17 Credit Analyst Resume Examples

Credit analyst resumes should include work experience, education, and relevant skills. Key elements are job titles, companies worked for, years of experience, and specific tasks performed. Highlighting technical proficiency and achievements is crucial. Educational background should be clear and relevant to the field.

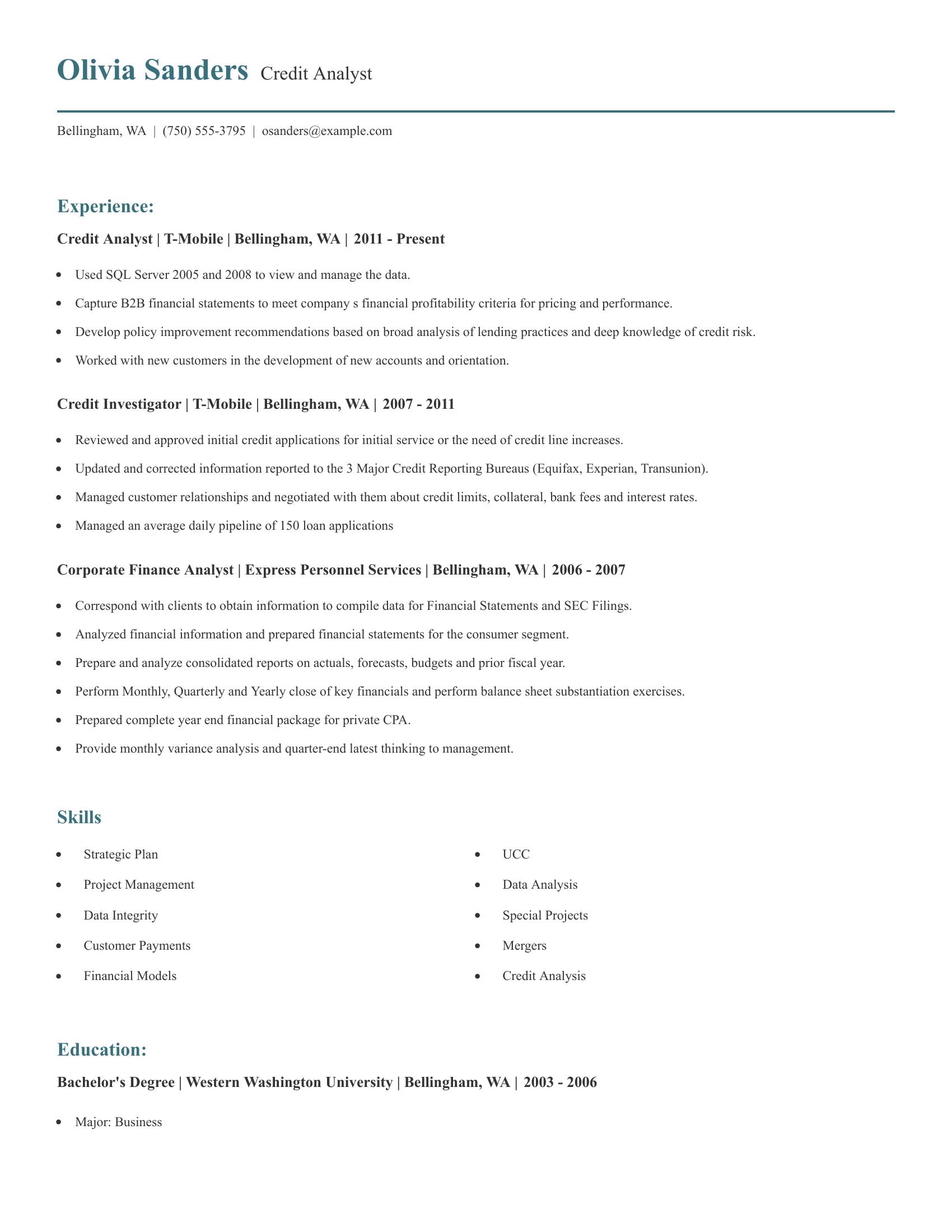

This resume effectively lists relevant job experiences with clear job titles and responsibilities. It includes detailed descriptions of tasks like managing data with SQL Server, financial analysis, and policy recommendations. The skills section covers important areas like strategic planning and data analysis. Educational qualifications are clearly stated along with the degree obtained.

A good senior credit analyst resume should highlight analytical skills, experience with financial statements, risk mitigation, and collection management. It should show a history of employment that demonstrates growth in responsibility and knowledge in the credit and finance industry. The resume should also include relevant education credentials and specific skills pertinent to the role, such as customer service and experience with financial software.

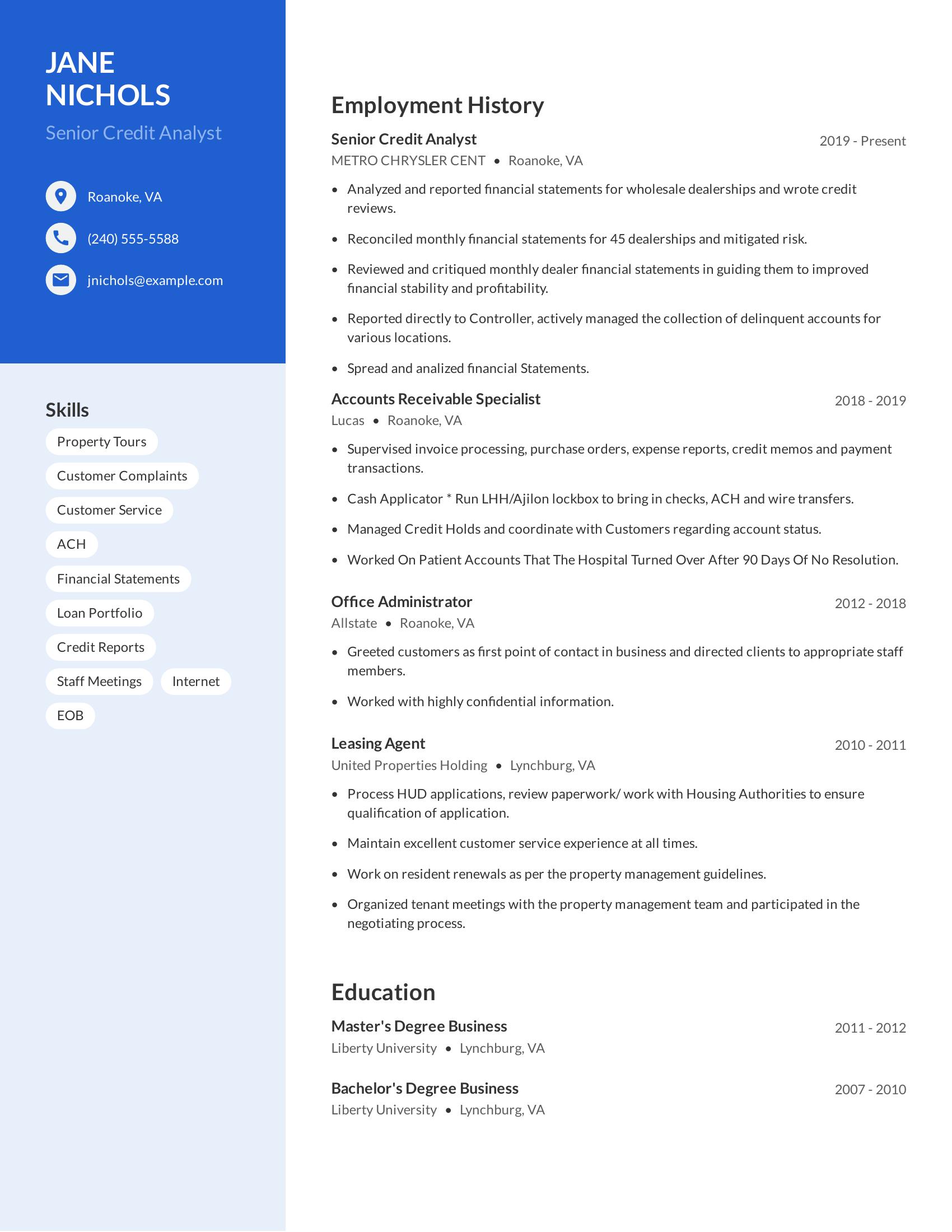

This resume includes all the necessary specifics. It lists relevant job experiences, showing a clear career progression from office administrator to senior credit analyst. The skills section is comprehensive, covering important areas like financial statements and loan portfolios. Education details are present, with both bachelor's and master's degrees in business. The employment history includes detailed job responsibilities that align well with the role of a senior credit analyst.

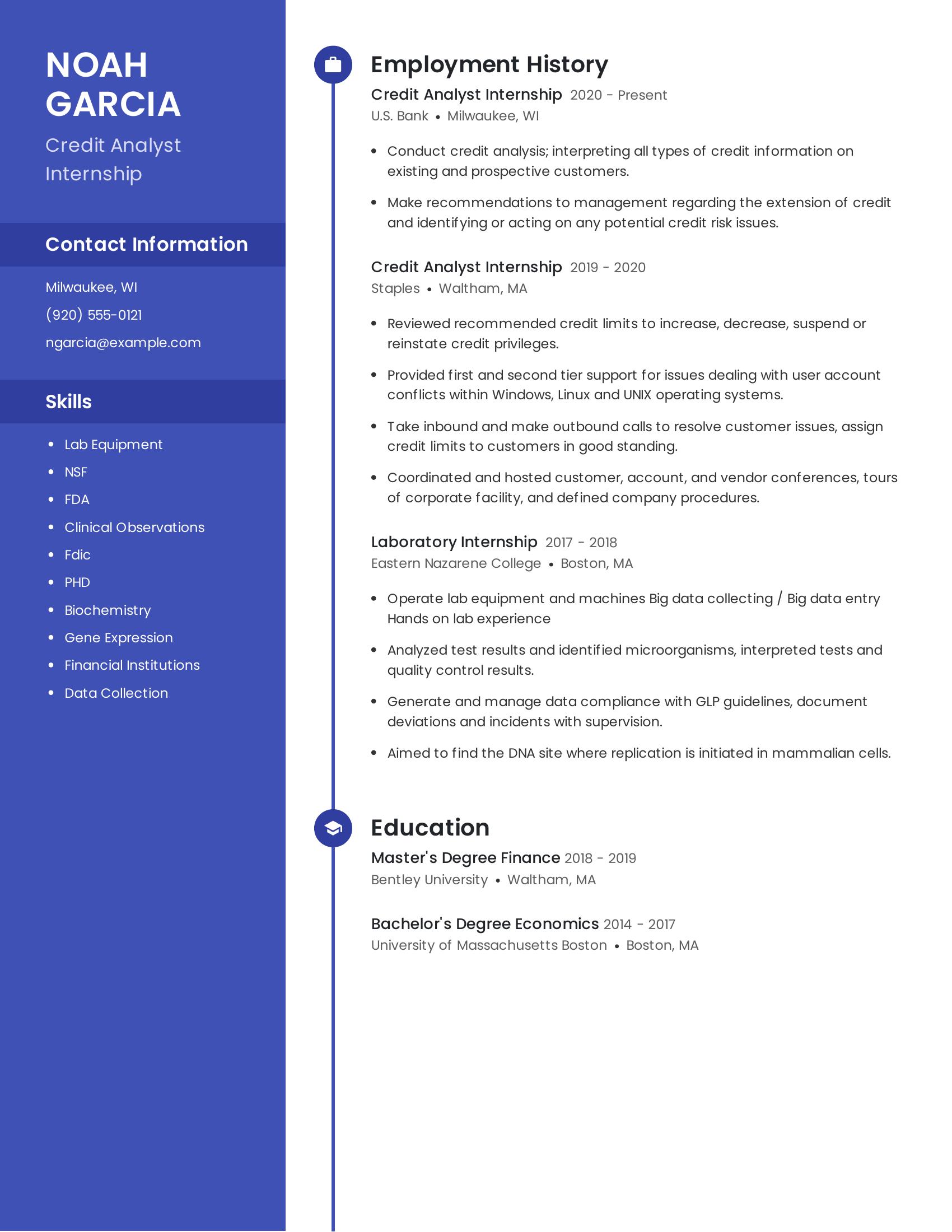

A credit analyst internship resume should highlight relevant skills, employment history, and education. It should focus on financial analysis abilities, familiarity with financial institutions, and experience in credit risk assessment. A good resume includes clear job titles, concise descriptions of duties, and quantifiable achievements. It should also list relevant educational qualifications and technical skills applicable to the role.

This resume effectively includes those specifics by listing relevant internships at U.S. Bank and Staples, detailing tasks such as conducting credit analysis and managing credit limits. The candidate also has a strong educational background with degrees in finance and economics from reputable universities. Skills like data collection and familiarity with financial institutions are mentioned, which are pertinent to the role of a credit analyst intern.

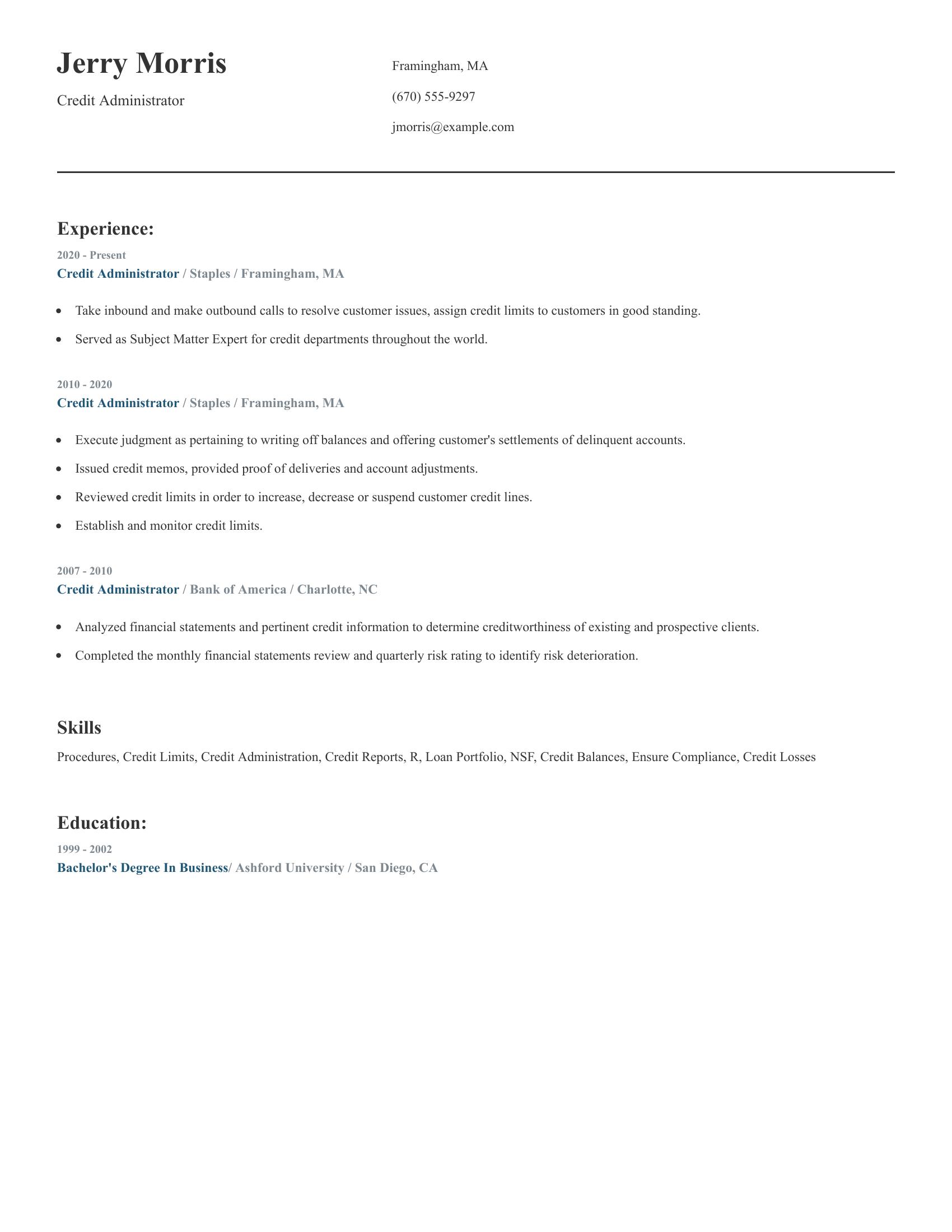

A credit administrator resume should highlight relevant experience, specific skills, and education in the field. The resume should include job titles, company names, locations, and dates of employment. It should detail responsibilities and accomplishments that demonstrate expertise in credit management, customer service, and financial analysis. The skills section should list technical proficiencies and key competencies related to credit administration.

This resume includes specific job titles, companies, locations, and employment dates, showing a clear career progression. It details responsibilities such as resolving customer issues, analyzing financial statements, and adjusting credit limits. The skills section lists relevant competencies like credit reports and loan portfolio management. The education section clearly states the degree earned and the institution attended.

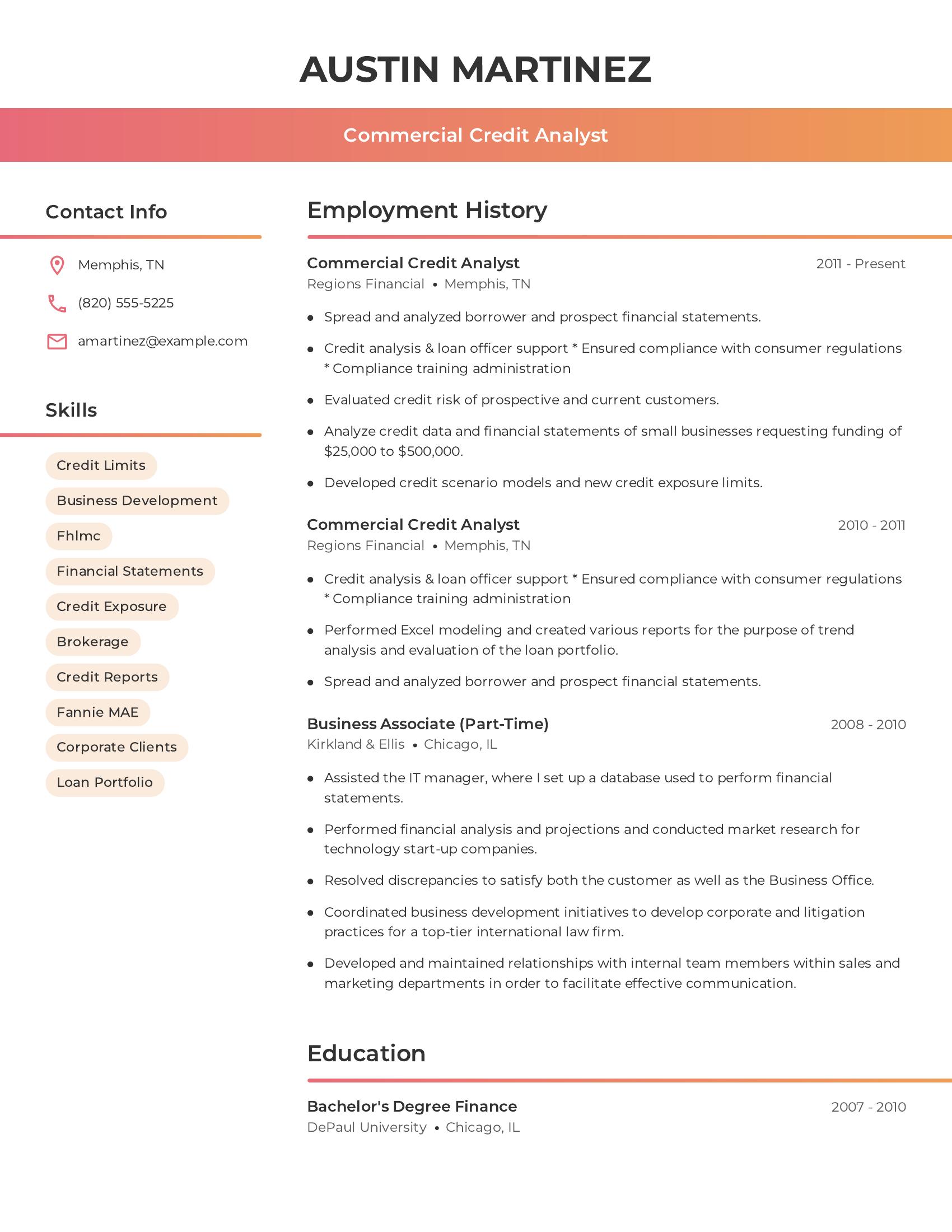

A commercial credit analyst resume should highlight relevant experience, essential skills, and educational background in finance. Key elements include job titles, employment history with dates, specific responsibilities, and accomplishments. Important skills to feature are credit analysis, financial statement evaluation, loan portfolio management, and compliance knowledge. Additionally, quantifiable results and specific scenarios showcasing analytical abilities and business development contributions enhance the resume.

This resume includes a clear employment history with dates and job titles, demonstrating consistent career progression in credit analysis. It highlights relevant skills such as credit limits, financial statements analysis, and loan portfolio management. The resume also details specific tasks like developing credit scenario models, performing Excel modeling, and evaluating credit risk. Educational background is clearly stated, and there is evidence of compliance training administration and business development initiatives.

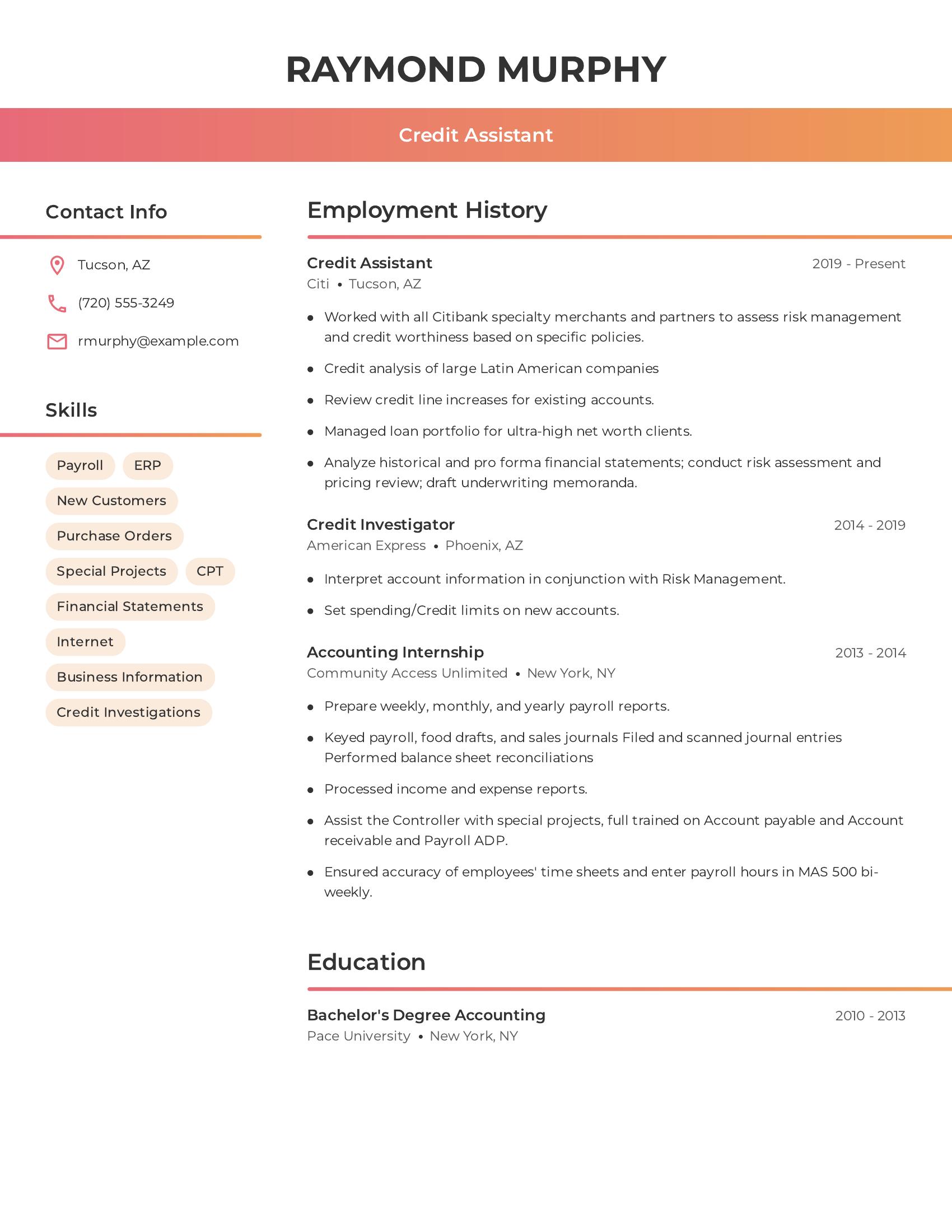

A credit assistant resume should highlight experience in financial analysis, credit investigations, risk management, and payroll processing. It should include specific job roles, responsibilities, and skills like handling financial statements, managing loan portfolios, and conducting credit analysis. Education background with relevant degrees and any internships or previous positions in finance or accounting are important. Contact information should be clear and concise.

This resume includes a comprehensive list of relevant experiences such as working with specialty merchants, assessing risk management and creditworthiness, managing loan portfolios for high net worth clients, and performing balance sheet reconciliations. It also lists important skills like payroll ERP, purchase orders, and credit investigations. The education section shows a relevant degree in accounting and an internship that provided practical experience. Contact information is straightforward and easy to find.

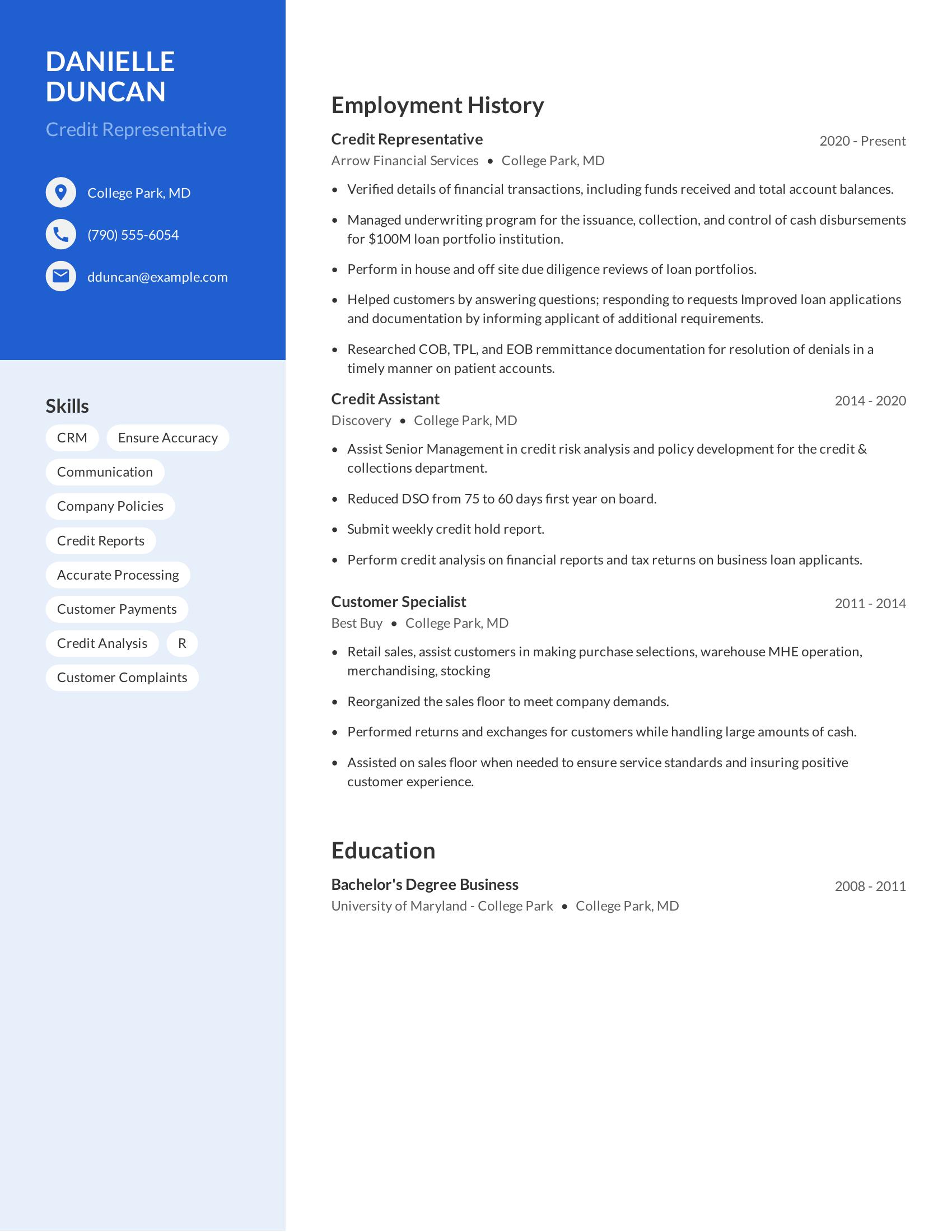

Credit representative resumes should highlight skills in financial analysis, customer service, and credit management. Key sections include contact information, skills, employment history, and education. Important competencies like communication, processing accuracy, and knowledge of credit reports should be evident. Experience with managing financial transactions and handling customer complaints is valuable. The resume should show a clear professional progression and specific achievements in previous roles.

This resume includes the necessary specifics for a credit representative role. It outlines relevant skills like CRM, communication, and credit analysis. Employment history shows progressive responsibilities from a customer specialist to a credit representative. Specific achievements like reducing DSO from 75 to 60 days are quantifiable and impactful. The education section provides relevant academic background supporting the professional experience.

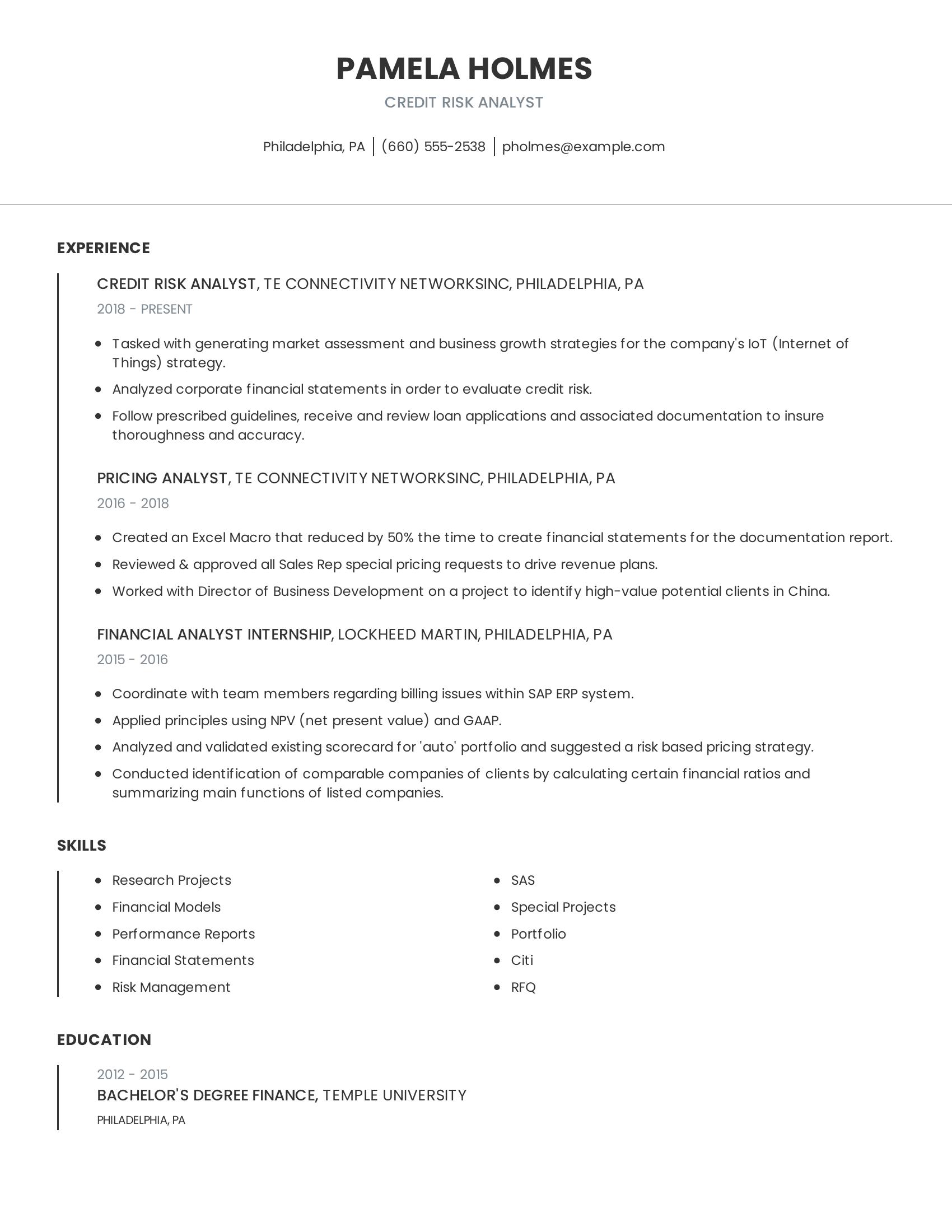

Credit risk analyst resumes should focus on relevant experience, technical skills, and educational background. They should show proficiency in analyzing financial statements, evaluating credit risk, and working with financial models. Highlighting experience with specific tools like SAS and familiarity with industry standards like GAAP is important. Additionally, showcasing any achievements that demonstrate the ability to improve processes or contribute to business growth can make a resume stand out.

This resume includes detailed job experiences that illustrate the candidate's ability to analyze corporate financial statements and evaluate credit risk. It also covers technical skills such as creating Excel Macros and working with SAP ERP systems. The candidate's educational background in finance from Temple University supports their qualifications. Additionally, the resume lists skills relevant to the role, such as research projects and risk management.

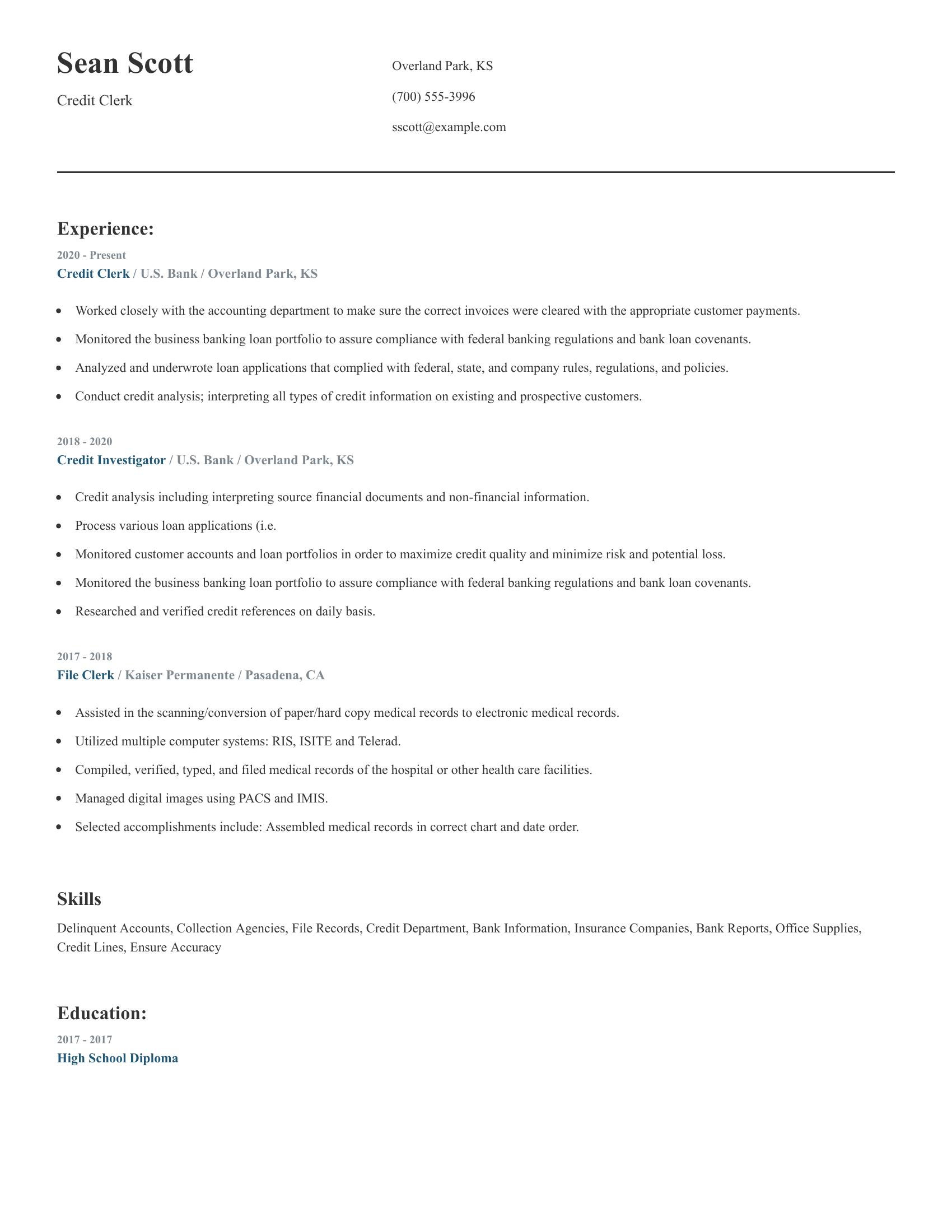

Credit clerk resumes should highlight specific job experiences, relevant skills, and educational background. They should emphasize roles related to credit analysis, loan application processing, compliance with regulations, and account monitoring. Relevant skills like handling delinquent accounts, using computer systems, and managing records are important. The resume should be clear and concise, showcasing a history of progressively responsible roles in the industry.

Sean Scott's resume effectively includes these specifics. It details experience as a credit clerk and a credit investigator at a bank, demonstrating a history of working with loans and credit analysis. The resume also shows skills in managing financial information and ensuring compliance with regulations. Education is included, showing the completion of high school. The progression from file clerk to credit clerk highlights the advancement in related roles.

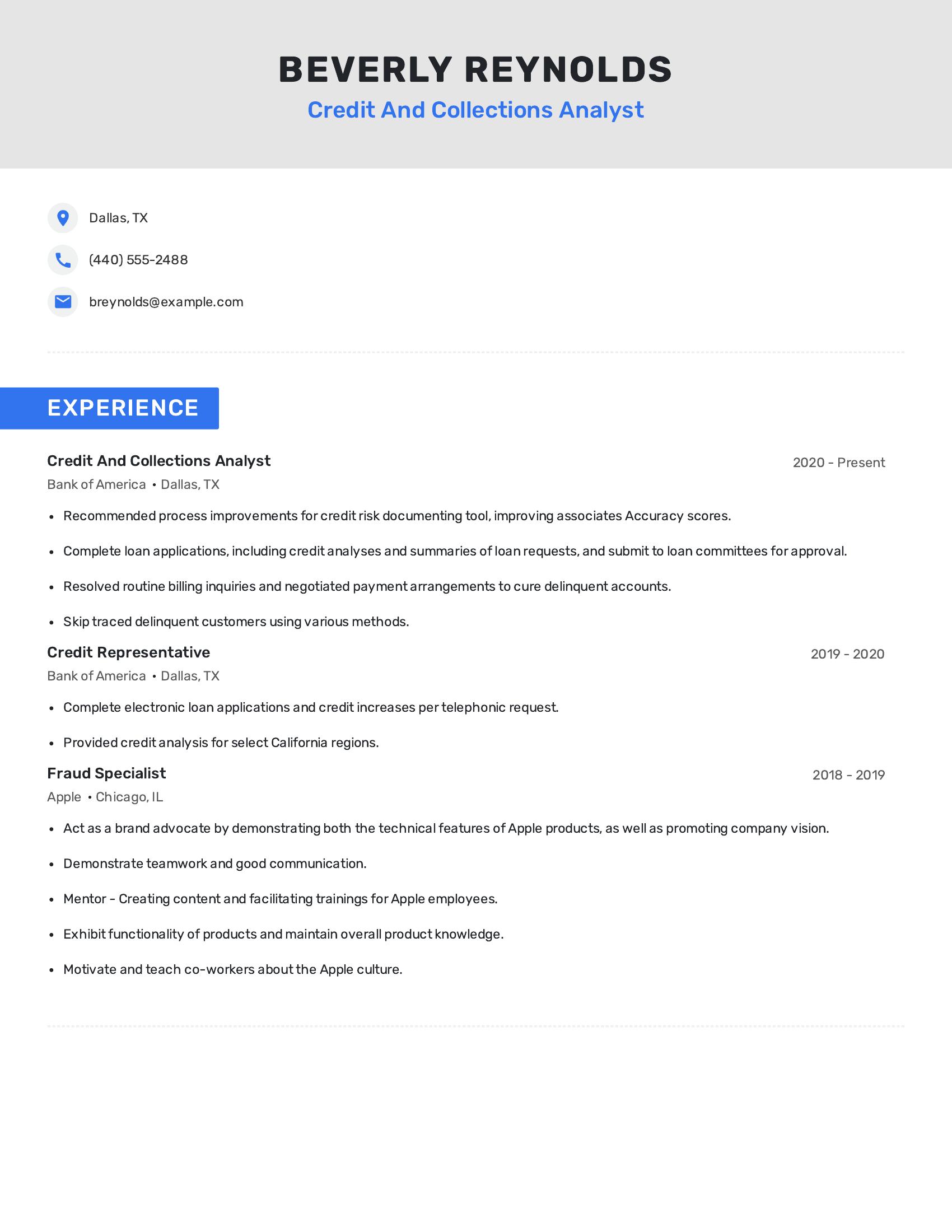

A credit and collections analyst resume should include relevant job experience, specific responsibilities, and measurable achievements. It should detail experience in managing credit applications, handling billing inquiries, and negotiating payment plans. The resume should also highlight skills in credit analysis, loan documentation, and customer delinquency resolution.

This resume includes those specifics by listing detailed job responsibilities such as recommending process improvements and completing loan applications. It also mentions resolving billing inquiries, skip tracing delinquent customers, and providing credit analysis. Additionally, the experience section is concise and covers all relevant positions held, showcasing a clear career progression in the field of credit and collections.

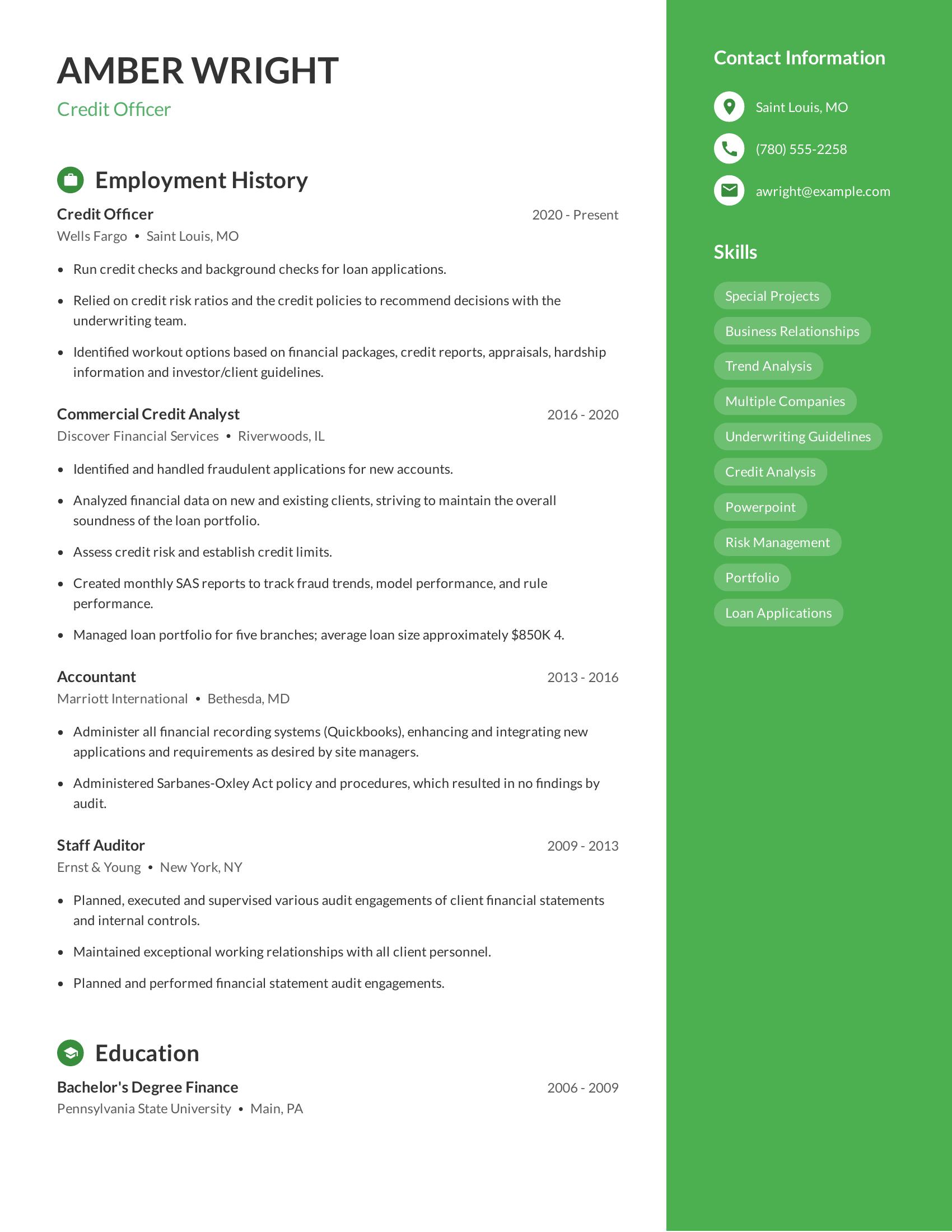

Credit officer resumes should clearly outline relevant work experience, educational background, and key skills. A good resume highlights specific duties and achievements in previous roles, demonstrates knowledge of credit analysis, risk management, and financial regulations, and includes contact information. It should also list technical skills like proficiency with financial software and tools relevant to the job.

This resume effectively captures the key components of a strong credit officer resume. It details Amber's employment history with clear descriptions of her responsibilities and accomplishments at each position. It shows her progression from staff auditor to credit officer and highlights relevant skills such as credit analysis and risk management. The resume also includes her educational background and contact information, making it comprehensive and informative despite the formatting issues.

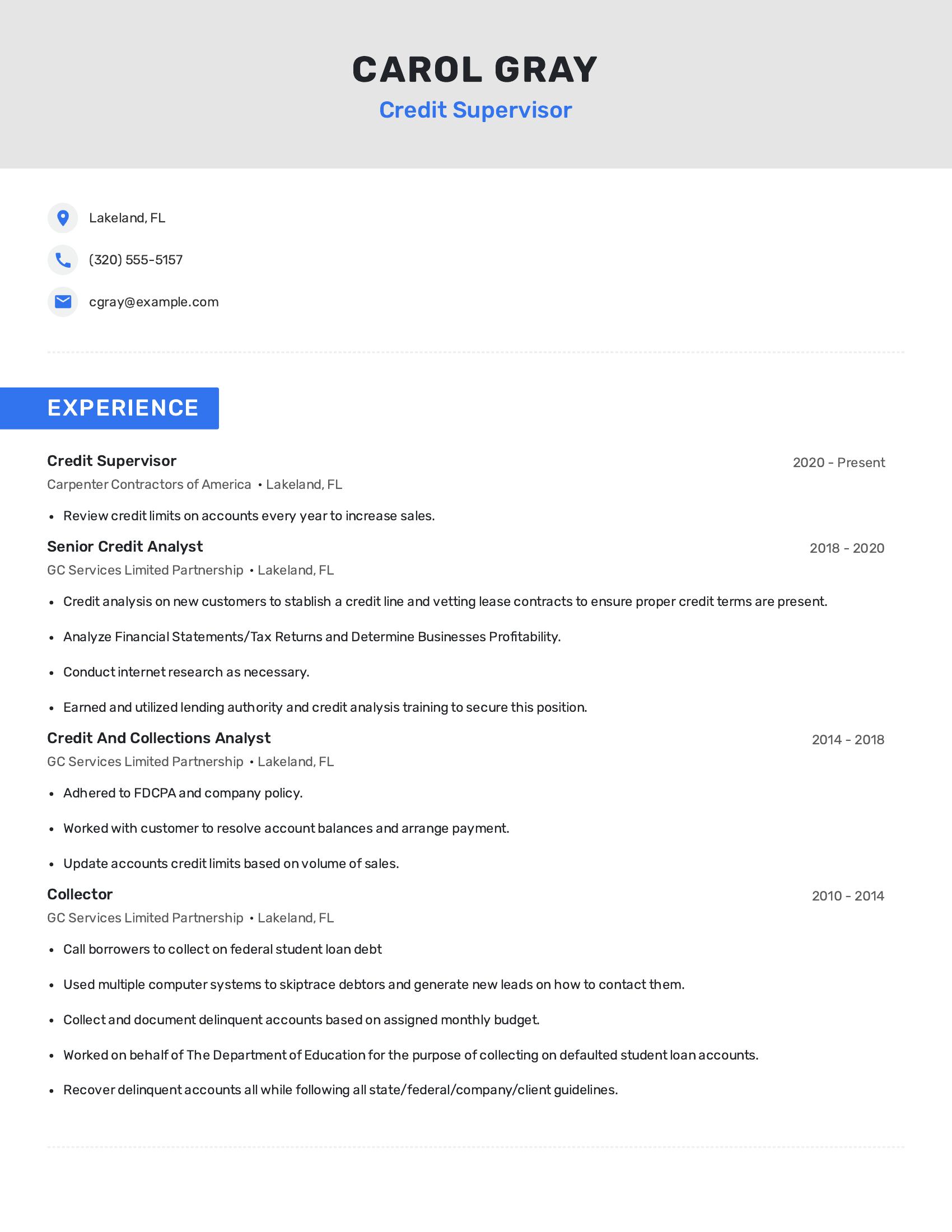

Credit supervisor resumes should highlight relevant work experience, demonstrate knowledge of credit policies, and show the ability to manage and review credit limits effectively. The resume should also indicate the candidate's experience in analyzing financial statements, handling collections, and adhering to regulatory guidelines. Clear job progression and specific achievements in each role are important.

This resume includes those specifics by detailing the candidate's experience from a collector to a credit supervisor. It shows the ability to review credit limits, analyze financial statements, and adhere to policies. It also highlights the candidate's progression through various roles, demonstrating their growing expertise in credit analysis and collections.

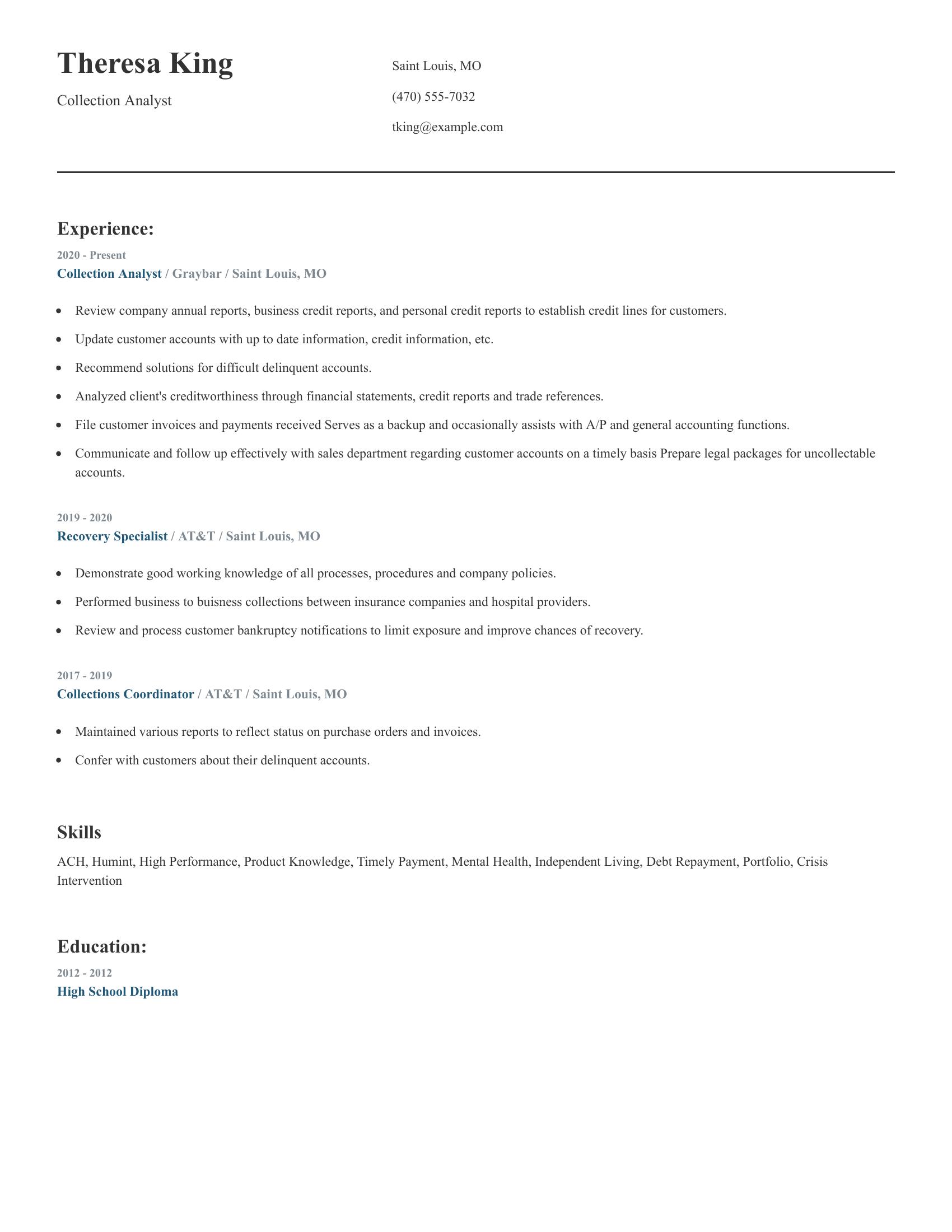

A collection analyst resume should highlight relevant experience, skills in financial analysis, and proficiency in handling delinquent accounts. It should include a history of roles that demonstrate the ability to review credit reports, communicate with customers, and recommend solutions for debt recovery. The resume should also showcase any specific achievements or responsibilities in previous positions that relate to collections and financial management.

This resume includes several specifics that make it strong. It details experience as a collection analyst, recovery specialist, and collections coordinator. The listed responsibilities show a clear track record of reviewing credit reports, updating customer accounts, and managing delinquent accounts. The skills section highlights relevant abilities like ACH, debt repayment, and crisis intervention. The education section is brief but includes a high school diploma, which is often the minimum requirement for such roles.

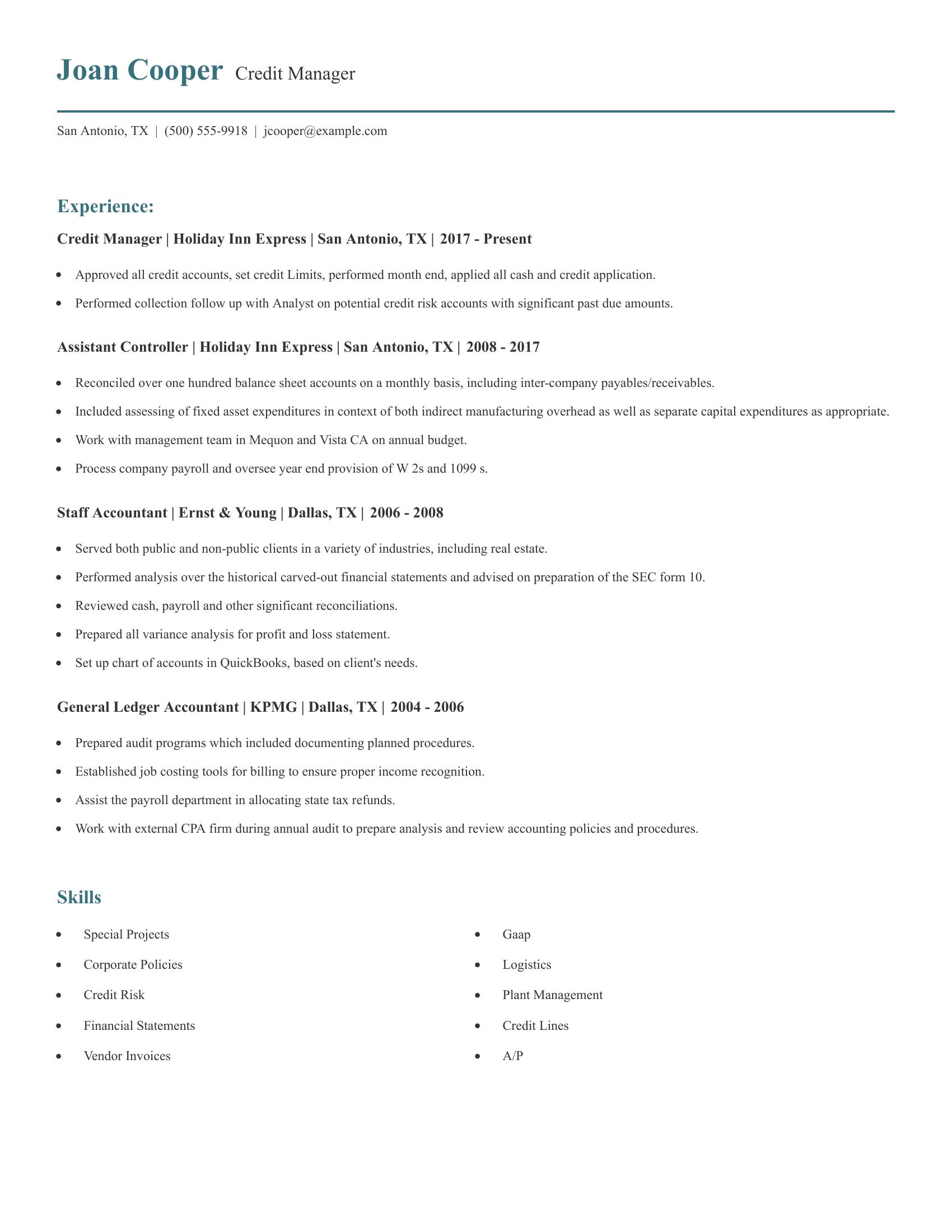

Credit manager resumes should highlight experience in credit approval, risk assessment, and financial analysis. They should show a history of managing credit limits, performing month-end tasks, and handling collections. Also important is experience in reconciling balance sheets, budgeting, payroll processing, and working with management teams. Skills in GAAP, corporate policies, logistics, and credit risk management are essential for demonstrating competency in the field.

This resume includes extensive experience in credit management, including approving accounts and setting credit limits. It shows a strong background in financial roles such as assistant controller and staff accountant, highlighting skills in balance sheet reconciliation, budget preparation, payroll processing, and variance analysis. The resume also lists relevant skills such as GAAP and credit risk management, which are crucial for a credit manager.

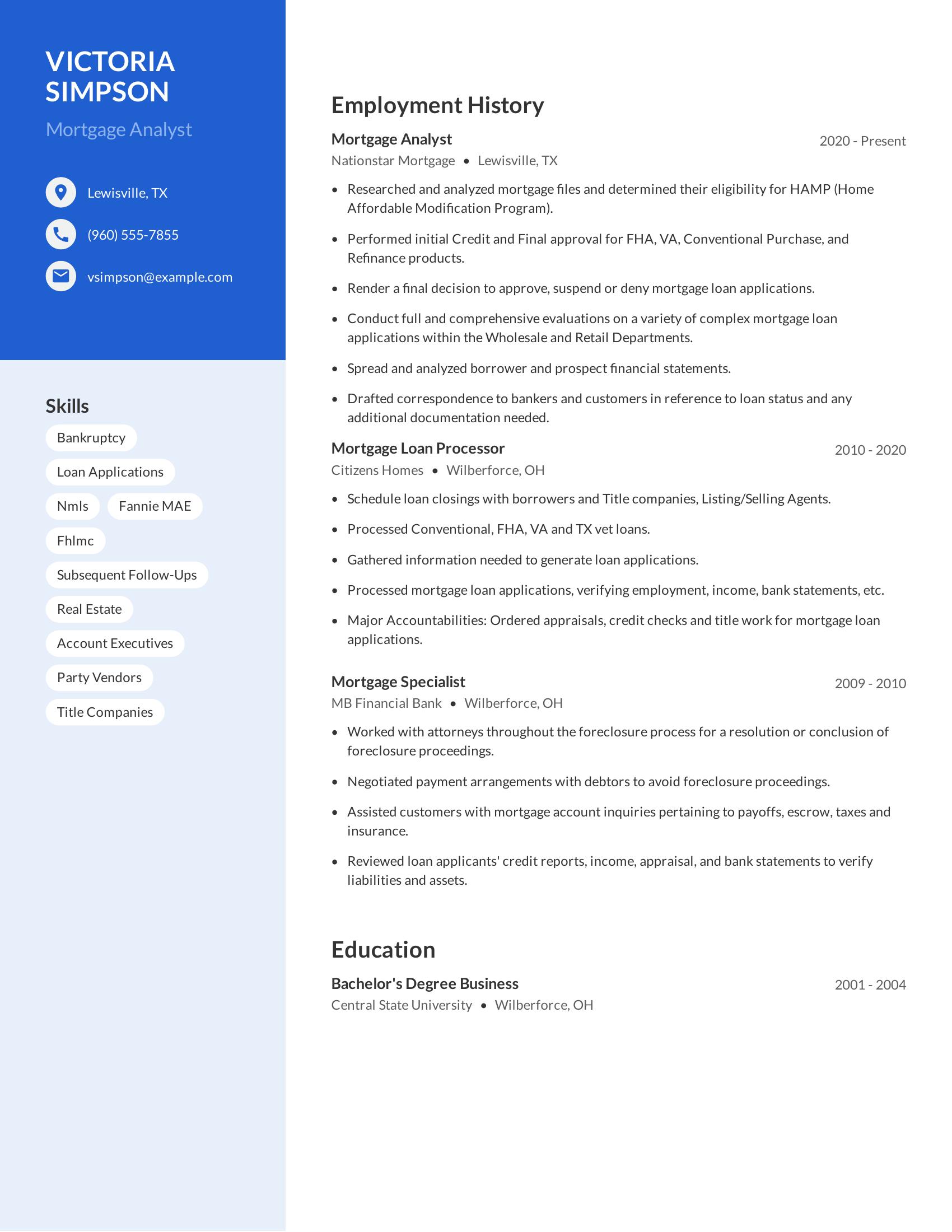

Mortgage analyst resumes should highlight skills such as loan processing, credit evaluation, and customer interaction. They must include employment history that showcases experience with different types of loans, such as FHA, VA, and Conventional. The resume should also demonstrate the ability to analyze financial statements and make final loan decisions. Education should be listed to confirm relevant academic background.

This resume effectively includes these specifics. It details experience with various mortgage loans and highlights skills in bankruptcy and loan applications. The employment history shows progressive roles in the mortgage industry, demonstrating growing expertise. Additionally, the education section confirms a relevant degree, adding credibility to the candidate's qualifications.

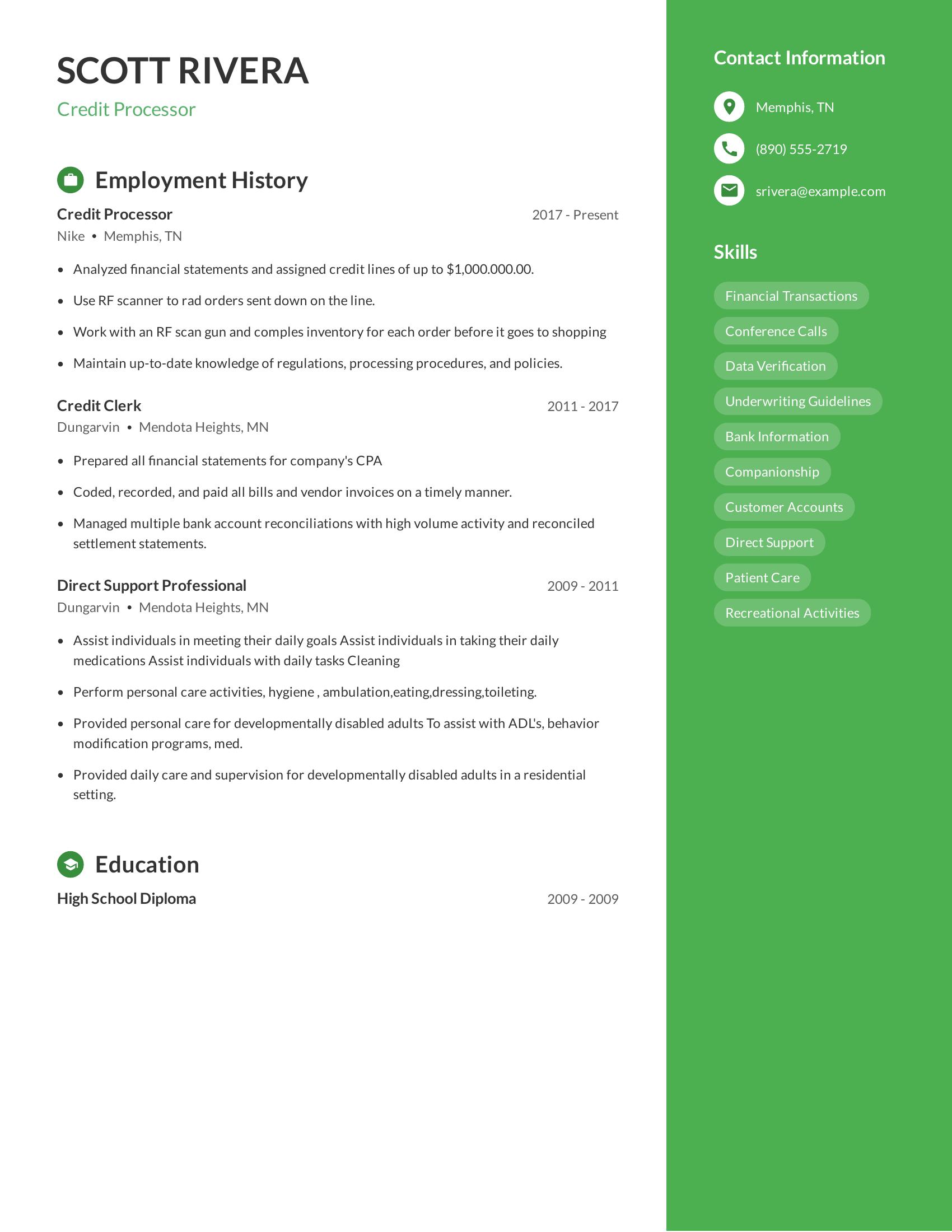

Credit processor resumes should highlight experience in financial statement analysis, credit line assignments, and familiarity with relevant regulations and procedures. They should also showcase skills in data verification, transaction management, and customer accounts. A strong resume includes a clear employment history with specific duties and accomplishments, demonstrating the candidate's ability to handle complex financial tasks and maintain up-to-date knowledge in their field.

This resume includes relevant work experience as a credit processor, detailing responsibilities like analyzing financial statements, managing inventory orders with an RF scanner, and maintaining regulatory knowledge. It also lists prior roles that build a foundation in financial tasks, such as coding and recording bills and managing bank reconciliations. The education section is concise, and the skills section covers important areas such as financial transactions and data verification.

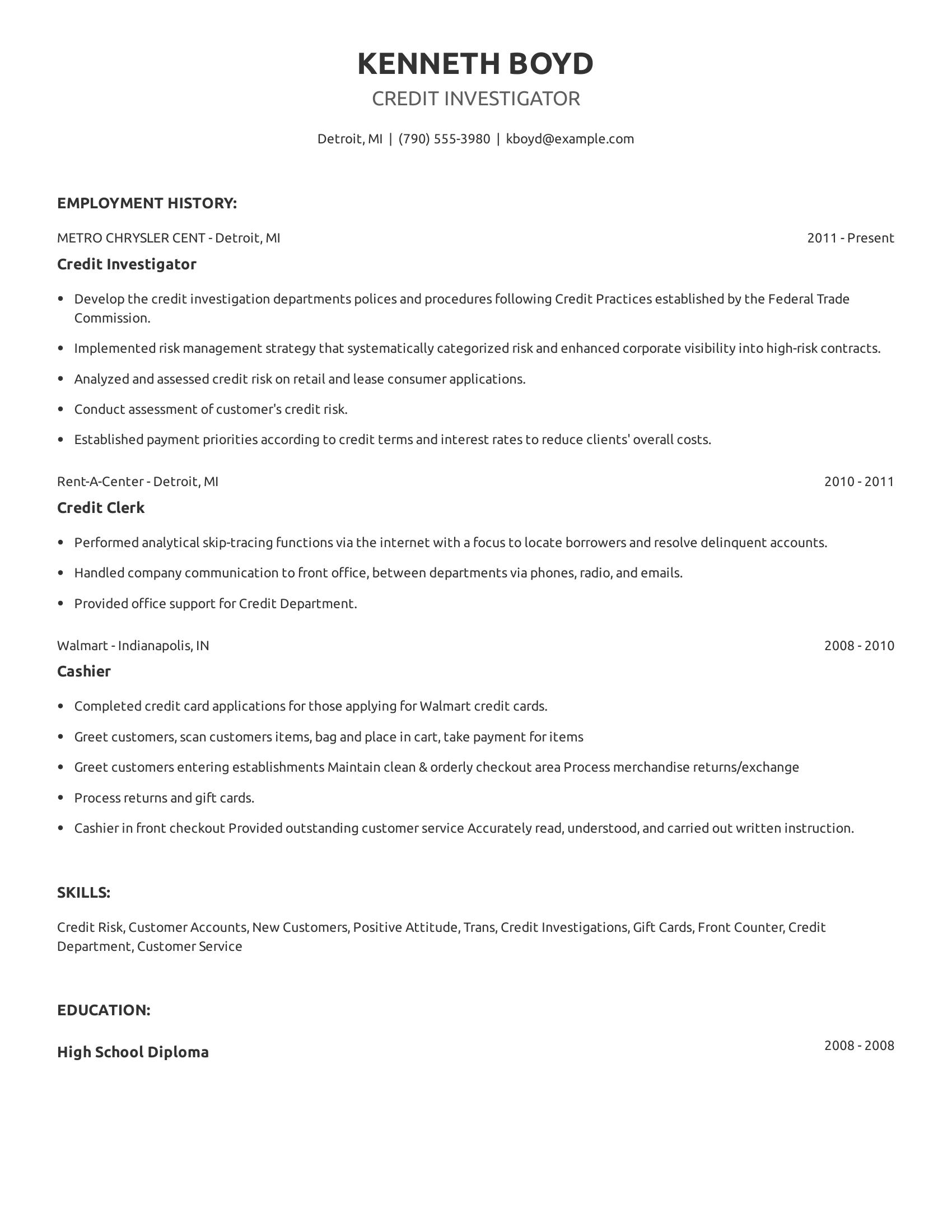

Credit investigator resumes should include specific skills and experiences relevant to the job. Important elements are previous work in credit risk assessment, familiarity with credit policies, and experience with customer accounts. It should highlight responsibilities like conducting credit investigations, handling delinquent accounts, and implementing risk management strategies. Additionally, practical skills like customer service and office communication add value.

This resume includes many of these specifics. It lists relevant job titles and tasks, such as developing credit policies, assessing credit risk, and performing skip-tracing functions. It also mentions working in customer service roles, which shows versatility. The inclusion of skills like credit risk and customer service further demonstrates suitability for the role.

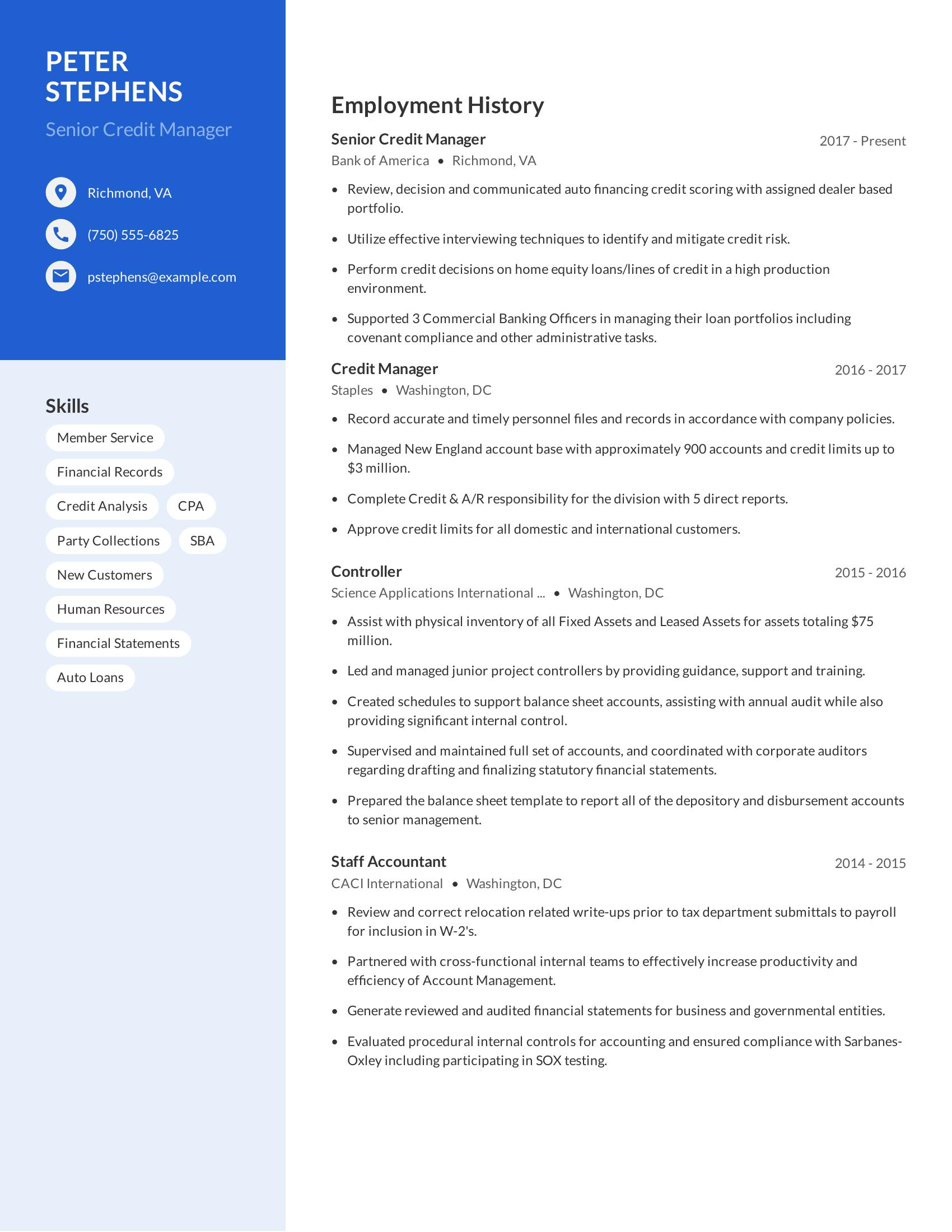

Senior credit manager resumes should highlight relevant experience in credit risk analysis, loan portfolio management, and financial record-keeping. They must showcase skills in decision-making, compliance, and team leadership. Employment history should reflect progressive responsibilities and quantifiable achievements. Key skills should be directly related to credit management and financial analysis.

This resume includes specifics such as experience in auto financing credit scoring, home equity loans, and commercial banking support. It demonstrates a strong background with roles from credit manager to staff accountant, showing career progression. The resume lists relevant skills like credit analysis, financial records management, and human resources, aligning with the responsibilities of a senior credit manager.

Highlight relevant experience. List past roles related to finance, banking, or credit analysis. Mention your experience in assessing credit risk, preparing financial reports, and working with financial software.

Showcase technical skills. Include skills like proficiency in Microsoft Excel, financial modeling, and data analysis. Highlight your ability to use credit analysis software and tools.

Quantify achievements. Use numbers to show your impact. For example, mention how you reduced bad debt by a certain percentage or how many loan applications you evaluated monthly.

A credit analyst's resume should highlight their ability to assess financial information and make informed decisions. The resume must be clear and organized to show their qualifications and experience.

A credit analyst summary should highlight your experience, skills, and results. Focus on what you have done and can do.

Your summary should be clear and concise. It should make a strong impression quickly.

When writing a credit analyst experience section, focus on demonstrating your analytical skills and ability to assess financial risk.

Make your resume stand out by being clear and direct about your previous roles and successes.

A credit analyst needs technical skills to evaluate financial risks and make decisions.

A credit analyst also needs soft skills to communicate effectively and work well with others.