17 Loan Processor Resume Examples

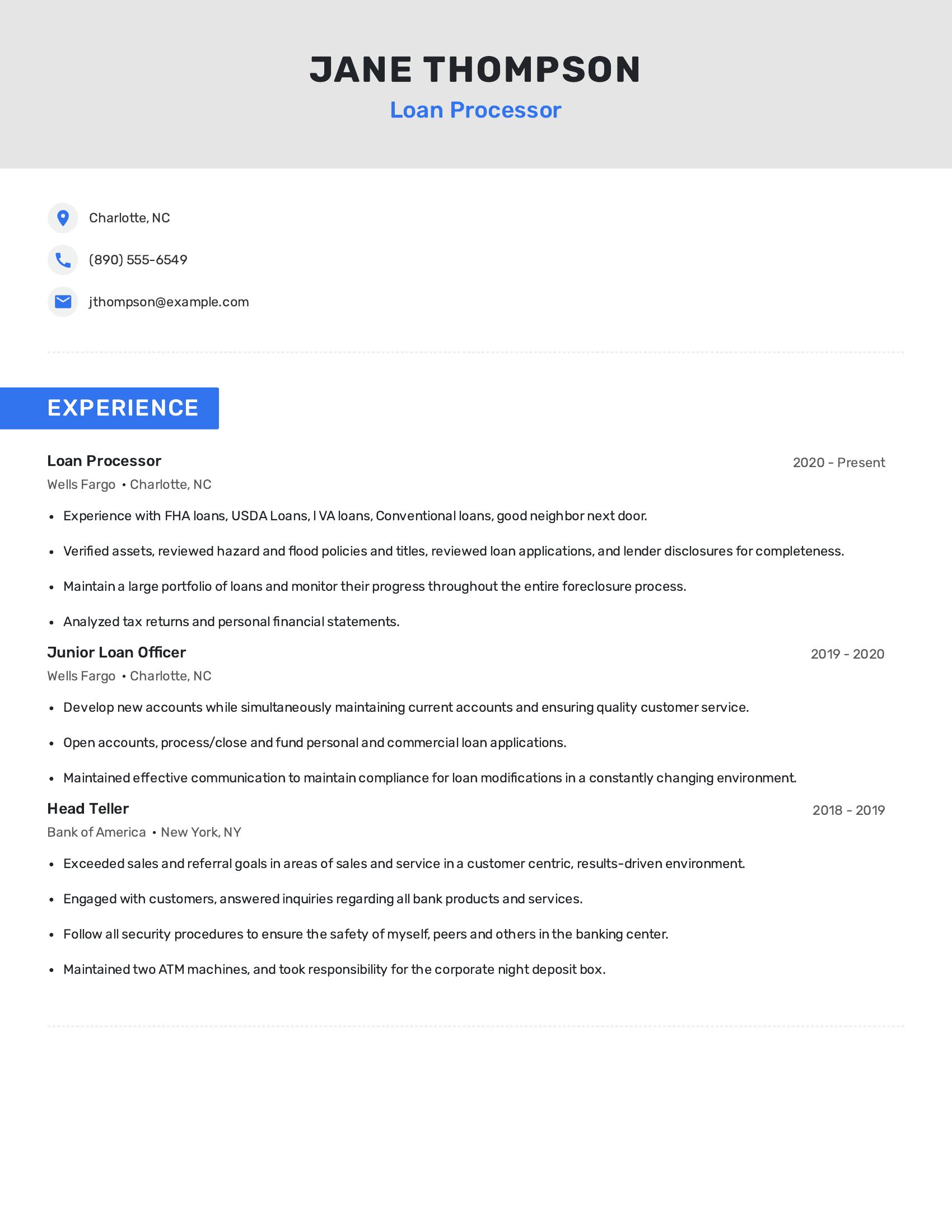

Loan processor resumes should highlight relevant experience, specific loan types handled, and key responsibilities undertaken. It should include job titles, dates of employment, and the names of the companies. Clear descriptions of duties, such as verifying assets, analyzing financial statements, and maintaining loan portfolios, are essential. Demonstrating experience with different loan products and showcasing effective communication skills are also important.

This resume effectively includes these specifics by detailing the candidate's experience with various loan types like FHA, USDA, VA, and conventional loans. It lists clear responsibilities such as verifying assets and reviewing loan applications. The resume also highlights a progression in roles from junior loan officer to loan processor and includes relevant duties at each position. This shows the candidate's growth and depth of experience in the financial sector.

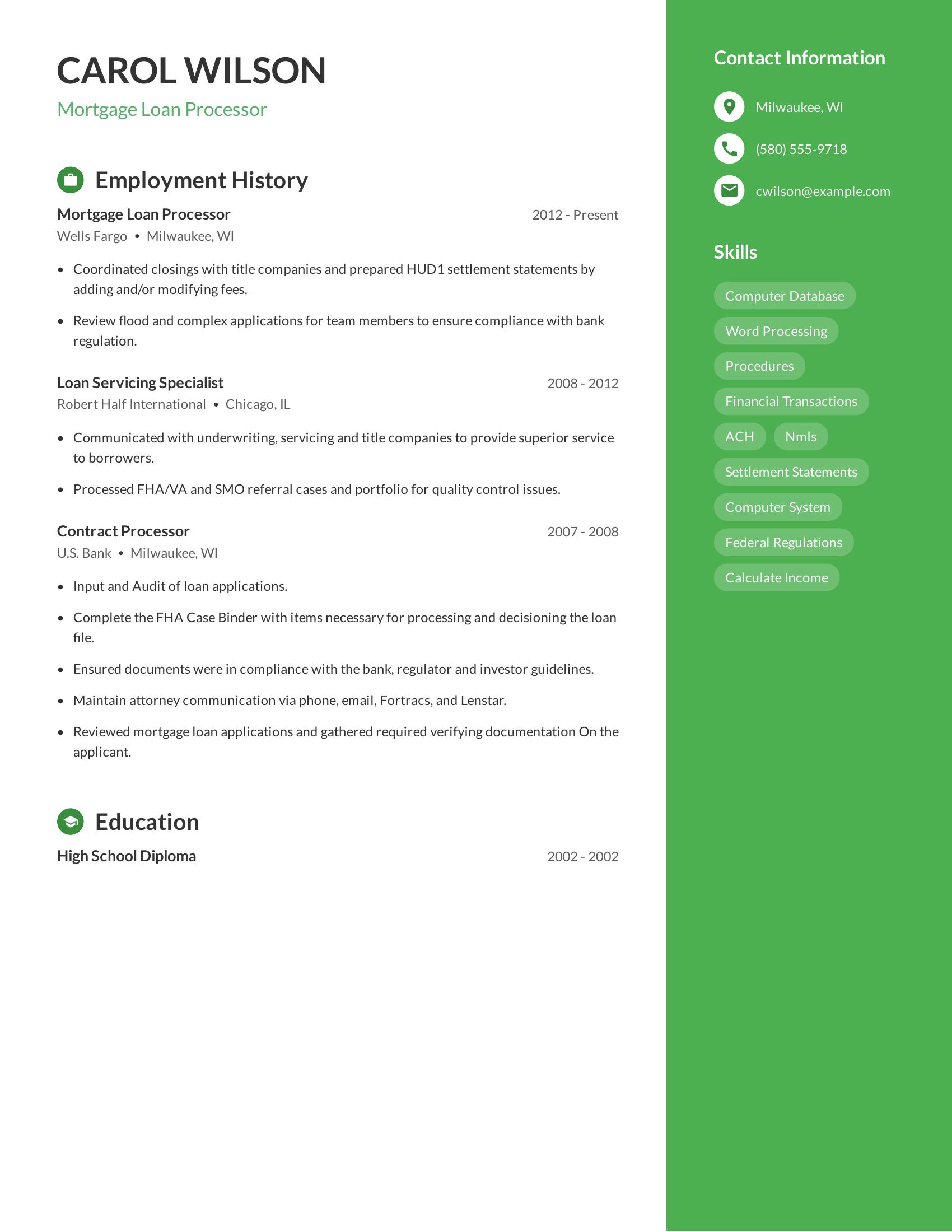

Mortgage loan processor resumes should highlight relevant work experience, education, and technical skills. Key aspects include job titles, durations of employment, and specific duties performed to show expertise in the field. The resume should also list relevant skills such as familiarity with federal regulations, proficiency with financial transactions, and experience with settlement statements. Clear contact information is essential for potential employers to reach the candidate.

This resume includes detailed employment history with specific roles and responsibilities at each job. It highlights relevant tasks like coordinating closings, processing FHA/VA cases, and ensuring compliance with regulatory guidelines. The resume also lists pertinent skills such as computer database management and knowledge of federal regulations. The inclusion of a high school diploma and clear contact information makes this resume comprehensive and functional.

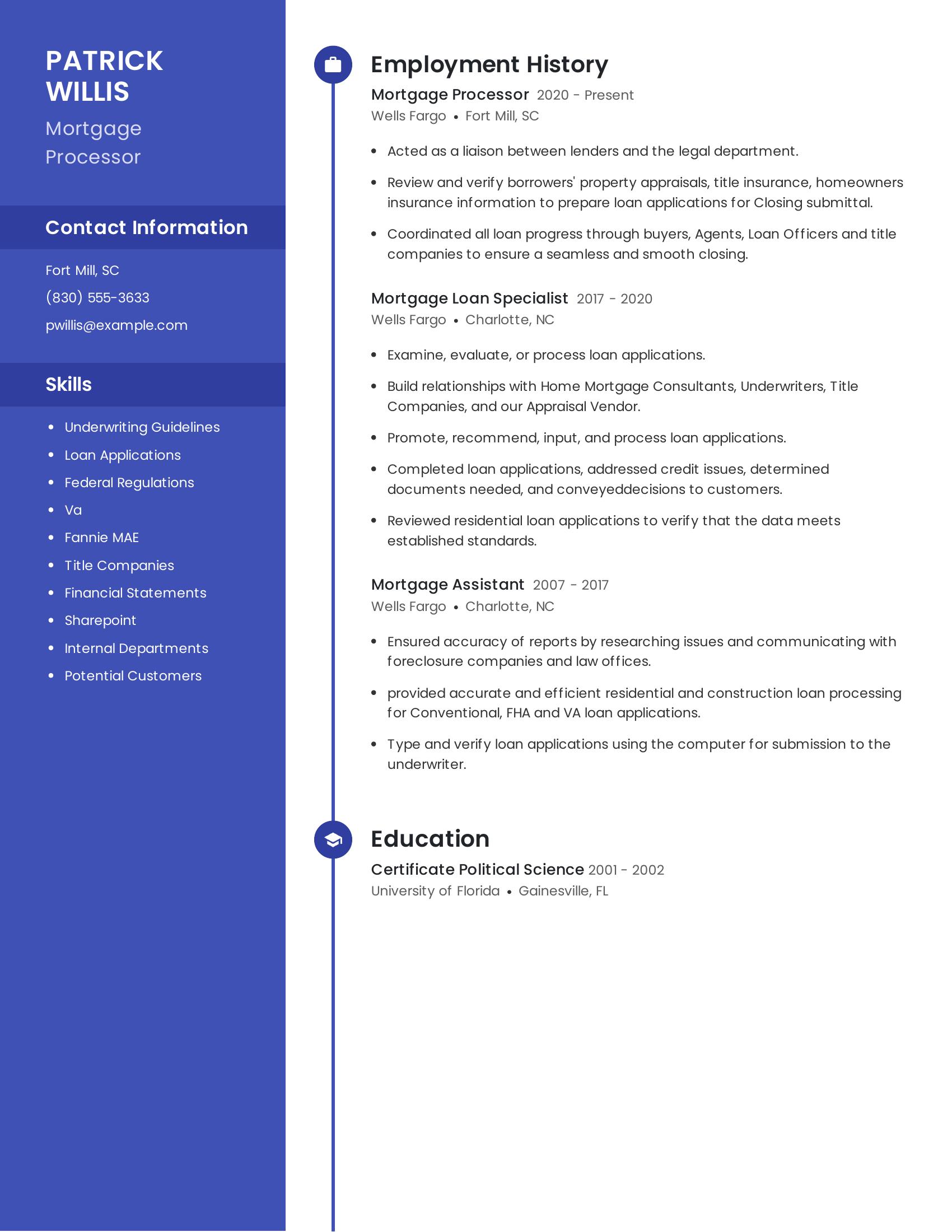

Mortgage processor resumes should highlight relevant skills, employment history, and education. Important skills include knowledge of underwriting guidelines, federal regulations, and experience with loan applications. The employment history should detail roles and responsibilities that demonstrate the candidate’s ability to process loans, coordinate with other departments, and ensure smooth closings. Education should be listed to show any relevant coursework or certifications.

This resume includes specifics like skills in underwriting guidelines and federal regulations and experience with VA and Fannie Mae loans. The employment history shows a progression from mortgage assistant to mortgage processor with detailed responsibilities like acting as a liaison between lenders and legal departments and coordinating loan progress. The education section lists a certificate in political science, which may support communication and analytical skills useful in mortgage processing.

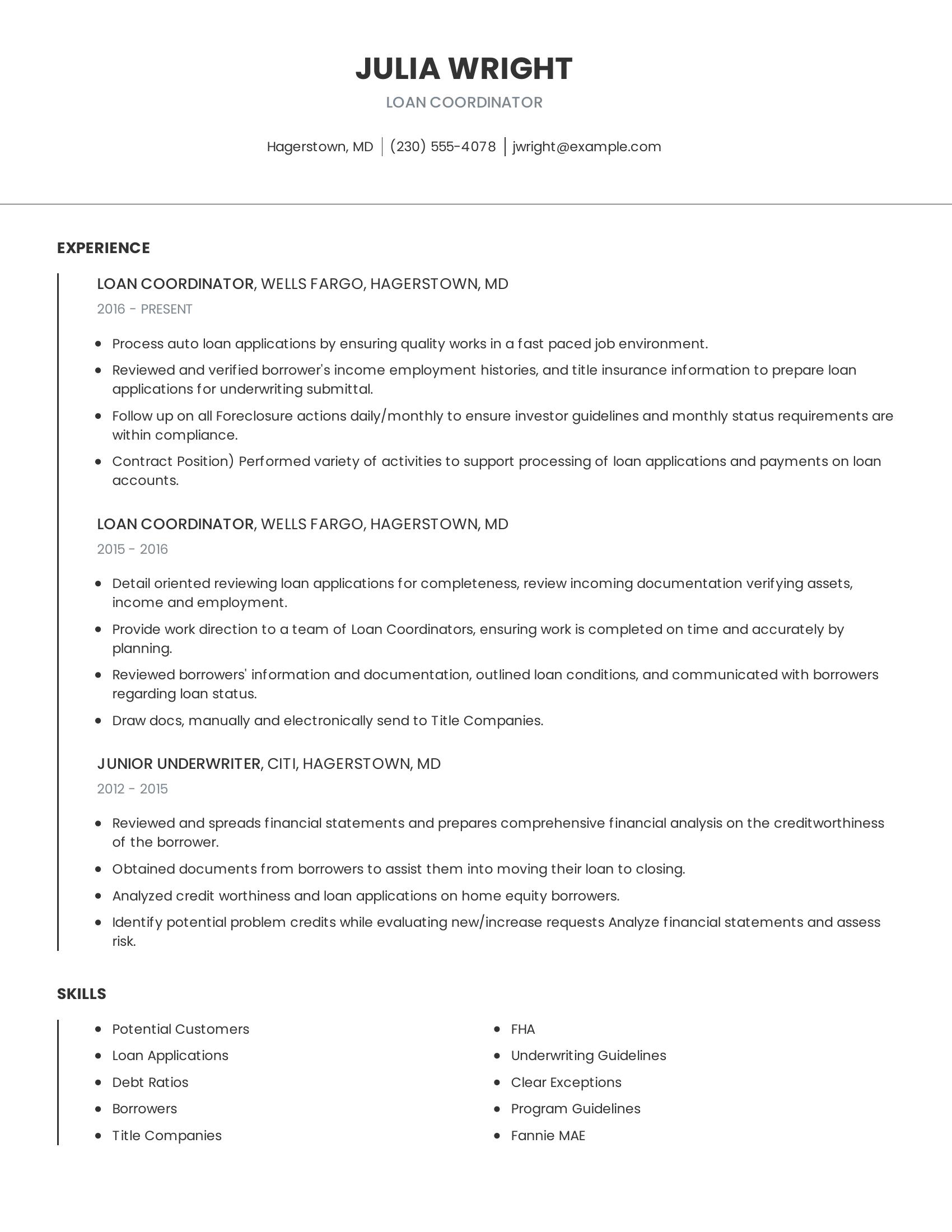

Loan coordinator resumes should highlight experience in processing loan applications, verifying borrower information, and managing compliance with investor guidelines. They should also show skills in providing direction to teams, analyzing financial statements, and communicating with borrowers. Including relevant job titles, employment history, and specific duties performed is important for showcasing expertise and reliability in the role.

This resume includes detailed descriptions of job responsibilities like processing auto loan applications, verifying income and employment histories, and preparing loan applications for underwriting. It also mentions leadership tasks such as directing a team of loan coordinators and ensuring work accuracy. The listed skills directly relate to the duties performed, adding further value by demonstrating the candidate's comprehensive knowledge in loan coordination and underwriting.

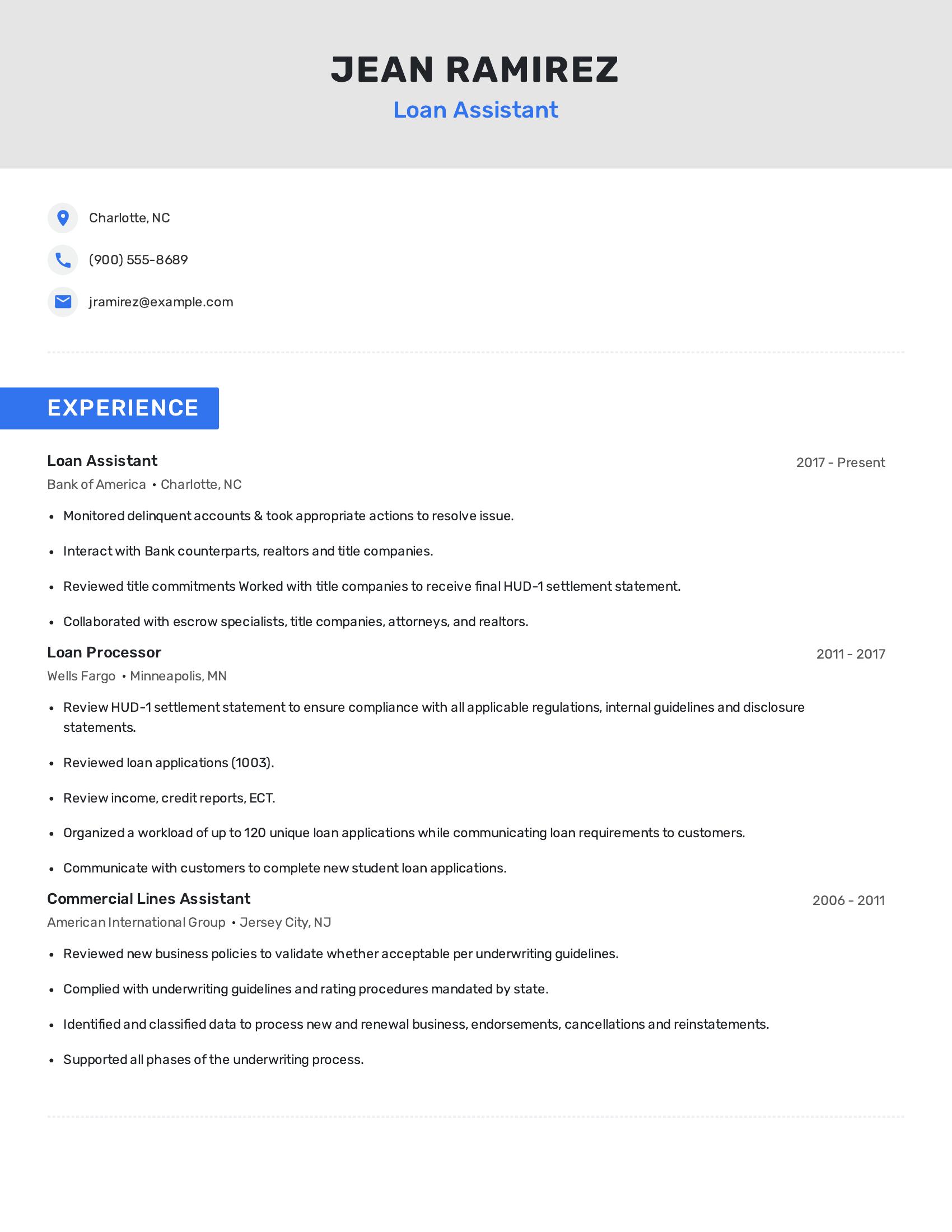

Loan assistant resumes should highlight relevant experience in loan processing, customer interaction, and compliance with regulations. Key elements include a history of handling loan applications, working with various financial documents, and collaborating with different stakeholders. Clear communication skills and the ability to manage a large volume of work are also important.

This resume includes these specifics by detailing experience in loan processing at multiple banks, including tasks like reviewing HUD-1 settlement statements and loan applications. It shows interaction with customers, realtors, title companies, and attorneys. The resume also indicates the ability to manage a high workload and ensure compliance with guidelines.

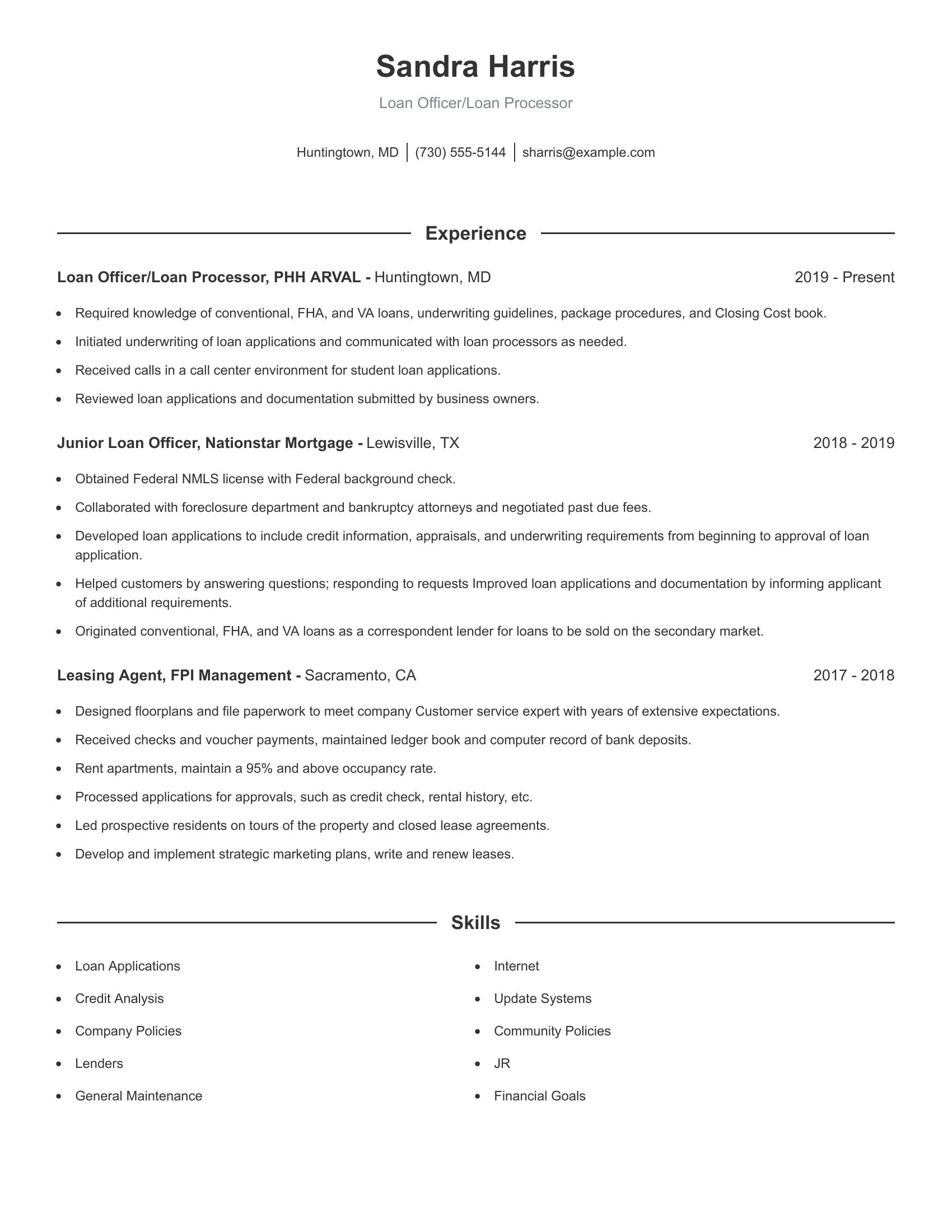

Loan officer/loan processor resumes should highlight experience with different types of loans, knowledge of underwriting guidelines, and proficiency in loan application procedures. Including past job titles, responsibilities, and relevant skills is important. Certifications like the NMLS license and collaboration with various departments can also strengthen the resume. Clear contact information and a concise summary of work experience are essential.

This resume includes specific job titles and dates, showing a clear career progression. It lists responsibilities like initiating underwriting, reviewing applications, and communicating with processors, demonstrating relevant skills. The inclusion of the NMLS license and experience with FHA and VA loans adds credibility. The resume also details tasks from previous roles, such as handling foreclosure negotiations and maintaining high occupancy rates as a leasing agent.

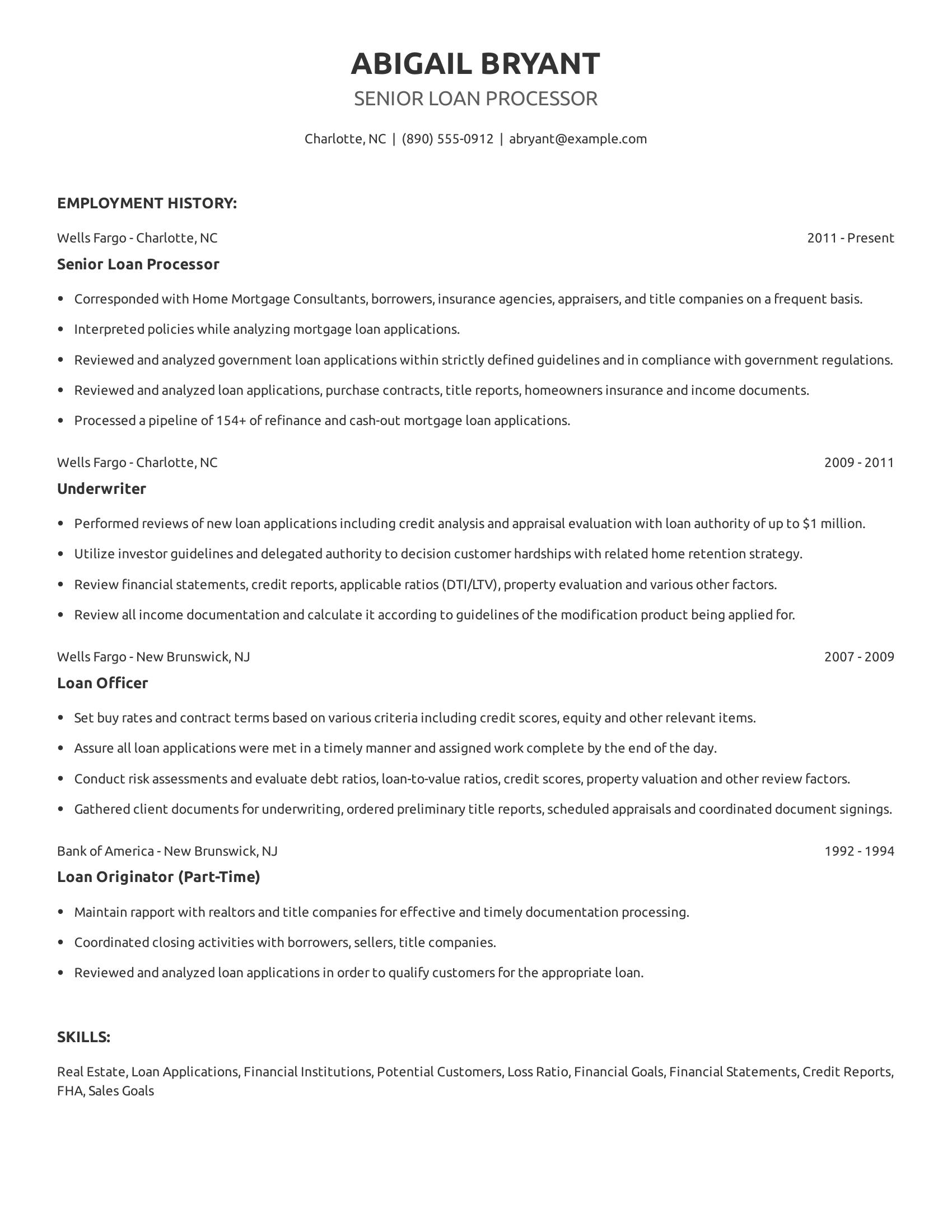

Senior loan processor resumes should highlight specific job responsibilities, relevant skills, and employment history in the mortgage and loan processing field. Key elements include experience with loan applications, customer interactions, and compliance with regulations. Additionally, a clear demonstration of the ability to manage multiple tasks and communicate effectively with various stakeholders is important.

This resume includes these specifics by detailing the candidate's extensive experience at well-known banks. It highlights roles such as senior loan processor, underwriter, and loan officer. The resume shows a strong background in analyzing mortgage loan applications, reviewing financial documents, and coordinating with different parties. It also lists relevant skills like handling credit reports and managing financial statements.

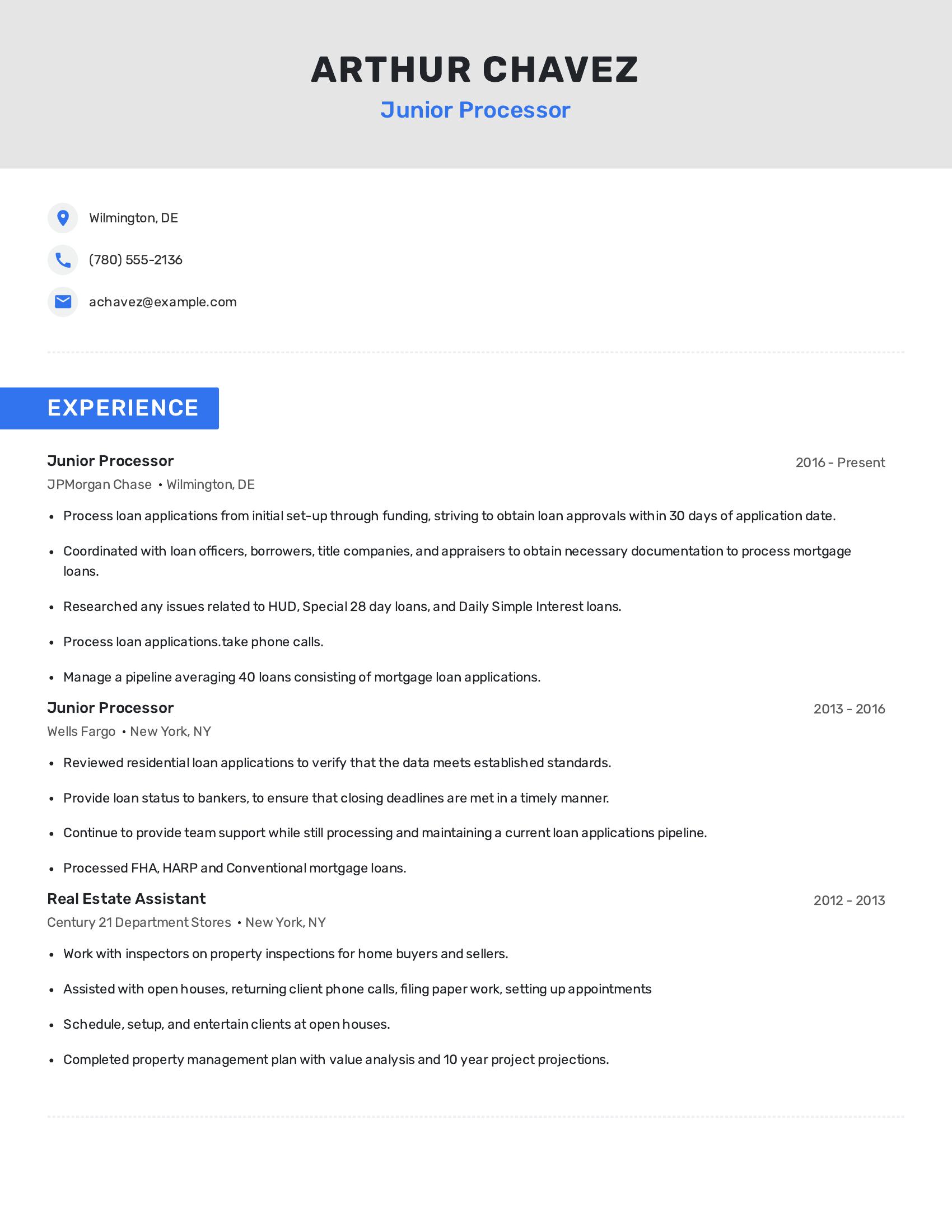

Junior processor resumes should highlight relevant work experience, technical skills, and the ability to handle multiple tasks. Important elements include job titles, dates of employment, duties performed, and accomplishments. Clarity and focus on specific responsibilities like processing applications and managing communications are crucial.

This resume includes detailed experience as a junior processor at two major firms, showcasing a history of handling loan applications and coordinating with various parties. It also lists tasks like managing pipelines and providing team support. The inclusion of a real estate assistant role adds further context to the candidate's background in related fields.

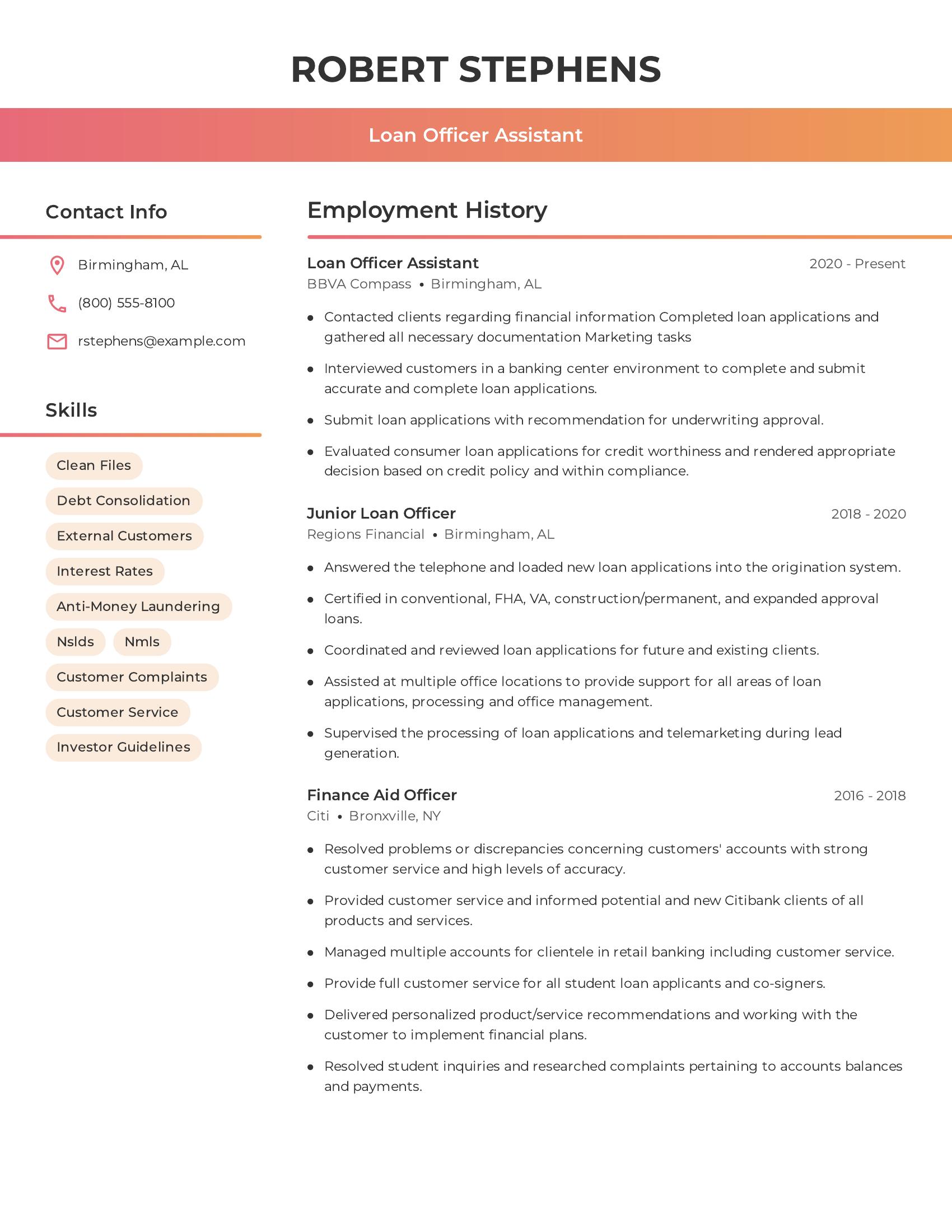

Loan officer assistant resumes should highlight relevant work experience, specific skills, and customer service abilities. A good resume includes clear job titles, concise descriptions of duties, and notable achievements. It should demonstrate proficiency in loan processing, customer interactions, and compliance with financial regulations.

This resume includes detailed employment history with clear job titles like loan officer assistant and junior loan officer. It lists valuable skills such as debt consolidation and anti-money laundering. The resume also describes specific duties like completing loan applications and resolving customer complaints, showing a well-rounded understanding of the role. Contact information is presented clearly, making it easy for potential employers to reach out.

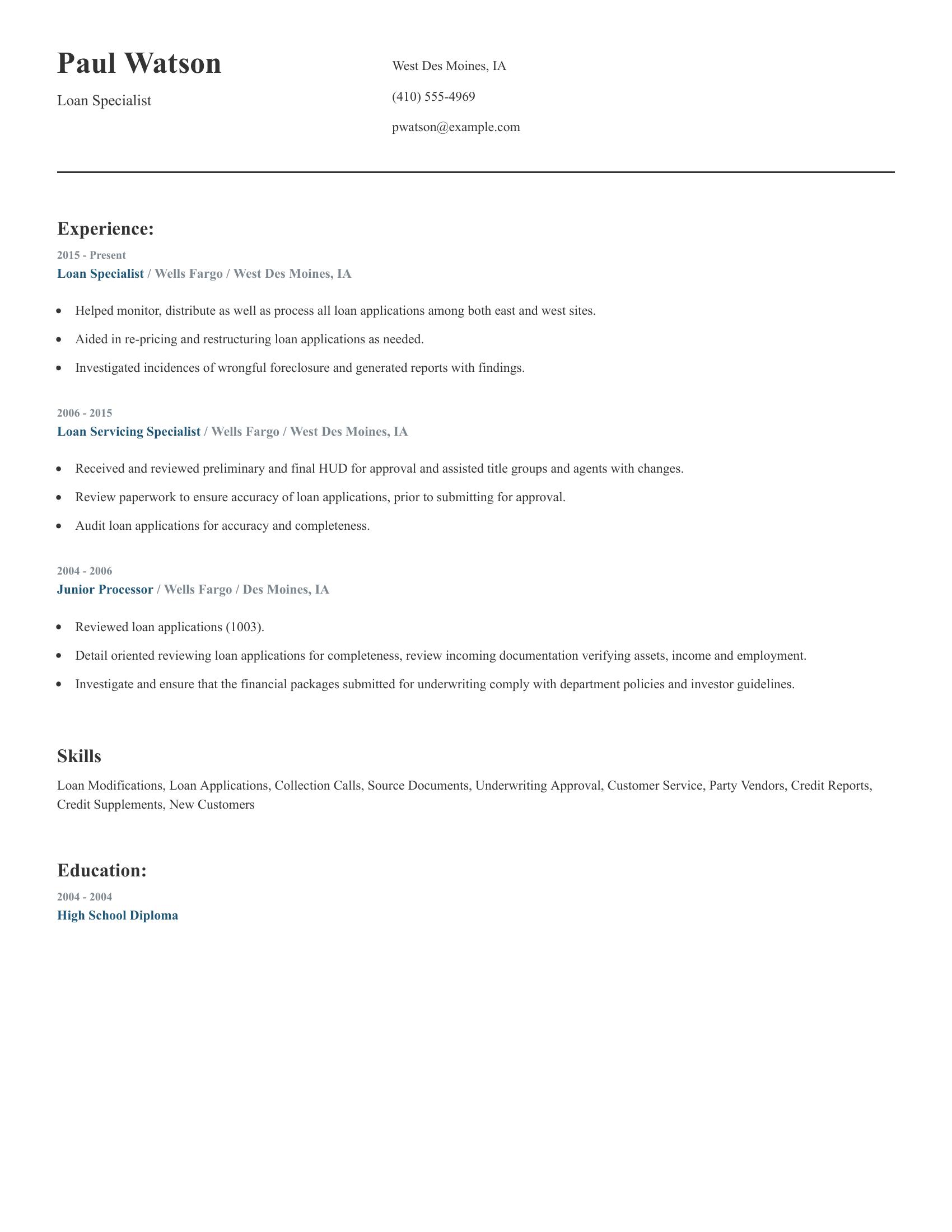

Loan specialist resumes should highlight relevant experience, skills, and education related to loan processing and management. A good resume includes clear job titles, employment dates, and specific duties performed. Skills pertinent to the industry, such as loan modifications and customer service, are essential. Education should be listed with the most recent first and should relate to the job.

This resume provides a detailed employment history with specific roles and responsibilities at each position. It lists relevant skills such as loan applications and underwriting approval. The resume also includes educational background, which supports the candidate's qualifications for the role. While the formatting needs work, the content effectively showcases the candidate’s experience and skills.

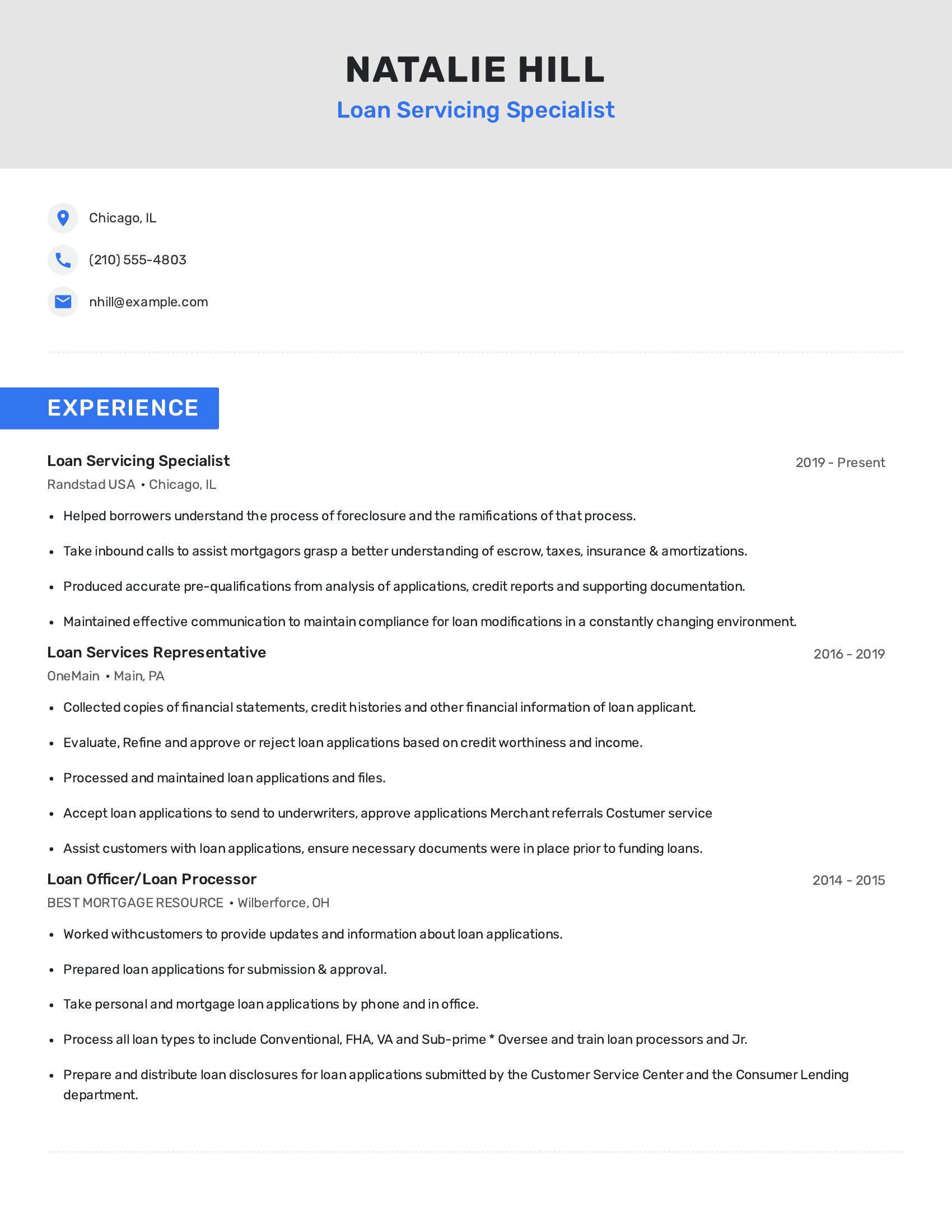

Loan servicing specialist resumes should highlight experience in handling loans, assisting customers, and maintaining compliance. Key elements include job titles, dates of employment, tasks performed, and skills gained. The resume should clearly show the candidate's ability to manage loan applications, communicate effectively with borrowers, and understand financial documents. It is also important to demonstrate a history of working in various aspects of loan servicing and customer service roles.

This resume includes relevant job experience with specific duties such as helping borrowers understand foreclosure processes and assisting with escrow, taxs, insurance, and amortizations. It shows experience from multiple positions in loan services, detailing responsibilities like evaluating loan applications and maintaining loan files. The resume demonstrates a range of skills from processing loans to training junior staff, indicating a comprehensive background in loan servicing.

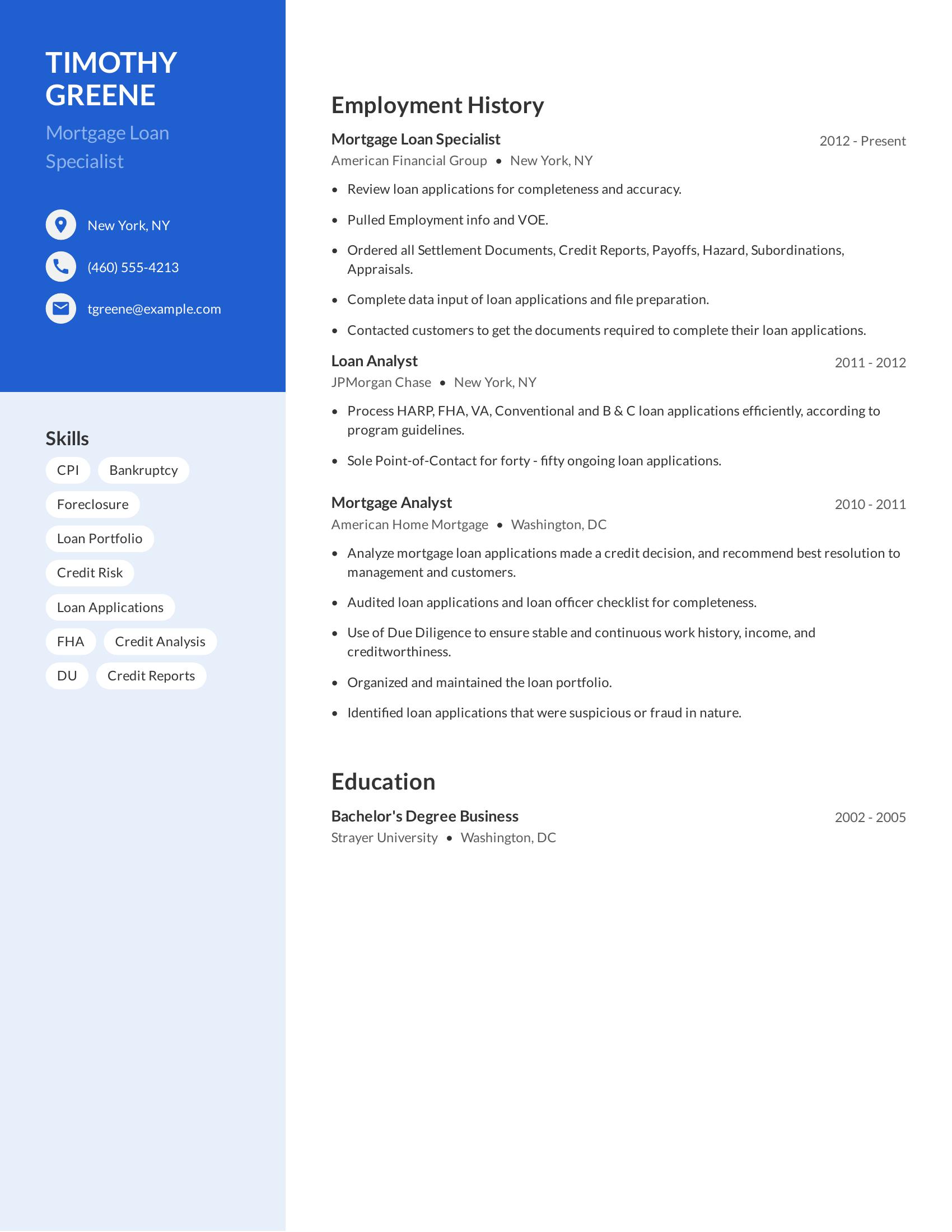

Mortgage loan specialist resumes should highlight relevant skills, employment history, and education. They should focus on key tasks like reviewing loan applications, processing various loan types, and communicating with clients. The resume should also show experience with credit analysis, organizing loan documentation, and detecting fraud. Educational qualifications must be mentioned to showcase the candidate's academic background.

This resume includes many of these specifics. It lists skills such as CPI, bankruptcy, foreclosure, and credit risk. The employment history shows experience in reviewing loan applications, processing different types of loans, and client communication. It also mentions educational qualifications with a bachelor's degree in business. The resume clearly shows the candidate's ability to handle various tasks associated with being a mortgage loan specialist.

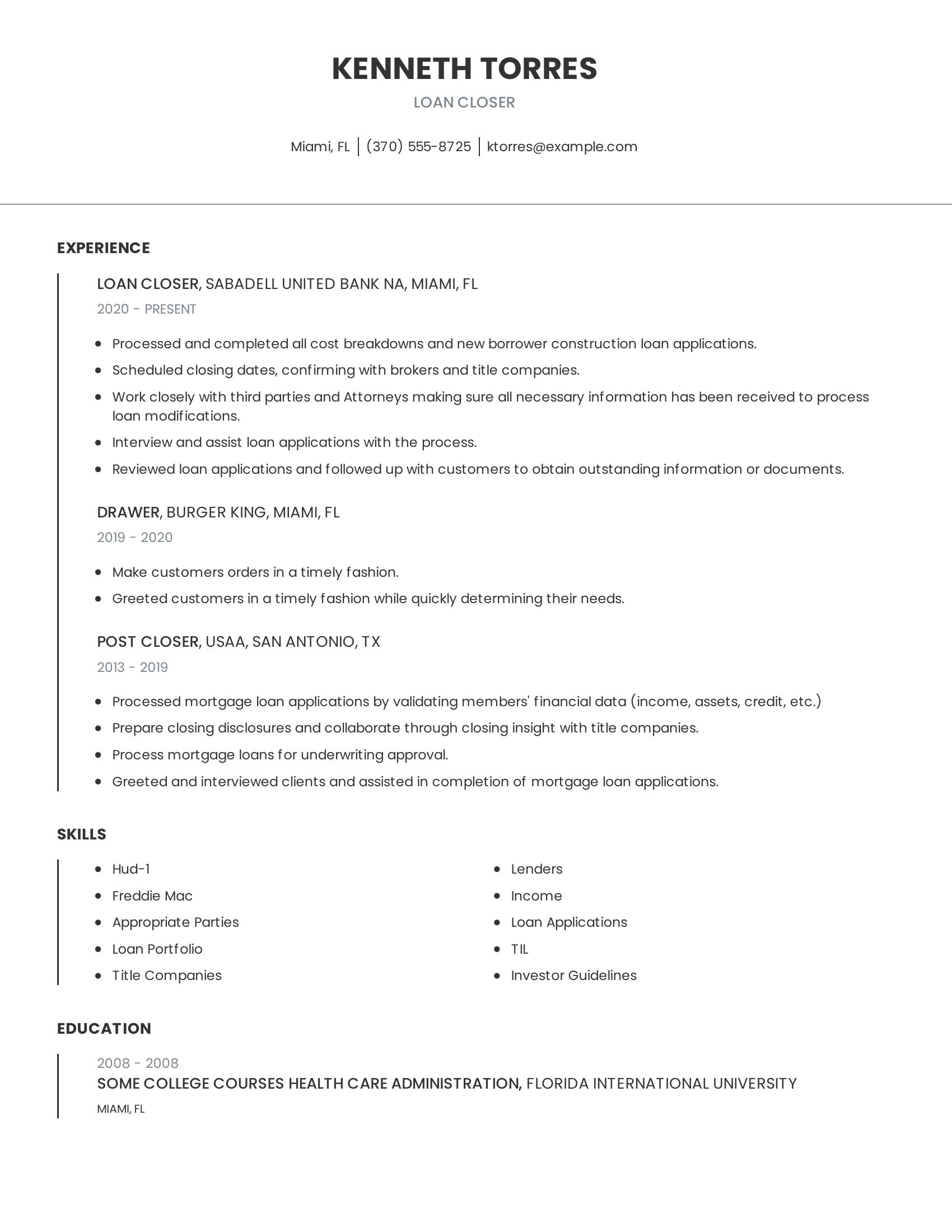

Loan closer resumes should highlight experience in processing and completing loan applications, scheduling closing dates, and working with third parties. A good resume includes specific job duties, such as reviewing applications, assisting applicants, and ensuring all necessary documents are received. Skills relevant to loan closers like familiarity with HUD-1 forms, Freddie Mac guidelines, and investor guidelines should also be documented. Education details, even if incomplete, add value by showing the candidate's educational background.

This resume effectively includes these specifics. The candidate details their experience with processing loans at different banks and mentions specific tasks like scheduling closing dates and reviewing applications. They list relevant skills such as working with title companies and understanding loan portfolios. The education section, though brief, provides additional context on their background. This comprehensive approach gives a clear picture of their qualifications for the loan closer role.

Loan representative resumes should emphasize relevant experience, showcasing tasks like assisting customers with loan applications, processing loans, and maintaining communication with loan officers and real estate brokers. They should highlight the ability to handle high volumes of work and effective communication skills. Including education and relevant skills is also important.

This resume effectively demonstrates these aspects. It shows experience in loan processing and customer assistance at two banks, handling high call volumes and maintaining communication with various parties. The resume details specific tasks performed and includes a section for skills relevant to the loan industry. While the formatting is incorrect, the content clearly aligns with what makes a good loan representative resume.

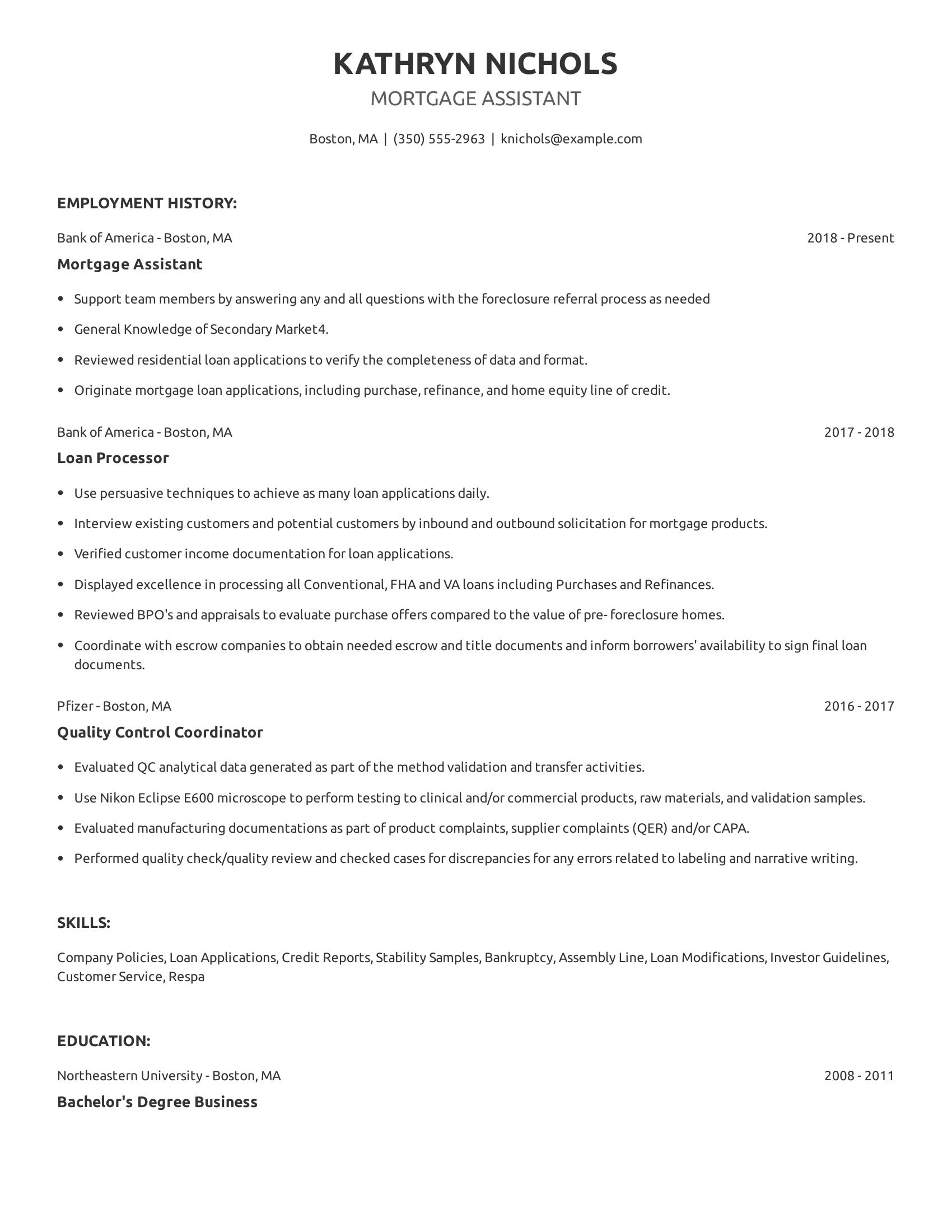

Mortgage assistant resumes should highlight relevant work experience, technical skills, and education. They should include past job positions related to mortgage processes, such as loan processing or quality control roles. Key responsibilities, such as reviewing loan applications and coordinating with escrow companies, demonstrate the candidate's competency. A good resume also lists skills like customer service and knowledge of company policies and investor guidelines. Education details, especially degrees in business or finance, add value.

This resume includes specific job experiences relevant to mortgage assistance. The candidate has worked as a mortgage assistant and loan processor, handling tasks like verifying income documentation and reviewing loan applications. Skills listed are pertinent to the role, including customer service and understanding of investor guidelines. The education section lists a bachelor's degree in business, which supports the candidate’s qualifications for the job.

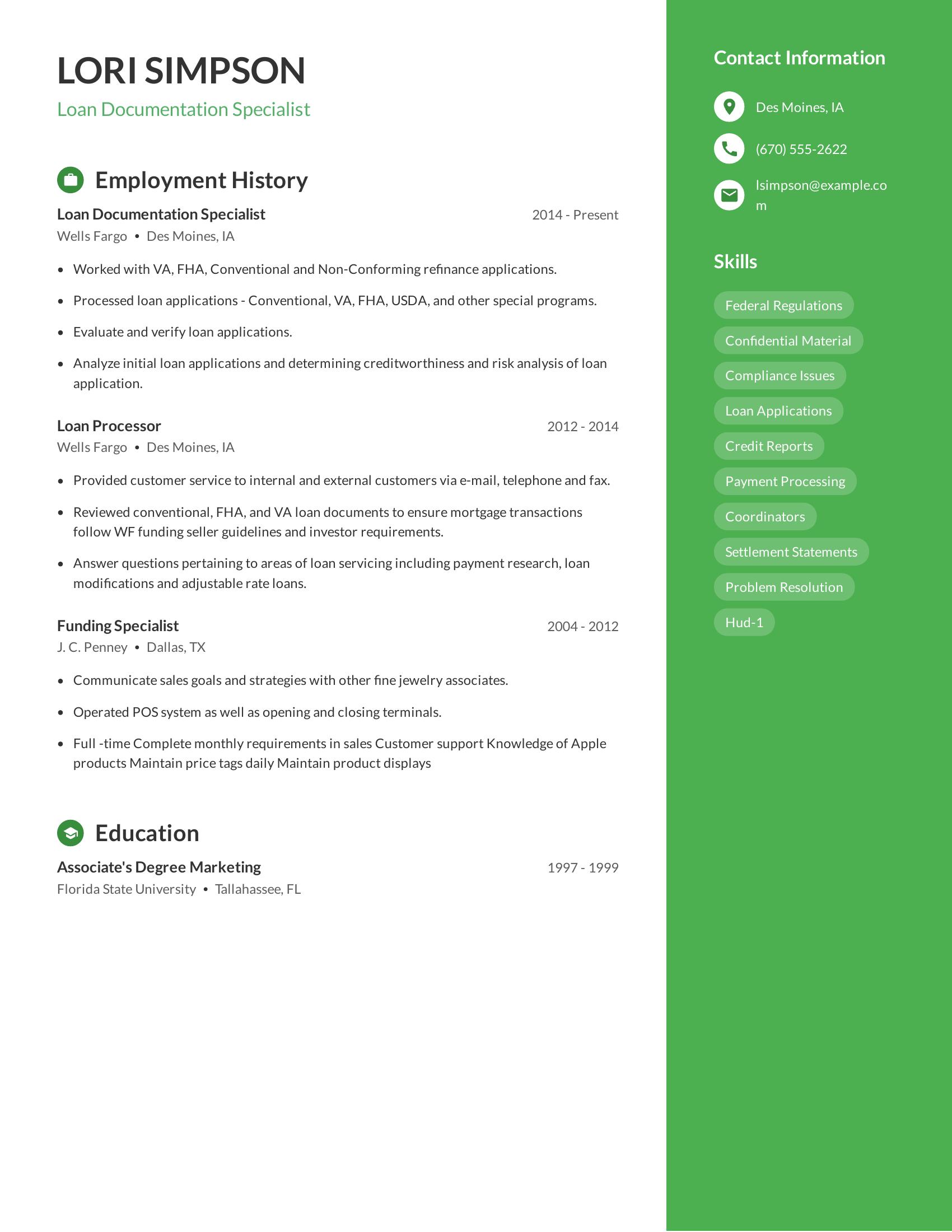

A loan documentation specialist resume should highlight experience in handling loan applications, knowledge of various loan types, and proficiency in compliance with federal regulations. It should include specific job roles and tasks, showcasing the ability to process and verify loan documents. Mentioning customer service skills and familiarity with industry tools can strengthen the resume.

This resume includes detailed employment history, showing long-term experience with companies like Wells Fargo and J.C. Penney. It lists specific tasks such as evaluating loan applications, processing different loan types, and providing customer service. The resume also mentions relevant skills like compliance issues and problem resolution, which are crucial for the role.

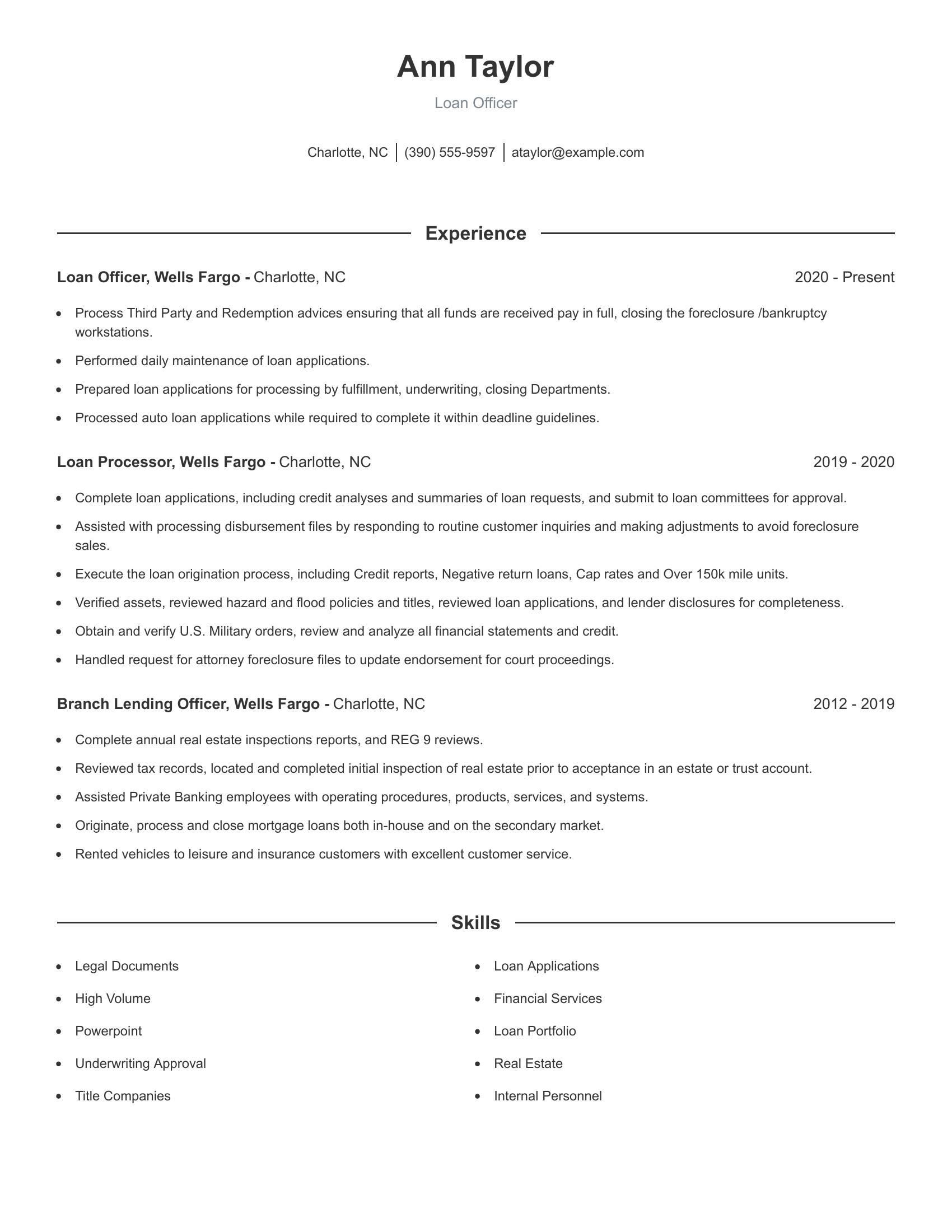

Loan officer resumes should highlight relevant work experience, specific job duties, and skills pertinent to the role. Key sections include contact information, a summary of work experience in reverse chronological order, and a list of relevant skills. The resume should showcase the candidate’s ability to process loan applications, perform credit analyzes, and handle customer inquiries effectively. Highlighting roles in various financial services and demonstrating familiarity with mortgage processes and legal documents are important.

This resume includes detailed work experience at Wells Fargo with specific responsibilities such as processing loan applications, performing credit analyzes, and executing loan origination processes. It shows progression from a branch lending officer to a loan officer. Skills listed include handling high-volume financial services, underwriting approval, and working with legal documents. The resume efficiently covers duties like preparing loan applications for processing by different departments and verifying assets and financial statements.

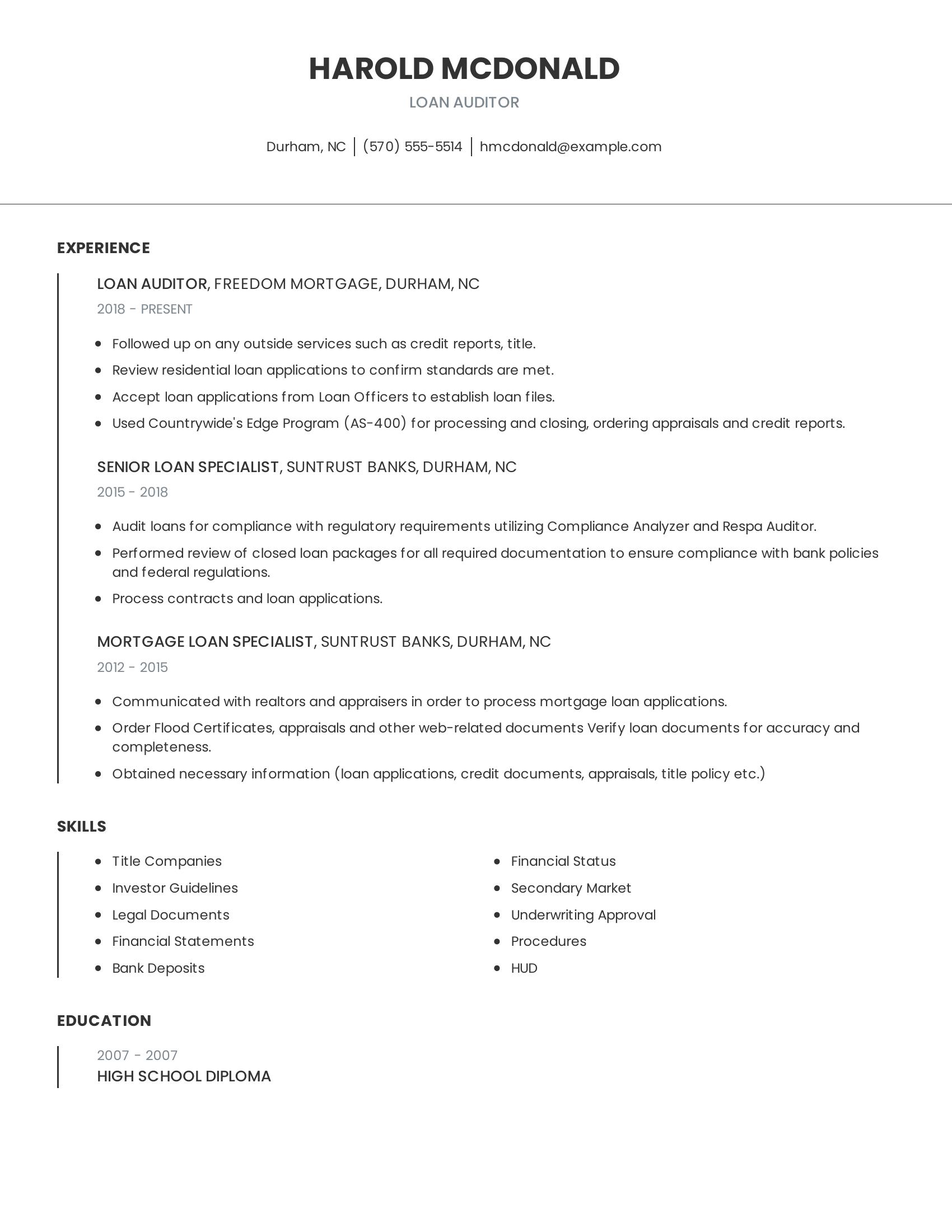

Loan auditor resumes should highlight experience in reviewing and auditing loan documents, ensuring compliance with regulatory requirements, and proficiency with financial software and systems. It should include the candidate's work history, specific tasks performed, and relevant skills. Education and certifications relevant to finance or auditing are also important to mention.

This resume effectively outlines the candidate’s experience in loan auditing roles at different banks, detailing tasks such as reviewing loan applications, processing contracts, and using specific software like Countrywide's Edge Program. The skills section lists relevant abilities like handling legal documents and understanding investor guidelines, while the education section confirms a high school diploma.

Showcase relevant experience. Highlight your experience processing loans, verifying documents, and working with underwriters. Mention specific software you have used like Encompass or Calyx Point.

Detail your skills. List skills such as attention to detail, customer service, and understanding of loan regulations. Provide examples of how you applied these skills in past roles.

Quantify achievements. Provide numbers to show your impact. For example, mention the number of loans processed per month or the percentage of loan applications approved due to your thorough review.

A loan processor's resume should highlight relevant experience, skills, and education to show their ability to handle loan applications efficiently. It is important to list specific job duties and achievements in past roles. Skills related to financial software and customer service should be included.

A loan processor summary should be clear and straightforward. Focus on your experience, skills, and what makes you a good fit for the job.

Keep your summary brief and to the point. Use bullet points to make it easy to read.

To write a loan processor experience, focus on specific tasks and achievements. Highlight your skills in handling loan applications and working with clients.

When writing your loan processor experience, use action verbs, quantify your achievements, and be concise.

A loan processor needs specific technical skills to handle daily tasks effectively.

A loan processor also needs strong interpersonal skills to work well with clients and teams.