17 Loan Officer Resume Examples

Loan officer resumes should highlight relevant experience in loan processing, underwriting, and customer service. Key roles and responsibilities should be detailed, showcasing expertise in handling various loan types, analyzing financial statements, and managing loan applications. A good resume also includes clear contact information and demonstrates a history of meeting deadlines and maintaining compliance with regulations.

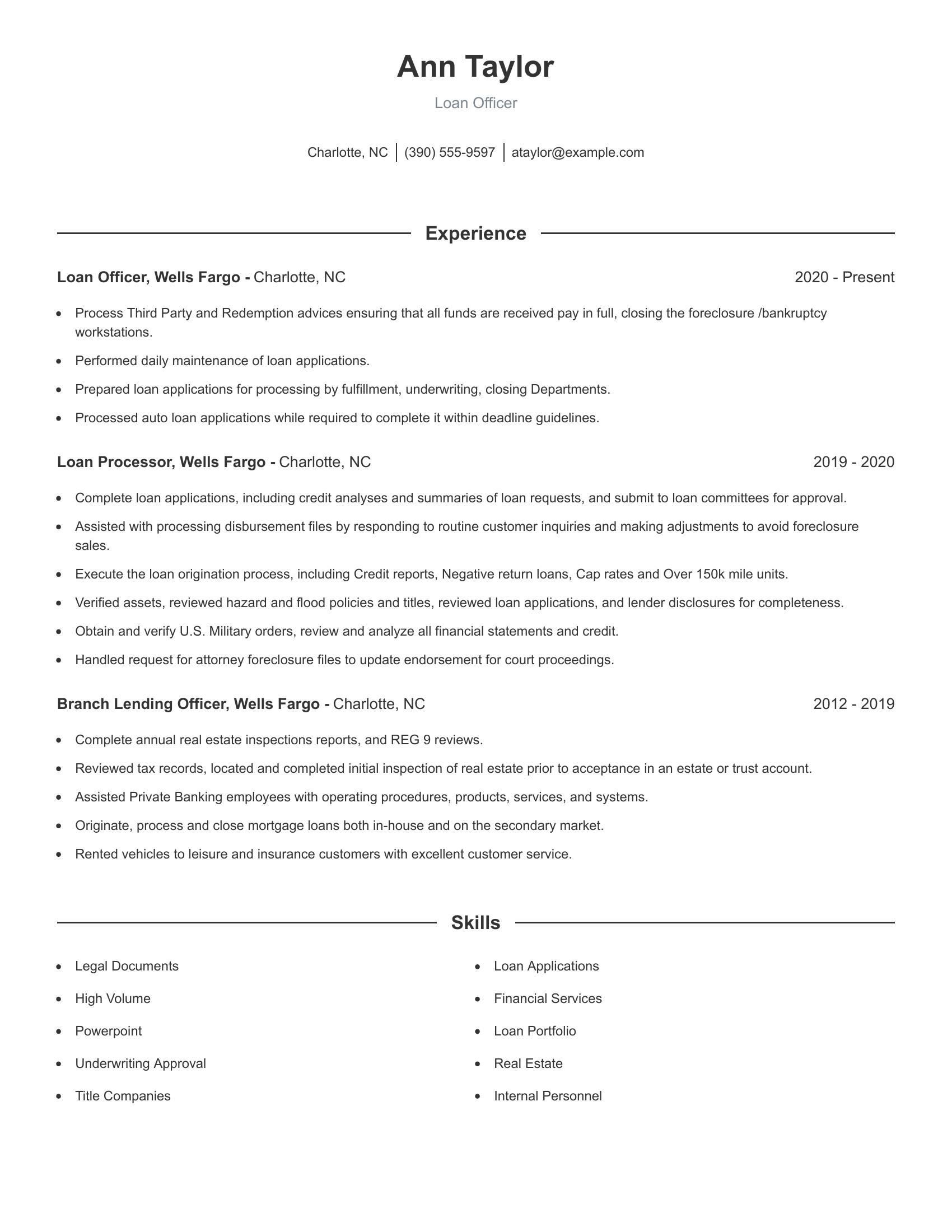

This resume effectively includes those specifics by listing job titles with corresponding responsibilities. It details the candidate's experience at Wells Fargo, involving tasks like processing loan applications, verifying assets, and handling foreclosure procedures. The resume also highlights skills like underwriting, legal documentation, and real estate inspections, making it comprehensive in terms of relevant experience.

Loan originator resumes should showcase relevant work experience, practical skills, and educational background. Key elements include a clear employment history with specific job duties, expertise in loan processes, relationship-building skills, and a solid educational foundation. Including specific achievements and responsibilities helps demonstrate your competency and suitability for the role.

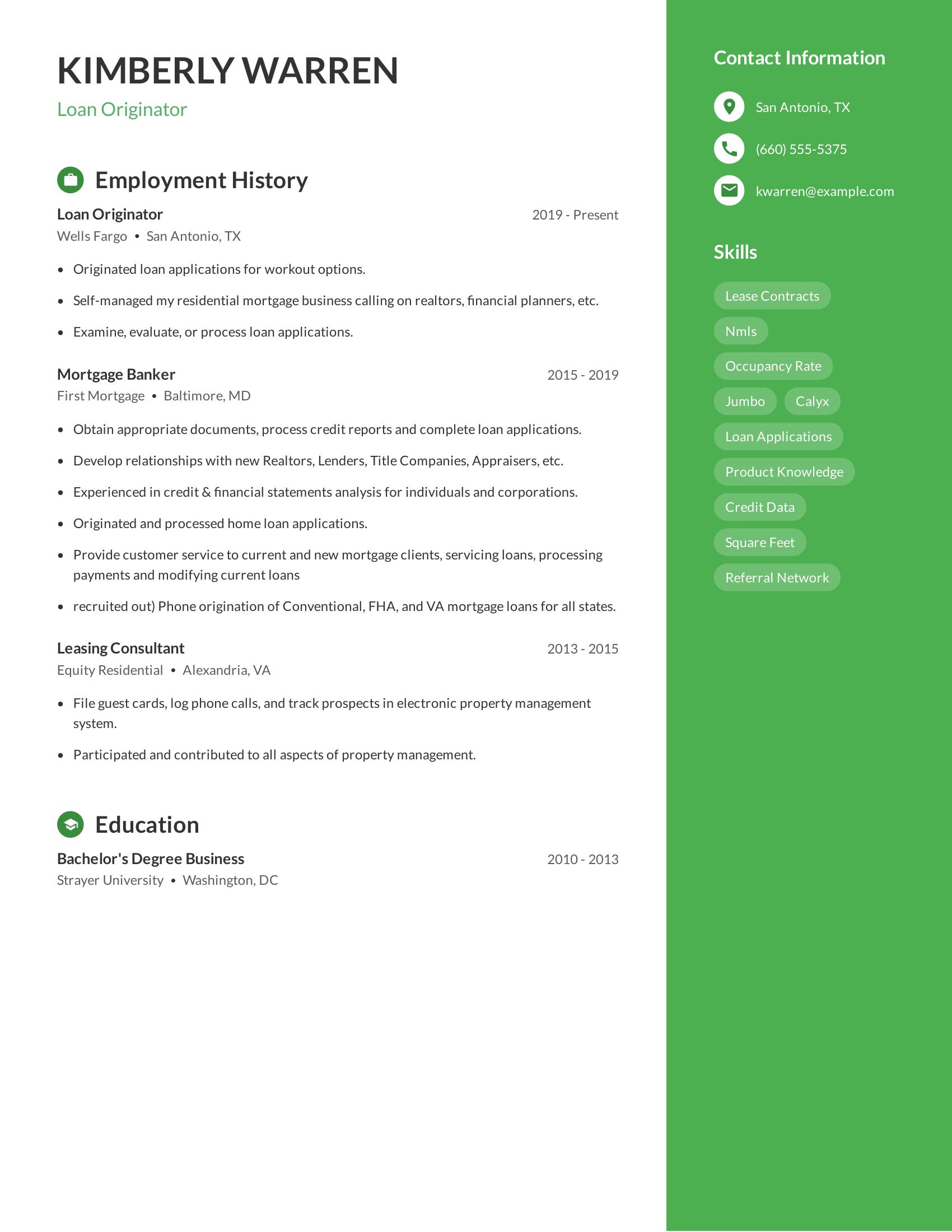

This resume includes detailed employment history showing progression from leasing consultant to loan originator. It lists specific responsibilities like originating loan applications and processing credit reports. The resume also highlights the candidate's ability to build relationships with realtors, lenders, and other stakeholders. It mentions relevant skills such as credit data analysis and knowledge of various mortgage products.

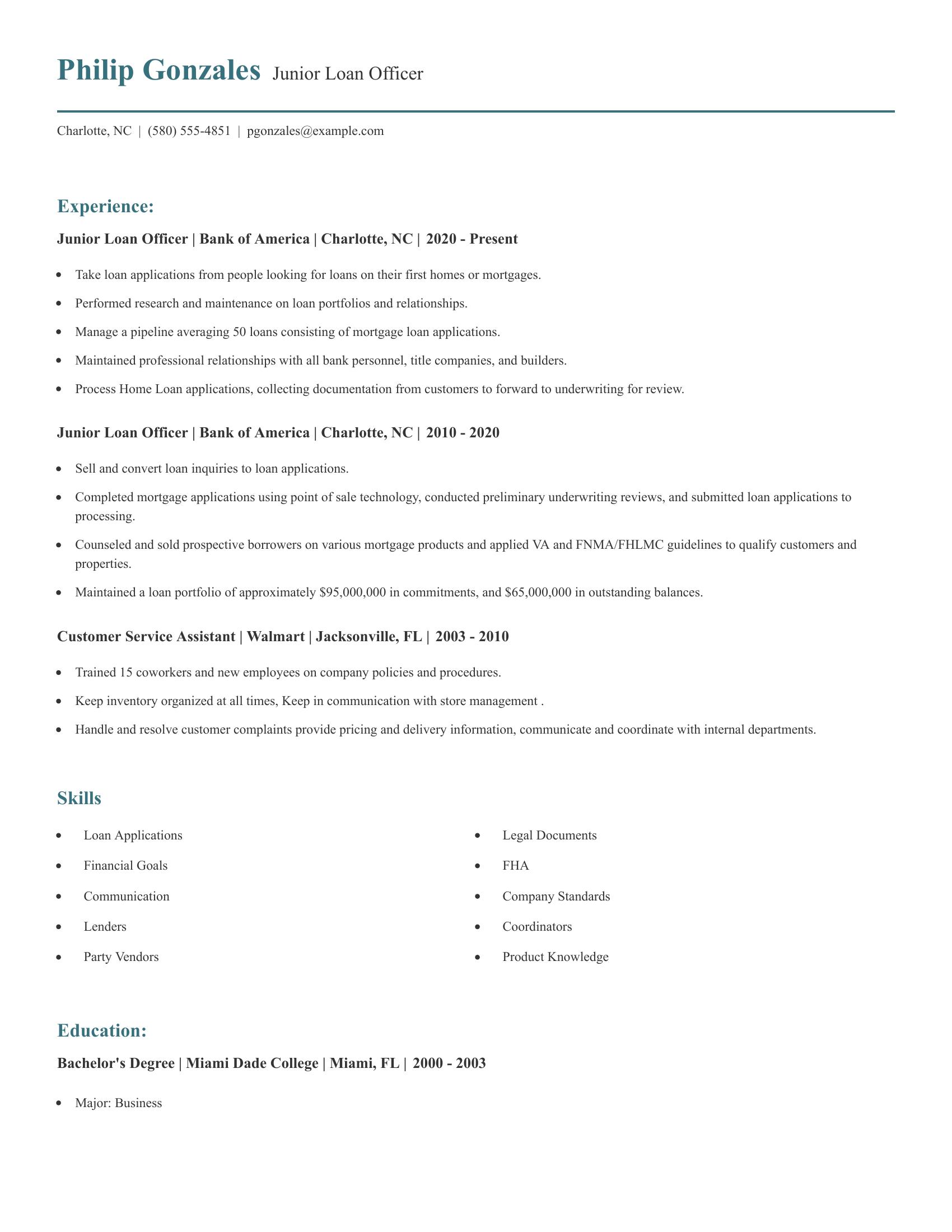

Junior loan officer resumes should highlight relevant experience, responsibilities, and skills in the finance and mortgage industry. They should showcase the ability to handle loan applications, manage pipelines, and maintain professional relationships. Additionally, demonstrating knowledge of legal documents and financial products is important. Education and previous job roles that contribute to the candidate’s qualifications should also be detailed.

This resume includes specific job experiences that emphasize handling loan applications, managing a significant pipeline of loans, and maintaining professional relationships. It lists responsibilities such as performing research on loan portfolios and converting loan inquiries into applications. The skills section effectively highlights knowledge in areas like legal documents and financial goals, which are pertinent to the role. Lastly, the educational background is clearly presented, showing a relevant degree in Business.

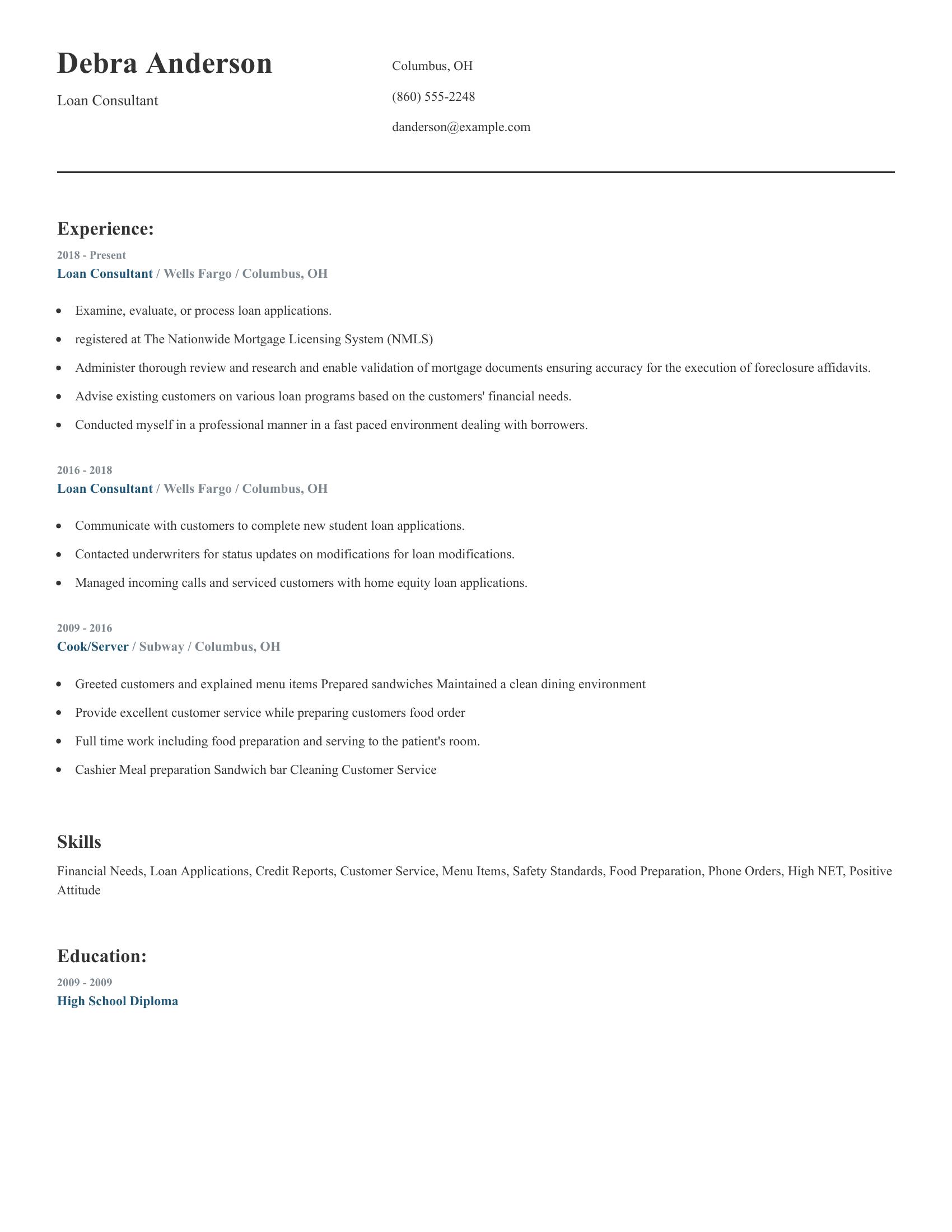

A loan consultant resume should highlight relevant experience, skills in loan processing, and customer service abilities. It should include a clear work history, showcasing roles with increasing responsibilities in the financial sector. Education and certifications related to finance or loans, such as registration with The Nationwide Mortgage Licensing System (NMLS), are important.

This resume effectively includes the necessary elements. The work history shows a progression from general customer service to specialized loan consulting. Skills listed are relevant to the job, such as financial needs assessment and loan application processing. Registration with NMLS is noted, which is pertinent for a loan consultant role.

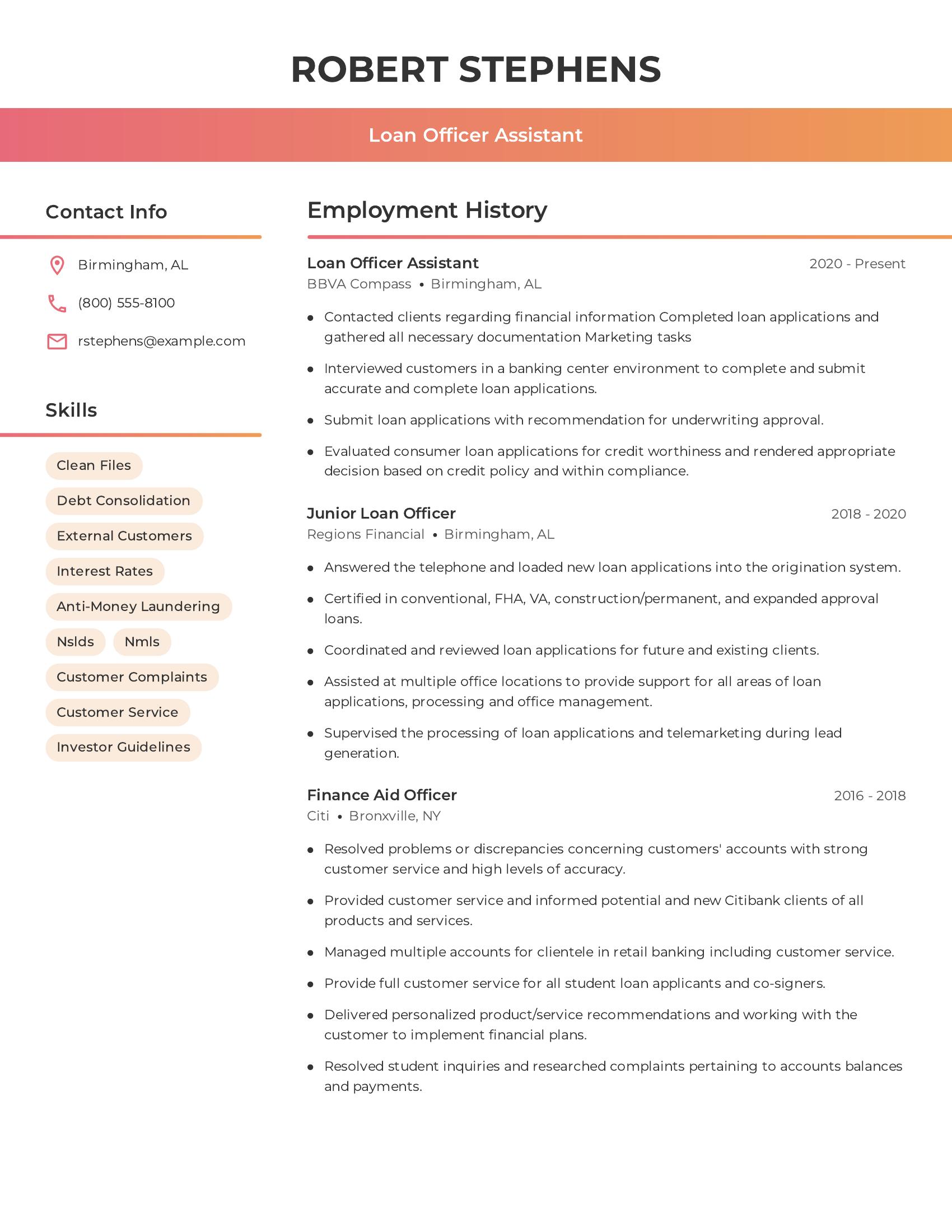

Loan officer assistant resumes should highlight relevant skills, work history, and qualifications. Important skills may include customer service, knowledge of loan processes, and familiarity with regulatory requirements. Work history should reflect experience in financial roles, showing progression and responsibility. Certifications or specialized knowledge in types of loans can set a candidate apart.

This resume includes key skills like debt consolidation, customer service, and anti-money laundering. The employment history shows progressive roles in financial services, from finance aid officer to loan officer assistant. Specific tasks like interviewing customers and submitting loan applications demonstrate relevant experience. Certifications in various loan types add credibility to the candidate’s expertise.

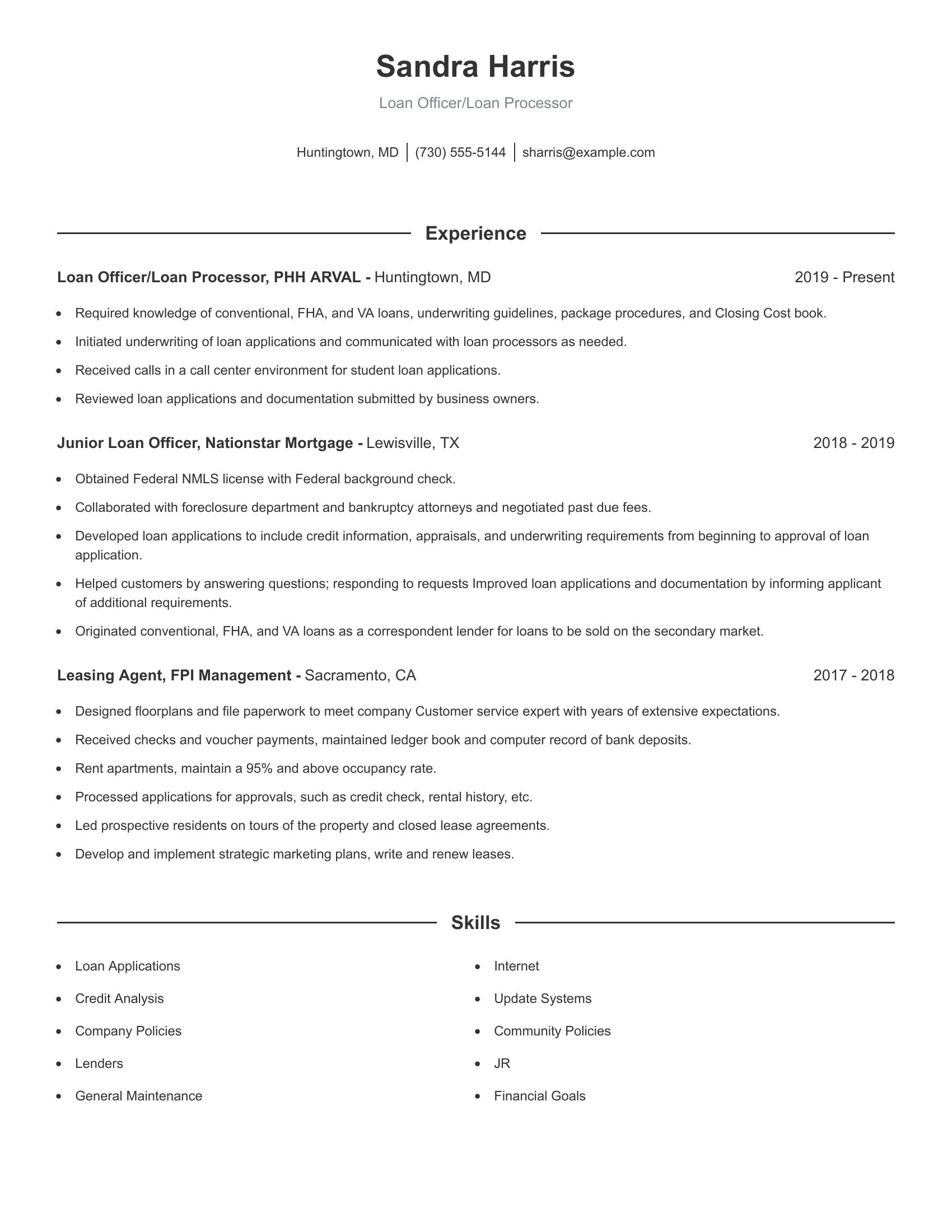

Loan officer/loan processor resumes include specific job responsibilities, industry knowledge, certifications, and experiences that highlight the candidate's expertise. They should detail familiarity with different loan types like conventional, FHA, and VA loans, as well as underwriting guidelines and procedures. Key tasks such as developing loan applications, reviewing documentation, and collaborating with other departments are crucial. Certifications like a Federal NMLS license demonstrate credibility. Experience in customer service and strategic planning also adds value.

This resume includes those specifics by listing relevant job experiences and responsibilities at various companies. It shows knowledge of conventional, FHA, and VA loans and outlines tasks such as originating loans and negotiating fees. The resume highlights the candidate's experience in both loan processing and customer service roles, giving a comprehensive view of their skills. Additionally, it mentions a Federal NMLS license, indicating professional qualification.

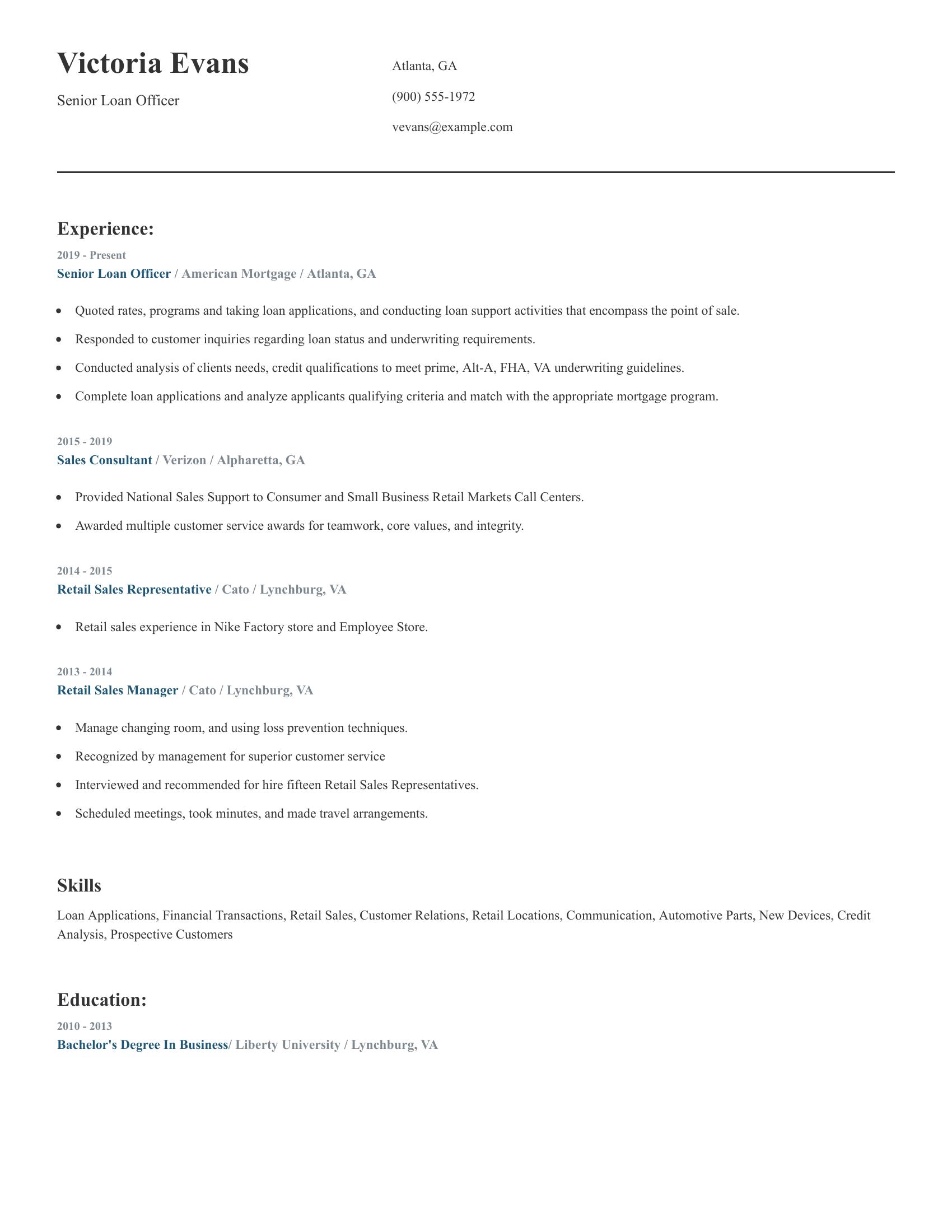

Senior loan officer resumes should highlight relevant job experience, education, and skills necessary for the role. This includes a strong background in loan processing, customer service, and financial analysis. Experience in managing loan applications, analyzing credit qualifications, and responding to customer inquiries is important. A good resume also lists educational qualifications and any awards or recognitions received.

This resume includes specific job roles that reflect the necessary experience for a senior loan officer. It details responsibilities such as quoting rates, conducting loan support activities, and analyzing client needs. It also mentions awards for customer service, indicating strong interpersonal skills. The education section shows a relevant bachelor's degree, and the skills section lists pertinent abilities like financial transactions and credit analysis.

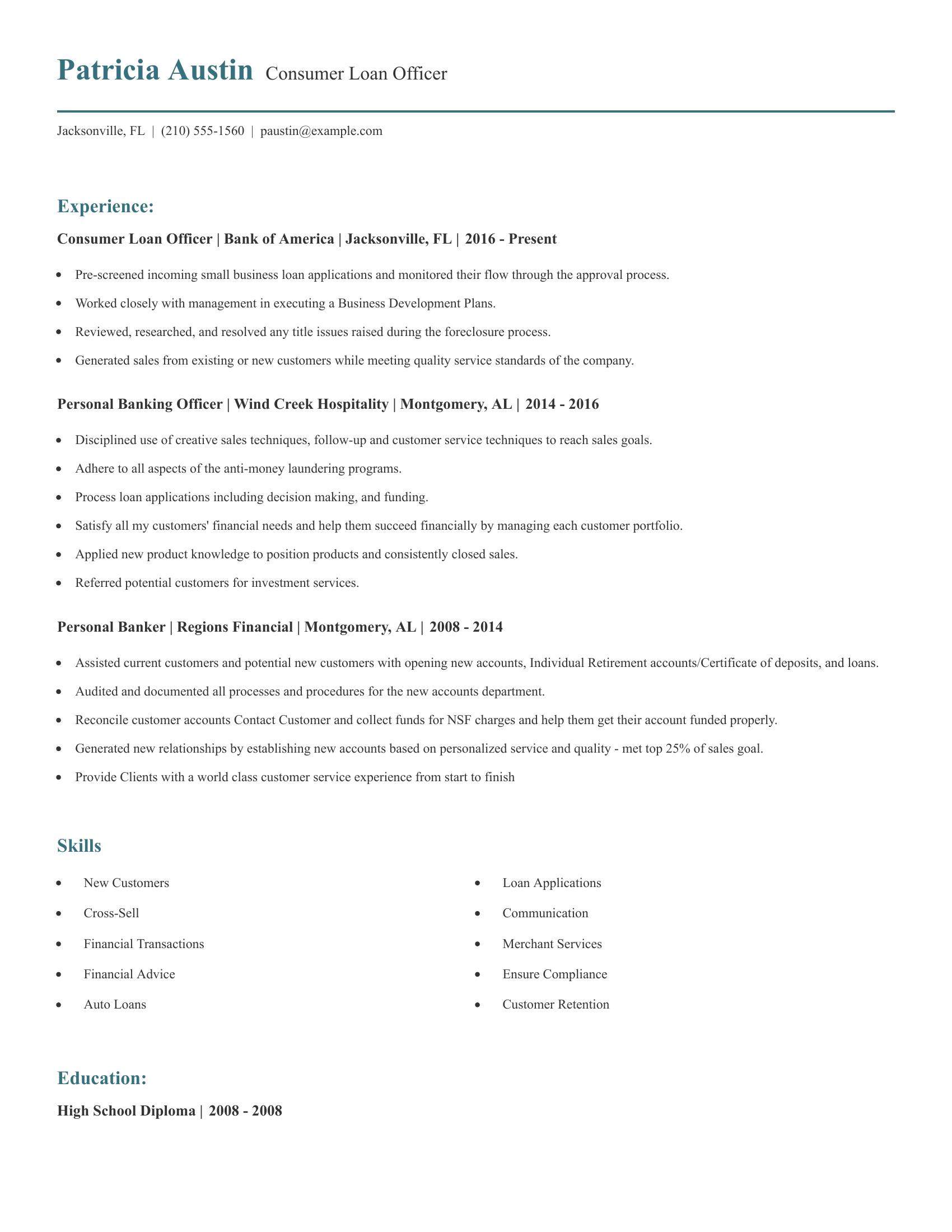

Consumer loan officer resumes should highlight relevant experience, skills in handling various loan products, and a proven track record in customer service and sales. Key elements include job titles, company names, locations, and dates of employment. Responsibilities should focus on loan processing, sales techniques, compliance with regulations, and customer relationship management. Skills should emphasize financial transactions, communication, and product knowledge.

This resume includes valuable information such as job titles and detailed descriptions of responsibilities at each position. It shows experience in loan application processing, issue resolution, customer portfolio management, and adherence to anti-money laundering programs. The skills section lists relevant abilities like cross-selling, ensuring compliance, and customer retention. This structure effectively conveys the candidate's qualifications and expertise in the field.

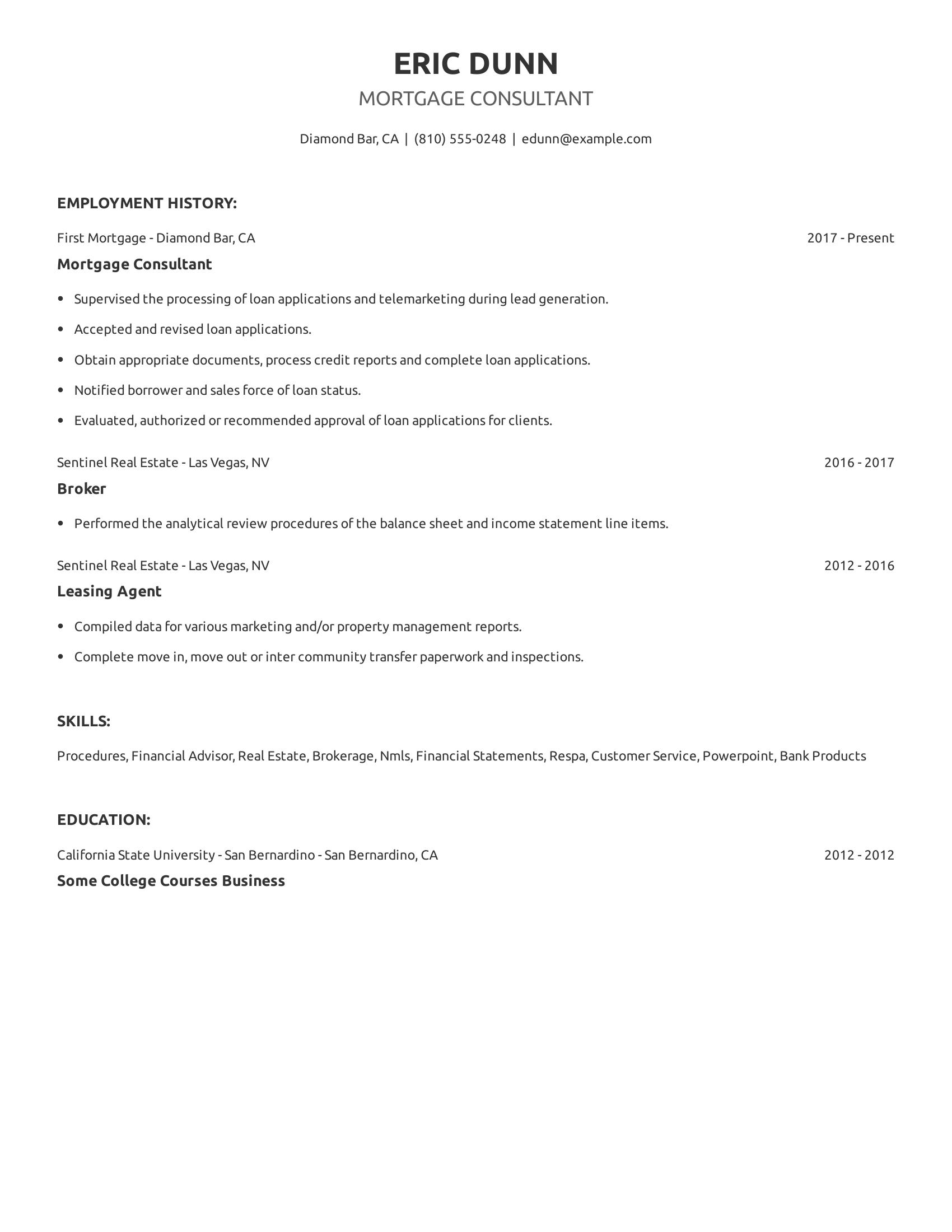

Mortgage consultant resumes should highlight experience in loan processing, client interaction, and financial analysis. Important elements include past employment in related fields, specific duties performed, and relevant skills. A clear chronological order of work history with precise job duties can showcase expertise in mortgage-related tasks.

This resume demonstrates strong qualifications by detailing job roles at multiple companies. It lists responsibilities like supervising loan applications, processing credit reports, and evaluating loans. The skills section includes relevant competencies such as financial advising and customer service. The education section, though brief, mentions business courses which add value to the applicant's background.

Loan representative resumes should highlight relevant experience in financial services, particularly in loan processing and customer interactions. Key elements include job titles, company names, locations, and dates of employment. Responsibilities should focus on tasks like assisting customers, processing applications, and communicating with loan officers and brokers. Skills should emphasize customer service, document handling, and problem-solving abilities.

This resume demonstrates these specifics by detailing the candidate's roles at different banks, including tasks like assisting customers with refinancing, initiating underwriting, and verifying income documentation. It also includes skills related to loan applications and customer service, which are crucial for the position. The resume clearly outlines the candidate's experience and responsibilities, making it easy to understand their qualifications.

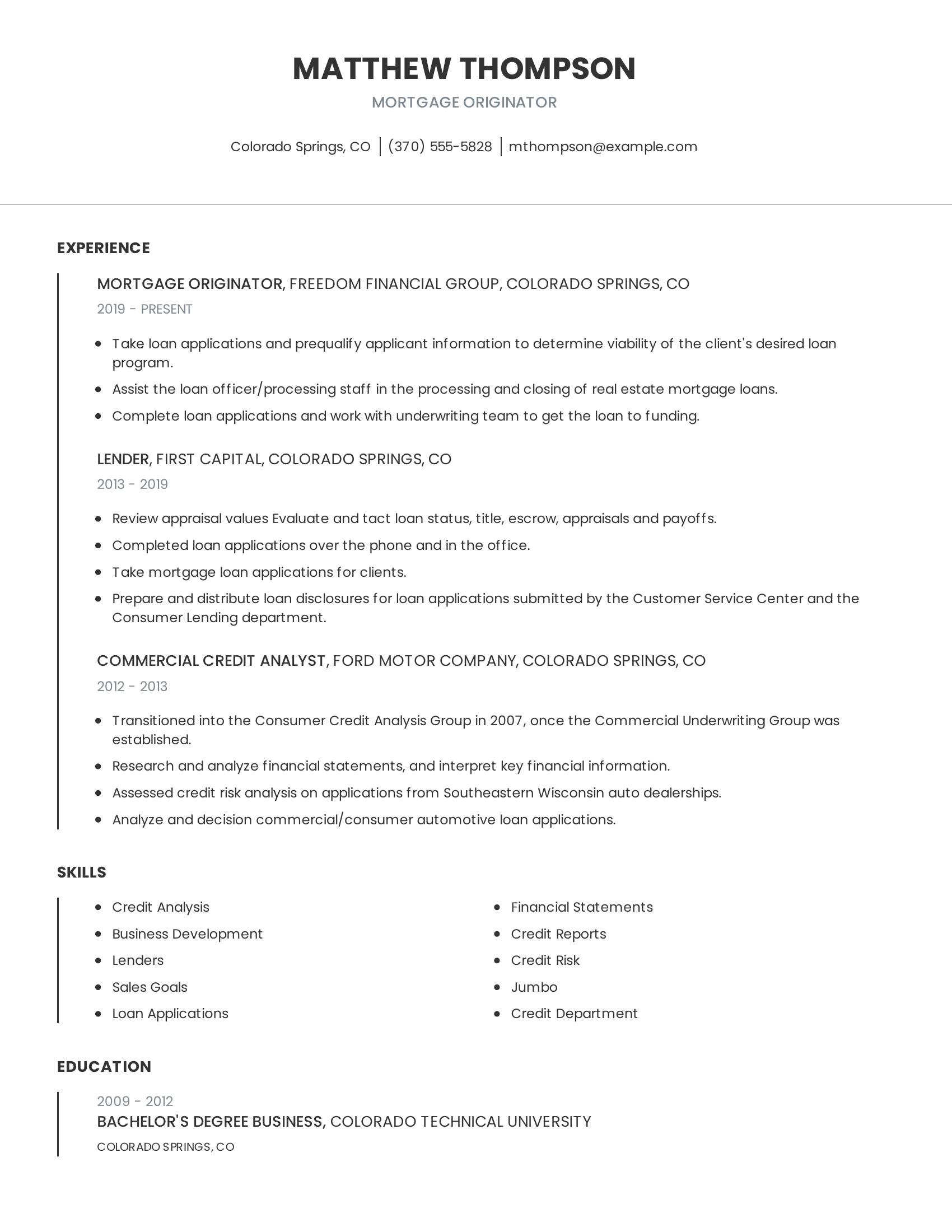

Mortgage originator resumes should highlight experience in taking loan applications, prequalifying applicants, and assisting in loan processing and closing. They should detail skills in credit analysis, business development, and handling various loan documents. Education background relevant to finance or business is also important. The resume should be clear and concise, showcasing the applicant's ability to work with underwriting teams and manage client relationships effectively.

This resume includes many of these specifics. It provides a clear history of job roles, such as mortgage originator and lender, detailing responsibilities like taking loan applications and working with underwriting teams. It lists relevant skills like credit analysis and business development. The education section shows a bachelor's degree in business, aligning with the required knowledge base. This makes it a comprehensive document that covers essential aspects of a strong mortgage originator resume.

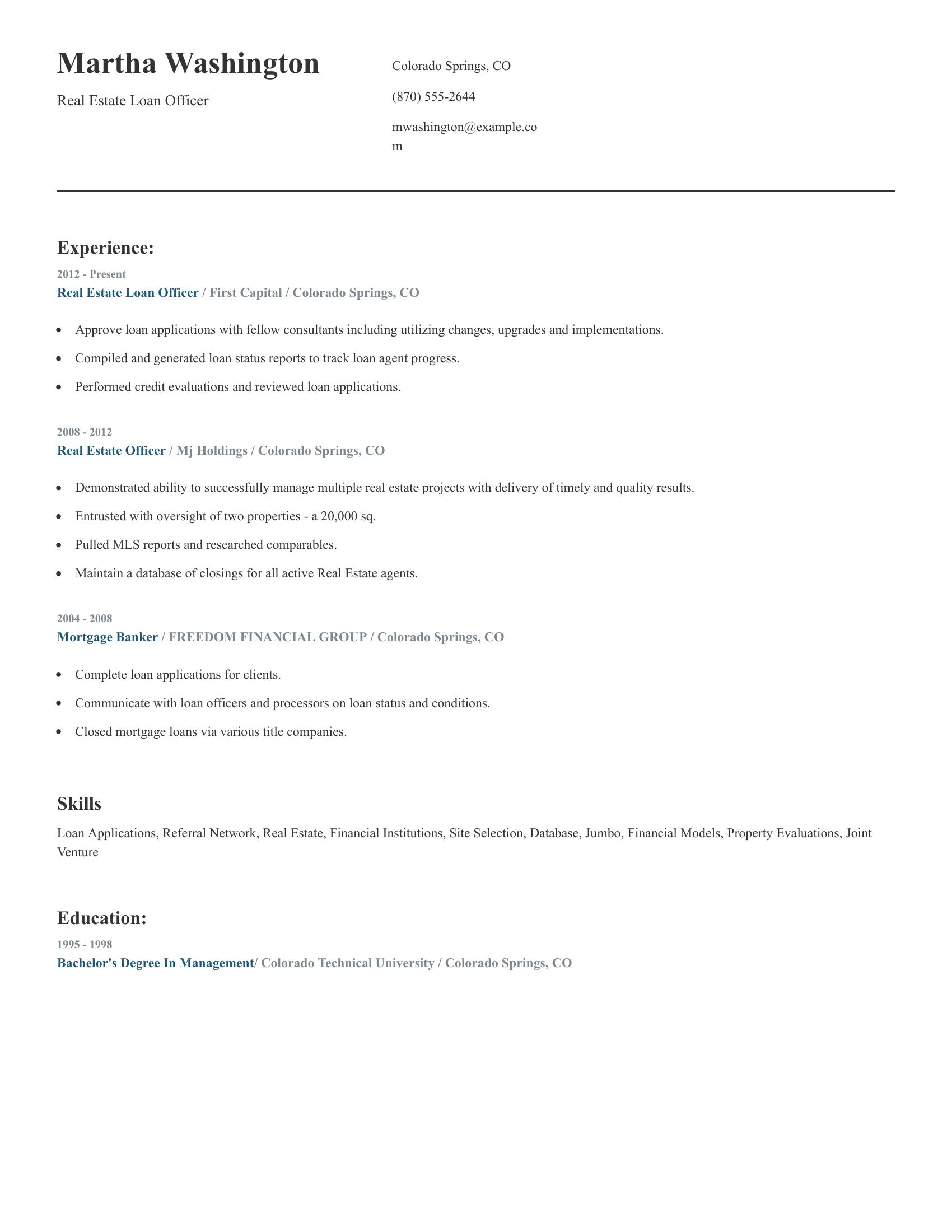

Real estate loan officer resumes should highlight experience in loan approval processes, credit evaluations, and application reviews. They should include roles in real estate project management and demonstrate the ability to handle multiple tasks. Skills in maintaining databases, generating reports, and communication with other professionals are important. Educational background in relevant fields like management is also beneficial.

This resume effectively includes these specifics. It details experience in loan approvals, credit evaluations, and project management. It shows involvement in maintaining databases and generating reports. The skills section lists relevant abilities such as financial models and referral networks. Lastly, it mentions a degree in management, reinforcing the candidate's qualifications.

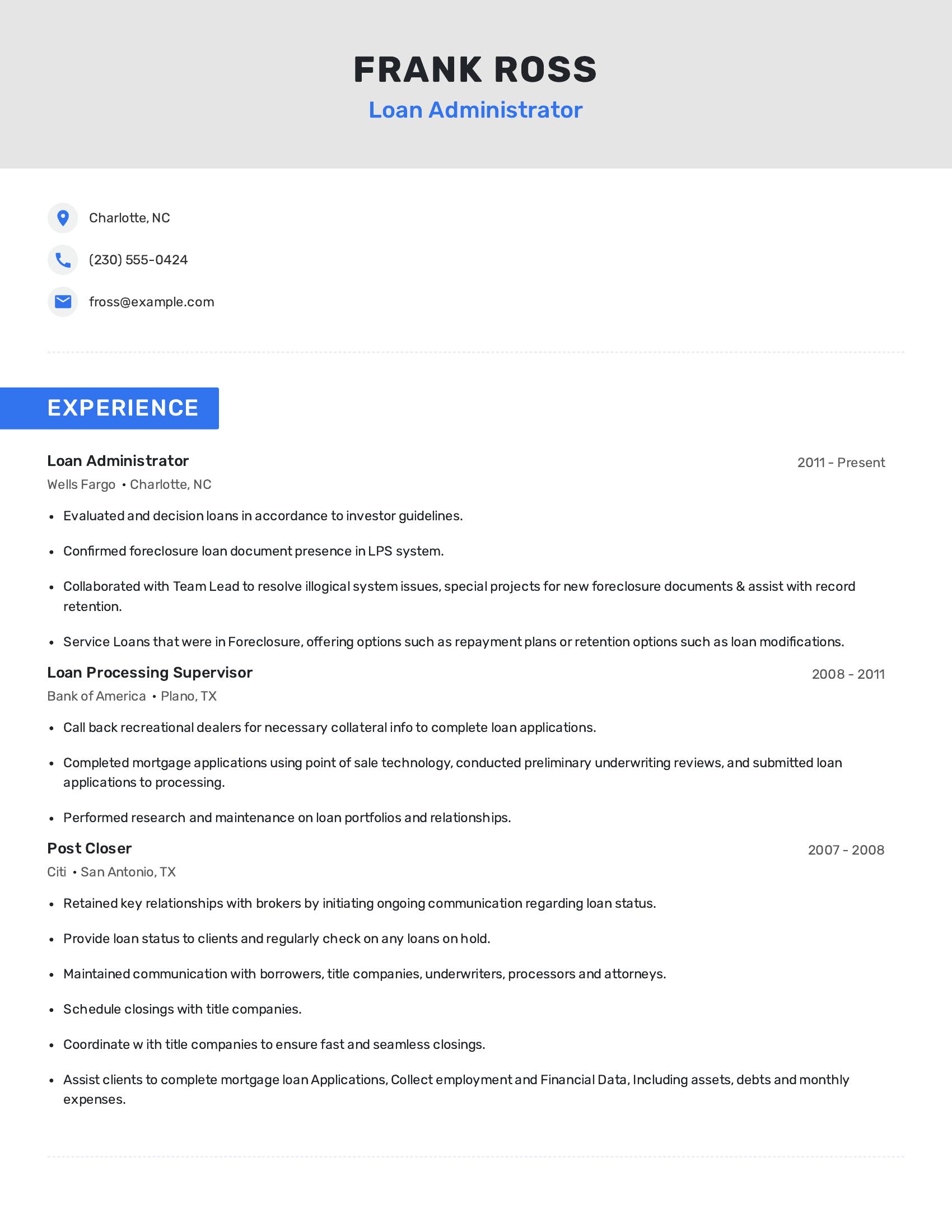

Loan administrator resumes should highlight experience in evaluating and decisioning loans, maintaining communication with clients and stakeholders, and collaborating with team members to resolve issues. They should also include experience in loan processing, mortgage applications, and post-closing activities. A clear focus on specific tasks and responsibilities, such as assisting clients with loan modifications or scheduling closings with title companies, is important.

This resume includes those specifics by detailing the candidate's roles at different companies. It lists specific job duties like evaluating loans according to guidelines, collaborating with team leads on system issues, and coordinating with title companies for seamless closings. It also shows a progression of roles from post closer to loan processing supervisor to loan administrator, reflecting a well-rounded experience in the field.

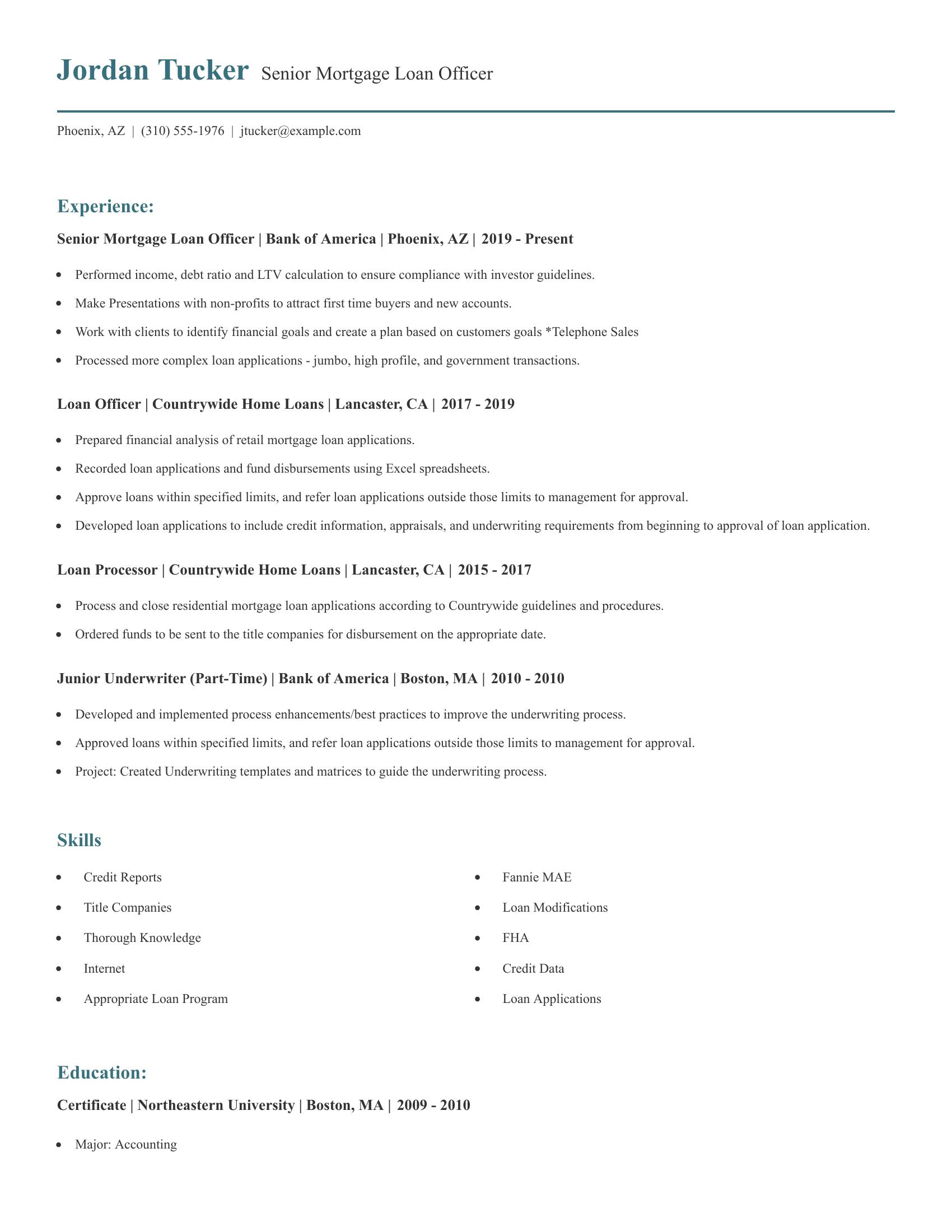

Senior mortgage loan officer resumes should highlight key areas including work experience, skills, and education. The focus should be on demonstrating expertise in mortgage loan processing, financial analysis, client relationship management, and compliance with industry guidelines. A good resume must clearly present job titles, employers, locations, and dates of employment. Additionally, it should list relevant skills and any certifications or education that support the role.

This resume includes relevant job experience from positions like senior mortgage loan officer and loan officer with detailed tasks such as performing income and debt ratio calculations, processing complex loan applications, and developing loan applications. It also highlights skills such as working with credit reports and knowledge of FHA guidelines. The educational background is succinctly mentioned with a certificate in accounting. This comprehensive coverage makes it a strong resume for the role.

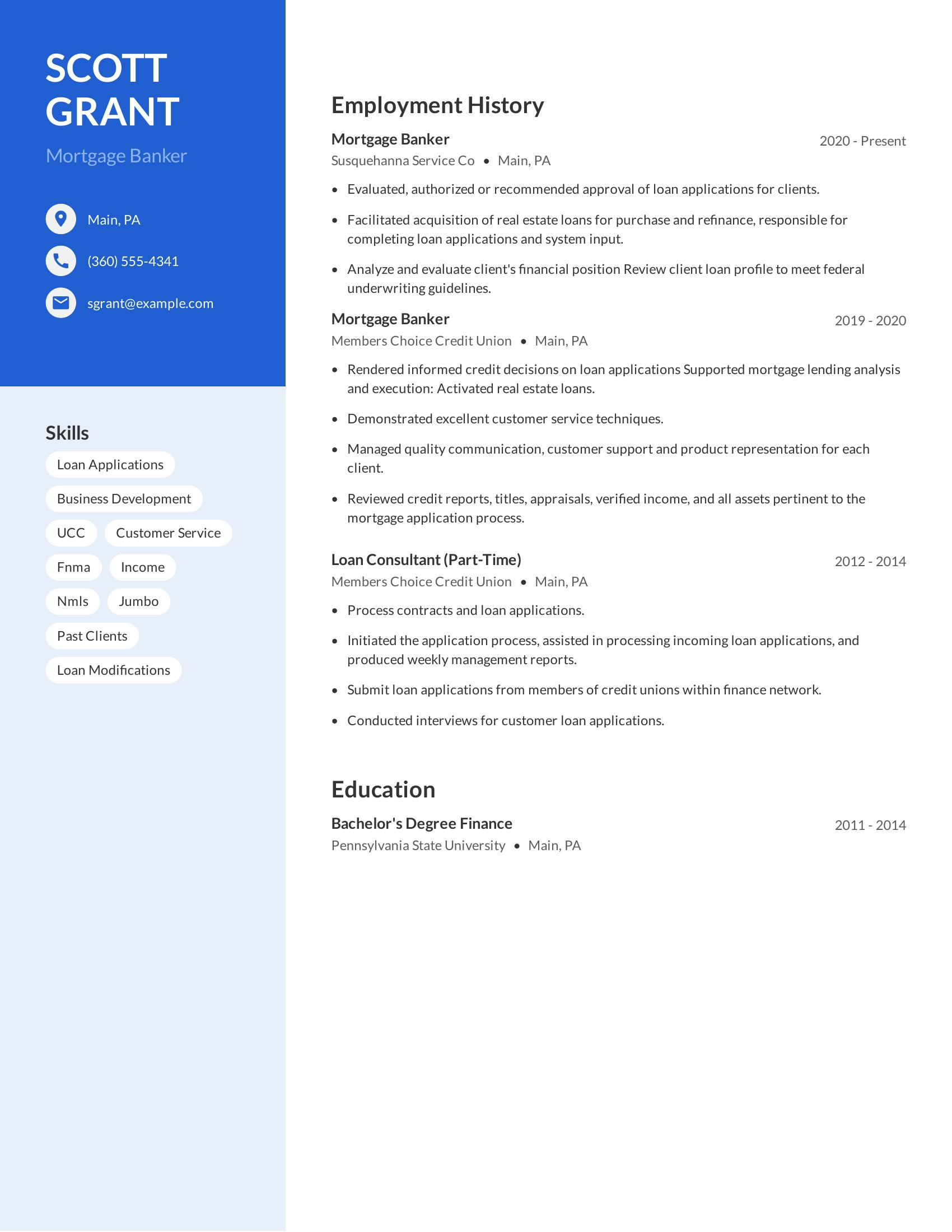

Mortgage banker resumes should showcase relevant skills, employment history, and education. Important skills include loan applications, customer service, and business development. Employment history should highlight roles, responsibilities, and achievements in mortgage banking. Education should be clearly listed with degree and institution details.

This resume includes essential elements of a good mortgage banker resume. It lists relevant skills like loan applications and customer service. Employment history is detailed, showing job titles, companies, locations, and responsibilities. Education is clearly stated with a degree in finance from a recognized university.

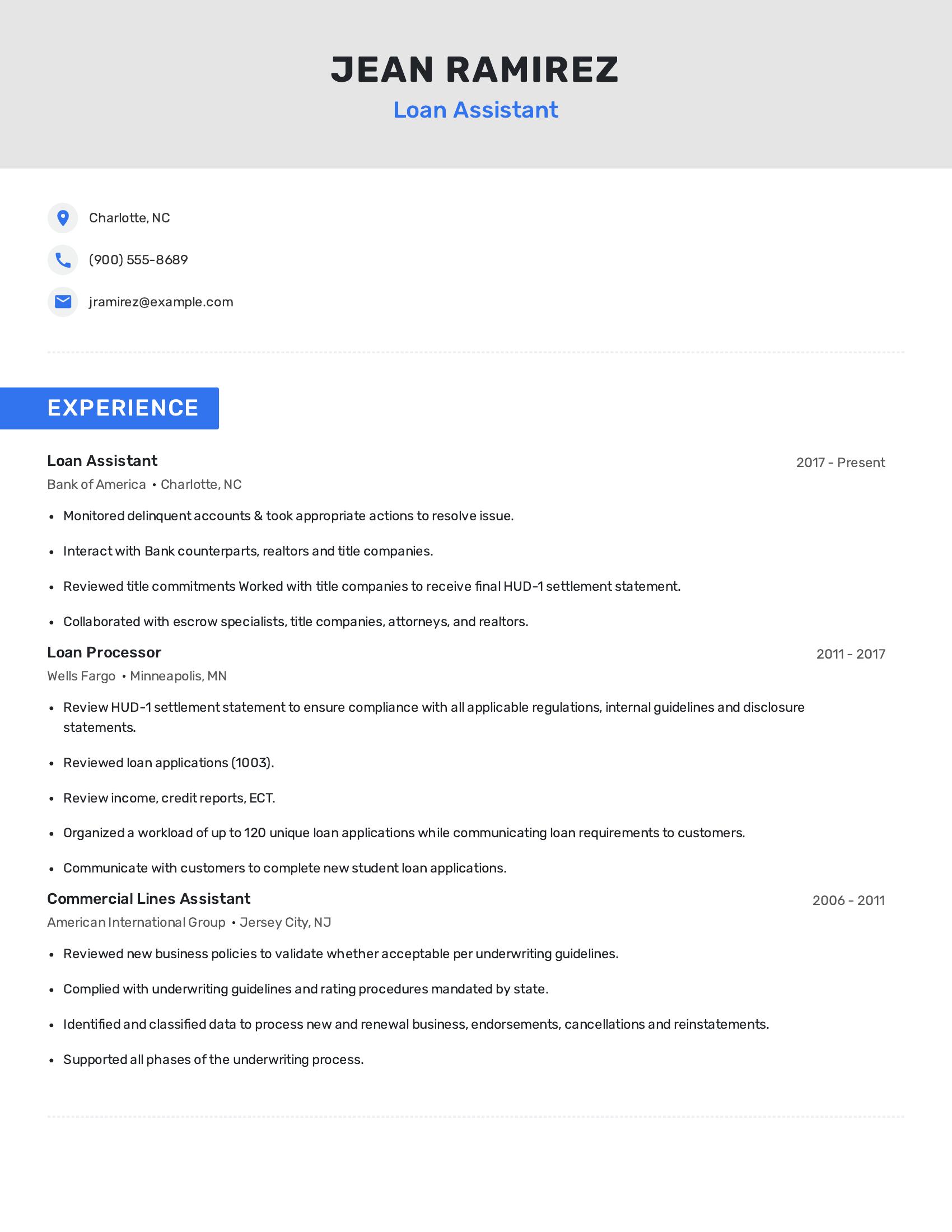

A loan assistant's resume should highlight experience in loan processing, attention to detail, and the ability to work with various stakeholders. It should show proficiency in reviewing financial documents, ensuring compliance with regulations, and handling customer interactions. Relevant job titles and dates should be clear, showcasing a history of responsibilities related to the lending industry.

This resume includes job titles like loan assistant and loan processor, showing relevant experience since 2011. It details tasks such as monitoring delinquent accounts, reviewing title commitments, and communicating with customers. The inclusion of multiple past roles demonstrates a strong background in loan-related tasks and compliance with underwriting guidelines, making it comprehensive for a potential employer.

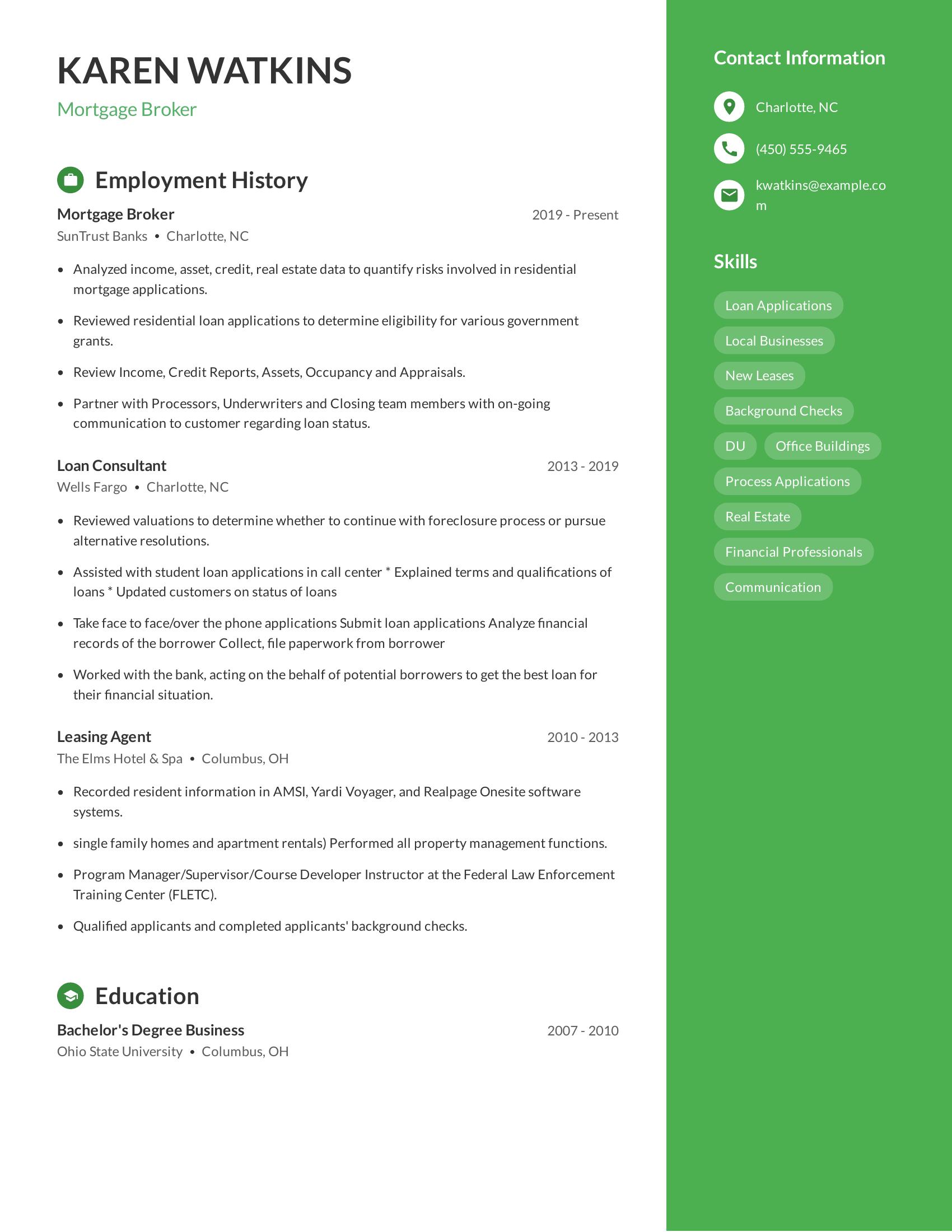

Mortgage broker resumes should include employment history, education, skills, and contact information. Employment history should detail relevant job roles, responsibilities, and achievements. Education should highlight degrees or certifications in finance or related fields. Skills should focus on loan processing, financial analysis, and customer service.

This resume includes a clear employment history with relevant roles at banks and leasing agencies. It shows specific tasks such as analyzing income and credit data, reviewing loan applications, and communicating with various team members. The education section includes a bachelor's degree in business, which is pertinent to the role. Skills listed align with mortgage broker responsibilities like loan applications and financial analysis.

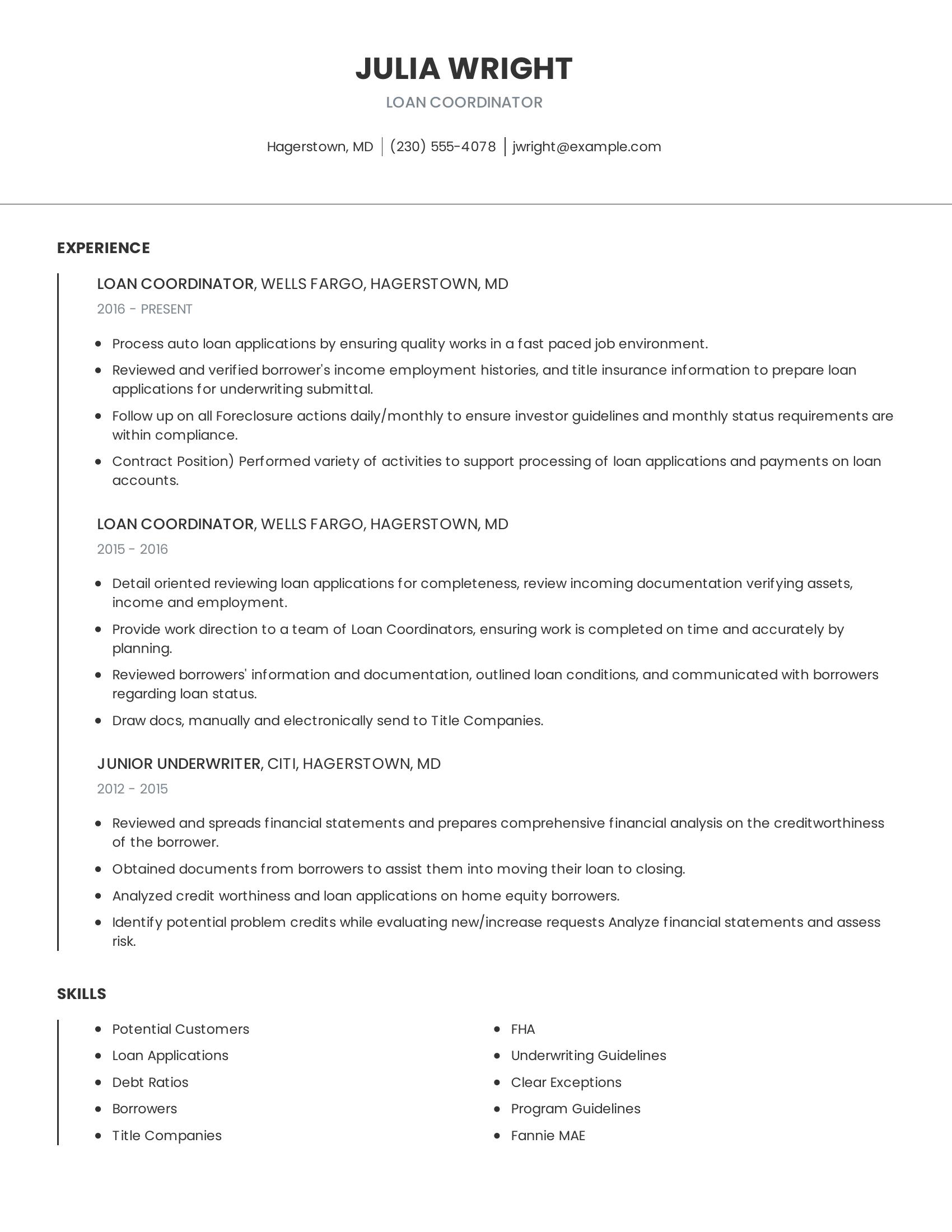

Loan coordinator resumes should include relevant job experience, specific skills related to the position, and clear examples of duties performed. Highlighting responsibilities like processing loan applications, reviewing documentation, and communicating with borrowers is crucial. Including job titles, company names, and locations helps establish credibility and context.

This resume effectively includes detailed job experience at reputable companies. It lists specific responsibilities such as processing auto loan applications, reviewing borrowers' information, and preparing loan applications for underwriting. The resume also mentions relevant skills like understanding FHA underwriting guidelines and working with Title Companies, which are important for a loan coordinator role.

Show your success rate. Mention how many loans you approved and the percentage of successful repayments.

Highlight your compliance knowledge. State your familiarity with regulations like the Equal Credit Opportunity Act.

Detail your customer service skills. Describe how you guided clients through the loan process and resolved issues.

A loan officer's resume must include clear sections that show relevant experience, education, and skills. Focus on professional experience in banking or finance, showcasing your ability to assess and approve loans. Highlight your knowledge of financial regulations and customer service abilities.

A loan officer summary should highlight experience, skills, and achievements. Mention years of experience and types of loans handled.

Keep it concise and focused. Use bullet points to make it easy to read. Tailor the summary to the job description.

A well-written loan officer experience section should highlight specific duties and achievements. Focus on quantifiable results and include relevant skills.

Follow these tips to make your loan officer experience section stand out. Focus on clarity and relevance.

A loan officer needs specific skills to process and approve loans efficiently.

A loan officer needs interpersonal skills to interact with clients and colleagues effectively.