17 Claim Processor Resume Examples

Claim processor resumes should highlight experience in processing claims, handling medical records, and managing communications with providers and peers. They should detail specific tasks such as working with different types of insurance claims, adjusting claims, and resolving issues. Including skills like timely processing, policy coverage knowledge, and familiarity with medical coding systems is important. Education background relevant to the job should also be mentioned.

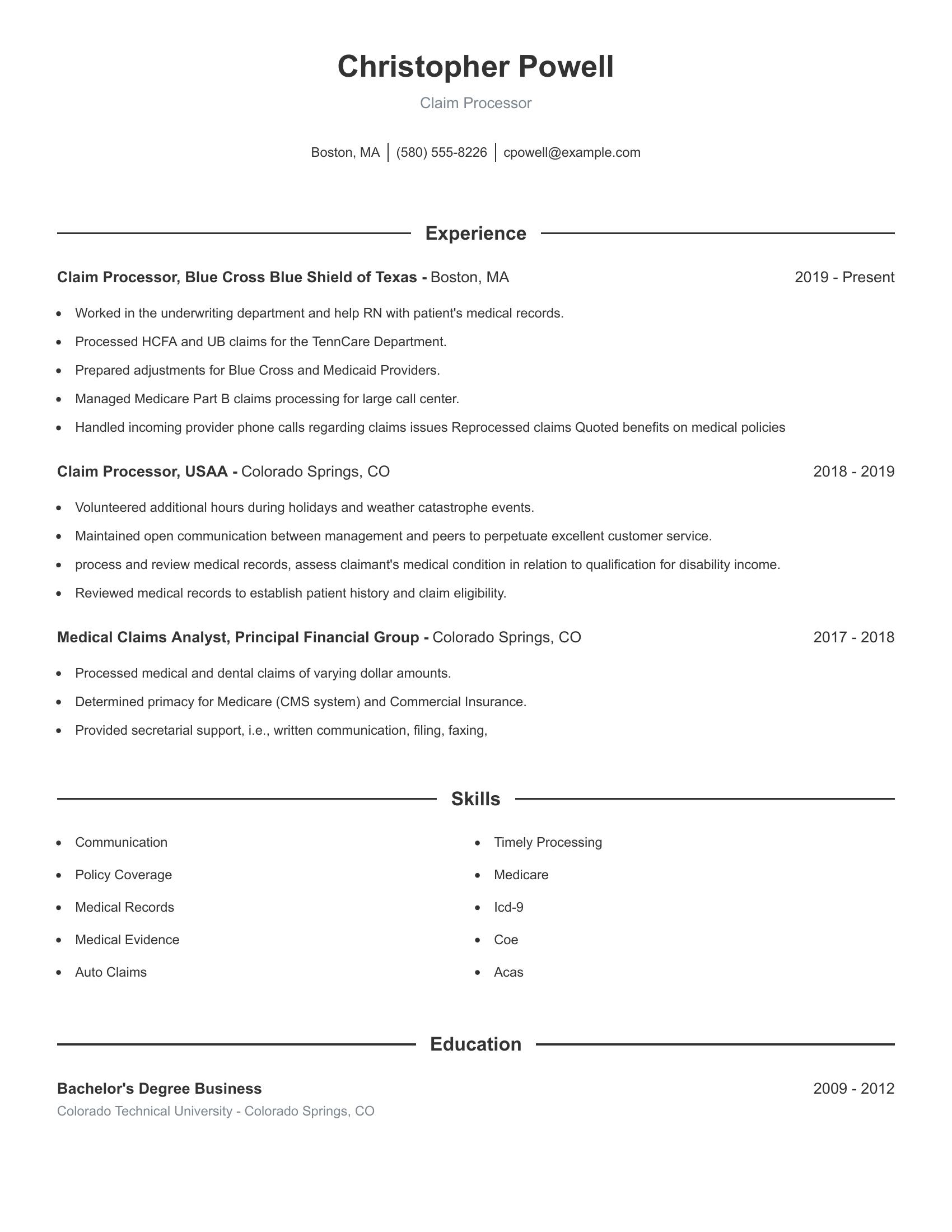

This resume includes extensive experience with Blue Cross Blue Shield, USAA, and Principal Financial Group. It shows proficiency in handling various claims types including HCFA, UB, Medicare Part B, and auto claims. The candidate has also demonstrated skills in communication, timely processing, and policy coverage. Their educational background in business supports their professional experience. This resume effectively showcases relevant skills and experience needed for a claim processor role.

Claim specialist resumes should focus on demonstrating expertise in claims processing, negotiation, and customer service. Relevant experience is vital, showing a clear history of handling various types of claims and resolving client concerns. Skills like claims management systems, handling high volume, and facilitating communication between parties are important. Educational background should also be included, especially if it is related to business or insurance fields.

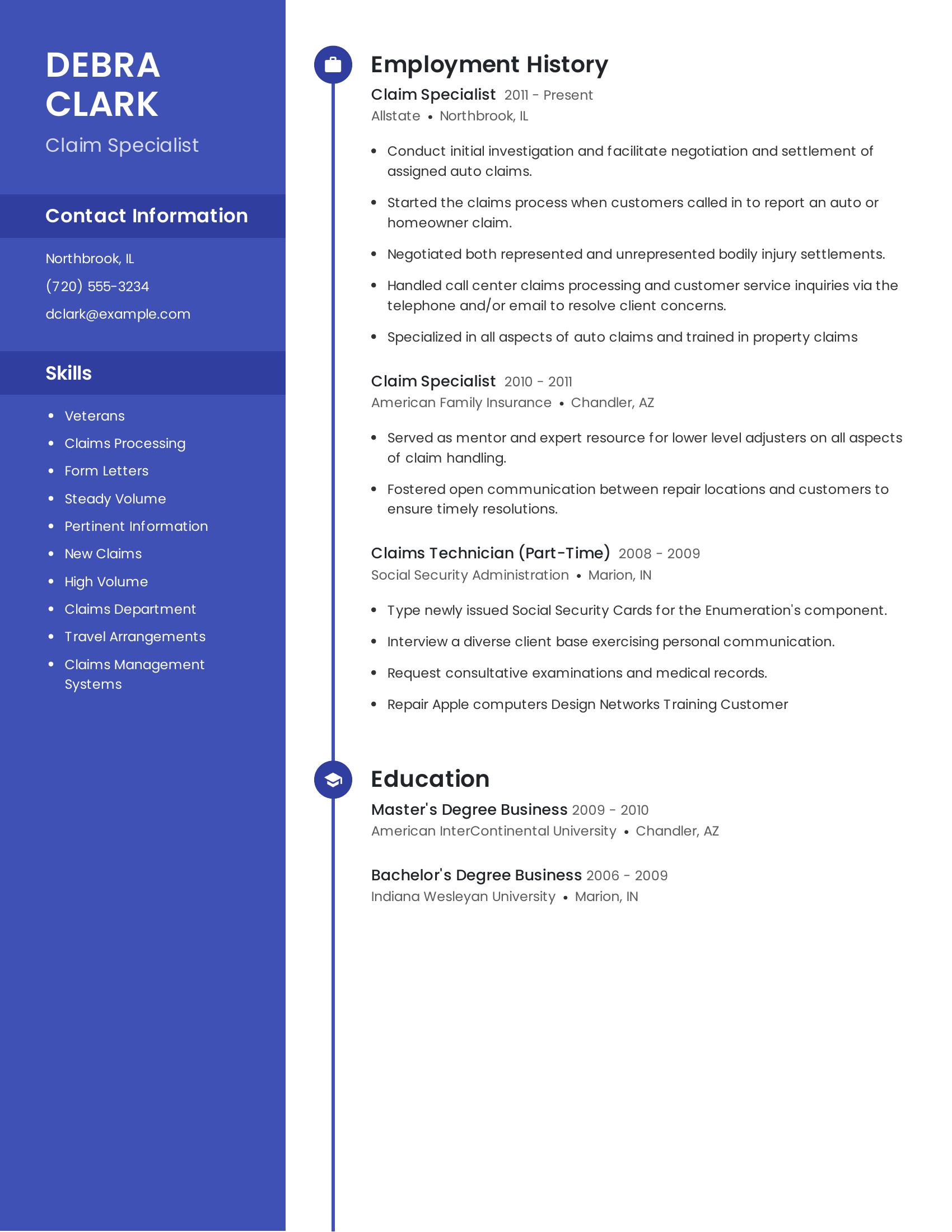

This resume effectively includes those specifics. It lists extensive experience in claims processing and negotiation from multiple employers. The skills section highlights relevant abilities like handling a steady volume of claims and managing travel arrangements. The educational background is also included, showing degrees in business which supports the role.

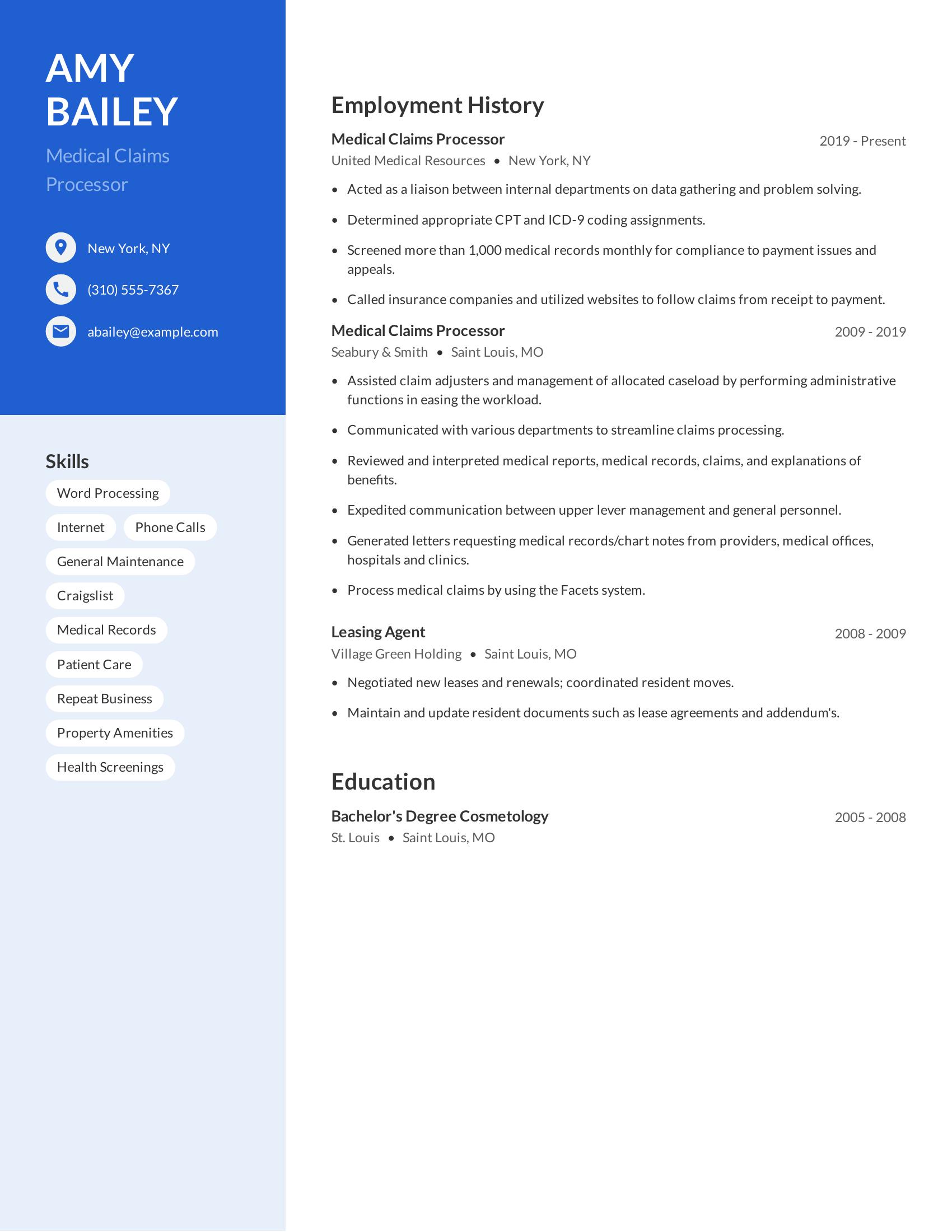

Medical claims processor resumes should highlight relevant skills, employment history, and education. Key components include experience with coding systems like CPT and ICD-9, handling medical records, and interacting with insurance companies. The resume should also showcase the ability to communicate effectively within departments and manage administrative tasks that support claims processing.

This resume includes specific skills such as word processing and medical records management. It details the candidate's experience as a medical claims processor at two companies, emphasizing tasks like coding assignments, claims follow-up, and interdepartmental communication. The employment history is clear and shows a progression in responsibilities. This resume also lists education, though it would benefit from highlighting any additional relevant coursework or certifications.

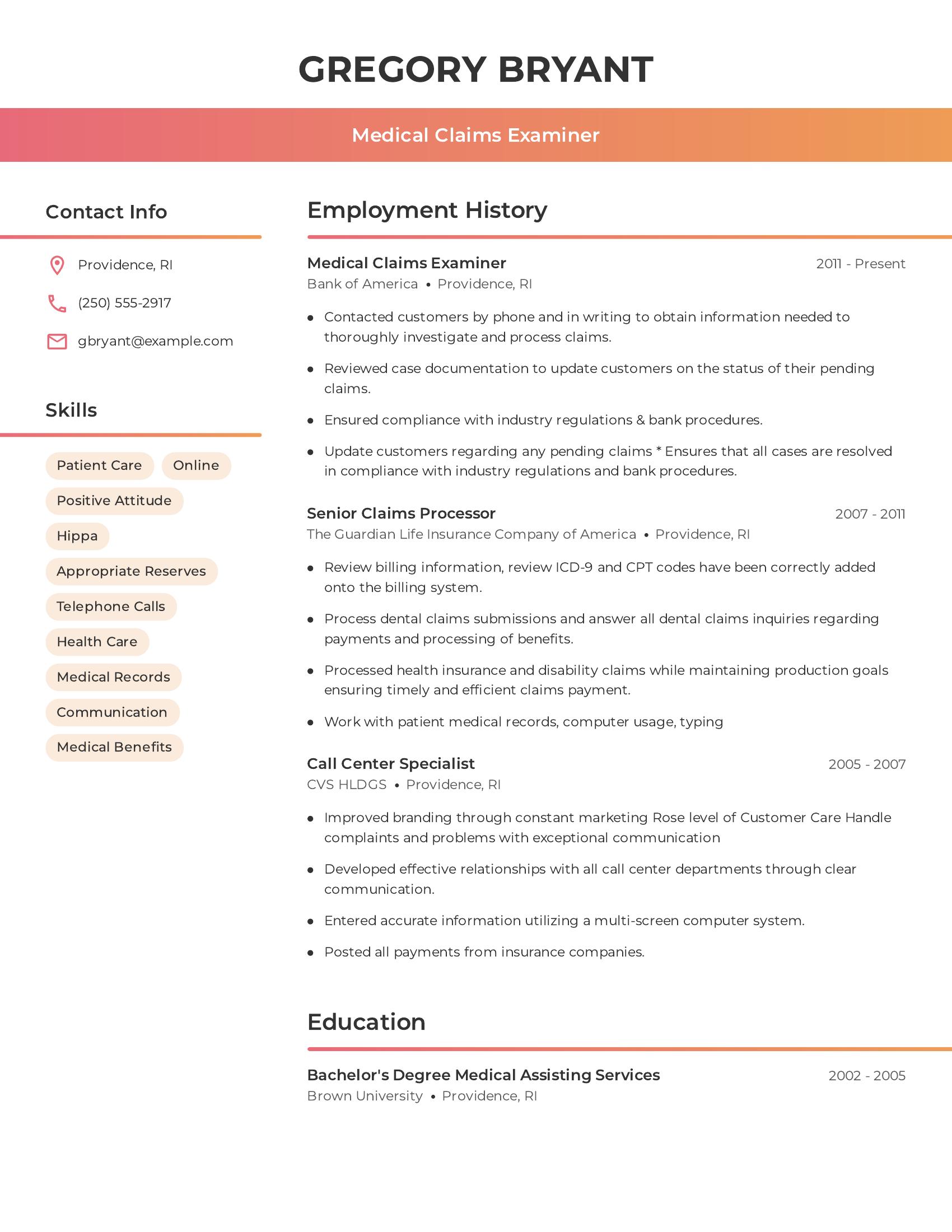

Medical claims examiner resumes should include relevant job experience, skills, and education in a clear, concise manner. They must highlight specific tasks such as processing claims, reviewing case documentation, and working with patient medical records. Skills like communication, knowledge of healthcare regulations, and proficiency in medical coding are crucial.

This resume includes detailed employment history, showing progression from call center specialist to senior claims processor and finally to medical claims examiner. It lists relevant skills such as patient care, HIPAA compliance, and communication. The education section includes a bachelor's degree in medical assisting services, which is pertinent to the role. The resume also mentions specific tasks performed in each job, such as processing dental claims and updating customers on claim status.

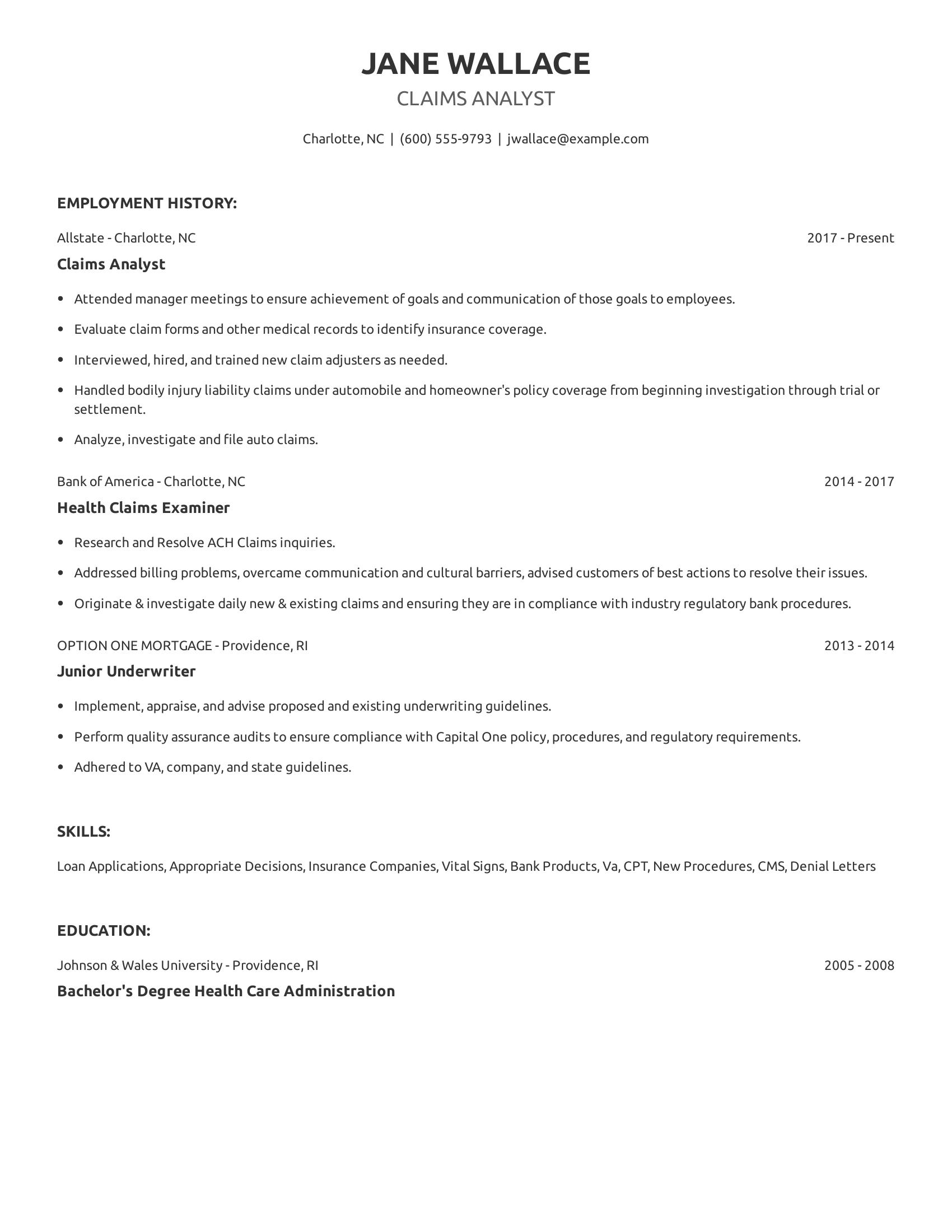

Claims analyst resumes should include relevant job experience, specific skills related to the field, and educational background. Highlighting roles in claims processing, analysis, and customer interaction is important. Demonstrating familiarity with regulatory compliance and industry practices adds value. It’s beneficial to showcase previous positions where responsibilities included evaluating claims, investigating issues, and training new staff.

This resume effectively includes relevant employment history with job titles such as claims analyst and health claims examiner. The resume details specific roles like evaluating claim forms, handling liability claims, and conducting quality assurance audits. It also lists pertinent skills such as loan applications and insurance procedures. Additionally, the education section shows a degree in health care administration, supporting the candidate’s qualifications for the role.

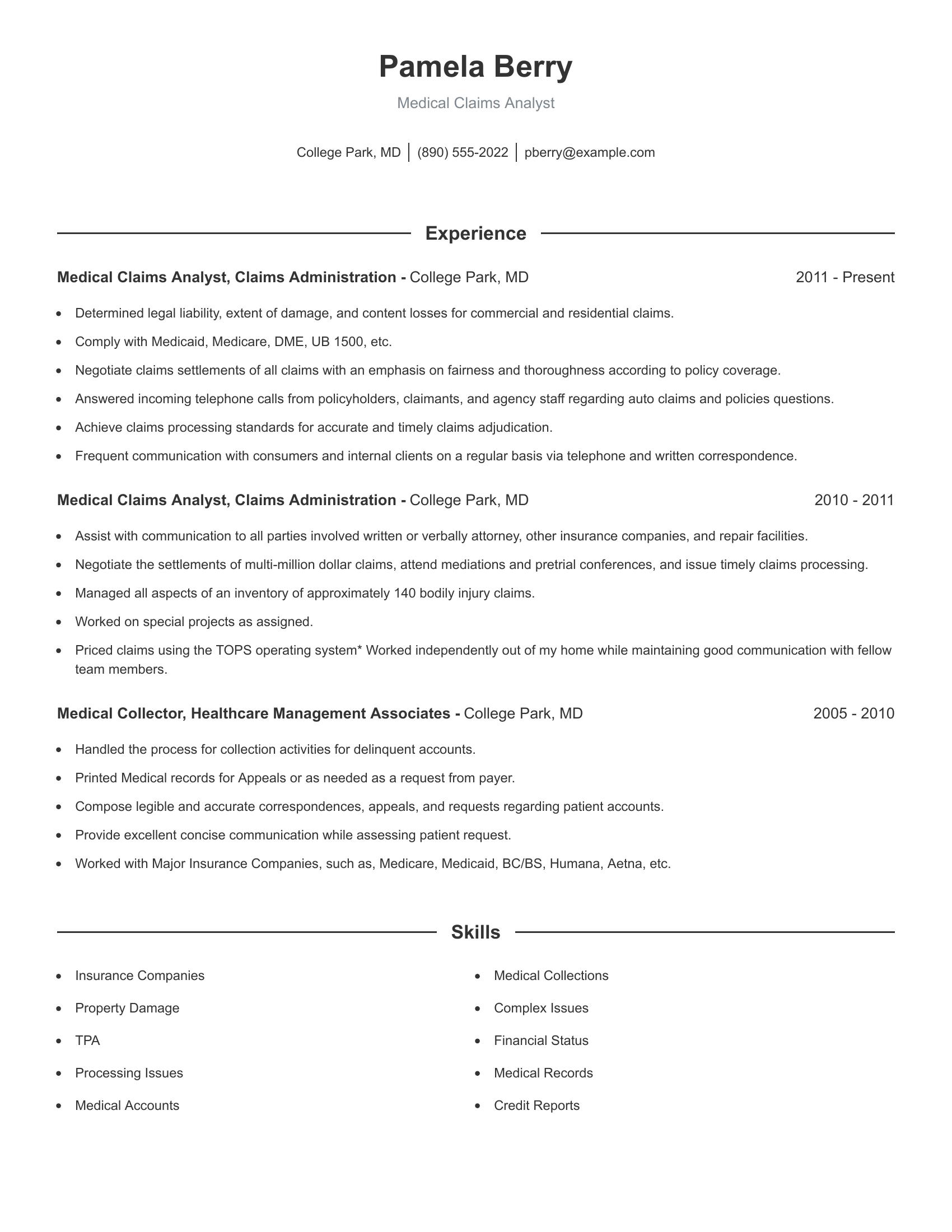

Medical claims analyst resumes should highlight specific skills and experiences relevant to the field. This includes details on job responsibilities such as determining legal liability, negotiating claim settlements, and managing communication with various stakeholders. Other important aspects are compliance with Medicaid, Medicare, and other regulations, as well as experience in claims processing and using operating systems for pricing claims. Effective communication skills and the ability to handle complex issues should also be evident.

This resume demonstrates these specifics by detailing experience in determining legal liability, negotiating settlements, and managing a large inventory of claims. It shows compliance with Medicaid and Medicare regulations and highlights proficiency in using specific operating systems for claims processing. The resume also emphasizes effective communication skills through various responsibilities such as answering calls, composing correspondence, and working on special projects. These elements collectively showcase the qualifications crucial for a medical claims analyst role.

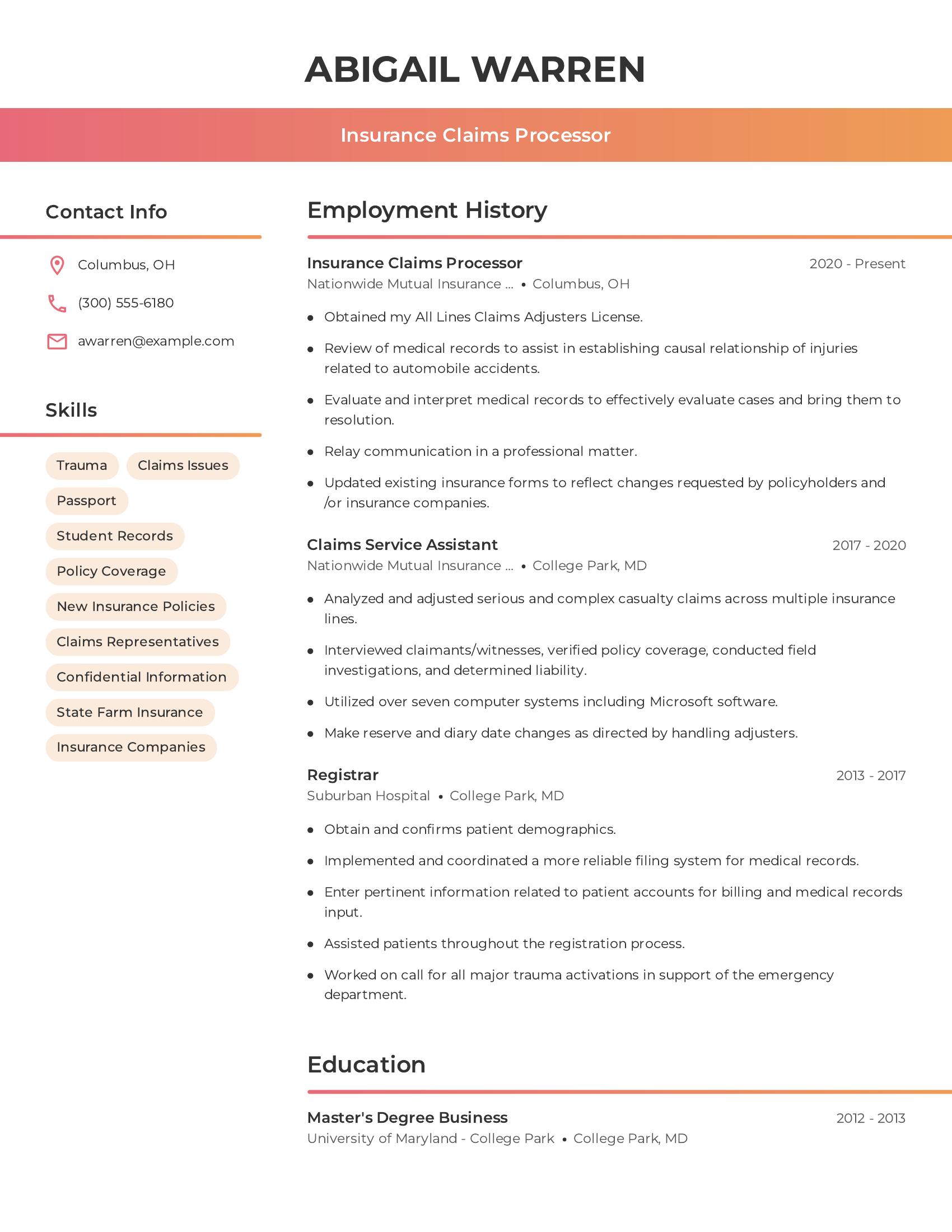

An insurance claims processor resume should highlight relevant experience, skills, and education. It should include job titles, employment history with dates, and specific responsibilities. Skills should be industry-specific. Education should list degrees and certifications relevant to the job. The resume should present information clearly and concisely.

This resume effectively includes relevant job titles and dates of employment. It lists important skills like policy coverage and trauma claims issues. The work experience section details specific duties such as evaluating medical records and handling complex casualty claims. The education section includes a master's degree in business and an All Lines Claims Adjusters License, demonstrating qualifications for the role.

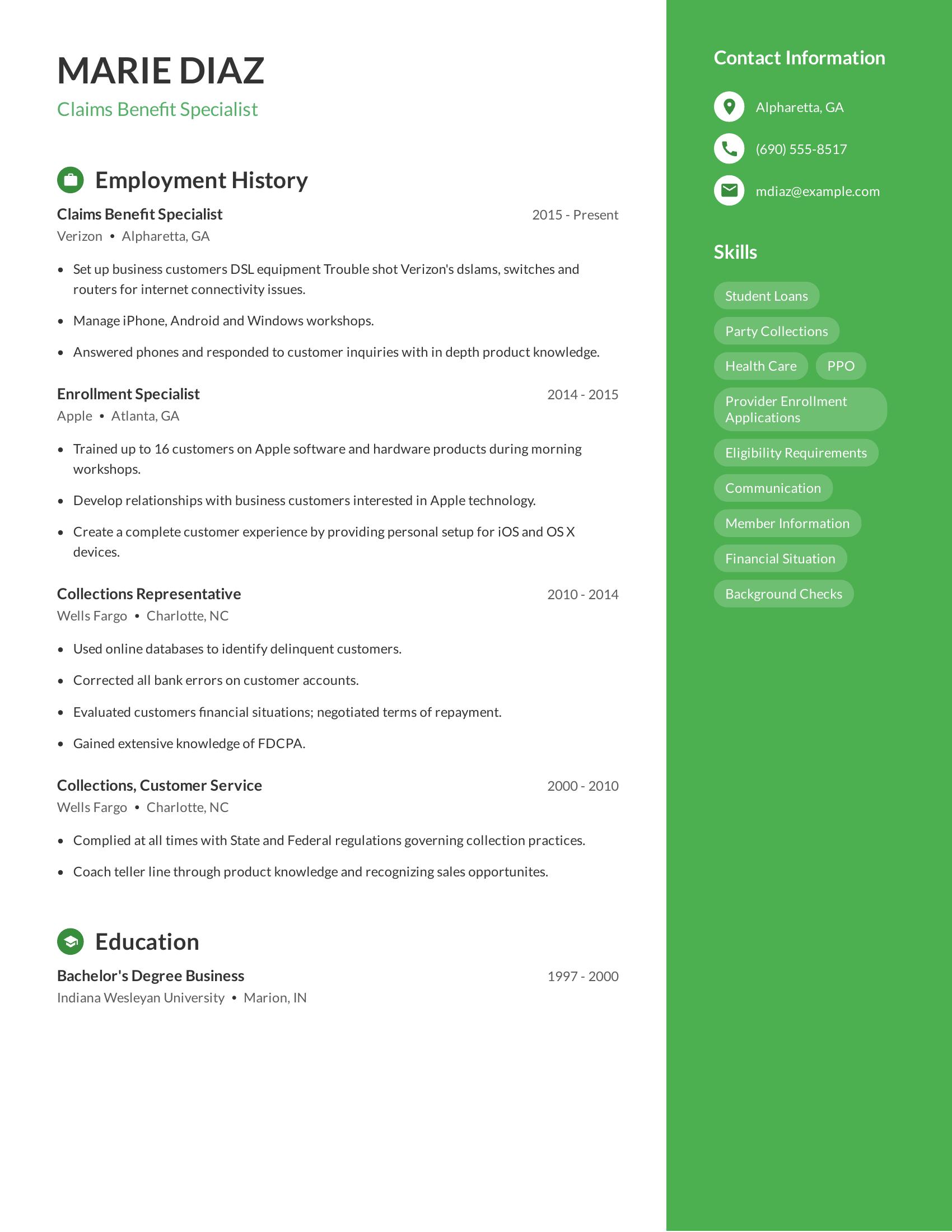

Claims benefit specialist resumes should highlight relevant work experience, specific skills in handling claims, and a strong understanding of regulations and procedures. They should also showcase the ability to manage customer relationships and resolve issues efficiently. Educational background and contact information must be clear and accessible.

This resume includes detailed job history with roles directly related to claims and customer service. It shows progression in responsibilities and expertise in various aspects such as troubleshooting, training, collections, and customer inquiries. The skills section is diverse, covering important areas such as communication and financial assessments. The educational background is clearly listed, along with contact information for potential employers.

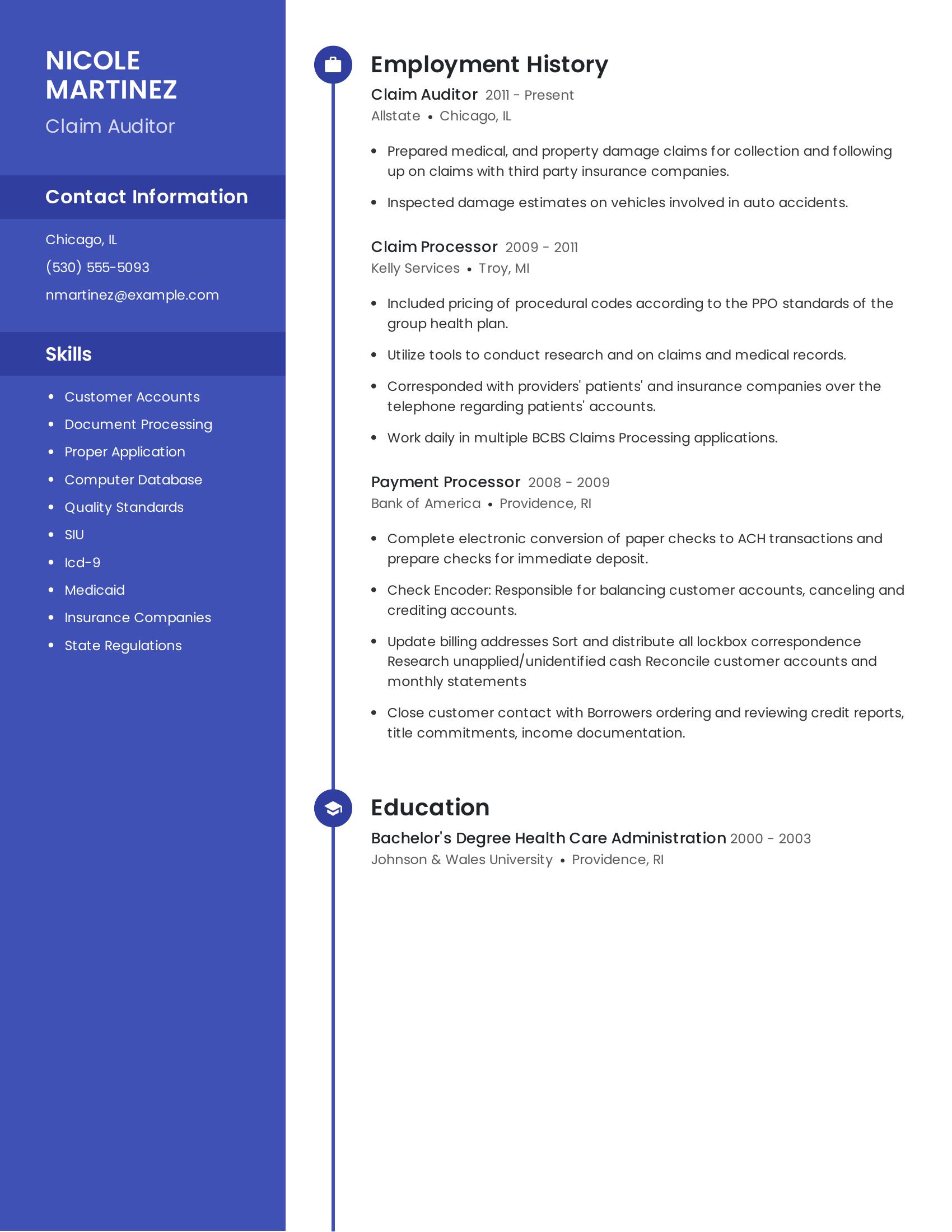

Claim auditor resumes should highlight relevant experience, technical skills, and knowledge of industry regulations. They need to include contact information, a summary of work experience, and educational background. Skills such as document processing, customer account management, and familiarity with insurance regulations are important. Experience in roles like claim processor or payment processor shows a well-rounded understanding of the claims process.

This resume includes essential elements for a claim auditor position. It lists relevant skills like document processing, ICD-9 coding, and knowledge of Medicaid and state regulations. The work history shows progression in related roles at reputable companies, demonstrating experience with claims and insurance processes. The educational background in health care administration is also relevant to the field.

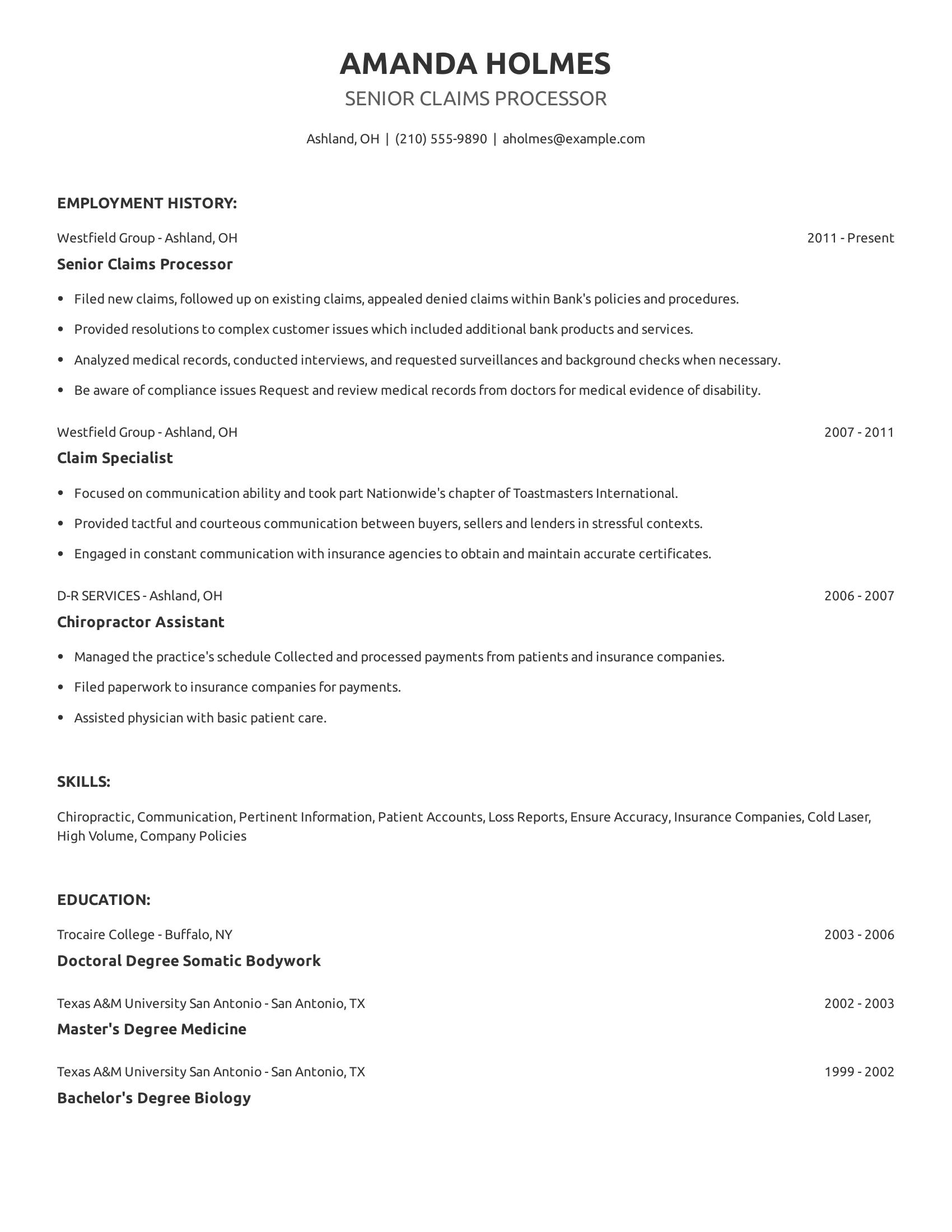

Senior claims processor resumes should highlight experience in managing claims, resolving complex customer issues, and analyzing relevant documentation. A good resume includes clear job titles, employment history with specific dates, a concise description of responsibilities, and key skills related to the job. It should also list educational qualifications that are relevant to the field.

This resume includes essential components such as detailed employment history with job titles and dates. It lists specific tasks like filing new claims, appealing denied claims, and handling customer issues. The resume also covers skills like communication and accuracy in processing claims. The education section is thorough, detailing degrees earned and institutions attended, which adds to the candidate's credibility.

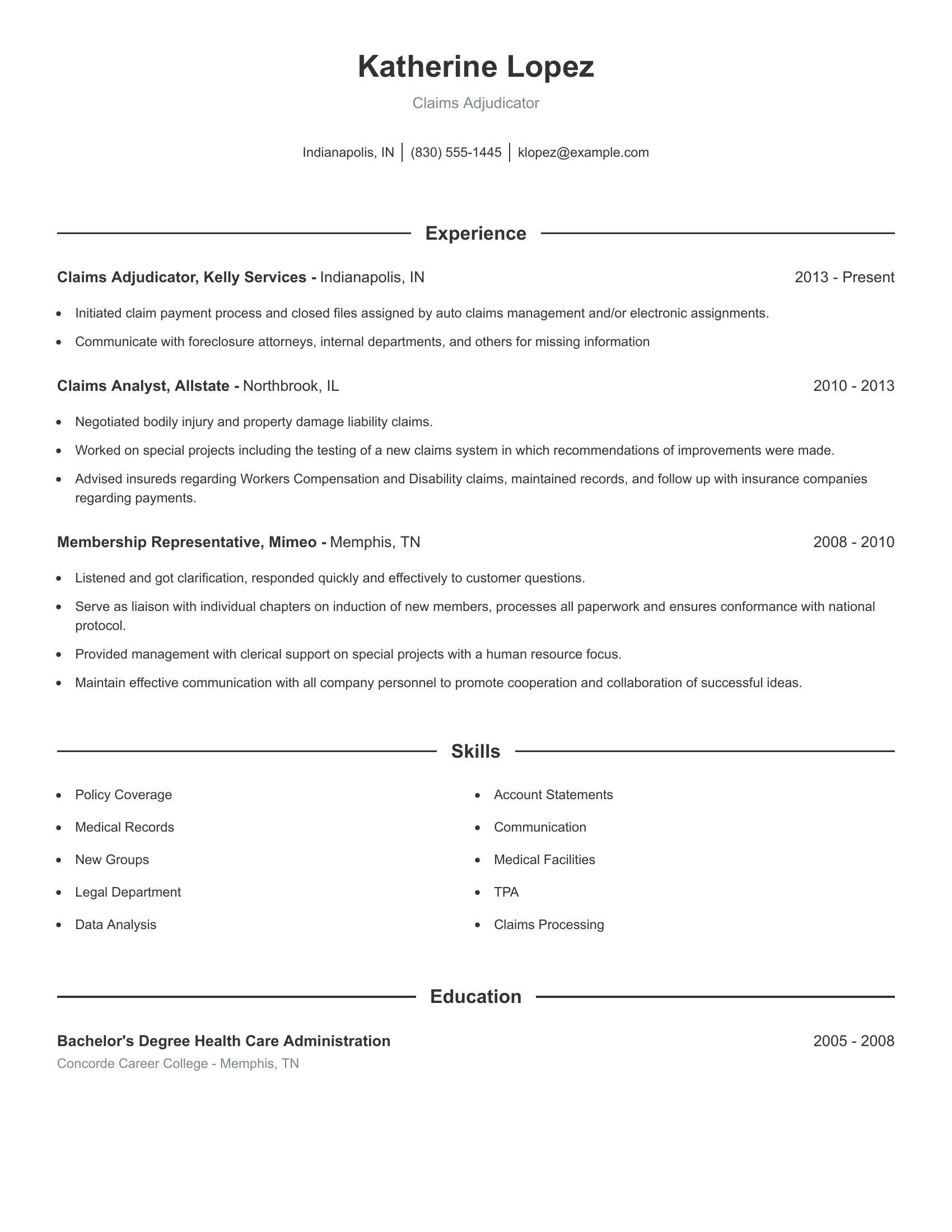

Claims adjudicator resumes should highlight relevant experience in claims processing, analysis, and communication. They should list previous job roles that involve evaluating claims, interacting with stakeholders, and ensuring accurate payment processes. Skills in data analysis, claims management, and familiarity with legal and medical records are important. Education in related fields adds value.

This resume includes specific job roles where the individual initiated claim payments, communicated with various parties for information, and worked on special projects. It shows experience as a claims analyst and membership representative, indicating a strong background in customer interaction and claims processing. The skills section lists relevant capabilities like data analysis and communication. The education section highlights a degree in health care administration.

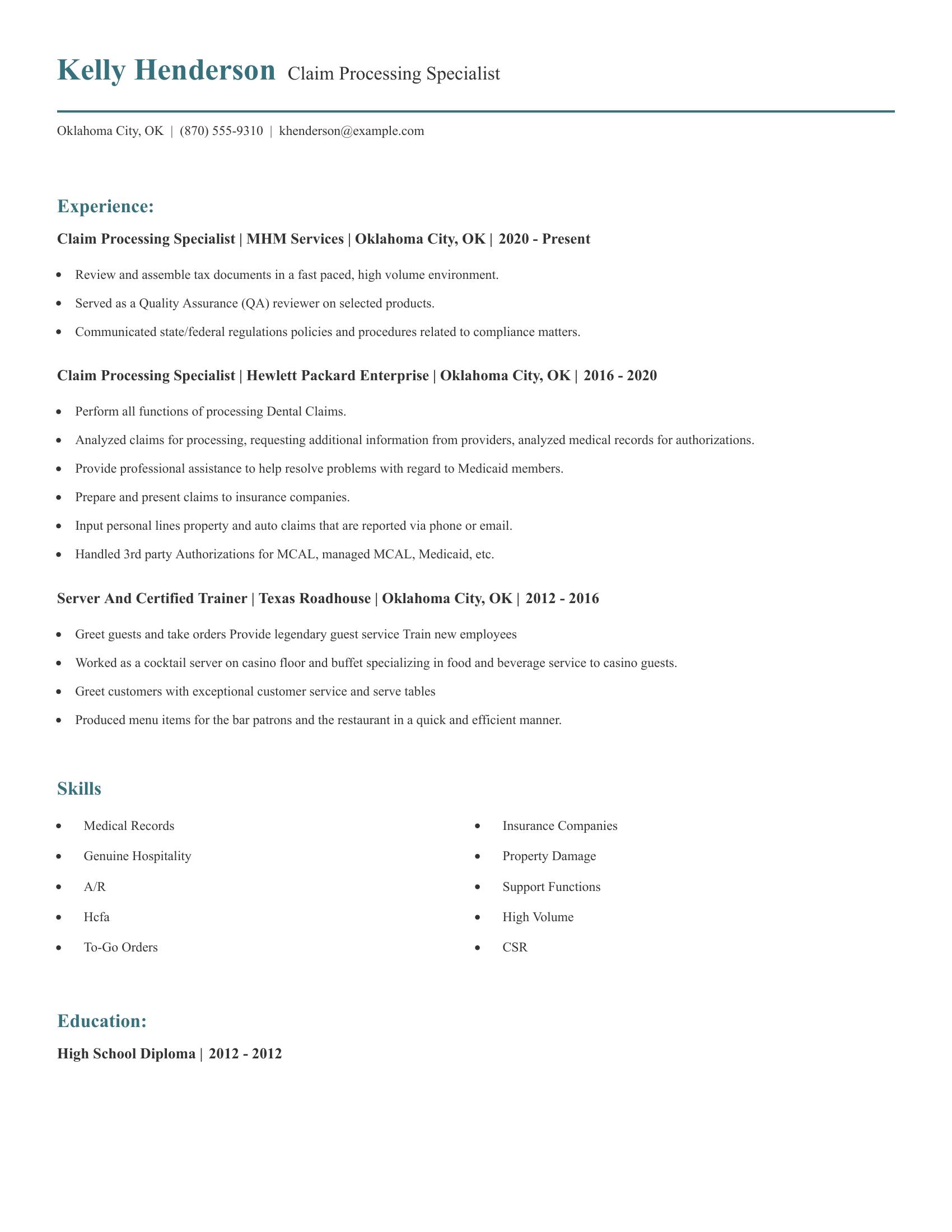

A claim processing specialist resume should highlight experience in handling and analyzing claims, familiarity with insurance protocols, and the ability to communicate regulatory policies. It should list job titles, companies, and employment dates clearly. Skills and qualifications like medical records management and customer service should be easily identifiable. Including relevant education and any specialized training or certifications is also beneficial.

This resume includes specifics like job titles, companies, and employment dates, showing a clear career progression. It lists relevant experience such as reviewing tax documents, performing dental claims processing, and handling Medicaid-related issues. The skills section highlights competencies like insurance knowledge and customer service, while the education section confirms the candidate's high school diploma. The resume provides a comprehensive view of the candidate's qualifications for the role.

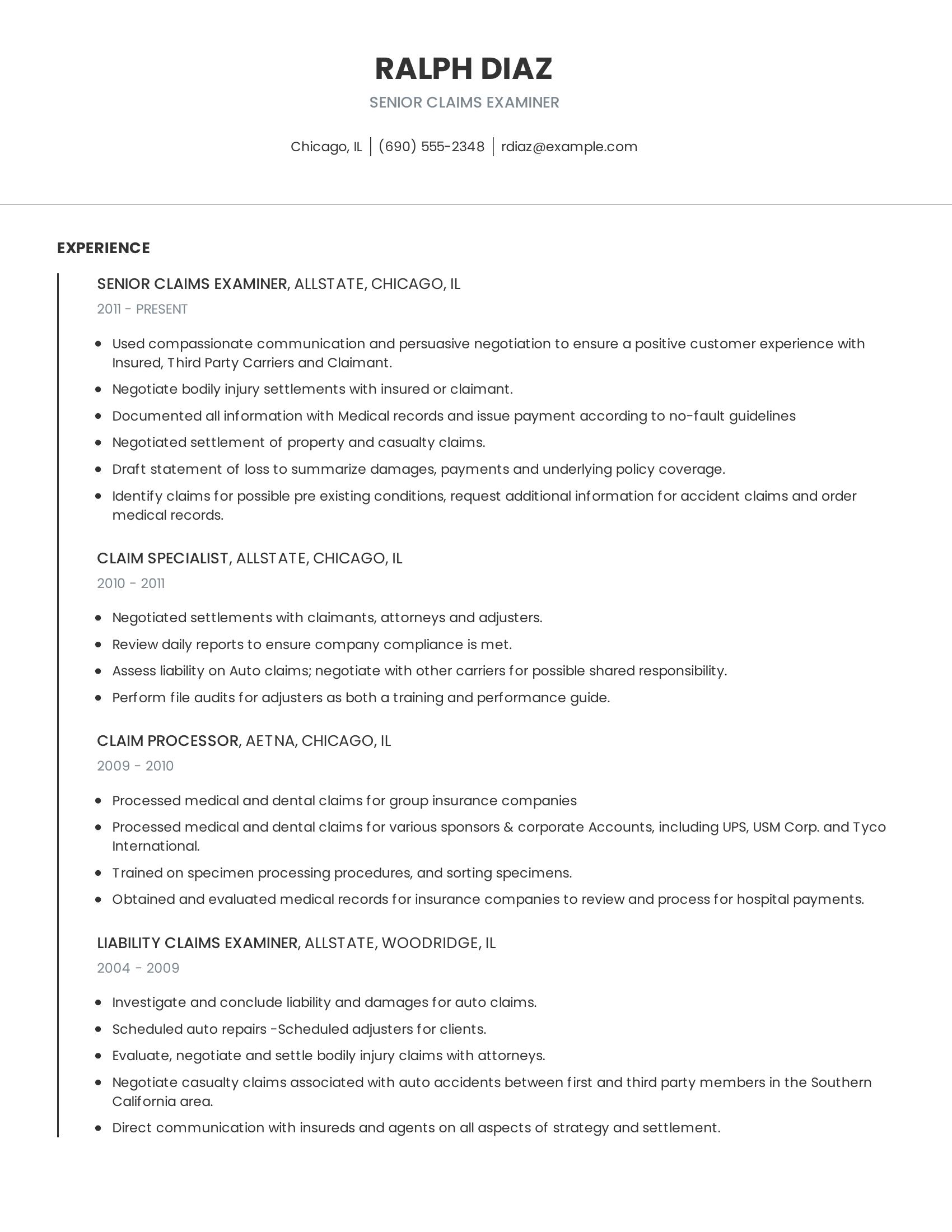

Senior claims examiner resumes should highlight extensive experience in handling and negotiating claims, strong communication skills, and a clear understanding of insurance policies and procedures. They should detail previous job roles, emphasizing specific responsibilities such as negotiating settlements, documenting claims, and interacting with insured parties, third-party carriers, and claimants. The resume should also demonstrate progression in responsibilities and roles within the industry.

This resume includes specific job titles and dates that show a clear career path within the claims industry. It outlines detailed responsibilities such as negotiating bodily injury settlements, documenting information, and assessing liability on auto claims. The resume also lists skills in compassionate communication and persuasive negotiation, which are important for a senior claims examiner role. Additionally, it highlights experience with both medical and property claims, showing a broad range of expertise.

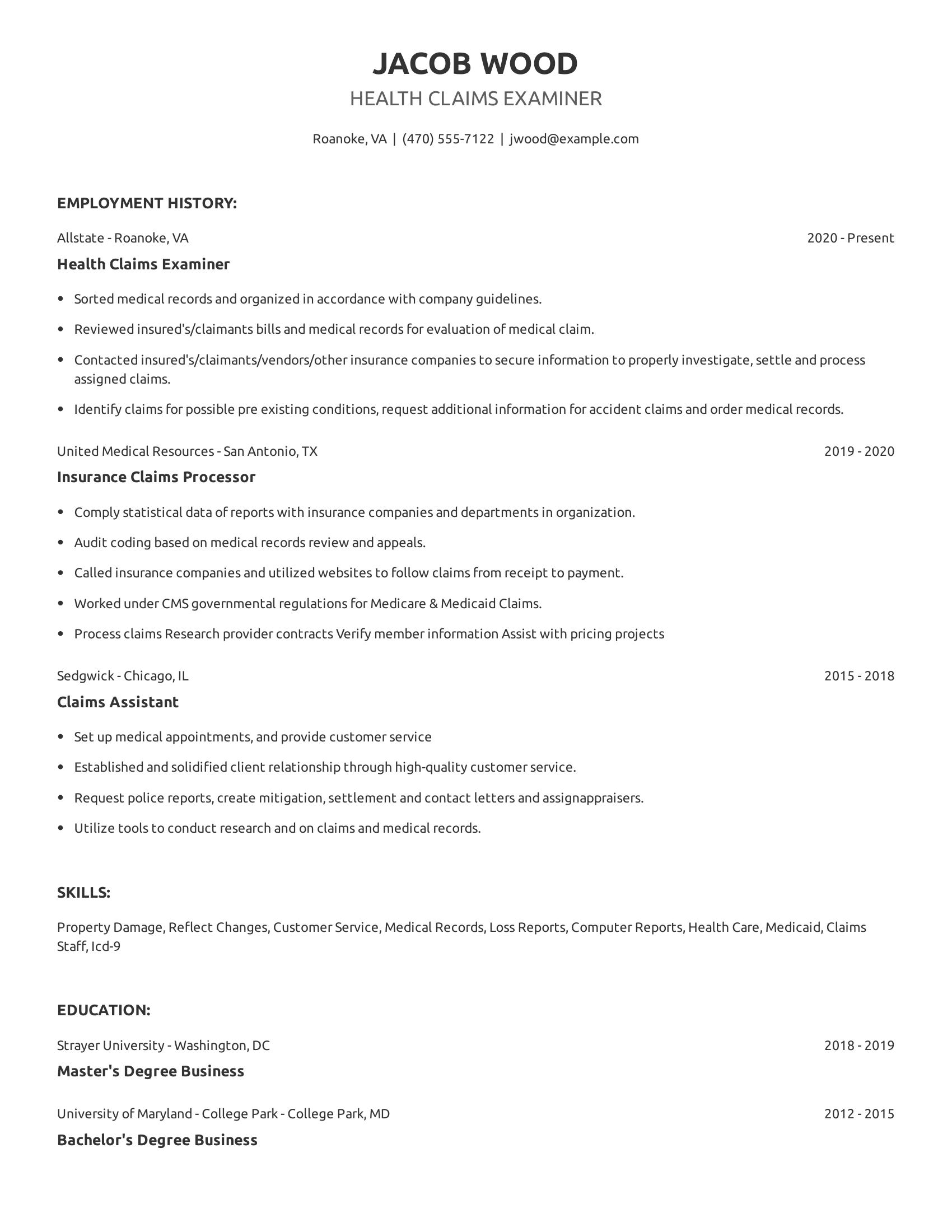

Health claims examiner resumes should highlight relevant work experience, specific skills related to claims processing, and educational background. Key elements include job responsibilities that show familiarity with medical records, claims evaluation, communication with stakeholders, and compliance with regulations. Skills such as customer service, knowledge of medical coding, and proficiency in handling insurance claims are also important. Including educational qualifications ensures the candidate meets the industry standards.

This resume includes those specifics by listing detailed job roles at different companies, showcasing expertise in sorting medical records, evaluating bills, and investigating claims. It highlights experience with Medicare & Medicaid and skills in customer service and medical coding. The educational background is clearly stated with both bachelor's and master's degrees in business, aligning with industry requirements.

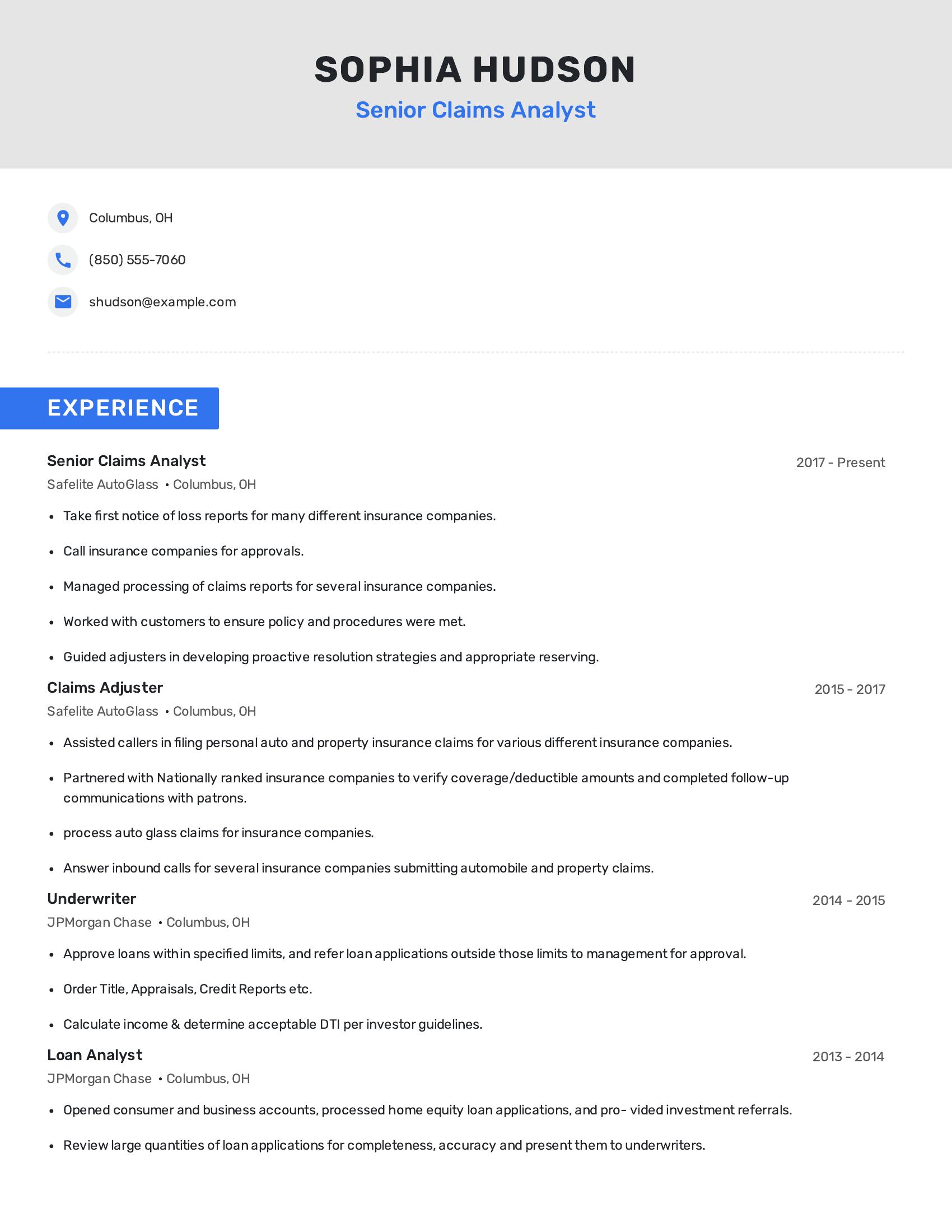

Senior claims analyst resumes should highlight relevant experience in handling insurance claims, showcasing skills in managing processes and working with various stakeholders. Key components include job titles, employment dates, company names, and a clear list of responsibilities. The resume should emphasize the ability to handle multiple tasks, such as taking initial loss reports, calling insurance companies for approvals, managing claims processing, and guiding adjusters.

This resume includes specific details about the individual's roles at different companies. It highlights responsibilities like taking first notice of loss reports, managing claims processing, and working with customers and adjusters. It also shows progression from previous roles like claims adjuster and underwriter, detailing tasks such as assisting callers with filing claims, verifying coverage amounts, and approving loans. This structure effectively demonstrates the candidate's breadth of experience and capability in the field of claims analysis.

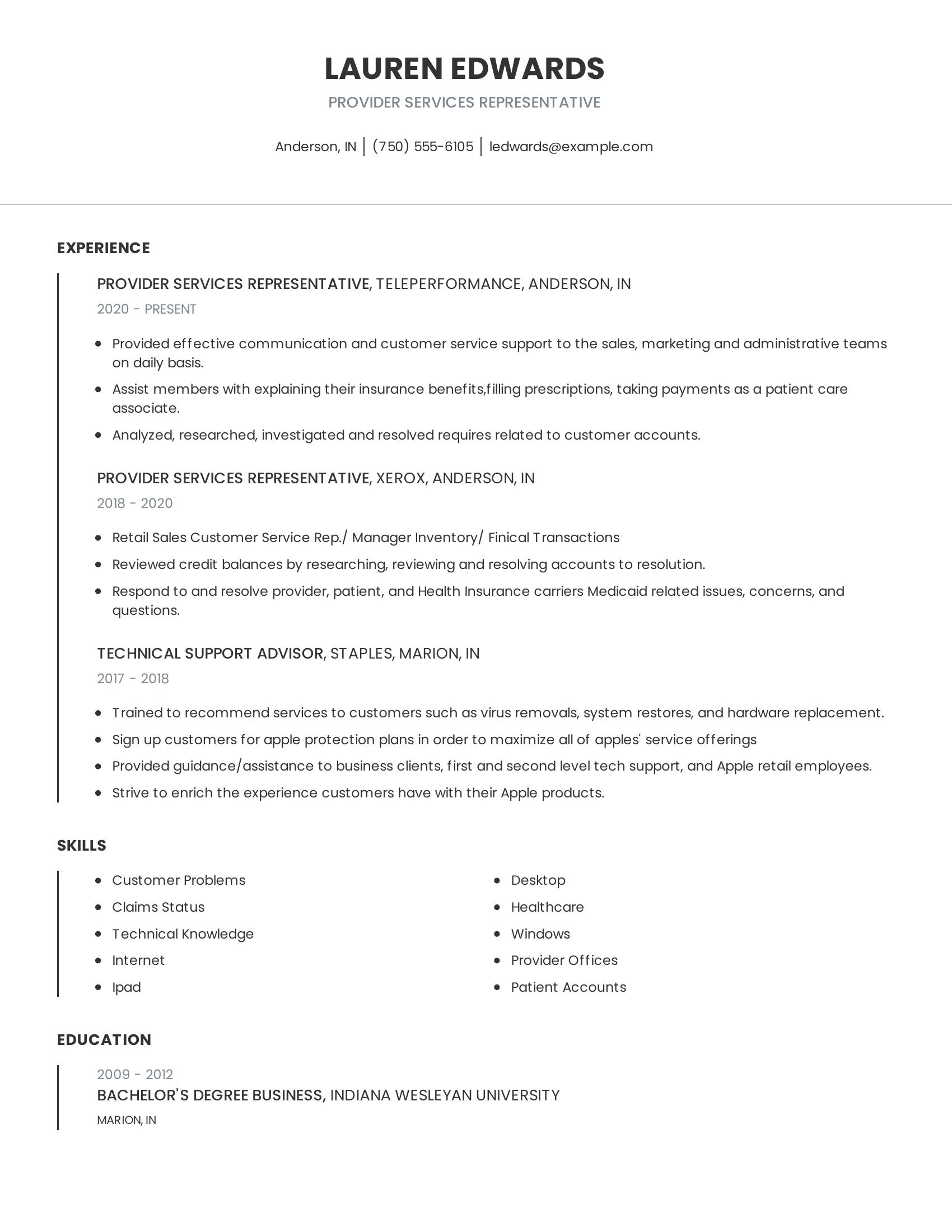

Provider services representative resumes should highlight experience in customer service, account management, and problem-solving within the healthcare industry. Important sections include professional experience, skills, and education. Clear descriptions of past roles, especially those involving communication with providers and patients, are crucial. Technical proficiency and familiarity with healthcare systems and software should also be evident.

This resume includes relevant work experience at different companies, demonstrating a history of assisting members with insurance benefits and resolving customer issues. It lists specific skills like managing patient accounts and technical support, which are important for the role. The inclusion of a business degree adds to the candidate's qualifications. The information is detailed yet concise, showcasing a strong background in provider services.

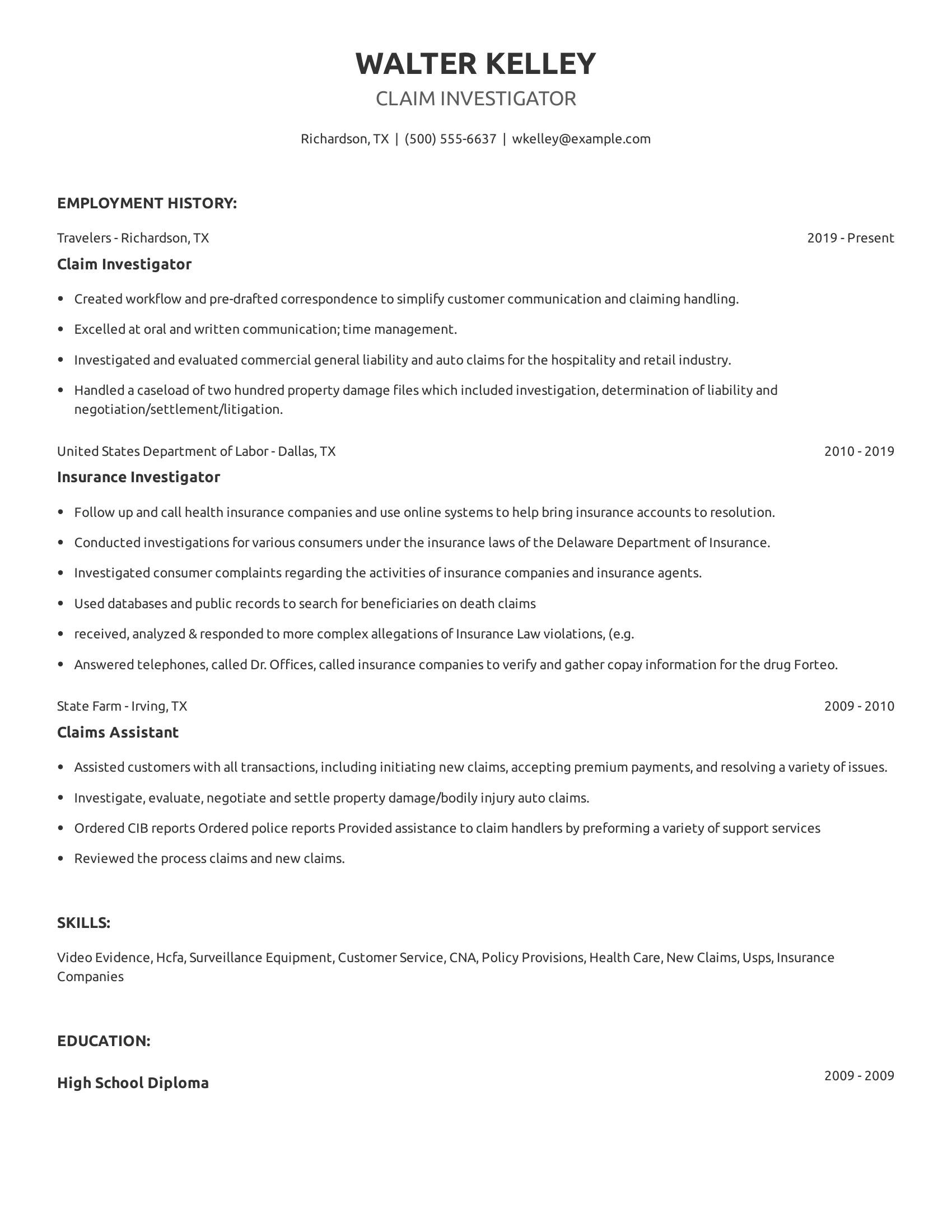

Claim investigator resumes should highlight relevant experience, investigative skills, and a strong understanding of insurance laws and procedures. They should list previous employment where the candidate handled claims, conducted investigations, and resolved disputes. It's important to showcase the ability to manage caseloads, communicate effectively, and use investigative tools like databases and public records. Skills related to customer service, negotiation, and settlement are also crucial.

This resume includes detailed job history with specific roles such as claim investigator and insurance investigator. It demonstrates experience in handling large caseloads and conducting thorough investigations. The resume also mentions key tasks like evaluating claims, negotiating settlements, and using various databases for information gathering. Additionally, it lists relevant skills like video evidence analysis and customer service, which are valuable in this field.

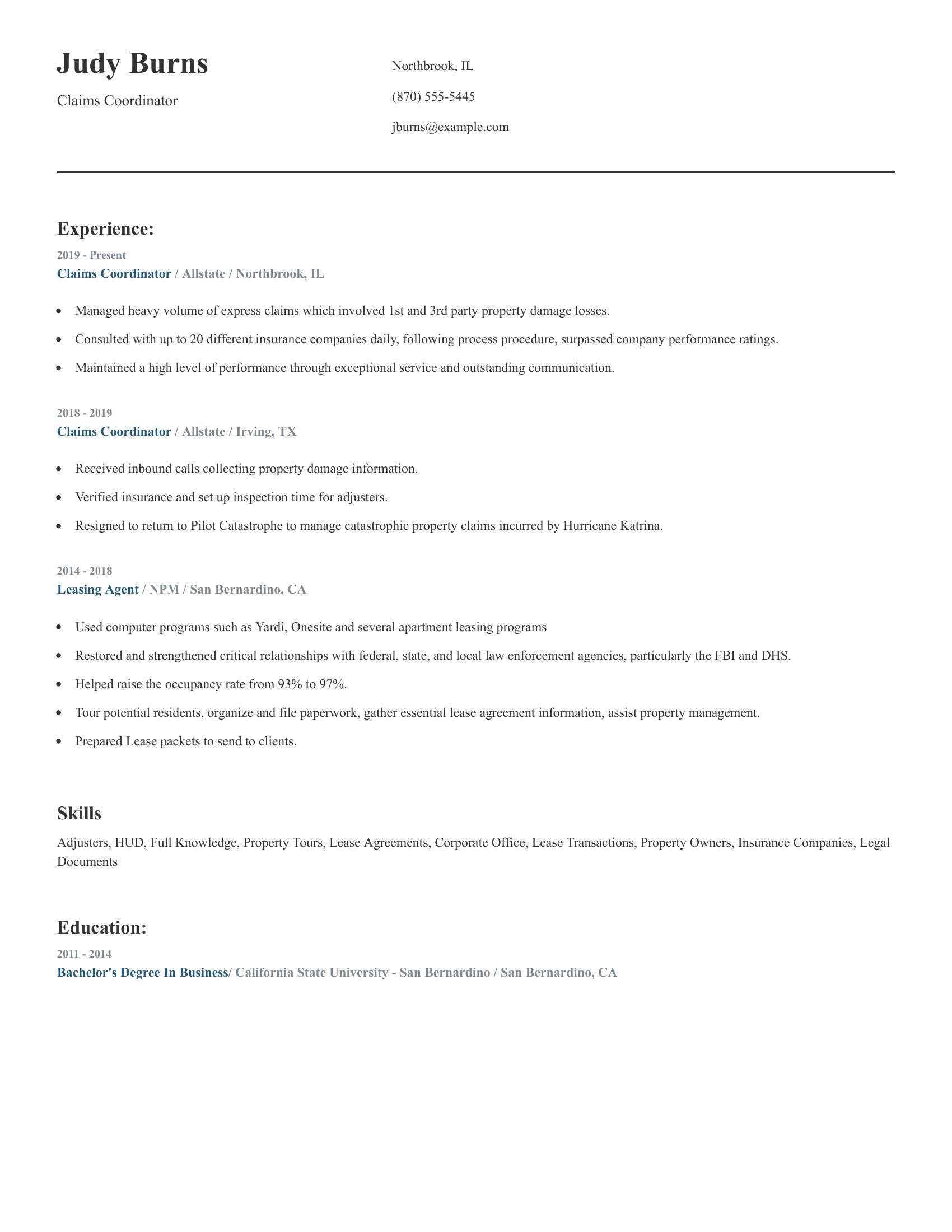

Claims coordinator resumes should highlight relevant work experience, skills, and education. They must detail experience in handling claims, consulting with insurance companies, and maintaining performance. Important skills include knowledge of insurance procedures, communication abilities, and proficiency with necessary software. Education related to business or insurance adds value.

This resume includes strong work experience with multiple roles as a claims coordinator. It mentions managing claims, consulting with insurance companies, and maintaining high performance. Skills like handling legal documents and using software are listed. The resume also includes a bachelor's degree in business, which is relevant to the role.

Highlight relevant experience. Detail your work as a claim processor, including specific tasks like reviewing claims for accuracy, investigating discrepancies, and processing payments. Mention any specialized claims you have handled, such as medical or insurance claims.

Showcase technical skills. List software and tools you use for claim processing, such as claims management systems, data entry software, or Excel. Emphasize your ability to learn new technologies quickly if required.

Emphasize attention to detail. Describe how you maintain accuracy while processing large volumes of claims. Provide examples where your careful review prevented errors or saved costs. Highlight your consistency in meeting processing deadlines.

A claim processor's resume should show their experience and skills in handling insurance claims. It should include contact information, a summary, work experience, skills, and education.

A well-written claim processor summary should highlight your experience, skills, and efficiency in handling claims. Focus on specific tasks and accomplishments.

Use clear language, focus on achievements, and tailor the summary to the job description.

A claim processor's experience should highlight specific tasks, achievements, and skills relevant to the role. Use bullet points to make it easy to read.

Focus on clarity and relevance when describing your experience as a claim processor. Make each bullet point count.

A claim processor needs specific technical abilities to handle tasks efficiently.

A claim processor needs interpersonal skills to communicate and work well with others.