17 Collections Representative Resume Examples

A collections representative resume should highlight relevant job experience, demonstrate strong communication skills, and list specific tasks handled in previous roles. It should also include a clear summary of skills pertinent to collections work, such as managing delinquent accounts and negotiating payment plans. Additionally, the resume must present education credentials and contact information clearly.

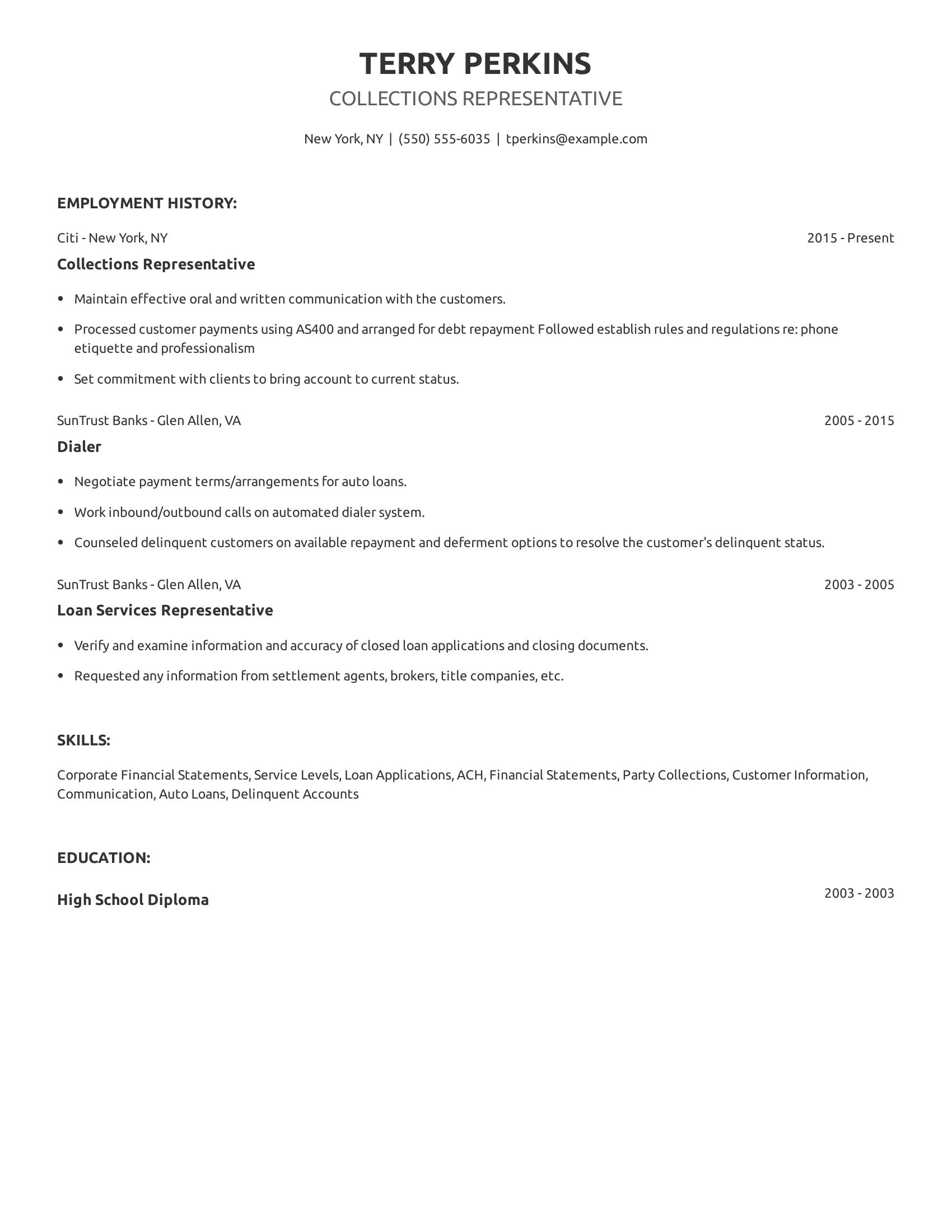

This resume effectively showcases the candidate's experience in collections by detailing their roles at different financial institutions. It includes specific tasks like maintaining communication with customers, processing payments, and negotiating payment terms, which are crucial for a collections representative. The resume also lists a variety of relevant skills such as handling corporate financial statements and managing auto loans, providing a comprehensive overview of the candidate's qualifications.

Collections, customer service resumes should highlight experience in managing delinquent accounts, communication skills, and proficiency with computer systems. They should also show a history of handling high volumes of information and balancing multiple tasks. Additionally, showcasing awards or recognitions can reflect strong performance. Skills in data collection, financial management, and customer interactions are important.

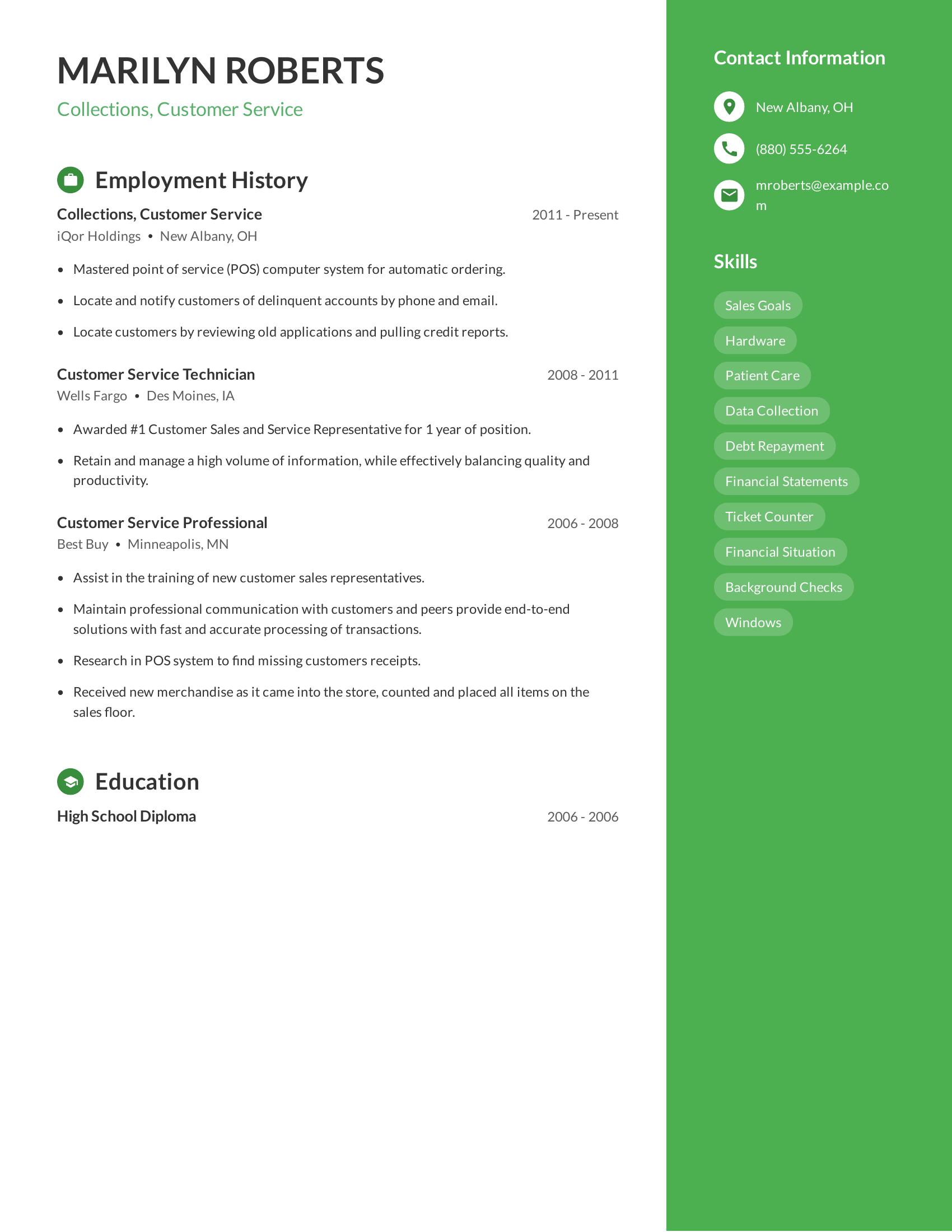

This resume effectively includes the necessary elements. It shows a long-term role in collections and customer service, demonstrating stability and expertise. The candidate highlights their ability to locate customers using various methods. Previous positions show a history of managing information and training new representatives. The resume also lists relevant skills like data collection and debt repayment.

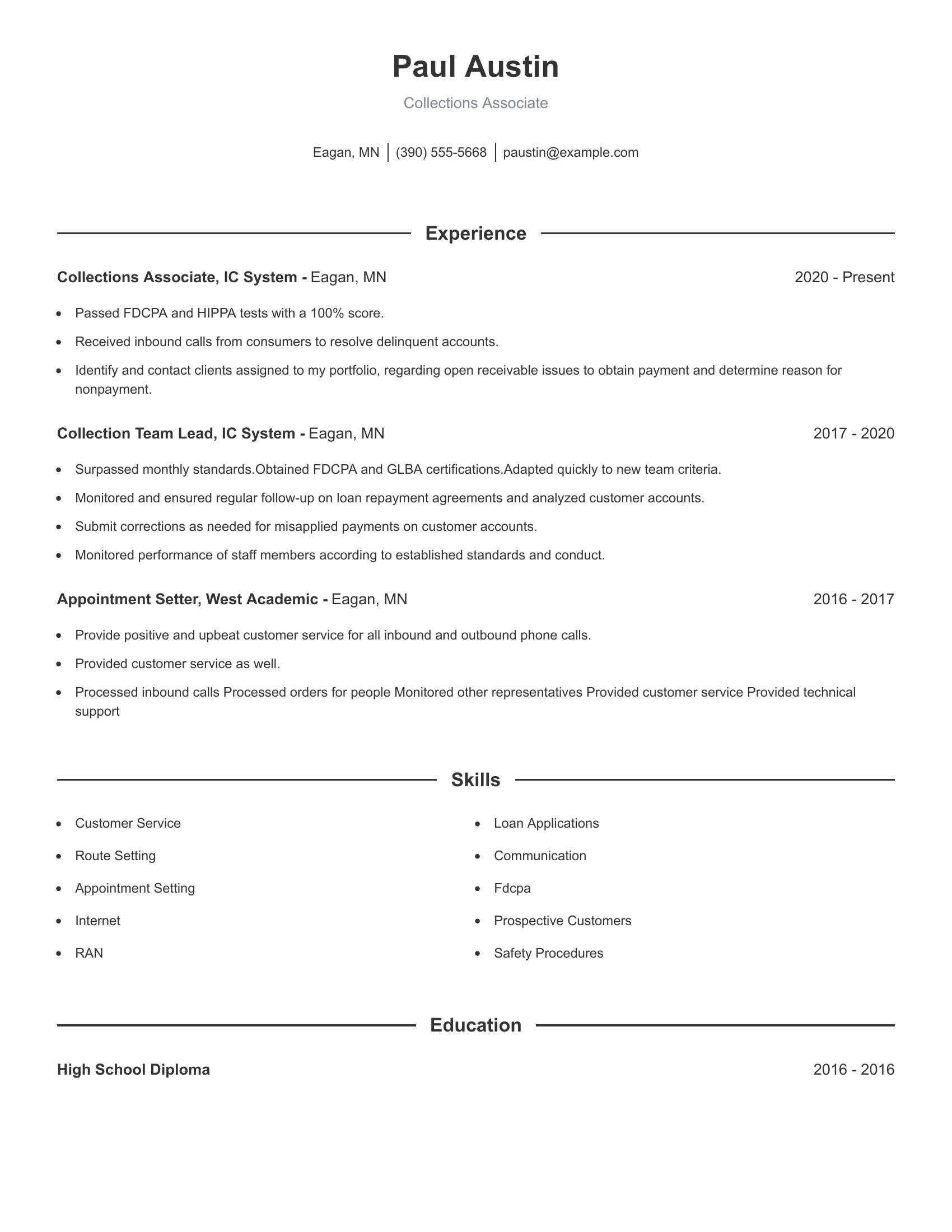

A collections associate resume should highlight relevant experience in debt collection, proficiency in handling customer accounts, and knowledge of industry regulations. It should include specific job roles and responsibilities, showcasing the ability to manage and resolve delinquent accounts, monitor payment agreements, and ensure compliance with financial laws. Education and certifications related to the field are also important to demonstrate qualifications.

This resume includes detailed job roles such as handling inbound calls, contacting clients regarding receivable issues, and monitoring staff performance. It also lists certifications like FDCPA and GLBA, indicating knowledge of industry standards. The resume outlines progression in roles, from appointment setter to collections team lead, showing career growth and increased responsibilities. Skills such as customer service and technical support are mentioned, providing a well-rounded view of the candidate's capabilities.

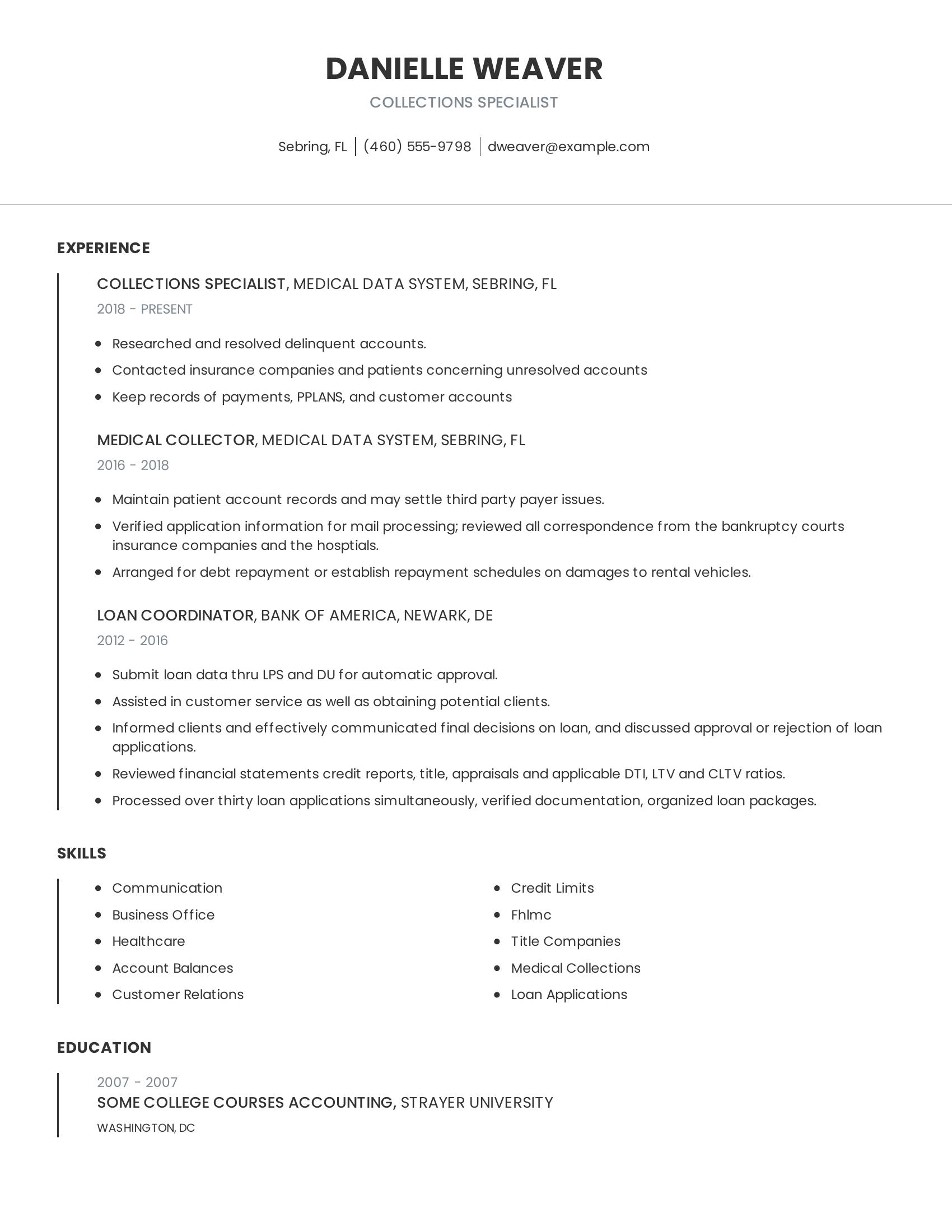

A collections specialist resume should highlight experience in handling delinquent accounts, contact with clients or insurance companies, and maintaining accurate records. Key skills include communication, customer relations, and familiarity with financial systems or medical collections. Education and relevant work experience should be clearly listed to show the candidate's background and expertise.

This resume includes specific roles like collections specialist and medical collector, detailing tasks such as resolving delinquent accounts and contacting insurance companies. It also mentions skills like communication and customer relations, which are important for the job. The education section shows relevant coursework in accounting. Overall, the resume effectively presents the candidate’s qualifications.

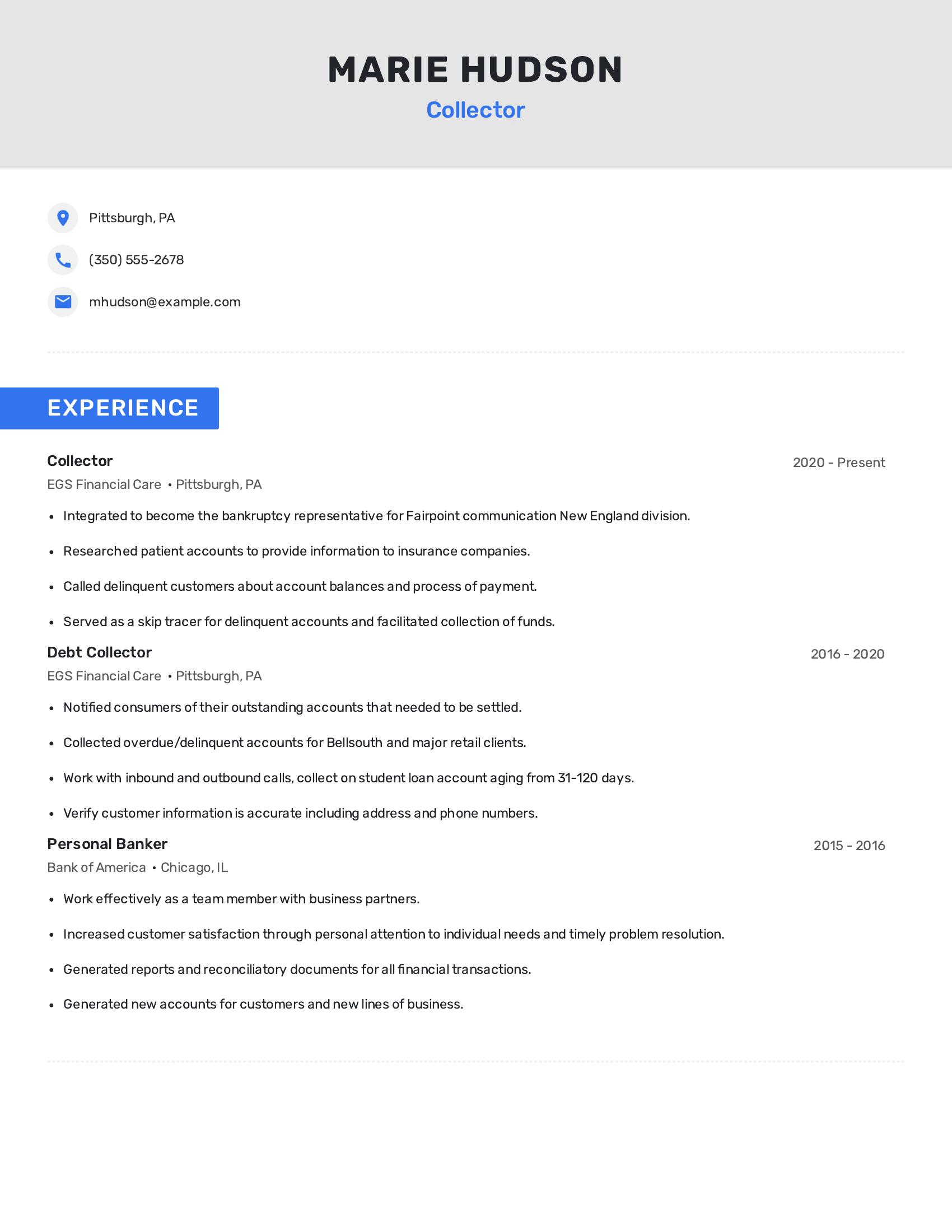

Collector resumes should include the candidate's contact information, job history, and relevant skills. Specific tasks and responsibilities that highlight experience in handling delinquent accounts, skip tracing, and customer interaction are crucial. The resume should show a clear progression in job roles, indicating an increase in responsibility and expertise.

This resume includes all the necessary elements of a good collector resume. It provides clear contact information and a detailed job history with specific tasks performed in each role. The candidate's experience spans from 2015 to the present, showing a progression from a personal banker to a collector at EGS Financial Care. The resume mentions tasks like handling inbound and outbound calls, collecting overdue accounts, and researching patient accounts, which demonstrate relevant skills for a collector position.

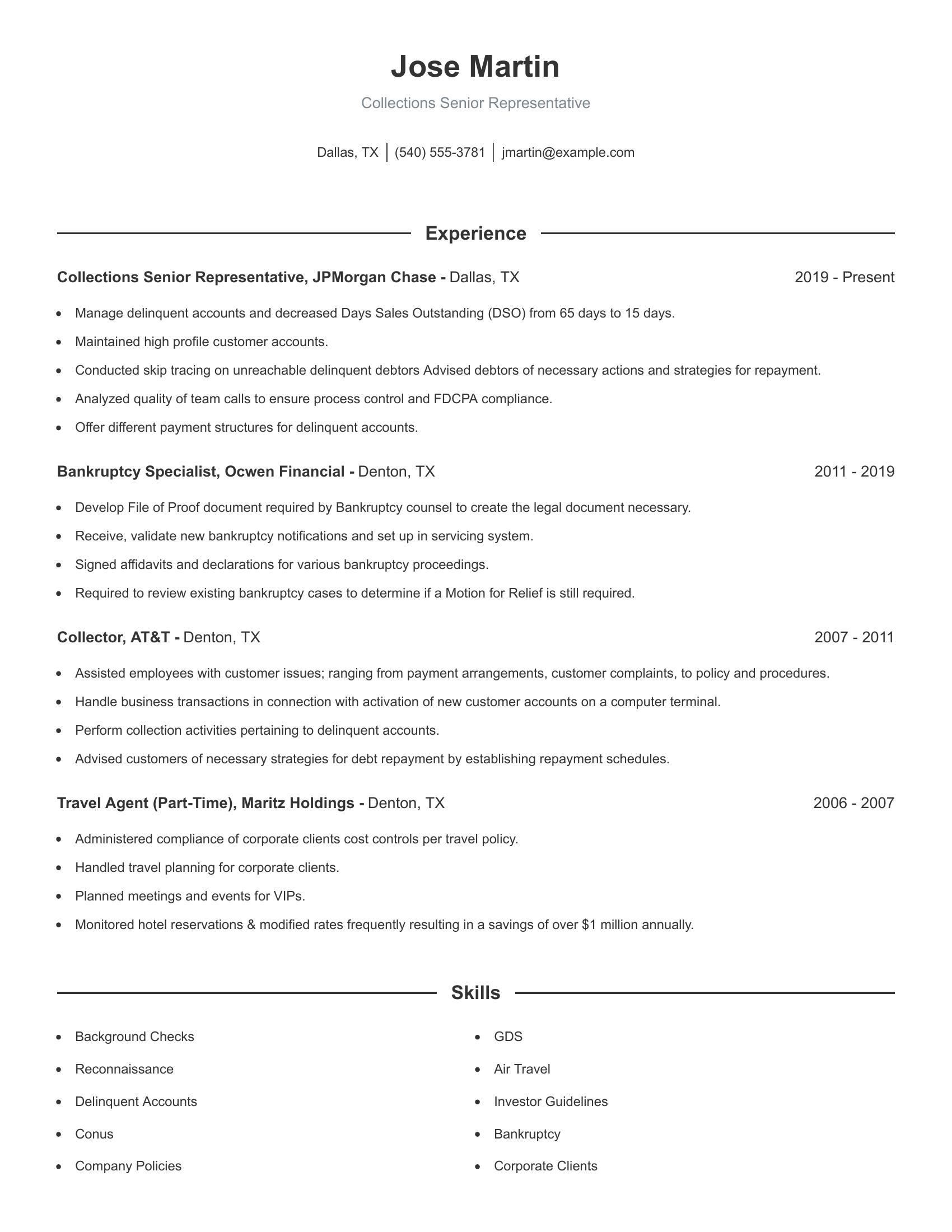

A collections senior representative resume should include specific job responsibilities, achievements, and relevant skills. It should highlight experience in managing delinquent accounts, reducing Days Sales Outstanding (DSO), conducting skip tracing, and advising debtors on repayment strategies. The resume should also show familiarity with legal documents related to bankruptcy, compliance with FDCPA, and offering various payment structures. Relevant work history with dates, locations, and roles held are important to demonstrate career progression and expertise in the field.

This resume includes those specifics by detailing roles at several companies, such as JPMorgan Chase and Ocwen Financial. It describes key responsibilities like managing delinquent accounts, reducing DSO significantly, advising debtors, and handling legal documents for bankruptcies. It also covers the candidate's prior experience in customer service and travel planning, showcasing a well-rounded skill set. Skills listed include background checks, investor guidelines, and corporate client management, indicating a broad range of relevant capabilities.

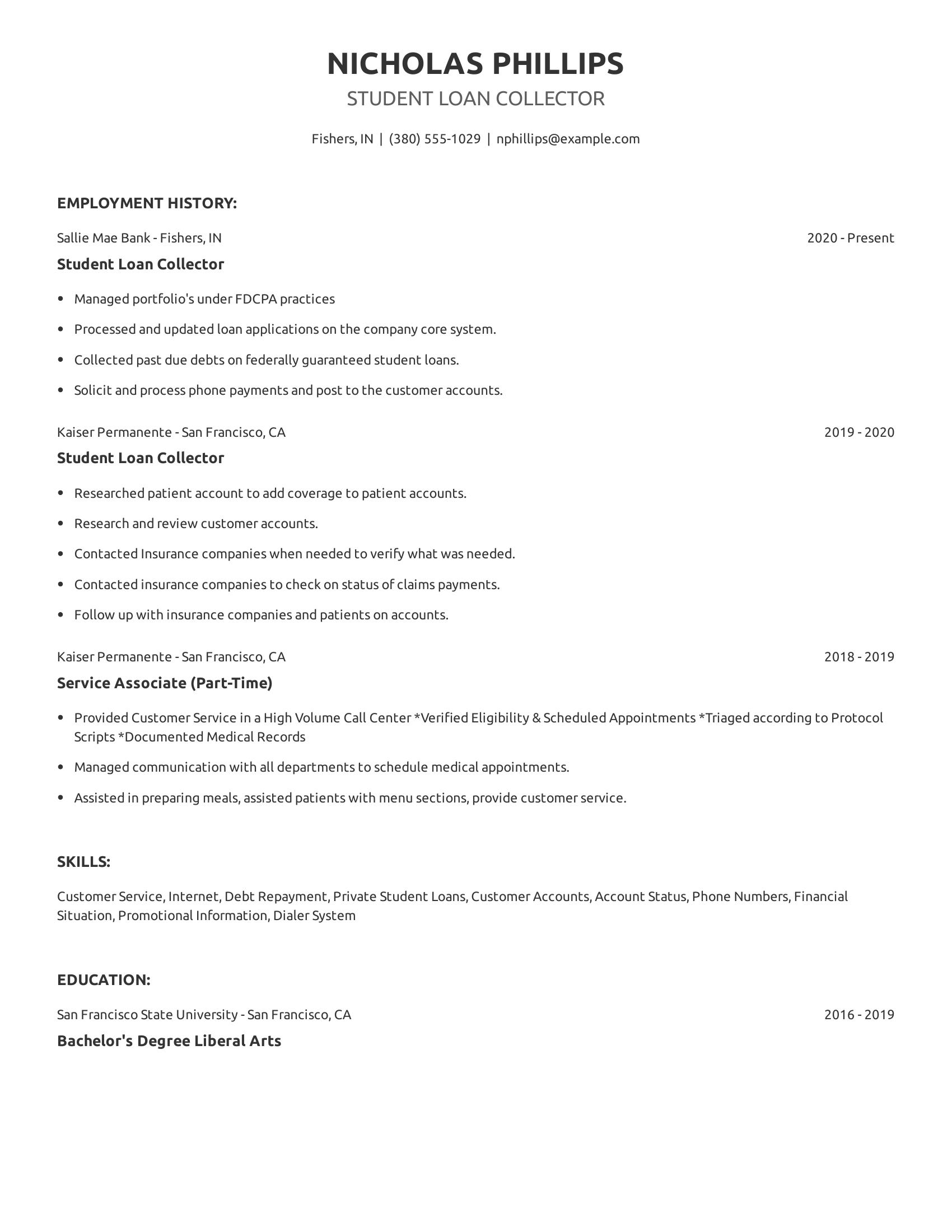

Student loan collector resumes should highlight experience in managing loan portfolios, processing payments, and handling customer interactions. They should also show familiarity with regulations like FDCPA and demonstrate an ability to work with various financial systems. Skills in customer service and communication are important as well.

This resume effectively showcases relevant experience by listing job roles with duties like managing portfolios, processing payments, and contacting insurance companies. It also mentions skills such as customer service and debt repayment, which are important for a student loan collector. The education section provides a relevant academic background, adding further credibility.

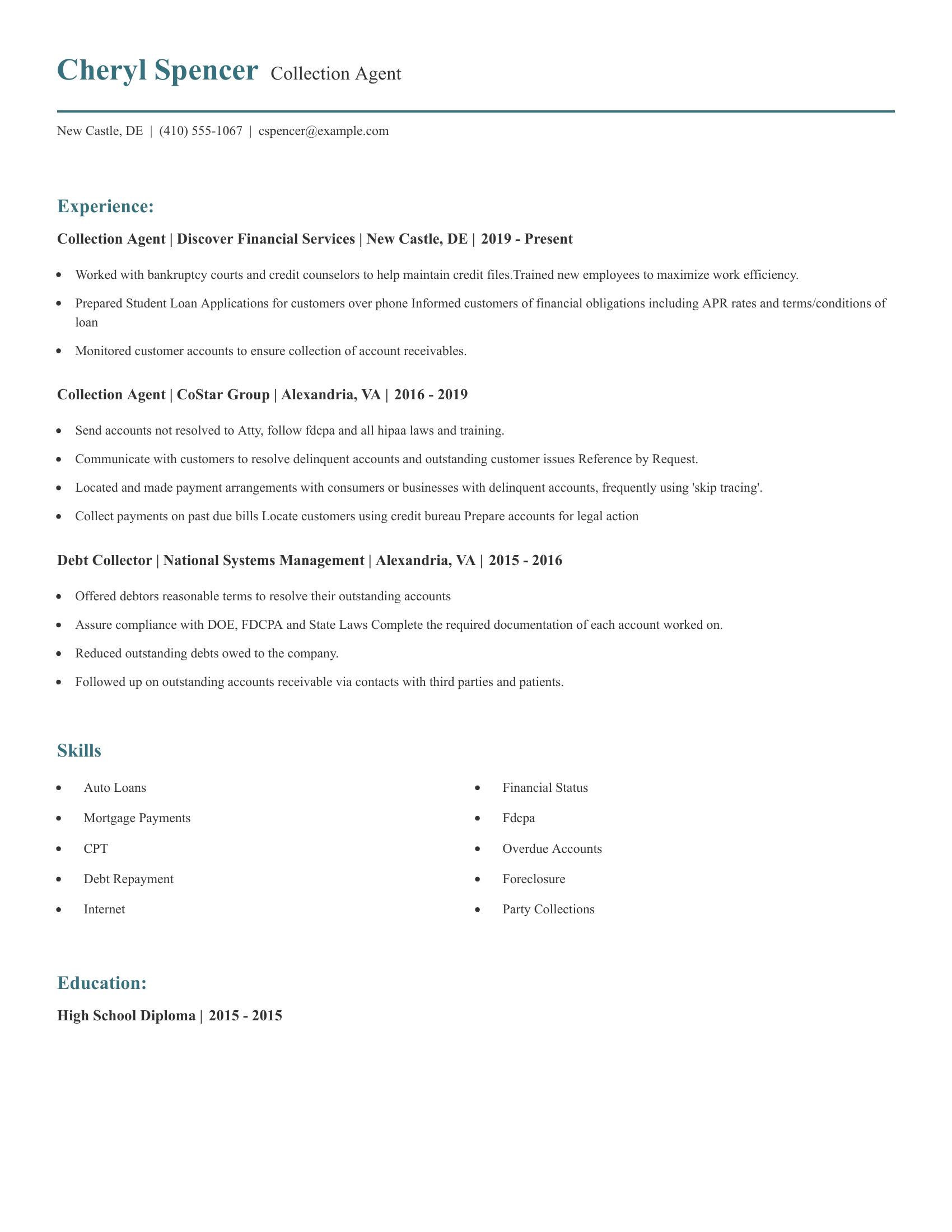

Collection agent resumes should highlight experience in debt collection, knowledge of relevant laws like FDCPA, and skills in managing delinquent accounts. It must include specific tasks such as working with bankruptcy courts, training new employees, and handling various types of loans. Clear communication skills and the ability to prepare legal documentation are important. A good resume should also list relevant skills and educational background.

This resume includes positions at multiple companies, demonstrating a range of experiences in debt collection, from working with bankruptcy courts to skip tracing. It lists specific duties such as informing customers about financial terms and monitoring account receivables. The resume also mentions training new employees and ensuring compliance with laws, showing an understanding of legal requirements. Skills related to financial status and debt repayment are listed, alongside a high school diploma.

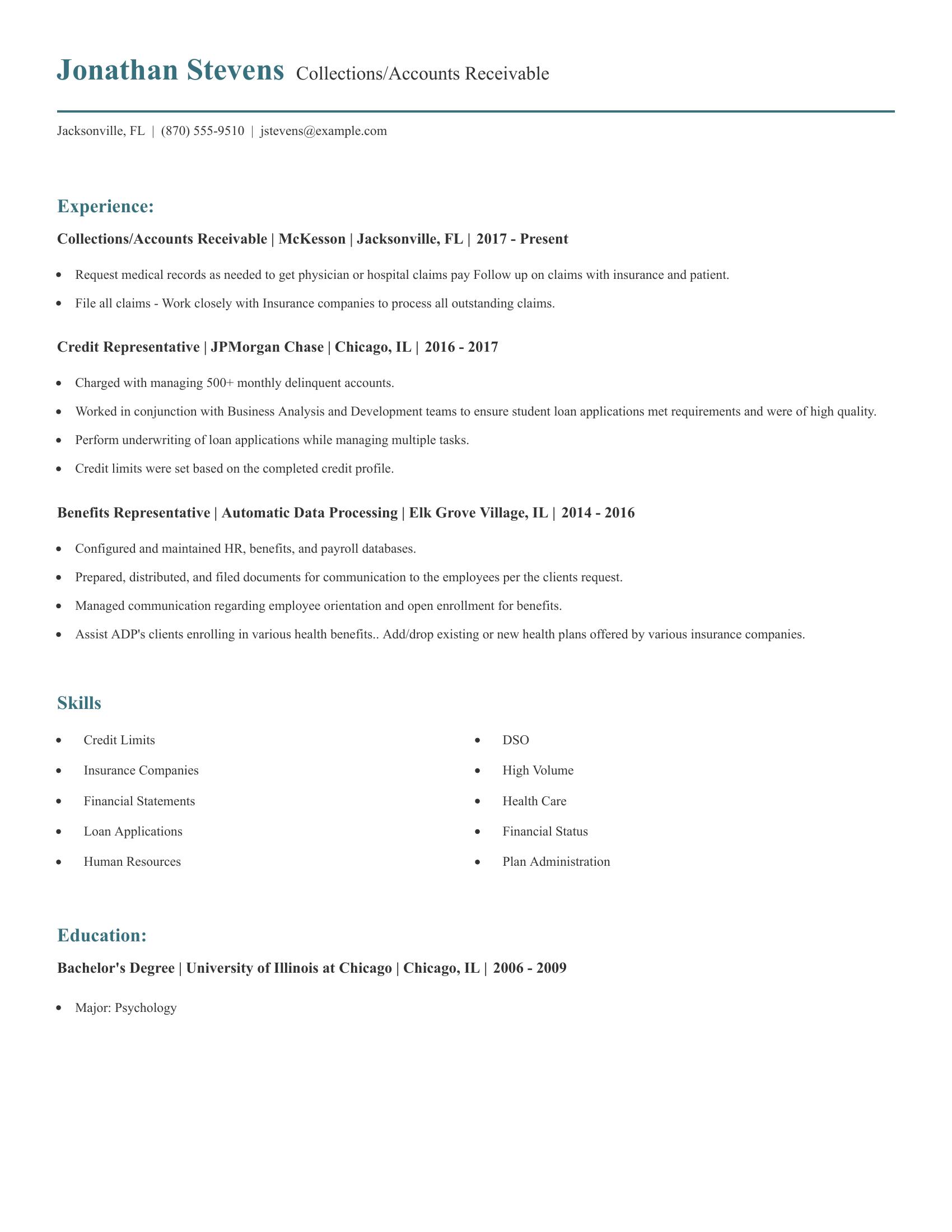

Collections/accounts receivable resumes should highlight experience in managing delinquent accounts, processing claims, and working with insurance companies. They should also show skills in financial analysis, loan applications, and human resources. Education details and relevant degrees are important. Strong communication skills and the ability to handle high-volume tasks are also necessary.

This resume includes specific job duties like requesting medical records, managing delinquent accounts, and configuring HR databases. It lists skills related to credit limits, insurance companies, and financial statements. The resume also mentions a relevant bachelor’s degree. The work experience covers different aspects of collections and accounts receivable, indicating a well-rounded skill set.

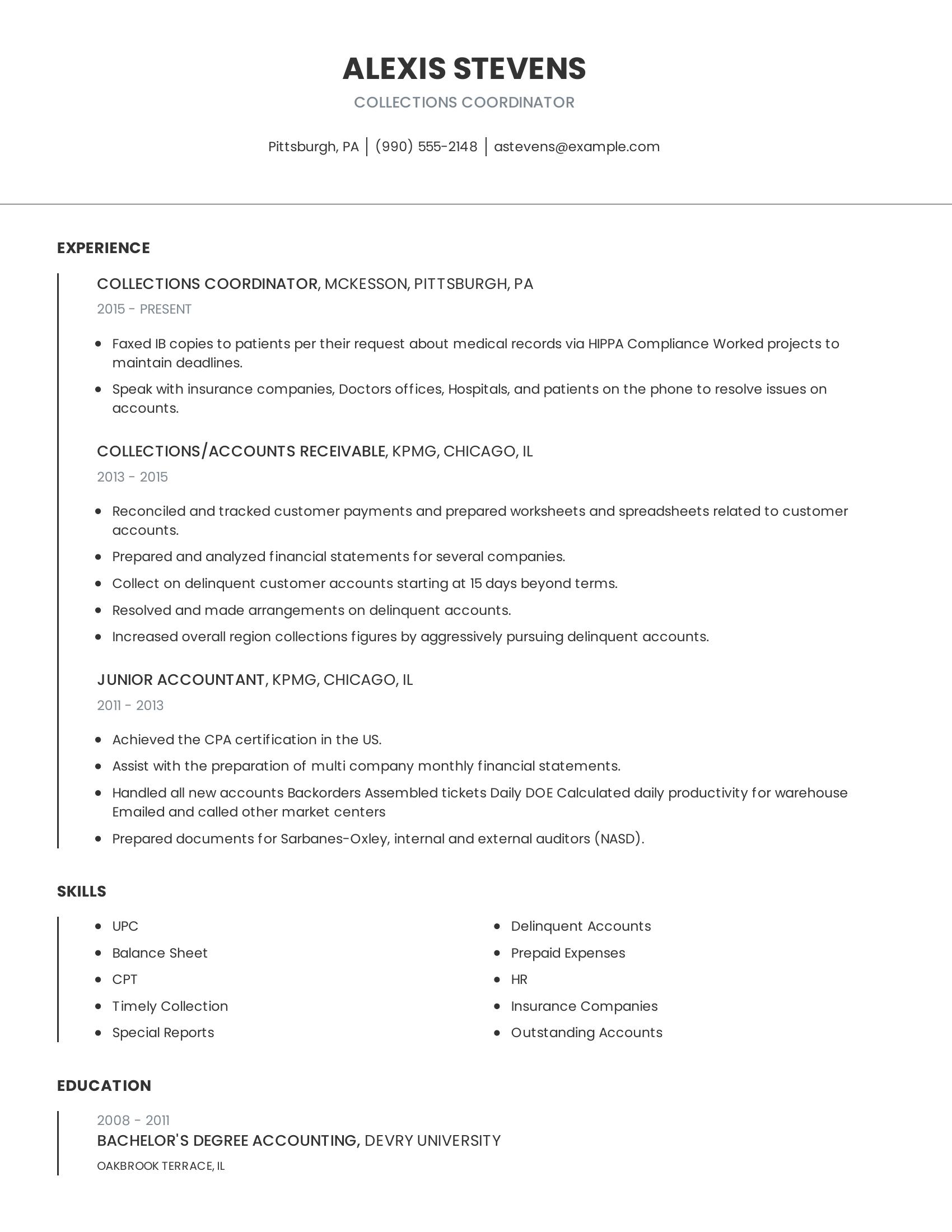

Collections coordinator resumes should highlight experience in managing accounts, resolving payment issues, and working with various stakeholders like insurance companies and patients. They should detail specific responsibilities and achievements in previous roles, such as improving collection rates or handling financial statements. Education and relevant skills like account reconciliation or knowledge of industry regulations should also be included.

This resume includes detailed job experiences that show a strong background in collections and accounts receivable. The candidate lists specific tasks like speaking with patients and insurance companies, reconciling payments, and preparing financial documents. They also mention their educational background in accounting and essential skills related to the job, making it a well-rounded resume despite the formatting issues.

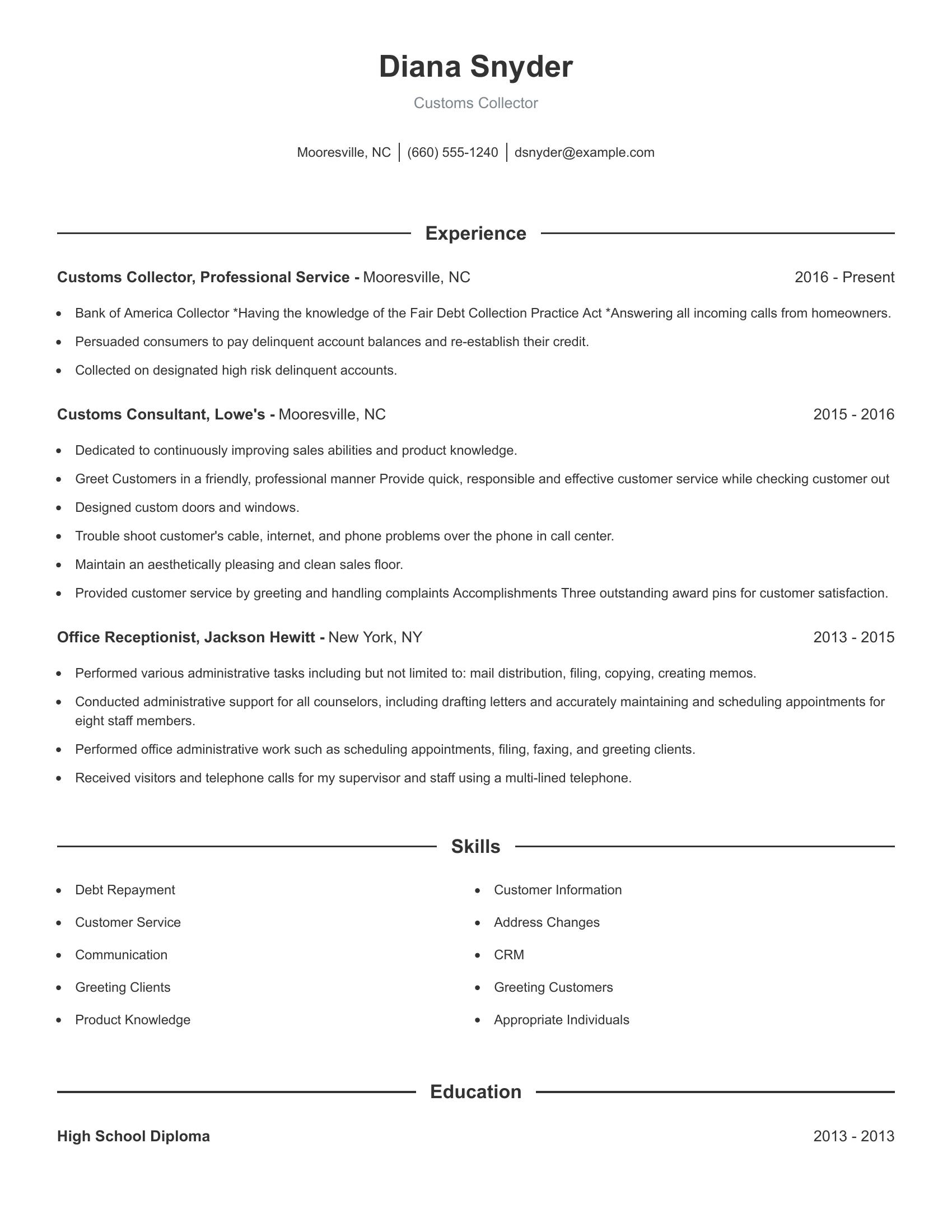

Customs collector resumes should highlight experience in handling financial transactions, customer interactions, and compliance with regulations. Key elements include detailed job descriptions showing responsibility for debt collection, account management, and customer service. It is important to demonstrate familiarity with industry-specific practices and the ability to manage high-risk accounts.

This resume effectively includes these specifics by listing roles such as customs collector and customs consultant, showing a clear progression of responsibilities. The candidate details tasks like answering calls from homeowners, persuading consumers to pay delinquent balances, and managing high-risk accounts. Previous roles also showcase relevant skills in customer service, problem-solving, and administrative support.

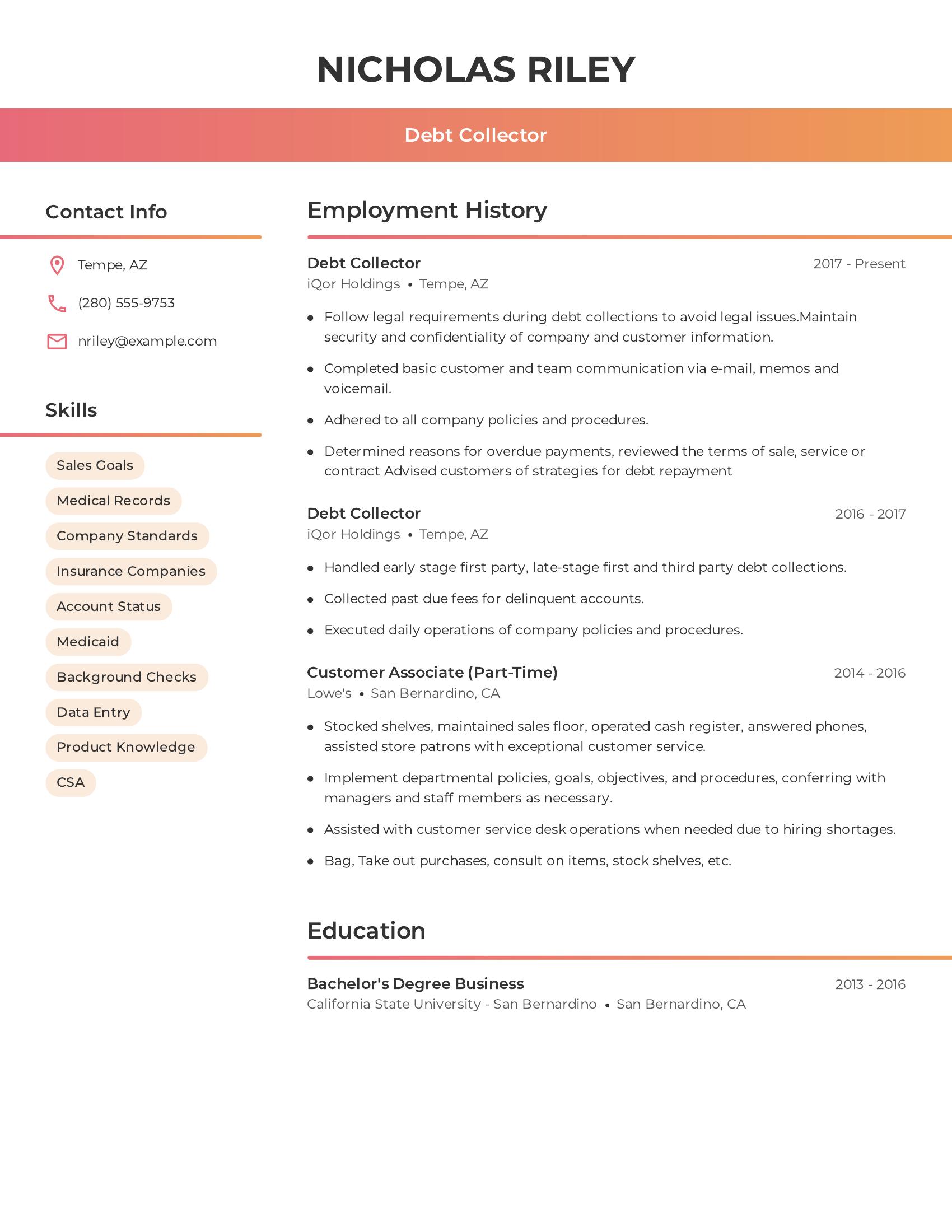

Debt collector resumes should highlight relevant experience, skills, and education. Key elements include job titles, employment history, specific tasks performed, and skills relevant to debt collection. A good resume also includes contact information, educational background, and any certifications or training related to the field. Clear organization and concise descriptions are important to make the resume easy to read.

This resume includes all necessary specifics for a debt collector. It lists relevant job titles and employment history, detailing tasks like handling early and late-stage debt collections and advising customers on repayment strategies. It also mentions important skills such as data entry, background checks, and product knowledge. The resume provides clear contact information and an educational background in business, which is relevant to the role.

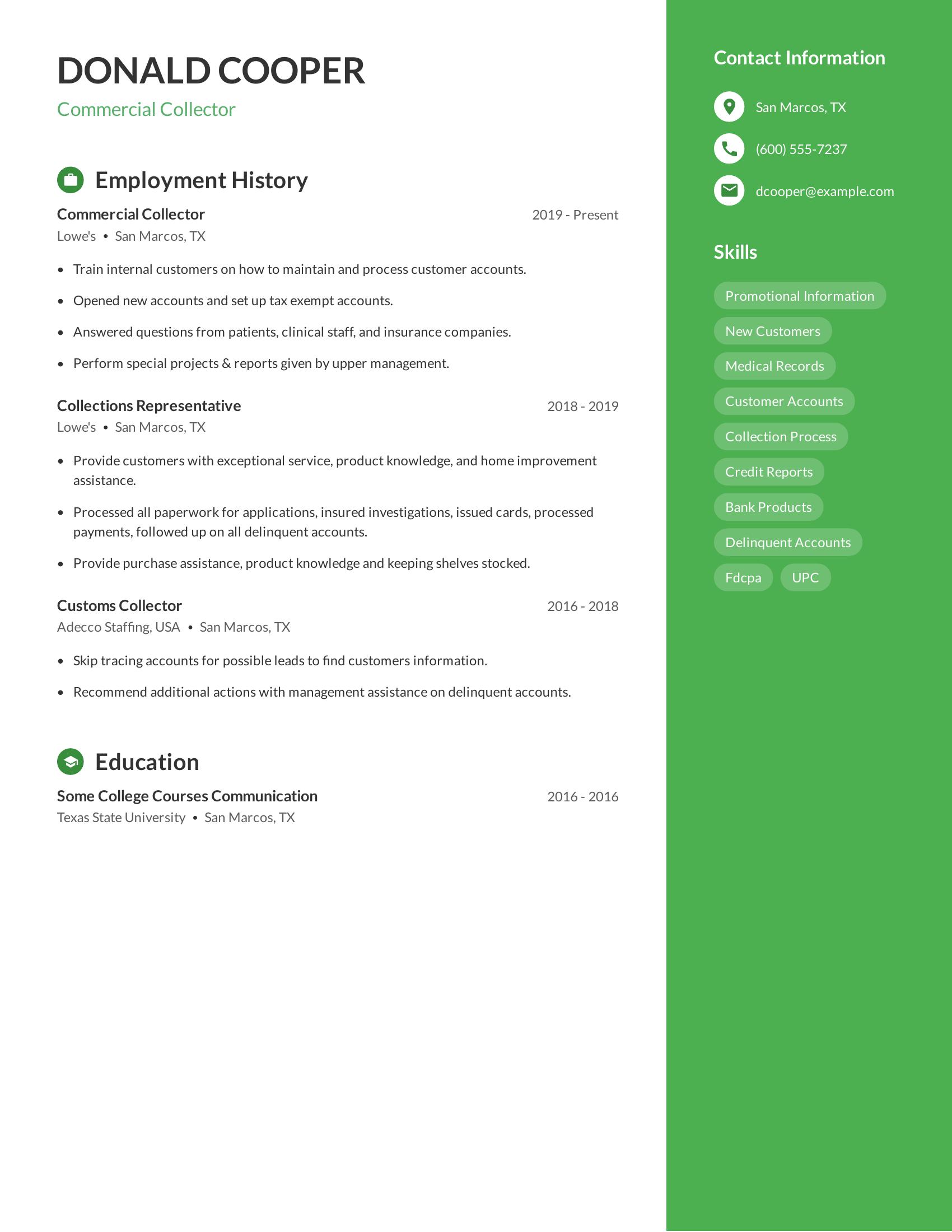

Commercial collector resumes should highlight relevant job experience, skills, and education. Important elements include a clear employment history with specific duties, relevant skills related to collections and customer service, and any educational background. A good resume for this role shows the ability to handle accounts, communicate effectively with customers, and manage delinquent accounts.

This resume includes detailed job experiences from multiple positions in collections and customer service. It lists tasks such as opening new accounts, skip tracing, and providing product knowledge. The skills section covers areas like medical records, collection process, and credit reports. The education section mentions relevant coursework in communication. This shows a well-rounded candidate with practical experience and relevant knowledge.

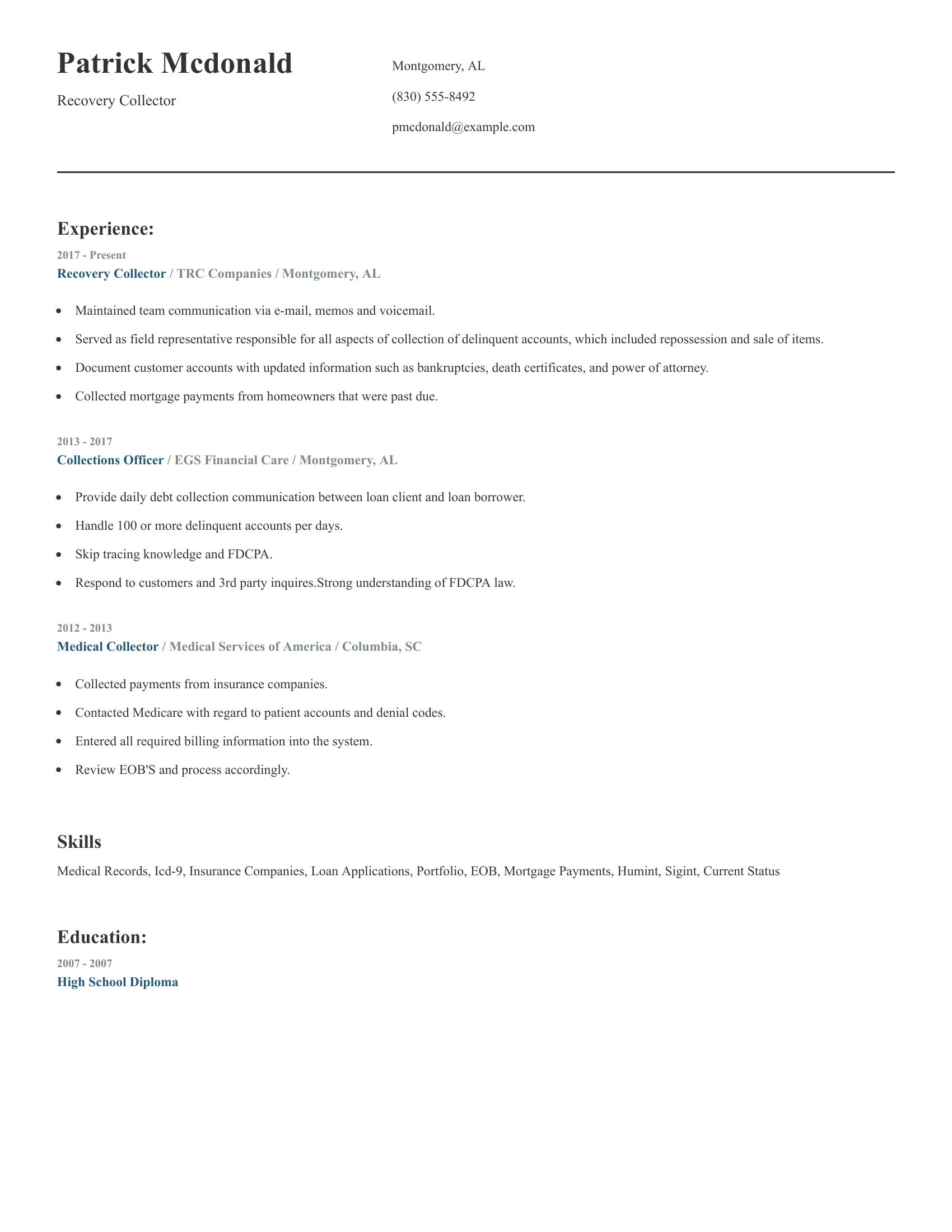

Recovery collector resumes should highlight experience in debt collection, communication skills, and knowledge of relevant laws. They should list specific tasks such as managing delinquent accounts and repossession. Skills in handling various types of collections, from mortgages to medical bills, are important. Education and technical knowledge relevant to the field should also be included.

This resume includes specific job experiences from 2012 to the present, detailing responsibilities like collecting payments and communicating with clients. It shows a range of collection types such as mortgages and medical bills. Skills listed include knowledge of FDCPA law, skip tracing, and handling insurance claims. Education information is also provided.

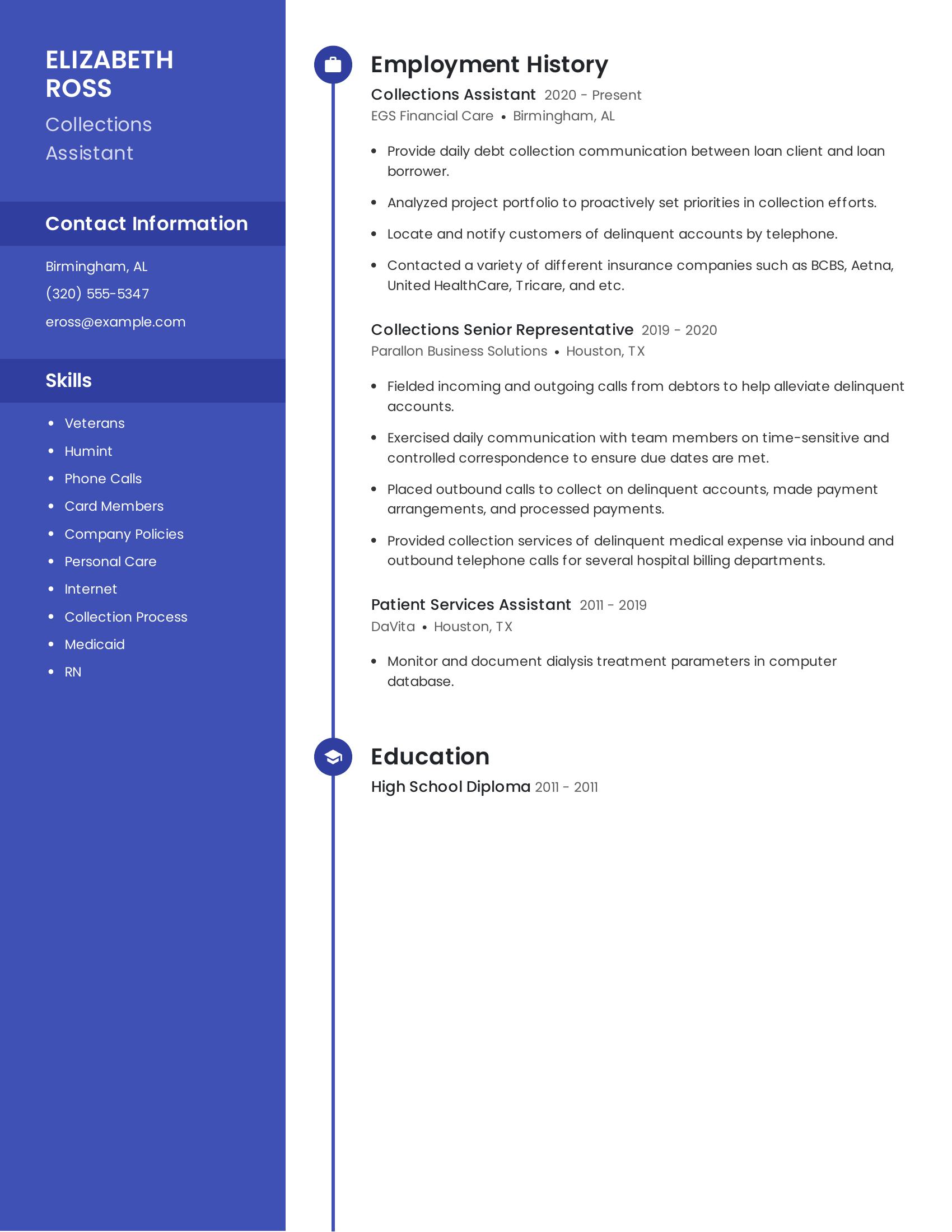

A collections assistant resume should highlight relevant skills, employment history, and contact information. It should include strong communication abilities, knowledge of collection processes, and experience handling delinquent accounts. Employment history must show progression in roles and responsibilities within the field of collections, emphasizing specific tasks performed. Clear and concise bullet points help demonstrate the candidate’s experience and capabilities.

This resume successfully includes the necessary components. It lists relevant skills such as handling phone calls, understanding company policies, and navigating the collection process. The employment history section shows progression from a patient services assistant to a senior representative and finally to a collections assistant, detailing specific duties like contacting insurance companies and managing delinquent accounts. The inclusion of contact information ensures potential employers can easily reach the candidate.

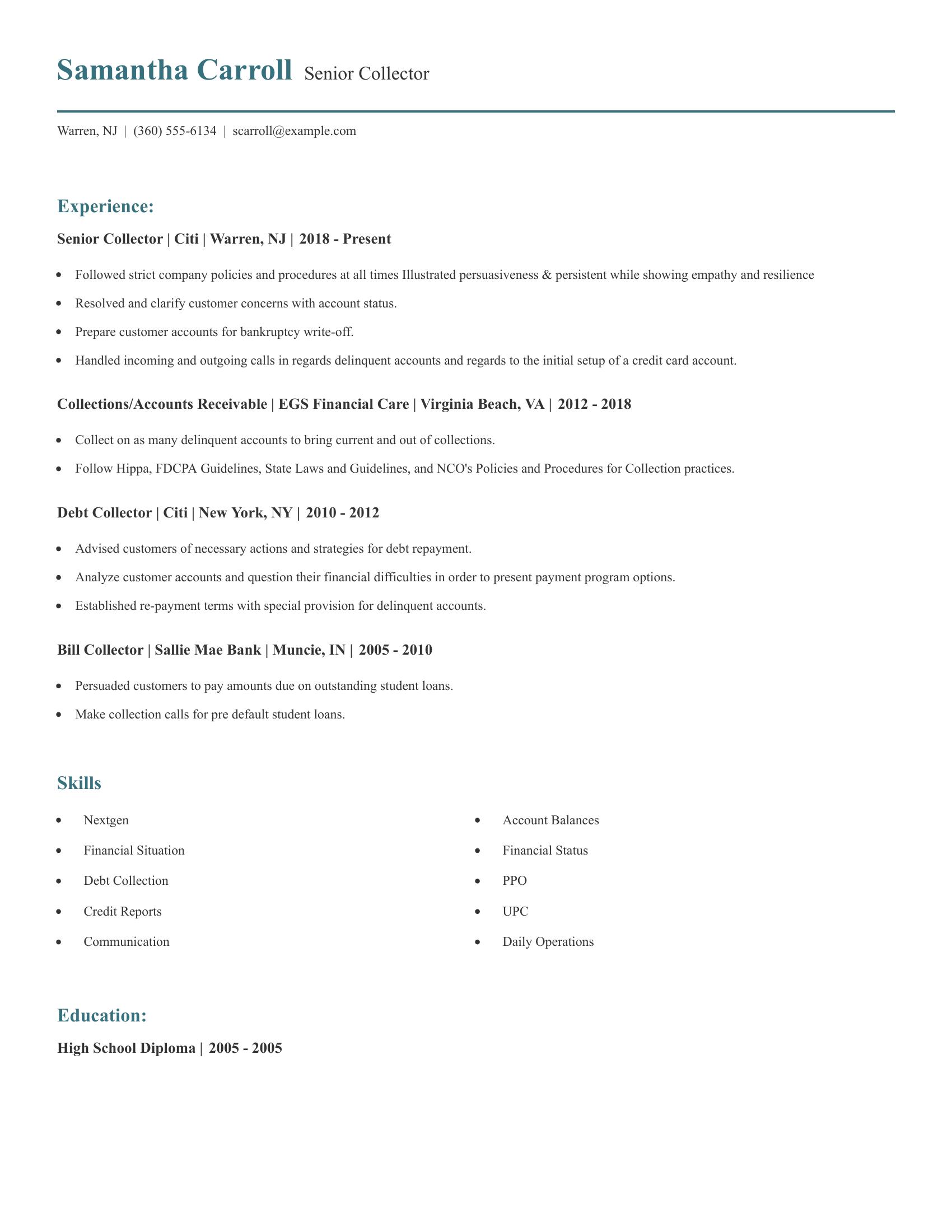

Senior collector resumes should highlight comprehensive experience in debt collection, familiarity with relevant laws and guidelines, and strong communication skills. The resume should include job titles, company names, locations, and dates of employment. It should list duties that show the ability to manage delinquent accounts, resolve customer issues, and adhere to company policies. Skills relevant to financial analysis and customer interaction are also important.

This resume includes detailed work experience with clear job titles and responsibilities. It shows long-term roles at different companies, demonstrating a solid history in collection positions since 2005. The listed skills are relevant to the role of a senior collector, such as handling account balances and understanding financial situations. The educational background is concise, listing a high school diploma which meets basic requirements for the position.

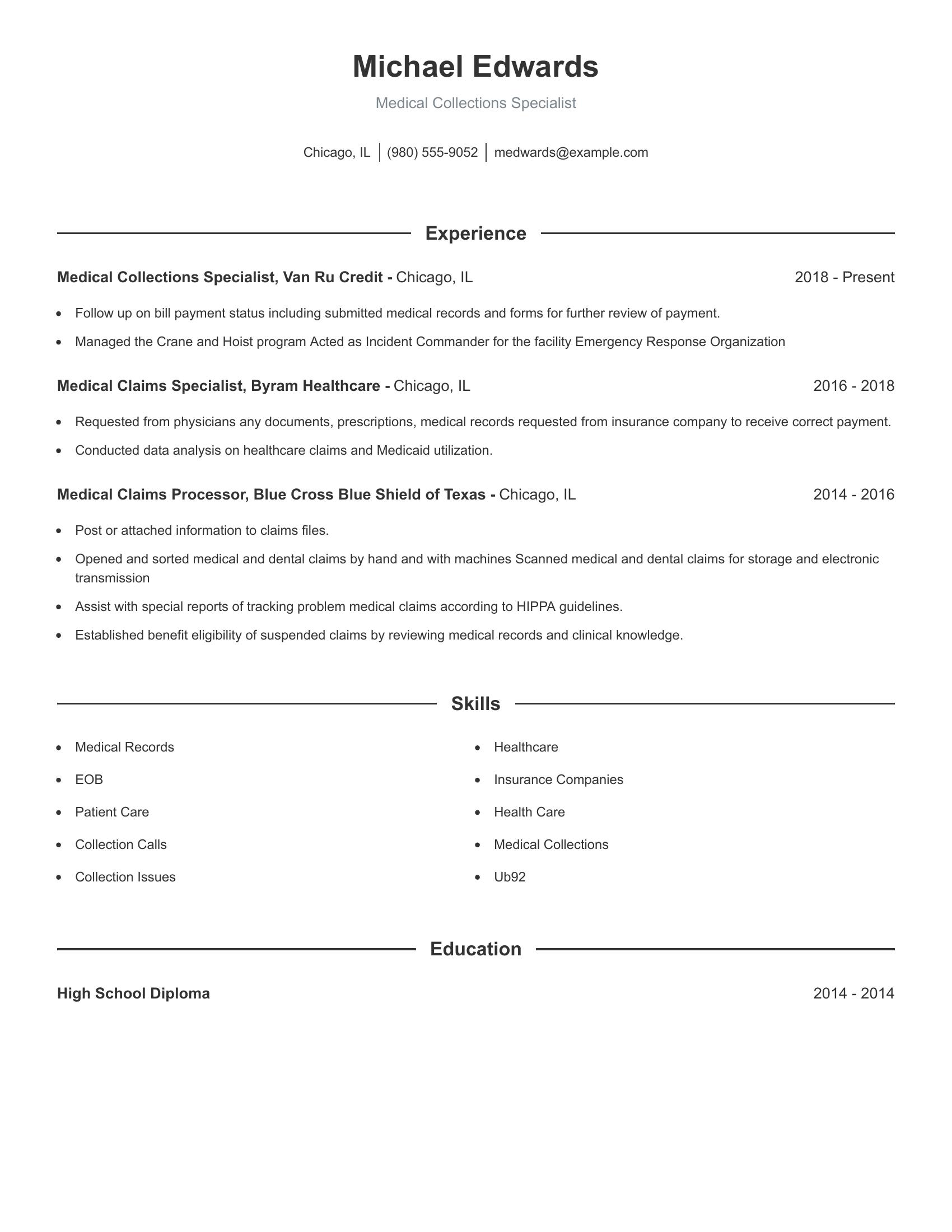

A medical collections specialist resume should highlight experience with billing, payment follow-up, and handling medical records. It should include previous job roles that demonstrate knowledge of healthcare claims and insurance processes. Key skills such as data analysis, problem-solving, and compliance with healthcare regulations are important. Education and relevant certifications should also be listed.

This resume effectively includes the necessary components. It details specific roles in medical collections and claims processing, showing experience at different companies. The resume also lists relevant skills like handling patient care and insurance issues. Education is noted clearly, which rounds out the qualifications.

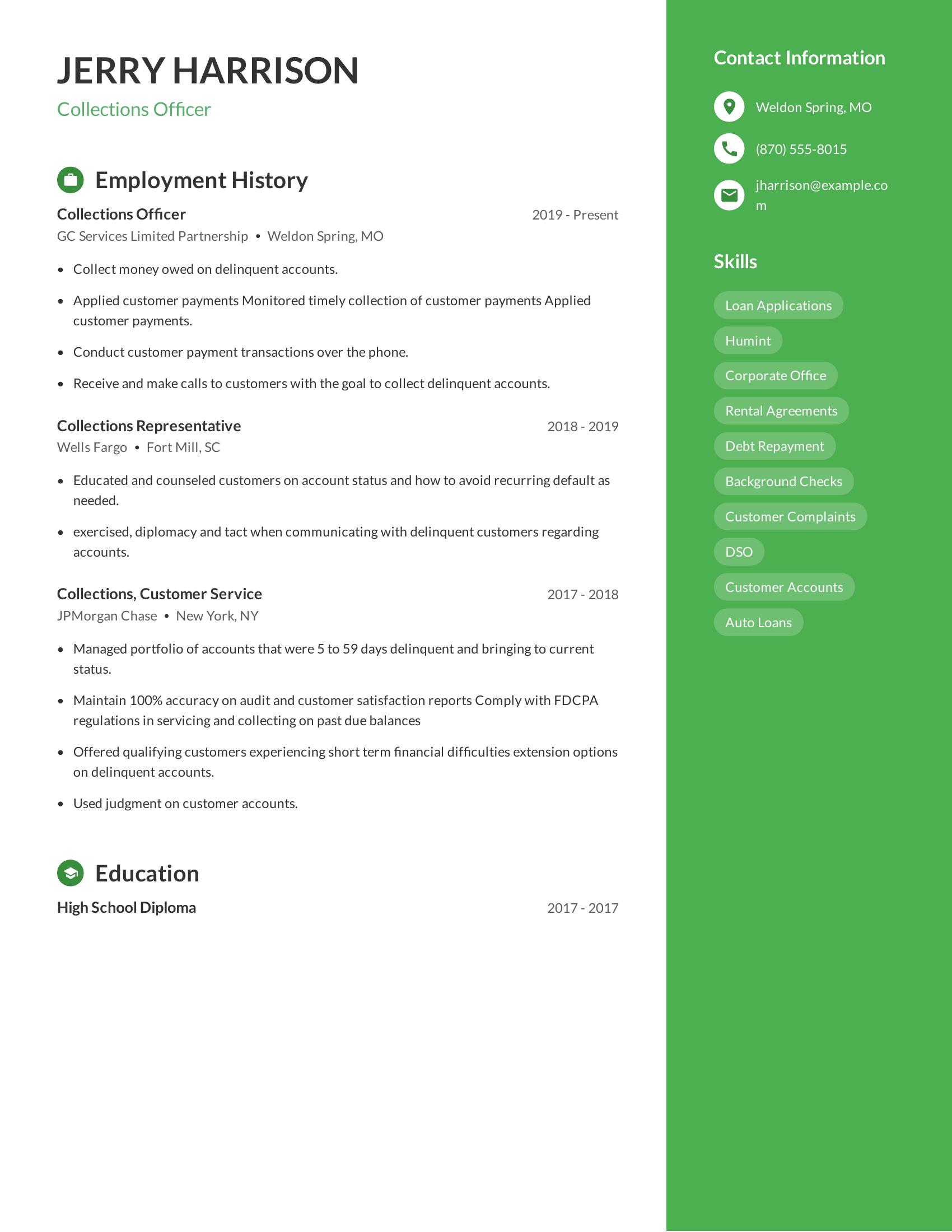

Collections officer resumes should highlight experience in handling delinquent accounts, strong communication skills, and knowledge of debt collection regulations. They should include employment history with specific duties, any relevant education, and a list of pertinent skills. Clear and concise descriptions of past roles help to demonstrate competence and reliability in managing collections tasks.

This resume effectively showcases relevant work history by listing positions held at various financial institutions with specific responsibilities like collecting overdue payments and managing delinquent accounts. It also includes an education section and a detailed skills list related to collections tasks such as loan applications and debt repayment. Although the formatting needs improvement, the content covers key elements expected in a collections officer resume.

Highlight achievements. Use numbers to show your impact. For example, "Recovered $50,000 in overdue accounts" shows success as a collections representative.

Showcase communication skills. Mention how you handle difficult conversations and negotiate payment plans. For example, "Successfully negotiated with clients to reduce outstanding balances."

Detail software proficiency. List the collections software you know. For example, "Proficient in using ABC Collections Software and XYZ Billing Systems" can attract employers.

A collections representative's resume should highlight experience in debt collection, strong communication skills, and familiarity with relevant software. It should also include education and any certifications related to finance or customer service.

A good collections representative summary highlights your experience and skills in managing overdue accounts. Mention your ability to communicate effectively with clients and resolve disputes. Include your knowledge of collection laws and regulations.

Be direct and use bullet points if needed. Focus on your results, such as recovery rates. Tailor the summary to the job you are applying for.

Your experience section should highlight your ability to manage accounts and collect payments. Focus on specific tasks and achievements.

Use numbers to show your impact. Be clear and concise.

A collections representative needs specific technical abilities to perform their job effectively.

A collections representative also needs strong interpersonal skills to succeed in their role.