17 Collections Specialist Resume Examples

A collections specialist resume should highlight relevant experience in managing delinquent accounts, contacting debtors, and maintaining accurate records. It should include job titles, company names, locations, and dates of employment. Key skills related to communication, customer relations, and financial transactions are important. Education and certifications, if any, should also be listed to show qualifications.

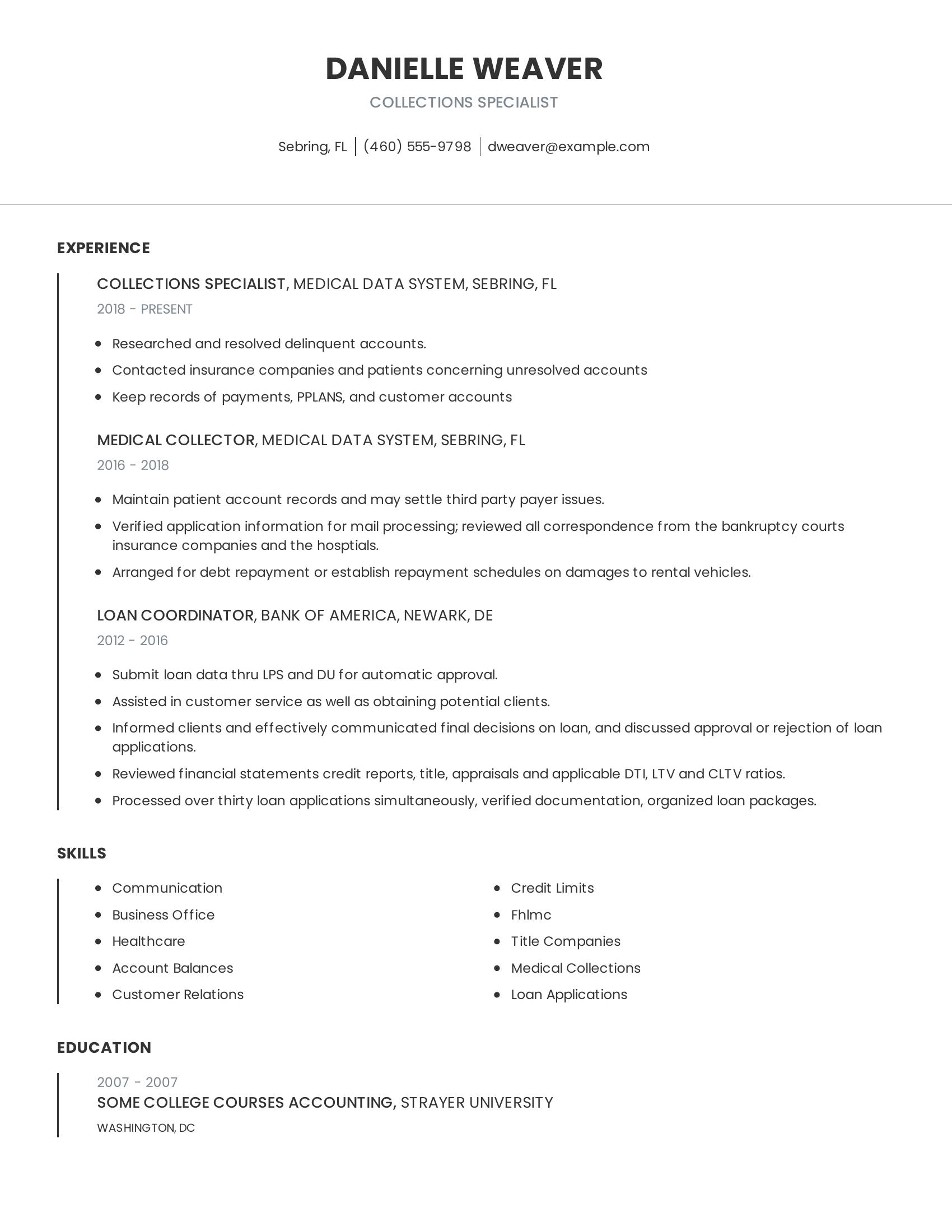

This resume includes specific job titles like collections specialist and medical collector, showing relevant experience in the field. It lists duties such as researching delinquent accounts and contacting insurance companies. The skills section covers essential areas like communication and medical collections. The education section briefly mentions college courses taken in accounting, adding to the candidate's qualifications.

Collections associate resumes should highlight relevant job experience, specific skills, and certifications. Key elements to include are job titles, dates of employment, and concise descriptions of duties. Skills relevant to collections, such as customer service, communication, and knowledge of regulations like FDCPA and HIPAA, should be emphasized. Education and any additional training or certifications that enhance the candidate's qualifications are also important.

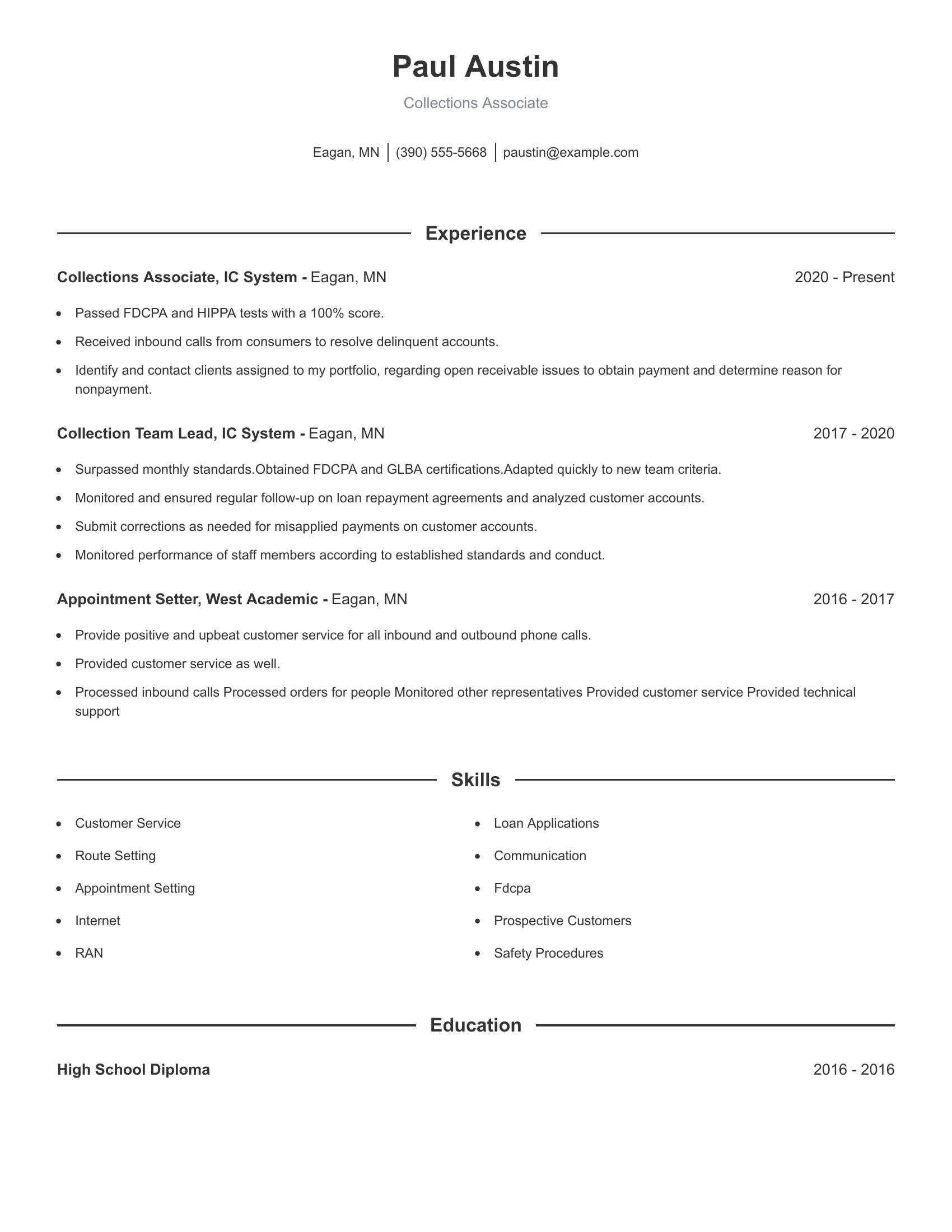

This resume includes a clear work history with titles such as collections associate and collection team lead. It lists specific duties performed in these roles, like resolving delinquent accounts and monitoring loan repayment agreements. The resume also shows relevant certifications and skills, such as FDCPA and GLBA certifications and customer service abilities. The education section is present, noting a high school diploma.

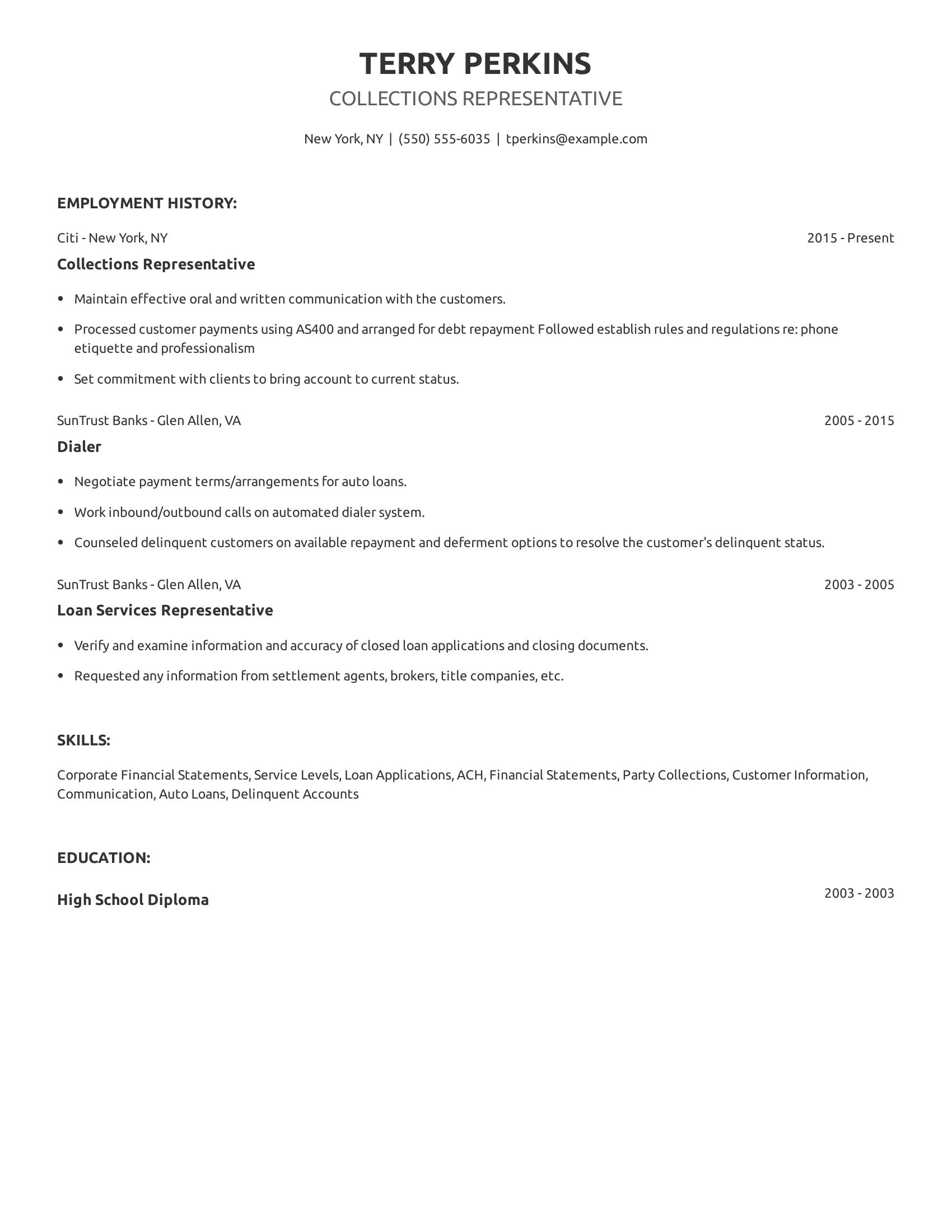

A collections representative resume should include clear information on job experience, skills relevant to the position, and education background. The work history must detail specific duties performed in past roles, particularly those related to debt collection, communication with clients, and payment processing. Highlighting proficiency with relevant systems and tools is also important. Skills should focus on financial knowledge, customer interaction, and problem-solving abilities.

This resume demonstrates these elements well. It lists detailed job responsibilities such as maintaining communication with customers, processing payments, and negotiating payment terms. The skills section covers important areas like loan applications and corporate financial statements. The employment history shows progression and relevant experience in collections and loan services.

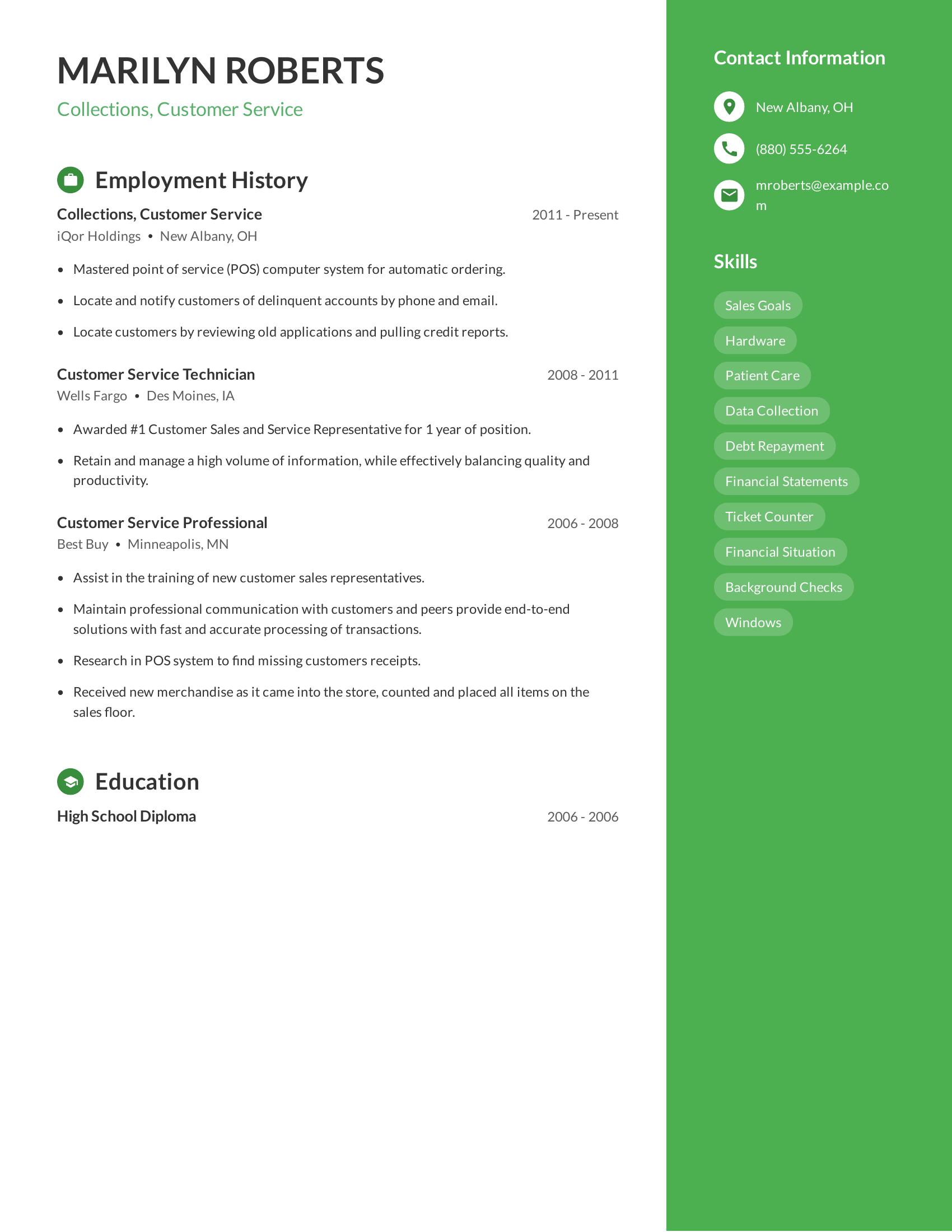

Collections, customer service resumes should highlight specific skills and experiences related to customer interactions and account management. Good resumes include clear employment history with job titles, company names, locations, and dates of employment. They should detail responsibilities and achievements in each role. Skills relevant to collections and customer service, such as data collection, debt repayment, and financial statements, should be listed.

This resume includes many important elements. It lists job titles and dates, providing a clear work history. Specific tasks and accomplishments are outlined for each position, like mastering POS systems and locating delinquent accounts. The skills section covers relevant areas such as sales goals and background checks.

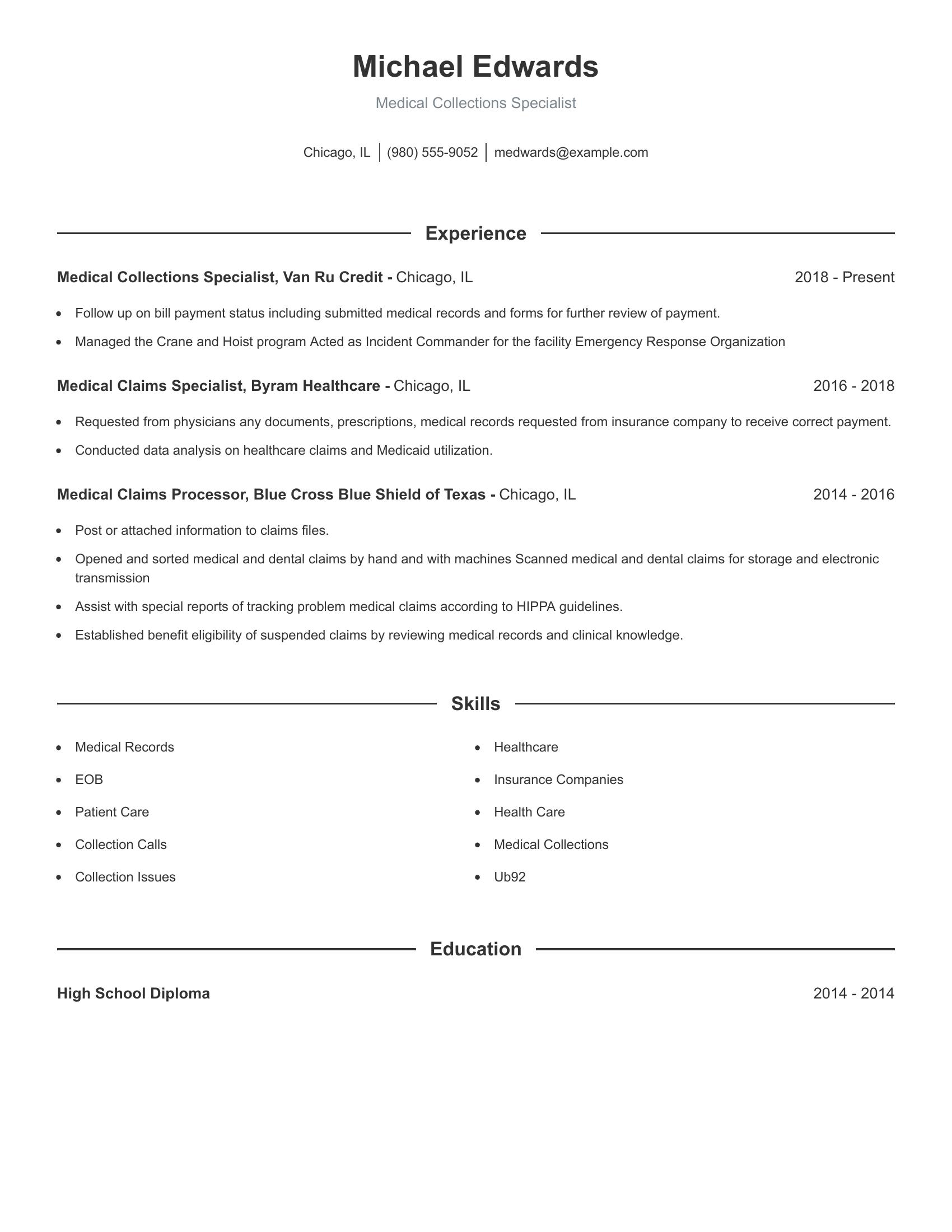

A medical collections specialist resume should focus on experience in handling medical billing, insurance claims, and patient accounts. It should highlight roles that involve following up on unpaid bills, managing medical records, and ensuring compliance with healthcare regulations. Skills related to data analysis, document management, and communication with insurance companies are also vital. The resume should also include relevant job titles, employers, dates of employment, specific responsibilities, and any relevant education or certifications.

This resume includes the necessary components by listing job titles such as medical collections specialist and medical claims specialist. It provides a clear timeline of employment history, mentioning specific tasks like following up on bill payment status and conducting data analysis on healthcare claims. Skills related to medical records, insurance companies, and patient care are noted, alongside education details like a high school diploma. These elements collectively demonstrate the candidate's qualifications for the role.

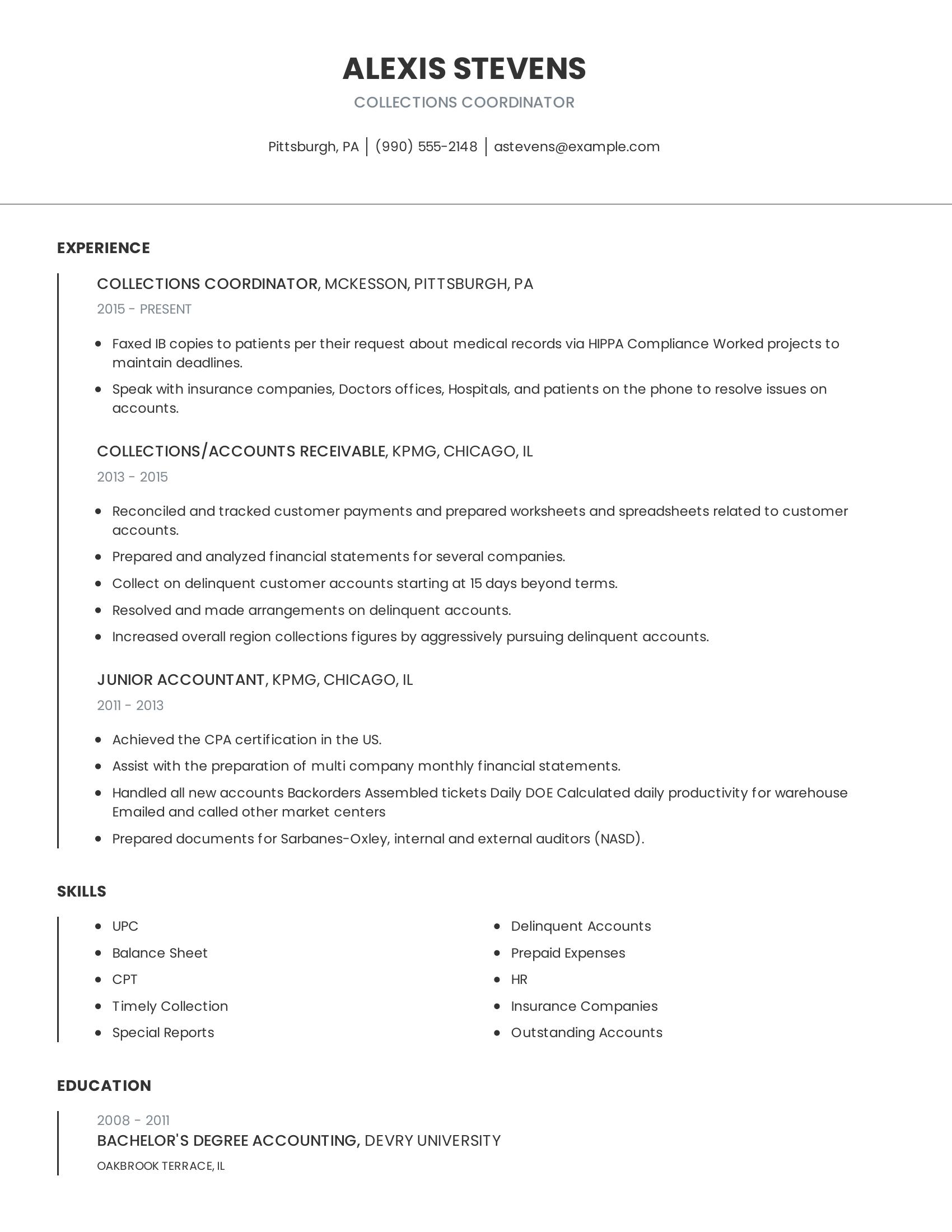

Collections coordinator resumes should highlight experience in managing accounts, resolving delinquent payments, and communicating with stakeholders like insurance companies and patients. It should also show skills in financial analysis, preparing documents for audits, and maintaining compliance with regulations. Education in accounting or a related field is important, along with certifications that add credibility to the role.

This resume includes relevant experience at multiple companies where the candidate managed collections and accounts receivable tasks. It details specific duties like resolving account issues, reconciling payments, and increasing collections figures. The resume also lists necessary skills such as timely collection, handling delinquent accounts, and preparing financial statements. The educational background supports the professional experience with a bachelor's degree in accounting.

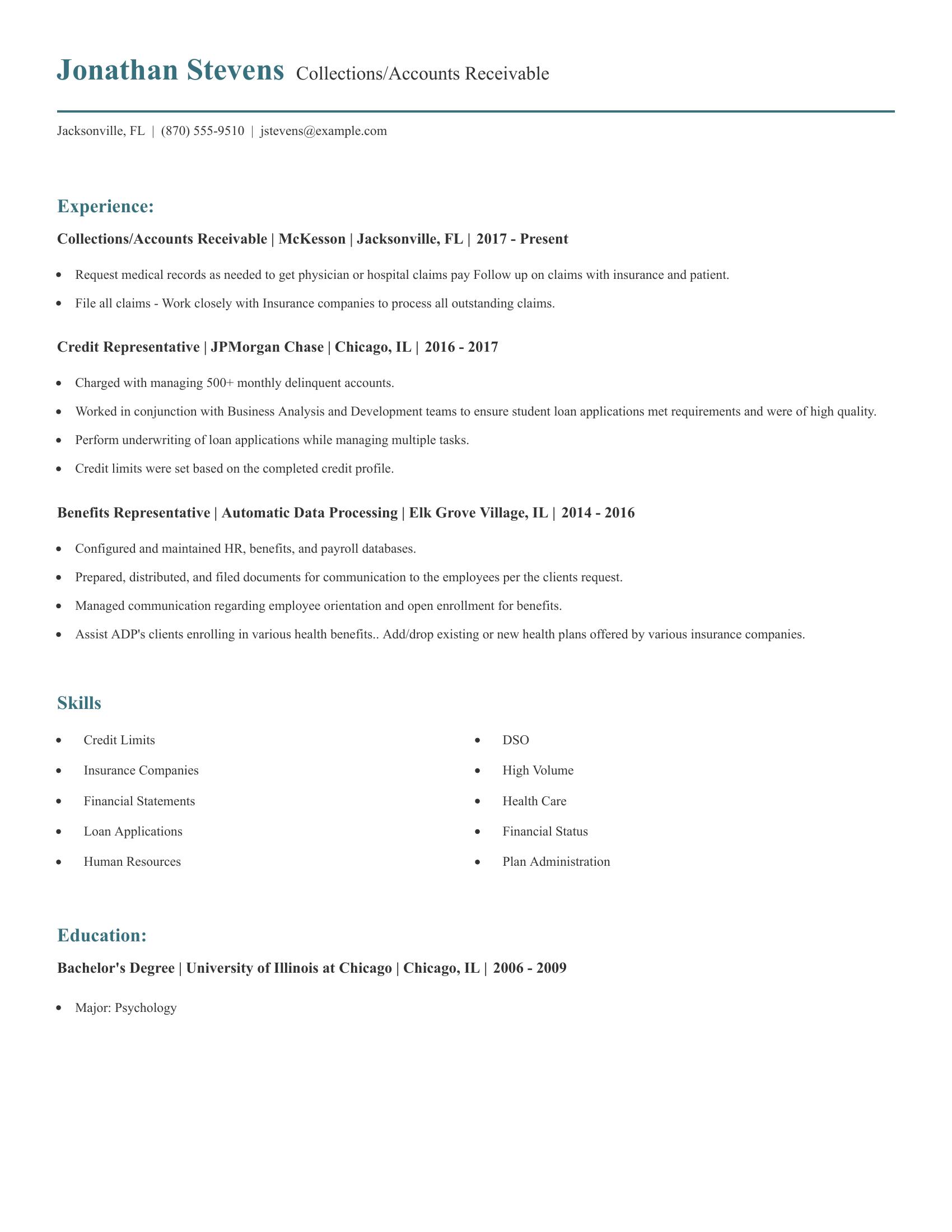

Collections/accounts receivable resumes should highlight experience with managing delinquent accounts, processing claims, and working with insurance companies. They should also show skills in credit management, financial analysis, and customer communication. Listing relevant job experiences, skills, and education is important for showcasing qualifications and expertise in the field.

This resume includes those specifics by detailing the candidate's experience at various companies where they managed accounts and processed claims. It clearly lists the job titles, company names, locations, and dates of employment. The resume also highlights skills related to credit limits, insurance companies, financial statements, and human resources. Additionally, it includes educational background with a bachelor's degree in psychology from a recognized university.

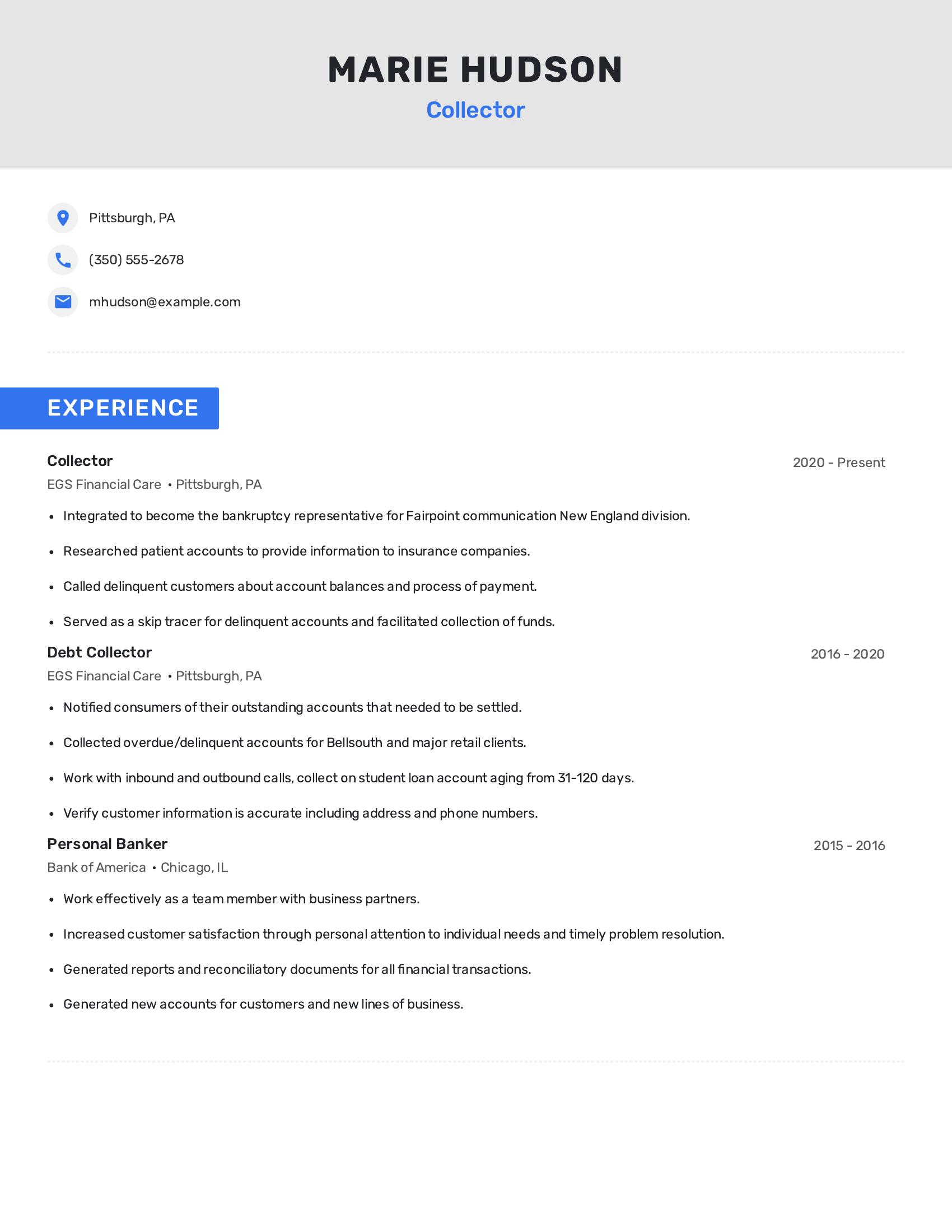

Collector resumes should include relevant job experience, specific duties performed, and contact information. They should highlight skills in managing delinquent accounts, customer interactions, and financial transactions. Key elements include work history with dates, companies worked for, primary responsibilities, and achievements in debt collection and related fields.

This resume includes all necessary specifics. It lists job titles like collector and debt collector with respective companies and dates of employment. Responsibilities such as calling delinquent customers, skip tracing, and account verification are detailed. Previous roles like personal banker show versatility in handling financial matters and customer service.

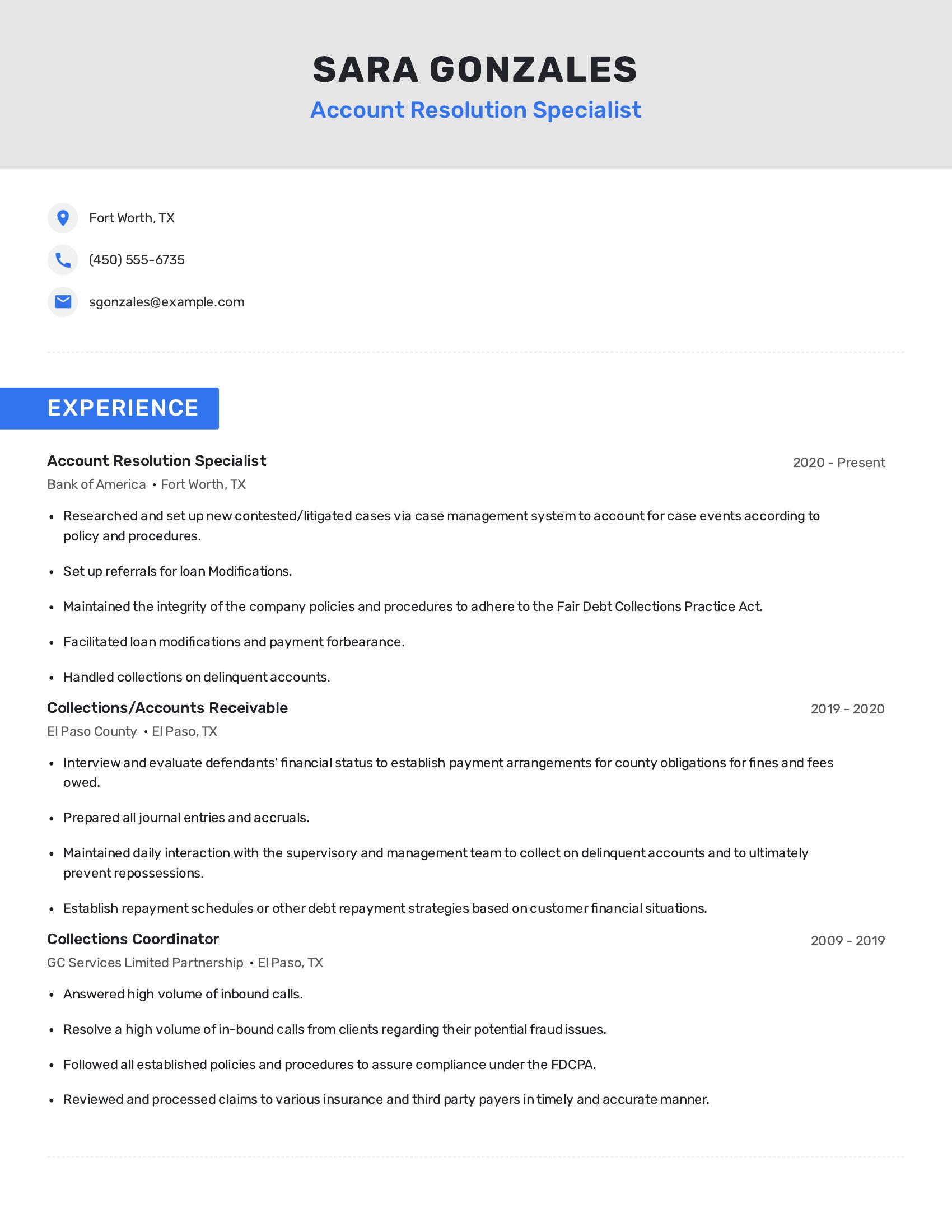

Account resolution specialist resumes should highlight experience in handling delinquent accounts, knowledge of debt collection laws, and proficiency with case management systems. They should showcase an ability to set up loan modifications, payment forbearance, and establish repayment schedules based on customer financial situations. Moreover, demonstrating experience in preparing journal entries, maintaining compliance with policies, and handling high volumes of inbound calls is crucial.

This resume includes many necessary specifics. It details the candidate's experience with loan modifications, delinquent account collections, and adherence to the Fair Debt Collections Practice Act. The resume also shows experience in evaluating financial statuses for payment arrangements and resolving fraud issues through inbound calls. This demonstrates a well-rounded background in account resolution and collections.

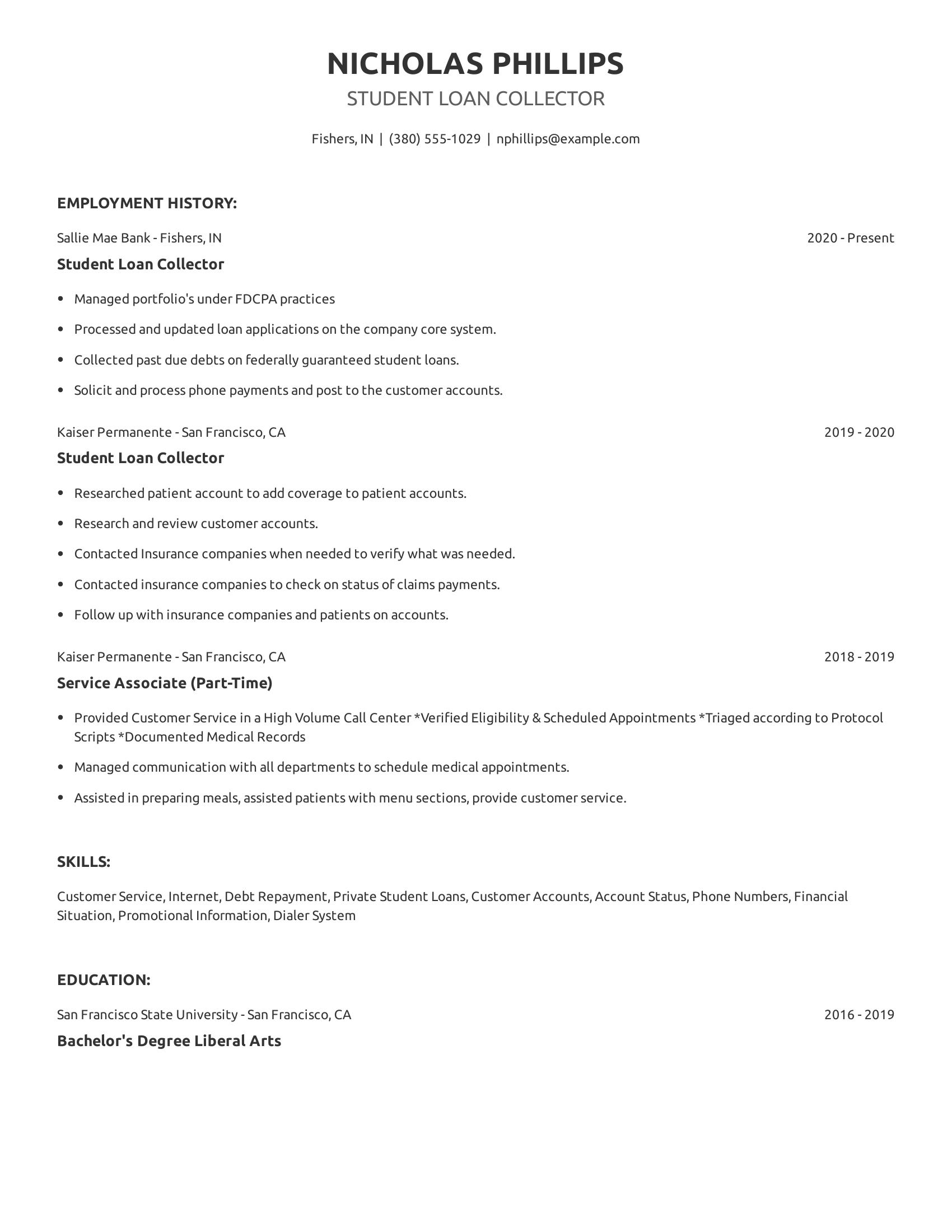

Student loan collector resumes should include employment history, specific duties related to debt collection, and relevant skills. Highlighting experience with loan processing, customer service, and compliance with regulations is vital. Education background ensures the candidate has the necessary knowledge base.

This resume effectively showcases relevant job experiences at Sallie Mae Bank and Kaiser Permanente. It details tasks like managing portfolios, processing payments, and contacting insurance companies. Skills listed align with duties performed, such as customer service and debt repayment. The education section provides a clear academic background in liberal arts.

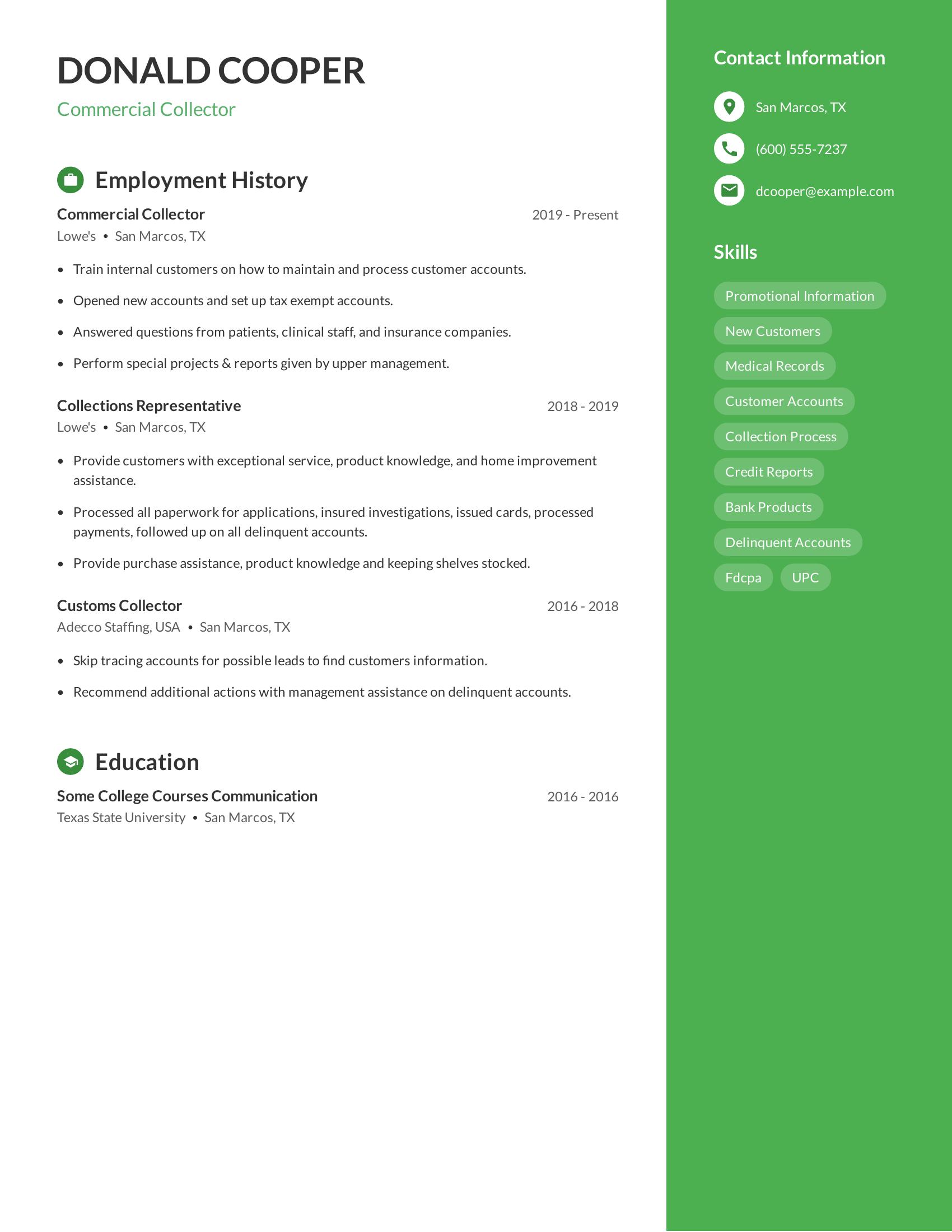

Commercial collector resumes should highlight experience in managing and processing customer accounts, handling delinquent payments, and conducting skip tracing. Important sections include employment history, education, and relevant skills like understanding credit reports and collection processes. Details about achievements, such as setting up new accounts or training staff, can show the candidate's expertise and impact in previous roles.

This resume includes necessary specifics by listing past job titles, duties performed, and skills acquired. It highlights experience in collections and interactions with customers and internal teams. The resume also mentions educational background and provides relevant contact information. Specific tasks like opening new accounts and skip tracing demonstrate practical expertise in the field.

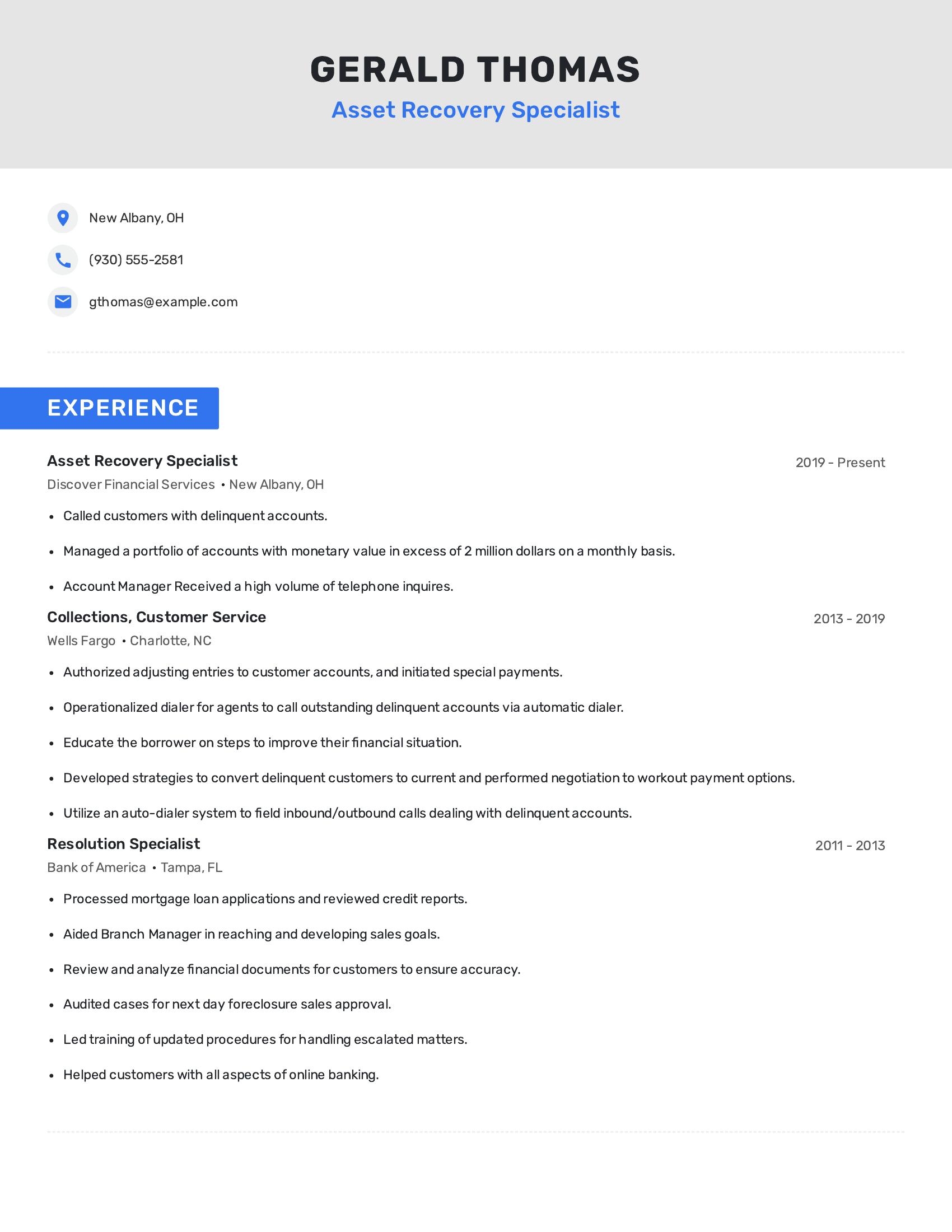

Asset recovery specialist resumes should highlight experience with managing delinquent accounts, negotiating payment options, and using automated systems for call management. It should include a history of positions held in financial institutions and detail job responsibilities such as processing loan applications, reviewing financial documents, and handling customer service inquiries. Experience in training and developing strategies to manage accounts is also important.

This resume includes valuable specifics like managing a significant portfolio of accounts and utilizing auto-dialer systems for efficiency. The candidate has substantial experience in collections, customer service, and account management at notable financial companies. The resume also shows involvement in training and developing strategies to handle delinquent accounts, which are crucial tasks for an asset recovery specialist.

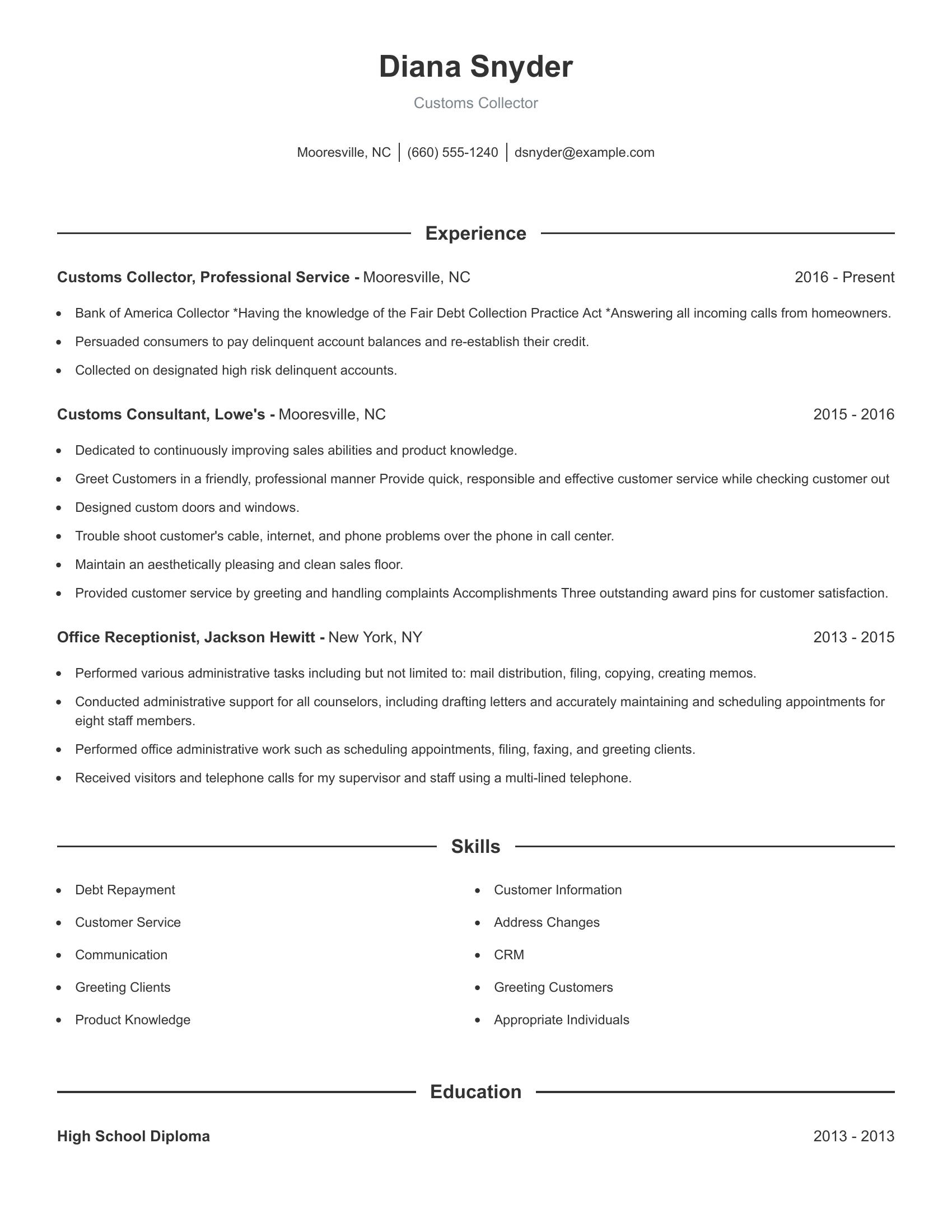

Customs collector resumes should include work experience relevant to customs and debt collection, highlighting skills such as knowledge of the Fair Debt Collection Practice Act, customer service, and problem-solving. They should also list specific duties and accomplishments in previous roles, showing a history of handling delinquent accounts and providing customer support. Education and any relevant certifications should be included to show formal qualifications.

This resume includes the necessary details for a customs collector position. It lists specific duties performed at each job, such as answering calls from homeowners, persuading consumers to pay delinquent balances, and handling customer service issues. It also highlights relevant experience from other roles, such as designing custom products and performing administrative tasks. The resume shows a consistent work history in related fields.

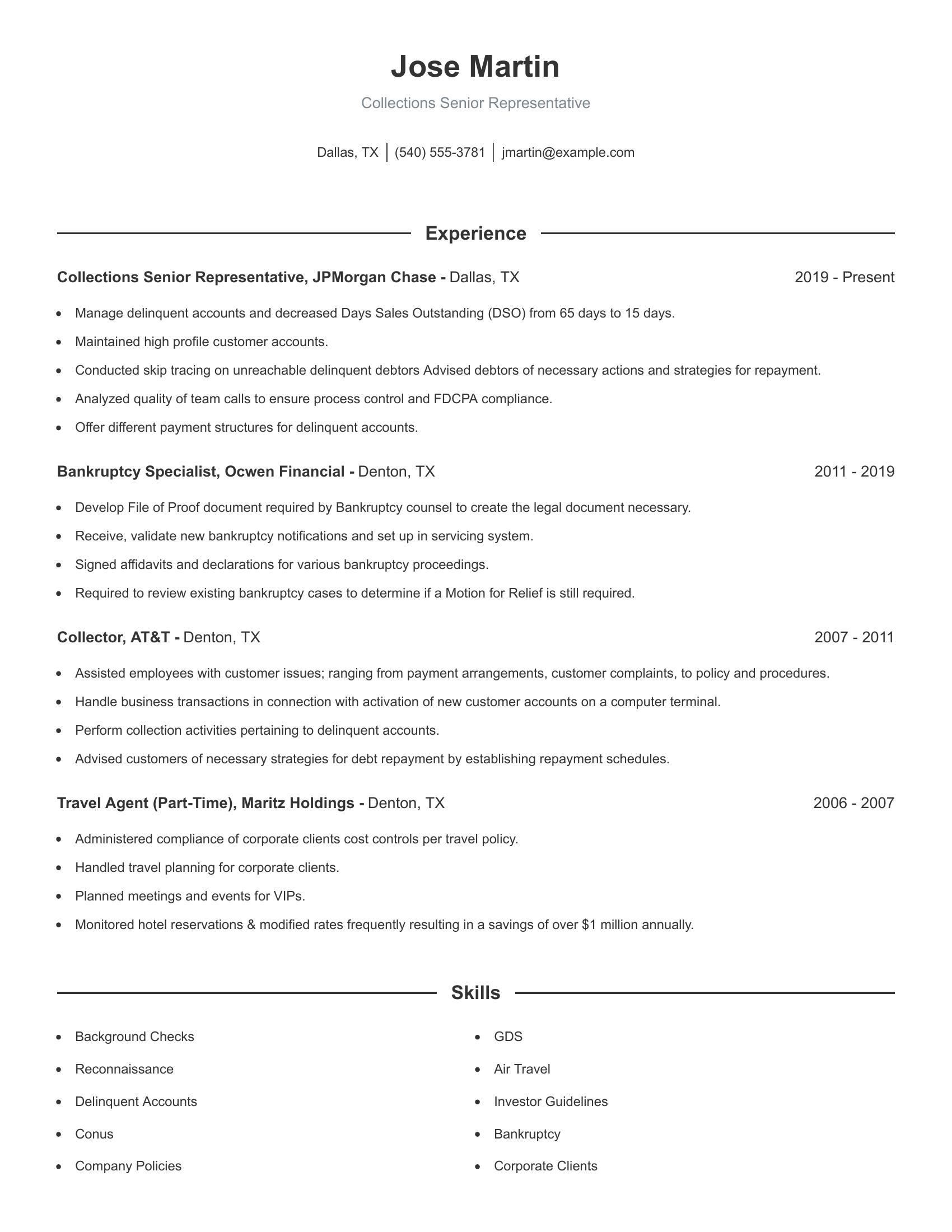

A collections senior representative resume should highlight a candidate's experience managing delinquent accounts, reducing outstanding debts, and advising debtors on repayment strategies. It should include specific achievements like reducing Days Sales Outstanding (DSO) and maintaining high-profile customer accounts. Skills in skip tracing, analyzing team calls for compliance, and offering various payment structures are important. Experience in related roles such as bankruptcy specialist or collector can also add value, showcasing the ability to handle complex financial transactions and legal proceedings.

This resume effectively includes these specifics by detailing the candidate's role in managing delinquent accounts at JPMorgan Chase, where they significantly reduced DSO. It lists tasks like conducting skip tracing and advising debtors on repayment. The background as a bankruptcy specialist emphasizes their ability to handle legal documents and proceedings. Previous roles demonstrate a history of assisting with customer issues and performing collection activities, providing a well-rounded view of the candidate's capabilities.

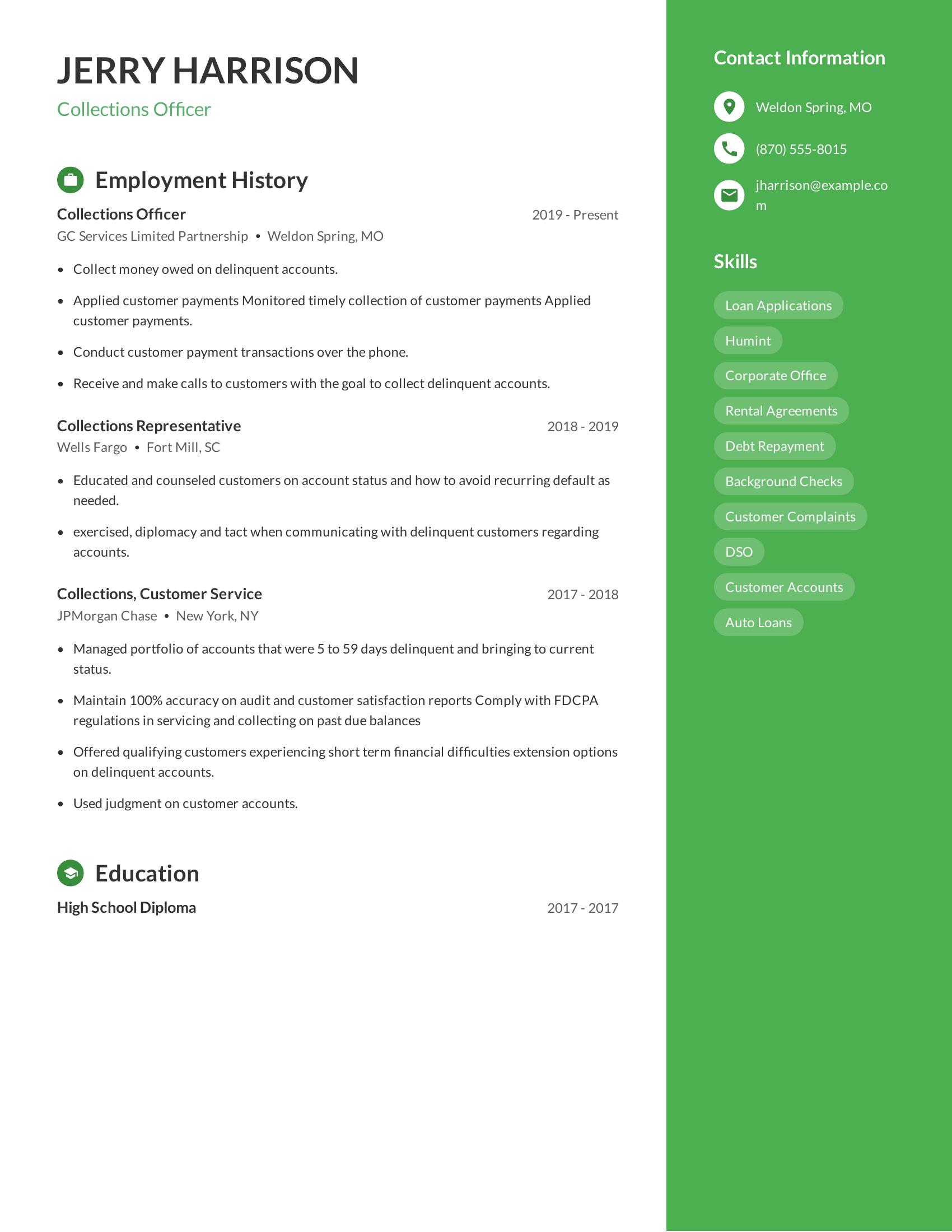

Collections officer resumes should include clear employment history, showcasing experience in managing delinquent accounts and customer interactions. They should detail specific tasks such as collecting payments, communicating with customers, and maintaining compliance with relevant regulations. Skills relevant to the job like debt repayment and handling customer complaints should also be listed.

This resume includes a detailed employment history spanning several years in different companies, outlining tasks like collecting delinquent accounts, educating customers, and maintaining compliance. It lists relevant skills such as loan applications, background checks, and customer accounts. The resume is comprehensive in demonstrating the candidate's experience and capabilities in collections.

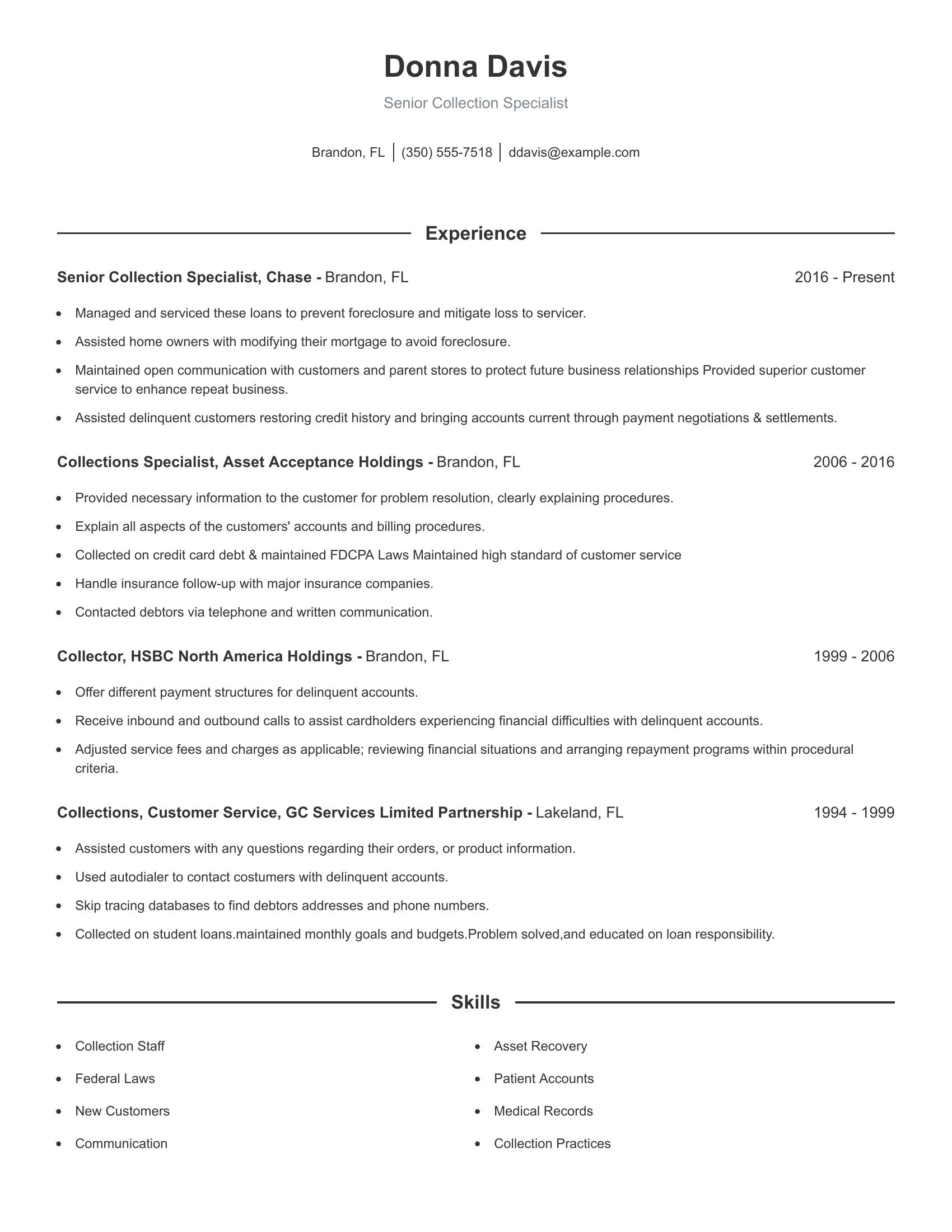

Senior collection specialist resumes should include relevant work experience, key responsibilities, and skills pertinent to debt collection and customer service. Highlighting experience in managing loans, negotiating settlements, and maintaining compliance with federal laws is important. Effective communication skills and a track record of assisting customers with account resolution are also crucial. Additionally, showcasing familiarity with various types of debt and collection practices adds value.

This resume includes specific job roles and responsibilities that align well with a senior collection specialist's duties. It details experience in managing loans, modifying mortgages, and negotiating payments which are crucial tasks in this field. The resume also shows a strong history of customer service and problem-solving abilities. It lists relevant positions held over a significant period, demonstrating extensive experience in collections and customer interactions.

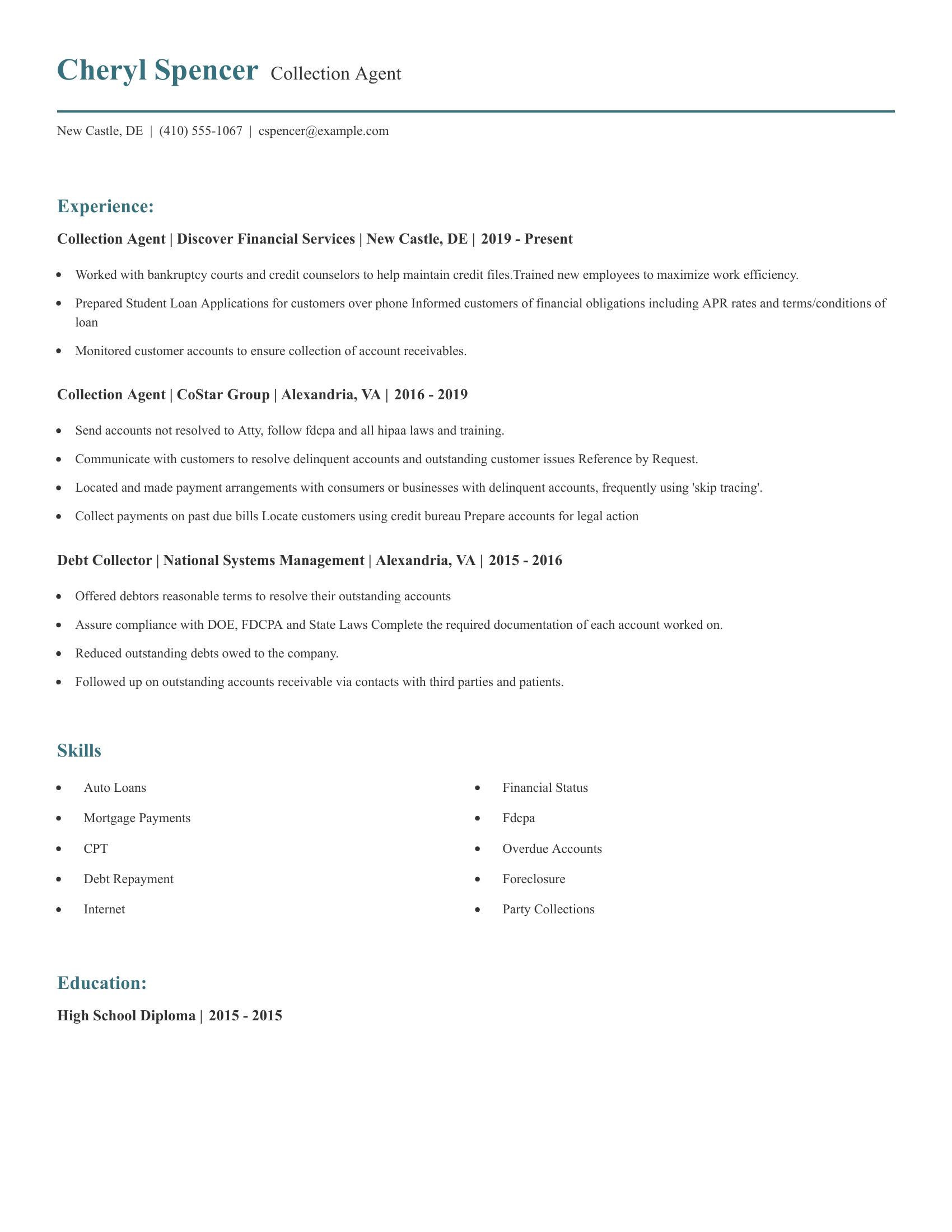

A collection agent resume should highlight relevant work experience, specific skills in debt collection, and familiarity with financial regulations like FDCPA and HIPAA. It should list job titles, employers, locations, and dates of employment. Responsibilities should be clearly outlined to show expertise in managing delinquent accounts, communicating with debtors, and preparing accounts for legal action. Education and certifications should also be included.

This resume includes the necessary elements of a solid collection agent resume. It lists job titles, employers, locations, and dates of employment. It outlines responsibilities such as working with bankruptcy courts, training new employees, preparing loan applications, and monitoring accounts. The skills section offers specific competencies like handling mortgage payments and overdue accounts. The education section is also present, listing a high school diploma.

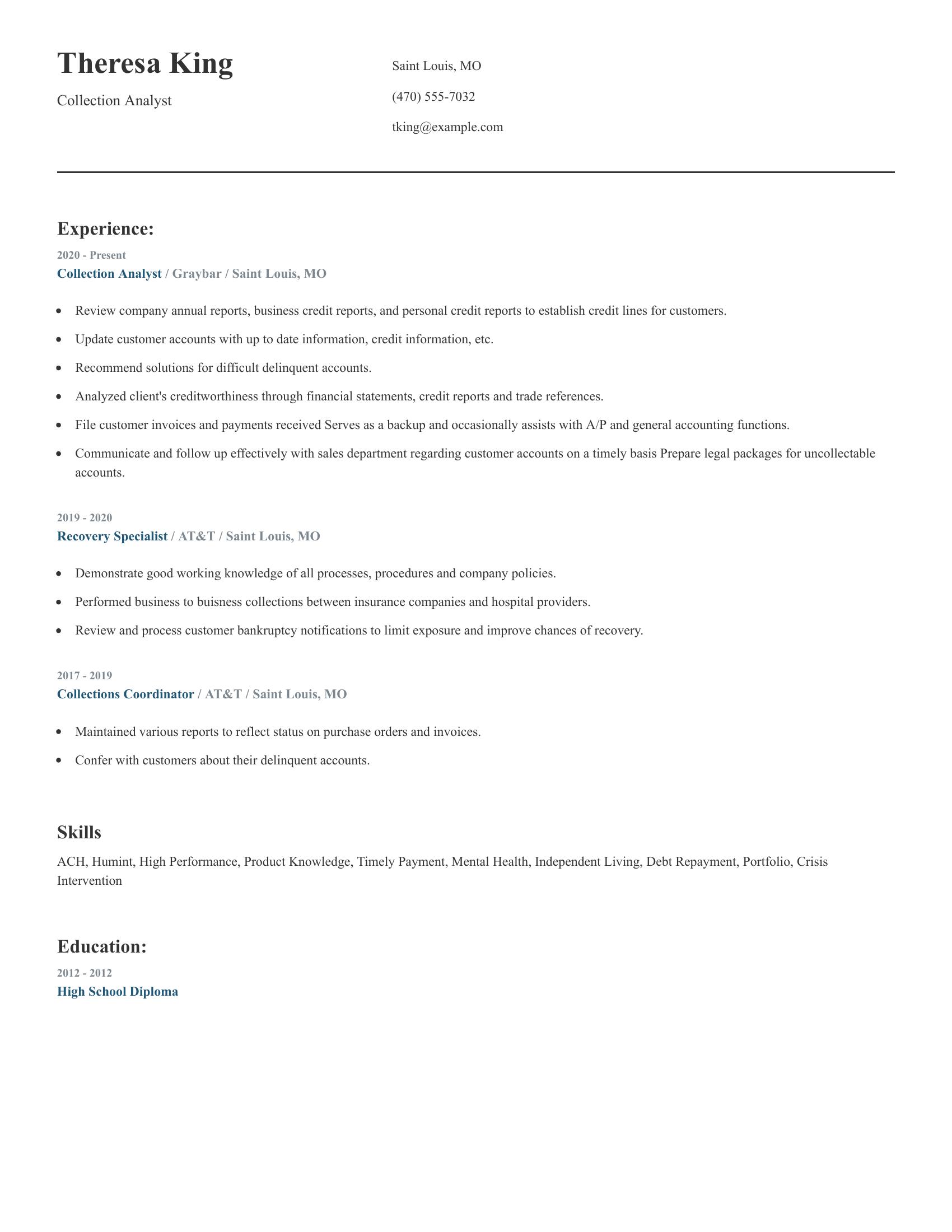

A collection analyst resume should include relevant job experience, specific skills, and education. It should highlight the ability to analyze credit reports, manage delinquent accounts, and communicate effectively with other departments. Key roles and responsibilities should be clearly stated to demonstrate proficiency in handling collections and financial reviews.

This resume includes all the necessary details for a collection analyst position. It lists job experiences at different companies, detailing tasks like reviewing credit reports, updating accounts, and handling delinquent accounts. It also highlights specific skills such as ACH and debt repayment. The education section is concise, showing the highest level of education achieved.

Highlight relevant experience. Focus on your work as a collections specialist. Mention specific tasks like contacting customers, negotiating payment plans, and managing overdue accounts.

Include measurable achievements. Use numbers to show your success. For example, "Reduced delinquent accounts by 20% in six months" or "Recovered $50,000 in past-due balances."

Showcase technical skills. List software and tools you use, such as CRM systems, Excel, and accounting software. This shows you can handle the technical side of being a collections specialist.

A collections specialist's resume should highlight their experience in debt recovery, knowledge of collection laws, and ability to handle difficult conversations. Include a clear summary, work history, education, and relevant skills.

A well-written collections specialist summary should highlight your experience, skills, and results in the field.

Follow these tips to craft a strong resume summary for a collections specialist role.

Write clear, concise bullet points that focus on specific tasks and achievements. Highlight your ability to manage accounts and recover debts.

Use action verbs, quantify achievements, and show relevant skills. Make your experience section easy to read.

A collections specialist needs specific technical skills for their job.

A collections specialist also needs strong interpersonal skills for effective communication and problem-solving.