17 Collector Resume Examples

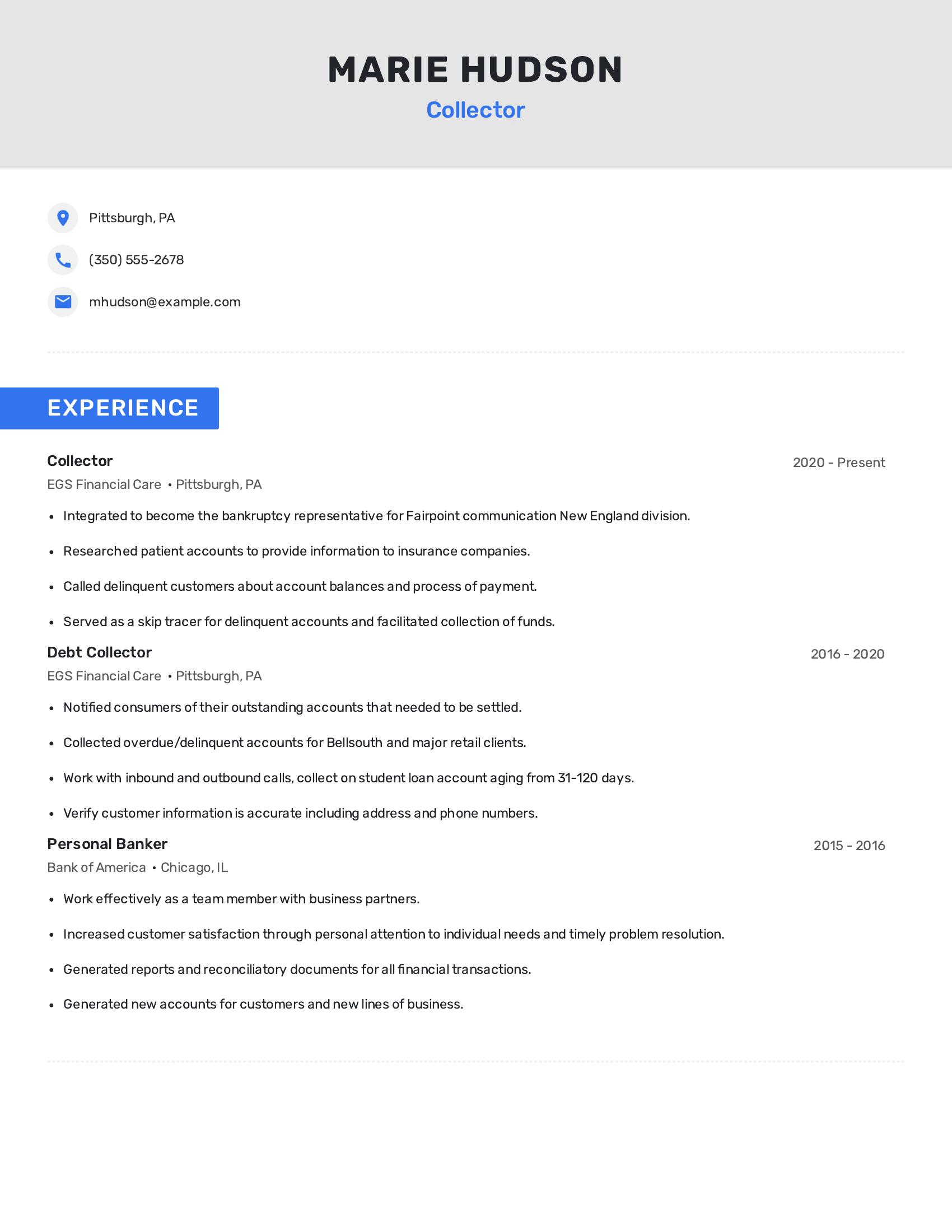

Collector resumes should include clear and concise information about relevant work experience, focusing on tasks like debt collection, account management, and customer interaction. Highlighting specific duties such as handling delinquent accounts, skip tracing, and working with both inbound and outbound calls is important. The resume should also list job titles, company names, locations, and dates of employment to provide a complete work history.

This resume includes relevant roles like collector and debt collector with detailed responsibilities such as calling delinquent customers, researching patient accounts, and acting as a bankruptcy representative. It also shows a progression in roles from personal banker to collector, indicating career growth. The inclusion of specific tasks such as verifying customer information and generating financial reports strengthens the resume by showing a range of skills and experiences.

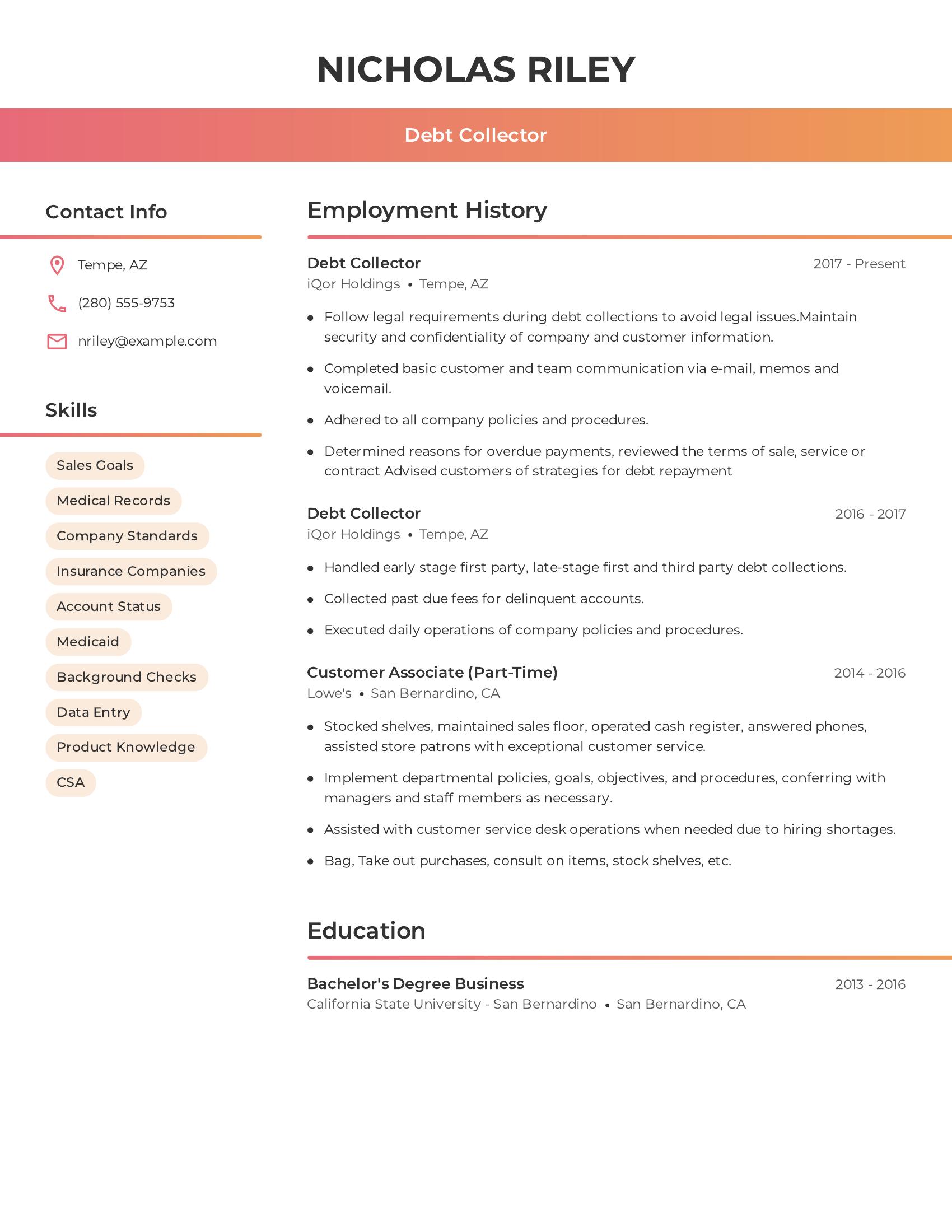

Debt collector resumes should include contact information, relevant skills, employment history, and education. Key skills such as familiarity with sales goals, knowledge of medical records, and experience with insurance companies are valued. A good resume also details specific duties like managing account statuses, conducting background checks, and data entry. It is important to demonstrate experience in following legal requirements and maintaining confidentiality.

This resume clearly lists the contact information and relevant skills like sales goals and medical records. It includes a detailed employment history showing progression in roles within the same company, which suggests reliability and growth. The educational background is solid with a bachelor's degree in business. Specific job duties are outlined, such as handling debt collections and maintaining company policies, showing a comprehensive understanding of debt collection processes.

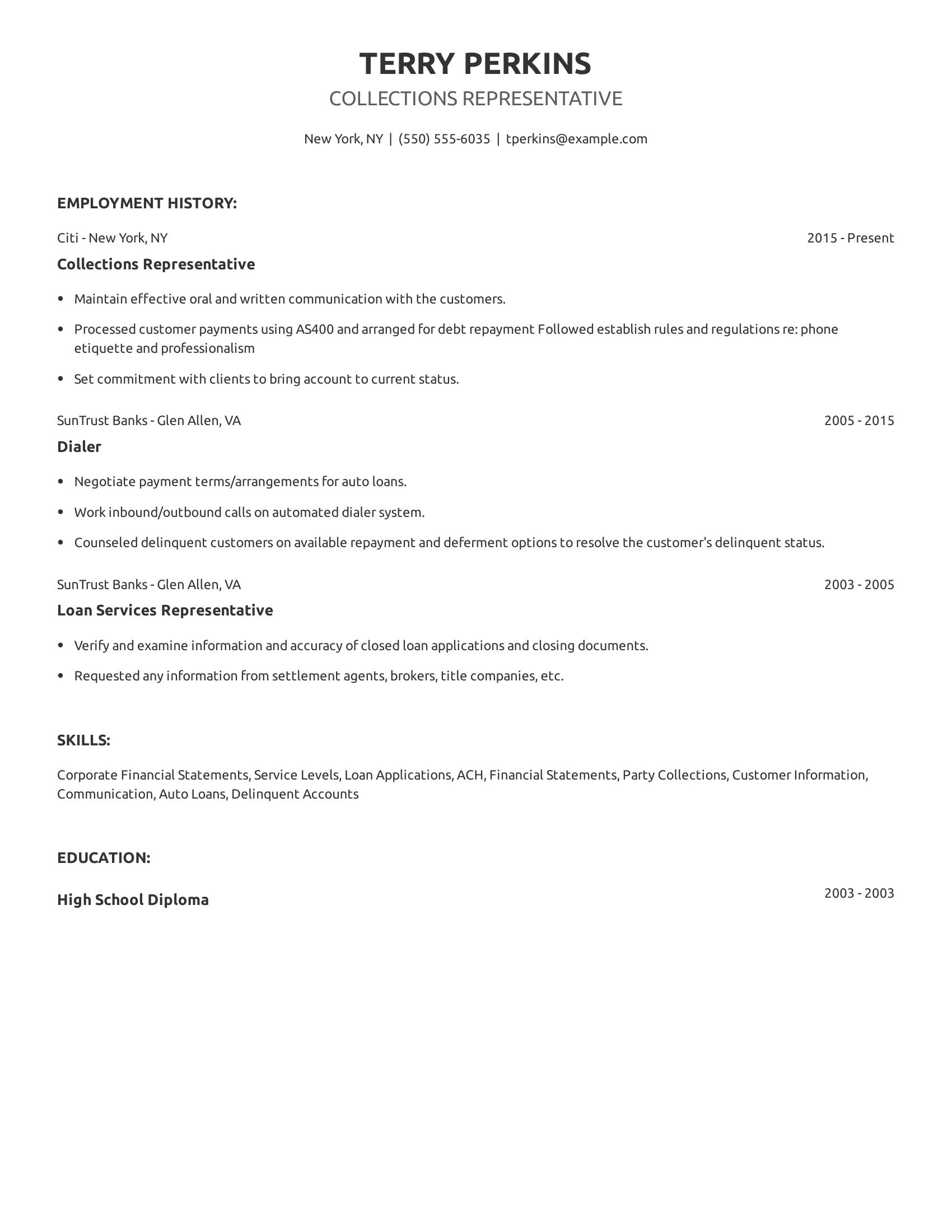

A collections representative resume should include clear and concise employment history, relevant skills, and education. It should list specific job duties and accomplishments in previous roles, showing experience in debt collection, customer communication, and payment processing. Skills related to financial statements, loan applications, and delinquent accounts are important. The resume should reflect the ability to handle inbound and outbound calls, negotiate payment terms, and counsel customers on repayment options.

This resume highlights experience as a collections representative with detailed job duties at two financial institutions. It includes tasks like maintaining customer communication, processing payments, and negotiating terms. The applicant lists relevant skills such as handling auto loans and delinquent accounts. The education section is concise, listing a high school diploma. This resume shows a solid background in collections and financial services.

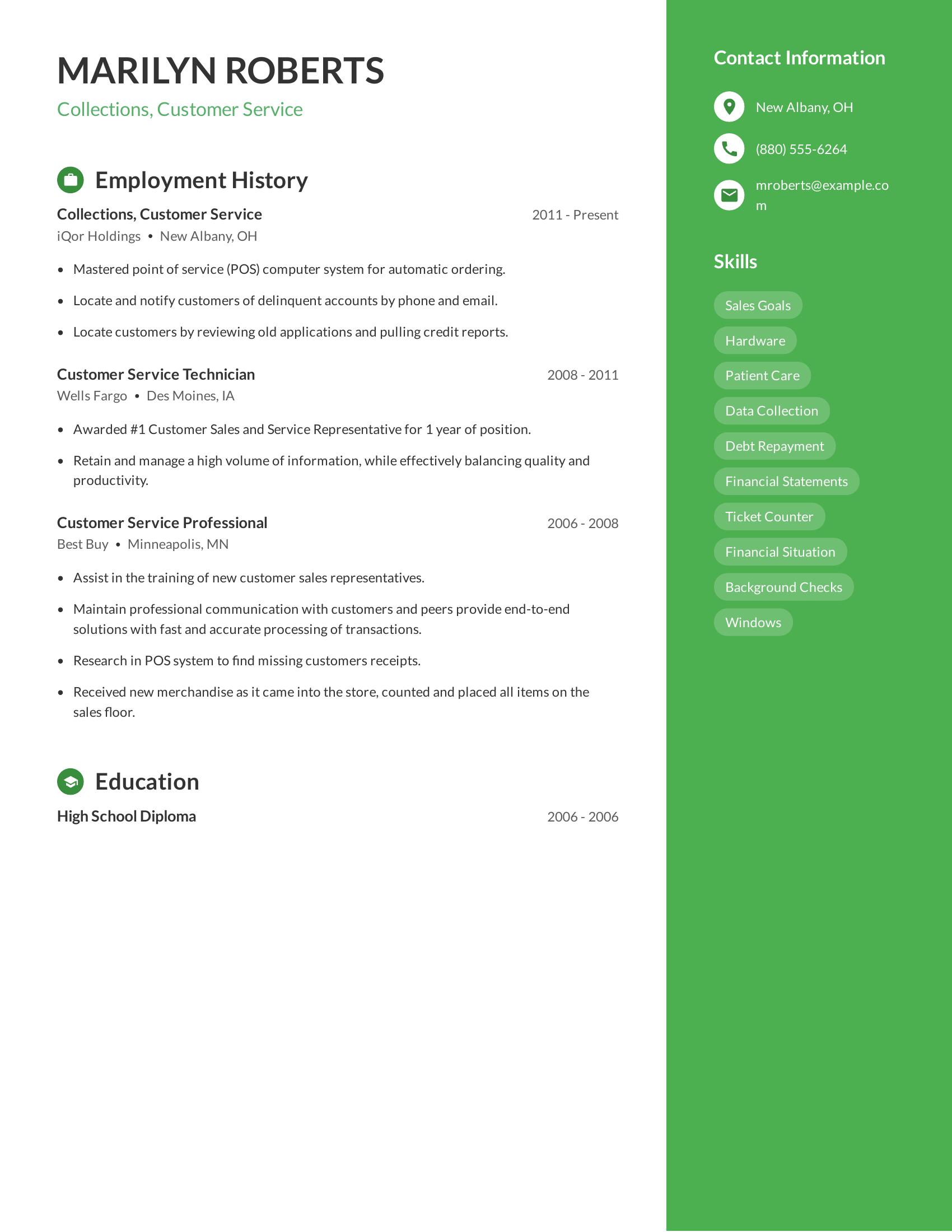

Collections, customer service resumes include specific employment history, relevant skills, and clear descriptions of job responsibilities. It should detail experience in managing delinquent accounts, customer interactions, and proficiency with relevant systems. A good resume highlights achievements and the ability to handle high volumes of information while maintaining quality.

This resume includes these specifics by listing roles held at various companies, from collections to customer service positions. It outlines responsibilities such as locating customers with delinquent accounts, managing POS systems, and assisting in training new representatives. Skills like data collection and financial management are also mentioned, showcasing a strong background in customer service and collections.

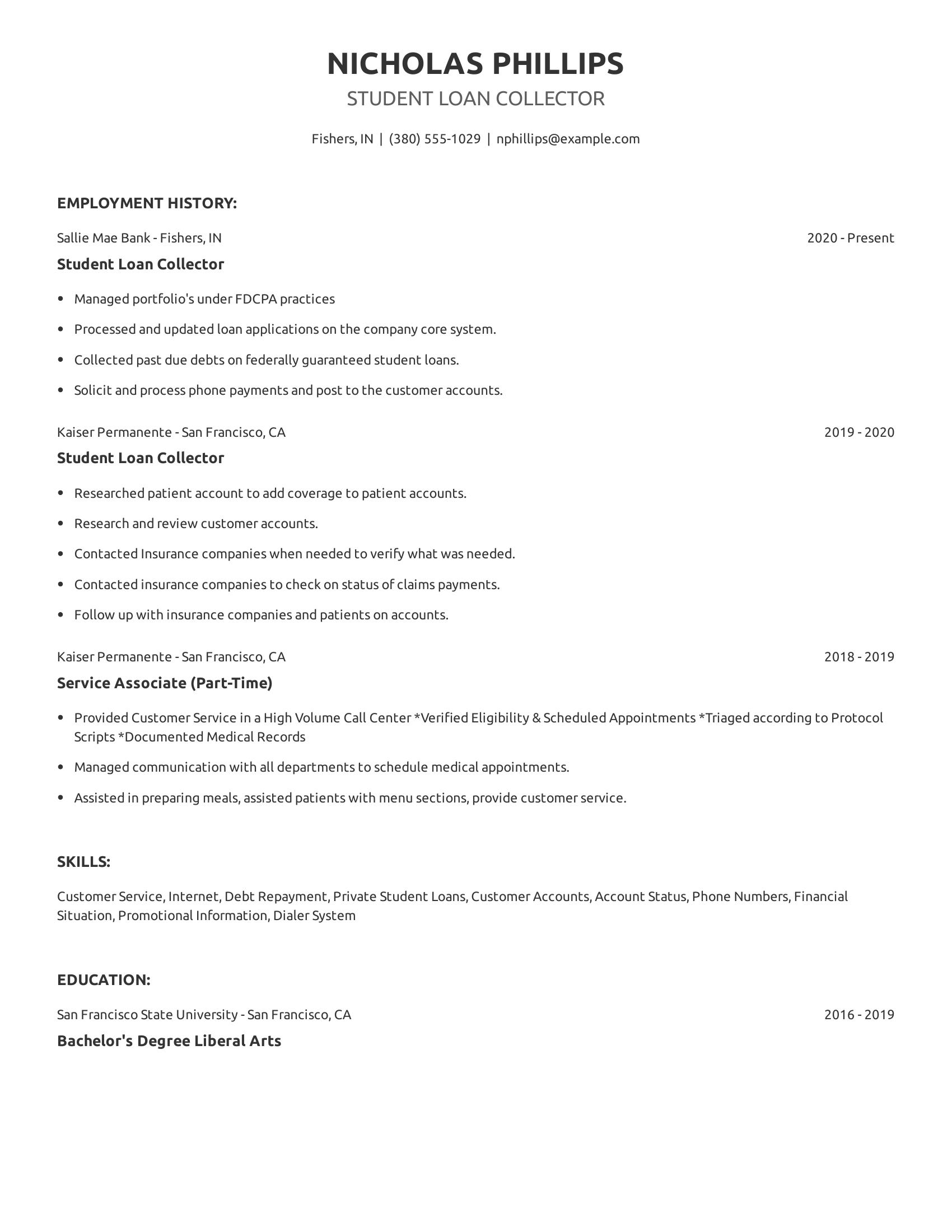

Student loan collector resumes should highlight experience in managing debt collection, processing loan applications, and interacting with customers and insurance companies. Key elements include a clear history of relevant employment, specific tasks performed, technical skills like debt repayment and account management, and educational background. The focus should be on demonstrating the ability to handle financial transactions, follow regulations, and provide customer service.

This resume includes those specifics by listing jobs at two companies where the individual worked as a student loan collector. It details tasks such as managing portfolios under FDCPA practices, processing phone payments, and researching customer accounts. The resume also mentions skills like customer service and knowledge of financial situations, supported by a relevant degree in liberal arts. The work history shows progression and diverse experience in handling accounts and providing service in different settings.

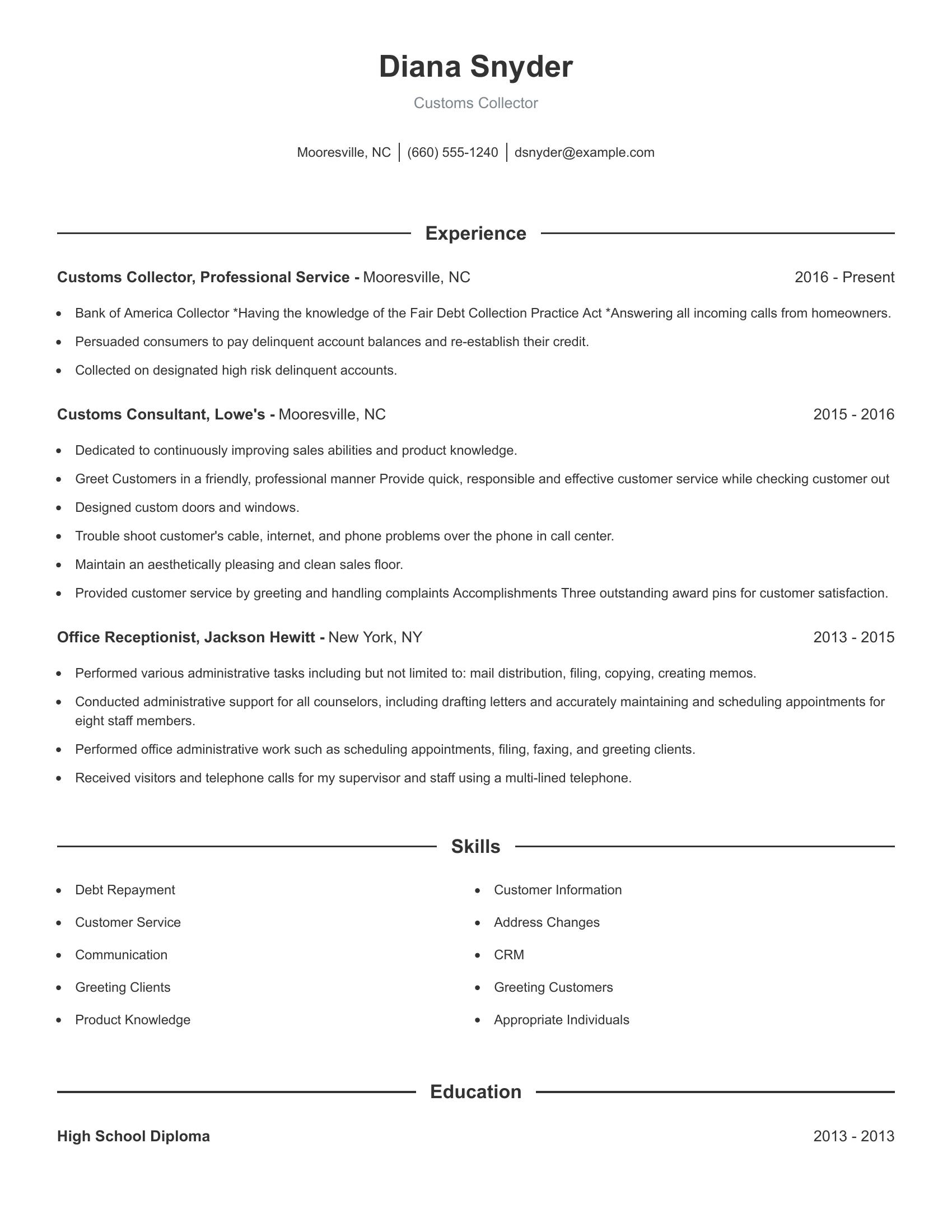

Customs collector resumes should highlight experience in handling customs duties, attention to detail, and strong communication skills. It should include previous roles that show the ability to manage financial records, negotiate with clients, and ensure compliance with legal requirements. The resume should also list relevant skills such as customer service, problem-solving, and familiarity with customs regulations.

This resume includes specific job titles and responsibilities demonstrating experience in collecting debts and working with customers. It shows a history of roles like customs collector and consultant, which involve customer interaction and financial management. The listed skills such as customer service and communication are relevant for the role. This resume also mentions achievements like award pins for customer satisfaction, which add credibility.

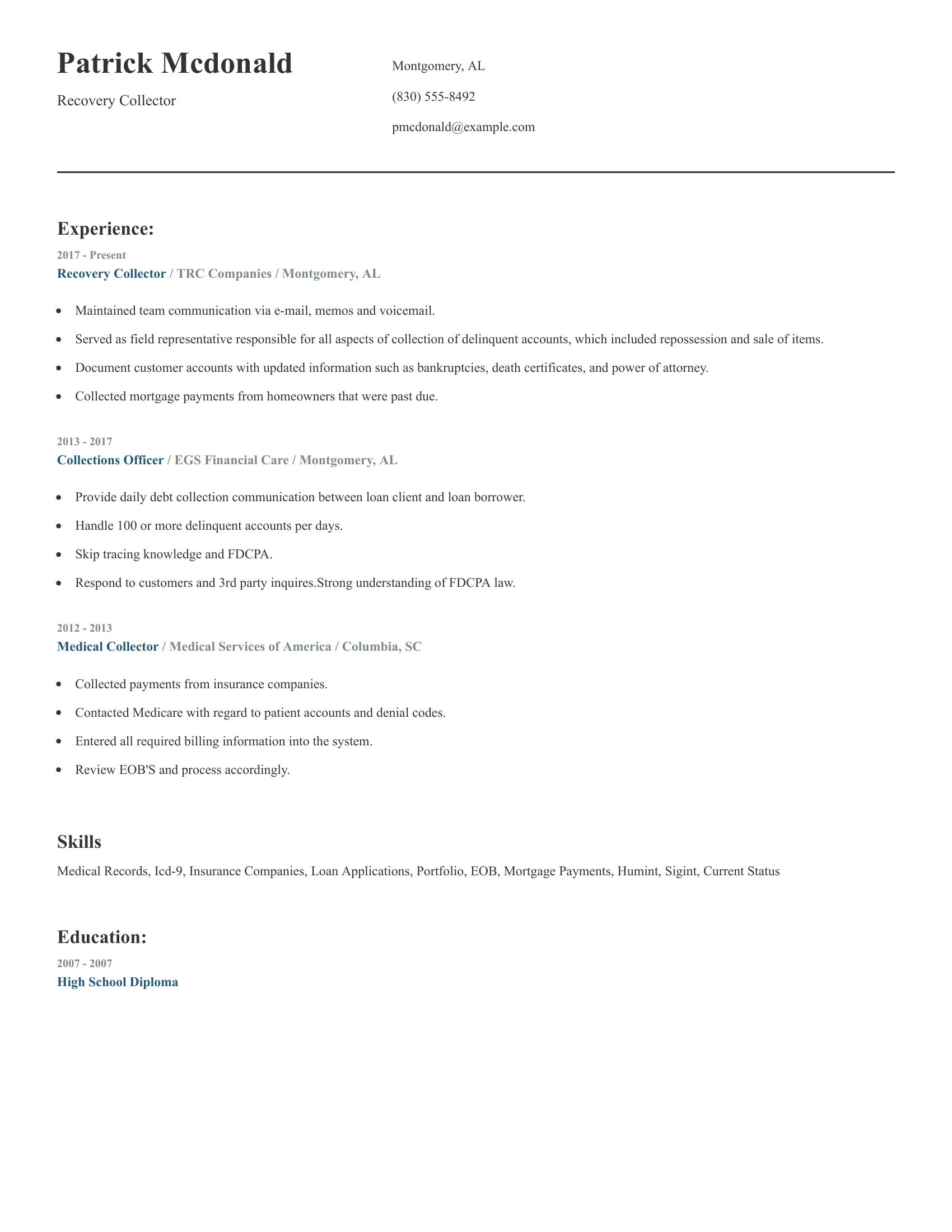

Recovery collector resumes highlight experience in managing delinquent accounts, knowledge of debt collection laws, and proficiency in skip tracing. They should showcase the ability to handle a high volume of accounts and communicate effectively with clients and third parties. Practical skills like maintaining accurate records, understanding financial documents, and utilizing various communication methods are important.

This resume includes specific experiences such as collecting mortgage payments, repossessing items, and handling over 100 delinquent accounts daily. It also demonstrates skills in documenting customer accounts, skip tracing, and familiarity with FDCPA law. The resume lists relevant skills like medical records management and understanding of various insurance processes. Additionally, it includes consistent employment history in related roles, emphasizing progressive responsibility in debt collection.

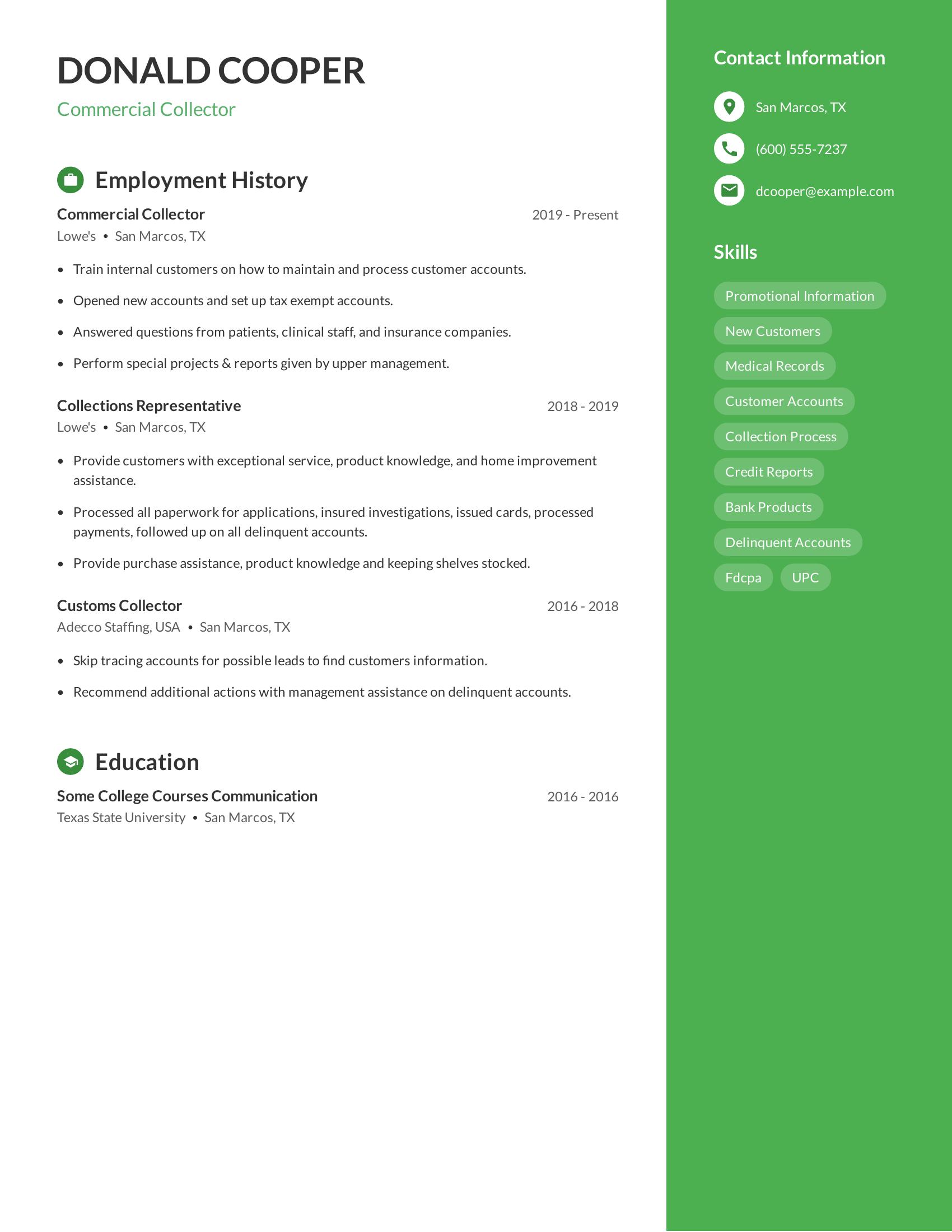

Commercial collector resumes should highlight experience in managing customer accounts, handling delinquent payments, and processing financial transactions. They should also showcase strong communication skills, ability to perform special projects, and knowledge of industry regulations. Education and relevant skills such as familiarity with credit reports and the collection process are important to include.

This resume includes several specifics that make it effective. It lists relevant job titles and responsibilities, demonstrating experience in account management and customer service. The resume also highlights skills such as processing payments, handling medical records, and skip tracing accounts. Additionally, it briefly mentions educational background and essential skills related to the commercial collection field.

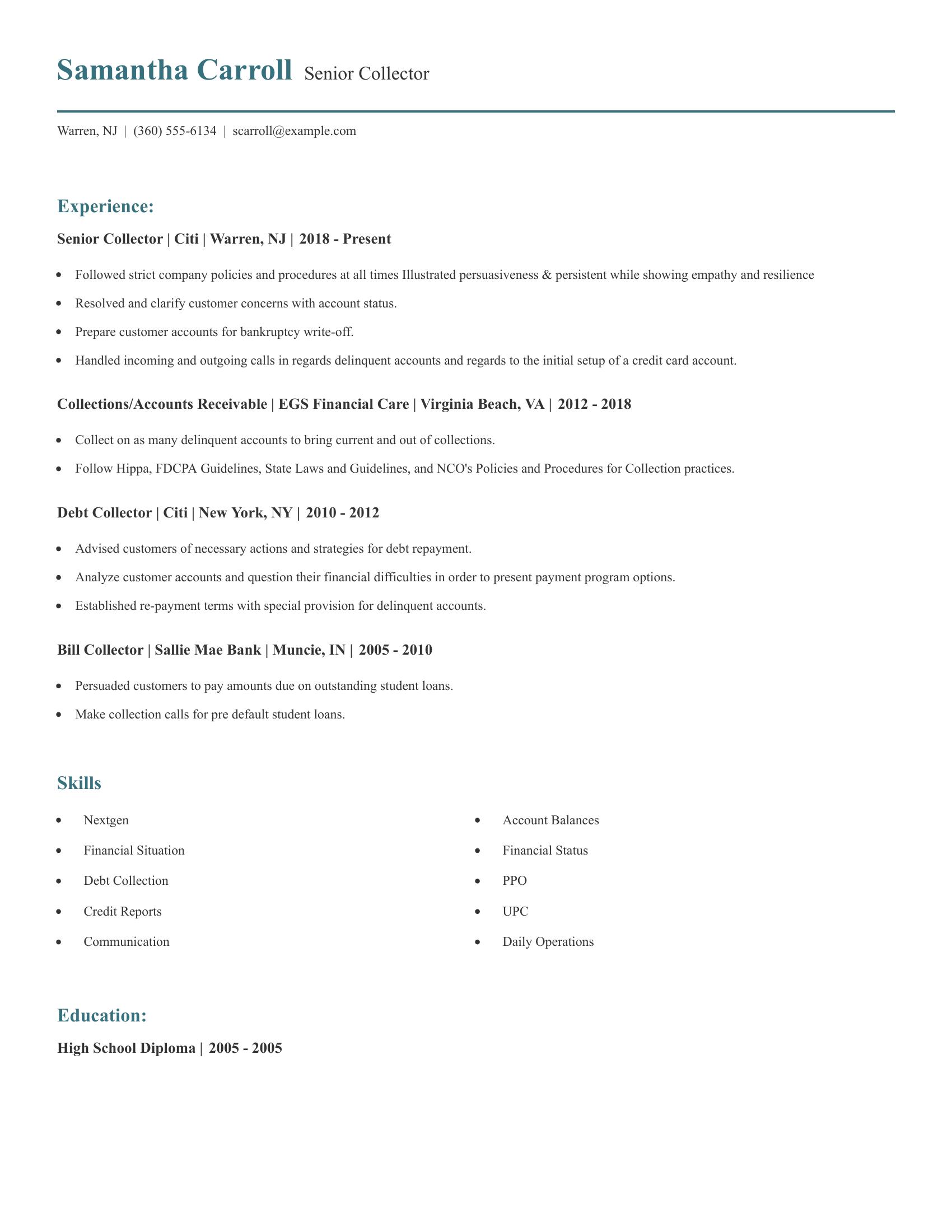

Senior collector resumes should highlight extensive experience in debt collection, strong communication skills, and knowledge of relevant laws and regulations. They must show a history of handling delinquent accounts, resolving customer issues, and following company policies. Additionally, they should list specific skills related to financial analysis and account management.

This resume includes substantial experience in debt collection roles across various companies, showcasing a consistent career path. It details tasks such as handling delinquent accounts, resolving customer concerns, and preparing accounts for bankruptcy. The listed skills demonstrate proficiency in financial management and daily operations related to collections.

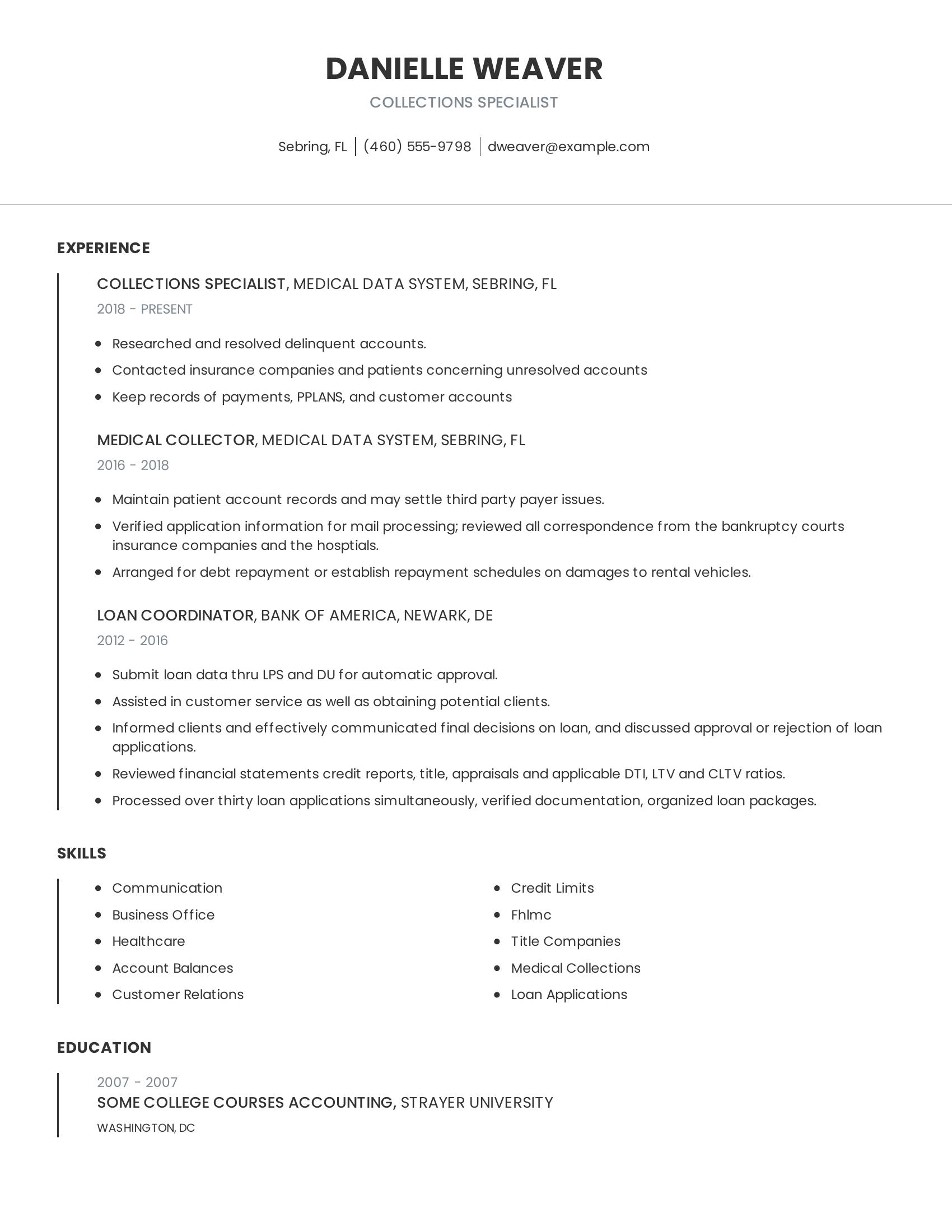

Collections specialist resumes should highlight experience in managing delinquent accounts, interacting with clients and insurance companies, and maintaining accurate records. Important skills include communication, customer relations, and knowledge of financial processes. The resume should show a progression of roles with increasing responsibility, relevant skills, and education that supports the job requirements.

This resume includes detailed work history with specific duties related to collections, such as researching delinquent accounts, contacting clients, and keeping payment records. It also lists relevant skills like business office management and medical collections. The educational background in accounting aligns well with the job responsibilities, making it a strong example of a collections specialist resume.

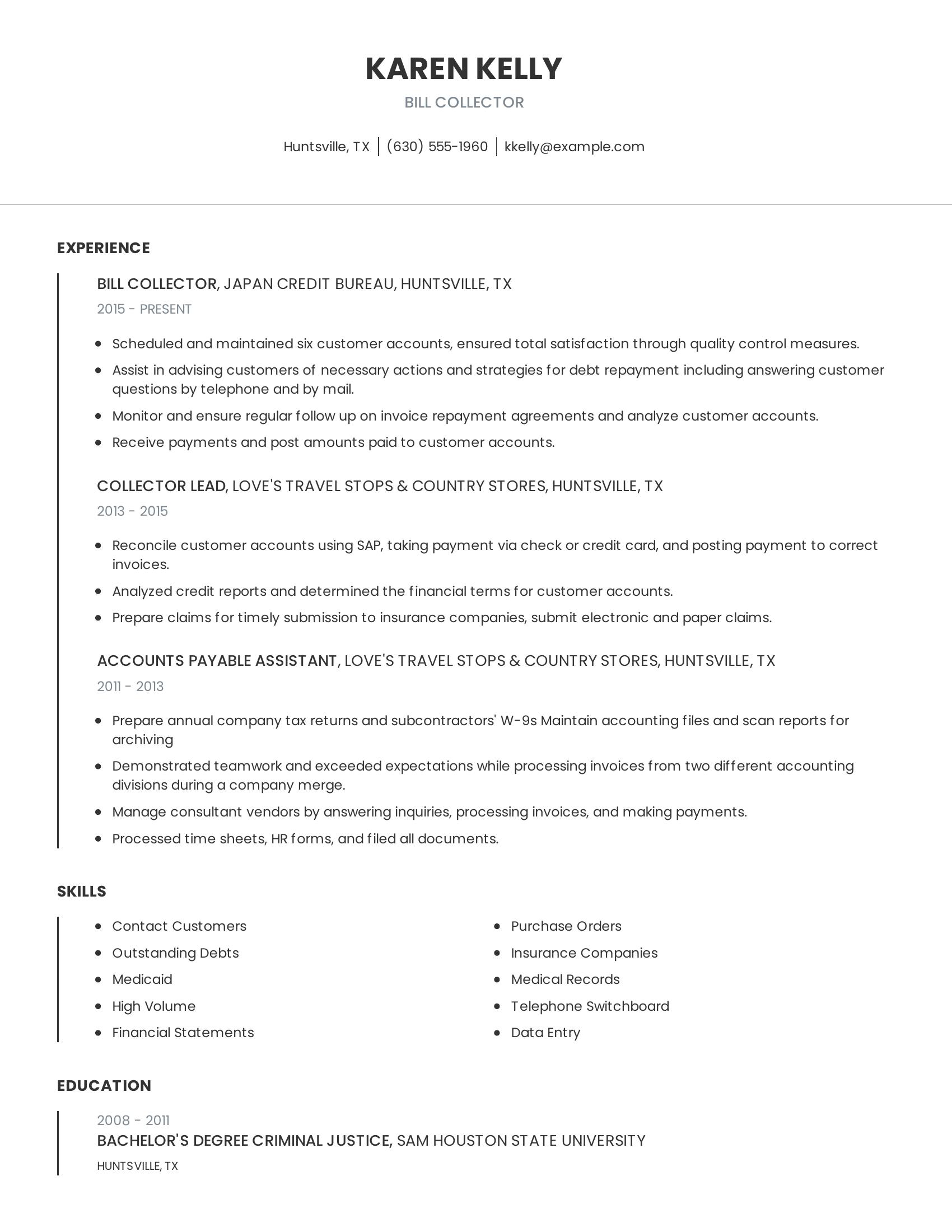

Bill collector resumes should highlight key skills such as debt recovery, account management, and customer service. They should include relevant work experience that demonstrates the ability to handle financial transactions, analyze customer accounts, and ensure timely payments. Educational background and specific skills related to the job, like proficiency in handling financial statements and data entry, are also important.

This resume includes these specifics by detailing the candidate's experience in managing customer accounts, processing payments, and analyzing credit reports. It lists relevant job roles with clear responsibilities, showing the candidate's progression and expertise. The skills section covers essential abilities like handling outstanding debts and working with insurance companies. The educational background supports the candidate's qualifications for the role.

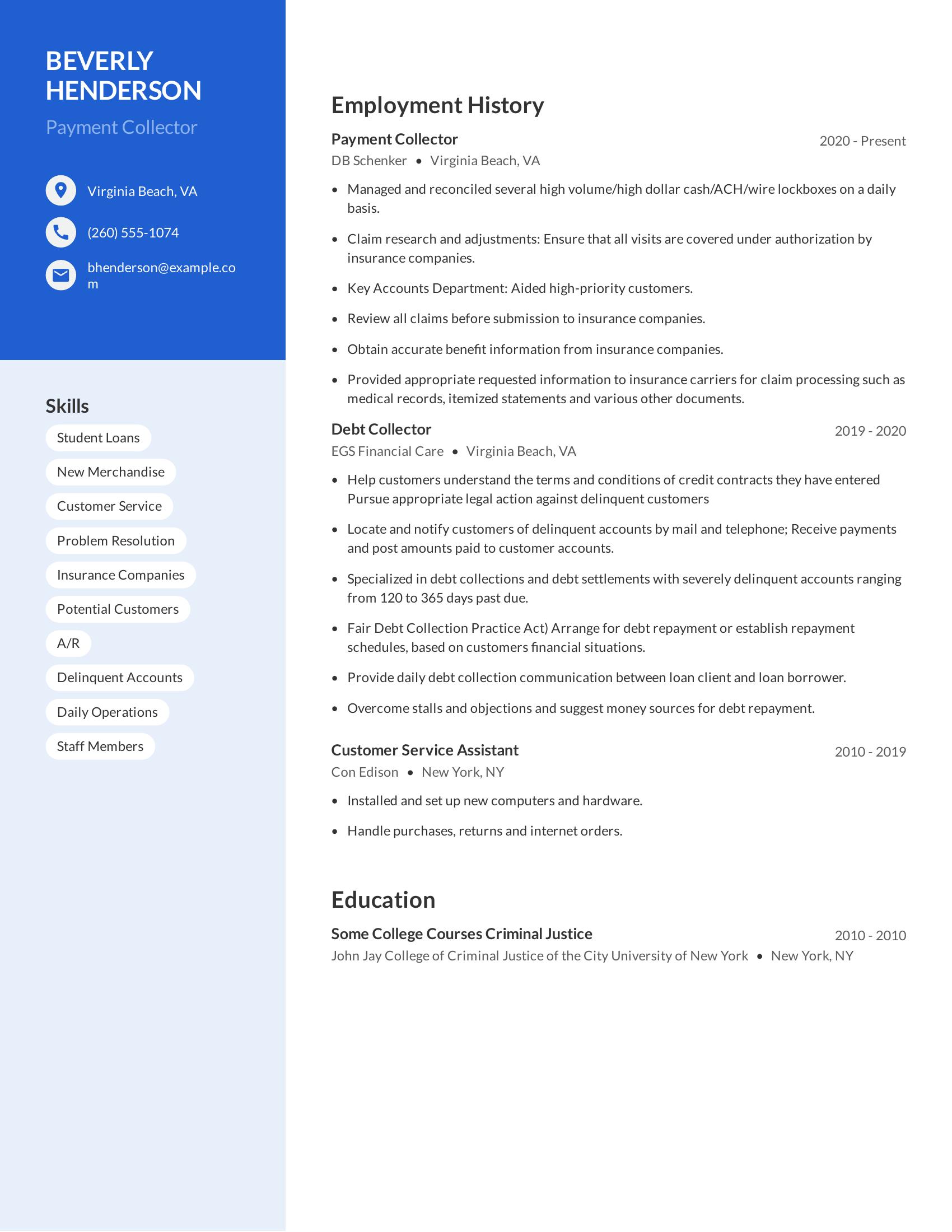

Payment collector resumes should highlight experience in managing and reconciling accounts, handling delinquent accounts, and working with insurance companies to resolve claims. Key skills include customer service, problem resolution, and knowledge of financial systems. A strong resume also shows the ability to handle high-volume transactions and communicate effectively with both customers and colleagues.

This resume includes specific experiences such as managing cash/ACH/wire lockboxes, aiding high-priority customers, and ensuring claim accuracy with insurance companies. It also lists relevant skills like customer service, problem resolution, and handling delinquent accounts. The employment history shows a progression in related roles, demonstrating expertise in payment collection and debt management.

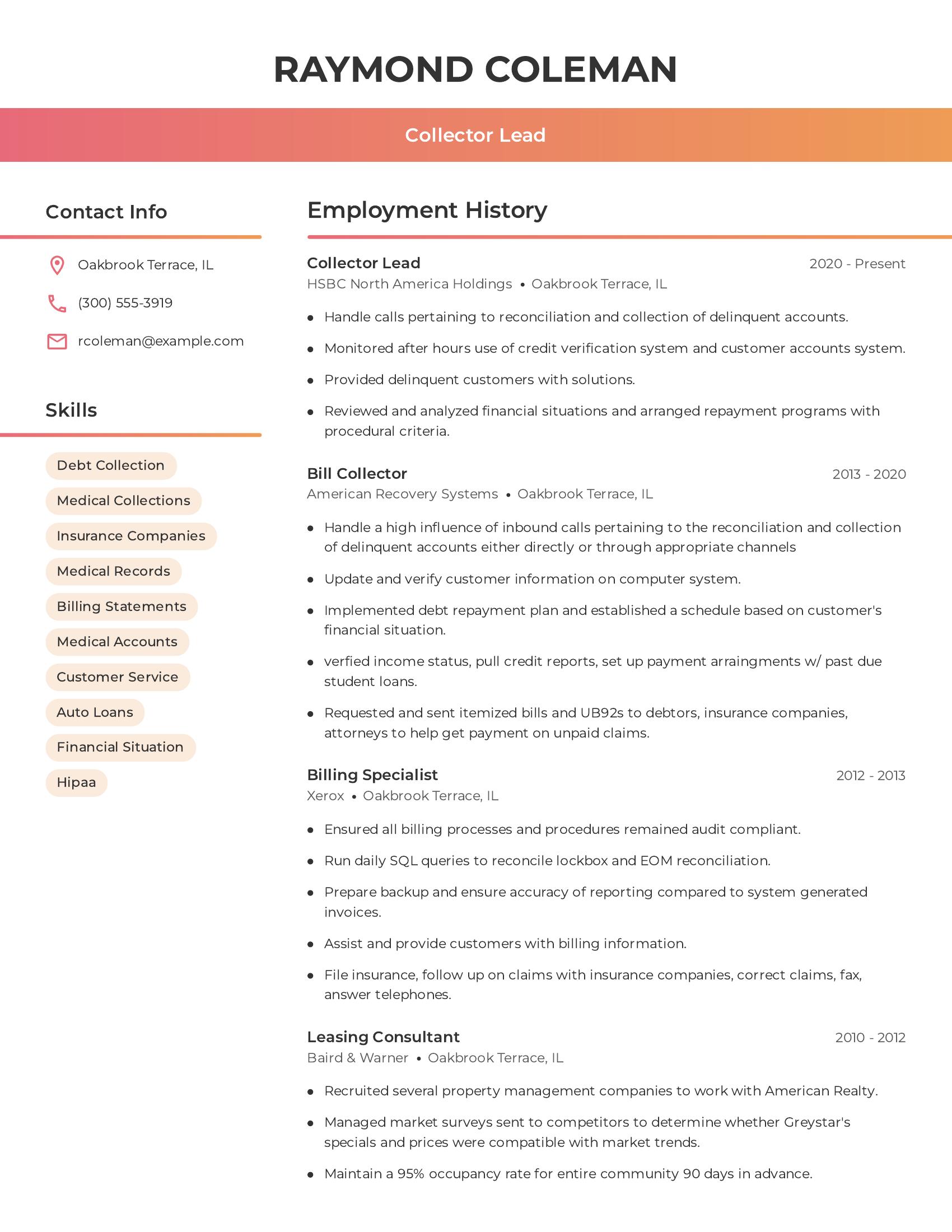

Collector lead resumes should highlight experience in debt collection, financial analysis, customer service, and compliance with regulations like HIPAA. They should include a clear employment history showing progression in responsibility. Skills such as handling inbound calls, setting up payment plans, and managing billing processes are important. The resume should also demonstrate experience with different types of accounts, including medical and auto loans.

This resume includes relevant skills like debt collection, medical collections, and handling billing statements. It shows a clear career progression from billing specialist to collector lead. The employment history details tasks such as analyzing financial situations, setting up payment arrangements, and ensuring compliance with billing procedures. It also covers diverse experience with different account types and customer service. This makes it a strong example of what a collector lead resume should include.

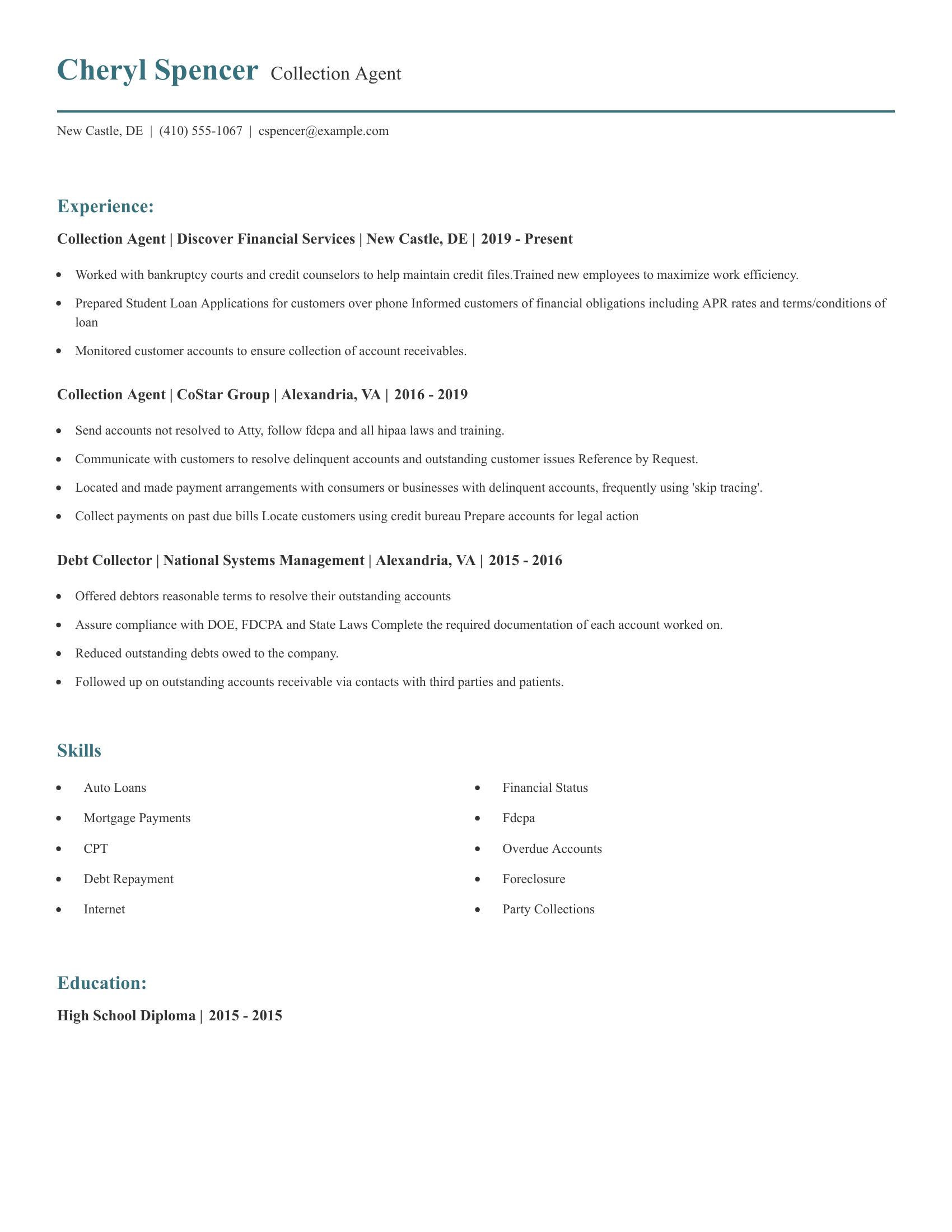

Collection agent resumes should highlight relevant experience, specific job duties, and skills pertinent to debt collection. These resumes often detail responsibilities such as communicating with customers, handling delinquent accounts, and ensuring compliance with industry regulations. Mentioning specific achievements or improvements in efficiency can also be beneficial. Skills like knowledge of FDCPA, skip tracing, and account monitoring are crucial for this role.

This resume includes detailed job experiences that showcase the candidate's ability to handle various collection tasks and interact with customers to resolve issues. It lists relevant skills such as managing overdue accounts and understanding financial obligations. The resume also highlights compliance with laws and training new employees, demonstrating a comprehensive understanding of the field.

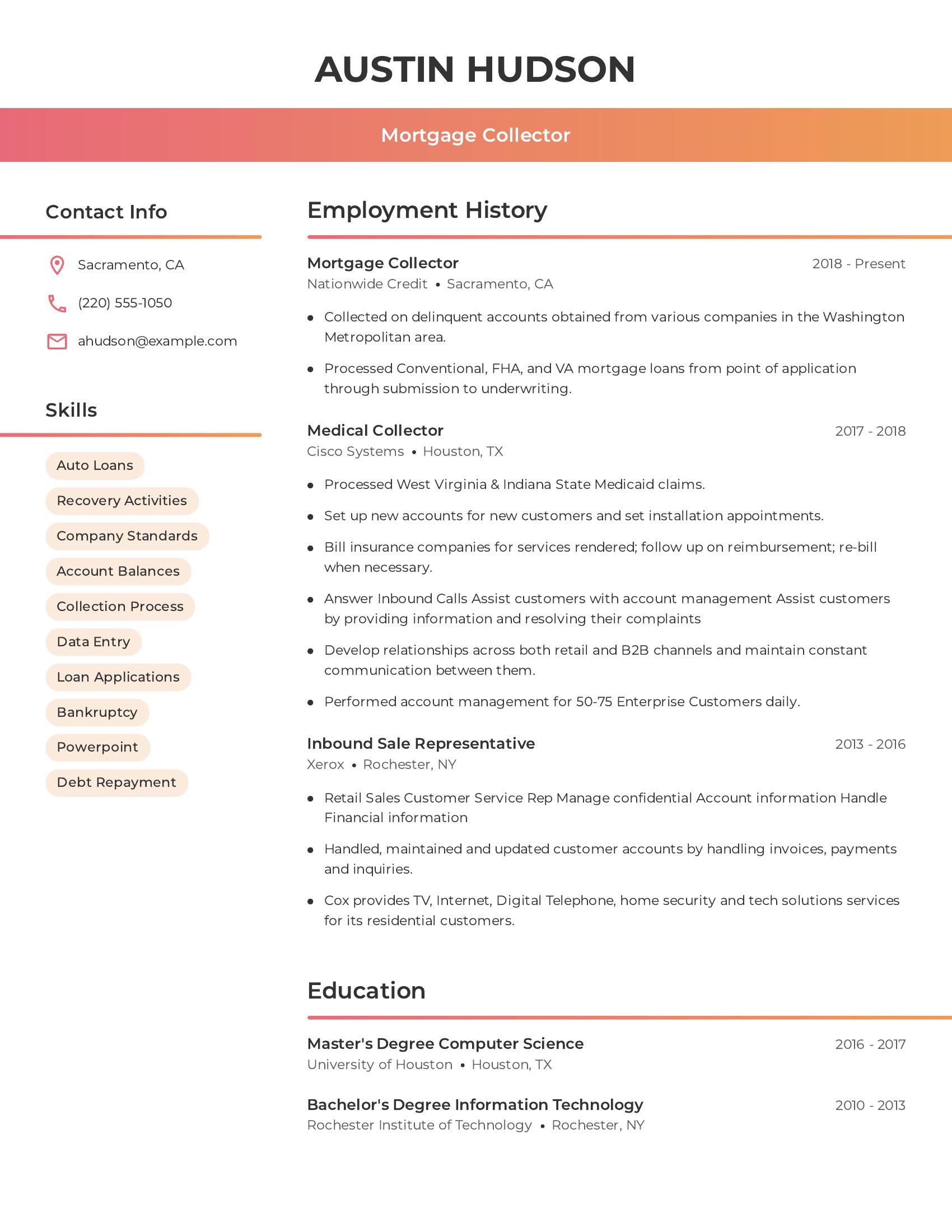

Mortgage collector resumes need to highlight specific skills and experiences related to debt recovery and customer service. This includes listing key tasks like processing loan applications, managing account balances, and handling bankruptcy cases. It’s also important to show experience with data entry and using relevant software tools. A good resume should clearly outline previous employment history in roles that involve financial transactions or customer interactions.

This resume includes many of those specifics. It lists skills such as auto loans, recovery activities, and debt repayment. The employment history shows relevant experience in roles like mortgage collector and medical collector. The tasks mentioned, such as processing mortgage loans and managing accounts, align well with the job requirements. The educational background in computer science and information technology also adds value by highlighting technical skills useful for this role.

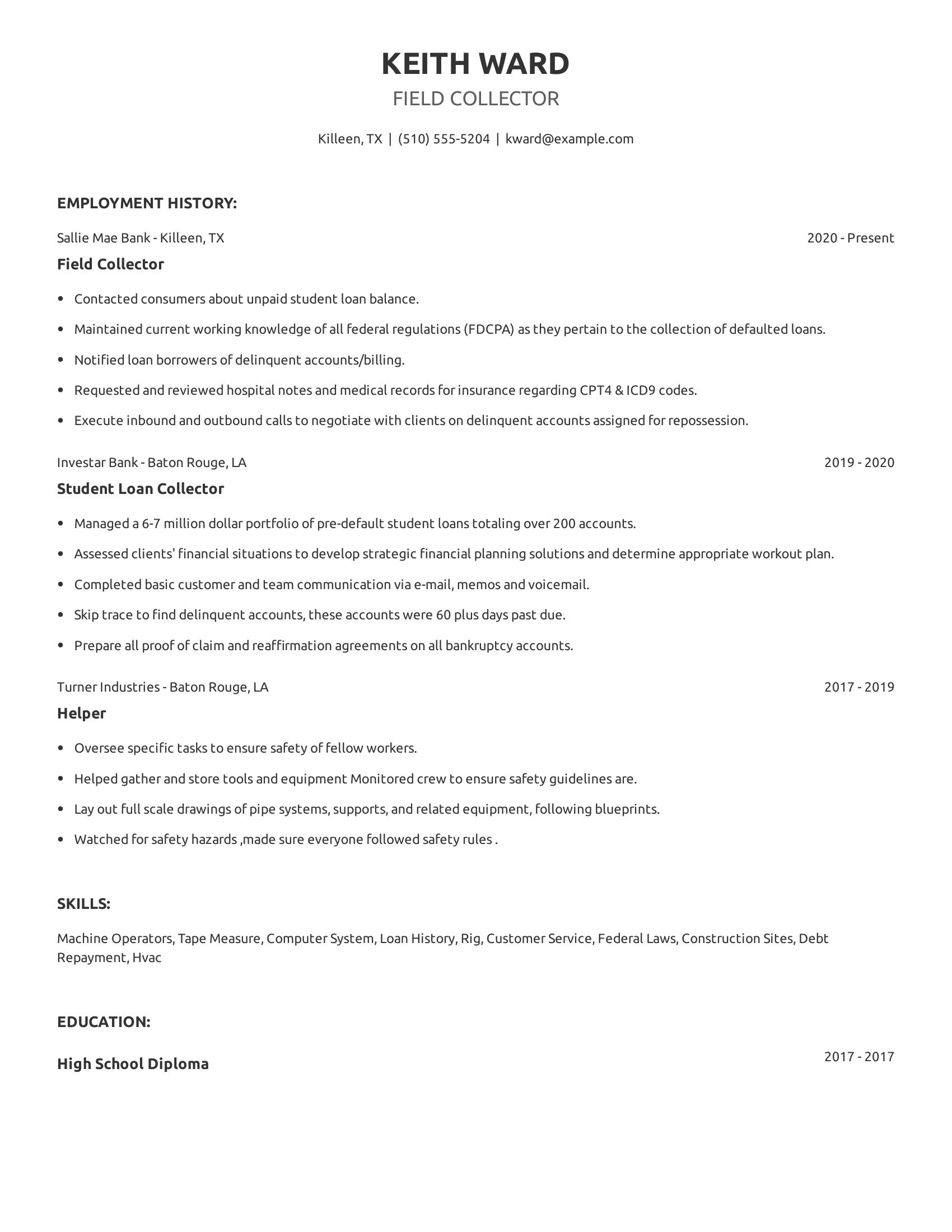

Field collector resumes should include job experience in debt collection, knowledge of federal regulations, proficiency in communication, and specific skills like customer service and computer systems. Relevant past job titles, responsibilities, and accomplishments are crucial. A clear layout with contact information, work history, skills, and education is necessary.

This resume includes those specifics well. It lists employment history with relevant job titles like field collector and student loan collector, showing experience. It details tasks such as contacting consumers about unpaid loans and maintaining knowledge of federal regulations. Skills like machine operators, customer service, and debt repayment highlight the candidate's expertise. The resume also includes clear contact information and education details.

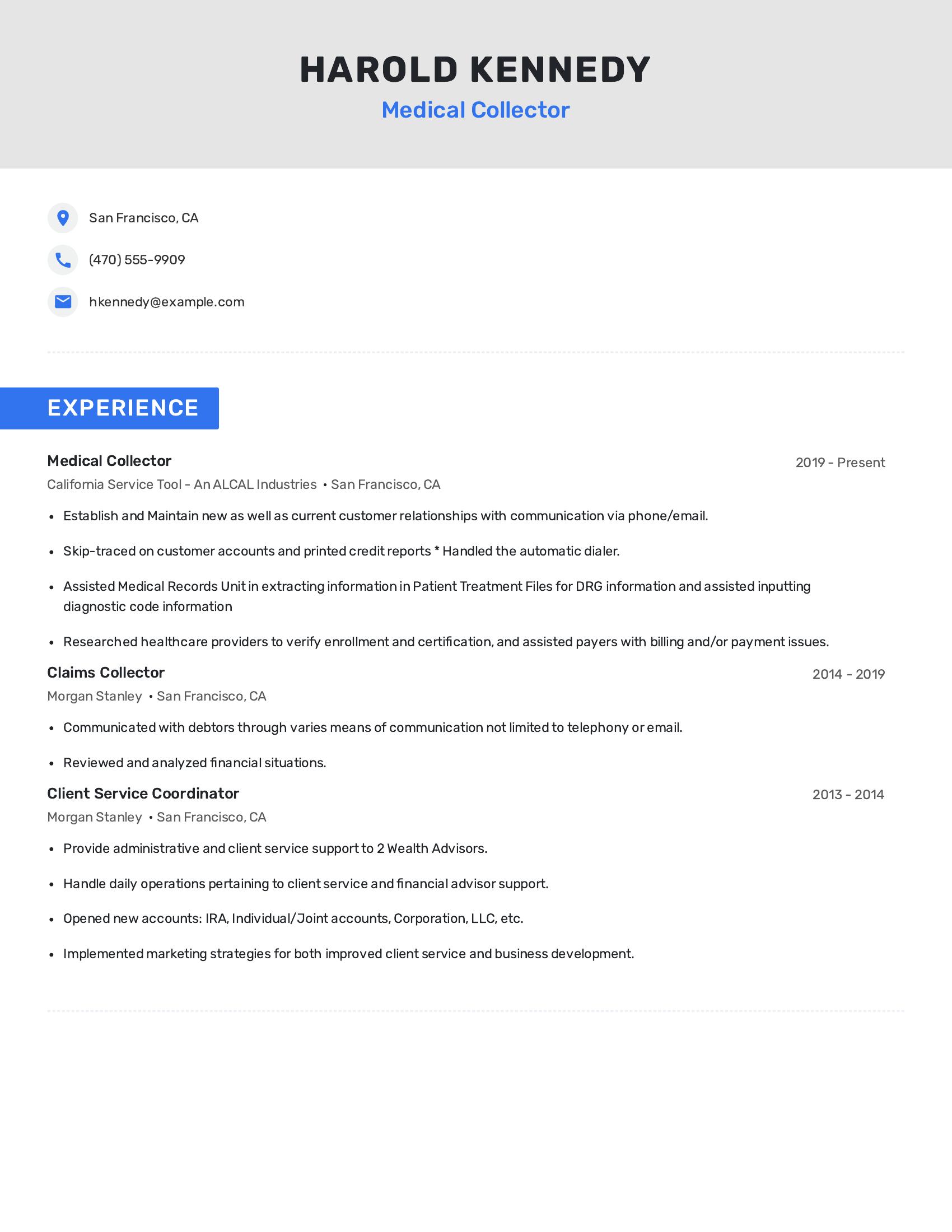

medical collector resumes should highlight experience in handling patient accounts, managing billing and payment issues, and working with medical records. Key elements include communication skills via phone and email, familiarity with diagnostic codes, and the ability to research and verify healthcare provider information. Experience with financial reviews and skip-tracing on customer accounts is also important.

This resume includes relevant experience in a medical collector role, such as maintaining customer relationships and handling billing issues. It also shows skills in skip-tracing, using automatic dialers, and assisting with medical records. Previous roles as a claims collector and client service coordinator demonstrate a background in financial analysis and administrative support.

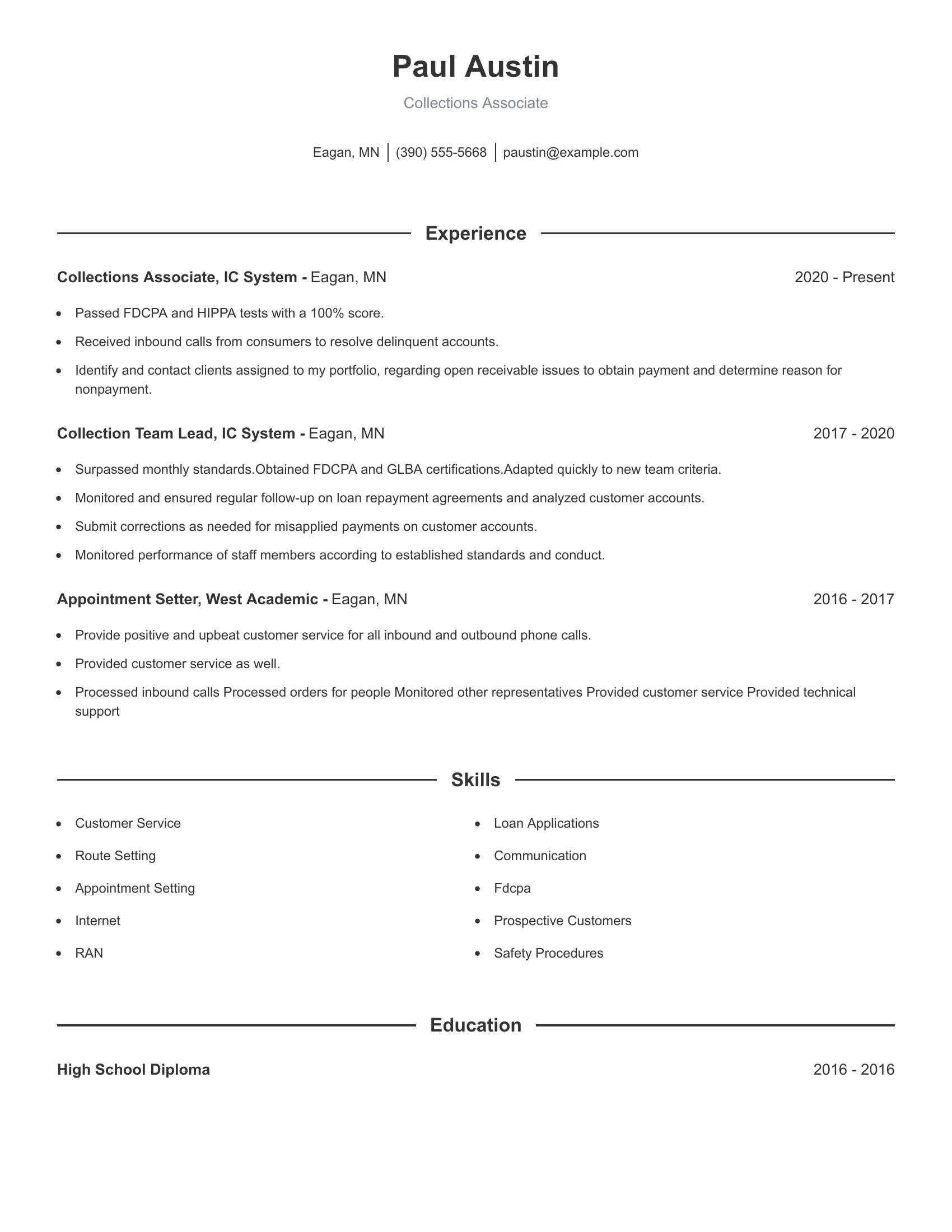

A collections associate resume should highlight experience in managing and resolving delinquent accounts, proficiency in relevant laws and certifications like FDCPA, and strong communication skills. It should list job roles with clear duties such as handling inbound calls, contacting clients to resolve payment issues, and overseeing a team if applicable. Certifications and educational background should be included to show qualifications.

This resume includes specific job roles and duties that showcase the applicant's experience in collections and customer service. It also lists certifications passed with high scores, demonstrating knowledge in important areas. The resume details tasks such as monitoring staff performance and processing orders, showing a range of relevant skills and responsibilities.

Highlight experience with debt recovery systems. List specific software like Experian or TLOxp to show your technical skills.

Showcase successful collections. Mention the percentage of delinquent accounts you resolved or the amount of debt recovered.

Include communication skills. Note your ability to negotiate payment plans and handle difficult conversations professionally.

A collector's resume must show experience and skills in debt collection, customer service, and communication. Include your contact details, a summary of your experience, work history, education, and relevant skills. Highlight achievements in recovering debts and handling difficult conversations. Use clear and direct language to show your success in meeting targets and resolving disputes.

A collector summary should highlight relevant experience and skills in debt collection. Mention the ability to meet targets, handle difficult conversations, and maintain records.

Use clear and concise language. Avoid jargon. Tailor the summary to the job description. Keep it brief and focused.

A strong collector experience section should detail specific duties, achievements, and skills. Focus on actions and results.

Make your collector experience stand out by following these best practices.

A collector needs technical abilities specific to debt collection.

A collector also requires strong interpersonal abilities.