17 Controller Resume Examples

Controller resumes should include a clear career progression, relevant skills, and specific achievements. Highlighting experience in financial management, team collaboration, and regulatory compliance is important. Educational background and certifications like CPA should be prominently listed. Skills should focus on financial analysis, software proficiency, and operational oversight.

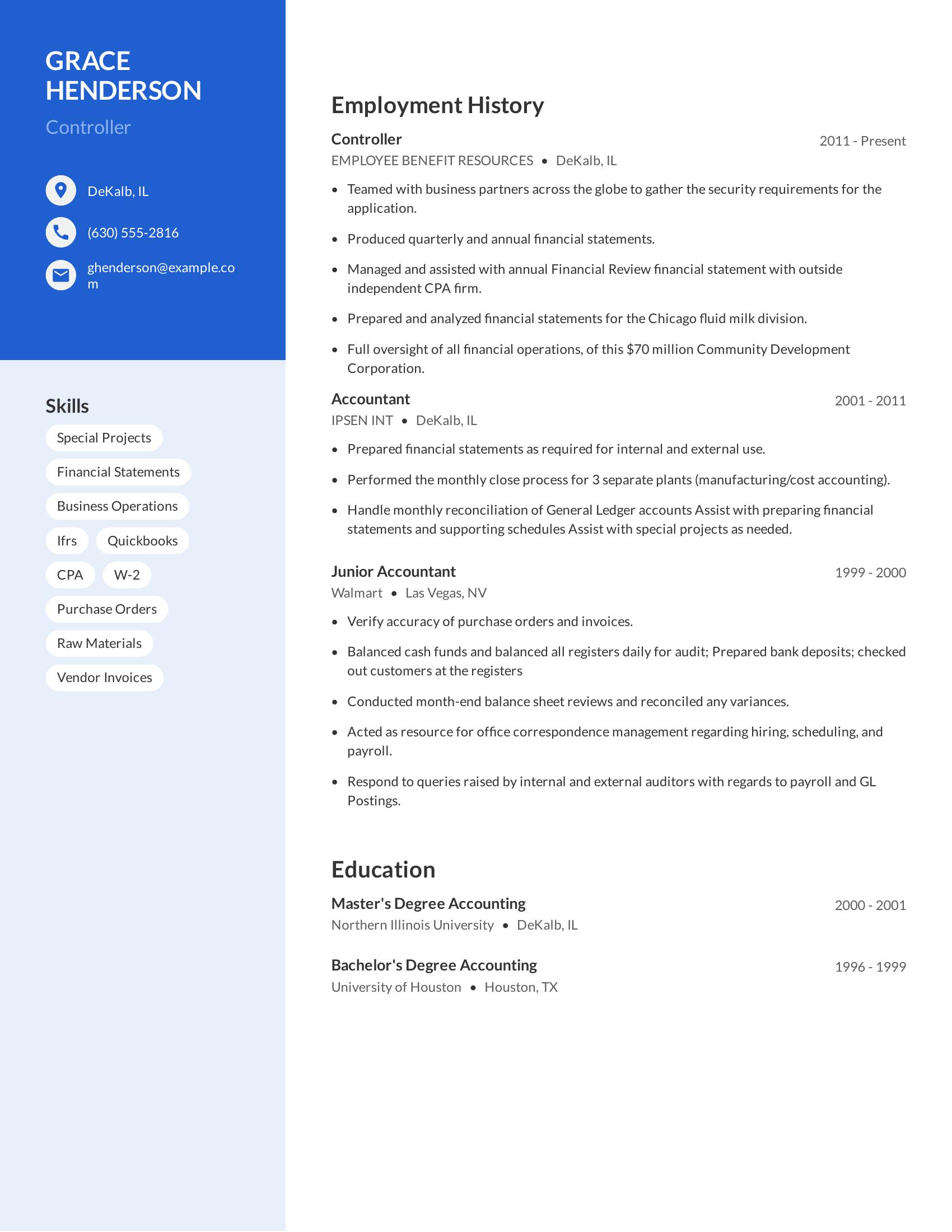

This resume includes a strong work history with progressive roles from junior accountant to controller. It outlines specific duties such as producing financial statements, managing audits, and handling reconciliations. The educational background is clearly stated with degrees in accounting. Relevant skills like QuickBooks, IFRS, and CPA are listed, making the candidate's qualifications evident.

Assistant controller resumes should highlight extensive experience in financial management, knowledge of accounting principles, and proficiency in financial software. Key elements include a history of preparing budgets, financial statements, managing audits, and ensuring compliance with industry standards. Additionally, leadership abilities, problem-solving skills, and experience with risk management are crucial.

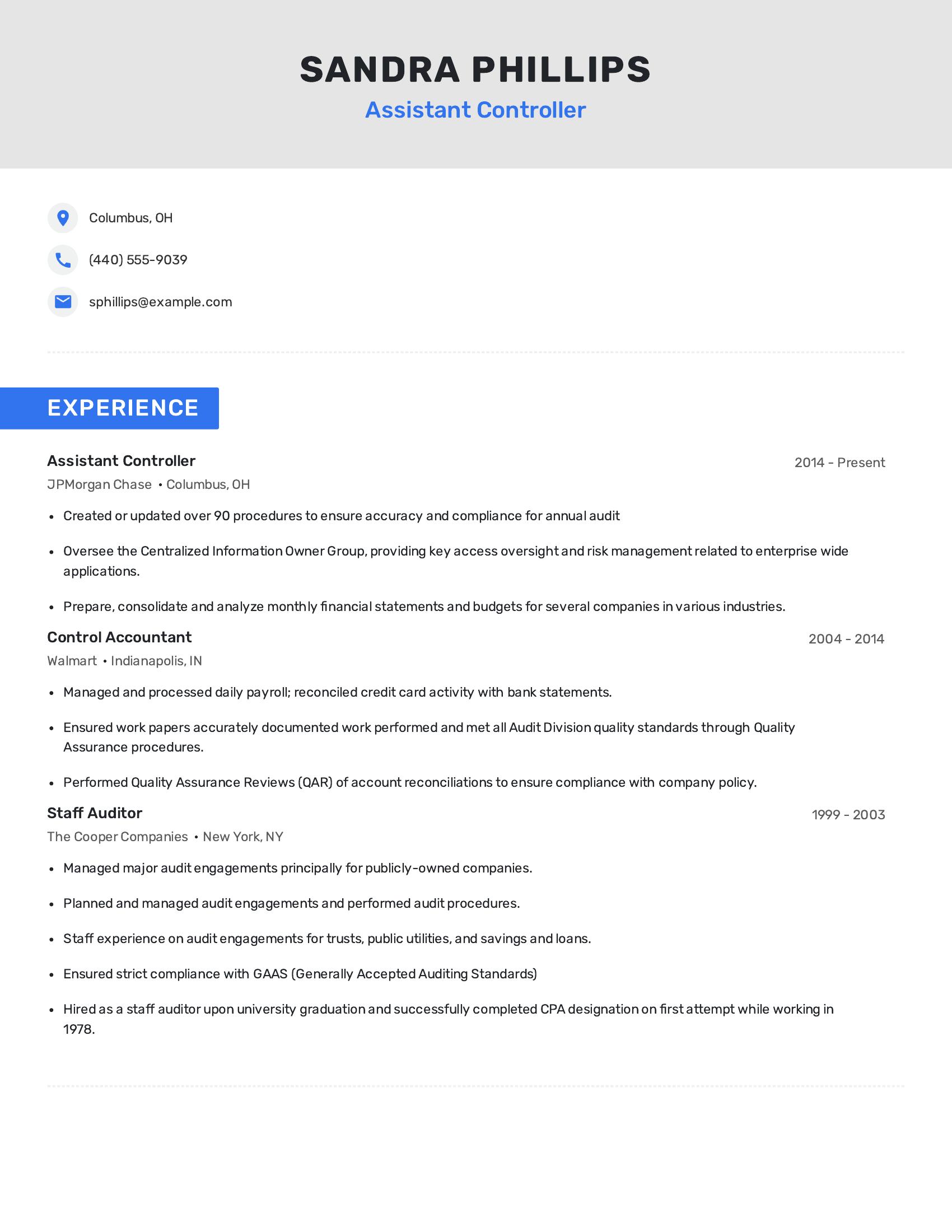

This resume demonstrates these specifics well. It includes over a decade of experience at a major financial institution managing procedures for accuracy and compliance. The candidate has experience in payroll management, quality assurance reviews, and audit engagements. They also have a CPA designation and have managed significant audit engagements, showing a strong background in both public and corporate accounting.

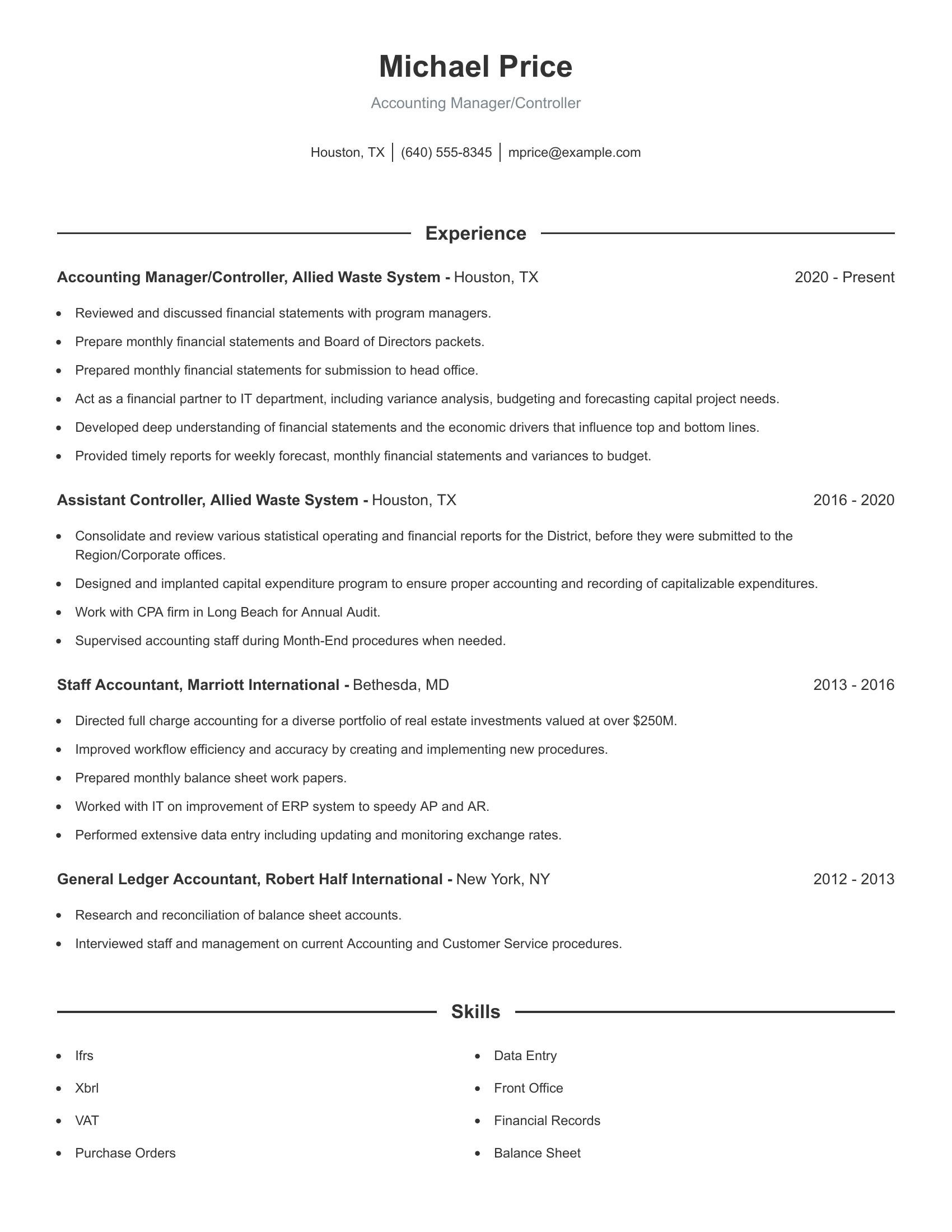

Accounting manager/controller resumes should focus on skills in financial analysis, reporting, and management. They should include detailed work experience showing responsibility for financial statements, budgeting, and audits. Experience in supervisory roles and collaboration with other departments is also important. Strong technical skills like ERP systems and data entry are valuable.

This resume includes relevant experience in financial reporting, variance analysis, and budgeting. It shows a progression from staff accountant to accounting manager/controller. The candidate has supervised accounting staff and worked with external auditors. Technical skills are evident through work on ERP systems and data entry. The roles listed demonstrate a solid background in both operational and strategic financial management.

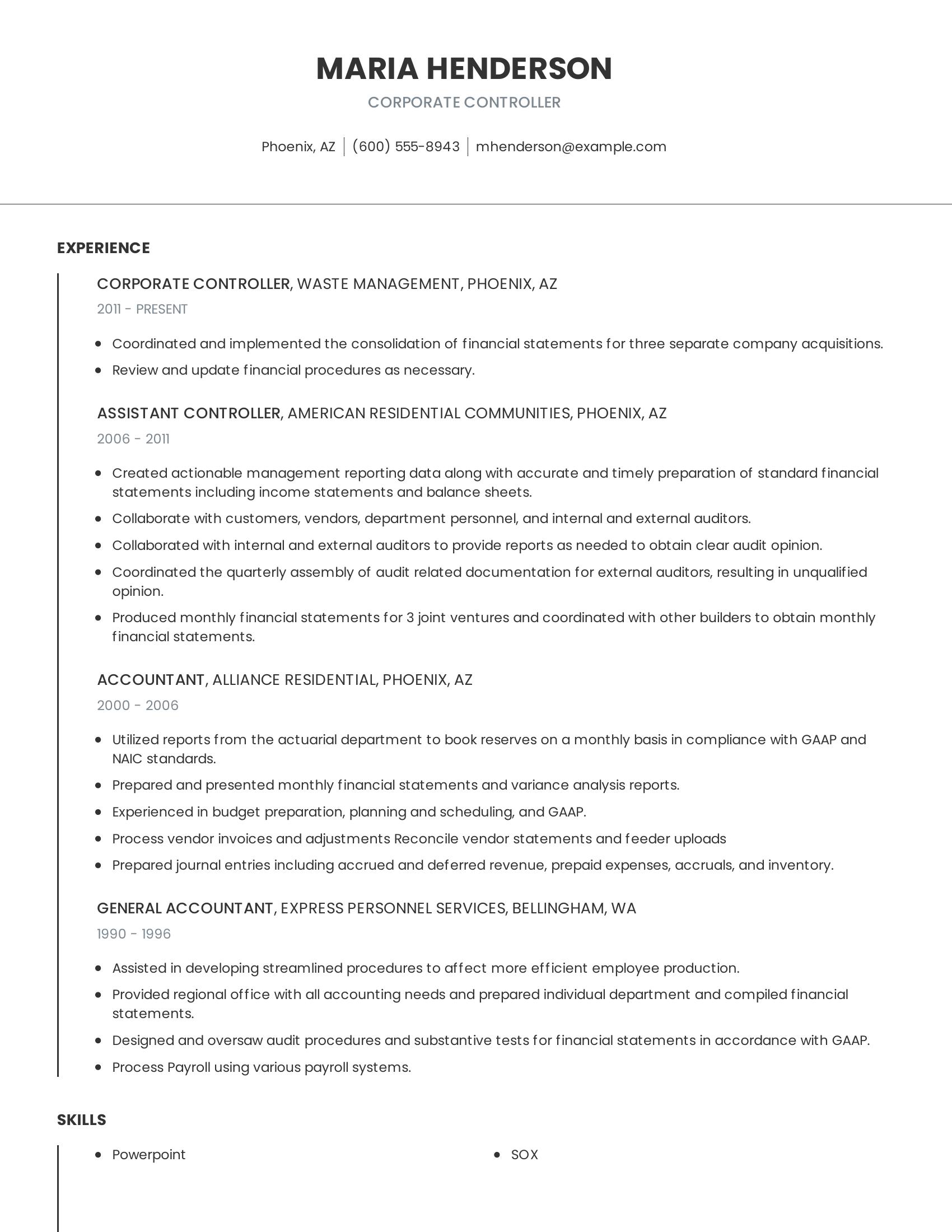

Corporate controller resumes should include clear and concise descriptions of relevant job experiences, skills, and achievements. They should highlight experience in financial statement consolidation, compliance with accounting standards, and collaboration with auditors. Demonstrating a history of improving financial procedures and processes is also important. Skills specific to the role, such as knowledge of GAAP and SOX, should be listed.

This resume effectively includes these specifics. It lists relevant positions held, such as corporate controller and assistant controller, along with detailed descriptions of responsibilities like consolidating financial statements and preparing audit documentation. The resume showcases skills in GAAP compliance and experience with SOX. The candidate's progressive job roles show a clear career advancement in accounting and finance.

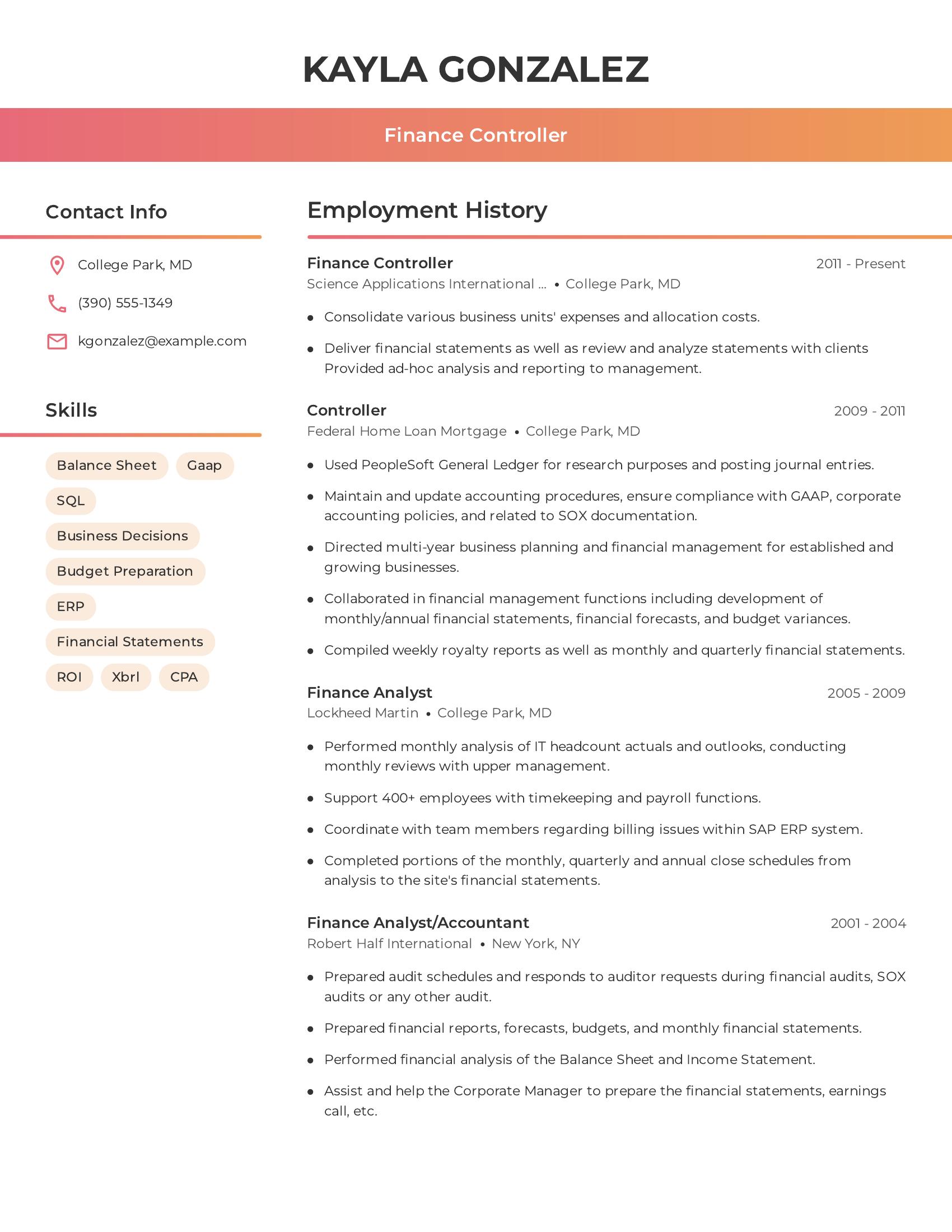

Finance controller resumes should highlight experience, skills, and qualifications relevant to financial management and analysis. Key elements include job titles, years of experience, notable employers, responsibilities, and skills like GAAP knowledge, ERP systems, budget preparation, and financial reporting. Education and certifications like CPA are also important.

This resume includes these specifics by listing detailed employment history with job titles and dates. It outlines tasks such as preparing financial statements, performing financial analysis, managing audits, and using ERP systems. Skills like GAAP compliance and SQL are clearly mentioned, along with a CPA certification.

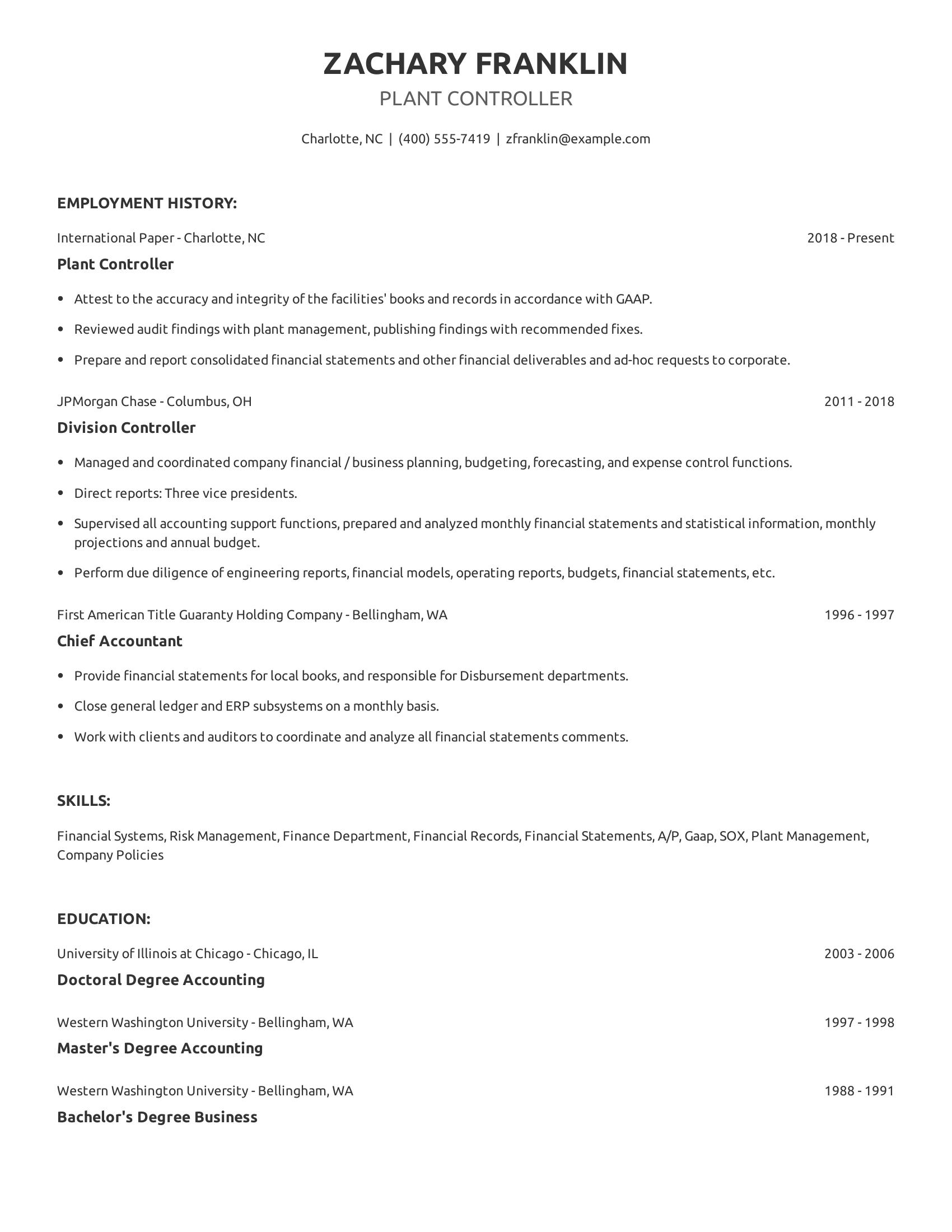

Plant controller resumes should include clear job responsibilities, specific achievements, and relevant skills. Employment history should highlight experience in financial oversight, auditing, and regulatory compliance. Skills should include proficiency in financial systems, risk management, and knowledge of accounting standards like GAAP and SOX. Education details must be precise, listing degrees and institutions attended.

This resume includes detailed employment history with job titles, responsibilities, and accomplishments. It lists relevant skills such as financial systems and risk management. Education information is thorough with degrees specified along with the universities attended.

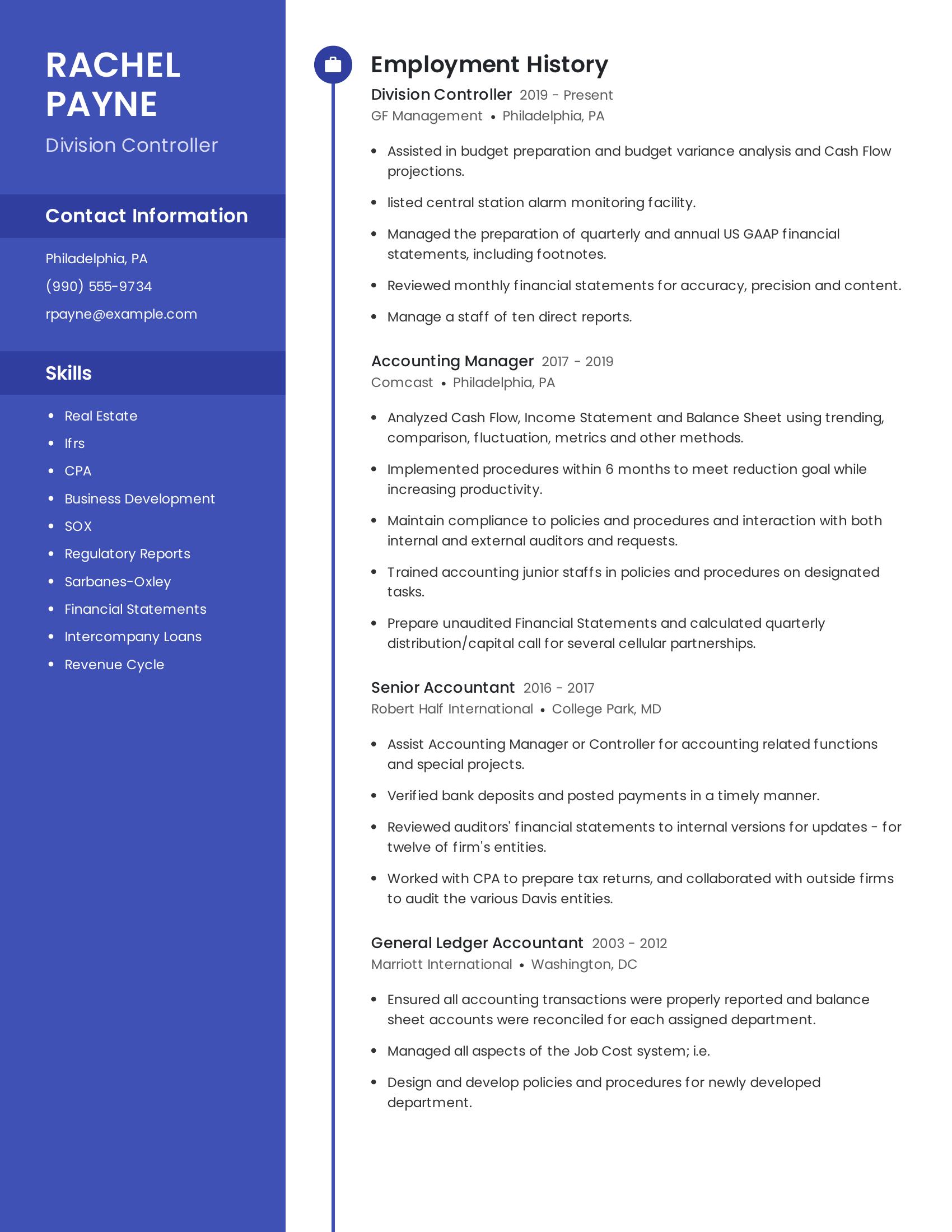

Division controller resumes should highlight extensive experience in financial management, budgeting, and regulatory compliance. Key elements include proficiency in GAAP, SOX, IFRS, and CPA certification. Experience in managing teams, preparing financial statements, and conducting financial analysis is crucial. Technical skills in business development and revenue cycle management are also valuable.

This resume effectively includes key specifics such as experience with GAAP financial statements, SOX compliance, and CPA certification. It lists substantial roles in budget preparation, financial analysis, and team management. The candidate has held significant positions in reputable companies and demonstrates a solid history of professional growth from general ledger accountant to division controller.

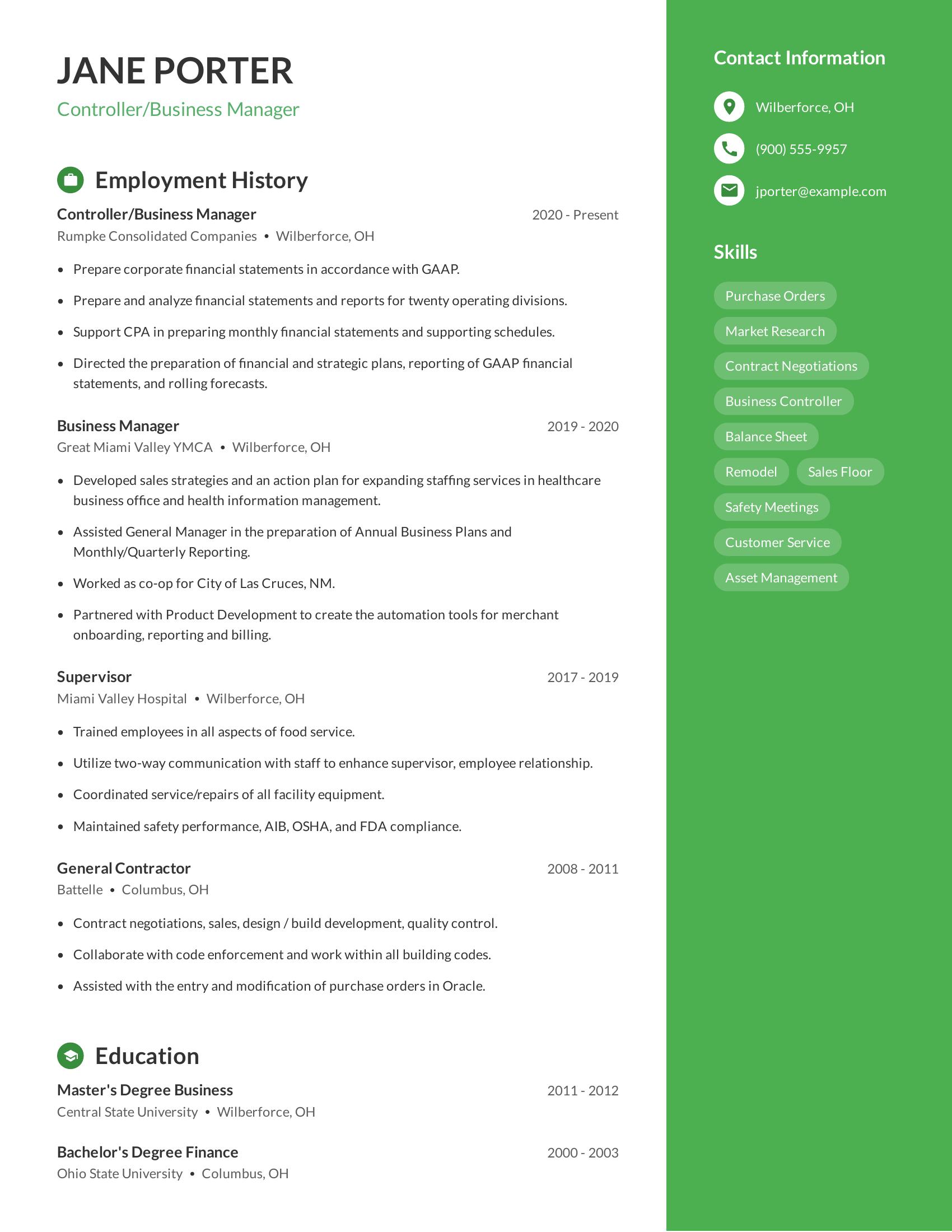

Controller/business manager resumes should highlight experience in financial management, strategic planning, and operational oversight. Key components include detailed job responsibilities, achievements in previous roles, and relevant educational background. Specific skills related to accounting standards, financial analysis, and business operations are crucial. Clear and concise presentation of work history with quantifiable results is important.

This resume effectively includes these specifics. It details experience in preparing financial statements, strategic planning, and developing sales strategies. The resume lists both management and supervisory roles, showing a progression in responsibilities. Educational qualifications in business and finance are clearly stated. Skills pertinent to the role such as market research, contract negotiations, and asset management are included.

Divisional controller resumes should highlight strong financial management skills, experience with financial statements, and knowledge of compliance regulations. Important elements include employment history with relevant job titles, clear descriptions of responsibilities, and specific achievements in financial performance. Skills such as asset value management, ERP systems knowledge, and experience with SOX compliance are also crucial. The resume should be concise and focus on concrete results and contributions to previous employers.

This resume includes those specifics by detailing the candidate's roles at various financial institutions. It lists the job titles and dates of employment, along with specific duties like reviewing payroll entries, facilitating audits, and preparing financial statements. The resume also demonstrates proficiency in crucial areas like SOX compliance and ERP systems. Notable achievements such as handling a $1.5 billion divestiture are clearly mentioned, showing the candidate’s impact on their previous employers' financial performance.

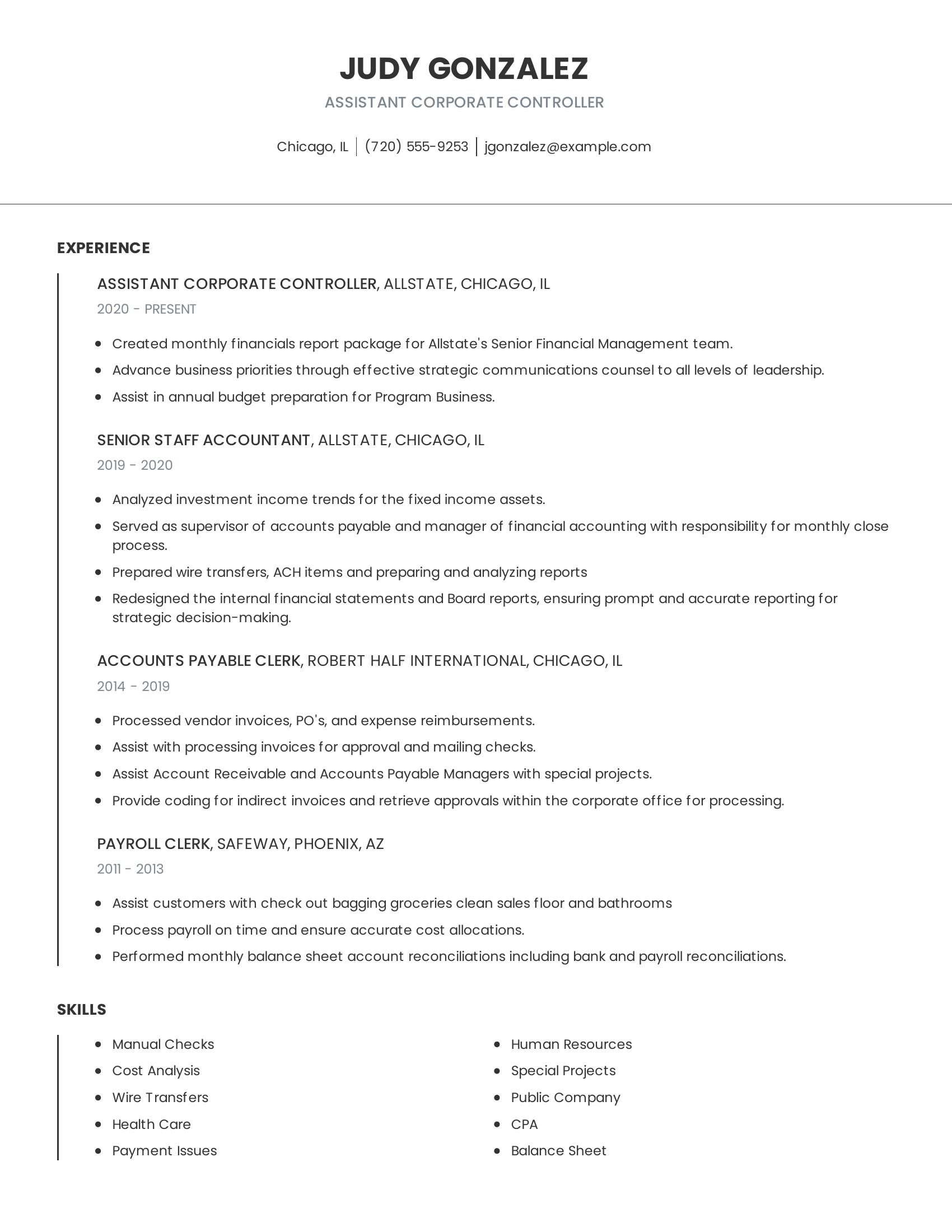

Assistant corporate controller resumes should focus on financial expertise, leadership, and relevant experience. The resume should highlight roles in financial reporting, budgeting, and strategic communication. Experience in supervising and analyzing financial processes is important. Skills such as cost analysis, wire transfers, and proficiency with financial systems are crucial.

This resume includes many of these specifics. It outlines various roles with increasing responsibility, starting from payroll clerk to assistant corporate controller. It mentions key tasks like creating financial reports, budget preparation, and process management. The skills section lists relevant abilities like cost analysis and balance sheet reconciliation.

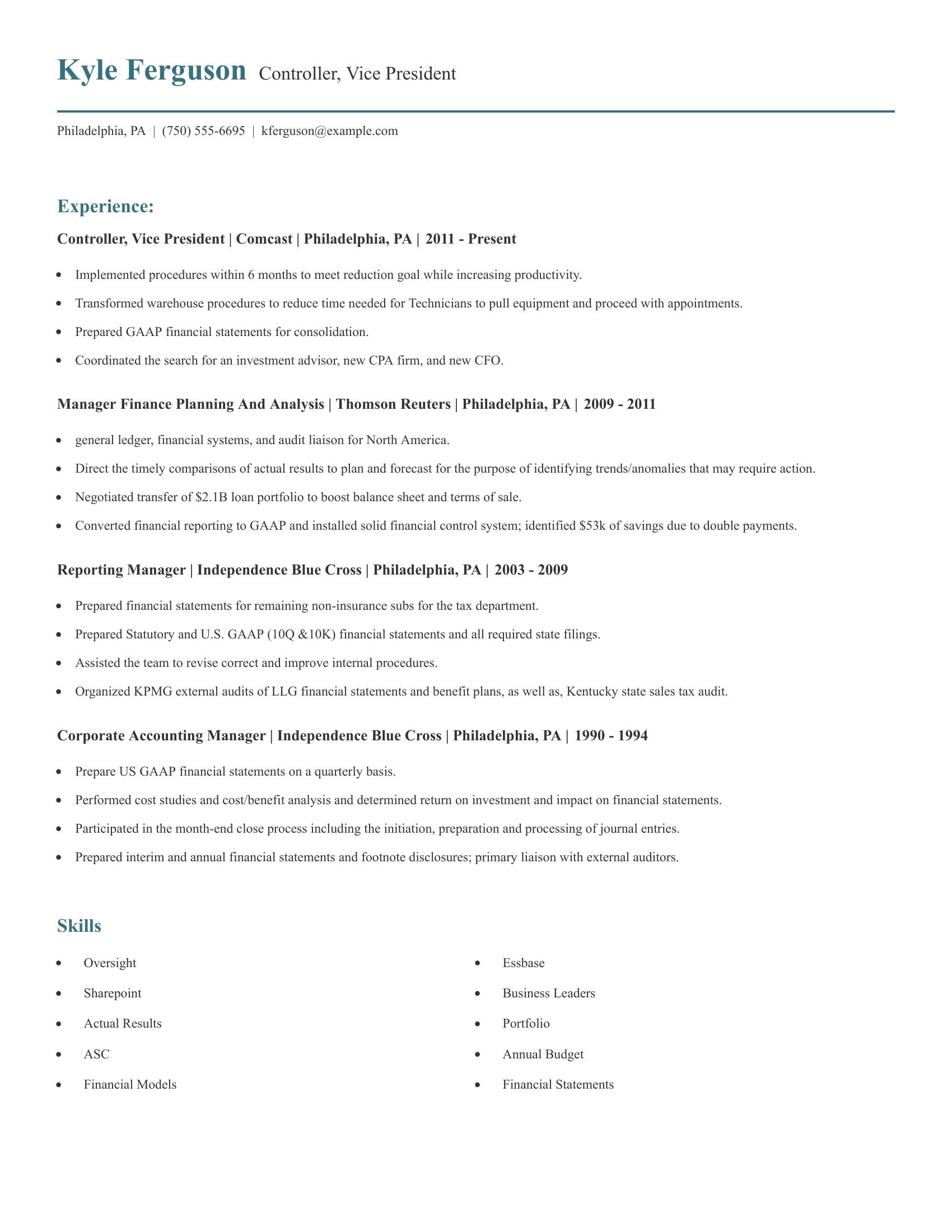

Controller, vice president resumes should focus on leadership experience, financial expertise, and strategic planning. They should highlight roles in financial management, including the preparation of financial statements, audit coordination, and implementation of procedures to enhance productivity. Experience in managing large teams and collaborating with various departments is important. Demonstrating achievements such as cost savings and successful negotiations is also crucial.

This resume includes strong elements such as detailed job roles and accomplishments. It shows experience in high-level positions at major companies with responsibilities like preparing GAAP financial statements, managing audits, and implementing cost-saving measures. The resume also highlights skills in financial systems and analysis, further emphasizing the candidate’s proficiency and leadership capabilities.

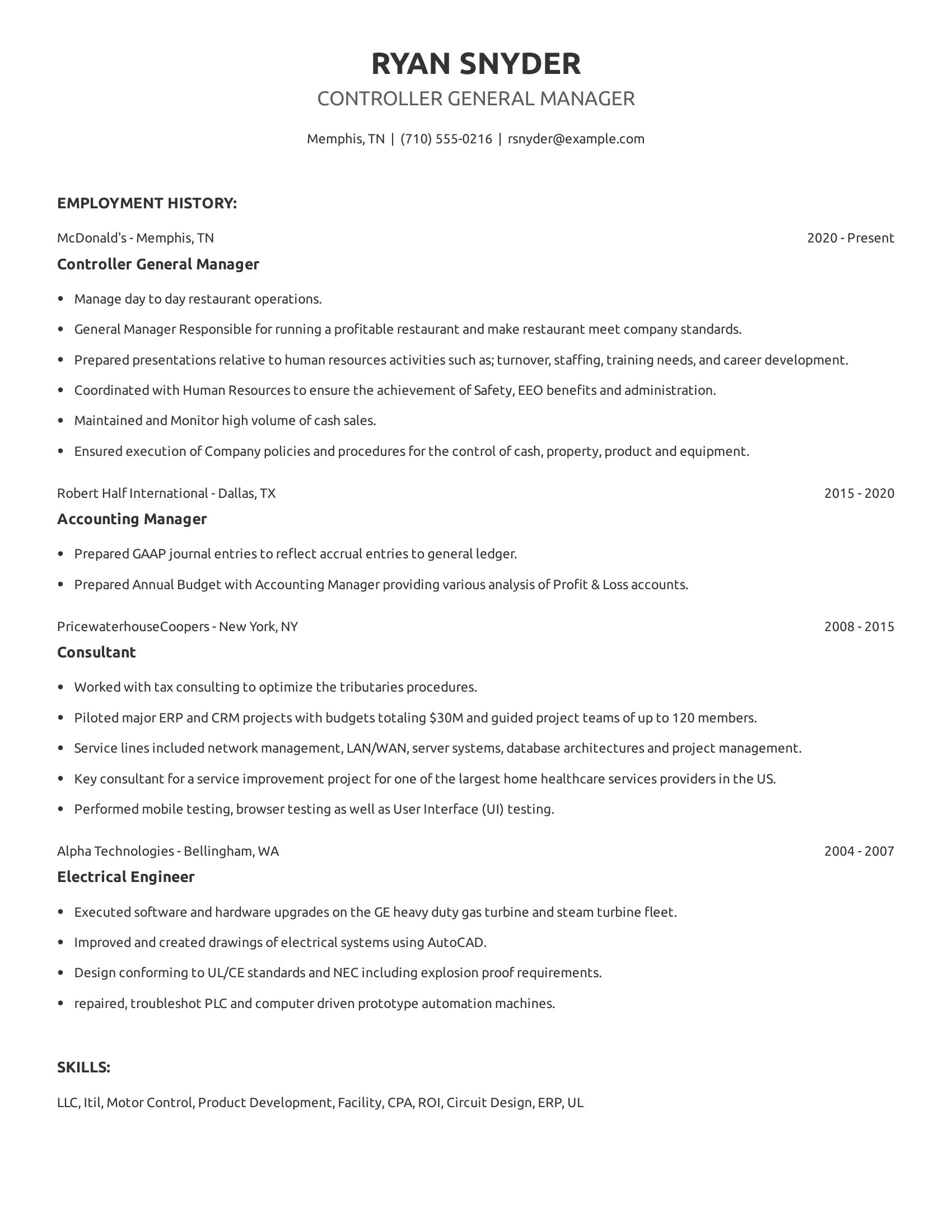

Controller general manager resumes should highlight a strong background in financial management, operational oversight, and team leadership. They should emphasize experience in managing day-to-day operations, ensuring compliance with company policies, and handling high-volume transactions. Demonstrated skills in budgeting, financial analysis, and human resources coordination are also important. Additionally, showcasing project management experience and technical skills relevant to the industry can strengthen the resume.

This resume includes those specifics well. It details experience managing restaurant operations and maintaining cash control at McDonald's. It shows budgeting and financial analysis skills from the role at Robert Half International. The resume also highlights extensive project management experience from time at PricewaterhouseCoopers, including leading large teams and handling significant budgets. The technical skills listed, such as ERP and circuit design, add further depth to the candidate's qualifications.

A good regional controller resume should emphasize financial management, team supervision, compliance with regulations, and analytical skills. It should include job titles, employment history with dates, specific responsibilities, and quantifiable achievements. Additionally, it should list relevant education and skills pertinent to financial control and management positions.

This resume effectively includes those specifics by detailing employment history with clear job titles and timeframes. It lists responsibilities such as balancing payroll, supervising employees, and implementing efficient reconciliation processes. It also highlights compliance with various financial regulations and provides a comprehensive list of relevant skills like SQL and financial statements. The education section is concise, listing a master's degree in accounting. The resume demonstrates a strong background in finance and accounting roles across different companies.

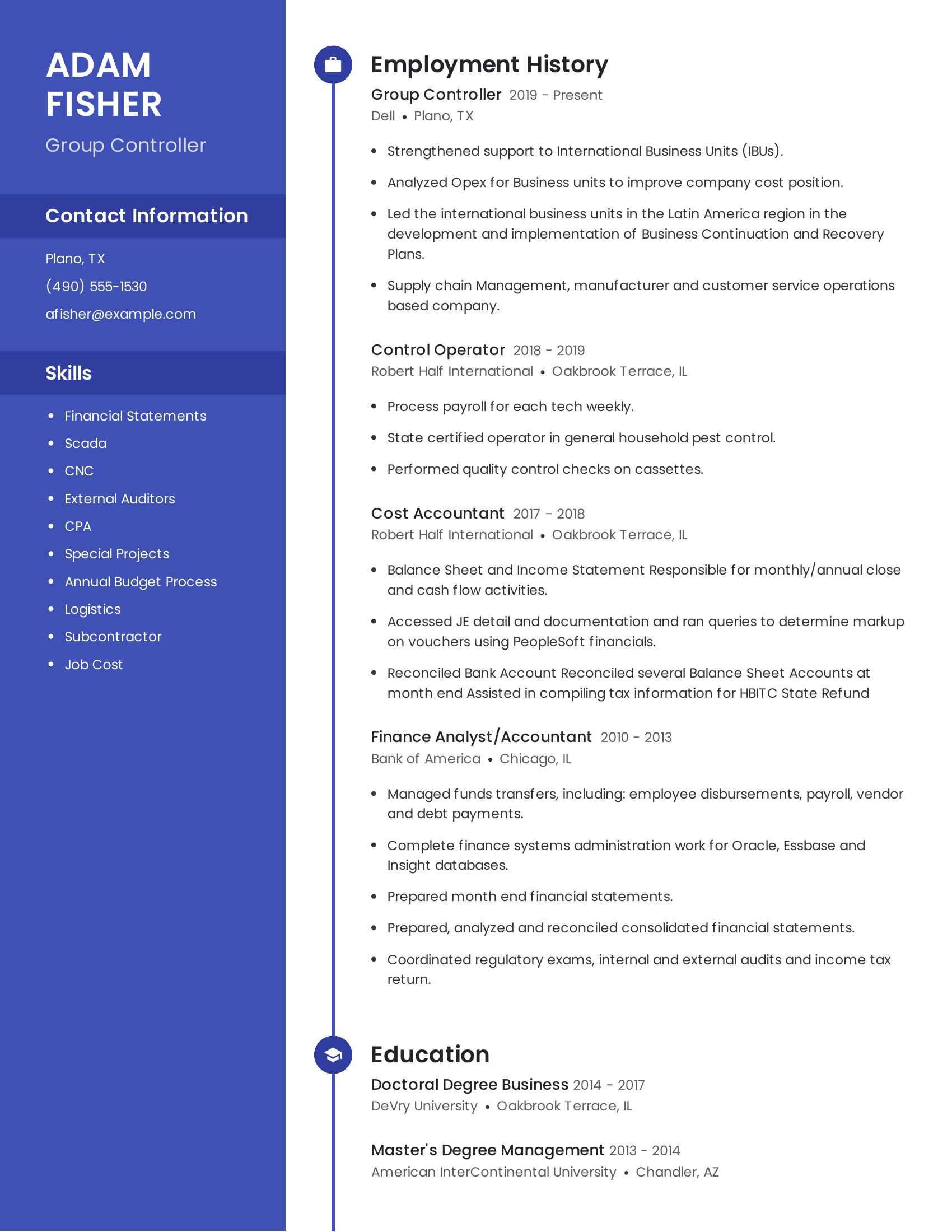

Group controller resumes should highlight experience in financial management, team leadership, and strategic planning. They should showcase skills in managing financial statements, budgeting, and working with external auditors. A good resume includes specific achievements, such as cost reduction or process improvements, and relevant software skills. Educational background and certifications like CPA are important.

This resume includes key elements such as extensive work history in finance roles, showcasing experience with financial statements, audits, and budget processes. It lists relevant technical skills like Scada and CNC, and mentions a CPA certification. The candidate's roles demonstrate leadership in international business units and supply chain management. The educational background includes advanced degrees in business and management.

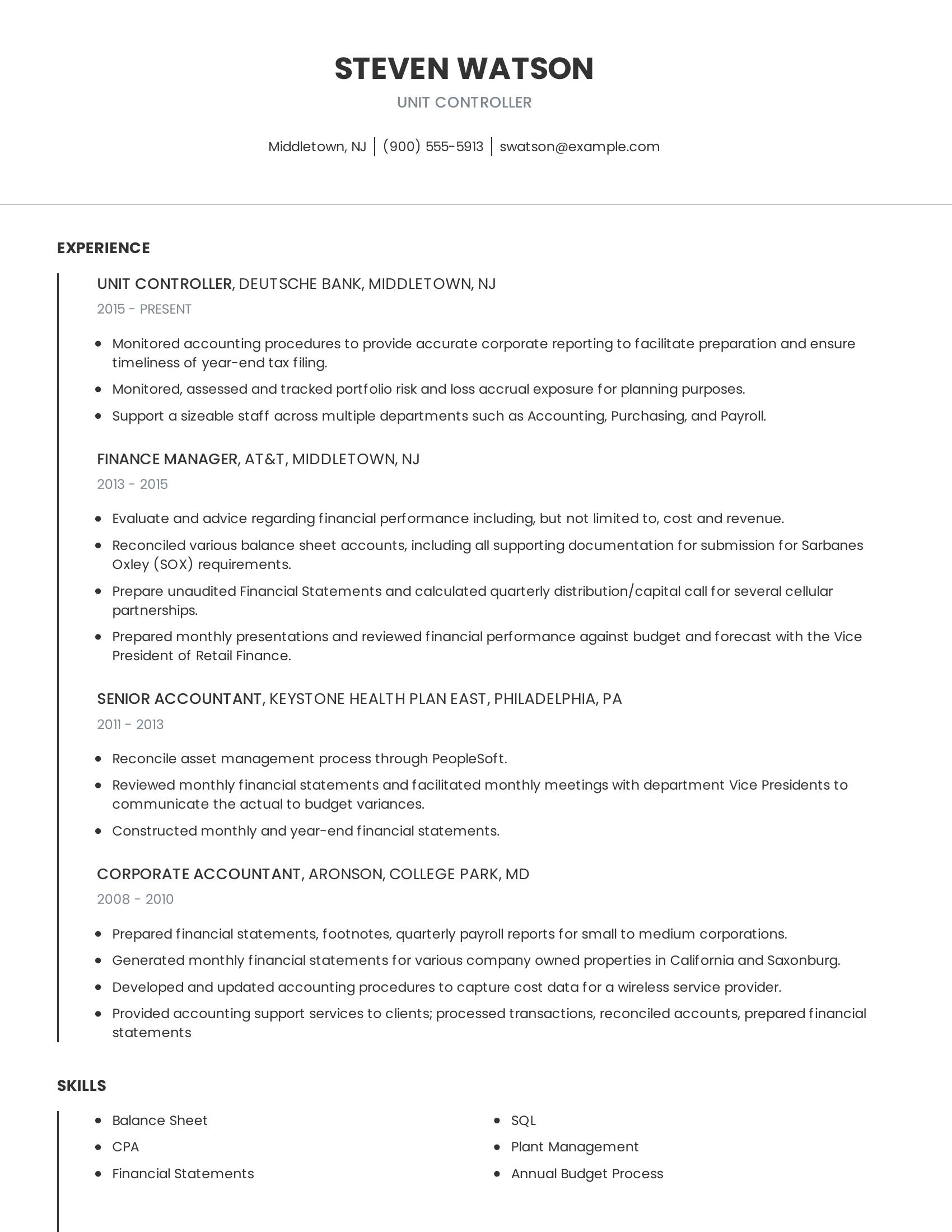

Unit controller resumes should highlight experience in financial management, accounting practices, and team support. They should showcase the ability to monitor procedures, assess risks, and manage diverse financial tasks. Important skills include preparing financial statements, reconciling accounts, and supporting various departments. A good resume also includes specific job titles and dates to show career progression.

This resume effectively includes those specifics. It details past roles at notable companies with clear descriptions of responsibilities like monitoring accounting procedures and evaluating financial performance. It lists relevant skills such as balance sheet management and SQL. The chronological format demonstrates career growth from corporate accountant to unit controller.

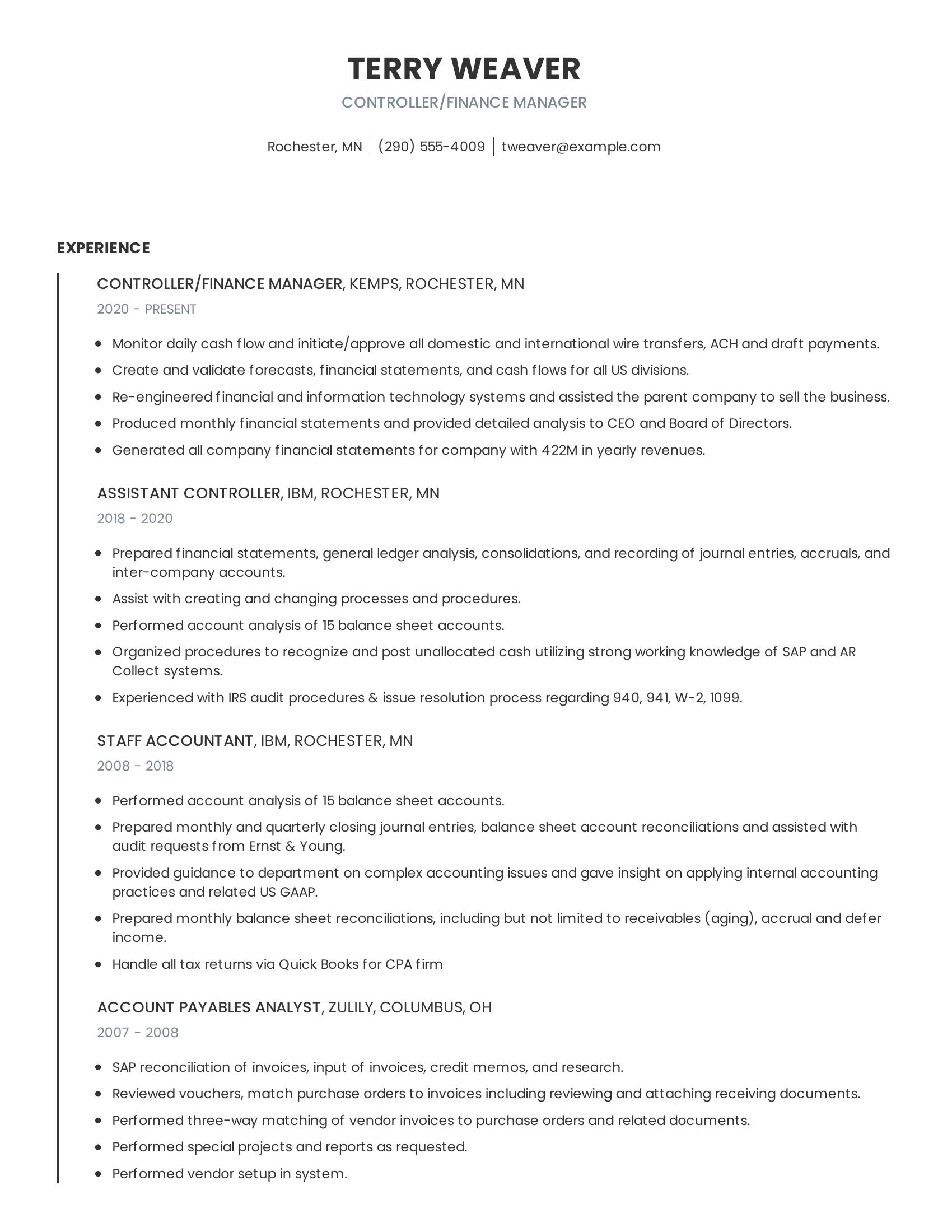

Controller/finance manager resumes should include relevant experience, technical skills, and achievements. A strong resume highlights financial management, forecasting, and system re-engineering. It should showcase the ability to produce financial statements, manage cash flow, and provide detailed analyzes. Experience in auditing, process improvement, and working with financial software is also important.

This resume effectively covers these points. It shows extensive experience in financial roles, from account payables analyst to controller/finance manager. The resume lists specific duties such as monitoring cash flow, preparing financial statements, and performing account analysis. It also mentions key achievements like re-engineering systems and assisting in business sales. The inclusion of technical skills like SAP and IRS audit procedures adds further strength.

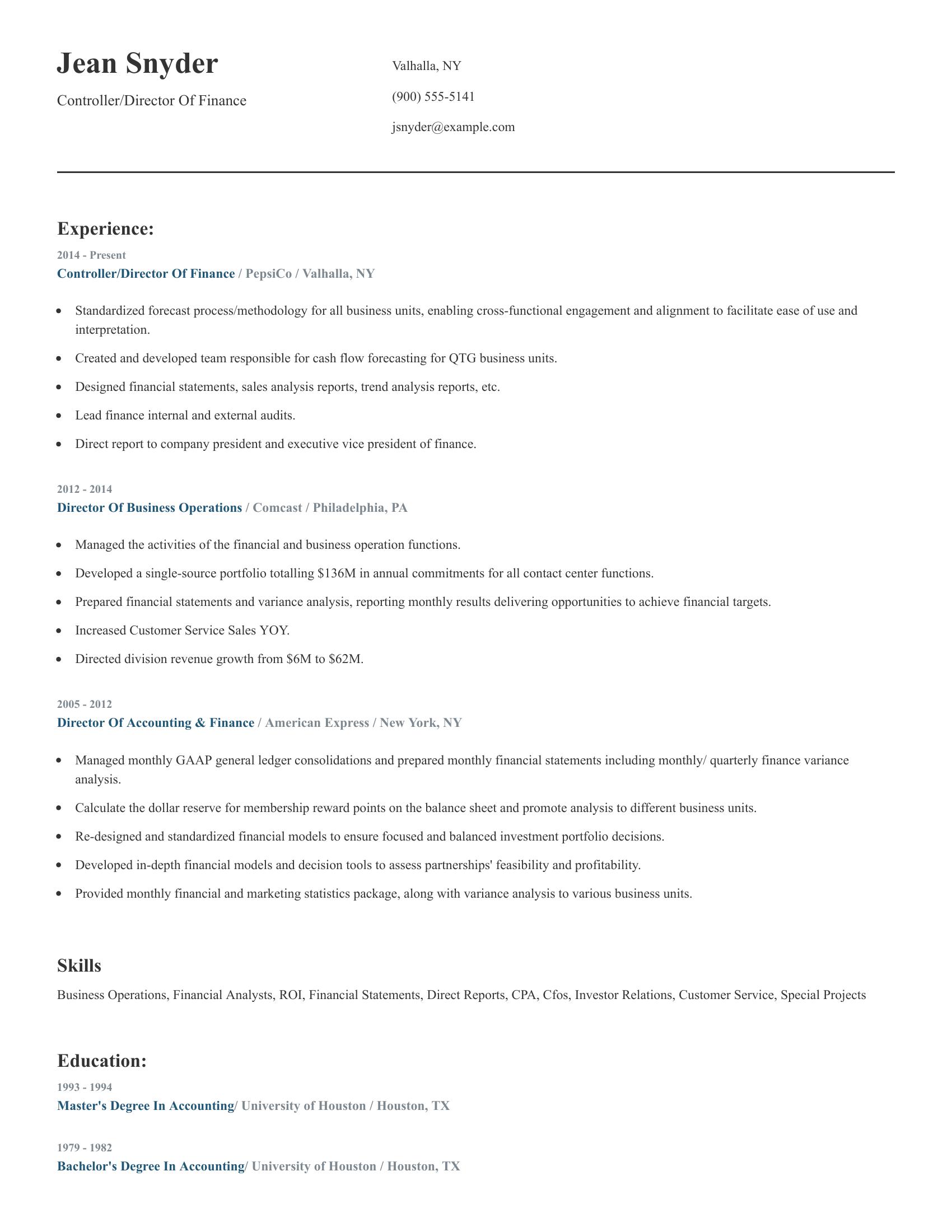

Controller/director of finance resumes should highlight extensive experience in financial management, team leadership, and strategic planning. A good resume for this role includes detailed descriptions of past job responsibilities and accomplishments, emphasizing skills like financial forecasting, audit leadership, and financial statement preparation. It should also detail the candidate's educational background in finance or accounting and include any relevant certifications.

This resume effectively includes all necessary specifics. It lists extensive experience with major companies, detailing roles such as controller/director of finance at a large corporation, director of business operations, and director of accounting & finance. The resume shows experience in financial forecasting, audit leadership, and the creation of financial reports. It also mentions the candidate's educational background with a master's degree in accounting. The skills section includes relevant competencies such as financial analysis, ROI, and CPA certification.

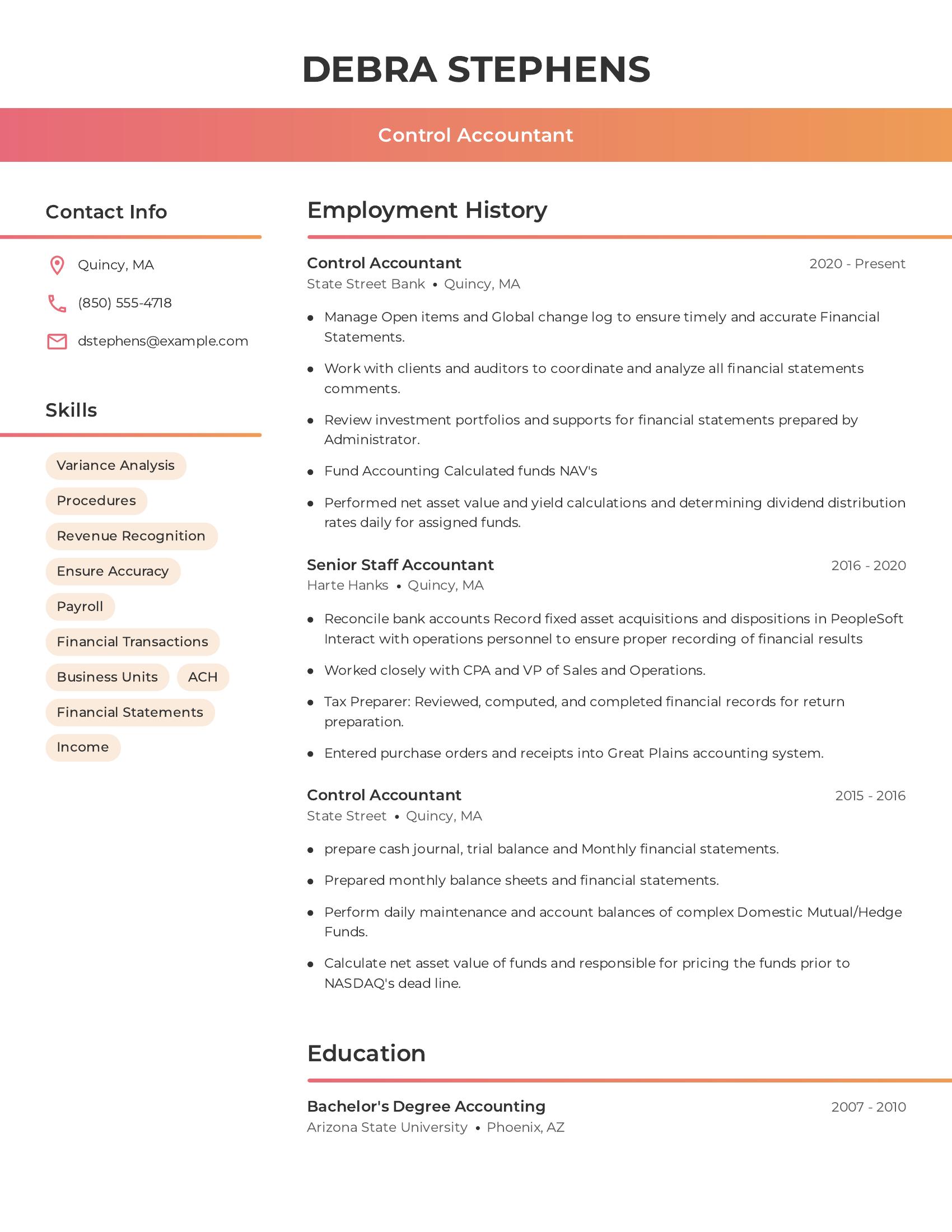

Control accountant resumes should include clear contact information, a summary of relevant skills, detailed employment history, and education background. Skills such as variance analysis, revenue recognition, payroll knowledge, and financial statement preparation are important. The employment history should list job titles, companies, locations, and dates of employment. Descriptions of job responsibilities and achievements are crucial, focusing on specific tasks related to the control accounting field.

This resume includes a well-defined set of skills like variance analysis and revenue recognition. It lists relevant job titles and responsibilities at different companies, showing progression in the control accounting field. The education section is specific about the degree obtained and the institution attended. The job descriptions detail tasks such as managing financial statements, working with auditors, and calculating net asset values, which are all pertinent to a control accountant's role.

Highlight your financial reporting skills by showcasing experience with GAAP or IFRS.

Detail your proficiency in financial software like QuickBooks, SAP, or Oracle.

Include examples of how you improved budgeting processes or reduced costs in past roles.

A controller's resume should focus on financial management, leadership experience, and software proficiency. It must highlight achievements in cost reduction, budget management, and regulatory compliance. The resume should also list relevant certifications and educational background.

A controller summary should highlight relevant experience and skills.

A controller resume should be clear and concise, focusing on relevant information.

A well-written controller experience section should highlight responsibilities and achievements. Focus on financial management, regulatory compliance, and team leadership.

Use numbers to show impact. Be clear and concise. Highlight specific skills and tools used.

A controller needs technical knowledge and practical abilities to manage financial operations.

A controller also needs interpersonal and organizational skills to lead teams and communicate effectively.