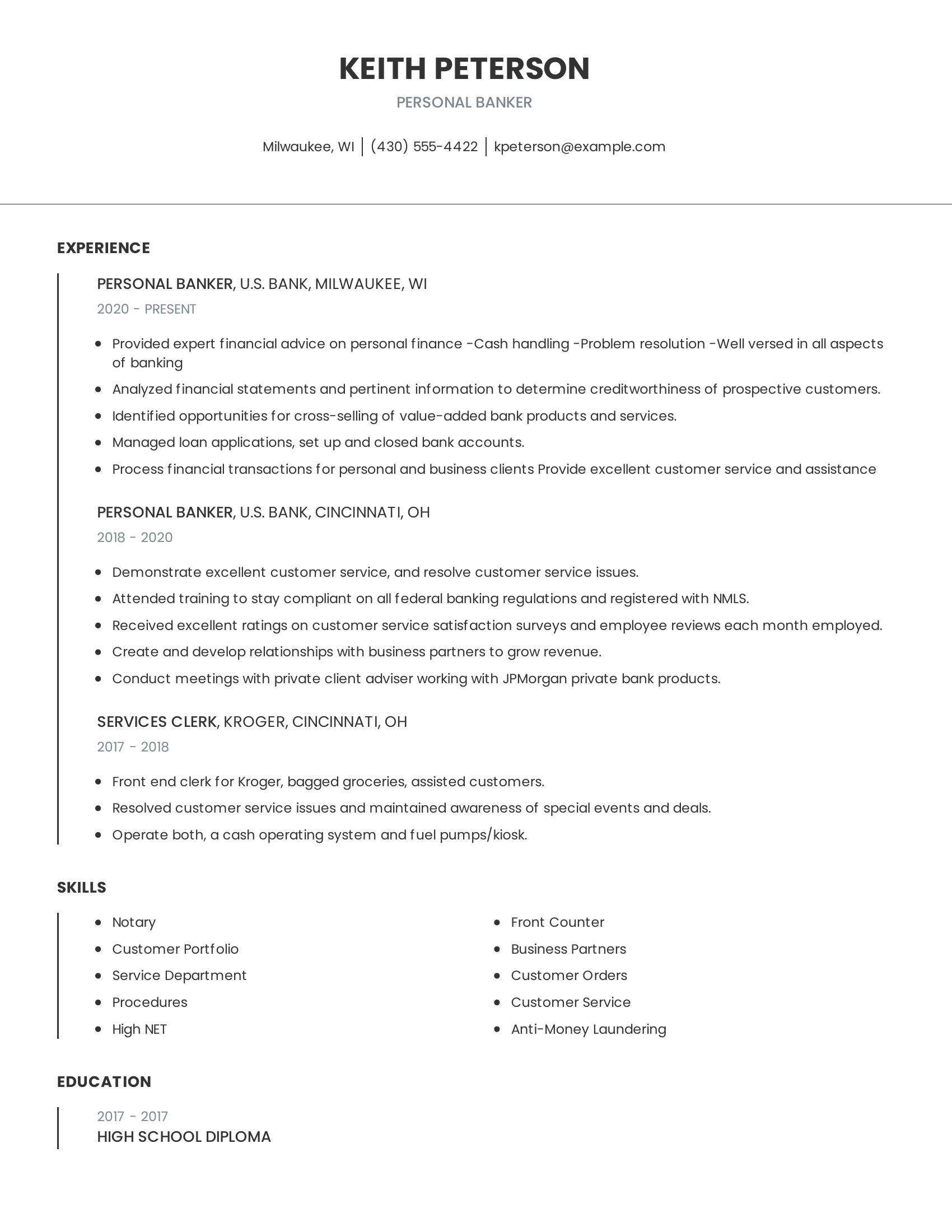

Personal banker resumes should highlight experience in providing financial advice, handling cash, resolving problems, and managing various banking tasks. They should also demonstrate an ability to analyze financial statements, identify cross-selling opportunities, and maintain excellent customer service. Skills relevant to banking like notary services, anti-money laundering procedures, and customer portfolio management should be included. Education and certifications that support the role are also important.

This resume includes all these specifics. It details extensive experience as a personal banker at different locations, emphasizing customer service, financial transaction processing, and problem resolution. It also lists relevant skills and education, demonstrating knowledge in areas such as anti-money laundering and customer service. The inclusion of training and compliance with federal regulations adds to its completeness.

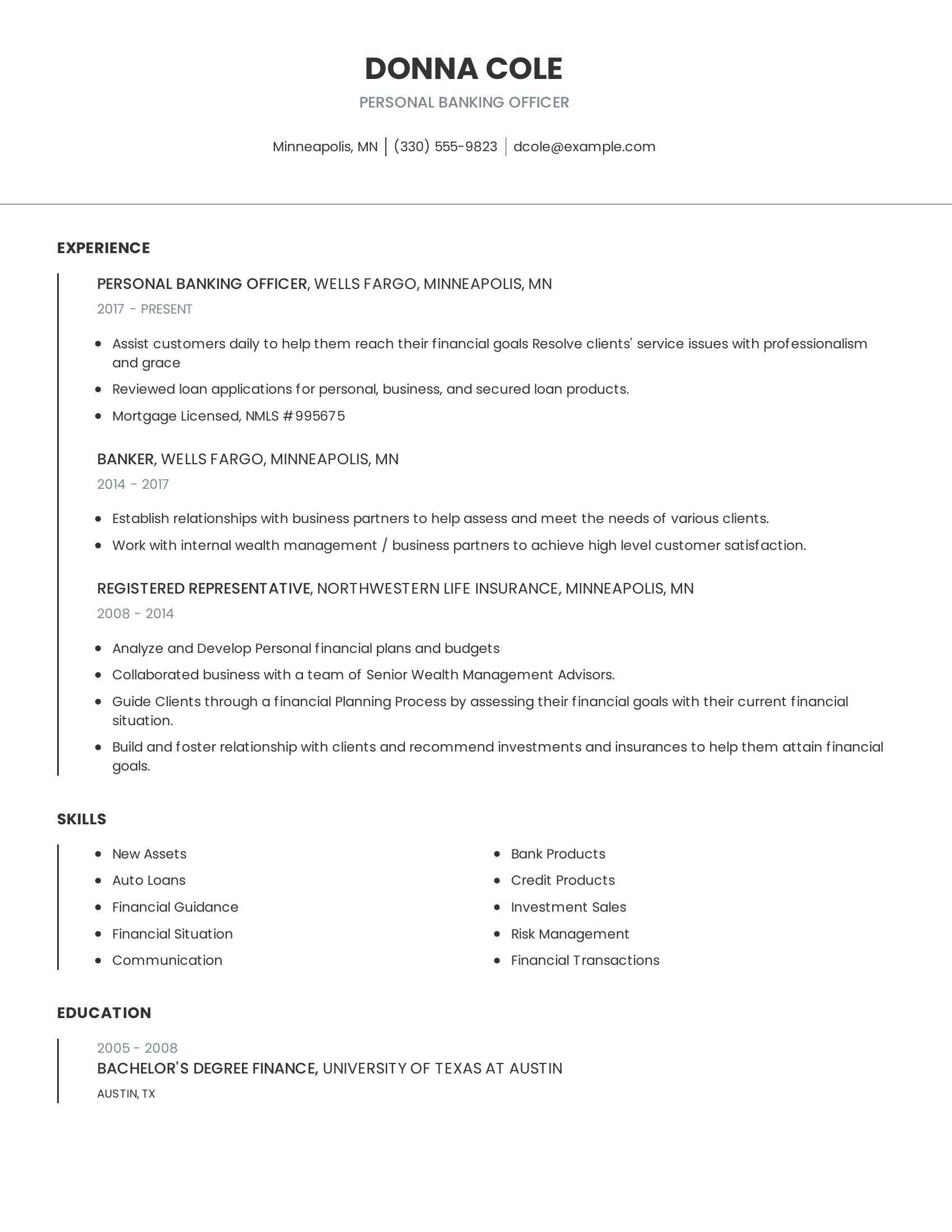

Personal banking officer resumes should highlight customer service skills, financial expertise, and problem-solving abilities. They should include experience with loan applications, relationship management, and financial planning. Relevant certifications or licenses are important, as is a strong educational background in finance.

This resume includes many of these specifics. It lists relevant job titles and responsibilities at different banks, showing a progression in the field. It mentions skills like assisting customers and resolving service issues. The inclusion of a mortgage license and a finance degree adds to its strength. The resume also highlights collaboration with business partners, which is key for customer satisfaction.

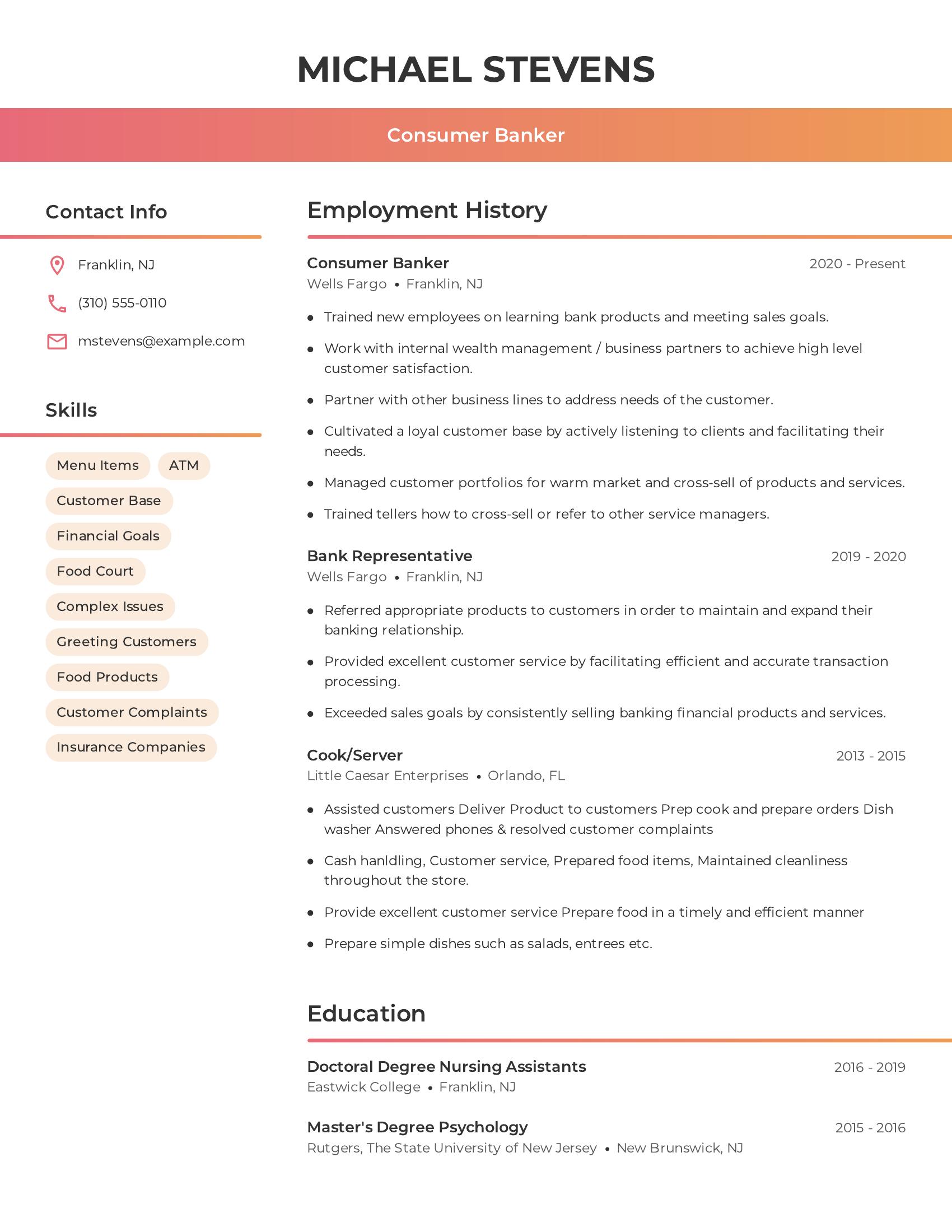

Consumer banker resumes should highlight relevant job experience, educational background, and specific skills related to banking. Important elements include employment history in banking roles, customer service experience, financial product knowledge, and the ability to manage customer relationships. Educational qualifications should be listed with the most recent degree first. Skills like handling complex issues and achieving sales goals are crucial to showcase.

This resume includes a clear job progression from a bank representative to a consumer banker at Wells Fargo, demonstrating relevant experience in the field. It lists an extensive range of skills such as managing customer portfolios, cross-selling products, and resolving customer complaints. The education section shows advanced degrees that complement the job role. Overall, the resume effectively presents qualifications and relevant experience for a consumer banker position.

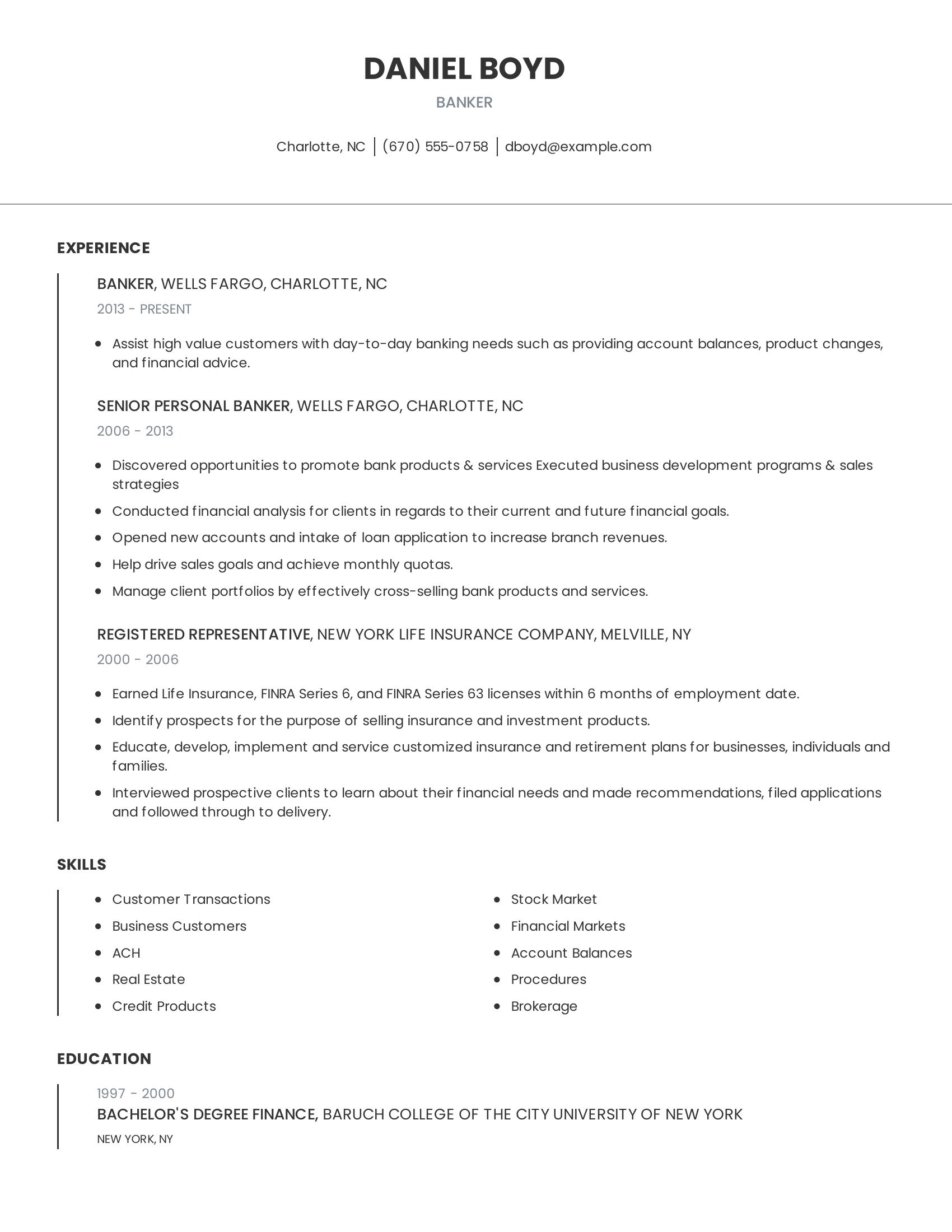

Banker resumes should highlight relevant experience, skills, and education. A good resume features a clear job history, showcasing roles and responsibilities. It benefits from a focus on customer service, sales, and financial expertise. Educational background and certifications should also be included to demonstrate qualifications.

This resume does well in detailing extensive banking experience. It lists specific duties such as assisting customers, promoting products, and managing client portfolios. It includes relevant skills like financial analysis and real estate knowledge. The education section clearly shows a finance degree, enhancing credibility.

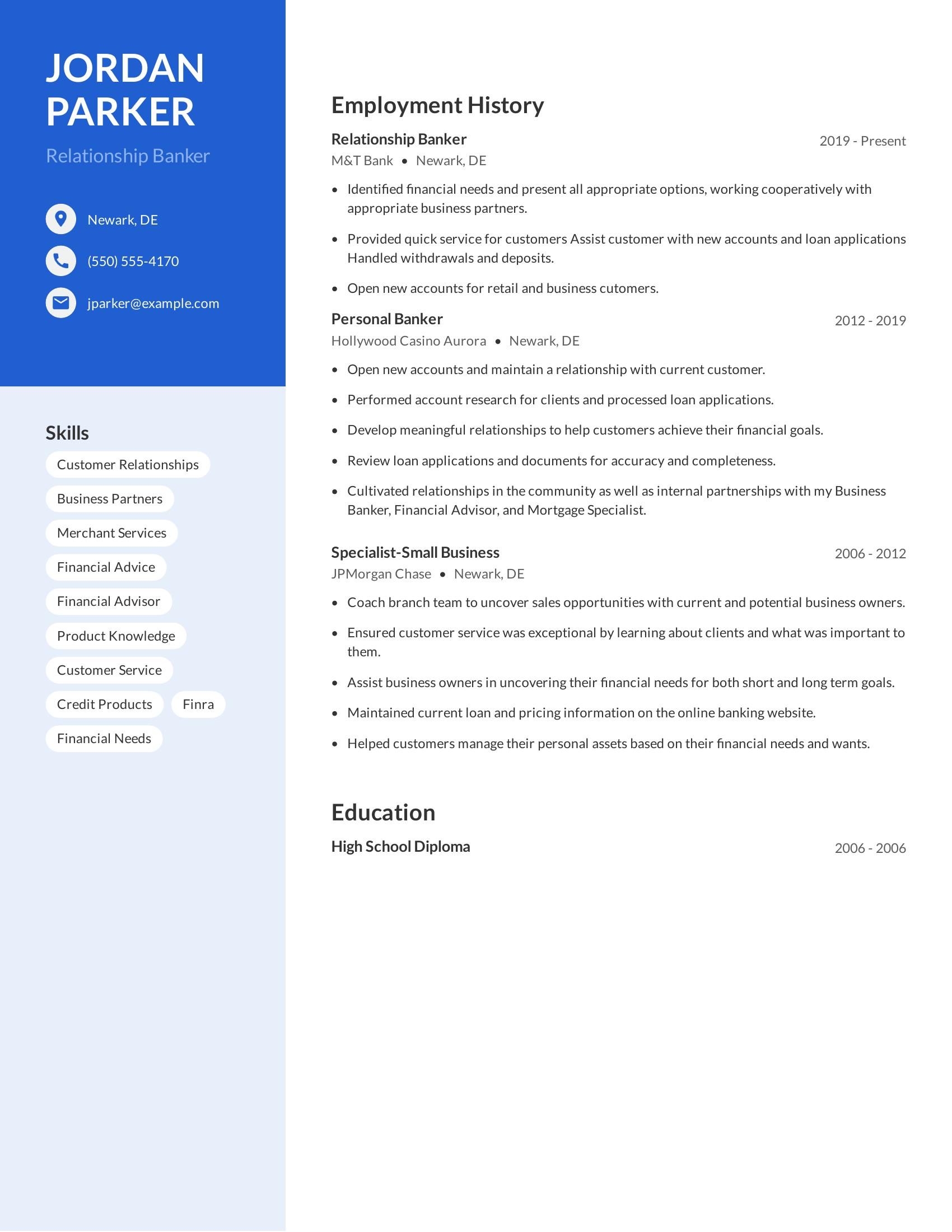

Relationship banker resumes should highlight skills in customer relationships, financial advice, and business partnerships. They should also include a history of employment with specific duties that show experience in handling accounts, providing financial advice, and improving customer satisfaction. Resumes must showcase the candidate's ability to manage and open new accounts, process loan applications, and cultivate relationships both internally and with clients. Education background is also important to show the candidate's foundational knowledge.

This resume includes these specifics by listing skills like customer service, financial advice, and product knowledge. Employment history shows roles at M&T Bank, Hollywood Casino Aurora, and JPMorgan Chase where the candidate identified financial needs, handled accounts, and cultivated relationships. It details tasks such as opening new accounts, processing loan applications, and coaching team members. The resume also includes a high school diploma, which provides a basic educational background.

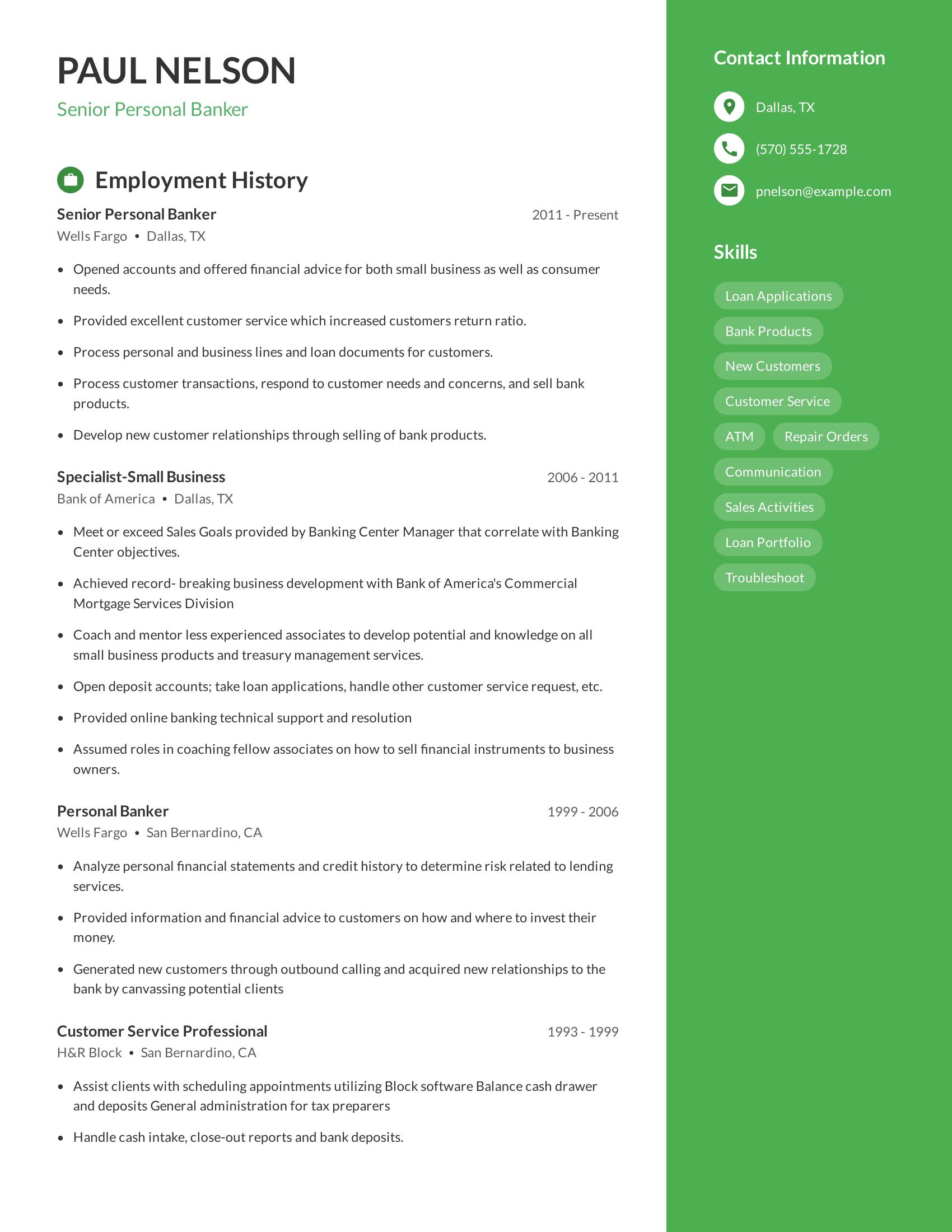

Senior personal banker resumes should highlight experience in customer service, financial advising, and sales within the banking industry. Key elements include a strong employment history with relevant job titles, responsibilities that demonstrate expertise in handling accounts, loans, and customer relations, as well as evidence of sales success and leadership skills. The resume should also list specific skills related to banking operations and customer interactions to showcase the candidate's comprehensive knowledge and capabilities.

This resume includes a detailed employment history with job titles like senior personal banker, specialist-small business, and personal banker, which are relevant to the position. It outlines specific duties such as opening accounts, providing financial advice, processing loans, and developing new customer relationships. The resume also highlights achievements like exceeding sales goals and mentoring less experienced associates. Skills listed are directly related to banking functions, reinforcing the candidate's qualifications.

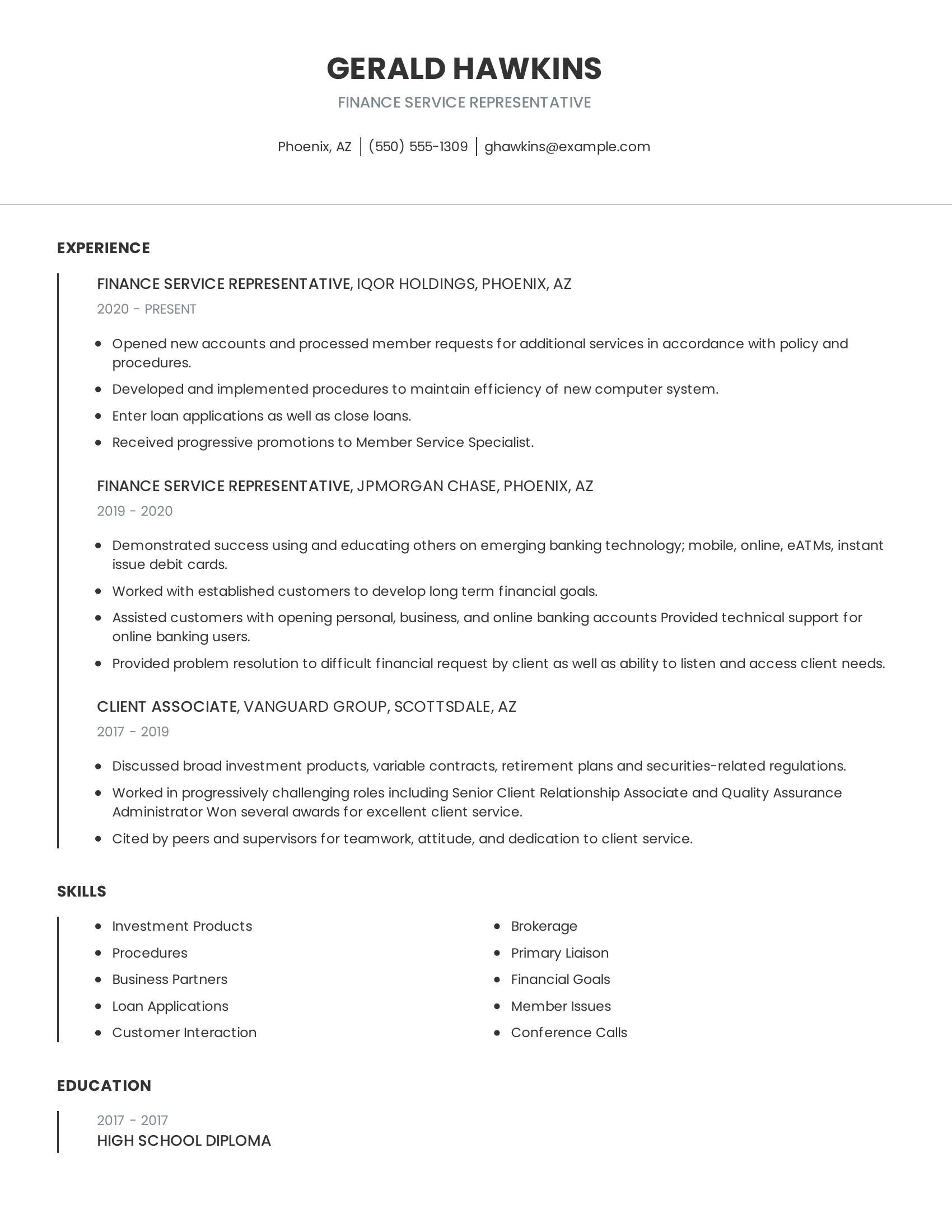

Finance service representative resumes should highlight a candidate's experience in financial services, customer interaction, and technical competencies. The resume should focus on work history, showcasing specific responsibilities and achievements in previous roles. Key skills such as account management, loan processing, problem resolution, and familiarity with financial products are crucial. Education and any relevant certifications should be included as well.

This resume covers essential aspects by detailing the candidate's experience across multiple financial institutions. It lists concrete tasks such as opening accounts, processing loans, and implementing new procedures. The resume also highlights experience with emerging banking technology and problem-solving. Skills like investment knowledge and customer interaction are clearly presented. The education section, while brief, provides necessary background information. Each role shows increasing responsibility and recognition for service excellence.

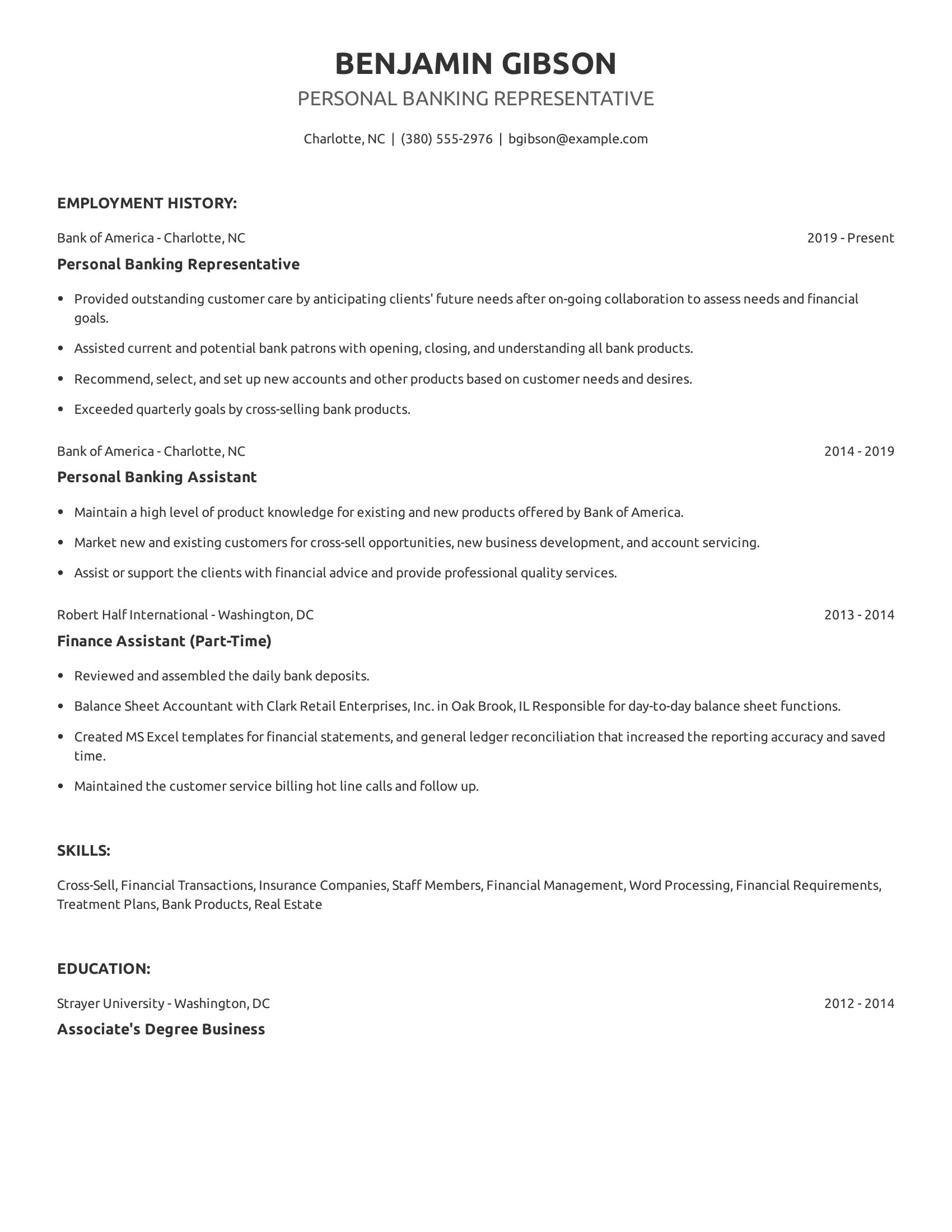

Personal banking representative resumes should highlight customer service skills, financial product knowledge, and sales achievements. They should include previous employment details showing a progression in roles, responsibilities undertaken, and specific accomplishments like meeting sales targets. Mentioning relevant skills and education also strengthens the resume.

This resume includes strong customer service experience, demonstrated through roles at Bank of America. It details tasks like account management, cross-selling products, and providing financial advice. The resume shows a clear career progression from assistant to representative. It also lists an associate's degree in business, which is relevant to the job.

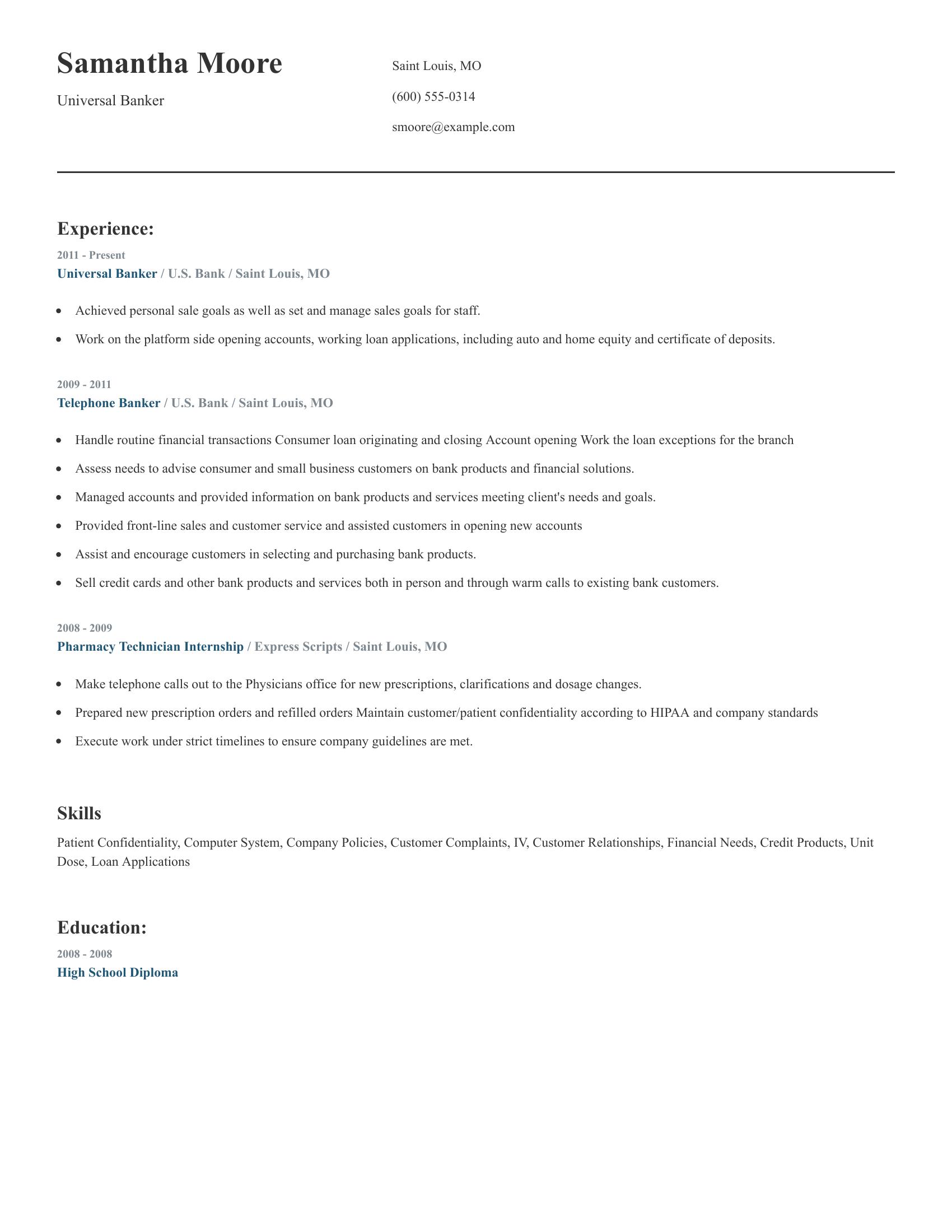

Universal banker resumes should highlight relevant banking experience, customer service skills, and a solid understanding of financial products and services. Key sections include contact information, work experience, skills, and education. Resumes should emphasize achievements in sales, account management, loan processing, and customer relations.

This resume effectively includes detailed work experience, showcasing progressive roles from telephone banker to universal banker. It lists specific duties like achieving sales goals, handling loans, and advising customers on financial products. The skills section highlights necessary competencies such as customer relationships and financial needs assessment. The education section confirms the candidate's background with a high school diploma.

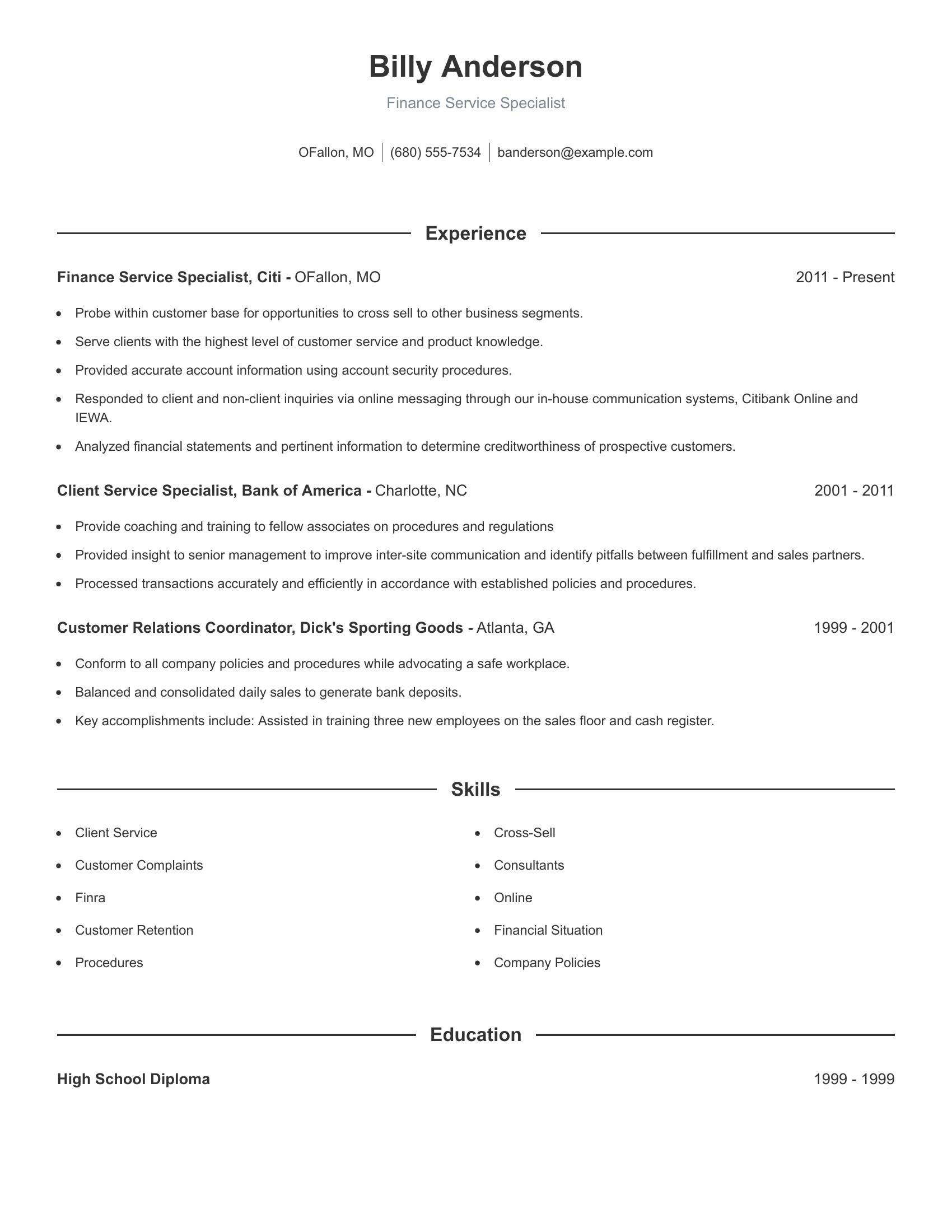

Finance service specialist resumes should emphasize key responsibilities and achievements in financial customer service. Highlighting experience with client interactions, cross-selling financial products, and handling financial statements is important. Including specific roles and contributions, such as training colleagues and improving processes, adds value. Skills in customer retention, understanding financial situations, and familiarity with relevant regulations are crucial.

This resume includes detailed job histories with specific duties like cross-selling, providing account information, and analyzing creditworthiness. It also mentions coaching associates and improving communication processes. The resume lists relevant skills and education, demonstrating a well-rounded background in finance and customer service.

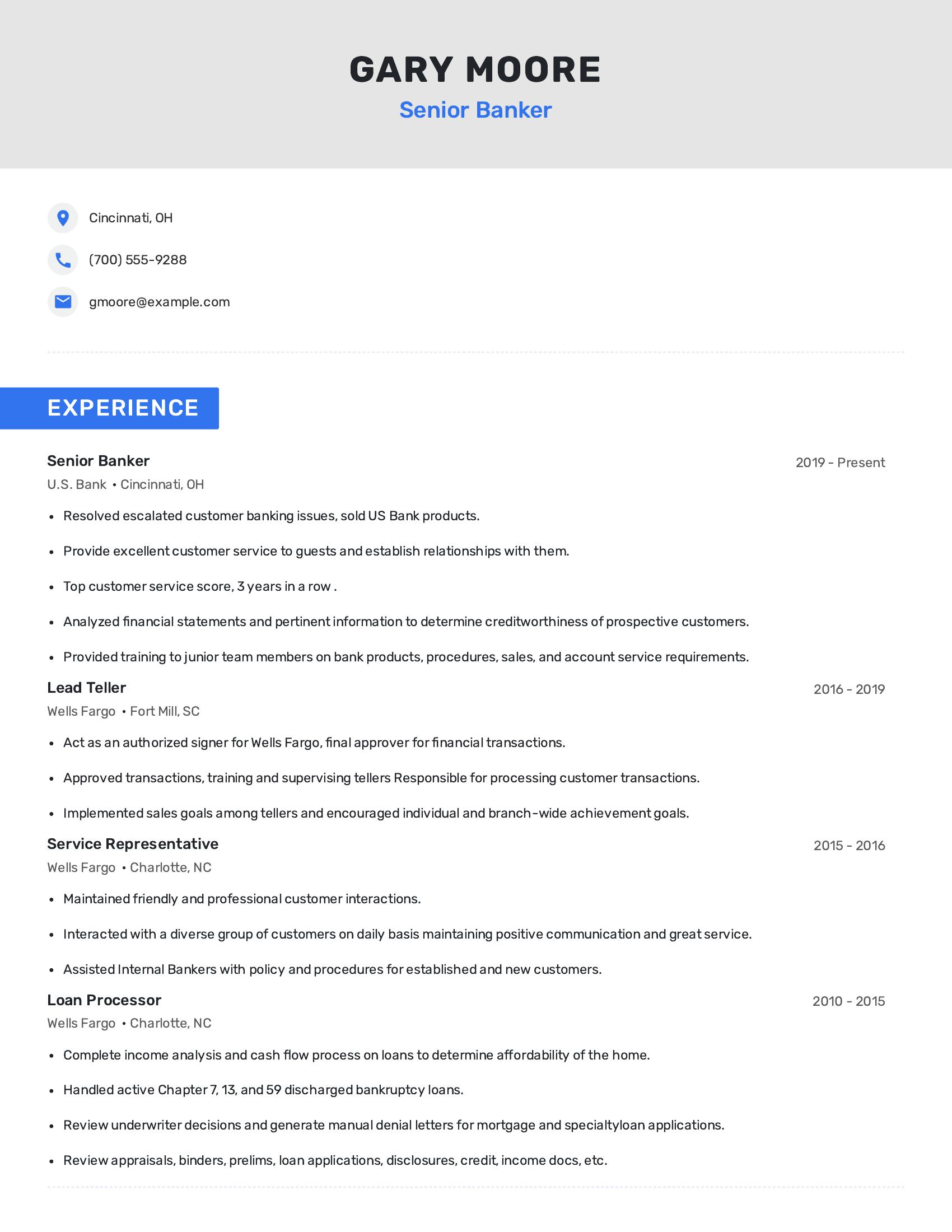

Senior banker resumes should highlight experience in financial analysis, customer service, and team leadership. They must show a strong background in banking operations, sales, and training. Clear examples of problem-solving and handling escalated issues are important. The resume should demonstrate achievements in improving customer service and meeting sales goals. Education and relevant certifications also add value.

This resume includes specifics like resolving customer banking issues and selling bank products, showing expertise in customer service. It highlights top customer service scores for three years, indicating strong performance. Experience in training team members is shown, reflecting leadership skills. The resume details various roles in different banks, showing career progression and diverse responsibilities. This demonstrates a solid foundation in banking operations and financial analysis.

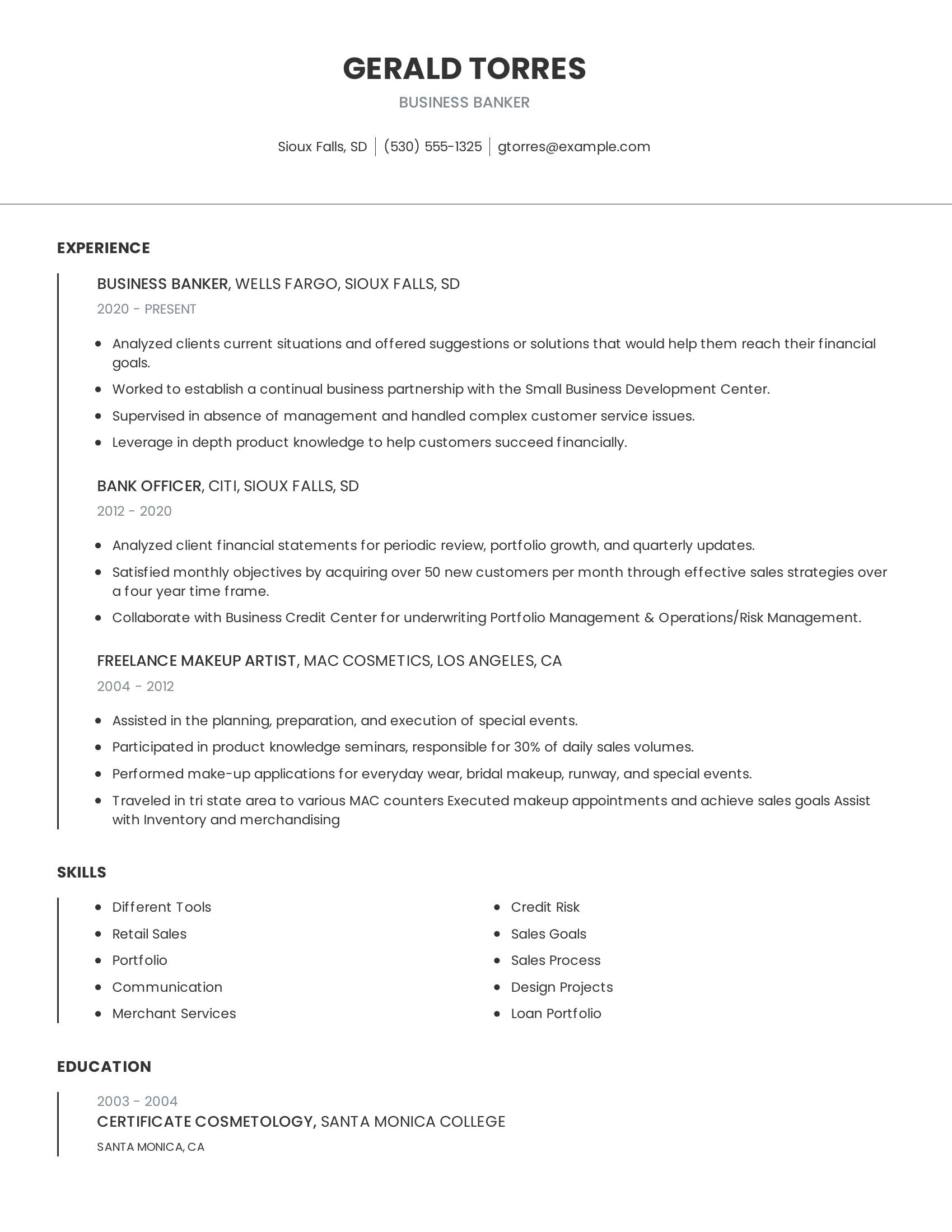

Business banker resumes should highlight experience in client relationship management, financial analysis, sales strategies, and product knowledge. They should also include supervisory roles, collaboration with financial institutions, and a track record of achieving sales goals. A good resume will detail specific responsibilities and achievements in these areas, demonstrating the ability to analyze financial statements and provide solutions to meet clients' financial goals.

This resume includes relevant experience working as a business banker at two major banks. It shows expertise in analyzing client situations, managing customer service issues, and achieving sales objectives. The resume also highlights collaboration with credit centers and supervisory roles. Although there is unrelated work experience as a freelance makeup artist, it still demonstrates skills in sales and customer interaction.

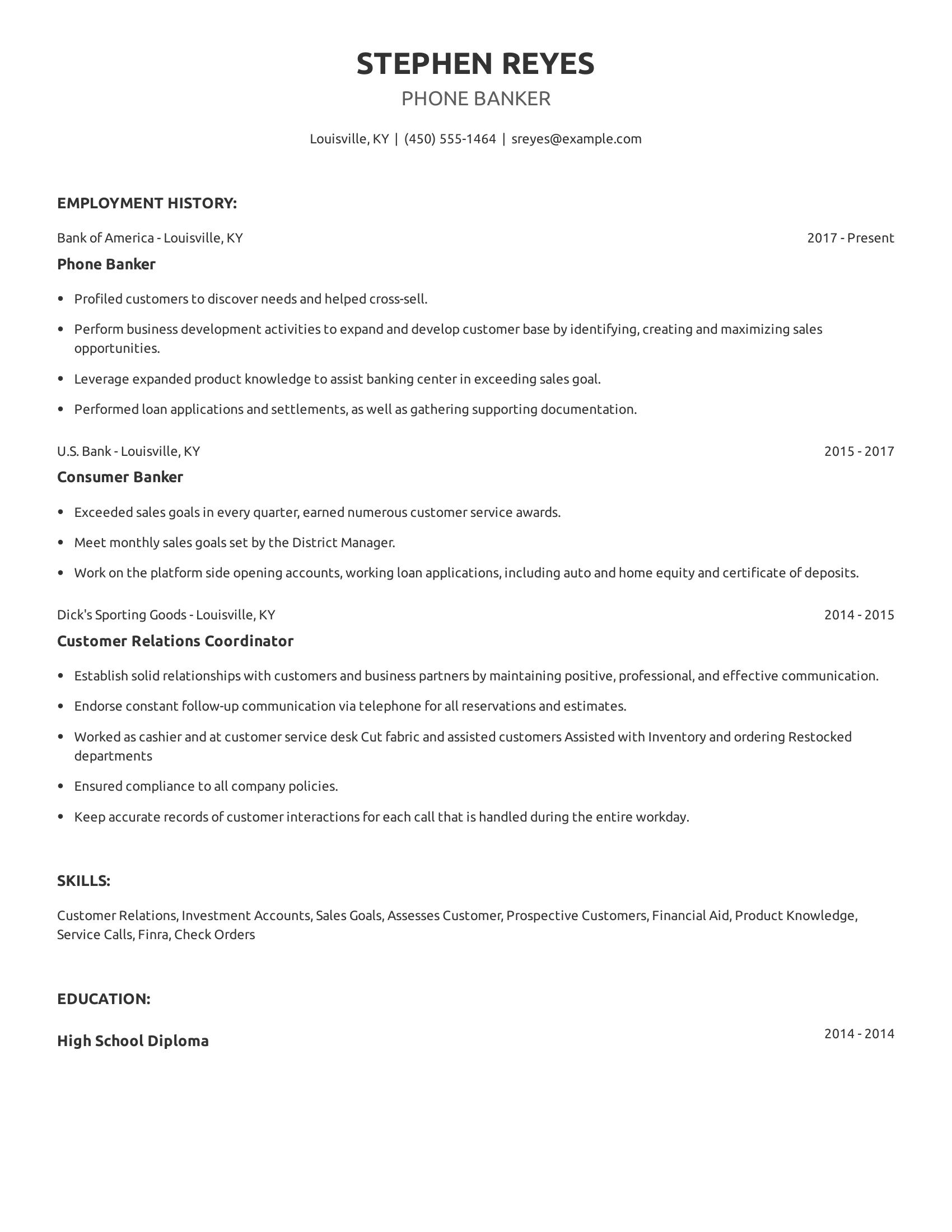

Phone banker resumes should highlight relevant work experience, customer service skills, and sales achievements. It should include job titles, employment dates, and specific duties performed. A good resume also mentions educational background and any relevant skills that demonstrate the ability to perform job tasks effectively. Clear and concise descriptions of responsibilities and accomplishments are crucial.

This resume includes specific job titles and employment dates, clearly showing a career progression in banking and customer service roles. It details responsibilities like profiling customers, performing loan applications, and exceeding sales goals. The resume lists relevant skills such as customer relations and product knowledge, which are important for a phone banker role. The education section is brief but provides necessary information about the candidate's academic background.

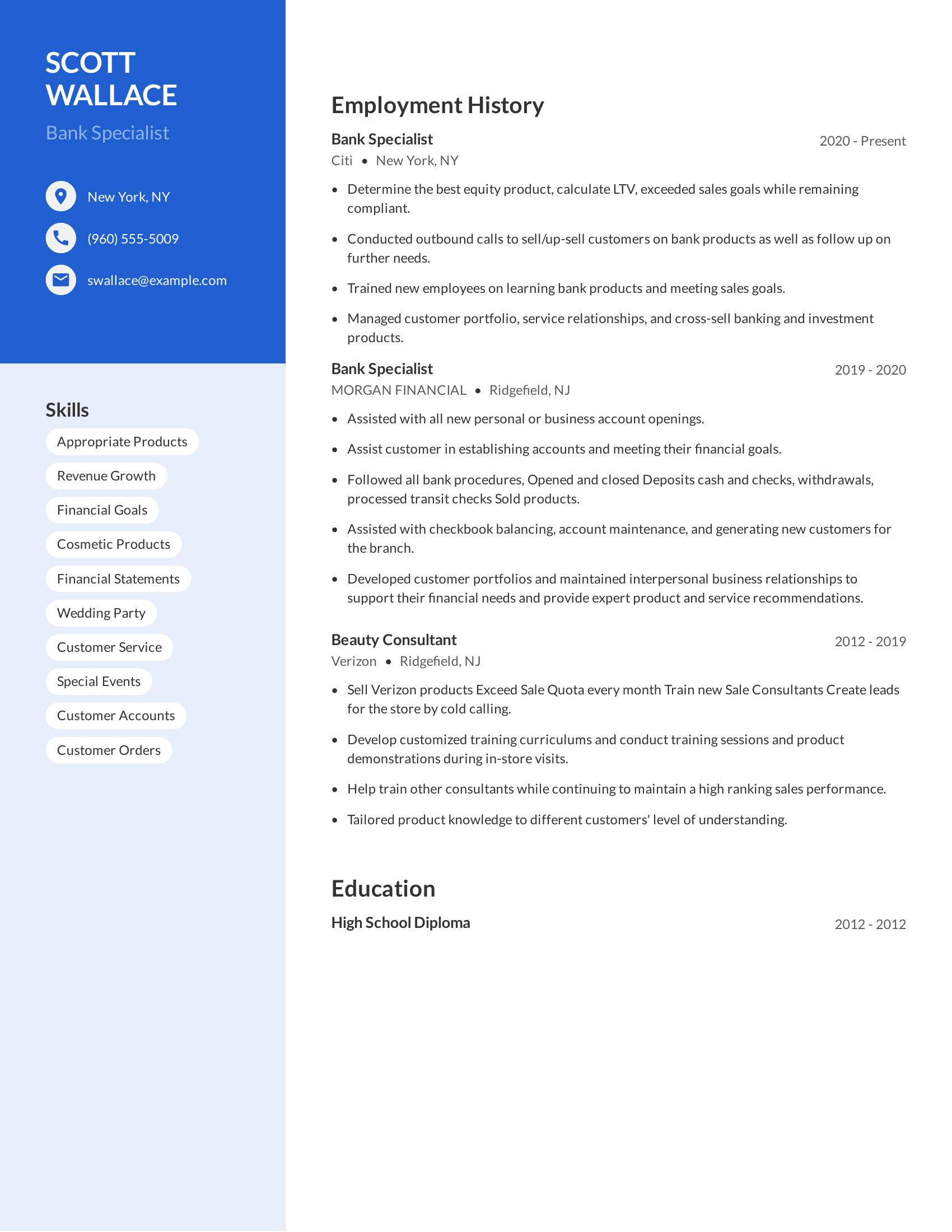

Bank specialist resumes should include details on skills, employment history, and education. Key skills like financial goals, customer service, and product knowledge should be clear. Employment history must show relevant experience, emphasizing achievements like sales goals met and customer relationships managed. Education provides the foundation for the role.

This resume includes specific skills such as appropriate products and revenue growth. It shows relevant work experience with detailed job responsibilities like managing customer portfolios and training new employees. It also highlights a high school diploma, which is basic but necessary educational background. This structure offers a comprehensive view of the candidate’s qualifications.

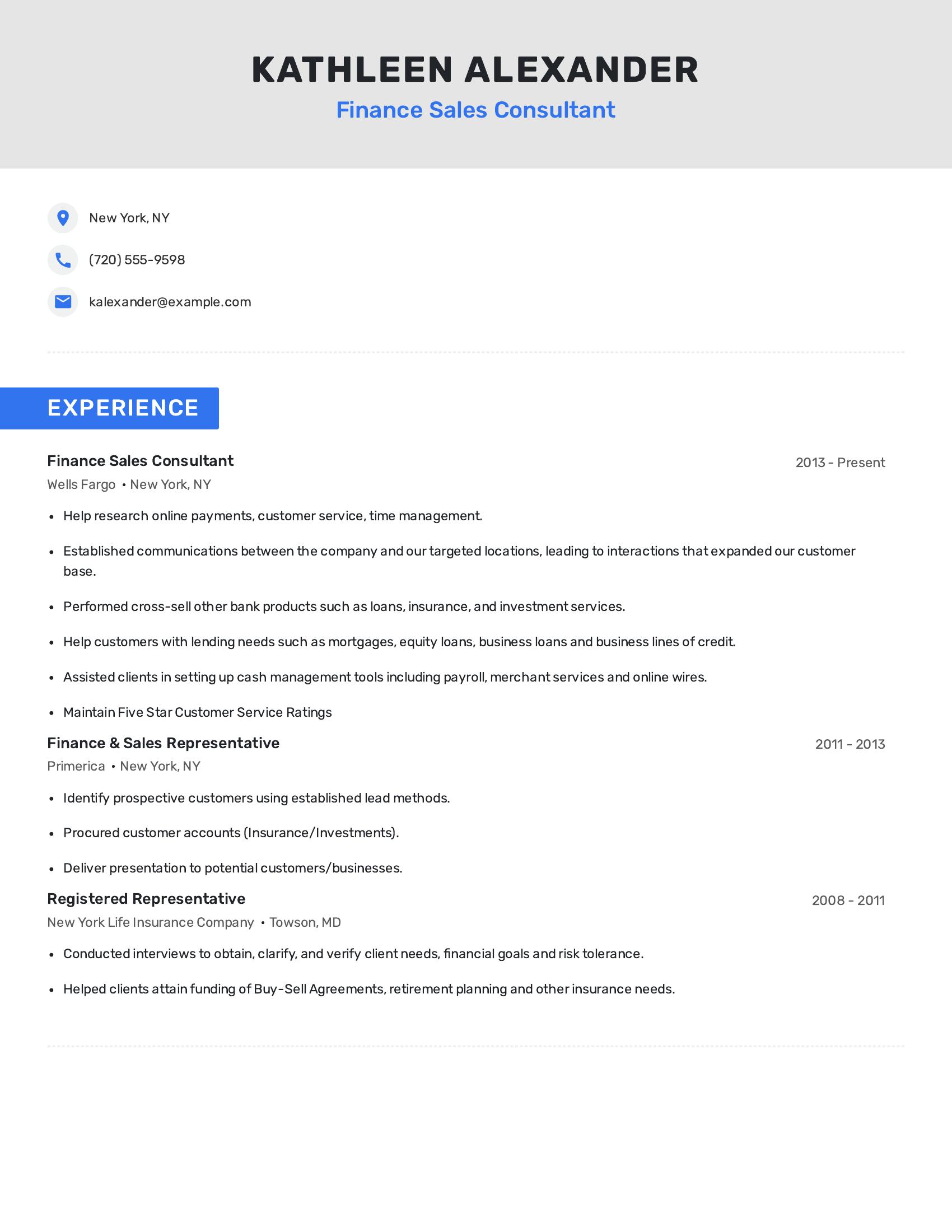

A finance sales consultant resume should highlight a candidate's ability to drive sales and manage client relationships within the financial sector. It should include job titles, dates of employment, and specific responsibilities that showcase expertise in financial products and services. The resume must also detail accomplishments in sales, customer service, and account management, demonstrating the applicant's ability to meet client needs and contribute to business growth.

This resume includes specific job titles such as finance sales consultant, finance & sales representative, and registered representative, along with employment dates and locations. It details responsibilities like researching online payments, cross-selling bank products, and helping customers with loans. The resume also highlights achievements in customer service ratings and expanding the customer base through targeted communications. This information clearly showcases the candidate’s skills and experience in the financial sector.

Telephone banker resumes should highlight experience in customer service, financial transactions, and product promotion. They must showcase skills in handling customer requests, balancing accounts, and adhering to federal regulations. A good resume includes clear job titles, employment history, relevant skills, and education details.

This resume effectively lists relevant job experiences such as promoting bank products, balancing ATMs, and handling loan applications. It also details skills like working with new tellers and managing customer transactions. The education section provides necessary qualification information, making it a well-rounded resume despite formatting issues.

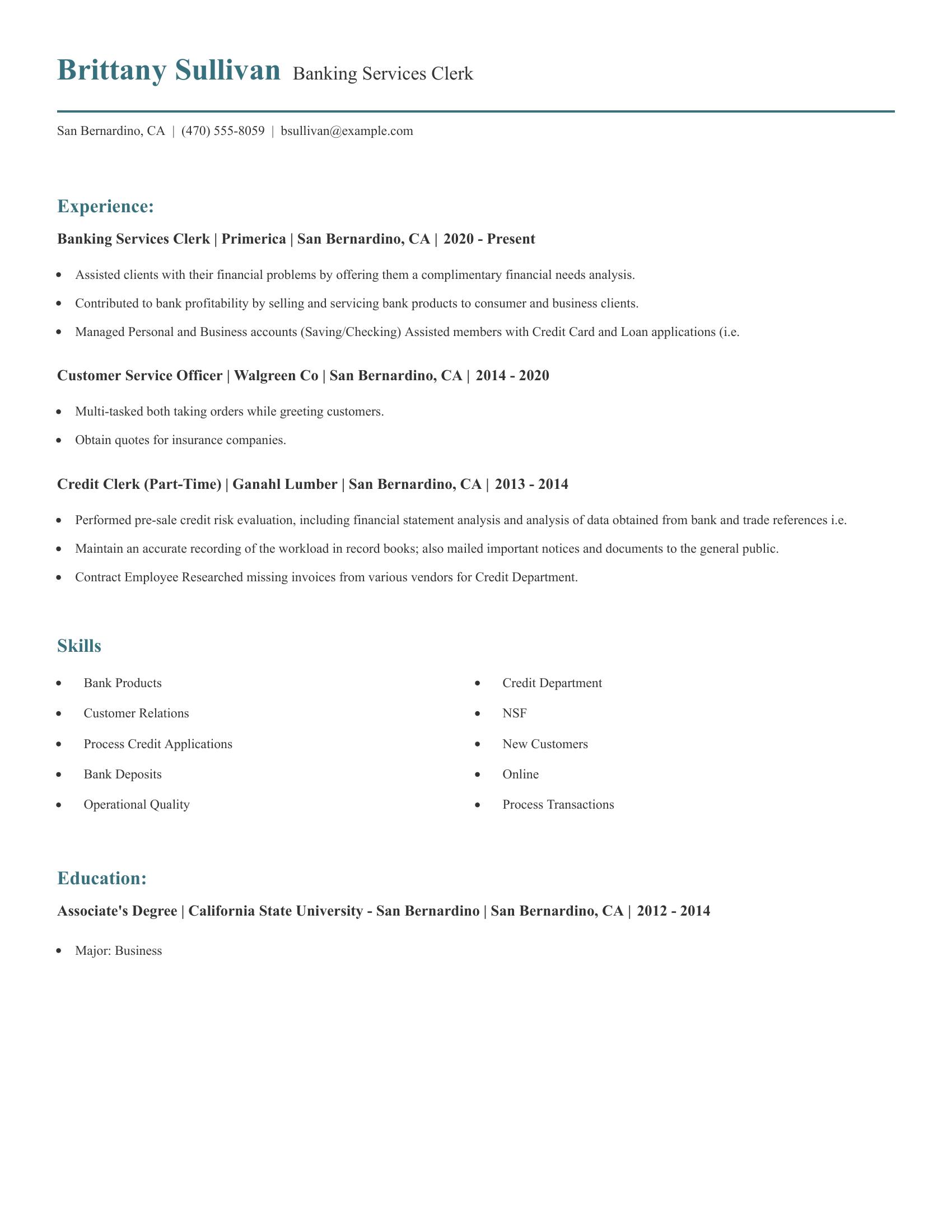

Banking services clerk resumes should highlight relevant experience, skills, and education. They should show a strong background in customer service, financial product knowledge, and account management. Important sections include job experience with clear duties, specific skills related to banking tasks, and educational background in business or finance.

This resume includes specific job experiences that show a history of customer service and financial responsibilities. It details roles like managing accounts, assisting with credit card and loan applications, and performing credit risk evaluations. The skills section lists relevant abilities such as processing credit applications and handling bank deposits. The education section shows a degree in business, which supports the applicant's qualifications for the role.

Highlight relevant skills. Showcase skills like customer service, sales experience, and financial product knowledge. Mention specific software like Microsoft Excel or CRM systems you have used.

Quantify achievements. Use numbers to show your impact. Example. "Increased loan sales by 20% in six months" or "Managed a portfolio of 150 clients."

Tailor your resume. Customize your resume for each job application. Include keywords from the job description like "client relationship management" or "cross-selling financial products."

A personal banker's resume should highlight relevant experience, skills in customer service, and knowledge of banking products. Include contact information, a summary, work experience, education, and relevant skills. Quantify achievements to show impact.

A well-written personal banker summary should highlight your experience, skills, and customer service abilities. It should be concise and focused on your ability to help clients with their banking needs.

Keep it short and relevant to the job. Use bullet points to emphasize key aspects of your experience and skills. Make sure you tailor the summary to the job description.

A well-written personal banker experience section should highlight specific duties and achievements that show your skills and contributions. Focus on quantifiable results and customer service excellence.

To make your experience section stand out, use these tips and best practices. Be clear and concise while focusing on achievements.

A personal banker needs specific technical skills to perform their job effectively.

A personal banker also requires certain interpersonal skills to interact well with clients and colleagues.