17 Bank Teller Resume Examples

Bank teller resumes should highlight relevant work experience, customer service skills, and knowledge of financial products. Key elements include contact information, a list of relevant skills, detailed employment history with specific responsibilities, and education background. It's important to focus on job-specific tasks like handling transactions, advising clients, promoting products, and training new staff.

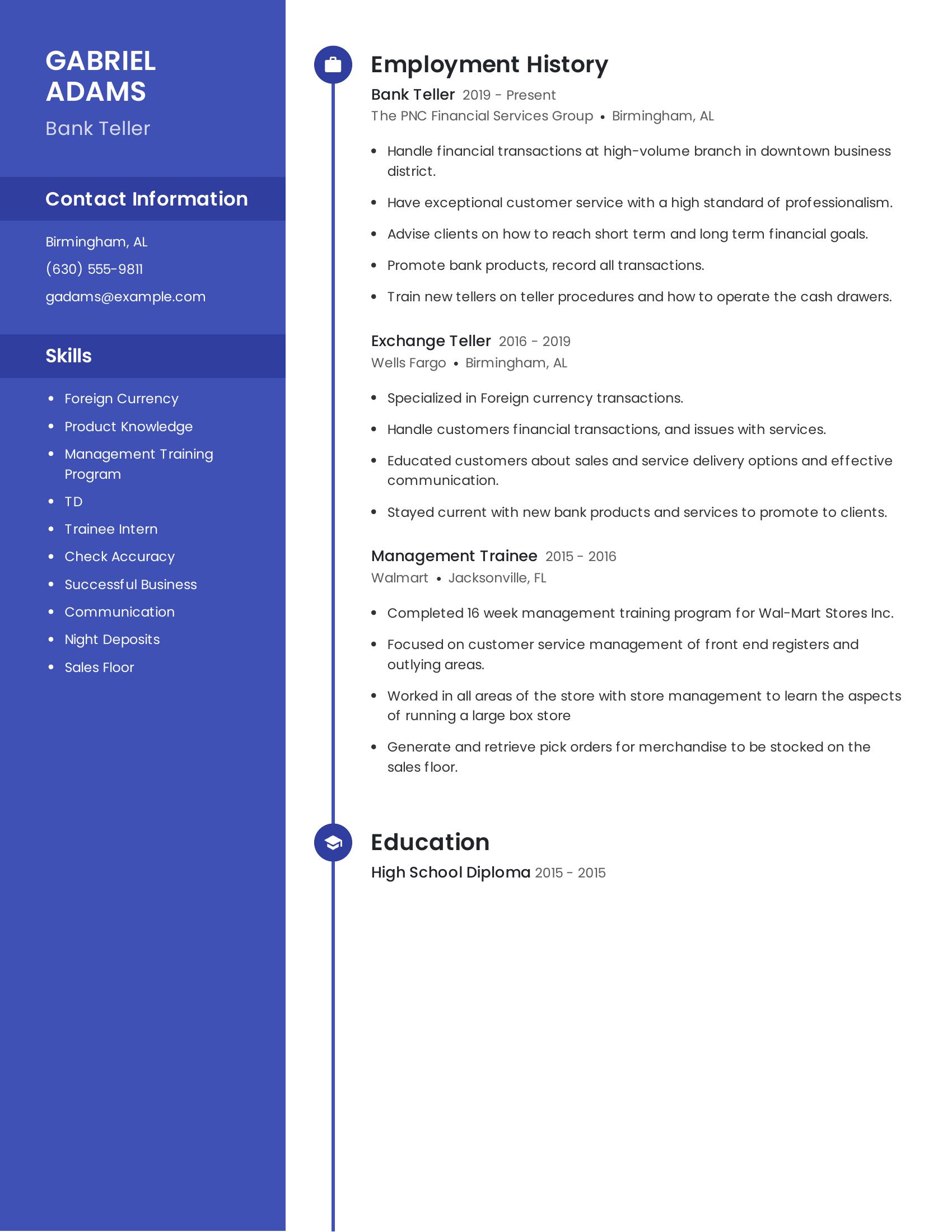

This resume includes all the necessary components. It lists the candidate's contact information and skills like foreign currency handling and product knowledge. The employment history details specific duties performed at each job, such as handling financial transactions and training new tellers. Additionally, the resume mentions the candidate's education, showing they have a high school diploma.

Teller resumes should highlight relevant experience, skills, and education. They should showcase experience in handling cash transactions, performing audits, and providing customer service. Specific duties like cross-selling bank products and conducting account reviews are important. Skills in financial goals, communication, and accuracy in transactions are valuable. Education details should include at least a high school diploma.

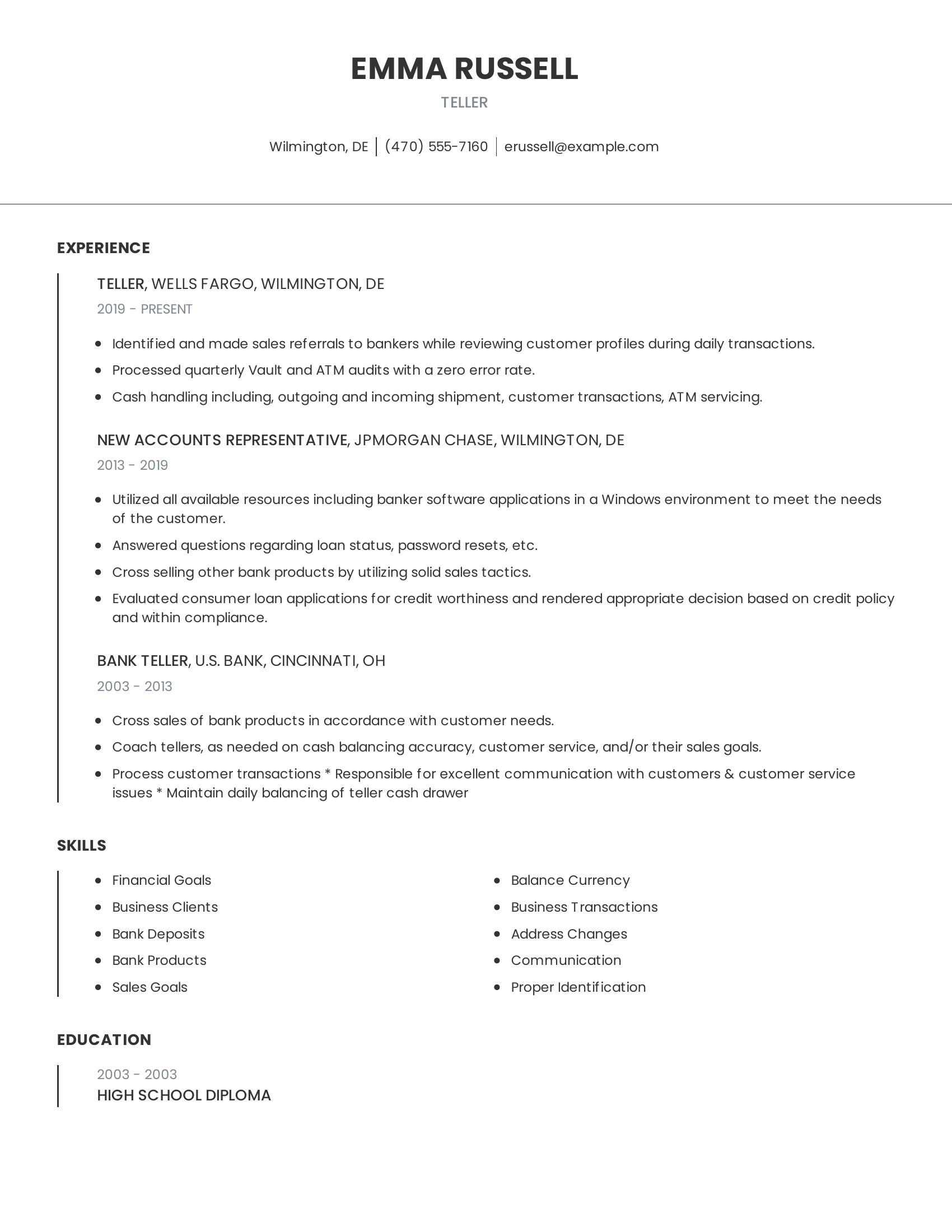

This resume includes specific teller responsibilities such as cash handling, customer transactions, and ATM servicing. It describes experience with sales referrals and cross-selling bank products. The resume also lists skills like balancing currency, business transactions, and communication. It mentions the teller's high school diploma, which is crucial for the role.

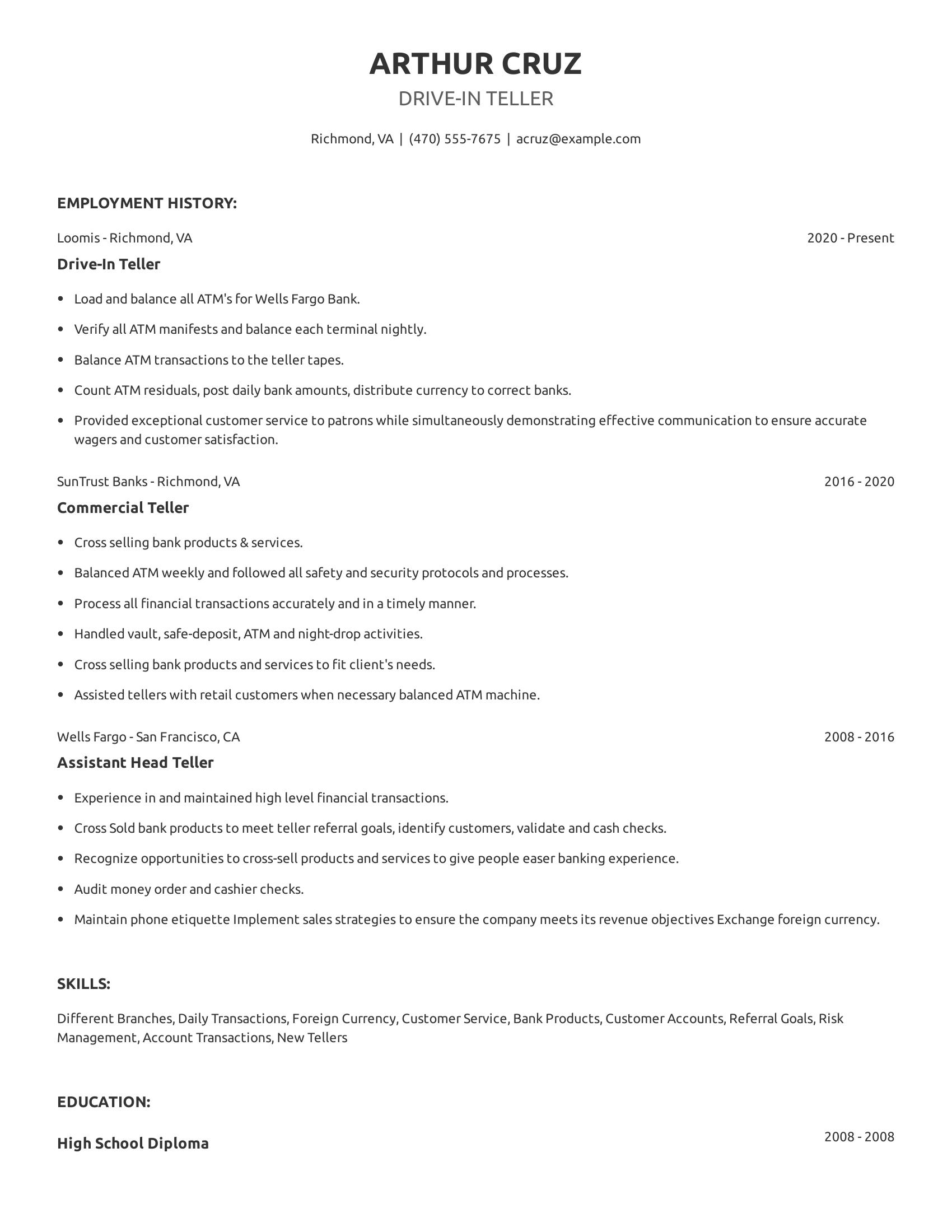

Drive-in teller resumes should highlight experience with financial transactions, ATM operations, customer service, and cross-selling bank products. Important details include employment history with relevant job titles and responsibilities, skills related to banking operations, and educational background. A good resume shows a candidate's ability to handle daily transactions, maintain accuracy, manage security protocols, and provide excellent customer service.

This resume includes specific job roles at multiple banks, detailing responsibilities like balancing ATMs, handling vault activities, and cross-selling products. The resume also lists skills critical to banking, such as customer service and risk management. The candidate's employment history shows progression in the banking field and experience in various teller functions. The educational background is mentioned briefly but serves its purpose.

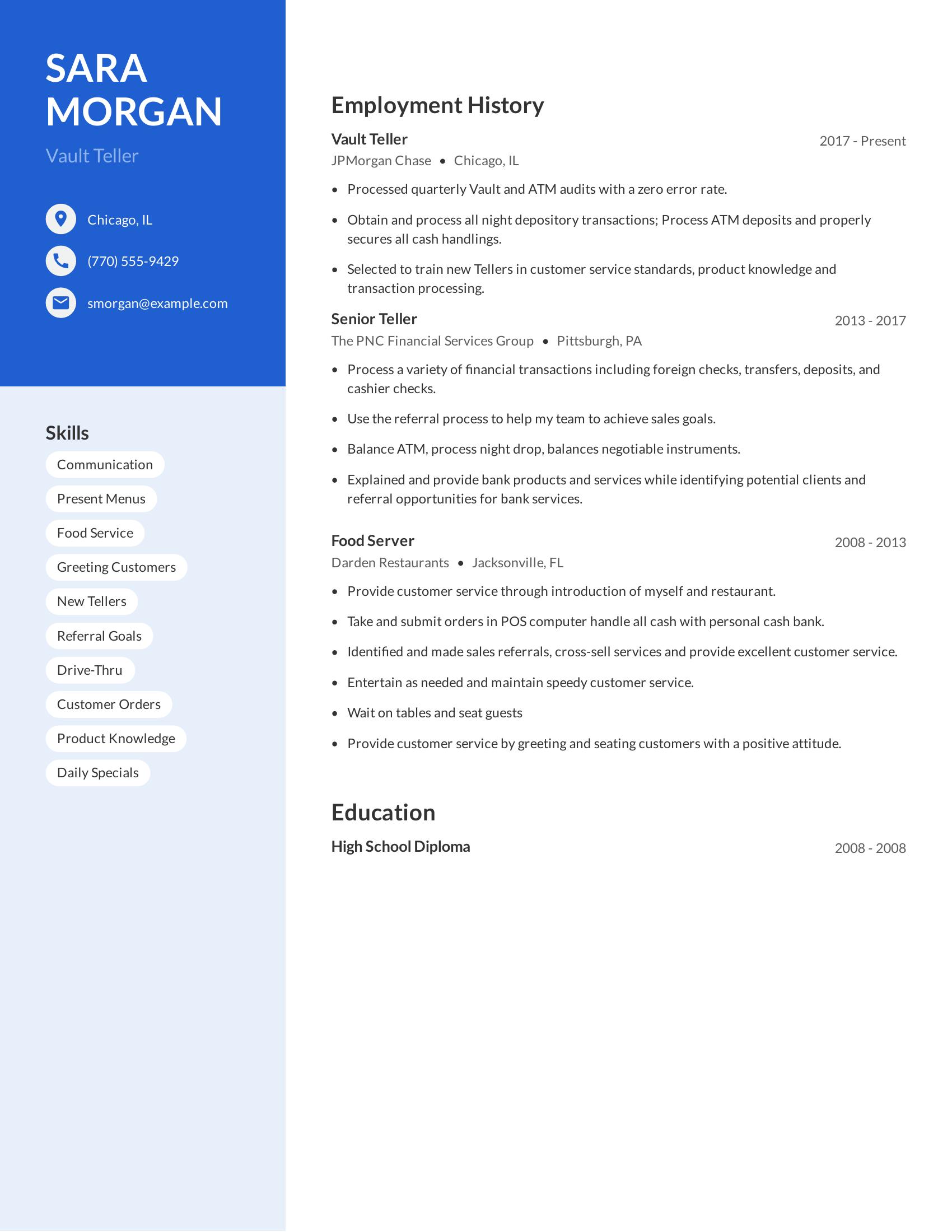

Vault teller resumes should highlight experience in handling cash, performing audits, and processing transactions. Skills in customer service and training new employees are important. Mentioning achievements like error-free audits and referral goals can make the resume stand out. The resume should also include relevant work history, emphasizing roles in financial institutions and any supervisory responsibilities.

This resume includes detailed job experiences with specific tasks performed, such as processing night deposits and training new tellers. It lists relevant skills like communication and product knowledge. The resume also highlights a progression in roles from food server to senior teller to vault teller, showing career growth. The inclusion of both financial and customer service experience makes it comprehensive.

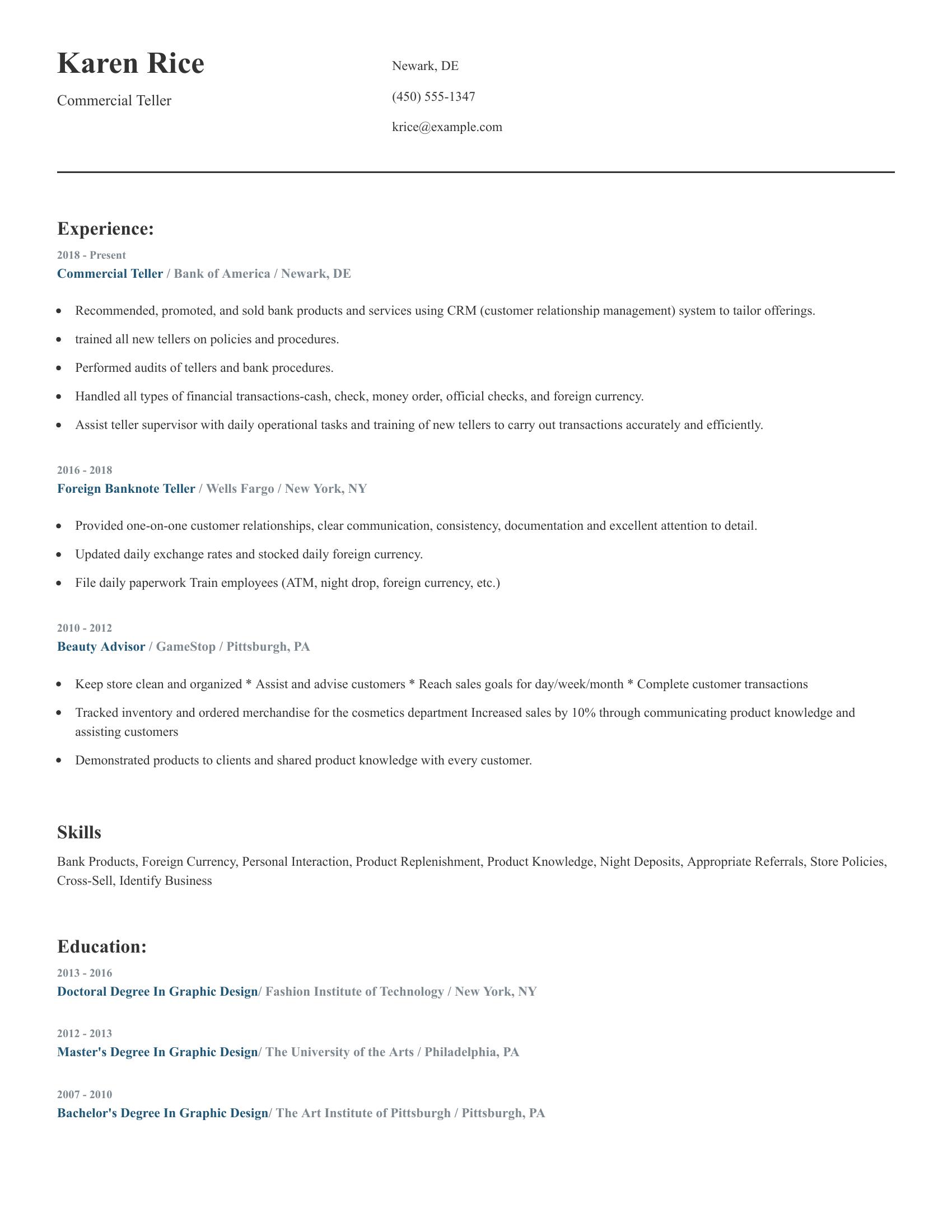

Commercial teller resumes should highlight experience in handling financial transactions, training new staff, and performing audits. The resume should include specific job responsibilities, such as recommending and selling bank products and services, using CRM systems, and managing foreign currency transactions. It is also important to mention skills like personal interaction, cross-selling, and product knowledge. Education details are necessary to show academic background.

This resume includes all key elements of a good commercial teller resume. It lists relevant job experience with clear descriptions of duties performed at each position. The resume demonstrates proficiency in banking tasks and customer service. It also includes a comprehensive list of skills and detailed educational qualifications.

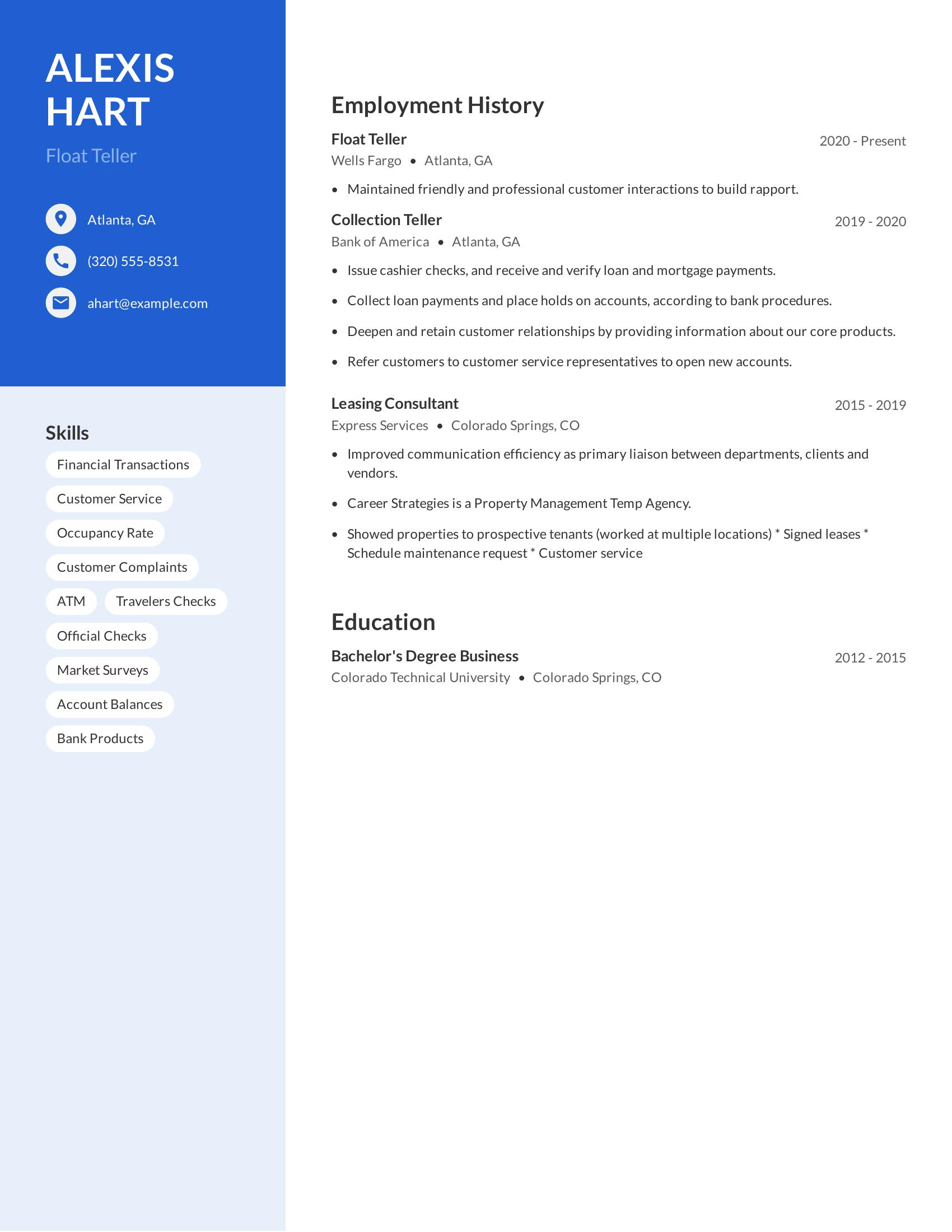

Float teller resumes should highlight relevant experience in the banking sector, strong customer service skills, and knowledge of financial transactions. Essential components include a clear list of skills, a detailed employment history with specific duties performed, and educational background. A good resume should also show the ability to handle various teller tasks, such as issuing checks and managing account balances.

This resume includes these specifics by listing skills like financial transactions and customer service. The employment history details roles at Wells Fargo and Bank of America, specifying tasks such as collecting loan payments and referring customers to open new accounts. The education section mentions a bachelor's degree in business, adding to the candidate's qualifications.

Teller and a sales associate resumes should highlight experience in financial transactions, customer service, and handling legal documents. A good resume will include clear job titles, employment dates, locations, and responsibilities. It should demonstrate skills like managing ATMs, conducting audits, coaching team members, and meeting sales goals. Additionally, educational background and relevant certifications should be listed to show qualifications.

This resume includes specific skills such as handling financial transactions, customer service, legal documents, and using office technology. It lists job titles with corresponding duties that show experience in banking and clerical work. The resume details roles at JPMorgan Chase and Wells Fargo, emphasizing responsibilities like managing ATMs and coaching tellers. Educational background is also provided, showing a certificate in biology from the University of North Carolina.

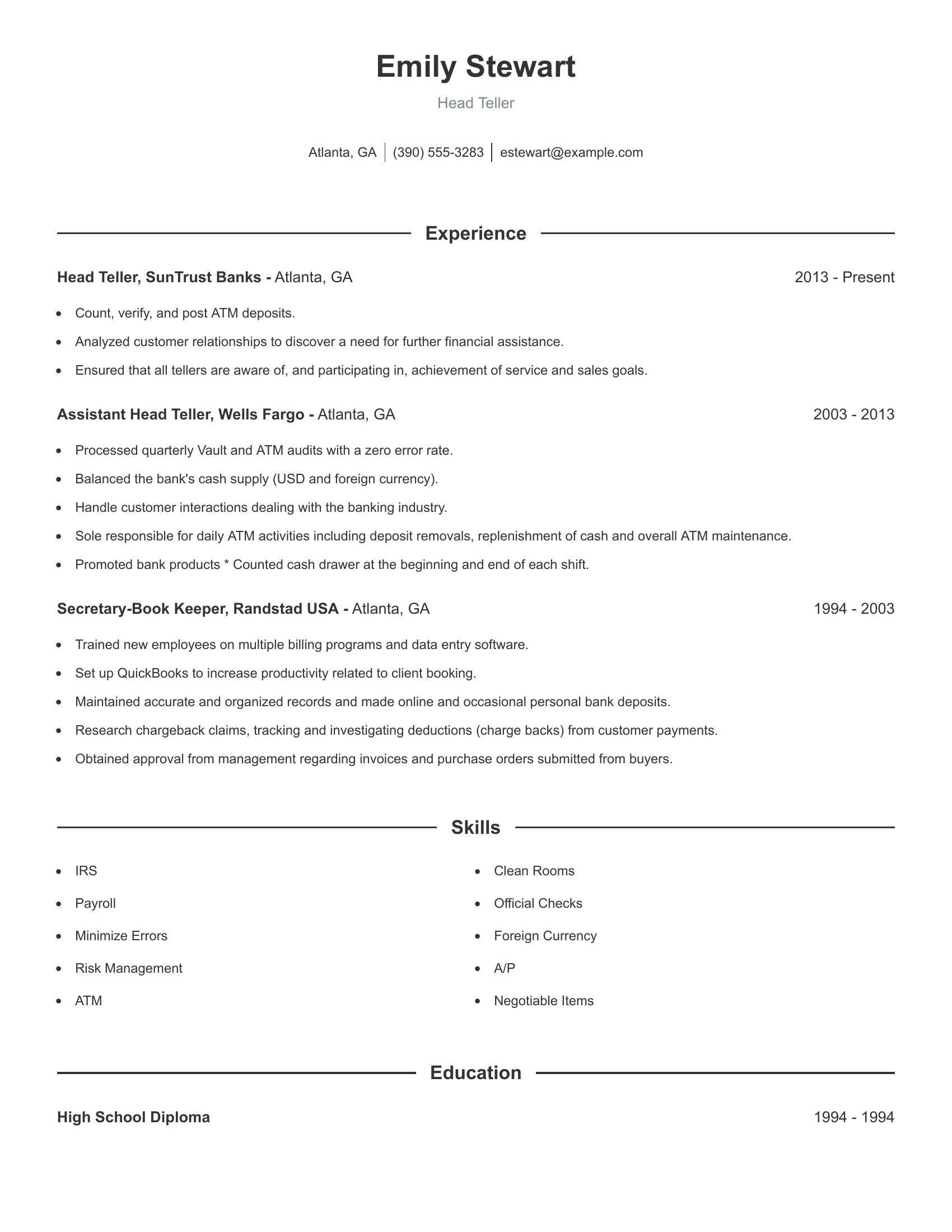

Head teller resumes should highlight relevant experience in financial operations, customer service, and team leadership. They should include previous job titles, employment dates, and specific duties that showcase the ability to manage cash transactions, analyze customer needs, and oversee teller performance. Educational background and skills related to banking, such as risk management and ATM maintenance, are also important.

This resume includes those specifics by detailing positions held at SunTrust Banks and Wells Fargo with clear descriptions of responsibilities like counting ATM deposits, analyzing customer relationships, and maintaining cash supplies. It also outlines prior experience as a secretary-bookkeeper with duties that demonstrate organizational skills and financial oversight. The resume lists relevant skills such as managing foreign currency and minimizing errors, providing a comprehensive view of the candidate's qualifications.

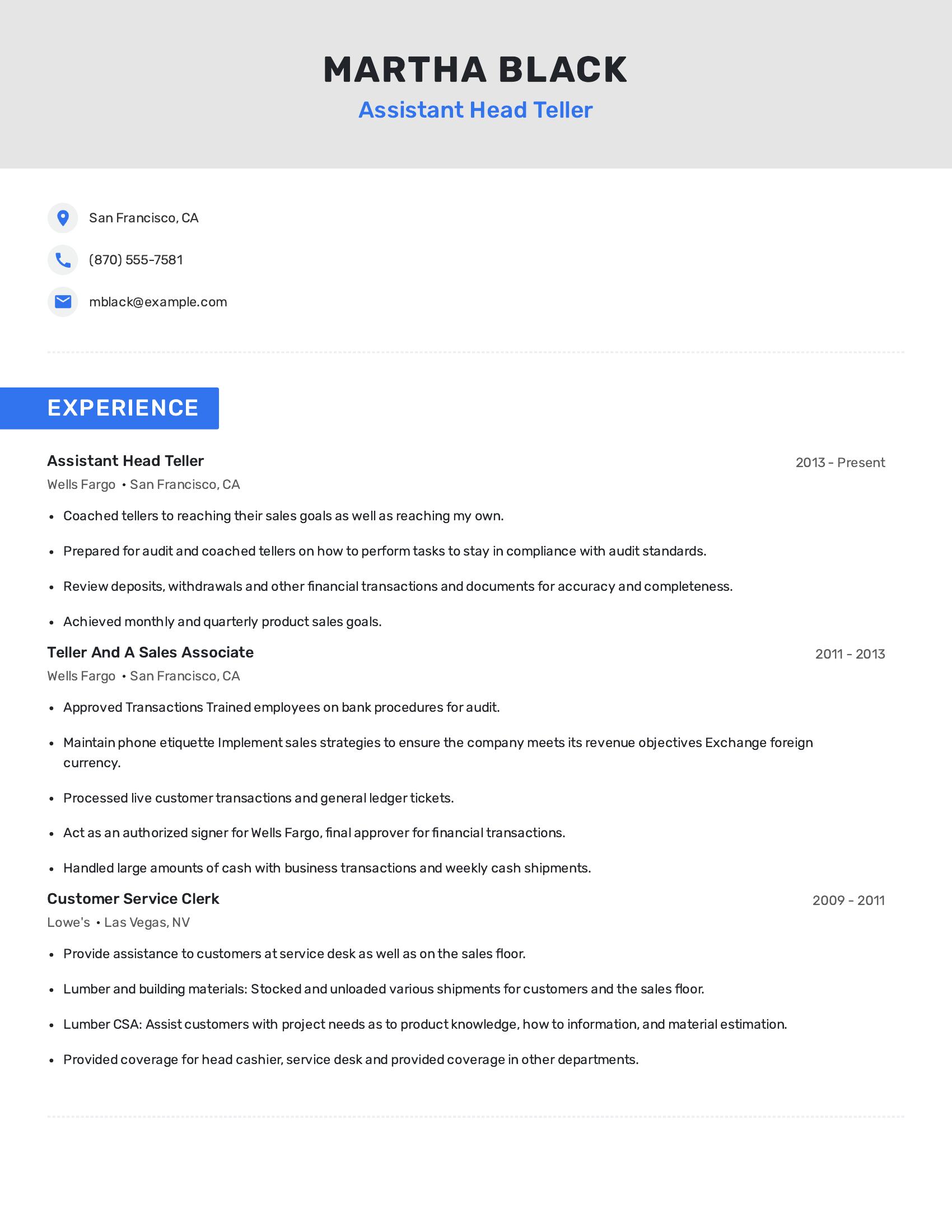

Assistant head teller resumes focus on leadership, coaching abilities, and proficiency in banking operations. They highlight experience in training tellers, managing audits, and handling financial transactions. These resumes also showcase achievements in meeting sales goals and maintaining compliance with banking standards.

This resume includes all necessary details such as experience in coaching tellers, preparing for audits, and reviewing financial transactions for accuracy. It also shows a successful track record in achieving sales goals and handling large cash transactions. The inclusion of previous roles like teller and sales associate provides a comprehensive view of the candidate's banking experience.

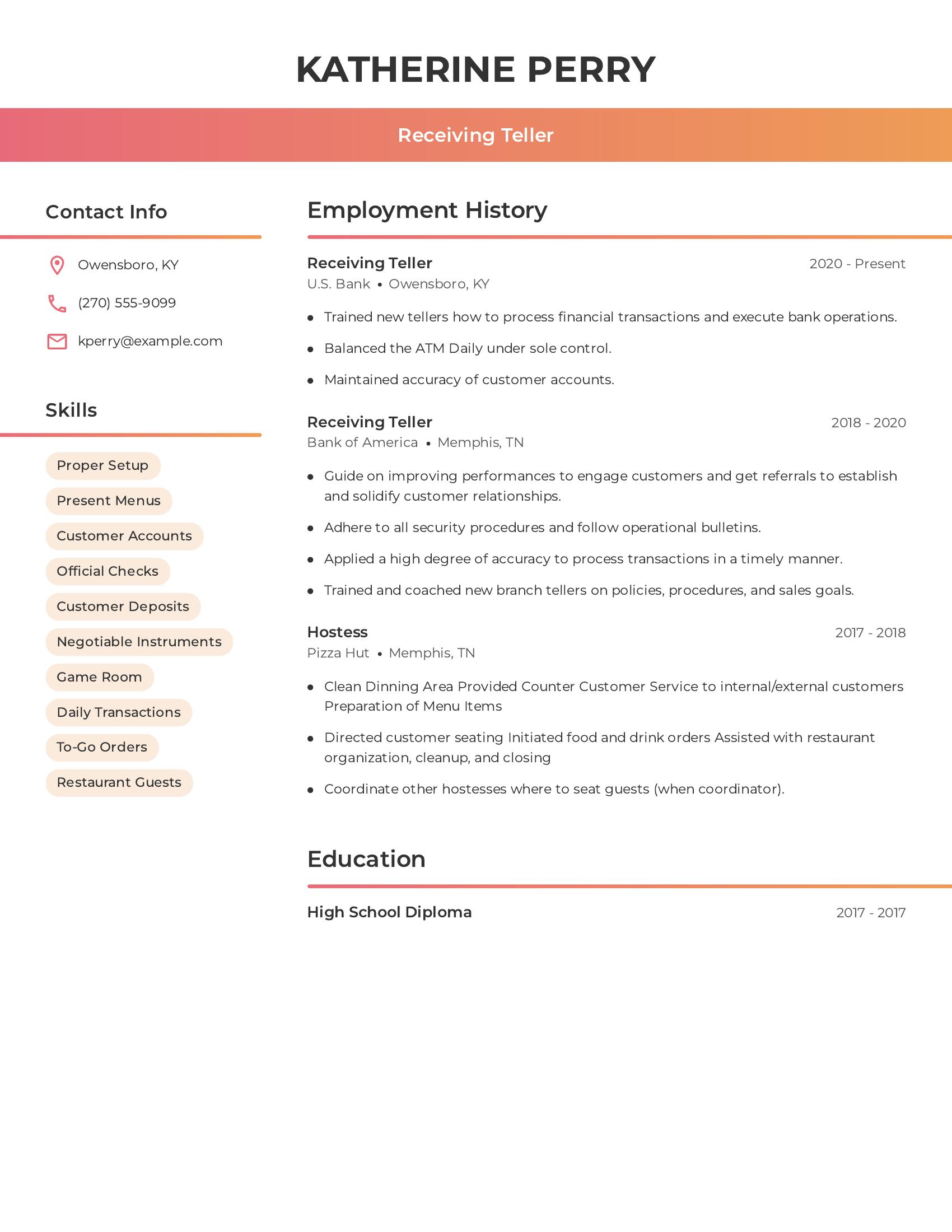

Receiving teller resumes should highlight relevant banking experience, customer service skills, and attention to detail. Key elements include work history in similar roles, specific banking tasks performed, and any training or supervisory responsibilities. Education and contact information are also important. The resume should reflect the candidate’s ability to handle financial transactions accurately and follow bank procedures.

This resume includes extensive experience as a receiving teller at two banks. It lists relevant skills like handling customer accounts, processing deposits, and balancing ATMs. The resume also shows the candidate's ability to train new tellers and adhere to security procedures. Previous roles in customer service further demonstrate strong communication skills and the ability to manage transactions efficiently.

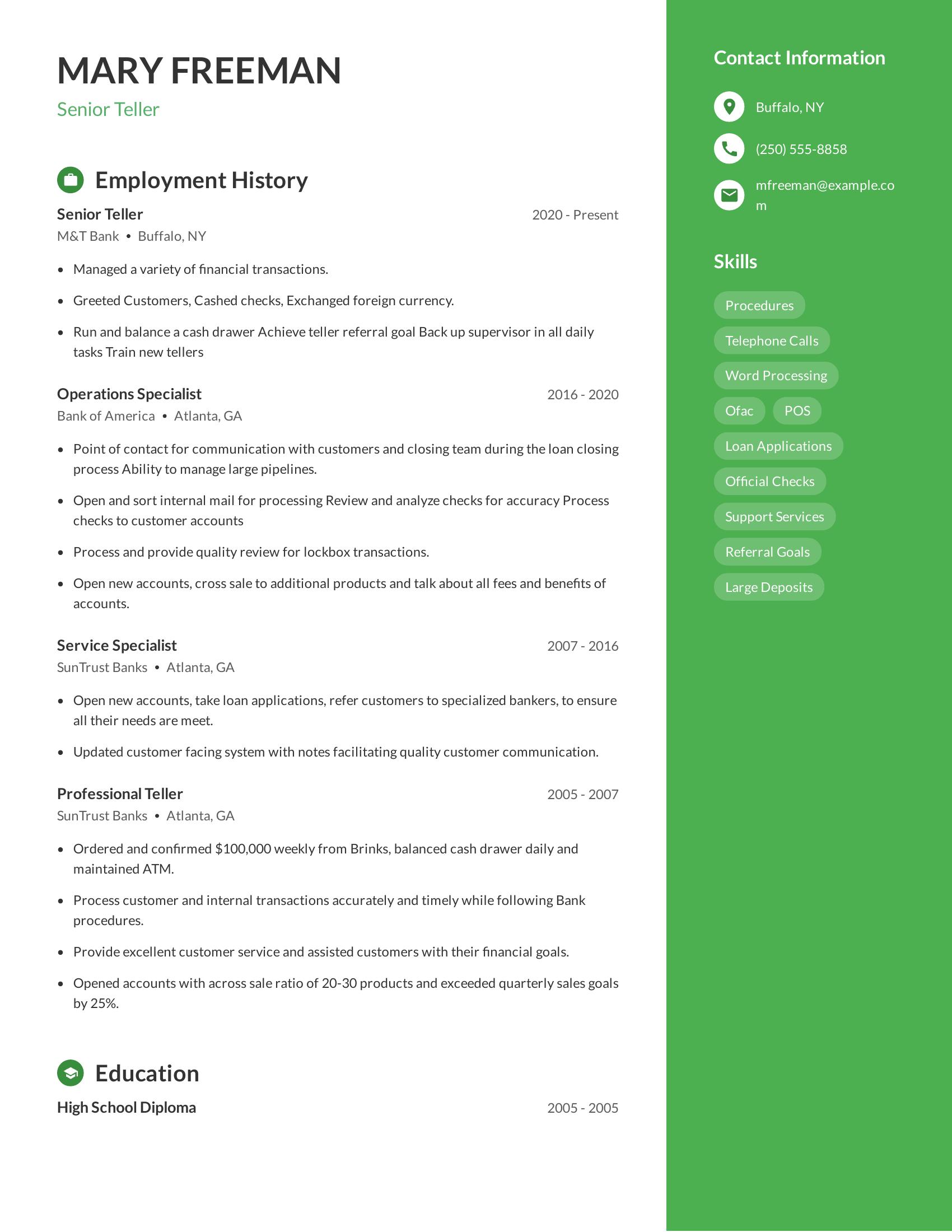

Senior teller resumes should highlight experience with financial transactions, customer service, and supervisory tasks. A good resume includes clear job titles, employment dates, detailed responsibilities, and achievements. It should also list relevant skills and education. This gives a potential employer a comprehensive view of the candidate's qualifications.

This resume includes detailed job responsibilities like managing financial transactions and training new tellers. It lists specific tasks at each job, showing growth in responsibility over time. The inclusion of measurable achievements, such as exceeding sales goals, strengthens the resume. Lastly, it provides a clear timeline of employment history and relevant skills.

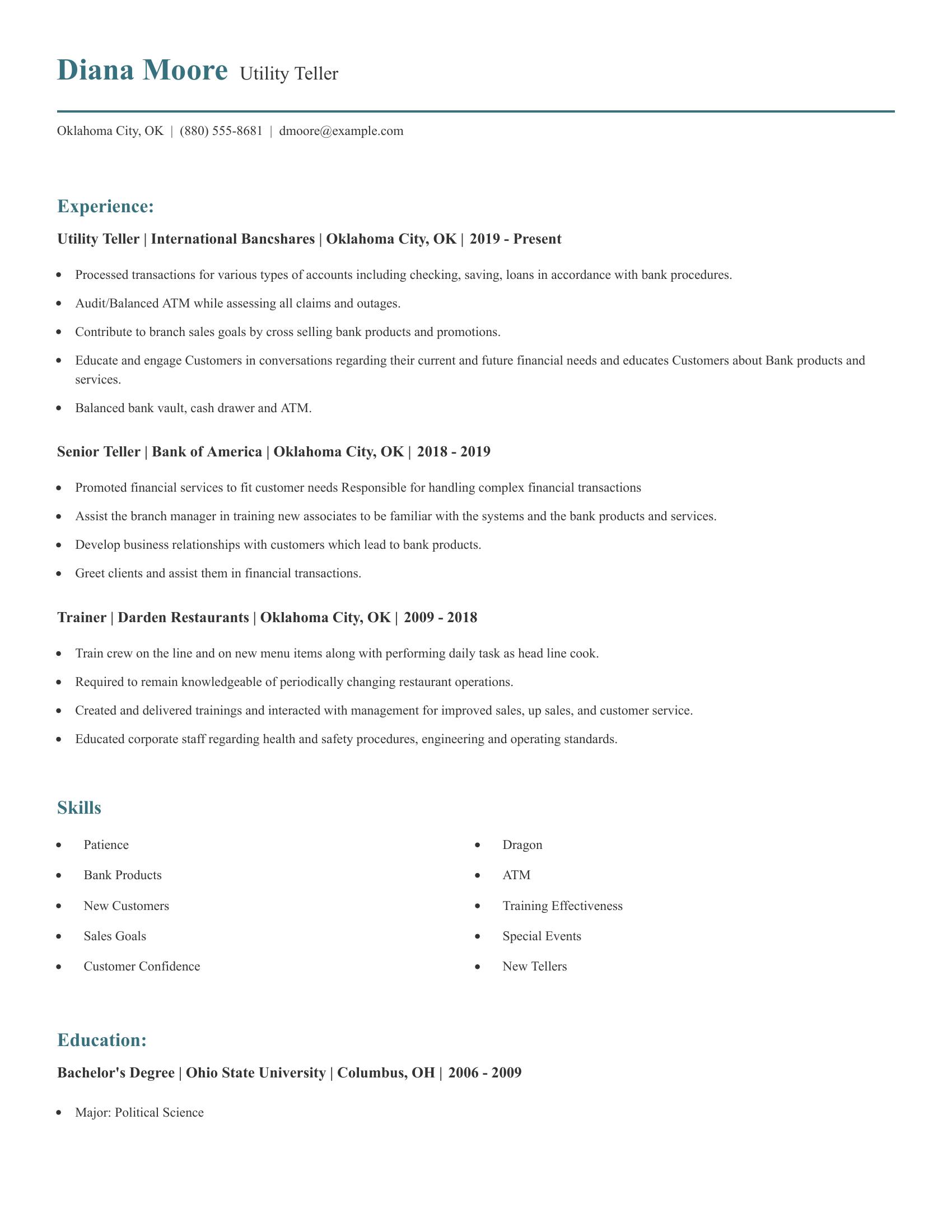

Utility teller resumes should highlight relevant job experience, skills in handling financial transactions, and customer service abilities. They should include a clear record of employment history with specific responsibilities, such as processing transactions, balancing ATMs, and promoting bank products. Skills related to financial services, customer interactions, and sales should be emphasized to show competence in the role. Additionally, educational background and any training experience should be noted.

This resume includes detailed job experience with specific duties like processing transactions, balancing ATMs, and cross-selling products. It also shows a history of customer engagement and training new employees, which demonstrates leadership. The skills section lists relevant abilities such as handling bank products and training new tellers. The education section provides a clear academic background, adding credibility to the candidate's qualifications.

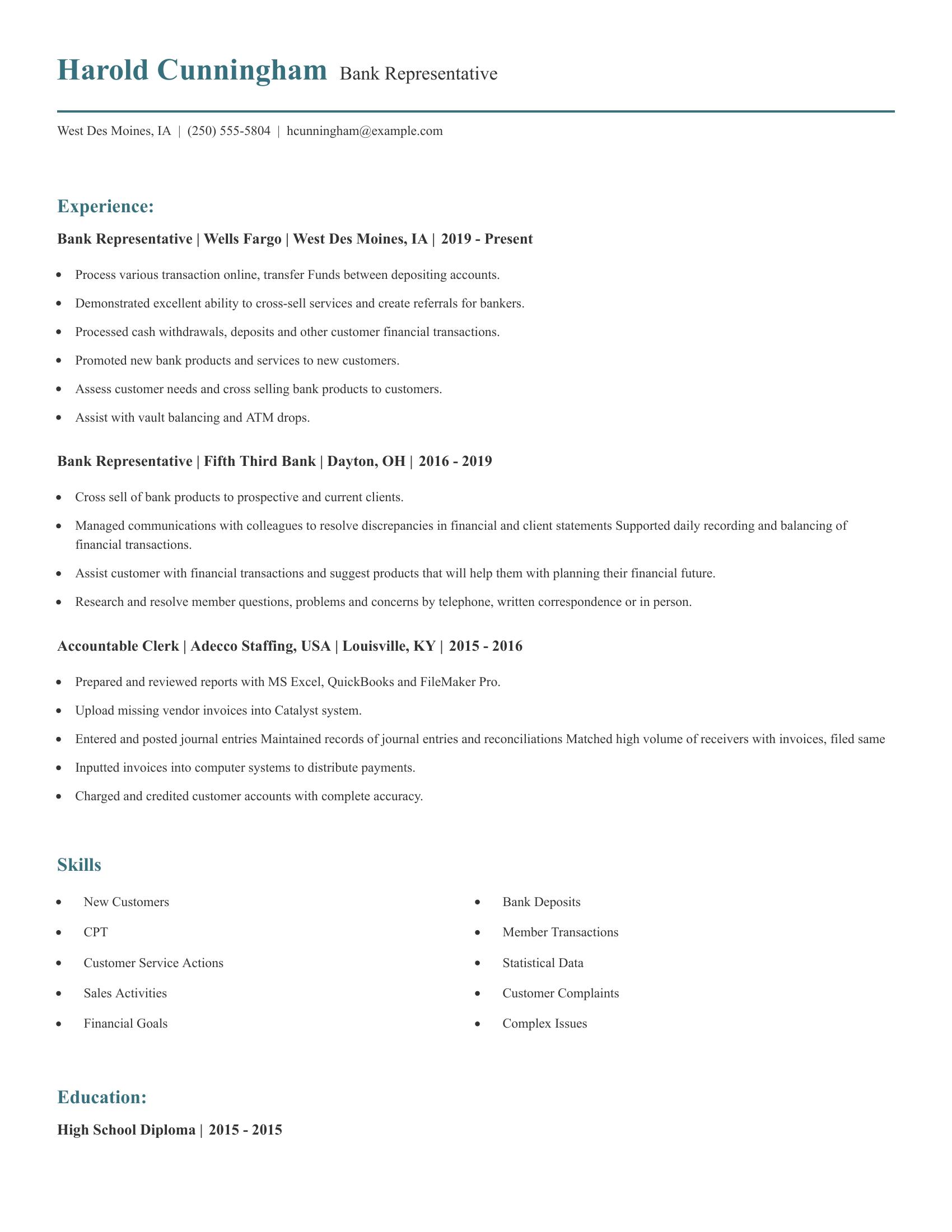

Bank representative resumes should highlight experience in handling financial transactions, customer service, and sales. They should list jobs where the applicant managed cash, assisted with vault balancing, and promoted bank products. Skills in resolving customer issues and cross-selling services are also important. Education details and proficiency with relevant software add further value.

This resume effectively includes those specifics. It lists two positions where the applicant processed transactions, promoted bank products, and managed customer interactions. The skills section mentions relevant abilities like customer service and handling complex issues. The education section is brief but complete, showing the applicant’s high school diploma. The resume also notes proficiency with software like MS Excel and QuickBooks.

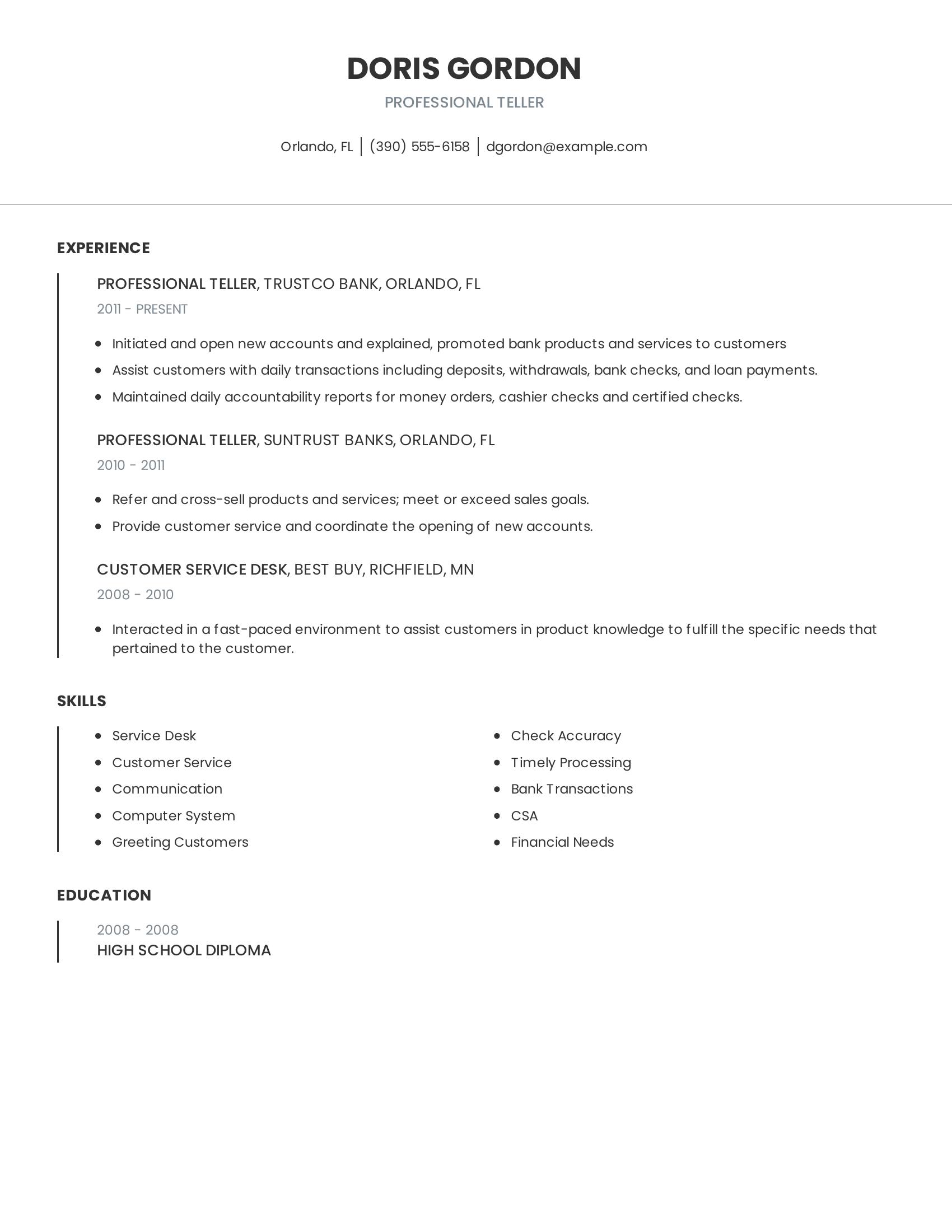

Professional teller resumes should highlight experience in handling financial transactions, assisting customers with their banking needs, and maintaining accurate records. Key elements include job titles, specific tasks performed, skills related to banking operations, and relevant customer service experience. A good resume also lists education and any additional skills that contribute to job performance.

This resume includes specific job titles and dates of employment, detailing duties like opening accounts, processing transactions, and promoting bank services. It lists relevant skills such as customer service, communication, and financial needs assessment. The resume also includes education details, showing the candidate's high school diploma completion.

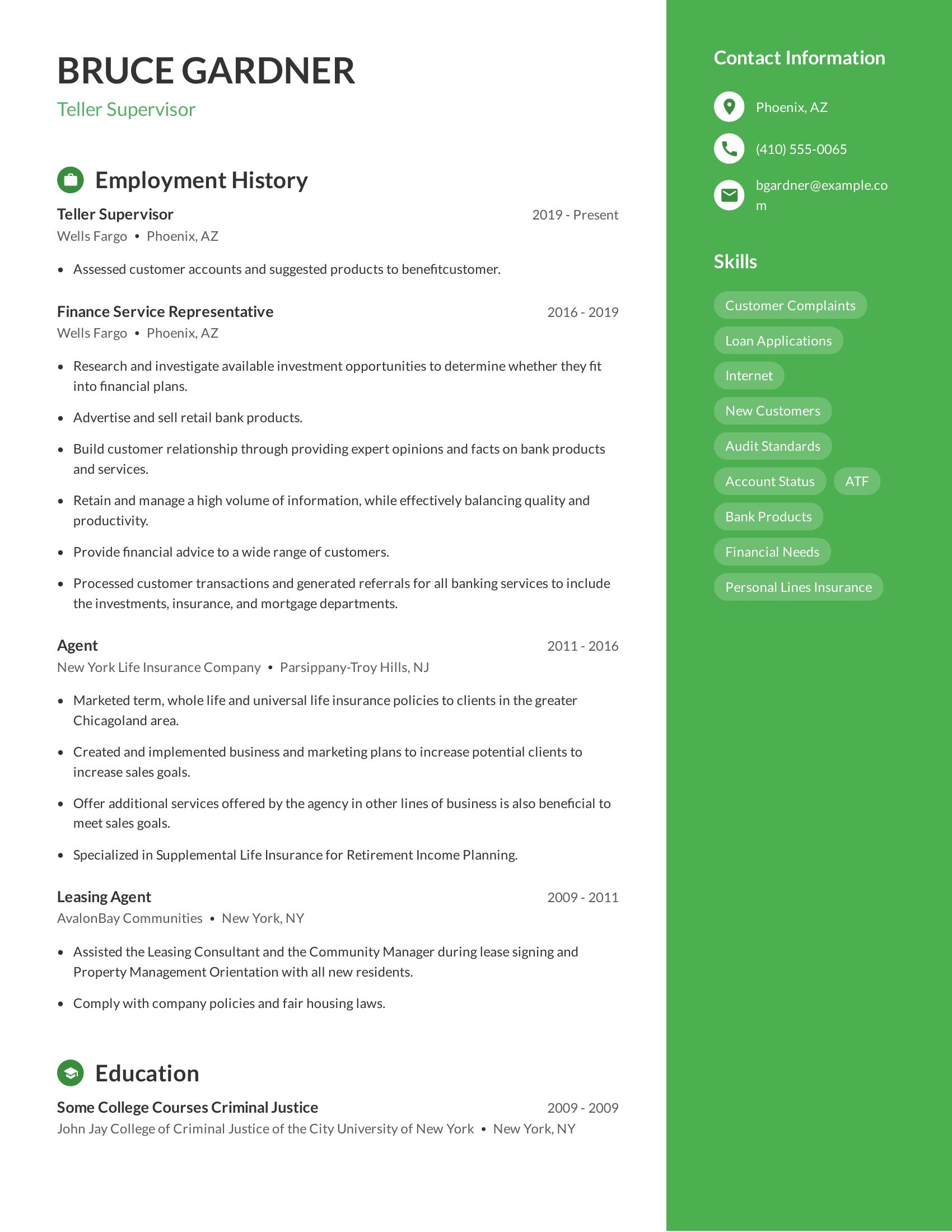

Teller supervisor resumes should highlight relevant experience in financial services, strong customer service skills, and leadership abilities. A good resume includes a clear job history with specific roles and achievements, showing progression in responsibilities. It should list pertinent skills like handling customer complaints, processing loan applications, and knowledge of bank products. Educational background and contact information should also be straightforwardly presented.

This resume effectively includes these elements by detailing employment history with relevant job titles and duties at each position. It shows career progression from leasing agent to teller supervisor, indicating growth in responsibility. The skills section lists specific competencies such as account status ATF and audit standards, which are pertinent to the role. The educational background is concise, and contact information is easy to locate.

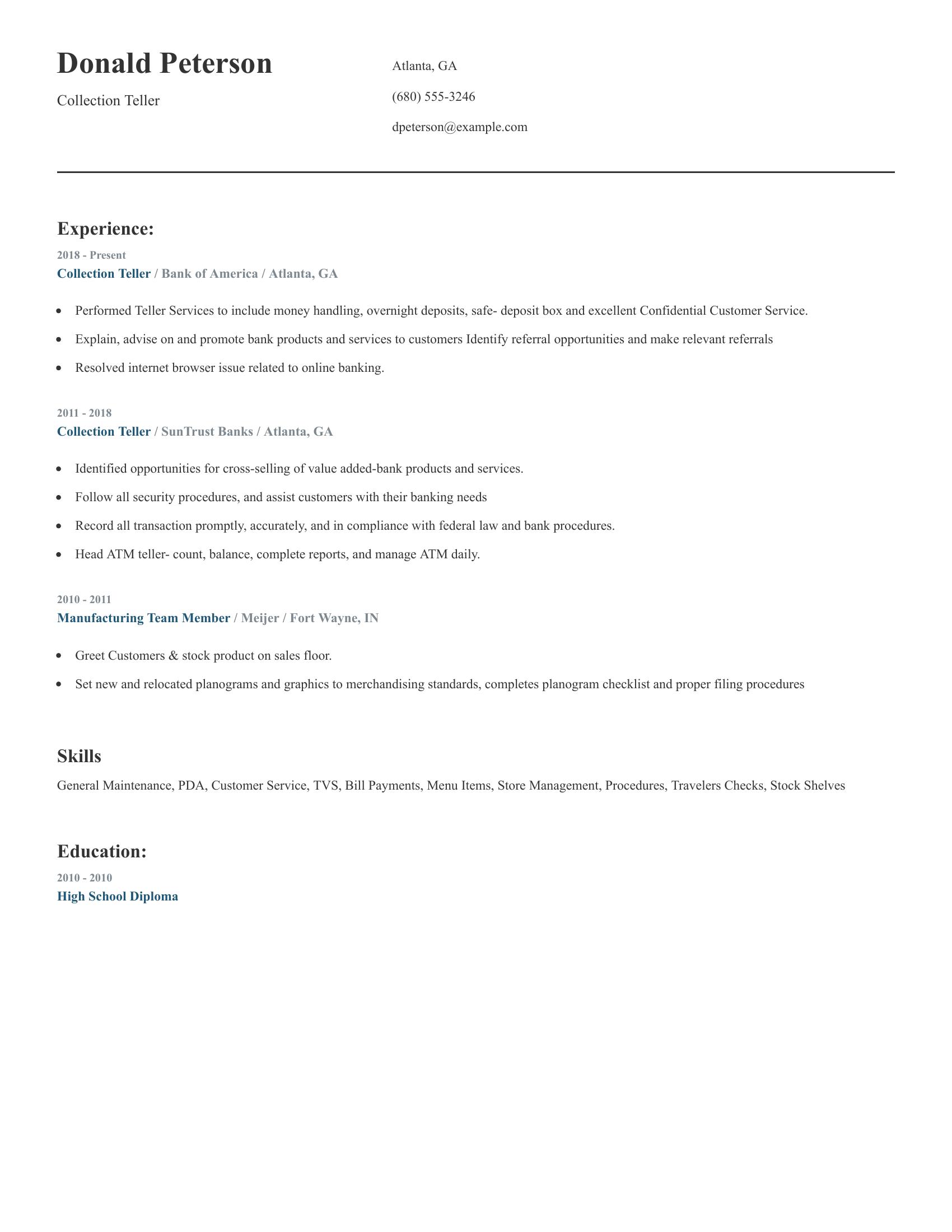

A collection teller resume should highlight experience with money handling, customer service, and knowledge of banking procedures. It should also show the ability to cross-sell bank products, resolve customer issues, and follow security protocols. Skills related to transaction processing, managing ATMs, and promoting bank services are important. The resume must include clear job history and relevant skills to demonstrate proficiency in these areas.

This resume includes specific experiences such as money handling, overnight deposits, and resolving online banking issues. It shows a history of employment at reputable banks and details roles in promoting bank products and identifying referral opportunities. The skills section lists relevant abilities like customer service and transaction processing, further supporting the candidate's qualifications for a collection teller position.

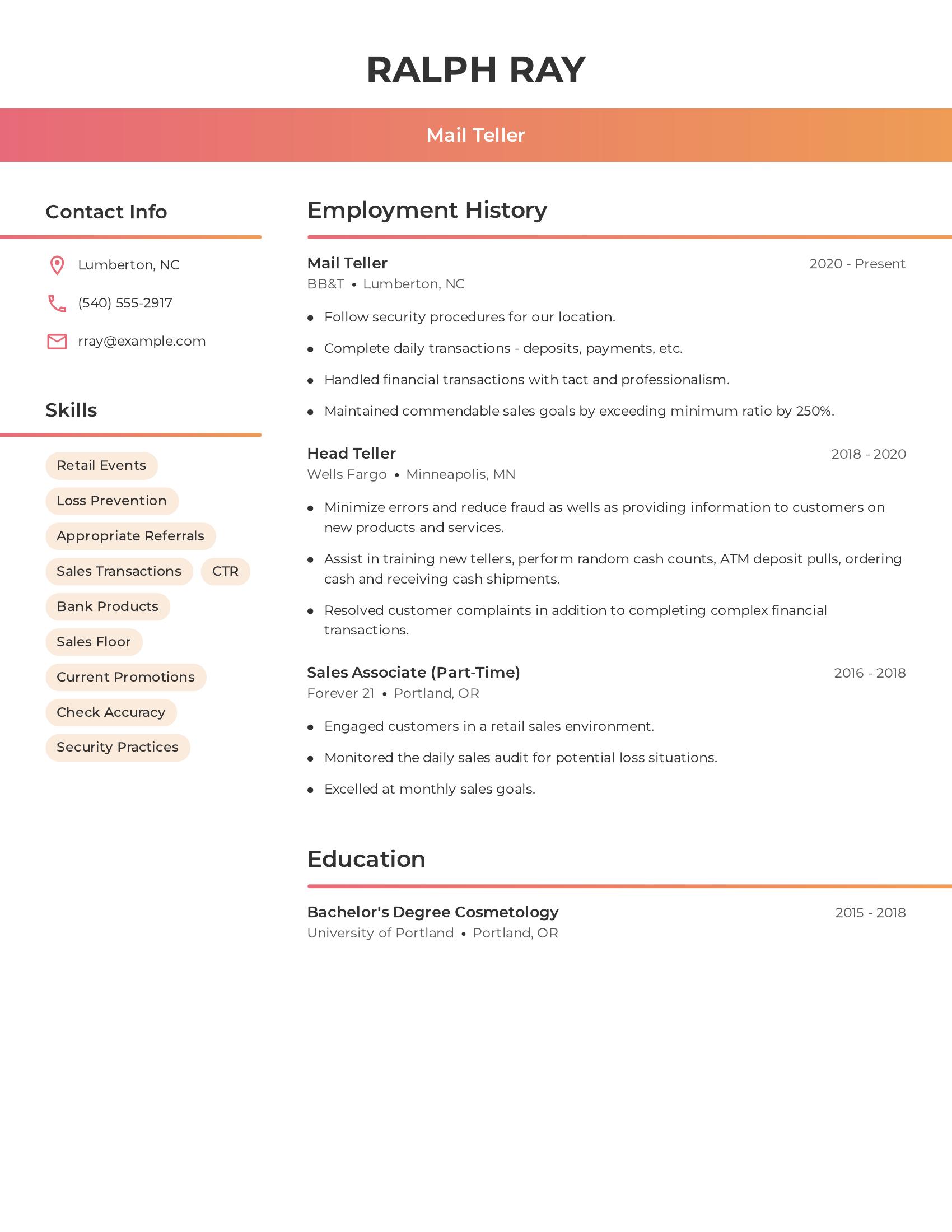

Mail teller resumes should highlight experience in handling financial transactions, customer service, and security practices. They should list relevant work history, skills related to financial services, and any training or education in related fields. A good resume includes clear job titles, dates of employment, and specific responsibilities to show proficiency in the role.

This resume includes detailed work history with clear job titles and dates, showing progression from a sales associate to a head teller and then to a mail teller. It lists relevant skills like loss prevention, sales transactions, and check accuracy. The education section is concise, with a degree related to customer service. The responsibilities are specific, including handling financial transactions, minimizing errors, training new tellers, and engaging with customers.

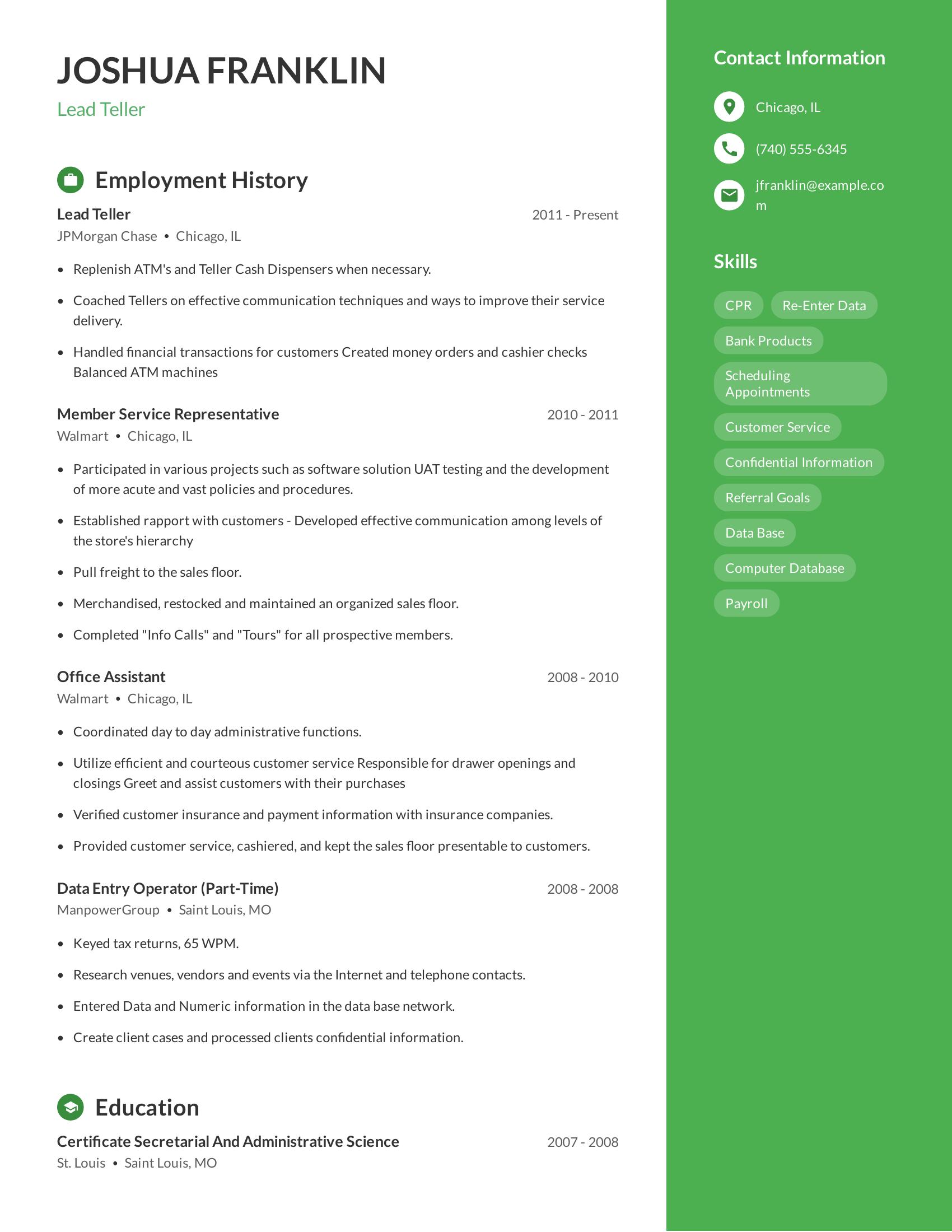

Lead teller resumes should highlight experience in financial transactions, coaching team members, and managing cash operations. Important sections include employment history, education, and skills. Relevant job duties like handling money orders, balancing ATMs, and customer service should be clearly listed. Specific achievements or responsibilities in previous roles are necessary to demonstrate capability in leadership and financial management.

This resume includes detailed employment history with specific job duties such as replenishing ATMs, coaching tellers, and handling financial transactions. It also lists previous roles that show a progression in responsibility and experience in customer service. Skills relevant to the position, like data entry and database management, are mentioned. The inclusion of a certificate in secretarial and administrative science demonstrates educational background related to the role.

Highlight cash handling experience. Mention any past jobs where you handled money, like cashier or retail positions, to show you can manage transactions and balances.

Show customer service skills. Share examples of helping customers solve problems or answering questions in previous roles to demonstrate you can assist bank clients effectively.

Include technical skills. List any experience with banking software, data entry, or managing spreadsheets to prove you can handle the technical side of being a bank teller.

A bank teller's resume should be clear and direct, focusing on relevant skills, experience, and education. Start with contact information at the top. Follow with a summary statement highlighting cash handling and customer service skills. Include a section for work experience, listing previous jobs in reverse chronological order. Highlight duties like handling transactions, balancing drawers, and providing account services. Add a section on education, noting any degrees or certifications. Include a skills section that lists abilities such as cash handling, customer service, and familiarity with banking software.

A strong summary should highlight your experience, skills, and achievements in a way that aligns with the job requirements.

Follow these best practices to ensure your resume stands out.

A well-written bank teller experience section should focus on specific duties and achievements. Use action verbs and quantify results when possible.

Follow these tips to make your bank teller experience stand out. Be specific about your role and results.

Bank tellers need specific hard skills to perform their job duties well.

Bank tellers also need specific soft skills to succeed in their role.